An Inflation / Deflation Model for Price Stabilization in Networks

Jun Kiniwa

1

, Kensaku Kikuta

2

and Hiroaki Sandoh

3

1

Department of Applied Economics, University of Hyogo, 8-2-1 Gakuen-nishi, Nishi, Kobe, 651-2197, Japan

2

Department of Strategic Management, University of Hyogo, 8-2-1 Gakuen-nishi, Nishi, Kobe, 651-2197, Japan

3

Graduate School of Economics, Osaka University, 1-7 Machikaneyama, Toyonaka, Osaka, 560-0043, Japan

Keywords:

Multiagent Model, Price Determination, Self-stabilization, Inflation, Deflation.

Abstract:

We consider a simple network model for economic agents where each can buy goods in the neighborhood.

Their prices may be initially distinct in any node. However, by assuming some rules on new prices, we show

that the distinct prices will reach an equilibrium price by iterating buy and sell operations. First, we present a

protocol model in which each agent always bids at some rate in the difference between his own price and the

lowest price in the neighborhood. Next, we show that the equilibrium price can be derived from the total funds

and the total goods for any network. This confirms that the inflation / deflation occurs due to the increment /

decrement of funds as long as the quantity of goods is constant. Finally, we consider how injected funds spread

in a path network because sufficient funds of each agent drive him to buy goods. This is a monetary policy

for deflation. A set of recurrences lead to the price of goods at each node at any time. Then, we compare

two injections with half funds and single injection. It turns out the former is better than the latter from a

fund-spreading point of view, and thus it has an application to a monetary policy and a strategic management

based on the information of each agent.

1 INTRODUCTION

Motivation. Conventionally, the topics of price de-

termination have been discussed in the context of mi-

croeconomics approach(J. E. Stiglitz, 2006). In sup-

ply and demand curves, if the price is higher (resp.

lower) than an equilibrium, there is excess supply

(resp. excess demand) and thus the price moves to the

equilibrium. At the equilibrium price, the quantity of

goods sought by consumers is equal to the quantity

of goods supplied by producers. Neither consumers

nor producers have an incentive to alter the price or

quantity at the equilibrium. Since such a conven-

tional approach cannot capture each person’s behav-

ior, it is difficult to reflect actual economic phenom-

ena. So we considered a multiagent network model(J.

Kiniwa and K. Kikuta, a; J. Kiniwa and K. Kikuta, b),

in which each agent makes auctions and the price of

goods is eventually determined. Our network model

consists of nodes and edges as cities and their links to

neighbors, respectively. Each node contains an agent

which represents people in the city. Agents who want

to buy goods make bids to the lowest-priced neigh-

boring node, if any. Then, agents who want to sell

the goods accept the highest bid. The process of

price stabilization can be shown by using the idea

of self-stabilization in distributed systems(S. Dolev,

2000). From any initial state, self-stabilizing algo-

rithms eventually lead to a legitimate state without

any aid of external actions. We notice that the prop-

erties of self-stabilization resemble those of price de-

termination in convergence to a equilibrium without

external operations.

Problem. The problem in our previous studies (J.

Kiniwa and K. Kikuta, a; J. Kiniwa and K. Kikuta,

b) is an ambiguous relation between the price and the

amount of funds / goods. The most unsuccessful rea-

son is that no other variables than “price” were used.

There was no way to determine the next stage of the

price other than using the prices of buyers and sellers.

So we failed to explain why such an equilibrium price

is determined. To estimate the equilibrium price, we

need auxiliary variables which explain the next stage

of the price under stabilization. In addition, our model

failed to reflect the change of price due to various fac-

tors, called inflation or deflation. To explain the in-

flation / deflation, we need auxiliary variables which

show the flow of money and goods under the process

of such phenomena.

Solution. In this paper, we develop a new model con-

taining a relation between the price and the amount

125

Kiniwa J., Kikuta K. and Sandoh H..

An Inflation / Deflation Model for Price Stabilization in Networks.

DOI: 10.5220/0005186101250132

In Proceedings of the International Conference on Agents and Artificial Intelligence (ICAART-2015), pages 125-132

ISBN: 978-989-758-073-4

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

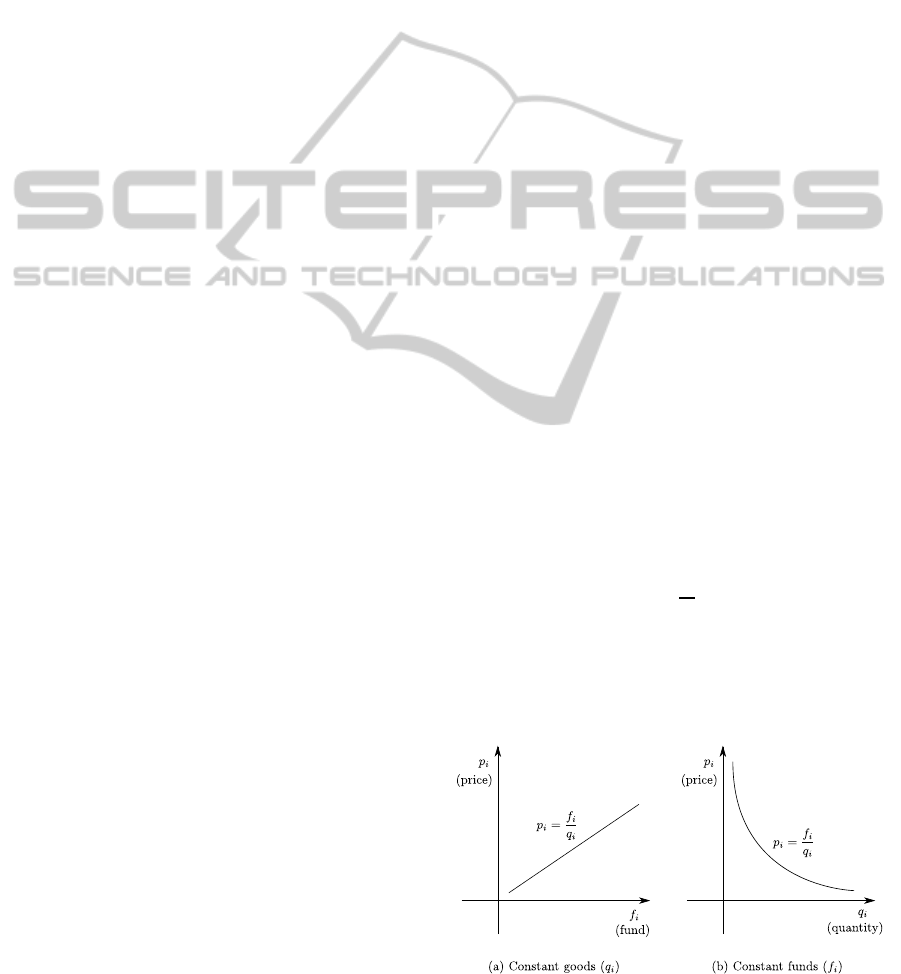

of funds / goods. We assume that the price is propor-

tional to the amount of funds and inversely propor-

tional to the amount of goods at each node. Further-

more, the volume of trade is assumed to depend on

the price difference between cities. As a result, the

flow of money and goods is determined by the market

principles, and thus the equilibrium price can be ex-

plained reasonably. Furthermore, it confirms that the

inflation / deflation depends on the amount of funds

as long as the amount of goods is constant.

Related Work. The classical theory of price deter-

mination in microeconomics is introduced, e.g., in (J.

E. Stiglitz, 2006; N. G. Mankiw, 2012), and a sur-

vey is in (T. A .Weber, 2012). We review the theory

from multiagent points of view. Though several eco-

nomic network models have been already known(L.

E. Blume, 2009; E. Even-Dar and S. Suri, 2007; S.

M. Kakade and S. Suri, 2004), such models contain

a bipartite structure(E. Even-Dar and S. Suri, 2007;

S. M. Kakade and S. Suri, 2004) or traders who play

intermediary roles (L. E. Blume, 2009). Agent-based

stabilization has been discussed in (J. Beauquier and

E. Schiller, 2001; S. Dolev and J. L. Welch, 2006;

S. Ghosh, 2000; T. Herman and T. Masuzawa, 2001).

Unlike our agents, their ideas are to use mobile agents

for the purpose of stabilization. It is useful in design-

ing protocols by what price we should make a bid.

Several kinds of game theoretic flavors have appeared

in self-stabilization, e.g., time complexity analysis(S.

Dolev and S. Moran, 1995), strategies with optimal

complexity(S. Dolev and P. Tsigas, 2008), relation-

ships between Nash equilibria and stabilization(A.

Dasgupta and S. Tixeuil, 2006; M. G. Gouda and H.

B. Acharya, 2009). Our protocol in Section 3 can

be considered as a kind of consensus algorithm. The

consensus algorithm in decentralized systems is de-

scribed in (N. A. Lynch, 1996), and its self-stabilizing

version is described in (S. Dolev, 2000; S. Dolev and

E. M. Schiller, 2010).

Contributions. We consider an inflation / deflation

network model, where the price is proportional to the

amount of funds, and is inversely proportional to the

amount of goods at each node. First, we present a pro-

tocol in which each agent always offers a fixed price

without considering other bidders’ strategies. Then,

we show that an equilibrium price is determined by

the total amount of funds and goods, and confirm that

inflation / deflation is determined by the amount of

funds. Next we focus on path networks and reveal the

price of each node and the amount of funds of each

node at each time. Finally, we show that the injection

of funds from two points is more effective than that

from a single point.

The rest of this paper is organized as follows.

Section 2 states our model. Section 3 shows that

our protocol can stabilize distinct goods prices. Sec-

tion 4 analyzes the behavior of our protocol in de-

tail. Section 4.1 investigates an equilibrium price in

an arbitrary network. Then, Section 4.2 estimates the

amount of funds at any node at any time for path net-

works. Furthermore, it suggests an effective fund-

injection method for a central bank. Finally, Section 5

concludes the paper.

2 MODEL

Our system can be represented by a connected net-

work G = (V,E), consisting of a set of nodes V and

edges E. In the network G, an arbitrary pair of

nodes i ∈ V and j ∈ V represent cities and an edge

(i, j) ∈ E between them, called neighbors, represents

direct transportation. Let N

i

be a set of neighboring

nodes of i ∈V, and let N

+

i

= N

i

∪{i}. We assume that

each node i ∈V has goods and their initial price may

be distinct. Let p

i

(t), or denoted by p

i

, be the price of

goods at node i for the time step t ∈ T = (0,1, 2,...).

Each node i ∈V has exactly one representative agent

a

i

who always stays at i and can buy goods in the

neighborhood N

i

. Each agent a

i

has funds f

i

, that is,

the total amount of money at i, and the quantity q

i

of

goods at i. The price p

i

is determined by the rela-

tionship between the quantity of goods and the pur-

chasing power, or called supply-demand balance. So

we simply assume that the price is proportional to the

amount of funds for constant goods (Figure 1(a)), and

is inversely proportional to the amount of goods for

constant funds (Figure 1(b)) at each node, that is,

p

i

=

f

i

q

i

. (1)

The buy operation is executed as follows. Each

agent a

i

assigns a value v

j

i

(t), or denoted by v

j

i

, to

the goods of any neighboring node j ∈ N

i

, where the

value means the maximum amount an agent is willing

Figure 1: Price determined by funds and goods at each

node.

ICAART2015-InternationalConferenceonAgentsandArtificialIntelligence

126

to pay. Agent a

i

compares its own goods price p

i

with

the neighboring price p

j

. If the cheapest price in N

i

is

p

j

and is less than p

i

, the agent a

i

wants to buy it and

submits a bid b

j

i

(t), or denoted by b

j

i

, to node j. We

consider v

j

i

(t) = p

i

(t) for any j ∈ N

i

because he can

buy it at price p

i

(t) in his node.

The sell operation is executed as follows. Af-

ter accepting bids from N

j

, agent a

j

contracts with

a

i

∈ N

j

, an arbitrary one of agents who submitted the

highest bid b

j

i

. Then, a

j

passes the goods to (receives

money from) the contracted agent a

i

until the price

p

j

(t +1) becomes b

j

i

derivedfrom the supply-demand

balance. We do not take the carrying cost of goods

into consideration but focus on the change of prices.

In this way, at every time, any price is updated if nec-

essary. The state Σ

i

of each node i ∈V is represented

by the price, the quantity of goods and the amount of

funds (p

i

(t),q

i

(t), f

i

(t)).

We assume a synchronous model, that is, every

agent periodically exchanges messages and knows the

states of neighboring agents. The global state of all

nodes is called a configuration. The set of all config-

urations is denoted by Γ = Σ

1

×Σ

2

×···×Σ

|V|

. An

atomic step consists of reading the states of neigh-

boring agents, a buy / sell operation, and updating

its own state. Then, a configuration is changed from

c

j

∈Γ into c

j+1

∈Γ (or c

j+1

is reached from c

j

) by the

atomic step. An execution E is a sequence of config-

urations E = c

0

,c

1

,... ,c

j

,c

j+1

,... such that c

j+1

∈Γ

is reached from c

j

∈Γ.

3 PROTOCOL DESIGN

In this section, we consider a protocol model, called

FundBidding, in which each agent a

i

always makes

a bid b

j

i

(p

j

(t) ≤b

j

i

≤ p

i

(t)) to an agent a

j

∈N

+

i

with

the lowest price in the neighborhood. For simplicity,

let k be a constant rate so that b

j

i

lies between p

j

(t)

and p

i

(t), where the price may not be an integer.

FundBidding

• Each agent a

i

makes a bid

b

j

i

(t) = p

j

(t) +

p

i

(t) − p

j

(t)

k

, (2)

where k ≥1, to node j ∈N

+

i

which has the lowest-

priced goods in N

+

i

.

• The agent a

j

contracts with the neighboring a

i

who has submitted the highest bid max

i∈N

j

b

j

i

(t).

If a

j

has submitted his bid to neighboring node at

the same time, it is postponed until the next time

1

2

3

4

1

2

3

4

Figure 2: An illustration of protocol FundBidding.

step. The goods of a

j

and the money of a

i

are ex-

changed, that is, the goods are moved from q

j

to

q

i

and the money is moved from f

i

to f

j

as long

as p

i

> p

j

. The prices p

i

(t + 1) and p

j

(t + 1) are

determined by the funds and the amount of goods.

• If several agents make bids to node j with the

same highest price, agent a

j

makes deals with one

of them at random.

Example 1. Figure 2 shows an example of our net-

work system consisting of 4 nodes V = {1,2,3,4}.

For the bidding price (2), let k = 2. At time t,

the prices of goods are (p

1

(t), p

2

(t), p

3

(t), p

4

(t)) =

(50,110,70, 10) as shown in Figure 2(a). Each agent

a

i

wants to buy the lowest-priced goods at node j ∈N

i

if its price is lower than p

i

, that is, p

i

> min

j∈N

i

p

j

.

Thus, agent a

1

makes a bid to node 4 with price

b

4

1

= 30. Likewise, agents a

2

and a

3

make bids to

node 1, respectively. Then, only a

2

’s bid is successful,

and a

2

makes a contract with a

1

.

At time t + 1, the prices become (p

1

(t + 1), p

2

(t +

1), p

3

(t + 1), p

4

(t + 1)) = (80,80, 70,10) as shown in

Figure 2(b). Since price p

1

has been changed, agent

a

1

’s bid b

4

1

is resubmitted as (80+ 10)/2 = 45. Since

the bids b

3

2

and b

4

1

are independent, they are executed

in parallel at time t + 1. ⊓⊔

We are concerned with whether or not the prices

of goods eventually reach an equilibrium price even if

they are initially distinct. So we define the legitimacy

of a configuration as follows.

Definition 1 (legitimate configuration). A configura-

tion is legitimate if the goods in every node have the

same price. ⊓⊔

Let C

t

⊆V be the set of nodes that have updated

their prices from time t to t + 1. The following lemma

proves that the protocol FundBidding is free from

deadlocks.

Lemma 1. The protocol FundBidding is deadlock-

free. That is, there exist some nodes in C

t

as long as

the configuration is illegitimate.

Proof. First notice that no cycle is generated by the

chain of bidding requests, as depicted in Figure 2,

AnInflation/DeflationModelforPriceStabilizationinNetworks

127

because every bidding request occurs from a higher

priced node to a lower priced node.

Next suppose that the configuration is illegitimate

at time t. Then, there is a pair of neighboring nodes

i, j ∈ V such that p

i

(t) = max

h∈N

j

p

h

(t) and p

j

(t) =

min

h∈N

i

p

h

(t), where p

i

(t) − p

j

(t) is the maximum

price difference in the neighborhood. In this case,

agent a

i

makes a bid to node j and agent a

j

accepts

the price. Since p

j

(t) is increased at time t + 1, j ∈C

t

holds. ⊓⊔

In (J. Kiniwa and K. Kikuta, b), we investigated a

condition such that any protocol satisfying the frame-

work of FundBidding achieves price stabilization.

Suppose that agents a

i

and a

j

make bids to node h. We

say that bids have the same order as values if v

h

i

≤ v

h

j

implies b

h

i

≤ b

h

j

for the goods of node h. Next lemma

shows that the bids having the same order as values is

necessary for price stabilization.

Lemma 2. (J. Kiniwa and K. Kikuta, b) If bids do not

always have the same order as values, price stabiliza-

tion is not guaranteed. ⊓⊔

The following theorem further shows that an addi-

tional condition leads to the price stabilization.

Theorem 1. (J. Kiniwa and K. Kikuta, b) Suppose

that bids have the same order as values. If any con-

tract price lies between buyer’s price and seller’s

price, price stabilization occurs. ⊓⊔

Since we assume that v

j

i

(t) = p

i

(t) for any neigh-

boring node j ∈ N

i

and a

i

makes a bid by (2), Fund-

Bidding satisfies the condition above.

4 ANALYSIS

In this section, we investigate several aspects of our

FundBidding for arbitrary networks and path net-

works.

4.1 Arbitrary Network

The following theorem claims that the equilibrium

price is determined by the total amounts of funds and

the goods regardless of the network topology.

Theorem 2. Let F be the total amount of funds, and

Q the total amount of goods. The equilibrium price,

denoted by P

e

, is

P

e

=

F

Q

regardless of the network topology.

Proof. By definition, the price of goods at node i

is p

i

= f

i

/q

i

. Suppose that the equilibrium prices

are different for each stabilization process. Then,

p

i

(t) 6= p

i

(t

′

) for time t and t

′

(t 6= t

′

) holds. Since

f

i

= p

i

(t)q

i

and f

′

i

= p

i

(t

′

)q

′

i

hold for any node i,

where F =

∑

i

f

i

=

∑

i

f

′

i

, we have

p

i

(t) ·

∑

i

q

i

= p

i

(t

′

) ·

∑

i

q

′

i

.

Since the total amount of goods Q is identical, we

have

Q =

∑

i

q

i

=

∑

i

q

′

i

.

Thus we obtain p

i

(t) = p

i

(t

′

), a contradiction. There-

fore, the equilibrium price P

e

is identical for each sta-

bilization process.

Next, since f

i

= P

e

·q

i

holds for every node i, the

total funds sum up to

F = P

e

·Q.

Thus we obtain P

e

= F/Q. ⊓⊔

The theorem above is known as the Fisher’s quan-

tity equation (N. G. Mankiw, 2012) FV = P

e

Q if the

velocity of money V equals to 1. This means the cor-

rectness of our assumption (1) at each node. Thus,

in our inflation / deflation model, the inflation (resp.

deflation) occurs if the total amount of funds increase

(resp. decrease) as long as the total amount of goods

is constant.

4.2 Path Network

In what follows, we restrict our concern to path net-

works. The path networks probably represent the dis-

tance feature in arbitrary networks. Then, we con-

sider how injected funds spread in the path network

because sufficient funds of each agent drives him to

buy goods. This is a monetary policy for deflation.

Section 4.2.1 considers the situation that incremental

funds are injected from a single point. Section 4.2.2

considers the situation that the half of incremental

funds are injected from two points.

4.2.1 Single Injection

We investigate the amount of funds at each node of a

path P = (1,2,...,n) at any time. For simplicity, let

k = 2 and let b

j

i

(t) = (p

i

(t)+ p

j

(t))/2 in (2). Suppose

that we inject funds m into node 1, called an injection

point. Let p

c

i

(t) be the temporary, intermediate price

of node i reached by trading exhaustively for a con-

tract between t and t + 1.

ICAART2015-InternationalConferenceonAgentsandArtificialIntelligence

128

Lemma 3. Let q

i

be the quantity of goods, and f

i

the

funds of agent a

i

before the trade at node i. Then, the

price after the trade will be

p

c

i

(t) =

f

i−1

+ f

i

q

i−1

+ q

i

.

Proof. Suppose that (q

i−1

, f

i−1

) and (q

i

, f

i

) change

into (q

′

i−1

, f

′

i−1

) and (q

′

i

, f

′

i

) after the trade, respec-

tively. Let F

i−1,i

and Q

i−1,i

be a sum of funds and

a sum of quantities of goods at nodes i−1 and i, re-

spectively. Since no other funds and goods do not

come into these values, we have

f

i−1

+ f

i

= f

′

i−1

+ f

′

i

= F

i−1,i

q

i−1

+ q

i

= q

′

i−1

+ q

′

i

= Q

i−1,i

.

At an equilibrium, since

f

′

i−1

q

′

i−1

=

f

′

i

q

′

i

= P

e

,

q

′

i−1

= f

′

i−1

/P

e

and q

′

i

= f

′

i

/P

e

. Then,

q

′

i−1

+ q

′

i

= ( f

′

i−1

+ f

′

i

)/P

e

,

that is, Q

i−1,i

= F

i−1,i

/P

e

holds. Thus, we have

P

e

=

F

i−1,i

Q

i−1,i

=

f

i−1

+ f

i

q

i−1

+ q

i

.

This means we can find the equilibrium price before

the trade. ⊓⊔

The following Figure and Example present a be-

havior of price diffusion in a path.

Figure 3: Price diffusion in a path.

Example 2. Figure 3 illustrates price diffusion in a

path (1,2,3), where the price at node 1 is initially

higher than others because funds have been injected.

The intermediate state of p

i

between t = 0 and t = 1

is denoted by p

c

i

(0) for convenience. Let k = 2 for the

expression (2). First,

p

1

(1) =

p

1

(0) + p

2

(0)

2

= p

c

2

(0),

and then

p

2

(1) =

p

c

2

(0) + p

3

(0)

2

=

p

1

(1) + p

3

(0)

2

= p

3

(1)

holds. ⊓⊔

Thus, in general, the price p

j

(t) at node j ∈P (2 ≤

j ≤ n−1) can be represented as follows.

p

1

(t) =

1

2

· p

1

(t −1) +

1

2

· p

2

(t −1) (3)

p

j

(t) =

1

2

· p

j−1

(t) +

1

2

· p

j+1

(t −1) (4)

p

n

(t) =

1

2

· p

n−2

(t) +

1

2

· p

n

(t −1) (5)

From (4), we have

∑

t≥1

p

j

(t)x

t

=

1

2

·

∑

t≥1

p

j−1

(t)x

t

+

1

2

·

∑

t≥1

p

j+1

(t −1)x

t

.

Using R

j

(x) =

∑

t≥0

p

j

(t)x

t

, we obtain

R

j

(x) − p

j

(0) =

1

2

(R

j−1

(x) − p

j−1

(0))+

x

2

R

j+1

(x)

2R

j

(x) = R

j−1

(x) + xR

j+1

(x) + (2p

j

(0) − p

j−1

(0))

For simplicity, we assume 2p

j

(0) − p

j−1

(0) = 0

and replace j by j −1. Then,

xR

j

−2R

j−1

+ R

j−2

= 0.

So we have

R

j

= A

1

1+

√

1−x

x

j

+ A

2

1−

√

1−x

x

j

.

Using our initial conditions R

0

(x) =

∑

t≥0

p

0

(t)x

t

= 0

and R

1

(x) =

∑

t≥0

p

1

(t)x

t

≈ p

1

(0),

A

1

+ A

2

= 0

A

1

(

1+

√

1−x

x

) + A

2

(

1−

√

1−x

x

) = p

1

(0)

lead to

R

j

= p

1

(0) ·

x

2

√

1−x

(

1+

√

1−x

x

j

−

1−

√

1−x

x

j

)

.

Using

x

2

√

1−x

= z,

R

j

=

p

1

(0)

2z

{(

1

x

+ z)

j

−(

1

x

−z)

j

}

=

p

1

(0)

2z

{2

j

1

1

x

j−1

z+ 2

j

3

1

x

j−3

z

3

+ ···}

= p

1

(0)

∑

r≥1

j

2r−1

1

x

j−(2r−1)

z

2r−2

= p

1

(0)

∑

r≥1

j

2r−1

1

x

j−(2r−1)

1−x

x

2

r−1

.

Thus,

R

j

= p

1

(0)

∑

r≥0

j

2r+ 1

x

r

·

1

(1−x)

j−1

= p

1

(0)

∑

r≥0

j

2r+ 1

x

r

∑

s≥0

j + s−2

s

x

s

= p

1

(0)

∑

r≥0

∑

0≤s≤r

j

2(r−s) + 1

j + s−2

s

!

x

r

.

AnInflation/DeflationModelforPriceStabilizationinNetworks

129

Therefore, we have

p

j

(t) = p

1

(0)

∑

0≤s≤⌊( j−1)/2⌋

j

2(r −s) + 1

j+ s −2

s

.

Then, p

1

(t) and p

n

(t) can be described as follows:

p

1

(t) =

p

1

(0)

2

t

+

∑

0≤k≤t−1

p

2

(k)

2

t−k

,

and

p

n

(t) =

p

n

(0)

2

t

+

∑

1≤k≤t

p

n−2

(k)

2

t−k+1

.

Let b

j

j−1

(t) = (p

j−1

(t) + p

j

(t))/2 be the bidding

price of node j −1 to node j. Let p

c

j

(t) (or simply

p

c

j

) denote the temporary, intermediate price at node

j between time t andt +1. Then, the amount of goods

q

j

(t + 1) can be determined as follows.

Lemma 4. The amount of goods at time t + 1 is

q

j

(t + 1) =

(b

j

j−1

+ p

j

)(b

j+1

j

+ p

c

j

)

(p

c

j

+ b

j

j−1

)(p

j

+ b

j+1

j

)

·q

j

(t)

Proof. Let x (resp. y) be the amount of goods moved

from node j to node j −1 (resp. node j + 1 to node

j). First, we consider the trade between node j −1

and node j. Notice that the funds of agent j reach

f

j

(t) + x·b

j

j−1

(t) and the amount of goods at node j

becomes q

j

(t)−x. By Lemma 3, when the price p

c

j

(t)

reaches p

c

j

(t) = ( f

j−1

+ f

j

)/(q

j−1

+ q

j

),

f

j

+ x·b

j

j−1

q

j

−x

= p

c

j

x =

p

c

j

q

j

− f

j

p

c

j

+ b

j

j−1

.

Since f

j

= p

j

q

j

, we have

q

c

j

= q

j

−x =

q

j

(b

j

j−1

+ p

j

)

p

c

j

+ b

j

j−1

.

Likewise, for the trade between node j and node

j + 1,

p

c

j

q

c

j

−y·b

j+1

j

q

c

j

+ y

= p

j

y =

p

c

j

q

c

j

−p

j

q

c

j

p

j

+ b

j+1

j

.

Thus,

q

j

(t +1) = q

c

j

+ y

=

q

j

(b

j

j−1

+ p

j

)

p

c

j

+ b

j

j−1

+

p

c

j

q

c

j

−p

j

q

c

j

p

j

+ b

j+1

j

=

(b

j

j−1

+ p

j

)(b

j+1

j

+ p

c

j

)

(p

c

j

+ b

j

j−1

)(p

j

+ b

j+1

j

)

·q

j

(t).

⊓⊔

Theorem 3. The amount of agent a

j

’s funds at time t

is

f

j

(t) = p

j

(t)

t−1

∏

i=1

(b

j

j−1

+ p

j

)(b

j+1

j

+ p

c

j

)

(p

c

j

+ b

j

j−1

)(p

j

+ b

j+1

j

)

·q

j

(0).

⊓⊔

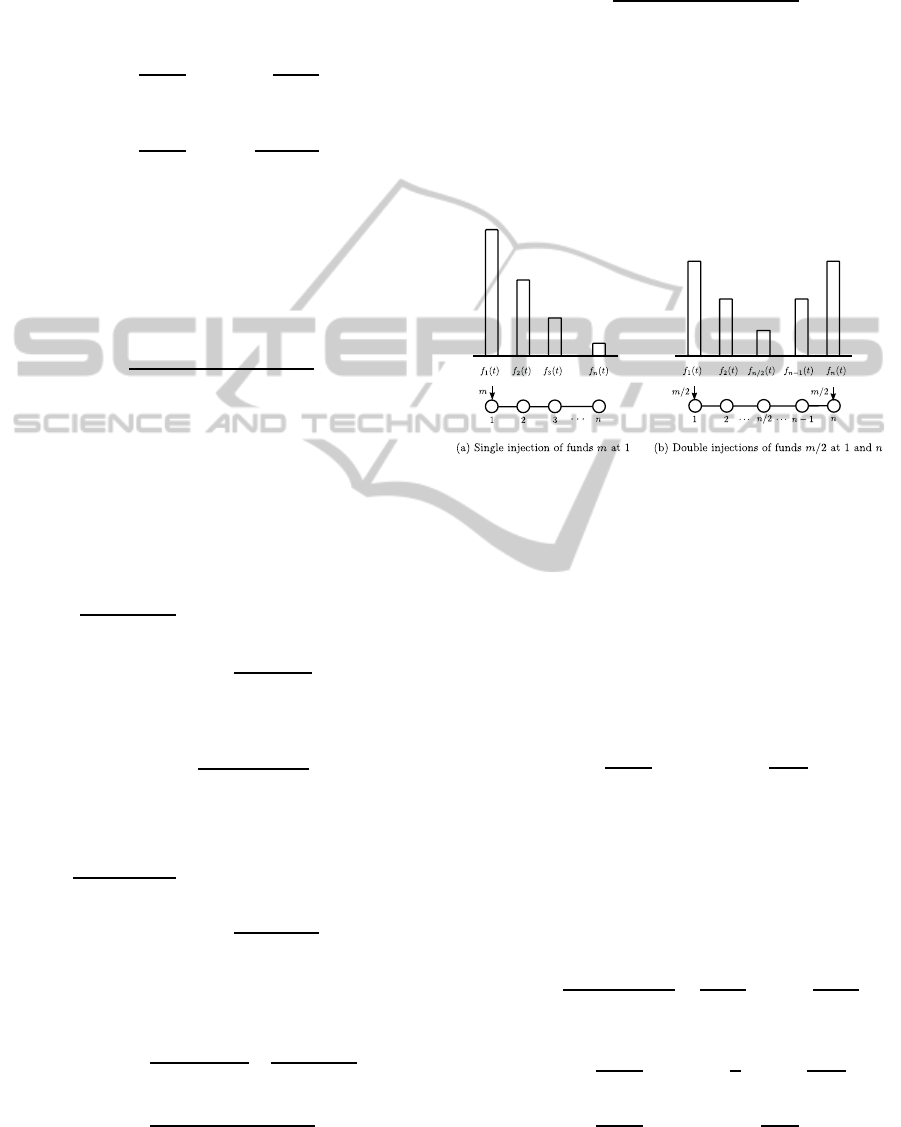

4.2.2 Double Injections of Half Funds

This section considers the half of incremental funds

are injected from two points. Figure 4 illustrates

(a) single injection and (b) double injections of half

funds.

Figure 4: Injection of funds.

First, we focus on the asymptotic behavior of the

terminal agent a

n

. Notice that agent a

n

’s funds only

increases and the amount of goods only decreases

under stabilization. Next, we show that the method

of double injections of half funds is better than that

of single injection from the fund-spreading point of

view. The investigation is motivated by exploring a

good monetary policy.

Lemma 5. Let p

c

n−1

(0) be the price at node n −1

immediately before bidding for node n. Then,

p

c

n−1

(0) =

p

1

(0)

2

n−1

+ p

n

(0)

1−

1

2

n−1

if we assume p

2

(0) = ··· = p

n

(0).

Proof. First, agent a

1

makes a bid to node 2 with

b

2

1

(0) = (p

1

(0) + p

2

(0))/2. Then, agent a

2

makes a

bid to node 3 with b

3

2

(0) = (b

2

1

(0) + p

3

(0))/2, and

so on. The bidding reaches node n with b

n

n−1

(0) =

(b

n−1

n−2

(0) + p

n

(0))/2. Thus, we have

p

c

n−1

(0) =

p

1

(0) + p

2

(0)

2

n−1

+

p

3

(0)

2

n−2

+ ···+

p

n

(0)

2

.

If we assume p

2

(0) = ··· = p

n

(0),

p

c

n−1

(0) =

p

1

(0)

2

n−1

+ p

n

(0)

1

2

+ ···+

1

2

n−1

=

p

1

(0)

2

n−1

+ p

n

(0)

1−

1

2

n−1

.

⊓⊔

ICAART2015-InternationalConferenceonAgentsandArtificialIntelligence

130

After the trade at time t, suppose that agent a

n

’s

funds become f

n

+ x·b

n

n−1

and the amount of goods

becomes q

n

−x. Since the price reaches b

n

n−1

,

f

n

+ x·b

n

n−1

q

n

−x

= b

n

n−1

x =

1

2

q

n

−

f

n

2b

n

n−1

holds. Thus,

q

n

(t + 1) = q

n

(t) −x =

1

2

q

n

+

f

n

2b

n

n−1

.

Let us denote q

t

=

1

2

q

t−1

+

f

t−1

2b

t−1

for simplicity.

Then,

q

n

(t) =

1

2

1

2

q

n

(t −2) +

f

n

(t −2)

2b

n

n−1

(t −2)

!

+

f

n

(t −1)

2b

n

n−1

(t −1)

=

1

2

2

q

n

(t −2) +

1

2

f

n

(t −2)

2b

n

n−1

(t −2)

+

f

n

(t −1)

2b

n

n−1

(t −1)

.

.

.

=

1

2

t

q

0

+

∑

0≤k≤t−1

1

2

k

f

n

(t −1−k)

2b

n

n−1

(t −1−k)

!

.

Since

1

2

t

q

0

→ 0 for large t and

f

0

2b

0

> ··· >

f

t−1

2b

t−1

,

q

t

≤

1

2

t

q

0

+

∑

0≤k≤t−1

1

2

k

f

n

(0)

2b

n

n−1

(0)

Since b

n

n−1

(0) = (p

c

n−1

(0) + p

n

(0))/2, we obtain

1

2

t

q

0

+

2f

n

(0)

p

1

(0)/2

n−1

+ P

e

(2−1/2

n−1

)

< q

t

and

q

t

<

1

2

t

q

0

+

2f

n

(0)

p

1

(0)/2

n−1

+ p

n

(0)(2−1/2

n−1

)

(6)

by Lemma 5.

Consider which is better for money spreading,

from one injection point or from two injection points

with half funds. We compare two cases, (a) one injec-

tion point is node 1, and (b) two injection points are

node 1 and node n. Clearly, the node with the mini-

mum funds at equilibrium, called min-funds node, in

case (a) is node n, and that in case (b) is node ⌈n/2⌉

(simply denoted by n/2). Thus, we have only to com-

pare f

n

in case (a) and f

n/2

in case (b). The following

lemma shows that the quantity of goods at the min-

funds node in case (b) is less than that in case (a).

Notice that q

[m→h]

i

(t) means the quantity of goods

at node i at time t on condition that incremental funds

m are initially injected into node h.

Lemma 6. For any t > 0,

q

[m/2→1,m/2→n]

n/2

(t) < q

[m→1]

n

(t)

holds.

Proof. From equation (6), we have only to compare

q

upper

(n/2), the upper bound of q

n/2

(t) −

1

2

t

q

0

, and

q

lower

(n), the lower bound of q

n

(t) −

1

2

t

q

0

. That is,

they can be described as

q

upper

(n/2) =

2f

n/2

(0)

p

1

(0)/2

n/2

+ p

n/2

(0)(2−1/2

n/2−1

)

and

q

lower

(n) =

2f

n

(0)

p

1

(0)/2

n−1

+ P

e

(2−1/2

n−1

)

.

Since f

n

(0) = f

n/2

(0) and p

n

(0) = p

n/2

(0) at timet =

0, we have

q

lower

(n)

q

upper

(n/2)

=

p

1

(0)/2

n/2

+ p

n

(0)(2−1/2

n/2−1

)

p

1

(0)/2

n−1

+ P

e

(2−1/2

n−1

)

=

p

n

(0)

P

e

·

p

1

(0)/p

n

(0)2

n/2

+ (2−1/2

n/2−1

)

p

1

(0)/P

e

2

n−1

+ (2−1/2

n−1

)

≈ 2

n/2−1

> 1.

Thus, q

upper

(n/2) < q

lower

(n) holds. So the lemma

follows. ⊓⊔

From Lemma 6, we claim the following theorem

because the equilibrium price is equal for each case.

Notice that f

[m→h]

i

means the amount of funds at node

i on condition that incremental funds m are initially

injected into node h.

Theorem 4. At an equilibrium, we have

f

[m→1]

n

< f

[m/2→1,m/2→n]

n/2

.

⊓⊔

The theorem above suggests that the multiple in-

jection points is better than the single injection point

for effective spreading of funds.

5 CONCLUSION

In this paper we considered a new network model for

the price stabilization. First, we presented a system

model in which the price of goods is proportional to

the amount of funds and is inversely proportional to

the amount of goods at each node. Then we provided

a protocol which stabilizes price and moves money /

goods. Next, we showed that the equilibrium price is

determined by the total amount of funds and the to-

tal amount of goods. Then, we concentrated on path

networks to reveal the behavior of the protocol more

precisely. We considered the price under stabilization

at each node. Finally, we investigated which injec-

tion method is better from the fund-spreading point of

view, motivated by an application to monetary policy.

In summary, our network model reveals the fol-

lowing facts.

AnInflation/DeflationModelforPriceStabilizationinNetworks

131

• The equilibrium price of goods can be estimated

if the price is proportional to the amount of funds

and is inversely proportional to the amount of

goods at each node.

• The price under stabilization at each node in a

path is investigated.

• The two injections with half funds is better than

the single injection from fund-spreading point of

view.

Our future work includes investigating an asyn-

chronous system and developing other protocols.

ACKNOWLEDGEMENTS

This work was supported by JSPS KAKENHI Grant

Number ((B)25285131).

REFERENCES

A. Dasgupta, S. and S. Tixeuil (2006). Selfish stabilization.

In Proceedings of the 8th International Symposium on

Stabilization, Safety, and Security of Distributed Sys-

tems (SSS 2006) LNCS:4280, pages 231–243.

E. Even-Dar, M. and S. Suri (2007). A network formation

game for bipartite exchange economies. In Proceed-

ings of the 18th ACM-SIAM Simposium on Discrete

Algorithms (SODA 2007), pages 697–706.

J. Beauquier, T. and E. Schiller (2001). Easy stabiliza-

tion with an agent. In 5th International Workshop

on Self-stabilizing Systems (WSS 2001) LNCS:2194,

pages 35–50.

J. E. Stiglitz, C. (2006). Principles of macro-economics.

W.W.Norton & Company, New York, 4th edition.

J. Kiniwa and K. Kikuta, a. A network model for price

stabilization. In Proceedings of the 3rd Interna-

tional Conference on Agents and Artificial Intelli-

gence (ICAART), pages 394–397.

J. Kiniwa and K. Kikuta, b. Price stabilization in networks

— what is an appropriate model ? In 13th Interna-

tional Symposium on Stabilization, Safety, and Secu-

rity of Distributed Systems (SSS 2011): LNCS 6976,

pages 283–295.

L. E. Blume, D. Easley, J. E. (2009). Trading networks with

price-setting agents. Games and Economic Behavior,

67:36–50.

M. G. Gouda and H. B. Acharya (2009). Nash equilibria in

stabilizing systems. In 11th International Symposium

on Stabilization, Safety, and Security of Distributed

Systems (SSS 2009) LNCS:5873, pages 311–324.

N. A. Lynch (1996). Distributed algorithms. Morgan Kauf-

mann Publishers.

N. G. Mankiw (2012). Principles of economics. Cengage

Learning, Boston, 6th edition.

S. Dolev (2000). Self-stabilization. The MIT Press, first

edition.

S. Dolev, A. and S. Moran (1995). Analyzing expected time

by scheduler-luck games. IEEE Transactions on Soft-

ware Engineering, 21(5):429–439.

S. Dolev, E. and J. L. Welch (2006). Random walk for self-

stabilizing group communication in ad hoc networks.

IEEE Transactions on Mobile Computing, 5(7):893–

905.

S. Dolev, E. M.Schiller, P. and P. Tsigas (2008). Strate-

gies for repeated games with subsystem takeovers im-

plementable by deterministic and self-stabilizing au-

tomata. In Proceedings of the 2nd International Con-

ference on Autonomic Computing and Communica-

tion Systems (Autonomics 2008), pages 23–25.

S.Dolev, R. and E.M.Schiller (2010). When consensus

meets self-stabilization. Journal of Computer and Sys-

tem Sciences, 76(8):884–900.

S.Ghosh (2000). Agents, distributed algorithms, and stabi-

lization. In Computing and Combinatorics (COCOON

2000) LNCS:1858, pages 242–251.

S. M. Kakade, M.Kearns, L. R. and S.Suri (2004). Eco-

nomic properties of social networks. In Neural Infor-

mation Processing Systems (NIPS 2004).

T. A. Weber (2012). Price theory in economics in The Ox-

ford Handbook of Pricing Management. Oxford Uni-

versity Press.

T. Herman and T. Masuzawa (2001). Self-stabilizing agent

traversal. In 5th International Workshop on Self-

stabilizing Systems (WSS 2001) LNCS:2194, pages

152–166.

ICAART2015-InternationalConferenceonAgentsandArtificialIntelligence

132