FORCE

Fully Off-line secuRe CrEdits for Mobile Micro Payments

Vanesa Daza

1

, Roberto Di Pietro

2

, Flavio Lombardi

2

and Matteo Signorini

1

1

Department of Information and Communication Technologies - Universitat Pompeu Fabra, Barcelona, Spain

2

Department of Mathematics and Physics - Roma Tre University, Roma, Italy

Keywords:

Security, Payment, Protocol, Off-line.

Abstract:

Payment schemes based on mobile devices are expected to supersede traditional electronic payment ap-

proaches in the next few years. However, current solutions are limited in that protocols require at least one of

the two parties to be on-line, i.e. connected either to a trusted third party or to a shared database. Indeed, in

cases where customer and vendor are persistently or intermittently disconnected from the network, any on-line

payment is not possible. This paper introduces FORCE, a novel mobile micro payment approach where all

involved parties can be fully off-line. Our solution improves over state-of-the-art approaches in terms of pay-

ment flexibility and security. In fact, FORCE relies solely on local data to perform the requested operations.

Present paper describes FORCE architecture, components and protocols. Further, a thorough analysis of its

functional and security properties is provided showing its effectiveness and viability.

1 INTRODUCTION

Market analysts have predicted that mobile payments

will overtake the traditional marketplace, thus pro-

viding greater convenience to consumers and a new

source of revenue to many companies. This scenario

can produce a shift in purchase methods from classic

credit cards to new approaches such as mobile-based

payments, giving new market entrants a further busi-

ness chance (Lewandowska, 2013).

Widely supported by recent hardware, mobile

payment technology is still at its early stages of evo-

lution but it is expected to rise in the near future

as demonstrated by the growing interest in crypto-

currencies. The first micro payment scheme, named

Payword, was proposed by Rivest and Shamir (Rivest,

1996) and was based on hash operations. Nowa-

days, crypto-currencies and decentralized payment

systems (e.g. Bitcoin (Martins and Yang, 2011)) are

increasingly popular, fostering a shift from physical

to digital currencies. However, such payment tech-

niques have yet to become commonplace, due to sev-

eral unresolved issues, including a lack of widely-

accepted standards, limited interoperability among

systems and, most importantly, security. A common

limitation of present approaches is that the payment

protocol either requires at least one of the involved

devices to be on-line (i.e. connected to an external

trusted third party), or it requires each transaction to

be linked to a bank account.

1.1 Problem and Objectives

Present digital payment solutions rely on the capabil-

ity of involved devices to go on-line, i.e. to connect to

a remote payment service/gateway. Although many

of them claim to provide off-line transactions, they

are limited to customer authentication whilst blindly

relying on trusting the bank for transactions (as for

credit cards). As a matter of fact, for all those cards

that do not rely on any bank account, such as prepaid

cards, a network connection to the Internet is required

in order to check card validity and balance. Unfortu-

nately, a network connection can be unavailable due

to either temporary network service disruption or due

to a permanent lack of network coverage. Last, but

not least, such on-line solutions are not very efficient

since remote communication can introduce delays in

the payment process. As a consequence, some mer-

chants would rather prefer off-line solutions to take

advantage of the low latency of the payment process

and of the data plan cost reduction. The lack of fully

off-line secure prepaid solutions not linked to bank

accounts is mainly due to the difficulty of checking

the trustworthiness of a transaction without a trusted

third party. This represents an important deficiency

125

Daza V., Di Pietro R., Lombardi F. and Signorini M..

FORCE - Fully Off-line secuRe CrEdits for Mobile Micro Payments.

DOI: 10.5220/0005053201250136

In Proceedings of the 11th International Conference on Security and Cryptography (SECRYPT-2014), pages 125-136

ISBN: 978-989-758-045-1

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

in nowadays mobile payment ecosystems, in particu-

lar for those emerging countries where mobile micro

paymentsolutions are flourishing (thanks to the recent

widespread success of low-cost smartphones) despite

difficulties in bank pervasiveness.

1.2 Contribution

This paper introduces and discusses a novel off-line

micro payment solution. The proposed solution,

named FORCE, does not require any kind of network

connectivity or bank account. In FORCE both the

vendor and the customer device can be disconnected

from the Internet and from any other trusted third

party thus relying only on local data. To the best of

our knowledge, this is the first approach that is able to

provide secure fully off-line payments while being re-

silient to different malicious adversaries as described

in Section 7.

2 RELATED WORK

Solutions proposed so far for mobile payments can be

classified according to the following taxonomy:

• Fully On-line: solutions such as (Chen et al.,

2010; Golovashych, 2005; Vasco et al., 2010) that

require the customer’s mobile device to be con-

nected to a network (e.g. 3G) in order to com-

municate with a bank, a payment-gateway or a

trusted third party;

• Semi Off-line: solutions such as (Kadambi et al.,

2009; Sekhar and Mrudula, 2012) that require an

active connection only on the vendor side;

• Weak Off-line: solutions such as (Dominikus and

Aigner, 2007; Nishide and Sakurai, 2011) that re-

quire a connection either to a shared dataset or to

a peer-to-peer network. Such approach, by allow-

ing access to past transactions, enables vendors to

check for customer’s account validity, thus pre-

venting malicious behavior such as double spend-

ing. Other solutions belonging to the weak-off-

line category work with digital cash designed to

be accepted either by specific vendors (known as

digital vouchers) or within a specific short time

window like in (Patil and Shyamasundar, 2004;

Aigner et al., 2007);

• Fully Off-line: solutions that do not require any

external connection but either assume involved

devices to be trusted (Juang, 2013; Salama et al.,

2011) or are limited to transactions tied to a bank

account.

As already introduced, the main issue of a fully

off-line solution is that keeping track of past trans-

actions can be hard, as it is difficult for a vendor to

check if some digital credits have already been spent.

This is the main reason why the solutions proposed

so far in the literature (see Table 1) require some kind

of Trusted Third Party (TTP) to store past transac-

tions and check such a list each time a new transac-

tion is started (Vasco et al., 2010) (as such they can

be considered run-time verified solutions). Alterna-

tively, off-line solutions that do not rely on TTPs ei-

ther assume a tamper proof/resistant smart card (such

as (Juang, 2013; Salama et al., 2011)) or just check for

customer identity (Wang et al., 2013) whereas secu-

rity checks, such as double spending prevention, are

verified and validated by the bank at a later time (such

solutions are classified as postponed).

3 PROPOSED MODEL

FORCE is the first solution that neither requires TTPs,

nor bank accounts, nor trusted devices to mitigate

the attacks that usually affect fully off-line payment

schemes (details in Section 6). To achieve such a

goal, FORCE leverages physically unclonable func-

tions (for short PUF, details in Section 4) and pro-

poses a novel, fully off-line system based on digital

credit, i.e. prepaid coins that can be spent only once.

Furthermore, by allowing FORCE customers to

be free from having a bank account, makes it partic-

ularly interesting as regards privacy. In fact, unlike

all other solutions, anyone can buy a FORCE scratch

card (e.g. at a local reseller) without disclosing her

identity. Digital credits used in FORCE are just a

digital version of real cash and, as such, they are not

linked to anybody else than the holder.

Differently from other payment solutions based

on tamper-proof hardware, FORCE assumes that only

the chips built upon PUFs can exploit the tamper evi-

dence feature provided by the PUFs themselves. As a

consequence, our assumptions are much less restric-

tive and more realistic than other approaches.

3.1 FORCE Model

FORCE can be applied to any scenario composed by

a payer/customer device, a payee/vendor device, a

scratch card (i.e. a digital credit physical wallet) and a

payee/vendor local storage device. In its current ver-

sion, as depicted in Figure 1, FORCE has been de-

signed using a smartphone as the customer device (for

short CD), a Point Of Sale as the vendor device (for

short VD), and a Near Field Communication (Coskun

et al., 2012) (for short NFC). The rationale behind the

SECRYPT2014-InternationalConferenceonSecurityandCryptography

126

Table 1: Some payment schemes with double spending attack prevention technique being adopted.

Scheme TTP-Free TTP Type Check Type

(Dai et al., 2006) % P2P Network Realtime

(Popescu and Oros, 2007) % Database Postponed

(Zhou, 2008) % P2P Network Postponed

(Srivastava et al., 2008) % Database Realtime

(Wang and Lu, 2008) % Database Postponed

(Zhan-gang and Zhen-kai, 2009) % Database Postponed

(Vasco et al., 2010) % Issuing Authority Realtime

(Salama et al., 2011) % Database Realtime

(Wang et al., 2013) % Database Postponed

(Juang, 2013) % Database Postponed

(Chaurasia and Verma, 2014) % Database Realtime

FORCE " None Realtime

choice of NFC is that it is much easier to use com-

pared to other wireless communication technologies

like Bluetooth or WiFi.

Customer Device

Vendor Device

NFC

Scratch Card

Storage Device

Figure 1: FORCE model.

In FORCE, as detailed in Section 6, all involved

devices can be tweaked by an attacker and are con-

sidered untrusted except from the storage device, that

we assume is kept physically secure by the vendor.

It is important to highlight that such an assumption

does not affect the security of the proposed system.

In fact, similarly to physical wallets, bank’s safety

vaults or crypto-currency digital wallets, the storage

device is not involved in the payment transaction and

represents a secure, write-only, place where collected

money are stored.

Furthermore, FORCE, rather than being an e-cash

system, has been designed to be a secure and reli-

able encapsulation scheme of digital coins into dig-

ital credits. This makes FORCE also applicable to

multiple-bank scenarios. Indeed, as for credit and

debit cards where TTPs (i.e. card issuers) guaran-

tee the validity of the cards, some common standard

convention can be used in FORCE to make banks

able to produce and sell their own scratch card. Any

bank will then be capable of verifying digital credits

of scratch cards issued by other banks, by requiring

banks and vendors to agree on the standard used for

the digital credits within the scratch card (see Section

4).

In contrast to all other solutions proposed so far,

in FORCE, vendors are able to verify digital credit

validity at run-time. This means that once a digital

credit has been verified, it can be directly and imme-

diately re-used (details in Section 5.4) and there is no

way such a credit could be refused or reclaimed.

FORCE does not require any special hardware

component apart from the scratch card that can be

plugged into any device able to read SD cards. Sim-

ilarly to a secure element (e.g MasterCard PayPass

chip), our scratch card is a tamper proof device that

provides a secure storage and execution environment

for sensitive data. Thus, as defined in the ISO7816-

4 standard, our scratch can be accessed via some

APIs while maintaining the desired security and pri-

vacy level. Such software components (i.e. APIs) are

not central to the security of the scratch card system

and can be easily updated. This renders infrastructure

maintenance easier.

3.2 Threat Model

In order to better describe all the possible threats a

fully off-line environment is subject to, a detailed de-

scription of both attacks and attackers is introduced in

this section. The first important distinction that has to

be made is about the position of the adversary:

• Internal Attacker: this adversary is directly in-

volved in the payment as the customer/vendor. As

such, he is capable of tweaking any device either

by injecting malicious code or by having physical

access to it;

• External Attacker: this adversary is not directly

involved in the payment. As such, he can only

access/alter the data being exchanged between the

vendor and the customer over the NFC channel.

FORCE-FullyOff-linesecuReCrEditsforMobileMicroPayments

127

The second classification is based upon the number of

tweaked devices as follows:

• Collector: this is an external adversary able to

eavesdrop and alter messages being exchanged

between the CD and the VD;

• Malicious Customer: this is an internal adver-

sary that can either physically open the CD to

eavesdrop sensitive information or inject mali-

cious code within the CD in order to alter its be-

havior;

• Malicious Vendor: (for short, M. Vendor) is an

internal adversary that can either eavesdrop in-

formation from the VD or inject malicious code

within the VD in order to alter its behavior;

• Ubiquitous: this is an internal adversary with

complete access to both CD and VD.

In the proposed payment scheme, as shown in

Section 6, no restrictions are made on the capabilities

of the adversary, always considered as ubiquitous.

4 FORCE: ARCHITECTURE

In this section, the architecture of our mobile payment

solution will be described (see Figure 2). The core

element of the whole payment system architecture is

a scratch card that can be built within the CD or used

as a separate element, such as Secure Digital cards

(for short SD). A scratch card is composed of:

• Scratch Memory: special read once memory

used to store digital credits;

• Authenticator: used to compute, on the fly, all

the cryptographic keys required for the payment

protocol;

• Memory Mapping Unit: used to retrieve the dig-

ital credit layout and to detect malicious attacks

based on guessing the memory layout.

Both the authenticator and the memory map-

ping unit elements are built upon physically unclon-

able functions. PUFs were introduced by Ravikanth

(Ravikanth, 2001) in 2001. He showed that, due to

manufacturing process variations, every transistor in

an integrated circuit has slightly different physical

properties that lead to measurable differences in terms

of electronic properties. Since these process varia-

tions are not controllable during manufacturing, the

physical properties of a device cannot be copied or

cloned. As such, they are unique to that device and

can be used for authentication purposes. However,

creating a device with a given electronic fingerprint is

difficult and expensive, whereas implementing a PUF

requires an electronic circuit that is able to produce

hardware outputs (i.e. responses) to given inputs (i.e.

challenges). These responses depend on the unique

physical properties of the device. As such, PUFs are

functions that are easy to challenge and whose re-

sponse is easy to measure, but very hard to repro-

duce. PUFs have been proposed in banking systems

in the past but so far they have only been used to

provide stronger customer authentication. One of the

most important features about PUFs is their tamper-

evidence capability.

In the remainder of this section, each element of

the scratch card will be described. Further, in Section

5 the transaction protocol will be depicted.

Authenticator

Memory Mapping

Unit

Scratch

Memory

Scratch Card ID

Secret Key Generator

Authenticator

Memory Mapping Unit

Scratch Card

Read-only (read-once) element

Tamper-evidence element

Credit Registers

Rescrambler

Canary Filter

Verier

Figure 2: FORCE scratch card architecture. Elements in

grey contain a physically unclonable function.

4.1 Scratch Memory

At the hearth of the scratch card lies a read-oncemem-

ory(Rens, 2006) named scratch memory. Such mem-

ory, used to store digital credits, has the property that

reading one value destroys/erases the original content.

FORCE is not tied/limited to any static digital

credit format. It just requires each digital credit to

be composed of at least two fields, namely the value

of the digital credit and an integrity verification value.

This value is used to guarantee that a specific credit

is created to be spent by a specific scratch card only.

Such value is computed at manufacturing time by first

encrypting the credit value with the public key of the

scratch card and then additionally signing it with the

private key of the card issuer. This is to avoid forgery

attacks. Once a digital credit has been created, it is

stored within the scratch memory in a non contiguous

way. During this step, the card issuer creates unique

random sequences, one for each credit, where unique

means that taken two credits C

a

and C

b

and given S

a

(the sequence of C

a

) and S

b

(the sequence of C

b

) then

S

a

∩S

b

=

/

0, ∀ (a, b) with a 6= b. Such sequences repre-

sent the layout of each credit within the scratch mem-

ory.

FORCE does not rely either on a specific scratch

memory size or on a specific number of digital cred-

SECRYPT2014-InternationalConferenceonSecurityandCryptography

128

its. It is the card issuer that has the responsibility of

managing the scratch memory layout as regards both

the size and the credit number. As such, FORCE can

work with scratch memories of any size and with any

number of digital credits. It is also important to high-

light that the scrambled layout of digital credits within

the scratch memory is not the core security element of

the solution proposed in this work. Digital credit lay-

out is only meant to prevent a subset of attacks based

on the guessing of the scratch memory (see Section 7

for details).

4.2 Authenticator

The authenticator is used to on-the-fly compute the

scratch card’s private key used to decrypt vendor re-

quests. In fact, rather than embodying a single crypto-

graphic key within the device, thus potentially allow-

ing an adversary to steal it, PUFs have been used in

FORCE to implement strong challenge-response au-

thentication. The challenge used as input for the PUF

is a publicly known scratch card identifier hard-coded

within the card and used in the payment protocol as

the public key of the card. Each scratch card is indeed

shipped with a public key, signed by the bank/card is-

suer to avoid forgery attacks and hard-coded into the

card itself. This allows the customer to broadcast the

public key of the card to vendors. As such they are not

required to know all the public keys of all the active

scratch cards.

As detailed in Section 5, vendors can encrypt pay-

ment requests with the public key of a scratch card

with the guarantee that such requests will be read only

by that card. Further, the tamper-evidence feature

of PUFs ensures that any attempt to open on the fly

the authenticator element to read the computed pri-

vate key will alter the behavior of the PUF causing a

different key to be produced and thus the loss of the

original key. Changing the original private key leads

to the impossibility to read vendor requests thus ren-

dering the whole scratch card useless.

4.3 Memory Mapping Unit

The memory mapping unit (MMU) is composed by

a set of credit registers and by a verifier element as

shown in Figure 2. Credit registers are hard-coded

into the MMU and each of them is given as input

to the rescrambler-PUF to compute the actual layout

of each digital credit within the scratch memory (see

Figure 3). Again, actual layout values of digital cred-

its are not stored anywhere within the card but are

computed on the fly each time, making it hard for an

adversary to eavesdrop them.

The latest element of the MMU is the canary fil-

ter, embedded into the verifier and used to protect the

scratch card from memory guess-based attacks by us-

ing special bits (canary bits). These bits have the main

goal of keeping track of scratch memory malicious ac-

cesses and, as depicted in Figure 3, they are designed

as a mapping function between input and output. If

a bit given as input to the canary filter matches a ca-

nary bit, the output is multiplexedto the whole scratch

memory. This guarantees that any attempt to read a

canary bit will automatically cause the entire scratch

memory to be read and, as such, erased. As for the au-

thenticator, the MMU takes advantage of the tamper-

evidence feature of its embedded rescrambler-PUF.

Rescrambler

100110001001000100101011

100010111001000001100001

Scratch Memory

Rescrambler

100110001001000100100111

100010111001000001101001

Scratch Memory

Verier

Verier

Credit Registers Credit Registers

Figure 3: An authorized read on the left and a malicious

read on the right. On the right, the canary bit is multiplexed

to all the addresses of the scratch memory.

4.4 Stable PUF Extraction

As described in Section 4.2 and Section 4.3, physi-

cally unclonable functions have been used in FORCE

to compute the private key of the scratch card and the

actual layout value of each digital credit. However,

given a fixed input, PUFs can producea responses that

is unique to the manufacturing instance of the PUF

circuit but that it is not bitwise-identical when regen-

erated multiple times. As such, in order to use PUFs

in algorithms where stable values are required, an in-

termediate step is required. This problem, usually

faced in cryptographic algorithms, is known as “se-

cret key extraction” and it can be solved using a two-

step algorithm. In the first step the PUF is queried,

thus producing an output together with some addi-

tional information called helper data. In the second

step, the helper data is used to extract the same output

as in the first step thus making the PUF able to build

stable values. It is also possible to construct a two-

step algorithm guaranteeing that the computed value

is perfectly secret, even if the helper data is publicly

FORCE-FullyOff-linesecuReCrEditsforMobileMicroPayments

129

known. Practical instances of such kind of algorithm

have been proposed in (Dodis et al., 2008) and the

cost of actual implementations thereof is assessed in

(Maes et al., 2009).

Recently, some solutions have been proposed to

correct PUF output on the fly thus providing the

generation of secret stable values within the de-

vice. FORCE uses this approach for the design of

both the key generator element (embedded in the au-

thenticator) and for the verifier element (embedded

in the MMU). Such special PUFs are built upon a

lightweight error correction algorithm proposed in

(Yu et al., 2011) and described in this section.

C0 C1 C63

PUF0 PUF2 PUF126

PUF127PUF3PUF1

+ + +

...

...

+ + +

Selected PUF

sum

Selected PUF

sum

PUF challenge

Tamper-evidence element

PUF response

Figure 4: Stable PUF response computation approach used

for the key generator and the MMU verifier.

As depicted in Figure 4, the basic 64-sum PUF

looks at the difference between two delay terms, each

produced by the sum of 64 PUF values. Given a chal-

lenge, its i

th

bit called C

i

determines, for each of the

64 stages, which PUF is used to compute the top de-

lay term, and which is used to compute the bottom

delay term. The sign bit of the difference between the

two delay terms determines whether the PUF outputs

a ‘1‘ or ‘0‘ bit for the 64-bit challenge C

0

·· ·C

63

. The

remaining bits of the difference determine the confi-

dence level of the ‘1‘ or the ‘0‘ output bit. The k-sum

PUF can be thought of as a k-stage Arbiter PUF (Lim

et al., 2005) with a real-valued output that contains

both the output bit as well as its confidence level. This

information is used by the downstream lightweight er-

ror correction block that is able to produce in output a

stable value within the scratch card.

By using such on the fly stable value generation

process, FORCE does not store either private keys or

digital credit actual layout within the customer device

thus protecting them from malicious customers and

ensuring that only the right scratch card can compute

its own private key with a single step each time it is

needed.

5 FORCE: PROTOCOL

This section describes all phases of the FORCE pro-

tocol. For completeness, the Redemption, Transac-

tion Dispute and the Rollover phases will be analyzed

even though they are not part of the payment proce-

dure that is composed by the Pairing and the Payment

phases only.

5.1 Pairing Phase

The current version of FORCE uses the NFC tech-

nology for all the communications between CDs and

VDs. Even though NFC requires both the involved

devices to be very close to each other, an adversary

could still be able to unleash man-in-the-middle at-

tacks (for short MITM) by using NFC boosters. As

such, a pairing setup process has being used as the

first step of each new transaction request. For the

pairing phase, FORCE relies on standard and well

known pairing protocols such as the Passkey Entry of

the Bluetooth Simple Pairing Process (for short SSP).

At the end of the pairing protocol, both the devices

will share their public keys used to guarantee integrity

and authenticity of messages being exchanged. Fur-

thermore, in order to avoid brute force attacks on the

pairing protocol, FORCE adopts a “fail-to-ban” ap-

proach based upon a failure threshold value. In this

case, if a malicious customer consecutively fails the

Passkey Entry procedure the system stops for few sec-

onds, usually 20 or 30 seconds. If the number of con-

secutive fail-to-ban reaches a security threshold value,

the vendor can decide to refuse the pairing request.

For the sake of simplicity, all the encryption oper-

ations involved in the SSP Passkey Entry protocol and

used in the FORCE pairing process will be omitted.

5.2 Payment Phase

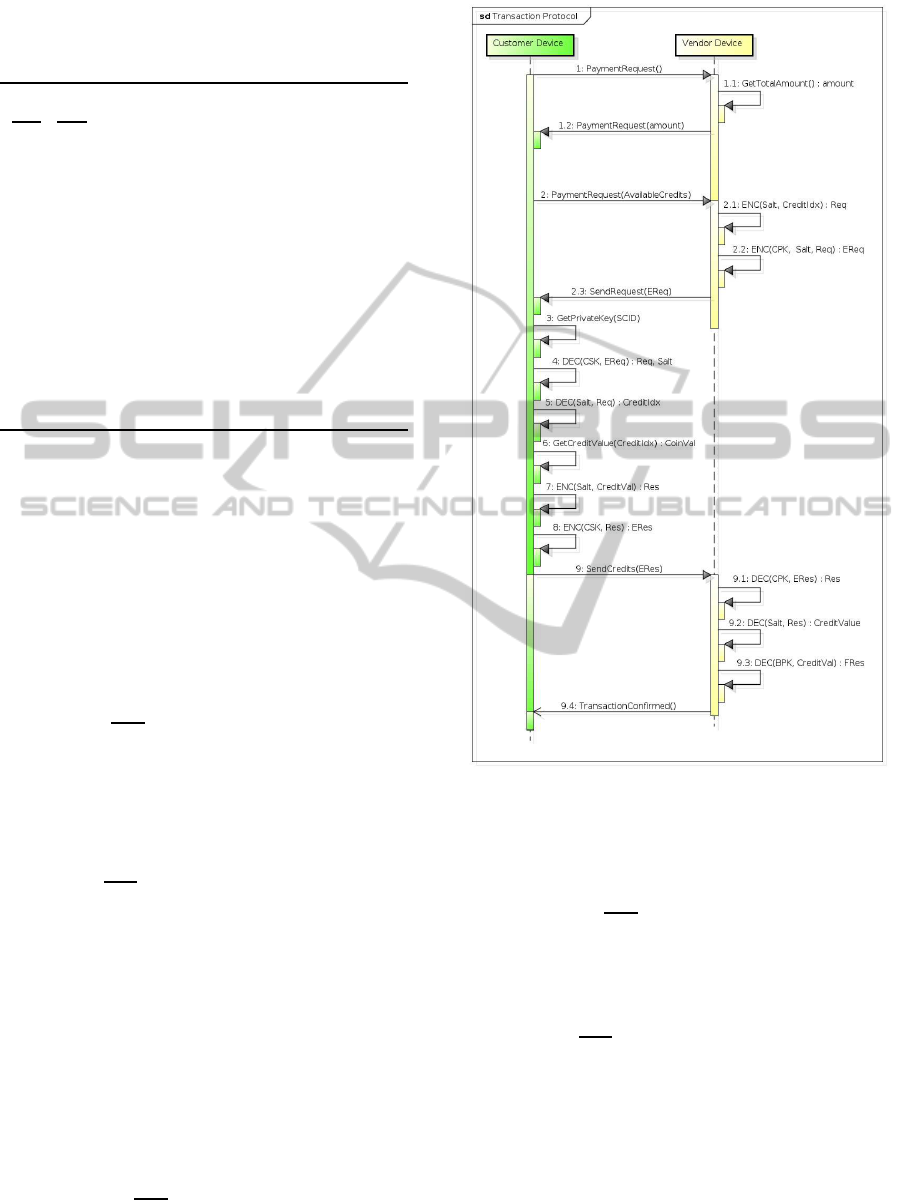

The FORCE payment phase is depicted in Figure 5

and it is composed by the following steps (symbols in

Table 2):

1. The customer sends a purchase request to the VD

asking for some goods;

2. The vendor computes the total amount and sends

it back to the customer;

3. The customer checks for the amount and either

confirms or denies the transaction. If the transac-

tion is confirmed, the CD creates a reply for the

VD with the indexes of all the credits that are still

available in the card. If the i

th

index number is

present in the reply, it means that the i

th

credit reg-

ister can be read in order to retrieve the i

th

digital

credit within the card;

SECRYPT2014-InternationalConferenceonSecurityandCryptography

130

Table 2: Symbols used in all the phases of the transaction

protocol

Symbol Meaning

Enc()/Dec() Symmetric encryption/decryption

Enc()/Dec() Asymmetric encryption/decryption

Salt Salt value

CreditIdx Credit memory addresses

CreditVal Credit memory content

Req Credit request built by VD

Res Response built by CD

CPK Card public key

CSK Card secret (private) key

BPK Bank/Card Issuer public key

BSK Bank/Card Issuers secret (private) key

VPK Vendor public key

VSK Vendor secret (private) key

EReq Encrypted request

ERes Encrypted response

FRes Final response

RReq Redemption request

Log Log entry

ELog Encrypted log entry

4. The vendor first creates a random salt value.

Then, for each credit that will be involved in the

transaction, a request is created by encrypting the

credit index with the random salt obtaining Req

Enc

Salt

(CreditIdx) = Req (1)

5. Such encrypted request along with the salt just

created are encrypted once again with the public

key of the scratch card, thus rendering the cus-

tomer the only party able to read it

Enc

CPK

(Req, Salt) = EReq (2)

6. When the customer receives such a request, the

private key is computed by the authenticator as

shown in Section 4.2 and it is used to decrypt the

message received thus obtaining the salt value and

the request

Dec

CSK

(EReq) = (Req, Salt) (3)

7. The salt is then used to decrypt the request Req

Dec

Salt

(Req) = CreditIdx (4)

8. CreditIdx is used by the MMU to read the scratch

card digital credit value (details in Section 4.3);

9. The credit value is sent back to the authenticator;

10. The salt is used once again to create an encrypted

response for the vendor

Enc

Salt

(CreditVal) = Res (5)

11. The response is encrypted with the private key of

the card thus providing authenticity and integrity

Enc

CSK

(Res) = ERes (6)

12. The encrypted response is then sent back to the

vendor;

Figure 5: Payment protocol. Operations from 3 to 8 are

executed within the scratch card but the whole process is

invoked by the customer device.

13. The vendor decrypts the ERes in two steps

Dec

CPK

(ERes) = Res (7)

Dec

Salt

(Res) = CreditVal (8)

14. Finally the content of the credit is decrypted with

the public key of the bank/card issuer

Dec

BPK

(CreditVal) = FRes (9)

15. If the credit value is correct, a new entry is stored

in the storage device of the vendor after having

being encrypted with the private key of the ven-

dor.

If all the steps are accomplished without errors

(see Section 5.3) the transaction is authorized and

the purchase is allowed. It is important to highlight

that, as already described in Section 1, FORCE has

been designed as a secure and reliable encapsulation

FORCE-FullyOff-linesecuReCrEditsforMobileMicroPayments

131

scheme rather than as an e-cash system. As such,

problems affecting digital currencies, such as digital

change, are beyond the scope of the proposed solution

and will not be analyzed here.

5.3 Transaction Dispute

Due to its truly off-line nature, FORCE does not pro-

vide a transaction dispute protocolphase to better pro-

tect both the customer and the vendor. Indeed, a ma-

licious customer could simulate an error in the trans-

action, thus requesting a direct refund to the vendor,

while a malicious vendor could simulate an invalid

transaction, even if digital credits were successfully

read from the customer’s scratch card.

As such, direct transaction disputes between ven-

dors and customers are avoided while on-line transac-

tion disputes are allowed. In fact, since the redemp-

tion phase is on-line (see Section 5.4), the correctness

and completeness of each off-line transaction can be

easily verified by the bank/card issuer thus rendering

a fake transaction dispute attempt too risky and unfea-

sible to the malicious party.

5.4 Redemption Phase

Vendors accepting FORCE scratch cards from their

customers can verify digital credits at run-time with-

out relying on any TTP. This is thanks to the fact that

what is actually exchanged between the customer and

the vendor is not a promissory note (as with credit

cards and all other postponed payment schemes that

claim to be off-line) but it is a digital value, represent-

ing real money, signed by the bank/card issuer. As

such, each FORCE payment transaction just needs the

pairing and the payment phases in order to be accom-

plished and evaluated by the vendor. However, for the

sake of completeness, the redemption phase will also

be briefly discussed.

As shown in Figure 6, once the off-line transac-

tion has been completed, the vendor owns the digital

credit just received from the customer. Such credit

is encrypted by the bank/card issuer and, as such, it

can be easily verified by everyone using the public

key of the bank/card issuer. Thus, once the credit has

been verified, the vendor can use the digital coin (en-

capsulated within the credit) either to send it back to

the bank/card issuer in exchange for real money or

to use it as a common crypto/digital currency. If the

vendor chooses to send it back to the bank/card is-

suer, the credit and the coins will be stored in the bank

database. On the contrary, if the vendor decides to use

the credit as an e-cash digital coin, the credit will be

broadcast over the network depending on the payment

scheme being used.

This “second-step” payment process relies on

common on-line payment protocols. Thus, its secu-

rity and reliability features are not discussed here.

Customer

Vendor

Vendor

Storage

Vendors

Banks

Possible future online usage of

FORCE o

ine-collected credits

FORCE - o ine transactions

Figure 6: Possible uses of digital credit obtained in past

transactions.

6 FORCE: SECURITY ANALYSIS

In this section the robustness of FORCE is discussed.

FORCE uses both symmetric and asymmetric crypto

schemes in order to guarantee the most important se-

curity principles as follows:

• Authenticity: it is guaranteed by FORCE both in

the pairing and in the payment transaction phase.

In the pairing phase the authenticity is ensured

by the PassKey Entry standard protocol while in

the payment phase the authenticity is ensured by

the authenticator element embedded in the scratch

card;

• Non Repudiation: the storage device kept phys-

ically safe by the vendor prevents the adversary

from deleting past transactions thus avoiding ma-

licious repudiation requests. In addition, the con-

tent of the storage device can be exported to an

external storage, such as a pen drive, on a timely

basis;

• Integrity: digital credit integrity is ensured by en-

crypting each digital credit with the private key

of the bank/card issuer. Furthermore, message in-

tegrity is ensured by FORCE thanks to the on the

fly computation of the private key of the scratch

card that is not stored anywhere within the scratch

card but it is computed each time as needed;

• Confidentiality: each response sent to the ven-

dor by the customer has a double layer encryp-

tion. Responses are first encrypted with the ran-

dom salt generated by the vendor at the begin-

ning of the payment phase and then encrypted

SECRYPT2014-InternationalConferenceonSecurityandCryptography

132

with the private key of the scratch card. This sec-

ond layer of encryption ensures that the response

was originated by that card as described in Section

4.2 while the encryption layer built upon the salt,

guarantees confidentiality and freshness of the re-

sponse generated by the card;

• Availability: the availability of the proposed so-

lution is guaranteed mainly by: first, the fully off-

line scenario completely removes any type of ex-

ternal communication requirement and makes it

possible to use off-line digital credits also in ex-

treme situations with no network coverage. Sec-

ond, the implementation with a passive card and

the lack of any registration phase, makes the pro-

posed scratch card able to be used by different de-

vices.

FORCE shares (Choi and Kim, 2012) the assump-

tion that the scratch card is tamper-evident. This as-

sumption is based on the size of nowadays IC and on

the impossibility for a casual adversary to open the

device without causing an alteration in PUF behav-

ior. This assumption is no longer valid if an expert

adversary with access to highly sophisticated and ex-

pensive tools, such as scanning electron microscopes

or focused ion beams, is taken into account. However,

such tools can be worth thousands of dollars and ap-

plying this kind of attack on each single deviceto steal

a few dollars will not be convenient to the attacker.

6.1 Key Rollover

As for all the real-world payment schemes based on

smart cards such as credit, debit and prepaid cards,

FORCE assumes that, in case of bank/card issuer pri-

vate key renewal a time-window is adequately cho-

sen to let customers decide whether to spend their last

credits or to exchange the current card with a newone.

These standard procedures are widely accepted in the

real world and, as such, no custom key rollover pro-

tocol has been designed in FORCE.

7 FORCE: ATTACK MITIGATION

In this section, the resiliency of FORCE to all the at-

tacks listed in Section 3.2 is discussed:

• Double Spending: the read once property of the

scratch memory prevents an adversary from read-

ing the same digital credit twice. Even if a mali-

cious customer creates a fake vendor device and

reads all digital credits (as described in Section

4.1) it will not be able to spend such credit due to

the inability to decrypt the request of other ven-

dors (see the payment protocol in Section 5.2).

Indeed, as described in Section 4.2 the private key

of the card is needed to decrypt the request of the

vendor and can be computed only within the de-

vice. The fake vendor could then try to forge a

new emulated scratch card with private/public key

pair. However, scratch card public keys are valid

only if signed by the bank/card issuer. As such,

any message received by an unconfirmed scratch

card will be immediately rejected;

• Credit Forgery: each credit is encrypted with the

private key of the bank/card issuer and thus it is

not possible for an adversary to forge new credit;

• Memory Poisoning: each completed transaction

is kept in the vendor storage device. If a digital

credit has been corrupted by a memory poison-

ing attack, such credit will not be accepted. Such

corrupted and unused credits can be claimed back

to the bank/card issuer that will check for both

vendor logs and on-line payment circuit databases

and if such credit is not present in any of them a

refund will be given back to the victim;

• Memory Deletion: this is a special case of the

Memory Poisoning attack in which all credits are

corrupted;

• Memory Dump: as shown in Sections 4.2 and

4.3 opening the scratch card to copy the content

of the scratch memory will alter the behavior of

the PUF, thus invalidating the whole scratch card;

• Memory Reconstruction: this is a special case

of the memory dump. By attempting a memory

reconstruction the adversary could be able to re-

construct each digital credit and then use them in

future transactions. However, reading the mem-

ory for dumping will change the PUF behavior,

thus preventing the authenticator from computing

the CD private key required to decrypt the vendor

request;

• Hardware Emulation: PUFs, by design, cannot

be neither dumped nor forged as in this case com-

puted responses will be different from the original

ones;

• Software Emulation: it is not possible, by de-

sign, to emulate PUFs without opening them and,

thus, corrupting them;

• Postponed Transaction: the only way to either

forcibly access or eavesdrop clear-text informa-

tion is by physically opening the scratch card.

Again, doing so will alter PUFs behavior thus in-

validating the whole card;

• Information Stealing: as shown in Section 6 the

private key of the CD and the real layout of each

credit is computed on the fly as needed. No sensi-

tive information is kept in the scratch card;

• Replay: each challenge, even if related to the

FORCE-FullyOff-linesecuReCrEditsforMobileMicroPayments

133

same digital credit, is different due to the random

salt generated each time by the vendor;

• Man In the Middle: digital credits are encrypted

by the bank/card issuer and contain, among all

other things, the scratch card ID. As a conse-

quence, an adversary cannot spend digital credits

of other customers by simply copying them from

the scratch card of the victim. Even changing the

content of the victim’s digital credit by replacing

the original ID with the ID of the adversary is not

possible. After such alteration of the credit, the

adversary would not be able to encrypt the credit

with the private key of the bank/card issuer, thus

rendering the malicious credit useless. Last but

not least, the adversary cannot pretend to be an-

other customer with a different ID because it will

not be able to compute the private key linked to

that ID;

• Reverse Engineering: by design, any attempt to

tweak the scratch card in order to try and steal

any useful information will alter the behavior of

the PUF thus rendering the whole scratch card no

longer usable;

• Denial of Services: the pairing process, based

on the Bluetooth Passkey Enter standard proto-

col, cannot be accomplished by an adversary be-

cause it requires a security code to be manually

and physically typed on the customer’s device. As

such, DoS and DDoS attacks where the adversary

wipes the credits on the SC are mitigated. Even

if the adversary is a malicious vendor, each trans-

action has to be confirmed by the customer thus

preventing batch attacks where the SC is repeat-

edly challenged;

• HW Modification: again, by design, it is not

possible for an adversary to add/modify/remove

any element belonging to the scratch card without

changing its behavior;

• HW Eavesdropping: it is well known that nowa-

days photon counting APD modules and photon

emission microscope with InGaAs image sensors

are used with Focused Ion Beam (FIB) systems

in order to locate faults within integrated circuits.

However, as explained at the beginning of this

section, we consider this kind of attack overkill.

• Repudiation: as described in Section 5.3,

FORCE does not provide a transaction dispute

protocol phase. However, while the payment

transaction is accomplished in a fully-offline sce-

nario, any additional operation (e.g. disputes

or refund requests) can be accomplished on-line.

This way, the customer cannot repudiate a valid

transaction (the log entry for that transaction will

be notified on-line by the vendor) and the same

applies for the vendor (a repudiated valid transac-

tion cannot be spent).

So far, we have discussed the resilience of our

payment scheme to the attacks introduced in Section

3.2. In the following, other considerations are shared

based on the different adversary models introduced in

the same Section above:

• Malicious Customer: as shown at the beginning

of this Section, forgery, dump and reply attacks

are mitigated by the architecture and physical na-

ture of the core elements of the scratch card.

• Malicious Vendor: the only feasible attack for a

malicious customer is the deletion of past transac-

tion entries from the storage device. However, this

is not possible as the storage device is assumed to

be kept physically secure by the vendor;

• Ubiquitous: the smarter attack that can be un-

leashed by such an adversary is the stealing of

information from both the VD and the CD to re-

construct the semantics of the scratch card mem-

ory content. However, in order to steal such infor-

mation the adversary has to physically tweak the

scratch card, thus invalidating it.

The robustness of FORCE is mainly based on

PUFs features but also on the high unpredictability

of digital credit layout within the scratch memory.

As regards physical attacks to PUFs, Integrated Cir-

cuits (ICs) and hardware in general, some relevant re-

sults are discussed in (Griffin et al., 2012) and (Choi

and Kim, 2012). The first one aims at protecting

IC integrity as each manufactured IC is rendered in-

operative unless a unique per-chip unlocking key is

applied. After manufacturing, the response of each

chip to specially generated test vectors is used to con-

struct the correct per-chip unlocking key. As concerns

(Choi and Kim, 2012), Choi and Kim aimed to pro-

tect the keys inside TPMs using a PUF. In fact, when

the keys are stored in memory and when they are

moved through the bus, their value is changed with

the PUF, thus rendering eavesdropping out of the PUF

IC useless. When the keys are needed for the crypto-

graphic module, they are retrieved from outside the

PUF IC and decrypted by the same PUF. However,

the values of the keys could be revealed through side-

channel attacks, e.g. non-invasive forms of physical

attack measuring timings, power consumption, and

electromagnetic radiation. Most cryptographic mod-

ules are known to be vulnerable to side-channel at-

tacks, and these attacks would be effective against the

TPM; thus, countermeasures against side-channel at-

tacks are necessary.

SECRYPT2014-InternationalConferenceonSecurityandCryptography

134

8 DISCUSSION

The problem of limiting data access in a physical de-

vice is extremely difficult. Attacks that try to infer

information from a device can be categorized as pas-

sive or intrusive attacks. In passive attacks the system

interface is probed for either timing or electrical dif-

ferences. In intrusive attacks the adversary is able to

breach the physical boundary of the package and can

scan, probe or alter the hardware itself.

In FORCE, on the one hand, intrusive attacks

are not feasible as they alter the functionality of the

scratch card. On the other hand, passive attacks have

been analyzed by subdividing them into powered and

un-powered attacks. In powered attacks the device

is monitored while running whilst in un-powered at-

tacks, information is extracted from the device while

the hardware is not powered on. In FORCE no value

used by the protocol is permanently stored in the CD.

As such, un-powered attacks are mitigated. On the

contrary, a run-time attack using extremely complex

monitoring tools could have access to the values be-

ing computed during each step of the protocol. How-

ever, stealing information on the fly at run-time would

require extremely expensive instrumentation whose

cost is well beyond the relatively small amount of

money that can be stored in a scratch card. Further, a

successful extraction of data from a scratch card will

not reveal any useful information about other scratch

cards, even if they are shipped by the same card is-

suer. As such, as already discussed in Section 6 we

can safely assume that this kind of attack is not worth

the effort and, as such, it is considered overkill.

9 CONCLUSION AND FUTURE

WORK

In this paper we have presented the first fully off-line

approach for micro-mobile payments. We have de-

scribed how our solution provides a higher security

level without any trustworthiness assumption over the

devices involved in the payment protocol. This has

mainly been achieved by leveraging PUF properties

and a special read-once memory where our digital

credits have been stored using a highly unpredictable

layout. Our proposal has been thoroughly discussed

with reference to state of the art solutions. Features

such as feasibility and convenience have been shown.

Finally, some open issues that will require fur-

ther investigation have been identified. In particular,

present FORCE only allows each off-line credit to be

spent once. We are working on an enhanced version

of FORCE that will allow digital credit to be spent

in multiple off-line transactions while maintaining the

same level of security and usability.

REFERENCES

Aigner, M., Dominikus, S., and Feldhofer, M. (2007). A

System of Secure Virtual Coupons Using NFC Tech-

nology. In IEEE PerComW’07, pages 362–366. IEEE.

Chaurasia, B. K. and Verma, S. (2014). Secure pay while

on move toll collection using {VANET}. Computer

Standards & Interfaces, 36(2):403–411.

Chen, W., Hancke, G., Mayes, K., Lien, Y., and Chiu, J.-H.

(2010). Using 3G network components to enable NFC

mobile transactions and authentication. In IEEE PIC

’10, volume 1, pages 441 –448.

Choi, P. and Kim, D. K. (2012). Design of security en-

hanced TPM chip against invasive physical attacks. In

IEEE ISCAS ’12, pages 1787–1790.

Coskun, V., Ok, K., and Ozdenizci, B. (2012). Near Field

Communication: From Theory to Practice. Wiley

Publishing, 1st edition.

Dai, X., Ayoade, O., and Grundy, J. (2006). Off-line micro-

payment protocol for multiple vendors in mobile com-

merce. PDCAT ’06, pages 197–202, Washington, DC,

USA. IEEE Computer Society.

Dodis, Y., Ostrovsky, R., Reyzin, L., and Smith, A. (2008).

Fuzzy extractors: How to generate strong keys from

biometrics and other noisy data. SIAM J. Comput.,

38(1):97–139.

Dominikus, S. and Aigner, M. (2007). mcoupons: An ap-

plication for near field communication (nfc). AINAW

’07, pages 421–428, Washington, DC, USA. IEEE

Computer Society.

Golovashych, S. (2005). The technology of identifica-

tion and authentication of financial transactions. from

smart cards to NFC-terminals. In IEEE IDAACS ’05,

pages 407–412.

Griffin, W. P., Raghunathan, A., and Roy, K. (2012). Clip:

Circuit level ic protection through direct injection of

process variations. IEEE Trans. Very Large Scale In-

tegr. Syst., 20(5):791–803.

Juang, W.-S. (2013). An efficient and practical fair buyer-

anonymity exchange scheme using bilinear pairings.

In Asia JCIS, pages 19–26.

Kadambi, K. S., Li, J., and Karp, A. H. (2009). Near-field

communication-based secure mobile payment service.

In ICEC ’09. ACM.

Lewandowska, J. (2013).

http://www.frost.com/prod/servlet/press-

release.pag?docid=274238535.

Lim, D., Lee, J. W., Gassend, B., Suh, G. E., van Dijk,

M., and Devadas, S. (2005). Extracting secret keys

from integrated circuits. IEEE Trans. Very Large Scale

Integr. Syst., 13(10):1200–1205.

Maes, R., Tuyls, P., and Verbauwhede, I. (2009). Low-

overhead implementation of a soft decision helper

data algorithm for SRAM PUFs. CHES ’09, pages

332–347, Berlin, Heidelberg. Springer-Verlag.

FORCE-FullyOff-linesecuReCrEditsforMobileMicroPayments

135

Martins, S. and Yang, Y. (2011). Introduction to bitcoins: a

pseudo-anonymous electronic currency system. CAS-

CON ’11, pages 349–350, Riverton, NJ, USA. IBM

Corp.

Nishide, T. and Sakurai, K. (2011). Security of offline

anonymous electronic cash systems against insider at-

tacks by untrusted authorities revisited. INCOS ’11,

pages 656–661, Washington, DC, USA. IEEE Com-

puter Society.

Patil, V. and Shyamasundar, R. K. (2004). An efficient, se-

cure and delegable micro-payment system. EEE ’04,

pages 394–404, Washington, DC, USA. IEEE Com-

puter Society.

Popescu, C. and Oros, H. (2007). An off-line electronic

cash system based on bilinear pairings. In EURASIP

’07, pages 438–440.

Ravikanth, P. S. (2001). Physical one-way functions. PhD

thesis, Massachusetts Institute of Technology.

Rens, B. J. E. V. (2006). Authenti-

cation using a read-once memory.

http://www.google.com/patents/US7059533. Ac-

cessed: 2013-07-30.

Rivest, R. L. (1996). Payword and micromint: two simple

micropayment schemes. In CryptoBytes, pages 69–87.

Salama, M. A., El-Bendary, N., and Hassanien, A. E.

(2011). Towards secure mobile agent based e-cash

system. In 1st Intl. Workshop on Security and Pri-

vacy Preserving in e-Societies, pages 1–6, New York,

NY, USA. ACM.

Sekhar, V. C. and Mrudula, S. (2012). A complete se-

cure customer centric anonymous payment in a digital

ecosystem. ICCEET ’12.

Srivastava, A., Kundu, A., Sural, S., and Majumdar, A.

(2008). Credit card fraud detection using hidden

markov model. IEEE Transactions on Dependable

and Secure Computing, 5(1):37–48.

Vasco, M. G., Heidarvand, S., and Villar, J. (2010). Anony-

mous subscription schemes: A flexible construction

for on-line services access. In SECRYPT ’10, pages

1–12.

Wang, C. and Lu, R. (2008). An ID-based transferable

off-line e-cash system with revokable anonymity. In

Intl. Symp. on Electronic Commerce and Security ’08,

pages 758–762.

Wang, C., Sun, H., Zhang, H., and Jin, Z. (2013). An im-

proved off-line electronic cash scheme. In ICCIS ’13,

pages 438–441.

Yu, M.-D. M., M’Raihi, D., Sowell, R., and Devadas, S.

(2011). Lightweight and secure PUF key storage using

limits of machine learning. CHES’11, pages 358–373,

Berlin, Heidelberg. Springer-Verlag.

Zhan-gang, W. and Zhen-kai, W. (2009). A secure off-line

electronic cash scheme based on ECDLP. In ETCS

’09, volume 2, pages 30–33.

Zhou, X. (2008). Threshold cryptosystem based fair off-line

e-cash. In IITA ’08, volume 3, pages 692–696.

SECRYPT2014-InternationalConferenceonSecurityandCryptography

136