Exploring the Bitcoin Network

Annika Baumann, Benjamin Fabian

and Matthias Lischke

Institute of Information Systems, Humboldt University Berlin, Spandauer Str. 1, 10178 Berlin, Germany

Keywords: Electronic Cash, Bitcoin, Network Analysis.

Abstract: This explorative paper focuses on descriptive statistics and network analysis of the Bitcoin transaction graph

based on recent data using graph mining algorithms. The analysis is carried out on different aggregations

and subgraphs of the network. One important result concerns the relationship of network usage and

exchange rate, where a strong connection could be confirmed. Moreover, there are indicators that the

Bitcoin system is a “small world” network and follows a scale-free degree distribution. Furthermore, an

example of how important network entities could be deanonymized is presented. Our study can serve as a

starting point in investigating anonymity and economic relationships in Bitcoin on a new structural level.

1 INTRODUCTION

Bitcoin is a decentralized digital currency based on a

peer-to-peer network architecture and secured by

cryptographic protocols. It was originally proposed

by Nakamoto (2009). Anonymity and avoidance of

double spending are realized via a block chain, a

kind of transaction log that contains all transactions

ever carried out in the network. In order to provide

some anonymity, personal, identifiable information

is omitted from the transaction. Therefore, the

source and destination addresses are encoded in the

form of public keys. Every public key, which serves

as pseudonym, has a corresponding private key

which is stored in an “electronic wallet”. Private

keys are used to sign or authenticate any

transactions. To become part of the peer-to-peer

network, one needs to install a client software that

runs either on a local device or at cloud providers

(Ober et al., 2013).

Authorization and verification are conducted by

a complex proof-of-work procedure. Nakamoto

(2009) proposed the use of a timestamp server which

takes the hash of a block of items, timestamps it, and

widely publishes the hash to the network. The proof-

of-work also creates new Bitcoins in the network;

this process is called “mining”. Creation of Bitcoins

is limited to a fixed amount of 21 million Bitcoins

that can be introduced to the system; this limitation

aims at avoiding inflation. Therefore, until that point

is reached around the year 2140, money supply will

increase at a certain rate every year (Drainville,

2012).

Our explorative work applies descriptive

statistics and network analyses to the Bitcoin

transaction graph. The network data was provided

by Brugere (2013) who applied several tools for

downloading and constructing the user network of

Bitcoin. Several aggregations are used to highlight

network characteristics. The research focuses on

global time-varying dynamics within the network.

As a first step of our methodology, qualitative

research was conducted in order to gain an insight

into related work and the transaction graph. Next,

we explored the provided data and undertook

required preprocessing steps for storing it

appropriately in a database. Statistics and network

analyses were conducted using this database; results

were evaluated, interpreted, and compared to recent

research on the transaction graph.

2 RELATED WORK

There are three main related research articles on the

Bitcoin transaction graph that were published within

the last two years. The most recent work carried out

by Ober, Katzenbeisser and Hamacher (2013)

focuses on time-varying dynamics of the network

structure and the degree of anonymity. Using data of

the period 03/01/2009 to 06/01/2013, the authors

discovered that the entity sizes and the overall

pattern of usage became more stationary in the last

12 to 18 months, which reduces the anonymity set.

369

Baumann A., Fabian B. and Lischke M..

Exploring the Bitcoin Network.

DOI: 10.5220/0004937303690374

In Proceedings of the 10th International Conference on Web Information Systems and Technologies (WEBIST-2014), pages 369-374

ISBN: 978-989-758-023-9

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

The authors also show that the number of dormant

coins is important to quantify anonymity. Inactive

entities hold many of these dormant coins and thus

further reduce the anonymity set (Ober et al., 2013).

Reid and Harrigan (2013) focus on anonymity in

the Bitcoin network, analyzing the topology of the

transaction and user network based on data of the

time interval from 03/01/2009 to 12/07/2011. The

authors adopt a preprocessing step to construct the

user network. In order to improve the anonymity

analysis, the researchers propose several methods

including the integration of external information that

is mainly held by businesses and other services

which accept Bitcoin as payment. They show that it

is possible to associate IP addresses from a public

service with the recipient’s public keys and link it to

previous transactions.

In the third paper by Ron and Shamir (2013) the

main focus lies on non-dynamic statistical properties

of the transaction graph. The authors analyzed data

of the period from 03/01/2009 to 13/05/2012, using

various statistics such as distributions of addresses,

incoming BTCs, balances of BTCs, number and size

of transactions, and most active entities. They found

that the majority of Bitcoins is not in circulation and

that most of the transactions amount to a rather

modest sum (less than 10 BTC). The researchers

also analyzed the largest transactions in the network

(greater than 50,000 BTCs) and determined their

flows. They showed that most of these transactions

are successors of the initial ones. Another interesting

finding is that the transaction flows reveal some

characteristic behaviors such as long chains, fork

merge, and binary tree-like distributions (Ron,

Shamir, 2013).

3 DATA MANAGEMENT

The data of the Bitcoin transaction graph is publicly

available in order to enable the proof-of-work

concept for verification of transactions. Sites such as

blockchain.info or blockexplorer.com can be crawled

for deriving the entire transaction graph. The data

used by our work was collected and to some extent

preprocessed by a project of the University of

Illinois at Chicago (Brugere, 2013). It contains the

time horizon from 01/03/2009 until 04/10/2013. We

applied tools developed by Martin Harrigan and

Gavin Andresen for extracting data from the

Bitcoin.dat files in order to construct a user network

according to the method introduced by (Reid and

Harrigan, 2013). This procedure results in several

raw text files (Brugere, 2013). The latest available

data for download at the time of writing contained

230,686 blocks with around 37.4 million edges and

6.3 million nodes. The text files were transformed

into a specific target format of two tab-separated

files, one relationship file and one node file. Once

the data had an appropriate structure, it was

imported into a relational database. For analyzing

the dynamics and topological characteristics of the

graph structure, NetworkX was used

(http://networkx.github.io/) (Hagberg et al., 2008).

4 ANALYSIS METHOD

In the first step of the analysis several descriptive

statistics were calculated. Some of our results were

earlier established by Katzenbeisser and Hamacher

(2011) and at the Chaos Communication Congress in

2013. Characteristics such as user activity and

transaction volume were linked to the Bitcoin

exchange rate provided by Mt.Gox, which provides

services for exchanging Bitcoins

(https://www.mtgox.com/).

The second part of the analysis regards the

network structure and topology. Since financial

transaction networks are always evolving and not

static, all measures were applied for different time

horizons in order to investigate the dynamics. In the

following the network measures are briefly

introduced.

The Degree distribution captures the structure of

networks in terms of the individual connectivity of

nodes. The in-degree of a node i is the total number

of connections to the node i and is the sum of the

ith-column of the adjacency matrix. For the out-

degree, the sum of the ith-row of the adjacency

matrix is calculated (Gross and Yellen, 2004). One

characteristic, often revealed by real networks, is

that the degree follows a power law (Clegg, 2006),

e.g., as shown by Barabasi, Albert and Jeong (2000)

for the World Wide Web and by Inaoka, et al.

(2004) in cases of financial transaction networks.

The Average Clustering Coefficient measures the

global cliquishness on the graph. Watts and Strogatz

(1998) applied the clustering coefficient in order to

discover the small world phenomenon within several

networks. The Average Shortest Path Length is

defined as the average number of steps along the

shortest paths for all possible pairs of nodes and

measures the efficiency of information or mass

transport in the network (Mao and Zhang, 2013).

According to network theory one can determine how

efficient Bitcoin is with respect to transactions.

Eigenvector Centrality measures the influence of

WEBIST2014-InternationalConferenceonWebInformationSystemsandTechnologies

370

one node on other nodes. For each node it is defined

as the value of the corresponding component of the

principal eigenvector of the adjacency matrix

defining the network. Accordingly, a node with a

high eigenvector score is one that is adjacent to

nodes that also have high eigenvector scores

(Borgatti, 2005). This measure is essential for

discovering central hubs such as exchanges, miners,

or “laundry services” that are important nodes in the

Bitcoin network.

5 ANALYSIS AND RESULTS

The descriptive statistics were applied over the

entire time horizon from 01/03/2009 until

04/10/2013. The transaction value per day has a

wide range beginning with the initial transaction of

50 BTC up to a daily amount of nearly 30 million

BTC (19th September 2012).

Table 1: Statistics of the Bitcoin network.

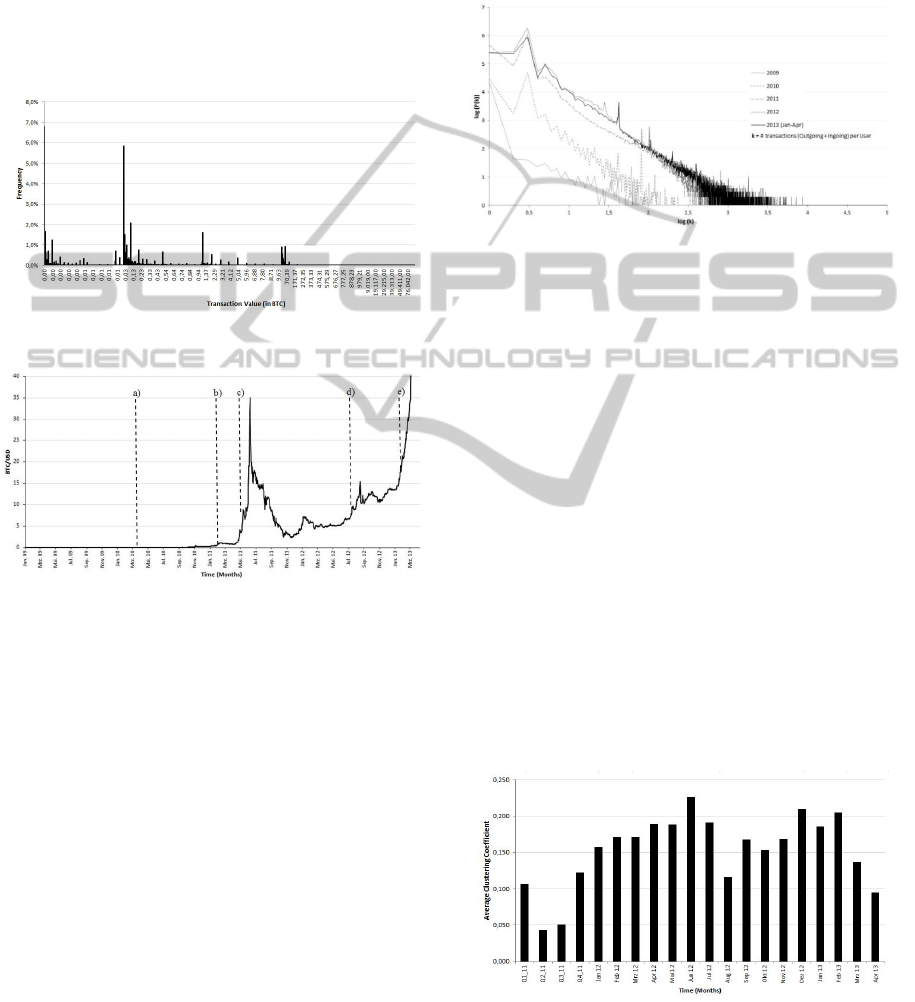

The distribution of the transaction values is strongly

skewed to the left. Another notable result is the high

correlation between the number of active users, the

number of transactions, and the MtGox exchange

rate (BTC/USD), see Figure 1.

There are cutoffs at the beginning of trades when

the dollar parity was achieved and maintained with

negligible changes on 04/13/2011, and at the end

when an extremely high exchange rate of around

237 BTC/USD was reached. Both figures show a

high heteroscedasticity of the data. This indicates a

highly speculative behavior in the network. The

relationship will be investigated more thoroughly

later on.

Table 2 shows the five largest entities in the

network according to their number of public keys.

The largest one has the entity ID 11 with over

318,221 public keys. One can also see that this entity

is involved in the biggest transactions within the

network. All the largest transactions are likely

related to each other as indicated by the close time

horizon and the entities involved.

Ron and Shamir (2013) conducted an analysis of

these Bitcoin flows and came to the conclusion that

nearly all major transactions are related. Another

interesting result regards the huge amount of tiny

transactions. The highest percentage of transactions

(6.80%) according to their trade volume corresponds

Figure 1: Correlations of user activity (left) and number of

transactions (right) to exchange rate.

to the transactions of the range from 0.00000001 to

0.00001 BTC. Figure 2 shows the transaction values

in a histogram, indicating the peaks of the highest

transactions occurring.

Table 2: Transactions and users in the network.

There is a strong relationship between the exchange

rate of Bitcoin and the activity in the network. User

activity increases immediately after a peak was

reached by the exchange rate. A rolling window was

constructed to investigate the relationship for

different time windows. The user activity was

measured for the last day, last 10 days, last 30 days

and the last 100 days. Every rolling window shows a

strong relationship but shrinks when extending the

time horizon. The correlation coefficient for the last

day is 0.736, last 10 days – 0.710, last 30 days –

0.671, and for the last 100 days – 0.641.

Figure 3 shows the BTC/USD exchange rate

provided by the Bitcoin exchange Mt.Gox. There is

a cutoff at the end of the time series due to a

tremendous increase up to $237. In the following,

some events are noted that might explain several of

the strong movements in the exchange rate and the

respective attention by more potential users of

Bitcoin:

ExploringtheBitcoinNetwork

371

a) Start of the public trading of Bitcoins.

b) First time reaching dollar parity on 10th

February 2011.

c) Several articles and media attention on Bitcoin,

e.g., Forbes, Businessweek, or Bloomberg.

d) Abandonment of Paypal on Cyberlocker sites

due to privacy concerns (Dotson, 2012).

e) Cyprus financial system about to collapse,

Bitcoin is considered as new safe haven (see

Mey, 2013).

Figure 2: Histogram of the transaction value.

Figure 3: BTC/USD exchange rate and events.

Such a strong relationship can also be seen for

the number of transactions carried out on the

network. This is not surprising since higher activity

of users leads to more transactions. The increasing

number of transactions follows the exchange rate

movements. The correlation coefficient to exchange

rate is 0.680 and to user activity 0.928. Between

transaction value and exchange rate there is a rather

low correlation coefficient with 0.198.

In the following, the focus is placed on network

structure. For this, the degree

distribution was

constructed. For every year since the start of Bitcoin

in 2009, the degree k was calculated for every user

entity by counting and summing ingoing and

outgoing transactions (in- and out-degree). The

resulting total degree distribution is drawn on a

double logarithmic scale. The distribution also gives

an insight into the network usage over time. In the

beginning of network activity in 2009, there have

been a lot of fluctuations. With increasing network

usage the degree distribution seems to converge over

time to a scale-free behavior that is also shown by

many other real networks. In case of the Bitcoin

network this means that the majority of users have a

low degree while a small but non-negligible amount

of users have a high degree k.

Figure 4: Degree distribution of the Bitcoin network.

Another important metric in the network analysis

is the average clustering coefficient. In order to find

evidence for a small world network, one can

compare the Bitcoin graph to a random network with

the same amount of nodes and edges like Watts and

Strogatz (1998) did in their analysis. This measure

was calculated on a monthly basis for the years 2012

and 2013. For 2011 the calculation was done

quarterly. The years 2009 and 2010 were omitted

from the analysis due to rather low activity in the

network and lots of transactions between the same

entities. Over time, the average clustering coefficient

is rather high, indicating a small world network.

It can be seen that clustering decreases with

increasing activity within the network. In quarter

two and three of 2011 the lowest measure was

calculated, while the user activity increased in that

time period. The same effect can be noted for

August 2012 and March 2013. Hence, higher user

activity in the network reduces the global

cliquishness in the graph.

Figure 5: Average clustering coefficient over time.

Due to restrictions on computing power, the metrics

average shortest path and the eigenvector centrality

WEBIST2014-InternationalConferenceonWebInformationSystemsandTechnologies

372

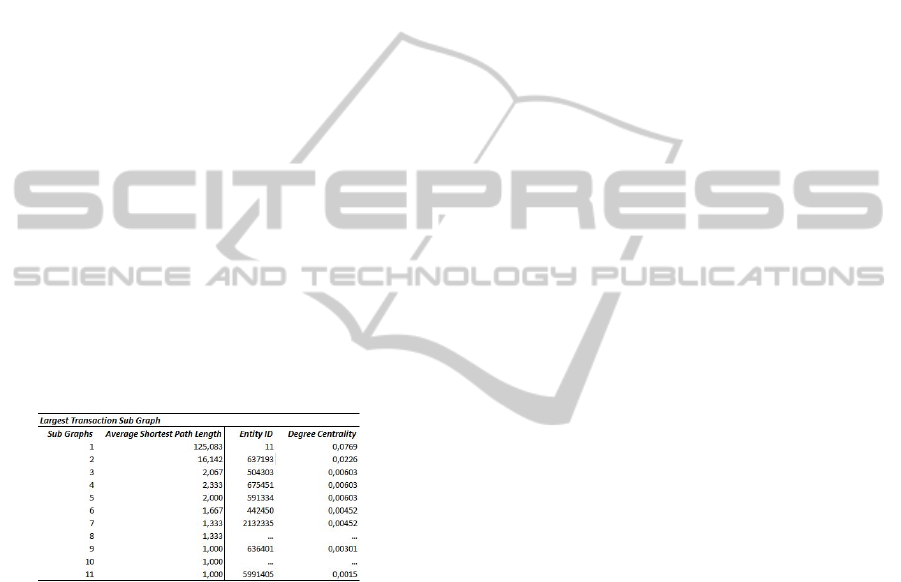

are calculated just on the subgraph containing all

transactions equal to and higher than 50,000 BTC.

Since the average shortest path is only applicable on

connected graphs, this metric is calculated for every

connected subgraph within the network. In the large

transaction network there are 11 disjoint subgraphs.

The largest average path length is 125.083 and the

lowest is 1.0. The first high value indicates a rather

inefficient transfer of Bitcoins through the network

according to a common interpretation of this

measure. But since users are in control of

transferring Bitcoins, this kind of inefficiency might

be intended to obfuscate financial transactions.

The eigenvector centrality calculation did not

converge to a solution within a reasonable time

frame (on convergence see Hagberg et al. (2008))

thus only the degree centrality measure was used.

The highest value occurs for the entity 11, which is

also confirmed by the visualization of the largest

hub in the graph. Degree centrality measures the

importance of nodes within a network; the results

show that the large transaction network node 11 is

the most important node and can be considered as a

hub for the others.

Table 3: Average shortest path length and degree

centrality of the largest transaction graph.

6 DEANONYMIZING ENTITIES

To demonstrate the possibility of deanonymizing at

least some users in the Bitcoin network, the largest

entity in terms of the number of public keys was

selected. This entity 11 is also involved in the largest

transactions that were carried out on the network.

The first approach was to investigate the IP address

belonging to the public key that initiates the

transaction which is available from the site

blockchain.info. It needs to be conceded that many

IP addresses just reveal information (via Whois)

about the last gateway before entering the block

chain and thus cannot directly be associated with the

real user. But one can receive information on the

regional distribution of hosted services and their

transactions. Users or business services accepting

Bitcoins that are not using hosting services could be

uncovered with this approach by using

getaddr.bitnodes.io.

Another finding is that large and highly active

entities providing exchange, laundry, mining,

gambling services such as Mt.Gox, SatoshiDice, or

BTC Guild are publicly known on the

blockchain.info, and entity 11 could be identified as

the exchange service Mt.Gox. To confirm this result,

several transactions until April 10, 2013, in which

Mt.Gox was involved were investigated using

blockchain.info and could be linked to entity 11.

Another method is to look up a particular public key

of Mt.Gox in the dataset and show that it belongs to

the public key pool of entity 11.

7 CONCLUSIONS AND

OUTLOOK

Our research can serve as an exploratory starting

point for the application of several techniques,

descriptive statistics, and network analysis of the

Bitcoin transaction graph. Recent results on the

transaction graph were introduced. Standard

descriptive statistics and more advanced methods in

the field of network analysis were applied.

The results of the descriptive analysis show

strongly skewed data series, especially for the

transaction value. Another finding is the strong

relationship between user activity, transaction

volume, and the exchange rate of Bitcoin. One could

also see that the largest entity is also involved in the

largest transactions carried out in the network, and

that the highest amount of transactions is of the

smallest possible transaction size. Furthermore, the

exchange rate was investigated and related to some

events explaining its volatility. A strong relationship

of user activity within different time horizons and

the exchange rate could be demonstrated.

The network analysis revealed some new

findings compared to previous research. We

confirmed that the network degree distribution

seems to converge to a scale-free network over time.

A new contribution was the analysis of the average

clustering coefficient, which is an indication for

Bitcoin being a small world network as described by

Watts and Strogatz (1998). The analysis of the

average path length and degree centrality was

conducted on a subgraph containing the largest

transactions (>= 50,000) in the network. The results

ExploringtheBitcoinNetwork

373

show a very large average shortest path of around

125 for the largest connected subgraph, indicating

inefficient user-driven transactions possibly aimed at

hiding Bitcoin flows. Using the degree centrality

measure, the largest hub in the subgraph, entity

number 11 (also the largest entity in the entire

network), could be found. Future work could aim for

deanonymizing other major hubs of the network

possibly by external information and experimental

transactions.

The analyses conducted in this work could also

be extended by further network measurements. One

could investigate the small world character more

thoroughly by advanced methods. Also further

analysis on centrality can be conducted such as

betweenness centrality or current flow betweenness

centrality in order to get more insights on important

hubs in the network. Further clique and clustering

analysis can be used to expose social interaction

characteristics

of users.

One could also extend the data set with IP

address and geo-location data in order to conduct

novel research on the geographic characteristics of

the network. Then it would be possible to analyze

the network structure in different regions and how

transactions occur between them. This can lead to a

more thorough picture of structures and topology of

the Bitcoin transaction graph. All of these analyses

can also serve as a starting point in investigating

anonymity and economic relationships in Bitcoin on

a new structural level.

REFERENCES

Barabási, A-L; Albert, R; Jeong, H (2000): Scale-free

Characteristics of Random Networks: the Topology of

the World Wide Web. Physica A: Statistical

Mechanics and its Applications 281(1–4): 69–77.

Borgatti, S (2005): Centrality and Network Flows. Social

Networks 27(1): 55-71.

Brugere, I (2013): Bitcoin Transaction Network

Extraction. https://github.com/ivan-brugere/Bitcoin-

Transaction-Network-Extraction. (Access Dec 2013).

Clegg, R (2006): Power Laws in Networks.

http://www.richardclegg.org/networks2/SpecialLectur

e_06.pdf. (Access Dec 2013).

Dotson, K (2012): Paypal’s Abandonment of Major

Cyberlockers May Become Bitcoin’s Big Win.

http://siliconangle.com/blog/2012/07/11/paypals-

abandonment-of-major-cyberlockers-may-become-

bitcoins-big-win/. (Access Dec 2013).

Drainville, D (2012): An Analysis of the Bitcoin

Electronic Cash System. https://math.uwaterloo.ca/

combinatorics-and-optimization/sites/ca.combinatorics

-and-optimization/files/uploads/files/Drainville,

Danielle.pdf. (Access Dec 2013).

Hagberg, A; Schult, D; Swart, P (2008): Exploring

Network Structure, Dynamics, and Function Using

NetworkX. In: Varoquaux, G; Vaught, T; Millman, J

(Eds), Proceedings of the 7th Python in Science

Conference: 11-15. Project documentation:

http://networkx.lanl.gov/.

Inaoka, H; Ninomiya, T; Taniguchi, K; Shimizu, T;

Takayasu, H (2004): Fractal Network Derived from

Banking Transaction – An Analysis of Network

Structures Formed by Financial Institutions. Bank of

Japan Working Papers 04(04).

Katzenbeisser, S; Hamacher, K (2011): Bitcoin – An

Analysis [28C3]. http://www.youtube.com/watch?v=-

FaQNPCqG58. (Access Dec 2013).

Mao, G; Zhang, N (2013): Analysis of Average Shortest-

Path Length of Scale-Free Network. Journal of

Applied Mathematics, Vol. 2013, Article ID 865643.

Mey, S (2013): Bitcoin Rallye: Hackerwährung als

sicherer Hafen für Sparer? http://blog.zdf.de/

hyperland/2013/03/bitcoin-rallye-hackerwaehrung-als-

sicherer-hafen-fuer-sparer/. (Access Dec 2013).

Nakamoto, S (2009): Bitcoin: A Peer-to-Peer Electronic

Cash System. http://bitcoin.org/bitcoin.pdf. (Access

Dec 2013).

Gross, J; Yellen, J (Eds) (2004): Handbook of Graph

Theory, CRC Press.

Ober, M.; Katzenbeisser, S; Hamacher, K (2013):

Structure and Anonymity of the Bitcoin Transaction

Graph. Future Internet 5(2): 237-250.

Reid, F; Harrigan, M (2013): An Analysis of Anonymity

in the Bitcoin System. In: Security and Privacy in

Social Networks, Springer: 197-223.

arXiv:1107.4524v2 [physics.soc-ph]

Ron, D; Shamir, A (2013): Quantitative Analysis of the

Full Bitcoin Transaction Graph. Lecture Notes in

Computer Science 7859: 6-24.

Watts, D; Strogatz, S (1998): Collective Dynamics of

Small-World Networks, Nature, Vol. 393, June 1998:

440-442.

WEBIST2014-InternationalConferenceonWebInformationSystemsandTechnologies

374