Combining Different Computational Techniques in the Development

of Financial Prediction Models

A. J. Hoffman

School of Electrical, Electronic and Computer Engineering, North-West University, Potchefstroom, South Africa

Keywords: Neural Networks, Linear Regression, Histograms, Financial Time Series, Prediction, Portfolio Management.

Abstract: The prediction of financial time series to enable improved portfolio management is a complex topic that has

been widely researched. Modelling challenges include the high level of noise present in the signals, the

need to accurately model extreme rather than average behaviour, the inherent non-linearity of relationships

between explanatory and predicted variables and the need to predict the future behaviour of a large number

of independent investment instruments that must be considered for inclusion into a well-diversified

portfolio. This paper demonstrates that linear time series prediction does not offer the ability to develop

reliable prediction models, due to the inherently non-linear nature of the relationship between explanatory

and predicted variables. It is shown that the results of histogram based sorting techniques can be used to

guide the selection of suitable variables to be included in the development of a neural network model. We

find that multivariate neural network models can outperform the best models using only a single explanatory

variable. We furthermore demonstrate that the stochastic nature of the signals can be addressed by training

common models for a number of similar instruments which forces the neural network to model the

underlying relationships rather than the noise in the signals.

1 INTRODUCTION

The prediction of financial time series is a topic that

has been widely researched (Fama and French,

2008; Altay et al, 2005, Alcock et al, 2005 and

many others). Modelling the future behaviour of

financial time-series is a non-trivial task as the

process of the formation of market prices is

influenced by many factors, some of these being

unknown to the researcher, making it impossible to

construct an exact model based on known

underlying relationships. To a large extent an

empirical process must therefore be followed.

Many techniques have been developed for the

fitting of empirical models to complex data sets,

including multiple regression and neural networks

(Bishop, 1996). In the case of financial time series

this is complicated by several factors. Firstly it is

not known which explanatory variables would be the

most suited amongst a large set of candidates. It is

however of critical importance to limit the model

inputs to the smallest possible number, as all

empirical modelling techniques suffer from the

‘curse of dimensionality’ (Bishop, 1995) – too many

input variables translate into too much modelling

capacity, resulting in a model that is fitted to the

noise in the training set and that do not generalize

well in an out-of-sample test set.

The second challenge is closely related to the

first: in order to ensure good generalization

properties the number of observations available in

the training set must be large compared to the

number of degrees of freedom offered by the model.

The number of training samples available for a

single financial instrument may however be limited:

one may be limited to training sets with less than

100 samples per instrument, as explained later in this

paper. If a multivariate neural model is trained the

number of degrees of freedom may be more than 50;

given the noisy nature of the signals a model trained

on so little data is almost guaranteed to train mostly

on the noise in the training set and hence not to

generalize well outside of the training set.

A third challenge is the fact that, in the case of

portfolio return maximization, one needs to select

those investment instruments that will display

extreme return behaviour. As regression techniques

tend to model the average behaviour of input-output

relationships, the accuracy of such a model may be

very bad for extreme behaviour, specifically if the

276

Hoffman A..

Combining Different Computational Techniques in the Development of Financial Prediction Models.

DOI: 10.5220/0005136502760281

In Proceedings of the International Conference on Neural Computation Theory and Applications (NCTA-2014), pages 276-281

ISBN: 978-989-758-054-3

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

relationship is not linear, as will be demonstrated

through an example later in this paper.

Some of the most consistent techniques for

selecting investment instruments are based on

histogram techniques that involves the ranking and

sorting of instruments with respect to one or more

explanatory variables (Fama and French, 2008).

While this approach has the benefit of simplicity and

of averaging out most of the noise in the time series

behaviour, it is limited to the modelling of simple

relationships and to the use of only a small number

of simultaneous input variables.

Results claimed for the successful application of

linear regression and neural network techniques to

financial time series have mostly been applied either

to a small number of instruments or to the modelling

of stock indices only (e.g. Altay et al); such results

may however not work equally well to support a

portfolio management approach that requires the

modelling of a large number of instruments to be

considered for return maximization combined with a

sufficient level of diversification.

There is hence a need to develop a technique for

reliably modelling the expected return behaviour of

a large number of individual instruments, typically

all stocks listed on an exchange. It is the purpose of

this paper to demonstrate a method that combines

the capabilities of several modelling techniques and

that can represent general return behaviour observed

on an exchange.

The rest of the paper is organized as follows:

section 2 provides a brief literature survey, while

sections 3 and 4 describe the results obtained using

histogram and linear regression techniques. In

section 5 we describe the methodology used to

develop a neural network model that overcomes

several of the limitation of the prior techniques.

Section 6 provides an overview of the most

important results obtained, while section 7 concludes

and makes recommendations about future work.

2 LITERATURE OVERVIEW

There has been much fundamental debate in

literature about the predictability of financial time

series, and more specifically of stock returns (Blasco

et al, 1997; Kluppelberg et al, 2002). Initial views

in favour of the efficient market hypothesis stated

that stock prices already reflect all available

knowledge about that stock, making the prediction

of stock returns to earn abnormal returns on a

portfolio impossible in principle. Much has

however been published in recent years confounding

those early views, and today it is widely accepted

that the strong form of market efficiency does not

hold up in practice (Fama and French, 2004).

Many studies have demonstrated the ability of

both linear and non-linear time series prediction

models to predict future stock behaviour, contrary to

earlier beliefs that the market behaviour should be

described as a random walk model (Lorek et al,

1983; Altay and Satman, 2005; Bekiros, 2007; Jasic

and Wood, 2004; Huang et al, 2007).

3 HISTOGRAM TECHNIQUES

The most direct approach to uncover the ability of an

explanatory variable to predict future returns is to

sort the available set of instruments based on the

value of the explanatory variable. This technique

has been used successfully by Fama and French

(2008) to identify a set of fundamental and technical

variables that can explain so-called anomalous

future stock returns. The technique involves the

periodic ranking of stocks based on the values of

each of the explanatory variables. The ranked stocks

are then sorted into a number of bins and the average

returns of the stocks in each bin are calculated to

provide periodic sorted returns for the set of stocks

under consideration. The set of sorted returns

effectively represents the histogram of returns with

respect to the sorting variable.

Based on previous results (Hoffman, 2012) we

considered the following set of sorting variables:

MC (log of market capitalization);

One month return over last month (Ret1(-1);

Momentum (12 month accumulated returns);

BtoM (book-to-market equity ratio);

DO (detrended oscillator, variable used to detect

the onset of upward or downward movements);

1 month (Ret1_Sector) and 12 month

(Ret12_Sector) returns of the sector from which

the stock originated.

Results obtained with the sorting of stocks listed

on the Johannesburg Stock Exchange (JSE) using 5

sorting bins are shown in table 1 below. By

calculating the t-statistics of the sorted returns it can

be determined whether the deviations in returns

between bins are statistically significant. If a hedged

portfolio is formed long positions will be taken in

stocks in the highest sorted bin and short positions

for stocks in the lowest sorted bin.

CombiningDifferentComputationalTechniquesintheDevelopmentofFinancialPredictionModels

277

Table 1: Sorted monthly returns of explanatory variables.

SortedBin

1 2 3 4 5

MC

0.76% 0.21% 0.48% 0.51% 0.08%

Momentum

‐0.60% 0.05% 0.31% 0.62% 1.56%

Ret1(‐1)

0.64% 0.59% 0.84% 0.77% 1.19%

BtoM

‐0.48% 0.13% 0.69% 0.42% 1.22%

YtoB

‐0.42% 0.48% 0.90% 0.60% 0.45%

DO_Value

‐0.62% 0.08% 0.27% 0.82% 1.39%

DO_Ret

‐0.42% 0.33% 0.47% 0.64% 0.95%

R1_Sector

‐0.11% 0.15% 0.28% 0.59% 1.06%

R12_Sector

‐0.05%‐0.10% 0.41% 0.78% 0.94%

Histograms rely on the averaging effect over all

sorted items to eliminate noise specific to individual

item properties and to retain only common aspects

of behaviour; an accurate reflection of the

underlying relationship is obtained only if there are a

significant number of items in each sorted bin. On a

smaller exchange like the JSE the total number of

listed stocks is approximately 400. Should two

sorting variables and five bins be used the number of

items in each of the 25 bins will be approximately

16, which is already marginal in terms of the

standard deviation of the sorted means. This

demonstrates the inherent limitation of the histogram

technique to be used as multivariate model.

4 LINEAR REGRESSION

Linear regression is probably the most widely used

modelling technique to uncover empirical

relationships; it provides consistent results as, in

contrast to neural networks, exact statistical

formulas can be used for extracting the values of

linear regression coefficients that e.g. minimize the

sum-of-squared modelling errors. In the case of

financial time series different versions of so-called

ARMAX techniques can be used as a special version

of linear regression, with the ARMAX model chosen

depending of the type of autoregressive and moving

average relationships that are included into the

model, and whether extraneous variables are

included or not.

While linear regression has significant appeal

due to its simplicity, consistency and the limited

computational effort required to extract the linear

regression coefficients, it is limited to the modelling

of linear relationships. We will demonstrate the

fitting of a linear regression model to an inherently

non-linear relationship that was uncovered by a

sorting method, resulting in linear regression

predictions that are counter-productive.

Table 2 below provides results for the sorting of

1 month future returns using 12 month historic

returns as sorting variable. The sorting technique

produces a very useful hedge return of 1.82% on

average per month. The size of the t-statistics for

extreme bins also indicates a statistically significant

relationship. It can be seen that, while there is not a

strong relationship between input and output over

bins 2 to 4, the relationship seems to bend strongly

up- and downwards in bins 2 and 1 respectively,

indicative of a non-linear relationship. We extract a

linear regression model using 12 month historic

returns as input and one month future returns as

output variable and calculate the predicted and

residual returns, the latter defined as the difference

between the actual and predicted returns. By sorting

the stocks based on predicted returns we calculate

the average returns and residual predicted returns

within each sorted bin, as displayed in table 3 below.

Table 2: Sorted monthly returns using 12 monthly historic

returns as sorting variable.

BinNo 1 2 3 4 5

AveRet‐0.08% 0.60% 0.76% 0.98% 1.74%

tStat‐5.52‐1.34‐0.34 1.02 5.73

High‐Low 1.82%

Table 3: Sorted monthly returns and residual returns using

linear regression based predicted returns as sorting

variable.

BinNo 1 2 3 4 5

AveRet% 0.69 1.02 0.53 1.03 0.80

tStat‐0.77 1.27‐1.77 1.38‐0.09

High‐Low% 0.11

ResPredRet% 6.6 2.0‐0.1‐1.0‐4.6

tStat 42.8 12.7‐0.7‐6.3‐30.3

It can be seen that, in contrast to the direct

application of sorting to the explanatory variable, the

linear regression prediction produced almost zero

hedge returns. In this case the average linear

correlation between input and output variable was -

0.044, even though there is a strong positive

correlation between input and output for items in the

extreme bins. It is also clear that the residual returns

in the extreme bins have means that are distinctly

positive or negative respectively, which is indicative

of an inherently non-linear underlying relationship;

this is confirmed by the large t-statistics obtained in

the extreme bins. This simple example demonstrates

the limitations of using linear models to financial

time series prediction.

NCTA2014-InternationalConferenceonNeuralComputationTheoryandApplications

278

5 DEVELOPING A NEURAL

NETWORK MODEL

The most popular technique for modelling non-

linear empirical relationships is neural networks

(NNs), based on their ability to model relationships

of arbitrary nature using small number of model

parameters (Bishop, 1996). A number of key

decisions have to be made as part of the NN

development process. The first of these is to decide

whether to develop a separate NN for each

instrument, one NN for all instruments or a separate

NN for each category of instruments that are

believed to display similar behaviour. A second

decision involves the selection of input variables; as

the number of model inputs impacts the number of

degrees of freedom, and given the limited number of

training observations and the need to generalize

outside of the training set, this decision is closely

link to the first. A third decision is the length of

time history to be included into the training set:

making the training set as large as possible in order

to reduce the impact of noise may not be optimal in

other respects, as the underlying nature of the

relationships to be modelled may change over time.

The above choices depend on the available number

of training observations, the strength and stability of

the expected relationships and the degree to which it

is expected that different instruments will display

common behaviour. The expected complexity of the

relationships will dictate the neural architecture to be

implemented. The stability of the relationships

should determine the time span of training sets.

It is clear that there are a significant number of

options to choose from, resulting in a potentially

very large number of model permutations. Given

the relatively lengthy process to train a NN (which

typically includes training several networks for each

permutation, given the stochastic nature of the NN

training process) it is not practically possible to

exhaustively experiment with all possibilities. A

more productive approach is use sorting and linear

regression techniques to select those variables that

show potential for inclusion into a set of NN inputs,

and to determine the presence of non-linearities in

the relationships.

For the purpose of this exercise we considered

those candidate inputs that were found to possess

significant explanatory power to predict one month

returns based on ranking and sorting. We selected

market capitalization (MC) and book-to-market ratio

(BtoM) as the fundamental variables with the most

prominent explanatory power. In order to improve

upon the predictive abilities of these fundamental

inputs we considered several technical variables; at

monthly time scales the most prominent

relationships between past and future returns are

mean reversion in returns (Cubbins et al, 2006) and

momentum in returns (Fama and French, 2008). We

therefore add momentum and a detrended oscillator

to the set of inputs; the latter is a commonly used

technical indicator used to detect changes in the

current trend and that has been found to display

consistent positive relations with future returns

(Hoffman, 2012). We also add sector 1 and 12

month returns as additional extraneous variables.

In the case of JSE listed stocks we are limited to

less than 400 stocks at any given point in time, with

an available time history spanning between 20 and

25 years. We are therefore limited to maximum 250

to 300 monthly observations per stock. To allow the

calculation of variables like momentum, requiring a

history of 12 months, the training set must be further

reduced. In order to determine whether the model

development technique produces repeatable results

we furthermore have to repeat the model training

and prediction process over a period of at least 10

years to observe the impact of the different market

(bull and bear) cycles. It is hence clear that we will

be left with less than 100 training observations per

stock for every model training cycle. If we include 5

or more input features and several hidden nodes the

number of model degrees of freedom will range

between 30 and 60; 100 training samples is thus too

few to allow the extraction of a separate NN model

for each stock, given the stochastic nature of the

relationships to be modelled. We are therefore

forced to group stocks together in order to

accumulate sufficiently large training sets.

As observed from the sorted returns results, the

behaviour that should be profitable to exploit occurs

in the extreme sorted categories. We assist the

neural training process to focus primarily on extreme

behaviour by weighing the training sets unevenly:

we identify extreme observations (observations

where either the input or the target value falls into an

extreme sorted bin) and load the training set with a

disproportionate fraction of extreme observations to

ensure that ‘average’ observations will not dominate

the learning process.

For each model extraction cycle we select a

training set that spans over a maximum period of 5

years and construct a training set that contains

observations selected with equal probability from

the available time history of all stocks. A separate

test set is constructed using the same selection

techniques but spanning over a time period that

directly follows on the time period representing the

CombiningDifferentComputationalTechniquesintheDevelopmentofFinancialPredictionModels

279

training set. After training the model it is applied to

the training and test sets. The prediction results are

then allocated to the individual stocks so that the

predicted returns for each stock can be determined

for the next investment period. The predicted stock

returns are ranked and sorted and a hedge portfolio

is formed by going long in the highest sorted

category and short in the lowest sorted category.

The above process is repeated over the available

time window, and the average sorted return for each

bin over the available time period as well as the

hedge portfolio returns is calculated.

The success of this combined approach to model

development will be measured by comparing the

sorted returns generated by the prediction model

against the sorted returns generated by any of the

individual explanatory variables used in the original

sorted returns exercise, as well as with the results

obtained from using linear regression models.

6 RESULTS

We use stock returns calculated relative to a value

weighted market return – a model with no predictive

capability should therefore produce sorted returns

that do not significantly differ from zero. Variables

with hedged returns that are statistically significant

from zero are displayed in table 4 below.

Table 4: Sorted monthly hedged returns and t-statistics of

explanatory variables used as model inputs.

High‐Low H‐LtStat

MC ‐0.68% ‐4.7

Ret1(‐1) 0.55% 3.4

Momentum 2.16% 14.8

BtoM 1.71% 11.7

YtoB 0.87% 6.0

DO

_

Value 2.00% 13.7

DO_Ret 1.37% 9.4

Ret1_Sector 1.17% 8.0

Ret12

_

Sector 0.99% 6.8

Secondly we use the above set of variables as

inputs in a linear regression model to determine

whether a multivariate linear model can produce

predicted return results that are superior to the sorted

return results of the individual variables. The sorted

predicted returns and residual predicted returns are

displayed in table 5. It can be seen that the hedged

return produced by the linear regression model is

significantly lower than the hedged returns produced

by any of the variables used as regression inputs.

This failure of linear regression to capture the true

input-output relationship is confirmed by the large

residual returns in the extreme bins.

Table 5: Sorted monthly returns using linear regression

predicted returns as sorting variable.

SortedBin 1 2 3 4 5

AveRet% 0.32 0.08 0.37 0.40 0.70

tStat‐0.43‐2.08‐0.06 0.15 2.26

High‐Low% 0.39

H‐LtStat 2.69

ResPredRet% 12.9 2.0‐0.22‐2.0 12.5

tStat 94.52 14.68‐1.64‐14.6 91.50

Thirdly we develop neural network models using

the same set of input variables. We start with the

single input variable that produced the highest sorted

returns. Other variables are then considered for

addition; such additional variables are only retained

if the sorted hedged returns of the resulting

prediction model exceed that of the model excluding

that variable. We verify if the modelled

relationships display gradual changes over the range

of inputs values (as would be expected in practice),

rather than abrupt changes (as can easily be obtained

with neural models if insufficient regularization is

used). This was done by varying one input at a time

between its extreme values while maintaining the

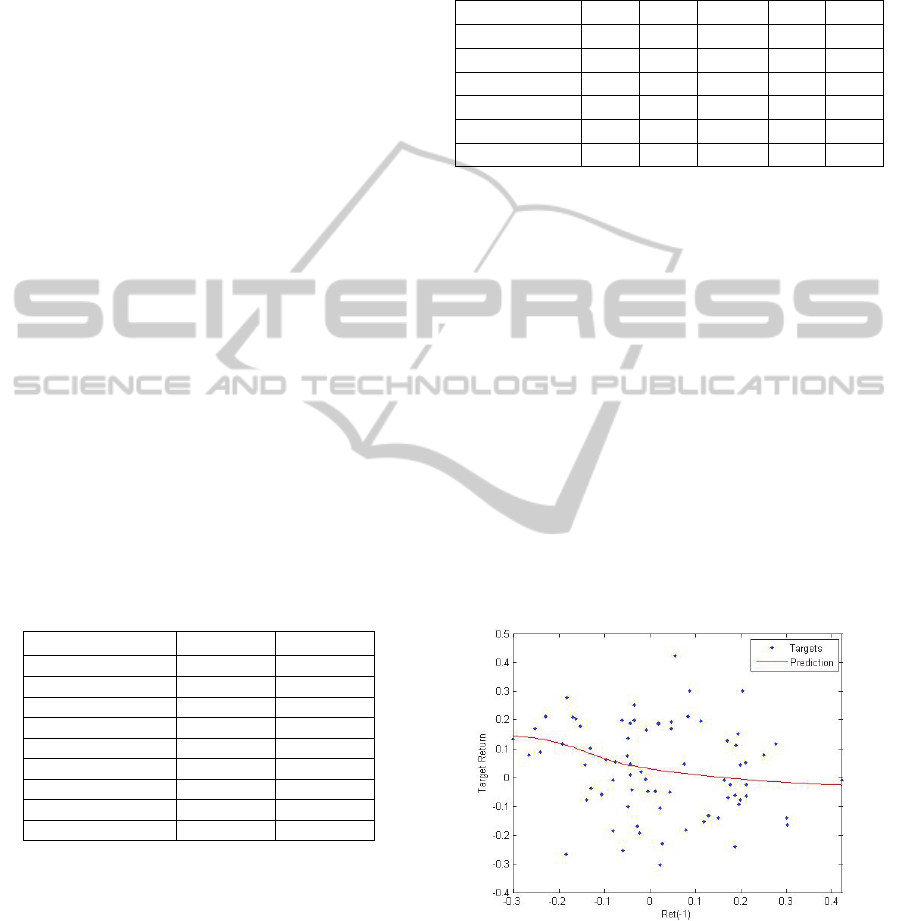

other inputs at their average values. One of the

modelled relationships is displayed in figure 1 below

– the relationship, however nonlinear, display

gradual changes over the ranges of input values; this

provides additional confidence in the model.

Figure 1: Typical input-target variable scatter plot and

neural network prediction.

The sorted returns as well as the High-Low

hedged returns using the NN prediction as sorting

variable are displayed in table 6 below. It is clear

that the neural model produce results that are

superior to the results of any of the individual

NCTA2014-InternationalConferenceonNeuralComputationTheoryandApplications

280

explanatory variables. Whereas the largest average

monthly hedged return for a single variable is

2.15%, the best neural model produced hedged

returns of 3.35% per month, which translates to an

annual return of approximately 48% relative to the

market return. This is a very significant result, given

that in practice the best stock based investment

funds seldom outperforms the market by more than

8-10 % per annum. It can furthermore be seen that

the residual returns are spread much more evenly

across all sorted bins, in contrast to the results

obtained using linear regression. This means that

the neural network model was able to effectively

capture the inherent non-linearity in the input-output

relationships.

Table 6: Sorted monthly returns and residual returns using

neural network predicted returns as sorting variable.

SortedBin 1 2 3 4 5

AveRet%‐1.27 0.03 0.40 0.67 2.08

tStat‐11.37‐2.45 0.15 1.98 11.62

High‐Low% 3.35%

H‐LtStat 22.98

AveResRet%‐1.03‐0.71‐0.34 0.05 1.62

tStat‐7.57‐5.24‐2.48 0.39 11.87

7 CONCLUSIONS

In this paper we demonstrated the value of

combining several different computational

techniques in an integrated methodology. We

described the results that can be obtained by ranking

and sorting returns as well as by using linear

regression techniques, and demonstrated that while

being useful, both approaches have specific

limitations. We then combined these techniques

with neural networks to exploit the non-linearities in

the relationships that were uncovered. Neural

network models were trained taking into account the

fact that stocks are selected to exploit extreme rather

than average behaviour. The methodology was

subjected to rigorous testing for all stocks forming

part of the JSE and over a period of approximately

20 years. The resulting multivariate NN model

produced significantly superior results compared to

any of the variables on their own.

In contrast to earlier work our results represent

the performance obtained by equally considering all

stocks available on the JSE, using explanatory

variables that have been demonstrated before to each

possess predictive power in their own right, and

applying the same stock selection methodology over

a period of more than 20 years that contains several

bull and bear cycles. We can therefore conclude that

multivariate NN models can outperform single input

sorting techniques as well as multivariate linear

regression techniques. It is furthermore clear that

each important model development decision must be

based on a solid understanding not only of the

modelling techniques used but also of the

application domain, in this case portfolio

management.

Future work will involve the expansion of the

same methodology to different categories of stocks,

as well as to decision making on a daily rather than a

monthly basis.

REFERENCES

Alcock, J., Gray, P., June 2005. Forecasting stock returns

using model-selection criteria. In The Economic

Record, 81(253).

Altay, E., Satman, M. K., Stock market forecasting:

artificial neural network and linear regression

comparison in an emerging market, 2005. In Journal

of Financial Management and Analysis, 18(2).

Bekiros, S. D., 2007. A neurofuzzy model for stock

market trading. In Applied Economics Letters, Vol. 14.

Bishop, C. M., Neural networks for pattern recognition,

Clarendon Press, 1995.

Blasco, N., Del Rio, C., Santamaria, R., The random walk

hypothesis in the Spanish stock market: 1980-1992.

June 1997. In Journal of Business Finance and

Accounting, 24(5).

Cubbins E, Eidne M, Firer C and Gilbert E. 2006. Mean

reversion on the JSE. Investment Analysts Journal, 63:

39 – 48.

Fama, E. F., French, K. R., 2004. The Capital Asset

Pricing Model: Theory and Evidence. In Journal of

Economic Perspectives, 18(3).

Fama, E. F., French, K. R., August 2008. Dissecting

Anomalies. In The Journal of Finance, LXIII(4).

Hoffman, A. J., 2012, Stock return anomalies: evidence

from the Johannesburg Stock Exchange. In Investment

Analysts Journal, No. 75, pp. 17-37.

Huang, W. et al, 2007. Neural networks in finance and

economic forecasting. In International Journal of

Information Technology and Decision Making, 6(1).

Jasic, T., Wood, D. 2004. The profitability of daily stock

market indices trades based on neural network

predictions. In Applied Financial Economics, 14.

Kluppelberg, C. et al, 2002. Testing for reduction to

random walk in autoregressive conditional

heteroskedasticity models. In Econometrics Journal,

5, pp. 387-416.

Lorek, K. S. et al, 1983. Further descriptive and predictive

evidence on alternative time-series models for

quarterly earnings. In Journal of Accounting Research,

21(1).

CombiningDifferentComputationalTechniquesintheDevelopmentofFinancialPredictionModels

281