Uncertainty Modeling in the Process of SMEs Financial Mechanism

Using Intuitionistic Fuzzy Estimations

George L. Shahpazov, Lyubka A. Doukovska and Vassia K. Atanassova

Institute of Information and Communication Technologies, Bulgarian Academy of Sciences,

Acad. G. Bonchev str., bl. 2, 1113 Sofia, Bulgaria

atlhemus@abv.bg, doukovska@iit.bas.bg, vassia.atanassova@gmail.com

Keywords: SMEs Financial Mechanism, Credit Risk, Creditworthiness, Intuitionistic Fuzzy Sets, i-Fuzzification.

Abstract: In the present paper, we discuss the mechanism of bank support of small and medium-sized enterprises

(SMEs). Analysis is made of the effectiveness of the bank’s internal financial structural unit and hierarchy,

and it is shown how the concept of intuitionistic fuzzy sets can be applied to the process of evaluating

creditworthiness of the SMEs applications for bank loans, from the bank’s perspective. The presented

approach aims to yield estimations of the effectiveness of the process, taking consideration of the aspects of

uncertainty, which is an inherent part of the processes of evaluation of applications for bank support and

evaluation of the process itself.

1 INTRODUCTION

Supporting emerging and present legal entities as

making a form of investment, such as financing

SME sector involves substantial risk in general and

particularly in emerging markets like Bulgaria. A

significant portion of this risks results from the lack

of business ethics in the market and a legislation,

which doesn’t support in particular this kind of

investments. Results published in paper (Shahpazov,

Doukovska, 2012), shows that the timing for

financial support in Bulgarian SMEs from the

manufacturing sector is perfect. The actual result

lays on deep analysis of the sector, which forecasted

a faster growth in the sector than local GDP growth

during a 5-8 year period spread.

Over the same period, the share of service sector

output in GDP is expected to raise from 61.5% -

63.4%.

Local agriculture sector is experiencing a boost

in the last few years, and falls under the program of

rehabilitation and modernization of value creating

industries, as the main focus is to overturn present

trade situation where the country imports more

goods than it exports. The overall aim is to utilize

the EU accession and its supportive instruments,

local Government programs assistance, and financial

institution involvement into accelerating growth

processes and SMEs further development.

The above mentioned facts allow us to look for

new techniques for intelligent analysis of the process

of SMEs financial mechanism.

In paper (Shahpazov, Doukovska, 2013), an

application of the apparatus of generalized nets is

proposed for modeling of the mechanism of

financial support of the SMEs.

The present work traces the most important steps

of the process of evaluation of a business project

proposal, applying for bank financing. It is a conti-

nuation of our previous research (Shahpazov,

Doukovska, 2013). The research model is offered

how the concept of intuitionistic fuzziness can be

applied to the process of evaluating creditworthiness

of the SMEs.

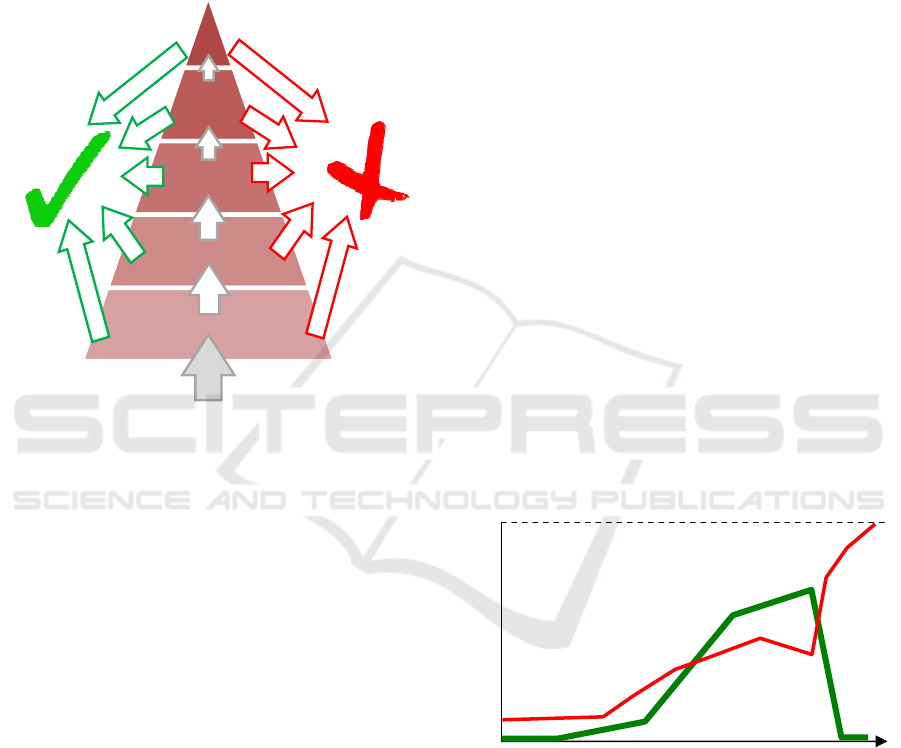

The evaluation follows a predefined hierarchy of

the levels of the bank’s decision makers, and

sophisticated policies and procedures.

For the needs of our discussion, we make a

relatively simple model, which takes into account

which levels of the bank hierarchy receive and

process the business applications for bank loans,

which levels make funding decisions, and in case of

uncertainty, which upper levels of the hierarchy are

these applications directed to, for taking a decision

at the higher level. This model is schematically

illustrated on Figure 1.

In this highly regulated process, for each level of

the bank’s decision making hierarchy, we are

interested to estimate and interpret in terms of

271

Shahpazov G., Doukovska L. and Atanassova V.

Uncertainty Modeling in the Process of SMEs Financial Mechanism Using Intuitionistic Fuzzy Estimations.

DOI: 10.5220/0005427002710275

In Proceedings of the Fourth International Symposium on Business Modeling and Software Design (BMSD 2014), pages 271-275

ISBN: 978-989-758-032-1

Copyright

c

2014 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

intuitionistic fuzzy sets the share of successfully

approved applications, the share of rejected app-

lications and the share of those applications, which

for various reasons, may exhibit certain uncertainty

(e.g. high risk / high return of investment) and thus

get forwarded from lower to upper level of bank

hierarchy, being a higher authority in the decision

making process.

Manage

ment

Board

Credit

Council

Headquarters

Bank Branch

Supervisory

Board

Accepted

applications

Rejected

a

pp

lications

Newapplication

Figure 1: Diagram of the process of bank loan applictions

review along the bank’s decision making hierarchy.

2 SHORT REMARKS ON

INTUITIONISTIC FUZZY SETS

Intuitionistic fuzzy sets (IFSs) were initially

proposed by Atanassov in 1983 (Atanassov, 1983;

Atanassov, 1986) as an extension of the concept of

fuzzy sets, introduced by Zadeh in 1965 (Zadeh,

1965). The theory of IFSs has been extensively

developed by the author in (Atanassov, 1991;

Atanassov, 2012) and further developed by many

other researchers worldwide.

In classical set theory, the membership of

elements in a set is evaluated binary terms as either

‘true’ or ‘false’: an element either belongs or does

not belong to the set. As an extension, fuzzy set

theory permits the gradual assessment of the mem-

bership of elements in a set; this is described with

the aid of a membership function valued in the real

unit interval [0, 1].

The theory of intuitionistic fuzzy sets further

extends both concepts by allowing the assessment of

the elements by two functions, µ for the degree of

membership and ν for the degree of non-mem-

bership, with which belong the element belongs to a

set, where both these degrees and their sum are

numbers in the [0, 1] - interval.

Speaking formally, if we have a fixed universe E

and A is a subset of E, we can construct the

intuitionistic fuzzy set A*, so that:

A* = {〈x, µ

A

(x), ν

A

(x)〉 | x ∈ E},

where 0 ≤ µ

A

(x), ν

A

(x), µ

A

(x) + ν

A

(x) ≤ 1. In the case

of strict inequality to the right, i.e.:

0 ≤ µ

A

(x) + ν

A

(x) < 1,

there is a non-negative complement of the sum of

membership and non-membership to 1, and this

complement is denoted by π

A

(x) = 1 – µ

A

(x) – ν

A

(x)

and usually called degree of uncertainty or hesitancy

margin.

IFSs represent a true generalization of fuzzy sets,

since in the partial case when the non-membership

function fully complements the membership func-

tion to 1, not leaving room for any degree of

uncertainty, is practically the case of fuzzy sets.

IFSs have different graphic representations, for

instance linear, which bears resemblance with the

graphic representation of fuzzy sets, radar-chart, or

triangular, which reflects the specifics of the IFS.

The standard linear graphic representation has the

form of Figure 2, where both functions µ and ν are

visualized as is.

Figure 2: Standard graphical interpretation of IFSs.

However, together with the standard linear

representation, a small modification of this graphics,

as shown in Figure 3, was introduced (Atanassov,

1991) representing not the exact function ν, but the

function ν* = 1 – ν. It plots the non-membership

function not in ‘bottom-up’ manner like the mem-

bership function µ, but in ‘top-down’ manner using

its mirror image. Thus, we can very already well

distinguish the formed in-between ‘belt of

uncertainty’, which for every x ∈ E complements the

μ

ν

1

0

x

∈

E

Fourth International Symposium on Business Modeling and Software Design

272

sum of µ

A

(x) and ν

A

(x) to 1. This modified linear

representation of IFSs is probably the one most often

used in practice.

Figure 3: Modified graphical interpretation of IFSs.

3 MAIN RESULTS

As we mentioned above, the process of evaluation of

every bank loan application passes through one or

more (rarely more than three) levels of the bank’s

decision making hierarchy. Usually the decision

about the approval or rejection of the applications is

taken on the Branch level or the Headquarters level,

however in certain cases when lower levels cannot

take a categorical decision, the application is sent to

the upper level.

Hence, it is of particular interest to trace the

degrees of acceptance, rejection and uncertainty in

taking the decisions on every bank hierarchy level,

and for this purpose we can use a simple i-fuzzifi-

cation procedure, analogous to the one given in

(Atanassova, 2013), where from crisp data sets we

can construct intuitionistic fuzzy data sets.

We can introduce intuitionistic fuzziness in these

estimations, using two possible schemes, which are

mathematically identical and can be used inter-

changeably, although visually they produce rather

different results. In both cases, we will denote the

levels of the bank’s decision making hierarchy with

the following denotations:

• Level 0 represents bank loan applicants,

• Level 1 is ‘Branch’ level,

• Level 2 is ‘Headquarters’ level,

• Level 3 is ‘Credit Council’ level,

• Level 4 is ‘Management Board’ level,

• Level 5 is ‘Supervisory Board’ level.

We will also agree to denote with µ

i

, ν

i

and π

i

respectively, the number of applications, which on

the i-th level are accepted, rejected or forwarded for

decision to the level (i + 1), and with t – the total

number of applications submitted for evaluation.

Obviously, in the top level of the Supervisory

Board, π

5

= 0, as all applications that have reached

this level must there get final resolution.

The whole process, interpreted in terms of IF

estimations can be graphically illustrated in the

following Figure 4.

µ

1

ν

1

π

1

µ

2

ν

2

π

2

µ

3

ν

3

π

3

µ

4

ν

4

π

4

µ

5

ν

5

All submitted

applications: t

Figure 4: IF estimations of the performance of the

different levels of decision making hierarchy during the

bank loan applications review process.

First Scheme of i-Fuzzification. In the first scheme

of i-fuzzification, on every level of the bank’s

decision making hierarchy, at a given moment of

time, we estimate what percentage of the total

number of submitted applications for evaluation

have been approved, and, respectively, hitherto

rejected. Let us denote these by

11

,,

ii

M

N i = 1, …, 5,

hence:

1

i

k

k

i

M

t

μ

=

=

∑

,

1

i

k

k

i

N

t

ν

=

=

∑

.

Second Scheme of i-Fuzzification. In the second

scheme of i-fuzzification, on every level of the

bank’s decision making hierarchy, at a given

moment of time, we estimate what percentage of the

applications for evaluation, received from the lower

level are approved, and, respectively, rejected, on

that level. Let us denote these by

22

,,

ii

M

N i = 1, …,

5, hence:

2

1

i

i

i

M

μ

π

−

=

,

2

1

i

i

i

N

ν

π

−

=

.

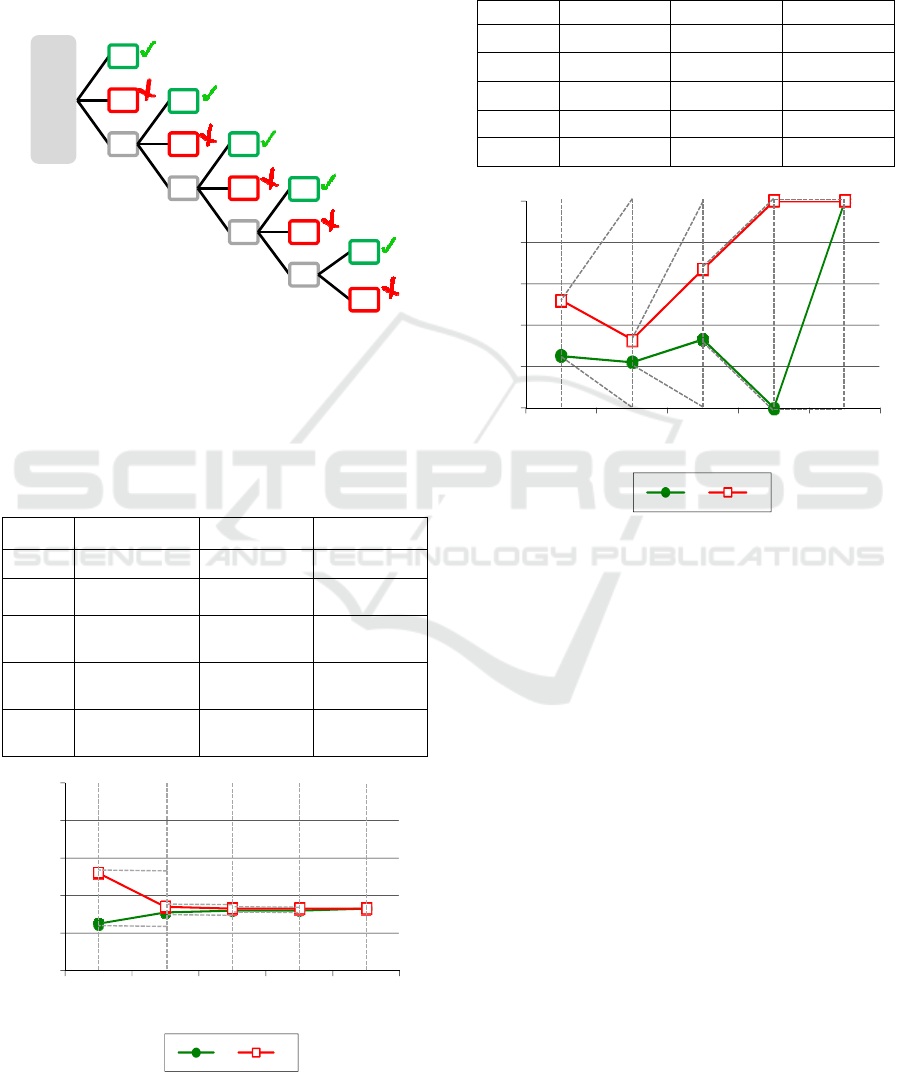

Numerical Example. Graphical Interpretation of

the Two Proposed i-Fuzzification Schemes. Let us

μ

ν

* = 1 ‒

ν

1

0

x ∈ E

zero

uncertainty

high

uncertainty

Uncertainty Modeling in the Process of SMEs Financial Mechanism Using Intuitionistic Fuzzy Estimations

273

give the following numerical example, which will

make the differences between both proposed

schemes easy to follow.

In given moment of time, let the following

exemplary distribution of project applications along

the levels in the bank’s decision making hierarchy

be observed, as shown on Figure 5.

25

48

27

6

18

3

1

1

1

0

0

1

1

0

All submitted

applications: 100

Figure 5: IF estimations for the numerical example.

Applying the first scheme of i-fuzzification over

these data, will give the results in the following

Table 1, as illustrated in Figure 6.

Table 1: Application of the first i-fuzzification scheme

over the data from Figure 5.

µ

i

ν

i

π

i

Level 1 25/100 = 0.25 48/100 = 0.48 27/100 = 0.27

Level 2 (25 + 6)/100 = 0.31

(48 + 18)/100 =

0.66

3/100 = 0.3

Level 3

(31 + 1)/100

= 0.32

(66 + 1)/100 =

0.67

1/100 = 0.01

Level 4

(32 + 0)/100

= 0.32

(67 + 0)/100 =

0.67

1/100 = 0.01

Level 5

(32 + 1)/100

= 0.33

(67 + 0)/100 =

0.67

0/100 = 0.00

0

0.2

0.4

0.6

0.8

1

Level1 Level2 Level3 Level4 Level5

µ ν*

Figure 6: Interpretation of the first i-fuzzification scheme.

Applying the second scheme of i-fuzzification

over these data, will give the results in the following

Table 2, as illustrated in Figure 7.

Table 2: Application of the second i-fuzzification scheme

over the data from Figure 5.

µ

i

ν

i

π

i

Level 1 25/100 = 0.25 48/100 = 0.48 27/100 = 0.27

Level 2 6/27 = 0.22 18/27 = 0.67 3/27 = 0.11

Level 3 1/3 = 0.33 1/3 = 0.33 1/3 = 0.33

Level 4 0/1 = 0.00 0/1 = 0.00 0/1 = 0.00

Level 5 1/1 = 1.00 0/1 = 0.00 0/1 = 0.00

0

0.2

0.4

0.6

0.8

1

Level1 Level2 Level3 Level4 Level5

µ ν*

Figure 7: Interpretation of the second i-fuzzification scheme.

4 CONCLUSION

The comparison between both i-fuzzification sche-

mes shows well that in the first scheme, at every

level i, the [0, 1] - interval corresponds to the initial

number of t submitted bank loan applications, and

11

,,

ii

M

N i = 1, …, 5, are cumulative. In comparison,

in the second scheme, on every upper level i we only

operate with the IF evaluations for that level, and

every time the degree of uncertainty from the lower

(i – 1)

-th

level is again re-normed to match the [0, 1]

- interval (see the grey dotted lines).

Both approaches can be used interchangeably,

and may prove useful in different situations, when it

is necessary to evaluate the effectiveness of the

different bank’s internal financial structural unit as

levels of the bank’s decision making hierarchy.

Fourth International Symposium on Business Modeling and Software Design

274

ACKNOWLEDGEMENTS

The research work reported in the paper is partly

supported by the project AComIn “Advanced

Computing for Innovation”, grant 316087, funded

by the FP7 Capacity Programme (Research Potential

of Convergence Regions) and partially supported by

the European Social Fund and Republic of Bulgaria,

Operational Programme “Development of Human

Resources” 2007-2013, Grant № BG051PO001-

3.3.06-0048.

REFERENCES

Atanassov K. (1983) Intuitionistic fuzzy sets, VII ITKR's

Session, Sofia, June 1983 (in Bulgarian).

Atanassov K. (1986) Intuitionistic fuzzy sets. Fuzzy Sets

and Systems. Vol. 20 (1), pp. 87-96.

Atanassov K. (1999) Intuitionistic Fuzzy Sets: Theory and

Applications. Physica-Verlag, Heidelberg.

Atanassov K. (2012) On Intuitionistic Fuzzy Sets Theory.

Springer, Berlin.

Atanassova, V. (2013) From fuzzy to intuitionistic fuzzy:

Easy and lazy. Notes on Intuitionistic Fuzzy Sets, Vol.

19, 2013, № 3, 51-55.

Shahpazov G., L. Doukovska (2012) Structuring of

Growth Funds with the Purpose of SME’s Evolution

under the JEREMIE Initiative, Proc. of the Second

International Symposium on Business Modeling and

Software Design - BMSD'12, Geneva, Switzerland,

ISBN 978-989-8565-26-6, pp. 159-164.

Shahpazov G., L. Doukovska, K. Atanassov (2013)

Generalized Net Model of the Methodology for

Analysis of the Creditworthiness and Evaluation of

Credit Risk in SMEs Financing, Proc. of the

International Symposium on Business Modeling and

Software Design – BMSD’13, Noordwijkerhout, The

Netherlands, ISBN 978-989-8565-56-3, pp. 292-297.

Shahpazov, G., L. Doukovska (2013) Generalized net model

of internal financial structural unit’s functionality with

intuitionistic fuzzy estimations. Notes on Intuitionistic

Fuzzy Sets, Vol. 19(3), 111-117.

Zadeh L.A. (1965) Fuzzy Sets. Information and Control

Vol. 8, pp. 333-353.

Uncertainty Modeling in the Process of SMEs Financial Mechanism Using Intuitionistic Fuzzy Estimations

275