Optimal Product Line Pricing for Two Customer Segments with an

Extension to Multi-Segment Case

Udatta S. Palekar, Govind Daruka and Manmeet Singh

Department of Business Administration, University of Illinois at Urbana-Champaign, Illinois, U.S.A.

Keywords:

Pricing, Product Line, Optimization.

Abstract:

In this paper we consider the problem of determining optimal prices for a product line. Items are distinguished

by a single attribute which we call quality and which is proportional to the cost of the item. Demand for an

item is dependent on the price differential between the item and the next item with higher cost. Customers

can be grouped into two segments based on the lowest features acceptable and the maximum acceptable price.

We develop an algorithm to determine the optimal pricing to maximize profit. We also consider assortment

decisions to add or drop items based on regularity conditions and optimality considerations.

1 INTRODUCTION

The existence of consumers with vast heterogeneity

in tastes has made it very common for firms to offer

multiple items with correlated demand, often called a

product line ((Shugan(1984))). A product line is a set

of items that cater to essentially the same customer

need, but that differ from each other due to either the

existence or non-existence of a feature; or variation in

performance with respect to some measure. A prod-

uct line consists of many individual items, which are

referred as variants or items or products. For consis-

tency, we use the term ‘items’ throughout this paper.

(Monroe(1990)) states that within the domain of

pricing strategy, product line price setting is the most

complicated decision area. Product line decisions are

difficult to make because the items in the line are not

usually independent. Substitution patterns of items in

a product line play an important role in this regard.

Some mathematical models for pricing product

lines that take the inter-item dependencies into con-

sideration have been developed like the model by

(Shugan and Desiraju(2001)). The authors assume

that the product line attracts a homogeneous set of

customers where all of them treat the product line as-

sortment alike. But usually, within a product line,

different items attract different classes of customers

based on customer preference. These heterogeneity

among customers can be better modeled by consider-

ing several customer segments.

In this paper, we extend the work of (Shugan and

Desiraju(2001)) to solve the optimal product line pric-

ing problem with multiple customer segments. The

presence of multi-customer segments adds many lev-

els of complexity to the mathematical analysis. First,

we present analysis for two customer segments and

devise an optimal algorithm for pricing. This is then

extended to multiple customer segments. We develop

important managerial insights on the ‘best’ items to

add to a product line and ‘best’ items to drop from a

product line.

2 LITERATURE REVIEW

Marketing literature in the managerially important

area of product line pricing strategies is relatively

sparse due to the interdependencies of the optimal

prices and demand of items in a product line. In

his seminal work on interdependencies in a product

line, (Urban(1969)) develops and tests a mathemati-

cal model encompassing the major factors and market

phenomena affecting the problem of finding the best

marketing mix for a product line. (Palda(1969)) was

amongst the first to consider individual item prices si-

multaneously and his model used interrelated demand

functions. (Little and Shapiro(1980)) were the first re-

searchers to demonstrate the necessity of a nonlinear

sales ‘response’ function in the context of pricing a

product line in supermarkets. Cross-elasticity terms

were explicitly considered while pricing each item in

the line by (Reibstein and Gatignon(1984)). (Lilien

et al.(1992)Lilien, Kotler, and Moorthy) and (Yano

311

S. Palekar U., Daruka G. and Singh M..

Optimal Product Line Pricing for Two Customer Segments with an Extension to Multi-Segment Case.

DOI: 10.5220/0004924303110316

In Proceedings of the 3rd International Conference on Operations Research and Enterprise Systems (ICORES-2014), pages 311-316

ISBN: 978-989-758-017-8

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

and Dobson(1998))present comprehensive discussion

of marketing models for product line selection.

(Blattberg and Nelsin(1990)), (Levy and

Weitz(2004)), (Shugan(1984)) and (Zenor(1994))

have emphasized the importance of an item’s

price on its item’s profits and the profits of other

items. (Blattberg and Wisniewski(1989)) show

that high-priced brands compete among themselves

and with low-priced brands. Within retail product

lines, high quality/price brands tends to steal sales

from low quality/price brands but converse is not

true ((Mulhern and Leone(1991)), (Sivakumar and

Raj(1997))). Considering these results (Shugan and

Desiraju(2001)) developed a mathematical pricing

model when items exhibit either symmetric or asym-

metric competition and discuss the implications of

asymmetry. They also provide guidelines for changes

in pricing strategies when costs or line composition

changes. (Moorthy(1984)) showed that the effect of

customer self selection leads to competition within

the firm’s own product line such that, the optimal

product and price cannot be determined separately

for each segment. Our work seeks to create such a

methodology that considers product-line pricing in

the context of multiple customer segments.

3 PROBLEM DESCRIPTION

In this paper we consider a vertically differentiated

product line. The demand for any item in the line fol-

lows the distribution function given by (Shugan and

Desiraju(2001)) who consider a product line with V

items and single customer segment. Let i = 1,2,...,V

denote the items which cost the firm c

1

,c

2

,...,c

V

such that c

i

< c

j

for all items i < j. Then the demand

of the i

th

item is given by

D

i

=

{

M (p

i+1

− p

i

) 1 ≤ i < V, p

i

< p

i+1

M (θ − p

i

) i = V, p

i

< θ

(1)

where, p

i

is the price of the i

th

item, M is a mea-

sure of aggregate demand and θ can be interpreted as

the maximum reservation price of the customer seg-

ment of this product line. The reservation price is the

maximum amount any customer is willing to pay.

Since positive demand requires that p

i

< p

j

for

all items i < j they propose a sufficient condition,

which they call regularity condition. Regularity re-

quires: c

i

< A ∀ i = 1,2,...,V , where A is the adjusted

average cost of the line given as

A =

∑

V

k=1

c

k

+ θ

V + 1

(2)

Then the optimal price p

∗

i

for item i is given by p

∗

i

=

i−1

∑

k=0

(A − c

k

), where c

0

= 0.

In this model, an item competes for customers

with the items that are priced immediately above it.

The demand for a particular item along the product

line can then be said to be driven by its price differ-

ence with respect to the next higher priced item.

Next consider two customer segments that are dis-

tinguished by two parameters. First, there is a seg-

ment specific reservation price that limits the items

that customers in that segment can purchase. Second,

each segment has minimum quality/attribute require-

ments that limits from below the items that customers

in that segment are willing to purchase. The poten-

tial consideration set for customers in each segment

is, therefore, bracketed from below and above. The

actual consideration set for each segment, of course,

depends on the prices that the firm sets. Let,

N

1

,N

2

: customer population of the two segments

u

1

,u

2

: index of the lowest acceptable item for the two

segments

H

1

,H

2

: consideration set for the two segments with-

out price

θ

1

,θ

2

: reservation price of the two customer segments

such that θ

2

> θ

1

a: costliest item available to customer segment 1 for

purchase or reservation price boundary item for cus-

tomer segment 1

V

1

= argmax

i=1,V

{c

i

< θ

1

}

Then the potential consideration sets for the two cus-

tomer segments are given by H

1

= {u

1

,...,V

1

} and

H

2

= {u

2

,...,V }.

Consider the most general case in which u

2

< V

1

.

Also let W (a) = {u

1

,...,a} be the set of items that

the firm, through pricing, makes available to segment

1. Then the pricing structure for the product line can

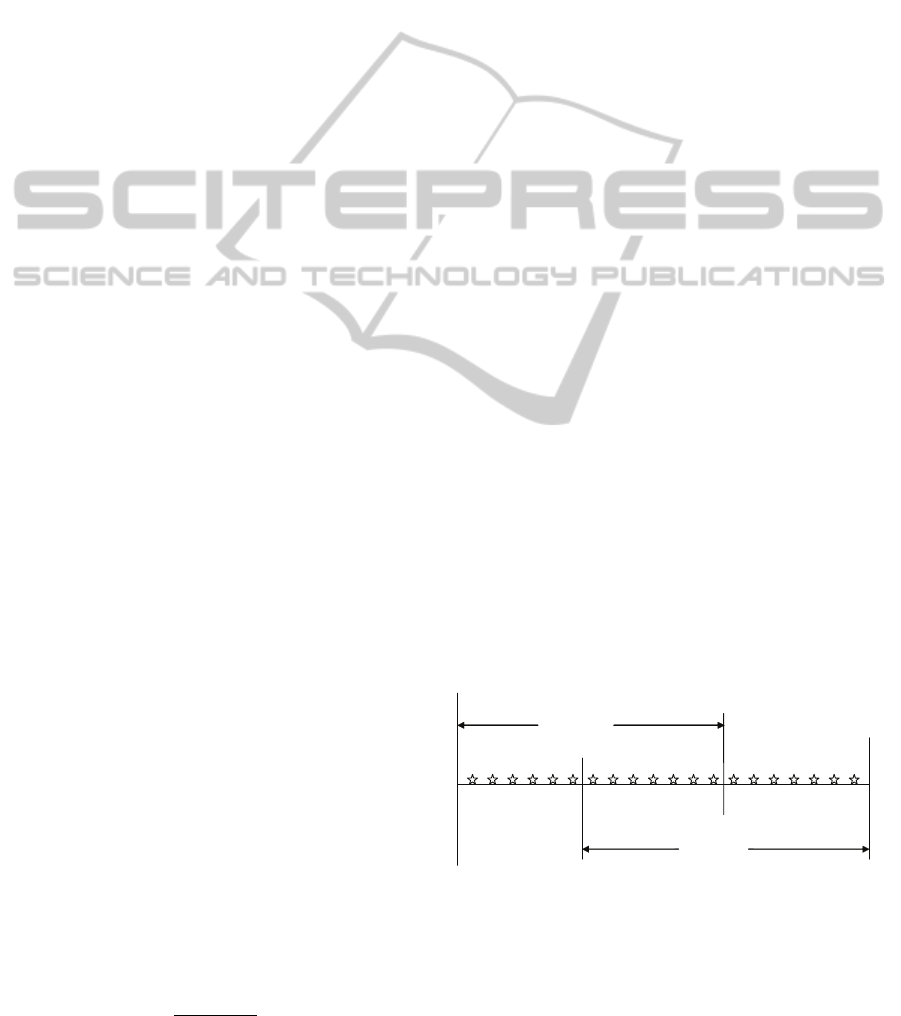

be represented as shown in figure 1.

Customer

Segment 1

Customer

Segment 2

Tier 1

Tier 2

Tier 3

θ

1

θ

2

a

u

2

u

1

1

V

Figure 1: Schematic representation of product line Pricing

for Two Customer Segments .

The solution of the optimal product line pricing

problem breaks up into two parts: the identification

of a; and subsequent pricing given a. Note that in

general u

2

≤ a ≤ V

1

. To obtain a feasible set of prices

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

312

for a given a, we require that the regularity condition

is satisfied and the prices are such that the firm’s im-

posed condition that is p

a

< θ

1

and p

a+1

≥ θ

1

is sat-

isfied.

Now supposing that we have identified a, then the

problem of optimally pricing the product line can be

broken down into managing three sets of items con-

sisting of items from 1 to u

2

− 1 attracting customers

from segment 1, items from u

2

to a attracting cus-

tomers from both segments and items from a+1 to

V attracting customers from segment 2. We refer to

these item sets as “tiers”.

The problem reduces to optimally solving three

pricing problems with different boundary conditions

for each tier. Let,

l

1

=

u

2

−

1 be the number of items in tier 1

l

2

= a − u

2

− 1 be the number of items in tier 2

l

3

= V − a be the number of items in tier 3.

Then the adjusted average costs for the tiers are

A

1

=

∑

l

1

k=1

c

k

+ p

u

2

l

1

+ 1

, A

2

=

∑

l

2

k=1

c

k

+ p

a

l

2

+ 1

and A

3

=

∑

l

3

k=1

c

k

+ θ

2

l

3

+ 1

Let Π

i

= (p

i

−c

i

)D

i

denote the profit generated by

the i

th

item in the line, where D

i

, the demand for the

i

th

item is

D

i

=

M

1

(p

i+1

− p

i

) 1 ≤ i ≤ u

2

− 1

(M

1

+ M

2

) (p

i+1

− p

i

) u

2

≤ i < a

M

1

(θ

1

− p

i

) + M

2

(p

i+1

− p

i

) i = a

M

2

(p

i+1

− p

i

) a < i ≤ V

where, p

V +1

= θ

2

; M

1

= N

1

/(θ

1

− c

u

1

); M

2

=

N

2

/(θ

2

− c

u

2

).

Solving for the optimal prices involves setting the

partial derivative of Π with respect to Π =

∑

Π

i

equal to zero for each of the three segments individu-

ally. The boundary conditions used are: p

0

= c

0

= 0,

p

l

1

+1

= p

u

2

, p

l

2

+1

= p

a

, p

l

3

+1

= p

V +1

= θ

2

. The op-

timal prices obtained are

p

i

=

iA

1

−

i−1

∑

k=1

c

k

1 ≤ i ≤ l

1

iA

2

−

i−1

∑

k=1

c

k

+

(

l

2

+ 1 − i

l

2

+ 1

)

(p

u

2

− c

u

2

) 1 ≤ i < l

2

iA

3

−

i−1

∑

k=1

c

k

+

(

l

3

+ 1 − i

l

3

+ 1

)

(p

a

− c

a

) 1 ≤ i < l

3

The optimal price of the u

2

item is given as,

p

u

2

=

M

1

M

1

+M

2

(

−

∑

l

1

k=1

c

k

l

1

+1

)

+

c

u

2

l

2

+1

+

∑

l

2

k=1

c

k

l

2

+1

+

p

a

l

2

+1

2 −

M

1

M

1

+M

2

(

l

1

l

1

+1

)

−

l

2

l

2

+1

(3)

For the special case of u

2

= 1, the lowest accept-

able item for the second customer segment is the same

as that of the first customer segment. In this case tier

2 merges with tier 1 and equation (3) need not be eval-

uated.

The optimal price of the a

th

item at the reservation

price boundary is given as,

p

a

=

M

1

θ

1

M

1

+M

2

+ z

1

A

3

+ c

a

z

2

−

∑

l

2

k=1

c

k

l

2

+1

+

(p

u

2

−c

u

2

)

l

2

+1

1 + z

2

−

l

2

l

2

+1

(4)

where z

1

=

M

2

M

1

+ M

2

and z

2

= 1 − z

1

(

l

3

l

3

+ 1

)

Simultaneously solving equation (3) and equation

(4) gives the value of p

a

and p

u

2

, which can then be

used to solve the rest of the prices.

3.1 Optimal Product Line Partition

Thus far, we assumed that the item a, which seg-

ments the product line was known to us. It is clear

though that an appropriate choice of a is required to

maximize product line profits. First we formalize an

intuitive observation, which says that items provide

higher margins when they are limited to the higher

customer segment than when they are made available

to the lower customer segment.

Proposition 1: Assuming regularity conditions,

the price for any item under W (a) will be higher than

under W (a + 1).

Proof: Available from authors.

Consider next any tier t within the product line

with l items having costs c

t

1

,c

t

2

,..., c

t

l

.

Now the optimal price is given as,

p

i

= (iA

t

−

i−1

∑

k=1

c

t

k

) +

(

1 −

i

l

t

+ 1

)

(p

t−1

l

− c

t−1

l

) (5)

The regularity condition p

i+1

− p

i

> 0 gives,

A

t

− c

i

−

(p

t−1

l

− c

t−1

l

)

l

t

+ 1

> 0 (6)

Since c

t

l

is the highest cost item, the regularity condi-

tion can be restated as,

c

t

l

+

(p

t−1

l

− c

t−1

l

)

l

t

+ 1

< A

t

(7)

Therefore, maintaining the regularity condition

implicitly requires that no item cost exceeds the ad-

justed average cost. This puts a constraint on the item

composition of the product line since inclusion and

deletion of items affects the adjusted average cost.

Now, even if the regularity condition is satisfied

and all the items have distinct prices, the firm’s con-

ditions p

a

< θ

1

and θ

1

≤ p

a+1

can get violated due

OptimalProductLinePricingforTwoCustomerSegmentswithan

ExtensiontoMulti-SegmentCase

313

to a linking effect. The condition p

a

< θ

1

is satisfied

if the regularity condition for segment 1 is satisfied

given that ratio of M

1

to M

2

is not very large or very

small. This linking effect and the regularity constraint

imposed over the product line composition makes the

problem hard to solve.

In Proposition 2, we establish that the violation

of the regularity condition for an item composition in

which the firm offers a total of a items to the first cus-

tomer segment implies that the regularity condition

would be violated if any more items are offered to first

segment. This result serves as a stopping criterion for

the search for a.

Proposition 2: If the condition p

a

< θ

1

is violated

for W (a) then corresponding condition ¯p

a+1

< θ

1

will

be violated for W (a + 1).

Proof: Available from authors.

3.2 Optimally Solving the Two Segment

Pricing Problem

We next describe the procedure to determine the opti-

mal item composition.

Procedure:

Step 1: a = u

2

. Solve the pricing problem and

check if the linking condition θ

1

≤ p

a+1

is satisfied.

If not, then let a = a + 1 and solve the new pricing

problem until the linking condition is satisfied giving

a feasible solution. Let the feasible solution is ob-

tained at a = h and z = 1 and the profit is Π(z).

Step 2: Let a = a + 1 and z = z + 1. If regularity

condition is satisfied then resolve the pricing problem

resulting in profit Π(z + 1). Repeat step 2 until regu-

larity condition is violated such that p

a

≥ θ

1

or a =V

1

.

Step 3: Let a = u

2

− 1. This is disjoint segment

scenario. Check if the regularity condition is satis-

fied. If not, let a = a − 1 until the regularity condition

is satisfied. Let z = 0 and z

′

= a. Solve the pricing

problem for such an a giving profit Π(0).

Step 4: Let Z = argmax

z

{Π(z)}. If Z = 0, then

a = z

′

else a = h + Z. Prices of the items are chosen

as per the prices for the item composition with a.

In the case that the two customer segments overlap

the constraint p

u

2

> θ

1

may not to be satisfied. The

profit function can be shown to be strictly concave and

p

u

2

= max{θ

1

, p

∗

u

2

}.

4 COMPUTATIONAL RESULTS

To test the model we collected online retail prices of

items for three different item categories from large na-

tional retail chains in United States. We refer to these

different product line data sets as set 1, set 2 and set

3. The three categories we considered are,

Set 1. Kenmore single room air-conditioners at

Sears.com with six variants,

Set 2. Apple ipods at Bestbuy.com with five vari-

ants, and

Set 3.Kenmore compact refrigerators at Sears.com

with six variants.

First, we estimate the item costs, by randomly se-

lecting a cost within 35% − 45% of the retail price.

We consider two customer segments, assuming that

the population of segment 1 is three times the popu-

lation of segment 2. The values of different param-

eters we use for our pricing model for two customer

segments are shown in Table 1. We assume that first

segment of customers considers all the items for pur-

chase if they are priced within their reservation price

and therefore u

1

= 1 for all the sets. Segment 2 treats

different sets of product line differently and therefore,

u

2

varies from set to set.

Table 1: Base Problem Sets .

Sets 1 2 3

u

1

1 1 1

u

2

2 2 3

θ

1

230 155 195

θ

2

380 275 330

4.1 Pricing Model Performance on Base

Data

To empirically test the performance of our pricing

model in terms of its predictability, we solved each

data set under the test parameters and compare the

prices proposed by our model with respect to current

retail prices. For computational purpose, we assume

that the retailer provides the last two items in each

product line data set exclusively to the second cus-

tomer segment.

Tables 2, 3 and 4 shows the results of applying our

pricing model to the three sets respectively. First col-

umn of the table represents the index of item number.

Second column is the estimate of item costs and the

third column shows the retail prices. Then, we deter-

mine the proposed price, shown in the fourth column

of each table, by solving the pricing problem using

our model.

The last column in each table shows the percent

price difference between the proposed price and the

retail price. These results indicate that the proposed

prices from our pricing model closely resemble the

current trend of retail prices.

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

314

Table 2: Comparison of Prices - Set 1 .

Item Estimated Retail Proposed % Price

Cost Price Price Difference

1 41 99.99 95.11 -4.88

2 61 139.99 149.23 6.60

3 72 189.99 193.74 1.97

4 88 229.99 227.26 -1.19

5 107 299.99 306.84 2.28

6 155 379.99 367.42 -3.31

Table 3: Comparison of Prices - Set 2 .

Item Estimated Retail Proposed % Price

Cost Price Price Difference

1 25 69.99 66.36 -5.18

2 38 99.99 107.72 7.74

3 53 149.99 143.88 -4.08

4 79 199.99 208.25 4.13

5 89 249.99 246.63 -1.35

Table 4: Comparison of Prices - Set 3 .

Item Estimated Retail Proposed % Price

Cost Price Price Difference

1 31 74.98 75.77 1.05

2 47 119.99 120.54 -0.46

3 57 154.99 149.30 -3.67

4 64 179.99 182.40 1.34

5 107 269.99 264.27 -2.12

6 119 299.99 303.13 1.05

Based on our mathematical model, an analysis of

profit by using prices generated from our pricing

model as compared to the store retail prices shows an

increase in profit by 0.5-3 %. The exact increases are

1.196 %, 2.575 % and 0.837 % for data sets 1, 2 and

3 respectively in favor of the prices generated by our

model.

4.2 Comparison with the 1-Segment

Model

We demonstrate the importance of considering two

segments over the single segment model by consider-

ing the prices set 3. We estimate the reservation price

(θ), for a single segment model by satisfying the regu-

larity condition described in equation (2). The result-

ing value is $408.00, which is very high as compared

to θ

2

($330.00), rendering items 4, 5 and 6 beyond

the buying capacity of even the second segment cus-

tomers.

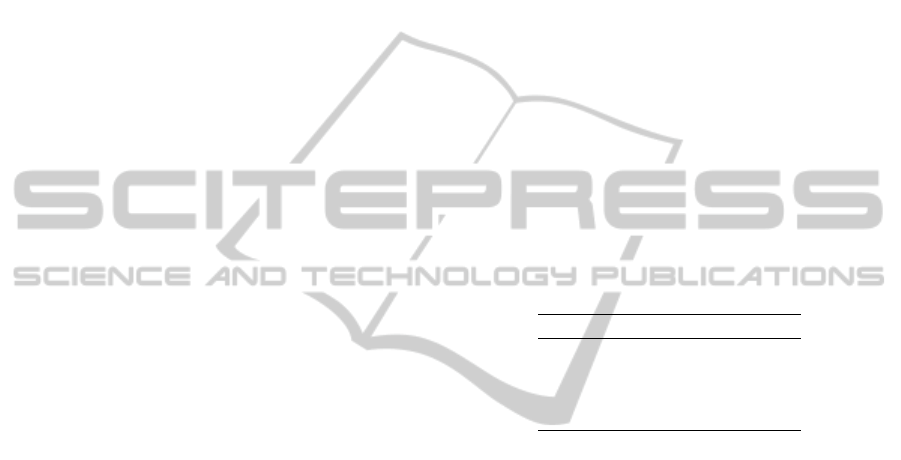

Figure 2 shows this large variation of proposed

prices by the 1-segment model from the retail prices.

Also notice in the figure that for the two segment

model, theproposed prices are very close to the retail

prices and within the reservation price of customers

in segment 2.

0

50

100

150

200

250

300

350

400

450

1 2 3 4 5 6

Product Number

Price ($)

Retail Price

2 Segment Model Proposed Price

1 Segment Model Proposed Price

330$

2

=θ

195$

1

=θ

Figure 2: Two Segment Model Proposed Prices vs One seg-

ment Model Proposed Prices .

0

10

20

30

40

50

60

70

80

90

100

(P

2

-P

1

) (P

3

-P

2

) (P

4

-P

3

) (P

5

-P

4

) (P

6

-P

5

)

Successive Product Pairs

Price Difference ($)

Retail Price Difference

2 Segment Model Price Difference

1 Segment Model Price Difference

Figure 3: Two Segment Model Price gap vs One segment

Model Price gap.

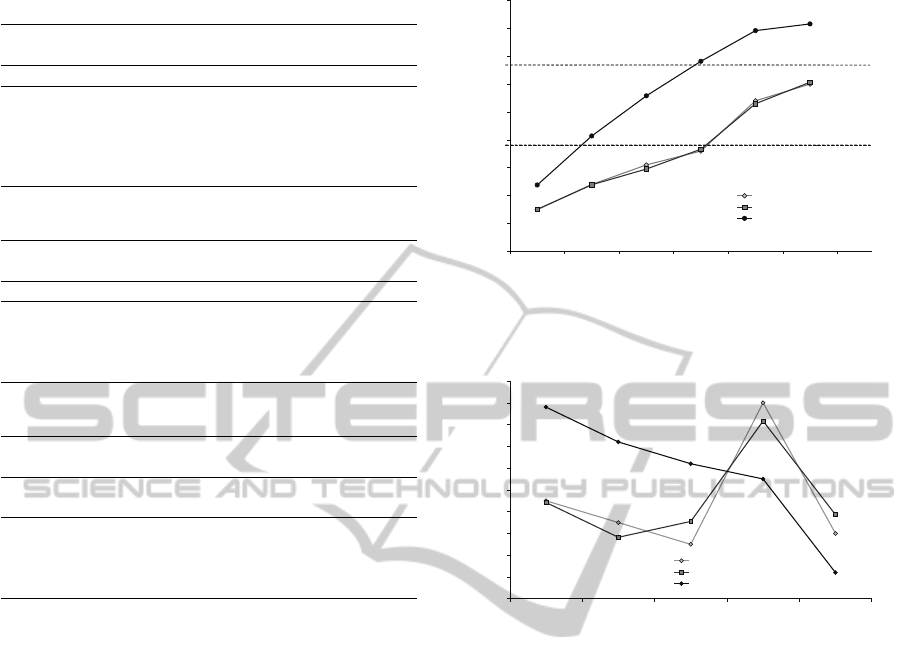

The price difference between successive items is

shown in figure 3. In the 1-segment model, the price

difference between successive items falls steeply. In

the 2-segment model, the price difference does not fall

steeply but has peaks at times when there is a change

in the customer population as the higher segment can

pay more and so this is an intuitively appealing and

more appropriate representation of the market.

5 GENERAL S-CUSTOMER

SEGMENT CASE

In general, the customer population can be divided

into more than two customer segments, say S-

customer segments. The segmentation of customers is

based on the same two measures, namely the lowest

acceptable item and the maximum reservation price.

The total number of tiers formed shall be in the range

of 1 to 2S −1. Since there are more than two customer

segments there is possibility of overlap of many dif-

ferent customer segments. If the lowest acceptable

OptimalProductLinePricingforTwoCustomerSegmentswithan

ExtensiontoMulti-SegmentCase

315

item or reservation price of any two customer seg-

ments are the same, then the total number of tiers

accordingly. Nonetheless, as the number of tiers in-

creases, the complexity of solving the problem also

increases.

The S-segment model can be solved in a man-

ner similar to the 2-segment model by partitioning

the product line into tiers. The mathematical analysis

as done for 2-customer segments is directly extend-

able to the S-customer segments with some general-

ization.Details about this procedure are omitted be-

cause of space. It is important to note that the pro-

cedure is computationally more demanding. How-

ever, the maximum number of computations that may

be needed is

∏

j=1,S−1

(V + 1 − u

j

), giving a worst-case

complexity of O(V

S−1

). However, because of the reg-

ularity condition and the requirement that a

j

≤ a

j+1

, many of these computations will not be needed and

therefore the actual computational burden will be a

lot less. Moreover, the number of customer segments

is unlikely to be very large and so enumerating the

whole problem is computationally not very costly.

REFERENCES

R. C. Blattberg and S.A. Nelsin. Sales Promotion: Con-

cepts, Methods, and Strategies. Engelwood Cliffs NJ:

Prentice-Hall, 1990.

R. C. Blattberg and K.J. Wisniewski. Price induced patterns

of competition. Marketing Science, 8:291–309, 1989.

M. Levy and B.A. Weitz. Retailing Management. Mc Graw

Hill, Inc., 5th edition, 2004.

G. L. Lilien, P. Kotler, and K.S.P. Moorthy. Marketing Mod-

els. Prentice-Hall, N.J., 1992.

J. D. C. Little and J.F. Shapiro. A theory for pricing nonfea-

tured products in supermarkets. Journal of Business,

53(3):199–209, 1980.

K. B. M onroe. Pricing: Making Profitable Decisions. Mc

Graw Hill, Inc., 2nd edition, 1990.

K. S. Moorthy. Market segmentation, self-selection, and

product line design. Marketing Science, 3:288–307,

1984.

F. J. Mulhern and R.P. Leone. Implicit price bundling of

retail products: A multi-product approach to maxi-

mizing store profitability. Journal of Marketing, 55:

63–76, 1991.

K. S. Palda. Economic Analysis for Marketing decisions.

Engelwood Cliffs NJ: Prentice-Hall, 1969.

D. J. Reibstein and H. Gatignon. Optimal product line pric-

ing: The influence of elasticities and cross elasticities.

Journal of Marketing Research, 21:259–267, 1984.

S. M. Shugan. Comments on pricing a product line. Journal

of Business , 57(1):S101–107, 1984.

S. M. Shugan and R. Desiraju. Retail product-line pricing

strategy when costs and products change. Journal of

Retailing, 77:17–38, 2001.

K. Sivakumar and S.P. Raj. Quality tier competetion: How

price change influences brand choice and category

choice. Journal of Marketing, 61:71–84, 1997.

G. L. Urban. A mathematical modelling approach to prod-

uct line decisions. Journal of Marketing Research, 6:

40–47, 1969.

C.A. Yano and G. Dobson. Profit optimizing product line

design, selection and pricing with manufacturing cost

considerations: A survey. In: Ho, T.H. and C.S.

Tang (Eds.), Product Variety Management: Research

Advances. Kluwer Academic Publishers, Dordrecht.,

pages 145–175, 1998.

M. J. Zenor. The profit benefits of category management.

Journal of Marketing Research, 31:202–213, 1994.

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

316