Networks and Imitations in an Agent based Asset Market

Souhir Masmoudi

CERGAM, Aix-Marseille University, France & URECA, University of Sfax, Sfax, Tunisia

1 STAGE OF THE RESEARCH

Revising and proofreading the draft.

2 OUTLINE OF OBJECTIVES

The basic argument for mimetic behavior is that

economic agents can be heavily influenced by the

behavior of their neighbors where neighbours are

defined as those with whom they have sufficient

contact to be informed about the forecasting strategy

that they follow and their success. Their

anticipations of the evolution of prices are the result

of their evaluation of the forecasting strategies’

success rather than on their own personal

anticipations. So agents can switch from one

forecasting strategy to another as the success of

strategies changes. We study how the imitation of

the rules of others as well as the structure of their

interaction can influence the market share of agents

and the prices of the asset traded on this market.

3 RESEARCH PROBLEM

How do the structures of information exchange

regarding the success of investment strategies

among investors influence the price volatility in

financial markets? How do the different ways in

which investors change their investment strategies

based on the acquired information from their

“friends” and “colleagues” affect the answer to this

question? These are the questions we try to answer

in this paper by conducting computational

experiments in an artificial asset market in which

investors who exhibit mimetic behavior operate and

switch from one forecasting strategy to another.

4 STATE OF THE ART

Understanding the relationship between the structure

of interactions among investors who imitate each

other and the dynamics of prices in financial markets

are of interest to us for, at least the following three

reasons (1) There is a growing awareness among

economists and policy markers alike that we need to

deal better with heterogeneity across agents and the

interaction among those (boundedly rational)

heterogeneous agents. (2) Among various

dimensions of bounded rationality, there has been

increasing interests among economists and

researchers in understanding the consequences of

mimetic behavior not only in financial markets

(Föllmer et al., 2005; Kirman, 1993; Lux, 1995; Lux

and Marchesi, 1999; Topol, 1991) but also in other

fields in management such as Marketing (Choi et al.,

2010; Zhou, 2006) and Strategy (Giarratana and

Mariani, 2013; Posen et al., 2013). Imitation impact

is also finding applications in various contexts such

as anthropology (Goodwin and Heritage, 1990),

social psychology (Levine et al., 1993), political

environment (McKinley, 1901). Furthermore, (3)

rapidly cumulating evidence shows the importance

of better understanding the ways local interaction

structures influence aggregate outcomes (Panchenko

et al., 2013; Jackson, 2008; Shiller, 1995; Shiller and

Pound, 1989).

5 METHODOLOGY

In this paper, we embed the model of Föllmer et al

(2005) into a family of network structures that can

be generated simply by a model of Watts and

Strogatz (1998) namely regular one dimentional

lattice networks, small world networks, and random

networks. In the model of Föllmer et al (2005), asset

market prices are determined as temporary equilibria

and agents’ excess demand is a function of the prices

they expect in the next period. For simplicity, agents

(who are investors) in our model use, at any point in

56

Masmoudi S..

Networks and Imitations in an Agent based Asset Market.

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

time, one of the following two forecasting strategies:

“chartists” and “fundamentalists.” Agents switch

between these two strategies by mimicking the

“successful” strategies employed by their local

neighbors. We consider two mimicking rules, the

most profitable rule and the average rule, by varying

the definition of “successful” strategies.

Under the most profitable rule, an agent copies

the forecasting strategy used by the most successful

neighbour. Under the average rule, an agent adopt

the forecasting strategy that resulted in the higher

average profit among their neighbors who were

using it. These two appear particularly adapted to a

model with boundedly rational agents (Ellison and

Fudenberg, 1995; Schlag, 1998; Selten and

Ostmann, 2001). In addition, we introduce a small

noise in the mimicking rule so that with a small

probability agents fail to employ the forecasting

strategy that these mimicking rules specify, and use

the other rule.

We employ computational experiments because,

as noted by the pioneering research in this field

(Arthur, 1994; Palmer et al., 1994), traditional

analytical approaches have difficulty in taking into

account changes individual behaviors and in

considering realistic market microstructures except

in a very few special cases. Computational models

are very often used in analyzing behavioral models

with heterogenous agents (Brock and Hommes,

1998; Hommes, 2006; LeBaron, 2006; Tedeschi et

al., 2010).

5.1 Anticipations and Price Formation

Process

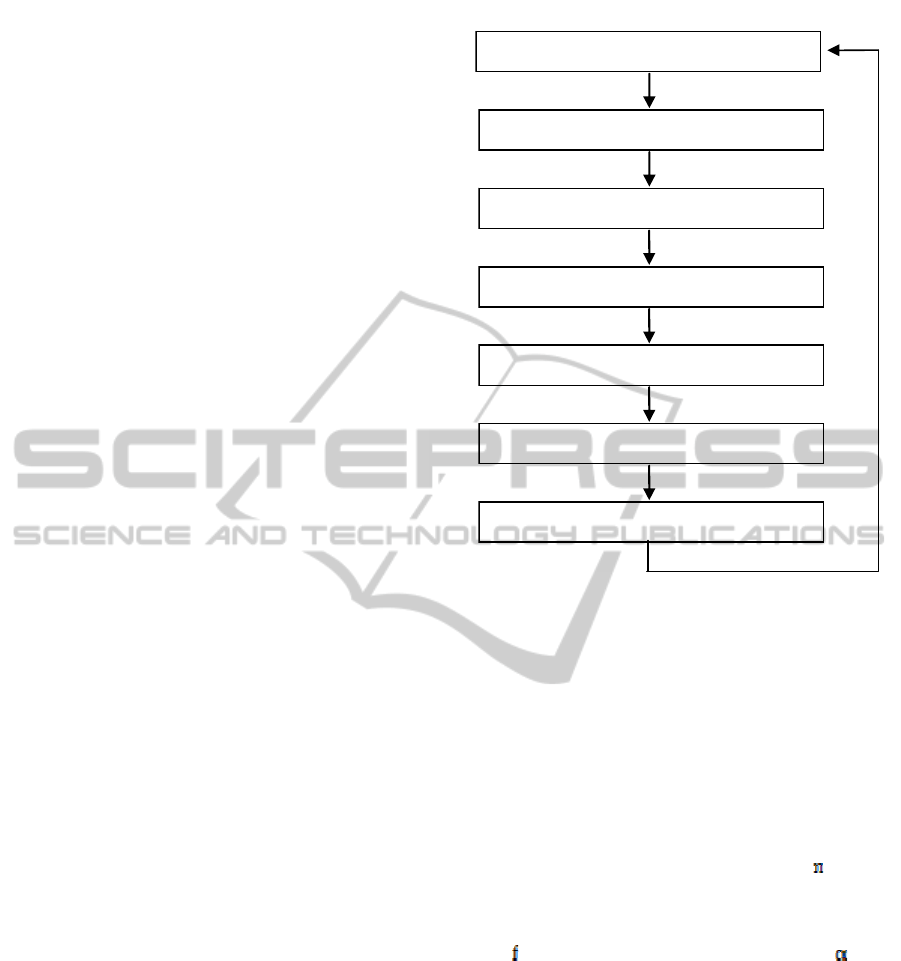

Our model progresses in the following way. We

initialize the model by creating interaction network

among agents, and assign investment strategies

among agents so that a half of investors are using

chartist investment strategy and remaining half are

using fundamentalist investment strategy. The

agents using each investment strategies are spread

randomly throughout the network. In each period,

each investor forms price expectation based on the

forecasting strategy s/he uses. The price expectation

of each investor determines his or her demand

schedule in that period, which in turn determines the

market price. The realized market price determines

the profit of each investor. Agents update their

forecasting strategies based on the mimicking rule

and the model enters the next period. This process is

summarized in Figure 1.

This process is summarized in.

Figure 1: Model progress.

In this section, we first describe the forecasting

strategies, and price determination process. The

creation of network structure is described in the next

section.

We consider a model that involves two different

types of forecasting strategies: “chartists” and

“fundamentalists.”

Fundamentalists are investors who follow the

fundamental rule, which predicts that market prices

will (gradually) return to their “fundamental” level.

Thus, the expected price for fundamentalist

for the

period t1 is given by

s

P

α

f

P

(1)

where

is the fundamental value of the asset. is a

constant that represents the fundamentalist’s

estimate of the speed of price adjustments. We

suppose that it is the same for everybody (in our

simulations we set α0.1). As is clear from

equation (1), if P

is below what traders believe to be

the fundamental value, they anticipate a price

increase. On the other hand, if P

exceeds the

fundamental value, they anticipate a price decrease.

Chartist’s strategy relies only on the history of

previous prices observed in financial markets and we

shall refer to investors following this strategy as

chartists. The latter attempt to extrapolate the past

movements of the stock price to predict its future

NetworkStructureConstructed

Initialization

Ex

p

ectations Formed

ExcessDemandCom

p

uted

MarketPriceDetermined

ProfitsCom

p

uted

Forecastin

g

Strate

gy

U

p

dated

NetworksandImitationsinanAgentbasedAssetMarket

57

price and form their expectations on the basis of the

history of the asset’s prices. To simplify matters we

have supposed that agents use only one observation

from the past. However they could be sophisticated

time series econometricians and this would not

change the analysis. Thus, the expected price for

chartist

for the period t1 is given by

s

P

αP

P

(2)

where αis the investor’s current estimates of the

speed of the trend-cycle. Equation (2) shows that if

P

is above P

, a chartist anticipates a price

increase. On the other hand, if P

is below P

, she

anticipates a price decrease.

Given the price forecast and an investor’s

idiosyncratic liquidity demand in each period, the

net demand schedule for the investor is determined.

Following the specification used by Föllmer et al

(2005), we define net demand schedule for agent

,

e

p in period as

e

p

logs

log

η

(3)

where s

is the expected price for agent in period

, P

is the asset price andη

is the exogenous

random liquidity demand. We assume thatη

⋲

1;1.

In other words, the net demand of agent

involves an exogenous liquidity demand and an

endogenous amount reflecting the deviation of the

price from the expected price. A positive net demand

at price

of the investor reflects his intention to buy

the stock at the price. If her net demand is negative,

she sells the stock at the price.

The equilibrium asset price in period

, P

is

defined as

e

P

0

⋲

(4)

Applying Equation (3) to Equation (4) gives the

asset price P

P

e

∗

∑

⋲

(5)

where η

∗

∑

η

⋲

. All agents obtain profits in

period

based on the order they have placed in

period t1, e

P

at the market price as

follows

П

P

P

e

P

(6)

Agents then forecast next period’s price at each step

and form their excess demand, which in turn

determines the next period’s price. In the next period

given the realised price, and profits, a new

forecasting rule is chosen, forecasts are made and

excess demand is determined.

Let us first show the outcomes of the model when

agents do not change their forecasting strategies.

These outcomes will serve as benchmarks when we

introduce mimicking and local interaction structures.

shows the time series of prices for three different

scenarios: (1) 0% chartists, (2) 50% chartists and (3)

100% chartists. In each case, we assume that there

are 100 investors in the market.

We can see from that figure that prices become

more volatile when there are more chartists in the

market.

We quantify price volatility by computing the

coefficient of variation of prices c

: a neutral

measure often used to gauge dispersion’s degree.

c

σ

μ

(7)

Figure 2: Difference in price evolution between a chartist

regime, a fundamentalist regime and a fifty-fifty regime.

The coefficient of variation of prices is defined

as the ratio of the standard deviation of prices σ for a

given period to the mean of prices μ for the same

period. This coefficient of price variation is between

14.5% and 25.6% when 50% of investors in the

market are chartists. This is relatively high because

it does not exceed 17.6% in case of complete

absence of chartists. When there are 100% chartists,

the coefficient of price variation can reach 127%.

The presence of chartists makes the price less stable

and sometimes drives it far away from the

fundamental value.

Our artificial asset market, even when there is no

switching between strategies, is thus able to

reproduce the stylized facts observed in real

financial market and illustrates in particular that

excess volatility of stock prices occurs when the

market is dominated by chartists (Kirman 2010

Chapter 4, Kirman and Teyssiere 2002, Föllmer et

al., 2005, Lux and Marchesi, 1999). However, while

these models allowed for switching of agents’

strategies, they did not consider the structure of local

0

20

40

60

80

100

1 101 201 301 401 501 601 701 801 901

Prices

Time

100Chartists 0Chartists

ICAART2014-DoctoralConsortium

58

interactions between agents. This is what this paper

introduces as we describe in the next section.

5.2 Network Topologies

As soon as we recognize that local interaction

between agents conditions their behavior, we have to

specify the network which governs that interaction.

The fact that networks play a significant role in

agents’ behavior and interaction in financial markets

and thus, in replicating the stylized facts of financial

time series has been recognized in the literature (See

e.g. Cont and Bouchaud 2000, Alfarano and

Milaković 2008.)

We want to investigate to what extent network

structure matters when, as in our model agents

mimic their neighbors. We employ the model of

Watts and Strogatz (1998) to generate a family of

network structures that spans regular network (one

dimensional lattice) and random network. The

method they used to generate various is as follows:

They consider a random rewiring method. They start

from a one-dimensional regular network with k

degree. That is each node is connected to k/2 closest

nodes on each side by undirected edges. And each

link is randomly rewired with probability

.

For p0, the graph network remains to be a

regular lattice. The degree of disorder increases with

increasing

. When p1 all edges are rewired

randomly. The graph is referred to as a “small-

world” network for intermediate values of p0

1.

We want to show how the differences in the network

structure determined by the various values of

influences the market share of agents and the asset

price volatility. To generate the different graphs, we

choose the method of Watts and Strogatz and the

formal notion of clustering coefficient that they

introduced. We study three different network

topologies (at both extreme values of p and for

intermediate values of p).

The Figure 3 below shows examples of networks

generated according to this model for three different

values of rewiring probability

. A regular network

(when the rewiring probability is equal to 0 p 0)

which is highly clustered and has a large

characteristic path lengths, a random network (when

the rewiring probability equals 1

p1

) which is

poorly clustered but has a short characteristic path

length and a small world network p 0.1 which

exhibits two properties, small average shortest path

length and large clustering coefficient. Watts and

Strogatz (1998) vary the basic parameter and show

that it is only in a small range of values that a small

world network is observed.

In our model, unlike Watts and Strogatz (1998),

we consider directed links to allow for the

possibilities that while agent

is observing carefully

about forecasting strategies used by agent

and its

performance, agent

does not pay attention to what

agent

does.

Regular Lattice Small World Network Random Graph

p=0 p=0.1 p=1

Figure 3: Network structure with N=100 nodes and k=4

neighbors.

5.3 Network Structure, Mimicking

Strategies and Prices Volatility

The basic argument for mimetic behavior is that

economic agents can be heavily influenced by the

behavior of their neighbors where neighbours are

defined as those with whom they have sufficient

contact to be informed about the forecasting strategy

that they follow and their success. Their

anticipations of the evolution of prices are the result

of their evaluation of the forecasting strategies’

success rather than on their own personal

anticipations. So agents can switch from one

forecasting strategy to another as the success of

strategies changes. We assume that all agents update

their forecasting rule at the same time and in every

period of timet. This is not entirely a passive

behavior in that the agents can choose whom to

imitate. We study how the imitation of the rules of

others can influence the prices of the asset traded on

this market.

As we have mentioned we examine the

consequences of two mimicking rules: the most

profitable rule and the average rule. When the most

profitable rule is adopted, traders follow the strategy

used by the most successful neighbor; each of them

compares the profit recorded in the previous period

of all his neighbors and copies the strategy of the

most profitable one. The average rule is designed to

copy the forecasting strategy, which resulted in the

highest average profit for those using it; they

compare the profit of neighbours who have used

NetworksandImitationsinanAgentbasedAssetMarket

59

each strategy in the previous period and then copy

the one, which resulted in higher average profit.

There are of course other rules which we would

have been justified in adopting such as the least

profitable rule (agents never copy the strategy used

by the least profitable neighbor), but for simplicity

we have chosen the two basic rules discussed above.

Indeed, these two appear particularly adapted to

a model with boundedly rational agents and they

have been studied in the literature. See for example,

Selten and Ostmann (2001), for the max rule and

Ellison and Fudenberg (1995) and Schlag (1998) for

the average rule.

We restrict our attention to mimicking rules with

limited memory. In particular, in this paper we have

decided to focus on the memory length of one that is

the profit realized in the previous period and not on

the cumulative profits or on the weighted average of

past-recorded profits. Choosing the cumulative

profits in the performance measure does not allow

for the fact that the most profitable agent may not

have always used her current strategy. This make it

difficult to determine which specific strategy worked

most effectively. We avoid this difficulty therefore

by only considering only one lag to measure agents’

performances.

We conduct simulations for the two mimicking

rules in three different network structures: a regular

network (rewiring probability

=0), a random

network (rewiring probability

=1) and a small

world graph (rewiring probability

=0.1) to

investigate if and how the network structure

influences agents’ market share. We follow

Panchenko et al (2013) in choosing p0.1 to

generate a small world network.

We start with a market in which half of the

investors are chartists and the other half are

fundamentalists. It should be noted that the

simulations assume that the fundamental value is at

all times constant.

We analyze the evolution of the distribution of

forecasting strategies for N 100agents. We study

two cases: K=4 (Each agent is connected to a small

fraction of the entire network: each one has 4

neighbors) and K=10 (Each agent has 10 neighbors).

Since there are only two strategies: a chartist

strategy and a fundamentalist strategy, we look at

one strategy: the chartist strategy.

In each case, a total of 100 of simulations were

conducted, each with 1000 periods of trading. We

ignore the first 250 periods and compute the fraction

of chartists and the market price for the last 750

periods of simulations. The network is regenerated

for each simulation and we check whether each time

the graph is connected.

We also study an additionally stochastic version

of our model. We assume that agents, with a small

probability, fail to employ the forecasting strategy

that these mimicking rules specify, and use the

opposite. The interaction between chartists and

fundamentalists leads to the evolution in their

market share; the proportion of each group in the

market is based on the choice of each investor of

how to update her forecasting strategy.

5.3.1 The Deterministic Model

5.3.11 Each Agent Has 4 Neighbors (K=4)

We now discuss the relationships between the

network structure, the mimicking rules and the

distribution of the forecasting strategies. The aim is

to show the impact of the mimicking rule and the

network topology on the distribution of the two

groups in the market and to demonstrate the effect of

the latter on price volatility.

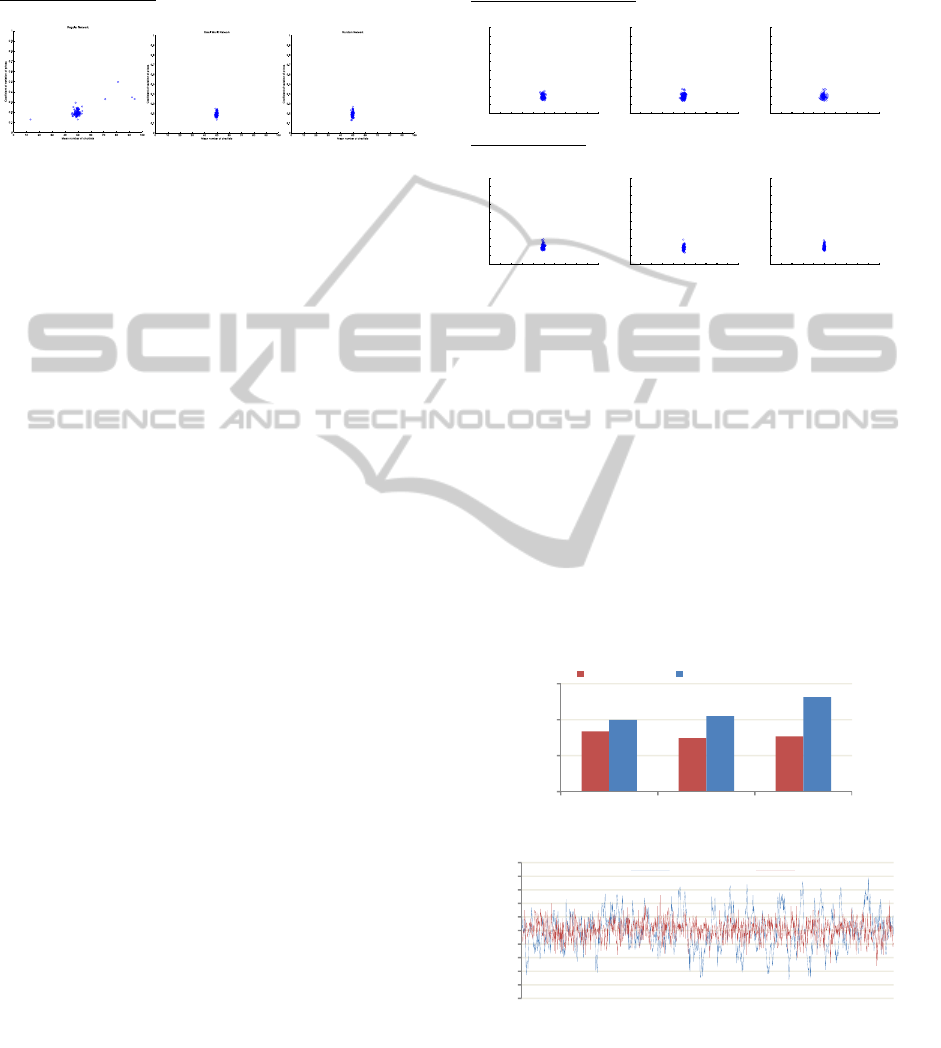

Figure 4 shows some simulated times series of

the evolution of chartists’ fraction for all networks

when the most profitable rule is adopted. We

observe that the network topology influences the

speed with which the system gets absorbed in one

extreme or the other. The regular graph is highly

clustered large world. Because of this, the

information transmission between agents who are

not neighbors is very slow. A small world network

represents both a low diameter and a high clustering

coefficient.

When the rewiring probability increases, both the

clustering coefficient and the diameter of the

network decrease thereby speeding up the spreading

of information. We notice that the stabilization is

more rapid than in the regular network.

The chance that both types of investors co-exist

in the market for a long time decreases significantly

in the small world network and disappears

completely in the random network. This

demonstrates that information transmission is much

faster in the random network.

However, few of these observed results are

representative cases. To better understand the

properties of the distribution of the forecasting

strategies generated by the three considered

networks, we show scatter graphs summarizing the

joint evolution between the coefficient of variation

of prices and the mean number of chartists computed

for the last 750 periods for each simulation (See

Figure 5.)

ICAART2014-DoctoralConsortium

60

Figure 4: Some simulated times series of the evolution of

chartists’ fraction for various network topologies when the

most profitable rule is adopted.

Histograms show the distribution of the chartist’s

fraction over simulations. For the regular network

model, the histogram of the fraction of chartists

shows that in half of the simulations the fraction of

chartists or fundamentalists reaches an extremity

within a relatively short period of time (less than 250

periods). The other half of the simulations indicates

that stability comes later as shown in

Figure 5. A

smaller persistence of the concurrent presence of

both investing types is demonstrated in less than

10% of the simulations in the case of the small

world network. In the case of the random graph, the

system clings on to situation of only one forecasting

strategy in a very short timeframe.

Fundamentalists are more likely to dominate the

market (61%) than chartists (39%) for the regular

network. A Similar finding is observed for the other

two network topologies. Prices volatility increases

along with the proportion of chartists. The

coefficient of price variation in some cases can rise

to 135%. When the proportion of chartists is high in

the market, the price of the asset may become

unstable and deviate continuously from its

fundamental value.

In the case of the average rule, the network

structure does not affect the distribution of

forecasting strategies. Neither chartists nor

fundamentalists dominate. A simultaneous existence

of these two groups is demonstrated for all network

topologies. The share of each type of agents

fluctuates around the half the number of agents (See

Figure 6.)

These results show a sharp difference between

the two mimicking rules when agents are connected

to a small fraction of the network. For the most

profitable rule, everyone is looking for the most

successful neighbor and copying exactly his

strategy. On the contrary, when the average rule is

followed, even if in a neighborhood one of the two

strategies is most profitable, on average investors

following these strategies may make the same

amount of profits and this does not give the same

results.

Contrary to the case of the most profitable rule,

the observed time series are representative outcomes

Most profitable Rule

Figure 5: The price dispersion and the share of agents for

different network topologies when all agents adopt the

most profitable Rule. Left: Cloud of points representing

the joint evolution between the coefficient of variation of

prices and the mean number of chartists for all simulations

(each point represents a simulation). Right: Histograms

show the distribution of chartists’ fraction over

simulations. Above: Regular network. Middle: Small

world network. Below: Random network.

0

20

40

60

80

100

1 251 501 751

Chartists'fraction

Regularnetwork

0 100 22 77 51

Meannumberofchartists:

0

20

40

60

80

100

1 251 501 751

Chartists'fraction

Smallworldnetwork

0 100 10 88

Meannumberofchartists:

0

20

40

60

80

100

1 251 501 751

Chartists''fraction

Randomnetwork

0 100 100 0

Meannumber ofchartists:

0 10 20 30 40 50 60 70 80 90 10 0

0

10

20

30

40

50

60

70

80

90

100

Histogram K4UP2Reg

Chartists Frac tion

Simulations frequencies

0 10 20 30 40 50 60 70 80 90 10 0

0

10

20

30

40

50

60

70

80

90

100

Histogram K4UP2S W N

Chartists Frac tion

Simulations frequencies

0 10 20 30 40 50 60 70 80 90 10 0

0

10

20

30

40

50

60

70

80

90

100

Histogram K4UP2Rand

Chartists Frac tion

Simulations frequencies

NetworksandImitationsinanAgentbasedAssetMarket

61

Figure 6: Representative time series simulations of

fluctuations in fraction of chartists for the three network

structures when the average rule is adopted.

of the evolution of the fractions of the two types of

agents (See Figure 7.) The coefficient of price

variation is between 14.23% and 31.19%. The

interval of the volatility’s degree is close to that in

the case of absence of imitation due to the fact that

both types of investors exist in similar proportions.

Average Rule

Figure 7: The price dispersion and the share of agents for

different network topologies when all agents adopt the

average Rule. Cloud of points representing the joint

evolution between the coefficient of variation of prices

and the mean number of chartists for all simulations. Left:

Regular network. Middle: Small world network. Right:

Random network.

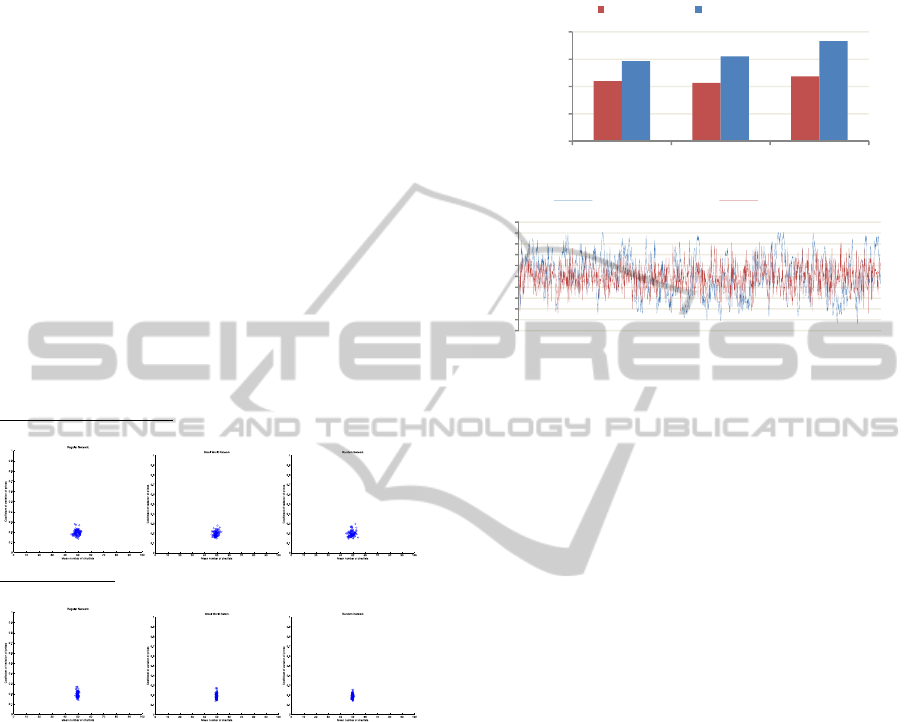

5.3.12 Each Agent Has 10 Neighbors (K=10)

This section also illustrates the impact of mimicking

rules and network structures on chartists’

distribution for the two different updating rules and

for three different network structures with the

difference that agents are connected to a greater

fraction of the network. Each agent has 10

neighbors.

Figure 8 shows that increasing the number of

neighbors has an impact on the speed with which all

individuals end up taking the same strategy. Similar

results were found for the small world and the

random networks. The system gets absorbed in one

of the two extremes fairly quickly. This can be

explained by the structural properties of the small

world network and the random network and more

precisely by their small characteristic path length.

On the other hand, for the regular network, the

stabilization is slower but still much rapid than in the

case of k=4.

Most profitable Rule k=10

Figure 8: The price dispersion and the share of agents for

different network topologies when all agents adopt the

most profitable Rule. Left: Cloud of points representing

the joint evolution between the coefficient of variation of

prices and the mean number of chartists for all simulations

(each point represents a simulation). Right: Histograms

show the distribution of chartists’ fraction over

simulations. Above: Regular network. Middle: Small

world network. Below: Random network.

Fundamentalists appear to dominate the market

in over 60% of simulations whatever the network

topology. The coefficient of price variation, as

expected, is high when chartists predominate.

When the average rule is followed, the distributions

of agents produced when each investor has 4

neighbors are very similar to those produced when

each agent has 10 neighbors. Both types of investors

exist in similar proportions for all network

topologies. This can clearly be attributed to the fact

that profits made by chartists’ group are much the

same as those realized by fundamentalists’ group.

5.3.2 The Stochastic Model

So far, we have seen that a sharp difference exists

between the most profitable rule and the average

rule. Indeed, without the noise and when the most

0

20

40

60

80

100

1 101 201 301 401 501 601 701 801 901

Chartists'fraction

Time

Regular SmallWorld Random

0 10 20 30 40 50 60 70 80 90 100

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

Mean number of chartists

Coefficient of variation of prices

Regular Network

0 10 20 30 40 50 60 70 80 90 100

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

Mean number of chartists

Coefficient of variation of prices

Smal l World Network

0 10 20 30 40 50 60 70 80 90 100

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

Mean number of chartists

Coefficient of variation of prices

Random Network

ICAART2014-DoctoralConsortium

62

profitable rule is adopted the chance that both types

of investors exist simultaneously in the market for a

Average Rule k=10

Figure 9: The price dispersion and the share of agents for

different network topologies when all agents adopt the

average Rule. Cloud of points representing the joint

evolution between the coefficient of variation of prices

and the mean number of chartists for all simulations. Left:

Regular network. Middle: Small world network. Right:

Random network.

long time decreases significantly in the small world

network and disappears completely in the random

network. However, the network structure does not

affect the distribution of the two groups of agents

when the average rule is adopted. A simultaneous

existence of these two types is shown for all network

topologies.

This subsection presents a doubly stochastic

version of our model. We assume that agents, with a

small probability (0.1), (a “trembling hand”), fail to

employ the forecasting strategy that these mimicking

rules specify, and use the alternative strategy.

5.3.21 Each Agent Has 4 Neighbors (K=4)

In the presence of noise in the mimicking rule, the

average rule and the most profitable rule lead to the

similar average fraction of two groups in the market

for all network structures. When the noise is small

and when agents are mimicking their local

neighbors, this provided periods of simultaneous

existence of both trading strategies whatever the

mimicking rule and whatever the network topology

introduces the price dispersion and the share of

agents over simulations for the two different

updating rules adopted and for three networks

topologies: the regular network, the small world

network, and the random network. The mean

number of chartists for all networks structures and

for the two updating rules is near the average. The

price volatility for the three different network

structures does not exceed 28.2%. The values are

also close across the different topologies of the

network.

There is, however, difference in the volatility of

the fraction of agents between the two rules even in

the presence of noise in the mimicking behavior.

Figure 11 graphs the coefficient of variation of

chartists ‘ proportion averaged over all simulations

Most profitable Rule

Average Rule:

Figure 10: The price dispersion and the share of agents for

different network topologies for the two mimicking rules.

Cloud of points representing the joint evolution between

the coefficient of variation of prices and the mean number

of chartists for all simulations. Left: Regular network.

Middle: Small world network. Right: Random network.

relative to the volatility of chartist’s proportion.

Indeed, when the most profitable rule is used there is

greater volatility. This is because each individual

plays the action of the best neighbor. We also show

that this volatility increases when there are more

random links, as the spread of the influence of the

lucky chartist in the network is higher. But if we are

looking in terms of average payoffs this is no longer

observed.

Figure 11: Difference in the volatility of the fraction of

chartists between the most profitable and the average rule.

0 10 20 30 40 50 60 70 80 90 100

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

Mean number of chartists

Coefficient of v ariation of prices

Regular Network

0 10 20 30 40 50 60 70 80 90 100

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

Mean number of chartists

Coefficient of v ariation of prices

Smal l World Network

0 10 20 30 40 50 60 70 80 90 100

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

Mean number of chartists

Coefficient of v ariation of prices

Random Network

0 10 20 30 40 50 60 70 80 90 100

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

Mean number of chartists

Coefficient of variation of prices

Regular Network

0 10 20 30 40 50 60 70 80 90 100

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

Mean number of chartists

Coefficient of variation of prices

Smal l World Network

0 10 20 30 40 50 60 70 80 90 100

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

Mean number of chartists

Coefficient of variation of prices

Random Network

0

0,1

0,2

0,3

Reg SWN Rand

Volatilityofchartists'

fraction

AverageRule MostprofitableRule

0

10

20

30

40

50

60

70

80

90

100

1 101 201 301 401 501 601 701 801 901

Chartists'fraction

Time

Mostprofitable Average

NetworksandImitationsinanAgentbasedAssetMarket

63

5.3.22 Each Agent Has 10 Neighbors (K=10)

In this subsection we extend the analysis to the

neighborhood of size ten. Let us consider

Figure 12,

which shows considerable similarity between the

two neighborhood cases. We thus note that the

distributions of agents produced by the two updating

rules when each investor has 4 neighbors are the

same as those produced when each agent has 10

neighbors. The average rule and the most successful

rule lead to the same distribution of the two groups

in the market. We demonstrate a concurrent

existence of both trading strategies with sometimes a

more pronounced presence of one of the two groups.

Profits generated by chartists and fundamentalists

groups sometimes rise and sometimes fall

accordingly. Moreover, an increasing relationship

between the number of neighbors and volatility of

fraction of chartists has been illustrated as shown in

Figures 11 and 13.

Most profitable Rule:

Average Rule:

Figure 12: The price dispersion and the share of agents for

different network topologies for the two mimicking rules.

Cloud of points representing the joint evolution between

the coefficient of variation of prices and the mean number

of chartists for all simulations. Left: Regular network.

Middle: Small world network. Right: Random network.

6 EXPECTED OUTCOME

Our results show a sharp difference between the

outcomes of two mimicking rules, the most

profitable and the average rules, when agents are

connected to a small fraction of the network (k=4

and k=10). When the most profitable rule is adopted,

the network topology influences the speed with

which all agents end up taking the same strategy.

When the rewiring probability increases, both the

clustering coefficient and the diameter of the

network decrease thereby speeding up the spreading

of information. Information transmission also

increases, as the number of neighbors is higher.

Figure 13: Difference in the volatility of the fraction of

chartists between the most profitable and the average rule.

Fundamentalists are more likely to dominate the

market than chartists. There is a greater chance that

the profit of the best performing fundamentalist is

higher than the profit of the best performing chartist

and that the average profit of fundamentalists

exceeds the average profit of chartists. When the

proportion of chartists is high in the market, the

price of the asset may become unstable and deviate

systematically from its fundamental value. On the

other hand, In the case of the average rule, neither

chartists nor fundamentalists dominate. A

simultaneous existence of these two groups is

demonstrated.

The difference in the outcome between two

mimicking rules, however, disappears when the

noise in the mimetic behavior is larger. In the

presence of noise in mimicking rule, the average rule

and the most successful rule lead to the similar

average fraction of two groups in the market

whatever the network structure. There is, however,

difference in the volatility of the fraction of agents

between the two rules even in the presence of noise

in the mimicking behavior. The most profitable rule

experiences greater volatility, and this volatility

increases when there are more random links, as well

as the number of neighbors each agent has.

In addition, we notice that price volatility

increases monotonically with an increase in the

proportion of chartists. Interaction between these

two types of investors involving endogenous

modification of strategies according to their

performance leads to unstable prices. Asset prices

0

0,1

0,2

0,3

0,4

Reg SWN Rand

Volatilityofchartists'

fraction

AverageRule MostprofitableRule

0

10

20

30

40

50

60

70

80

90

100

1 101 201 301 401 501 601 701 801 901

Chartists'fraction

Time

MostprofitableRule AverageRule

ICAART2014-DoctoralConsortium

64

may move away for considerable periods from

fundamentals and then return abruptly. This is due to

the link between the profitability and the fraction of

the different strategies, which engenders a self-

reinforcing contagion process.

REFERENCES

Alfarano, S., and Milaković, M. (2008). Should Network

Structure Matter in agent-Based Finance? Econ. Work.

Pap. Christ.-Albrechts-Univ. Kiel Departement Econ.

Arthur, W. B. (1994). Inductive reasoning and bounded

rationality. Am. Econ. Rev. 84, 406–411.

Brock, W. A., and Hommes, C. H. (1998). Heterogeneous

beliefs and routes to chaos in a simple asset pricing

model. J. Econ. Dyn. Control 22, 1235–1274.

Choi, Hui, and Bell (2010). Spatiotemporal Analysis of

Imitation Behavior Across New Buyers at an Online

Grocery Retailer. J. Mark. Res. 47, 75–89.

Cont, R., and Bouchaud, J.P. (2000). Herd behavior and

aggregate fluctuations in financial markets.

Macroecon. Dyn. 4, 170–196.

Ellison, G., and Fudenberg, D. (1995). Word-of-mouth

communication and social learning. Q. J. Econ. 110,

93–125.

Föllmer, H., Horst, U., and Kirman, A. (2005). Equilibria

in financial markets with heterogeneous agents: a

probabilistic perspective. J. Math. Econ. 41, 123–155.

Giarratana, M. S., and Mariani, M. (2013). The

relationship between knowledge sourcing and fear of

imitation. Strat. Manag. J.

Goodwin, C., and Heritage, J. (1990). Conversation

Analysis. Annu. Rev. Anthr. 19, 283–307.

Hommes, C. H. (2006). Chapter 23 Heterogeneous Agent

Models in Economics and Finance. In Handbook of

Computational Economics, (Elsevier), pp. 1109–1186.

Kirman, A. (1993). Ants, rationality, and recruitment. Q.

J. Econ. 108, 137–156.

Kirman, A. (2010). Complex Economics: Individual and

Collective Rationality (London).

Kirman, A., and Teyssiere, G. (2002). Microeconomic

models for long memory in the volatility of financial

time series. Stud. Nonlinear Dyn. Econ. 5, 281–302.

LeBaron, B. (2006). Chapter 24 Agent-based

Computational Finance. In Handbook of

Computational Economics, (Elsevier), pp. 1187–1233.

Levine, J. M., Resnick, L. B., and Higgins, E. tor. (1993).

Social Foundations of Cognition. Annu. Rev. Psychol.

44, 585–612.

Lux, T. (1995). Herd Behaviour, Bubbles and Crashes.

Econ. J. 105, 881–896.

Lux, T., and Marchesi, M. (1999). Scaling and criticality

in a stochastic multi-agent model of a financial

market. Nature 397, 498–500.

McKinley, A. E. (1901). The transition from Dutch to

English Rule in New York: A study in political

imitation. Am. Hist. Rev. 6, 693–724.

Palmer, R. G., Brian Arthur, W., Holland, J.H., LeBaron,

B., and Tayler, P. (1994). Artificial economic life: a

simple model of a stockmarket. Phys. Nonlinear

Phenom. 75, 264–274.

Panchenko, V., Gerasymchuk, S., and Pavlov, O.V.

(2013). Asset price dynamics with heterogenous

beliefs and local network interactions. J. Econ. Dyn.

Control http://dx.doi.org/10.1016/j.jedc.2013.06.015.

Posen, H. E., Lee, J., and Yi, S. (2013). The power of

imperfect imitation. Strat. Manag. J. 34, 149–164.

Schlag, K. H. (1998). Why imitate, and if so, How? A

boundedly rational approach to multi-armed bandits. J.

Econ. Theory 78, 130–156.

Selten, R., and Ostmann, A. (2001). Imitation equilibrium.

Homo Oeconomicus 43, 111–149.

Shiller, R. J. (1995). Conversation, information, and herd

behavior. Am. Econ. Rev. 85, 181–185.

Shiller, R. J., and Pound, J. (1989). Survey evidence on

diffusion of interest and information among investors.

J. Econ. Behav. Organ. 12, 47–66.

Tedeschi, G., Iori, G., and Gallegati, M. (2010). Herding

effects in order driven markets: The rise and fall of

gurus (Department of Economics, City University,

London).

Topol, R. (1991). Bubbles and volatility of stock prices:

effect of mimetic contagion. Econ. J. 101, 786–800.

Trichet, J.-C. (2010). Reflections on the nature of

monetary policy non-standard measures and finance

theory. Open. Address ECB Cent. Bank. Conf. Frankf.

18 Novemb. 2010 http://www.ecb.europa.eu/

press/key/date/2010/html/sp101118.en.html.

Watts, D. J., and Strogatz, S. H. (1998). Collective

dynamics of “small-world” networks. Nature 393,

440–442.

Zhou (2006). Innovation, Imitation, and new product

performance: The case of China. Ind. Mark. Manag.

35.

NetworksandImitationsinanAgentbasedAssetMarket

65