Secure Protocol for Financial Transactions Using Smartphones - SPFT

Formally Proved by AVISPA

Shizra Sultan, Abdul Ghafoor Abbasi, Awais Shibli and Ali Nasir

Department of Computing,School of Electrical Engineering & Computer Sciences,

National University of Science and Technology, Islamabad, Pakistan

Keywords: Financial Protocol, Smartphones, Secure Payment Protocol, Formal Verification, AVISPA.

Abstract: Smartphones are overpowering the IT world by rising as a prerequisite for other technologies. Emerging

technology paradigms such as Cloud computing, web data services, online banking and many others are

revamping them as compatibility to smartphones. Banking is a vital and critical need in daily life. It

involves routine financial transactions among sellers, buyers and third parties. Several payment protocols

are designed for mobile platforms which involve hardware tokens, PIN, credit cards, ATMs etc. for secure

transactions. Many of them are not properly verified and have hidden flaws .Numerous vulnerabilities have

been found in existing solutions which raise a big question about the defense capability of smartphones to

protect user’s data. In this paper we propose a secure payment protocol for smartphones without using any

hardware token. It implicates bank as a transparent entity and users rely on a payment gateway to mark a

successful transaction. Suggested protocol uses symmetric keys, Digital certificates X.509, and two-factor

authentication to make a secure financial deal. To prove the secrecy and authentication properties of the

protocol we have formally verified it by AVISPA.

1 INTRODUCTION

Over the years technology has covered every aspect

of human life and has transformed into a utility. Aim

of technology is to facilitate humans as much as

possible so it’s moving towards integrating real life

critical areas such as education, health, finance and

many others with emerging technologies (Chang,

2012). There has been so much overlapping among

various fields of IT that one cannot clearly

demarcate the boundary of any technology. So now

when we talk about throughput, efficiency and

security of any system we just can’t look at one

component, we have to take in account the share of

all modules involved in a finished product (Isaac,

2007). We need to utilize different technologies in a

way that they combine to give a better product. For

example online banking on Smart phones; both

mentioned technologies have benefits and problems

of their own so we efficiently incorporate both to

gain as much throughput as we can. On one hand it

benefits the users; and on the other hand there have

been evil elements involved which provide a greater

harm by exploiting the vulnerabilities of such

systems. Financial indiscretion in e-commerce is

becoming a major concern for individual users as

well as for the organizations worldwide. Cyber

criminals are gradually launching well-organized

and effective attacks by exploiting the vulnerabilities

in existing architectures (Ahamad, 2012).Taking in

account all the above facts, there is a need of a

secure e-commerce solution which does not only

facilitate users’ financial needs but also fulfils the

security parameters compulsory in any transaction.

To do that we have to accommodate many different

problems like mobility and ease of access for users

so we suggest a financial solution based on smart

phones (Kungpisdan,2004).Conventional financial

solution lack extensibility, openness, privacy, and

cost effectiveness (Liu, 2005). We realize that Smart

phones are prone to attacks too so if we want to use

them for financial transactions, we need a highly

efficient and secure design (Hamid, 2012)

For large multi-national organizations there are a

lot of business transactions within & outside the

organization which requires hardware tokens, PIN or

access codes to acquire the resource (Avalle, 2014).

What if personal information of an employee is

stolen or one of the insiders tries to exploit the

system weaknesses like stolen card information or

387

Sultan S., Abbasi A., Shibli A. and Nasir A..

Secure Protocol for Financial Transactions Using Smartphones - SPFT - Formally Proved by AVISPA.

DOI: 10.5220/0005059903870392

In Proceedings of the 11th International Conference on Security and Cryptography (SECRYPT-2014), pages 387-392

ISBN: 978-989-758-045-1

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

mobile devices. So why not make the whole

organization transactions and resources strictly need

to know basis and anonymous (Vilmos, 2003) which

are highly secure and easy to use. So we recommend

a financial solution that does not require hardware

tokens or physical presence and is based on smart

phones focusing on close networks.

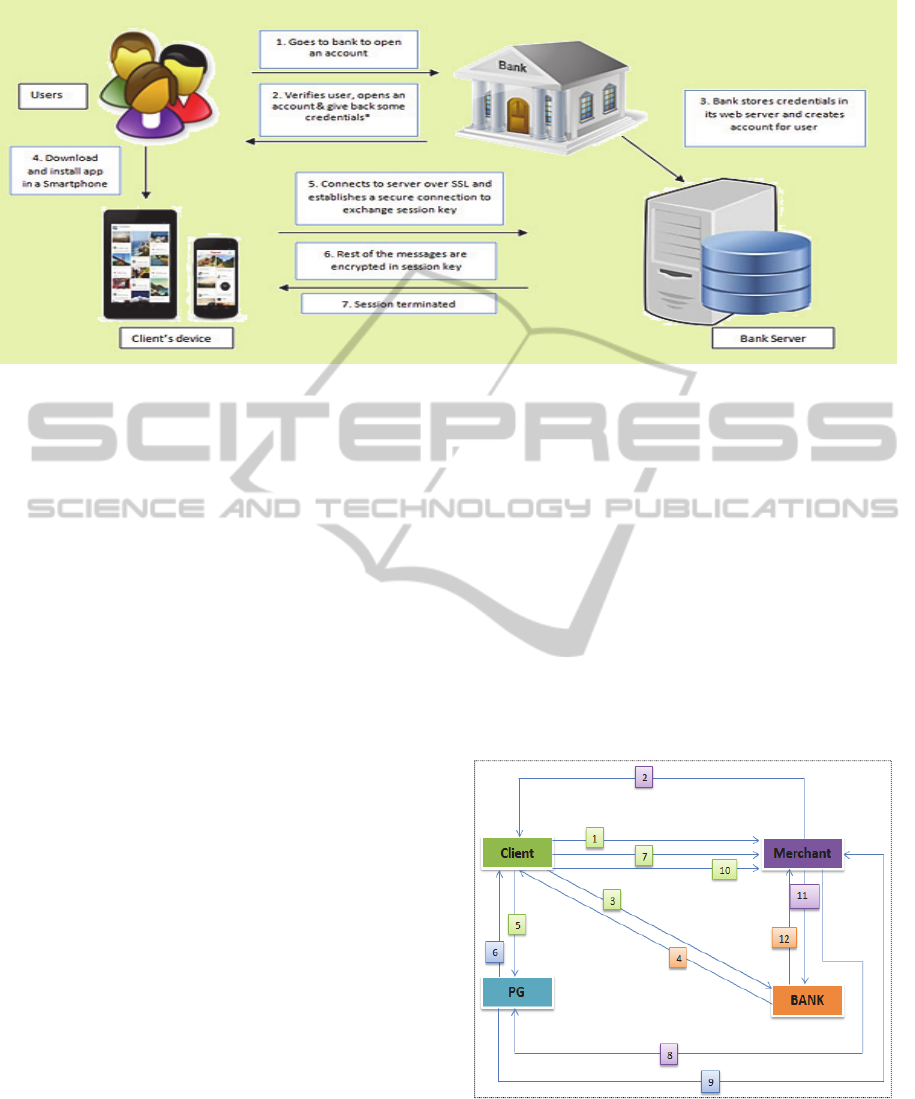

We propose a Secure Protocol for Financial

Transactions SPFT- based on smart phones. All

transactions are performed by smartphone and a user

does not have to carry cash or cards. Entities

involved in a process are; Client-C, Merchant-M,

Bank- B, Payment Gateway– PG.SPFT ensures

privacy, authentication and integrity of all entities,

provides anonymity and mechanism to resolve

disputes and is formally tested before

implementation. And to achieve that we have used

low cryptographic operations, less reliance on banks,

an honest payment gateway, Digital Certificate &

time stamping (

Xueming,2009). Formal techniques

are an efficient way to verify the security

specifications of a system. We have formalized the

authentication and secrecy properties of our protocol

(Avalle, 2014). We have verified the protocol by an

automated verification tool AVISPA.

The paper is organized as follow: Section 2

deliberates the related work. Section 3 discusses our

contribution which is a proposed protocol. Section 4

verifies the protocol via AVISPA, Section 5

accomplishes the conclusion and future work and

Section 6 states the references

2 RELATED WORK

Several protocols have been offered in past few

years for outfitting the need of payments via mobile

devices or smartphone. Significant ones are given

below: In (Kungpisdan, 2004) they addressed the

limitations of mobile devices i.e., lower

computational power & less storage space so they

proposed a secure account based mobile payment

protocol. Protocol is composed of two sub protocols,

one is merchant registration and other is called

payment protocol. In former client is registered to

merchant and its issuer while merchant gets

registered to payment gateway, in later client and

merchant communicate order and transaction details

and share with the payment gateway. Party

authentication, Transaction privacy & Transaction

integrity is ensured by credit card info, symmetric

key and MAC respectively. Third parties are a

necessary evil in financial services; they pose

privacy threats and unsolved repudiation conflicts,

(Liu, 2005) authors have suggested that with the

introduction of time stamping server and data center

this can be resolved. If all-inclusive confirmations

route via data center and all transactions carry a

signature time stamp then non-repudiation can be

achieved while privacy is achieved by reserving the

user info at user payment processor and doesn’t

travel with the transaction messages. Most of the

protocols work on a principle that all entities in a

system have internet access all the time so (T´ellez,

2007) designed a new protocol which caters the

problem when merchant can’t directly connect with

the client. Finance is always linked with banks so

they have complete control over all transactions

(Vilmos, 2003) but it can be shifted to different

entities like mobile network operators MNO for

better performance. Proposed solution (SEMOPS) is

built on credit push concept, Merchant provides

customer with specific data that can identify the

merchant & particular transaction, and client

remains anonymous throughout the process.

Customer receives the data combines with his

information authorizes it and sends to the payment

processor (can be bank or MNO). In current state

SEMOPS uses a large number of computations

which consumes a lot of mobile’s resources so

(Hamid, 2012) presents a light & secure mobile

payment system based on SEMOPS. In SIP

enhanced SEMOPS, SIP sessions are established

between associated parties to isolate different

communications between respective entities and for

signing they have used ECC (elliptic curve

cryptography) instead of RSA accomplishing higher

security with smaller key size. They have used PIN,

nonce & OTPs for mutual authentication, session

keys for privacy, PKI for integrity & non-

repudiation. Now after studying different approaches

(Xueming, 2009) logical approach will be to merge

the developments into one framework that will be

beneficial in developing a new mobile payment

method which will be more secure, flexible and

convenient assuring anonymity, non-repudiation,

confidentiality & integrity. (Avalle, 2014) Formal

methods are an effective way to verify system

specification, and are being largely used for the

verification of security protocols.

Formal methods are going towards computational

model for verifying different protocols for which

many tools are available like CryptoVerif, Athena,

TAPS, ProVerif, FDR, AVISPA etc. We have

chosen AVISPA due to its adaptability to verify

different security parameters like secrecy,

authentication, proof of origin and accountability.

SECRYPT2014-InternationalConferenceonSecurityandCryptography

388

Figure 1: Architecture Diagram - SPFT.

3 OUR CONTRIBUTION

SPFT is a smartphone based payment system for

close network. Now -a- days smart phones have

become a daily life necessity, there are all those

applications which have made phones a single unit

to handle most of the chores like utility bills, online

financial transactions e.g., what we propose is to

make it more convenient that it eliminates the use of

paper money in a close environment (cafeteria bills,

buying/selling, pays) like big organizations. An

application that can control daily life small or big

transactions just with few clicks and does not have

to keep trail of paper money on daily basis. The

protocol is based on conventional actors’ i.e.,

customer, merchant, payment gateway & a financial

intuition. What is different is the kind of access

these parties have with each other, bank is always

thought to be a close system, in this protocol it’s not.

All parties will be completely transparent; there will

be no transaction trails and anonymity will be

preserved.

3.1 Proposed Solution

The proposed protocol comprises of following steps:

1) All users (customer & merchants) get

registered with the financial institution. Users

get their usernames & passwords to access the

service along with a unique master key shared

with bank and every user

2) User logs in to the system, views the multi-

merchant multi services and choses a service

he wants to avail and puts an order request to

merchant. Every service has unique ID (e.g.

café: 01, printer: 02) and then further every

item has a unique ID (tea: 02, coffee: 04) etc.

3) Merchant receives the requests and reserves

the order and replies to user with a vending-

token. The vending token has item and price

info (not item id)encrypted with sessionKey

CM

while an additional token for bank which only

has price info signed by banks public key and

then merchant private key user will 1

st

peel of

merchant’s seal and verifies the hash which

will prove that it came from the merchant

Figure 2: Flow Diagram.

4) User accesses his bank account, requests the

money equivalent to {Price} amount form the

account. {Price} passed to bank is signed by

bank’s public key

SecureProtocolforFinancialTransactionsUsingSmartphones-SPFT-FormallyProvedbyAVISPA

389

5) Bank checks 1

st

if user is legit and requested

funds are available then it generates a

purchase- ticket and reserves that money from

the users account and sends a sms/email

confirmation to user.

6) Bank sends the ticket to client enveloped in a

session key

7) Client with an addition of session key sends to

payment gateway to envelope it with two keys

i.e. two man rule and payment gateway

generates a new ticket which is in actual the

old ticket locked by two keys and signs the

original ticket. Bank deducts money from the

account and keeps with him for safe keeping so

conflicts don’t occur, bank cant access this

money until its authorized by payment gateway

8) Payment gateway replies user with TICKET2,

PIN enveloped in Client’s public key so only

client can access it and a hash of PIN signed by

payment gateway to check if it is authentic or

not

9) Client sends a TOKEN and TICKET2 to

merchant enveloped in a session Key shared

between merchant and client

10) Merchant then sends a TICKET ID to payment

gateway to request for OTP related to this ID

11) Payment gateway replies user with a TICKET

ID, OTP encrypted by Merchant’s public key

so only he can access it, hash of PIN and OTP

both signed by payment for verification and all

above are enveloped in a message encrypted

by a session key

12) Client sends TICKET ID and PIN relative to

that ID encrypted in merchant’s public key and

whole enveloped with session key

13) Merchant unlocks the ticket2 from OTP and

then by the PIN sent to him by the client after

receiving product

14) Bank transfers the amount reserved by token to

merchant’s account and sends merchant a

conformation message

3.2 Notation Scheme

For conventional actors C- client, M- merchant, B-

bank and PG-payment gateway is used while for

public key

PB

prefix and for private key

PR

is used

Table 1: Notation table followed in protocol.

Symbols Definition

TransactionID

Unique ID for specific transaction

ItemID

Unique ID for specific item

provided by related service

ServiceID

Unique ID for specific service

provided by merchant

TOKEN

Token ID, Item (description +

price)

HASH1

sha256(TransactionID, ItemInfo,

Price)

HASH2 sha256 (PIN)

HASH3 sha256 (OTP)

HASH4

sha256({Digital money} B

PU

)

TICKET1

TICKET ID, {Digital money} B

PU

,

[HASH4] B

PR

,

timestamp

TICKET2

TICKETID,{{Digital money} B

PU

}PIN}OTP, timestamp

MasterKey

Master key shared between two

entities

sessionKey

Session key shared between two

entities

CM

shared between client & merchant

CB

shared between client & bank

MB

shared between bank & merchant

CT

shared between client & ticket

checker/payment gateway

ItemInfo

Item description + its price

3.3 Protocol in Alice-Bob Notation

Registration process:

A. U B:{name, email ID, Cell No, DoB ,

username} B

PU

B. B U:{userID, password ,MasterKey

CB

}

Payment process:

1. C M : {TransactionID, ServiceID ,ItemID,

n1 , sessionKey

CM

} M

PU

2. M C : {TransactionID ,TOKEN,

{Price}B

PU

, [Hash1]M

PR

} sessionKey

CM

3. C B : { userID, password, {Price}B

PU,

sessionKey

CB

} MasterKey

CB

4. B C : { TICKET1} sessionKey

CB

5. C PG: { TICKET1, sessionKey

CT

} PG

PU

6. PG C : { TICKET2, {PIN} C

PU,

[HASH2]

PG

PR

} sessionKey

CT

7. C M : {TOKEN ,TICKET2 } sessionKey

CM

8. M PG: { TICKETID, sessionKey

MT

} PG

PU

9. PG M: { TICKETID ,{OTP} M

PU,

[HASH3]PG

PR,

[HASH2] PG

PR

} sessionKey

MT

SECRYPT2014-InternationalConferenceonSecurityandCryptography

390

10. C M: { TICKETID, [PIN] M

PU

}

sessionKey

CM

11. M B : {TICKET1} MasterKey

MB

B M : { TICKETID, Conform Message} 12.

M

PU

4 ANALYSIS USING AVISPA

It is an automation tool to validate security

protocols. Protocols that need to be verified against

properties like (secrecy, authentication, proof of

origin etc.) are written in a specification language

HLPSL. AVISPA at back-end works on principles

of formal methods like model checking to achieve

security goals and exemplify threat models. It covers

four back-end practices; OFMC (on the fly model-

checker), CL-AtSe (attack searcher), SATMC (SAT

model checker) and TA4MC (automata based

protocol analyser). We have tested the proposed

protocol with first two techniques

4.1 Program Code

Code written in HLPSL (modelling language for

AVISPA) will be provided on request

4.2 Attacks

There are three major concerns for any protocol

when seen from the security perspective, Secrecy,

authentication and integrity. We have analysed the

protocols from these three viewpoints in AVISPA

4.2.1 Secrecy

Most important parameter in financial transaction is

the secrecy of transaction details and privacy of

user’s personal information. In our protocol we have

put secrecy check on critical points when modelling

in AVISPA e.g.

I. secret(SessionKeyCM',purchase_order,{C,

M})

II. secret(SessionKeyCB',sessioncb, {C,B})

III. secret(SessionKeyCP,sessioncp, {C,P})

IV. secret(OTP,otp, {C,P})

These are some security goals written in AVISPA

format to check if the session keys and OTP are

secure or they have been compromised during the

protocol. They have all given SAFE results which

means there is no information leakage

4.2.2 Authentication

Authentication is a property which ensures that both

parties are what they are posing to be; actually it is

to develop a trust to communicate with each other.

Assuming that digital certificates haven’t been

compromised when any party digitally signs

something it assures that the certain thing belongs to

that party. In code below hash messages have been

digitally signed to confirm authentication and proof

of origin e.g.

I. RCV({TICKETID'.{DigMoney'}_inv(Sign

K_B)}_SessionKeyCB')

II. RCV({(TOKENID.ItemInfo.Price).(TICKE

TID'.{{{DigMoney'}_inv(SignK_B)}_PIN'

}_OTP').h(PIN)}_SessionKeyCM)

In above code statements message parameter {

Digital Money} is digitally signed by Bank’s private

key, which shows that certain message came from

Bank that can be verified by decrypting the message

by bank’s public key

4.2.3 Integrity

This property ensures that data has not been altered

or destroyed, and mostly its proved by the use of

hashes. In our protocol we have attached a digitally

signed hash of a message with itself to certify the

integrity of message itself. e.g.

I. SND({TransID'.(TOKENID'.ItemInfo.{Pric

e}_SignK_B).{h(TransID'.Price.ItemInfo

)}_inv(SignK_M)}_SessionKeyCM')

II. SND({(TOKENID.ItemInfo.Price).(TICKE

TID'.{{{DigMoney'}_inv(SignK_B)}_PIN'

}_OTP').h(PIN)}_SessionKeyCM)

In first message hash of (TransID +Price

+ItemInfo) is digitally signed by merchant public

key, now if anyone tries to alter the ID or price in

any of the message, this hash won’t be equal to the

hash calculated of the alter values which will show

that data in transition has been tempered with and

that transaction will be dropped

4.3 Results

Results of two AVISPA back-end formal methods

on above protocol is as follow

4.3.1 OFMC

OFMC practices several symbolic techniques to

symbolize the state-space. OFMC is used to prove

the falsification of protocols by finding efficient

SecureProtocolforFinancialTransactionsUsingSmartphones-SPFT-FormallyProvedbyAVISPA

391

attacks on them and also for the verification. i.e., for

proving the protocol correct in certain situations for

bounded number of sessions. Output generated by

OFMC for SPFT in AVISPA is as follow:

% OFMC GOAL - as specified

BACKEND OFMC

STATISTICS

parseTime: 0.00s

searchTime: 0.53s

visitedNodes: 73 nodes

depth: 14 plies

4.3.2 ATSE

It’s a constraint based attack searcher works on the

principle of reducing redundant data. It translates the

protocol in such specific language which can be

useful to effectively find attacks on protocol. Output

of our protocol is:

GOAL As Specified

BACKEND CL-AtSe

STATISTICS

Analysed : 55 states

Reachable: 20 states

Translation: 0.13 seconds

Computation: 0.00 seconds

5 CONCLUSIONS AND FUTURE

WORK

We have suggested a radical secure payment

protocol to make daily life transactions easy and

secure for users, where client and merchant does not

need to blindly rely on financial service providers.

Each entity has a part of whole transaction; all

entities need to put their part to make an effective

transaction. Client’s identity is hidden from

merchant and bank does not need to know what is

bought. Client places a request with merchant and

requests bank to reserve money for specific deal

after it is routed to the payment gateway to look over

the transaction and locks the digital money by two-

factor authentication and authorizes both parties to

complete the transaction. After conformation by

both client and merchant, funds are transferred to the

merchant’s account. It fulfills all the security

parameters required in a payment protocol like

secrecy, authentication and conflict resolution and to

prove this we have formally tested the code by

AVISPA.

For future work we will modify the protocol

involving two different banks and formally prove it

by Model checking to draw the comparison and to

employ it in a cloud environment. As an end result,

we state that suggested protocol is flexible and

extensible to all environments. Besides it also

ensures the secrecy of personal information as well

as the anonymity of user

REFERENCES

Kungpisdan, S., Srinivasan, B., and Dung Le. P., 2004. “A

Secure Account-Based Mobile Payment Protocol” In

(ITCC’04), Proceedings of the International

Conference on Information Technology: Coding and

Computing

Liu, J., Liao, J., Zhu, X., 2005. “A System Model and

Protocol for Mobile Payment” .In (ICEBE’05),

Proceedings of the IEEE International Conference on

e-Business Engineering

T´ellez, J., Camara, J., 2007. “An Anonymous Account-

Based Mobile Payment Protocol for a Restricted

Connectivity Scenario” In (DEXA’03), 18th

International Workshop on Database and Expert

Systems Applications

Vilmos, A., Karnouskos, S., 2003. “SEMOPS: Design of

a new payment service” In 14

th

international

workshop on Database & Expert Systems Applications

Abdel-Hamid, A., Badway, O., Aboud, M., 2012.

“SEMOPS+SIP+ECC: Enhanced secure mobile

payments” In (INFOS2012), 8

th

international

conference on Informatics & systems

Xueming, W., Nan, C., 2009. “Research of security

mobile payment protocol in communication restriction

scenarios”. In international conference on

computational intelligence & security

Chang, C., Yang.J., Chang,k., 2012. "An Efficient and

Flexible Mobile Payment Protocol”. In (ICGEC

’12) Genetic and Evolutionary Computing (ICGEC),

2012 Sixth International Conference

Ahamad, S., Sastry, N., Udgata, K., 2012. "Enhanced

Mobile SET Protocol with Formal Verification”. In

(ICCCT ‘12), Third International Conference of

Computer and Communication Technology

Isaac, J., Camara, J, 2007. "An Anonymous Account-Based

Mobile Payment Protocol for a Restricted

Connectivity Scenario," In (DEXA '07) Database and

Expert Systems Applications

Avalle, M., Pironti, A., Sisto, R., 2014. "Formal

verification of security protocol implementations: a

survey". Journal of Formal Aspects of Computing

Volume 26, Issue 1, pp 99-123 2014

Secure Electronic Transaction (SET) Protocol,

http://www.isaca.org/Journal/Past-

Issues/2000/Volume-6/Pages/Secure-Electronic-

Transaction-SET-Protocol.aspx

SECRYPT2014-InternationalConferenceonSecurityandCryptography

392