Newsvendor Model in Rail Contract to Transport Gasoline in Thailand

Kannapha Amaruchkul

Graduate Program in Logistics Management, School of Applied Statistics,

National Institute of Development Administration (NIDA), Bangkok, Thailand

Keywords:

Newsvendor model, Rail freight, Stochastic Model Applications in logistics management.

Abstract:

A long-term contract between a railroad company and a shipper who wants to transport gasoline daily is

studied. The contract specifies an upfront payment for reserving bogies and a per-container freight rate. The

shipper also uses a trucking company to transport the excess demand, but its per-liter transportation cost

is higher. The shipper’s problem is to determine the number of bogies to reserve at the beginning of the

contract duration, before daily demand is revealed. Since demand is perishable, we formulate the problem as

a newsvendor model. The expected cost function is not convex. We show that the expected cost is unimodal

and derive an optimal solution under certain conditions, which are not very restrictive. We also provide a

sensitivity analysis with respect to the change in the contract parameter.

1 INTRODUCTION

Global demand for gasoline and diesel continue to

grow over the next few decades (Organization of the

Petroleum Exporting Countries (OPEC), 2013). Pop-

ulation growth is one of the key drivers in growing

demand for transportation and motor gasoline con-

sumption (Energy Information Administration (EIA),

2008). The supply chain for fuel starts from crude oil

sources and ends at gas stations, passing through re-

finery factories and storages (e.g., tank farms, depots,

terminals, and so on). From the distribution centers

to gas stations, gasoline and diesel can be transported

through road, rail, or pipeline if exists.

Pipeline is environment-friendlyand always avail-

able all year round 24-7-365 with high service level

at a relatively low cost. Products are delivered on

time via pipelines, because the flows can be contin-

uously monitored and controlled by a computer, and

they are not affected by weather or climate conditions.

Spills or product losses are minimal, compared to

trucks or trains. Accidents involving trucks or trains

with petroleum products are fairly common. Never-

theless, in some developing countries, e.g., Thailand,

pipelines for refined products are not extensive and

cover only a limited geographic area. In this article,

pipeline is not considered.

In Thailand, gasoline and diesel are transported

among regional depots by road or rail. Rail is better

for the environment, produces less greenhouse emis-

sion gas, and the transportation cost is usually lower.

On the other hand, road usually allows faster speed,

better delivery consistency, and less product losses.

A rail company serves both passengers and cargo

shippers/freighters. Bogies (under-carriage assem-

blies commonly referred to as “trucks” in US) are

needed for both cargo tanks and passenger rail cars.

When there are not enough bogies for both, the rail

company often allocates bogies first to the passen-

ger cars and then box cars for general commodities

or tanks for liquid and gas.

To alleviate the problem of bogie availability,

some petroleum companies enter a long-term contract

with the railroad company. The long-term contract we

study is found in practice between the State Railway

of Thailand and one of the biggest petroleum com-

panies in Thailand. The contract specifies an upfront

payment for reserving bogies and a per-liter freight

rate. For each day during the contract period, the

number of bogies provided by the railroad company

is at most that reserved at the beginning of the con-

tract period. If daily demand is greater than total ca-

pacity of reserved bogies, then the excess demand is

handled by a trucking company. A per-liter charge by

the trucking company is typically higher. The shipper

needs to decide how many bogies to reserve before

knowing actual daily demand.

The shipper’s problem is similar to the newsven-

dor problem, in which an order quantity must be de-

termined prior to the start of the selling season. In

237

Amaruchkul K..

Newsvendor Model in Rail Contract to Transport Gasoline in Thailand.

DOI: 10.5220/0005198102370246

In Proceedings of the International Conference on Operations Research and Enterprise Systems (ICORES-2015), pages 237-246

ISBN: 978-989-758-075-8

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

both ours and the newsvendor problem, a fixed quan-

tity is committed before random demand is material-

ized. Reviews of the newsvendor model can be found

in e.g., (Qin et al., 2011) and (Khouja, 1999). Stan-

dard textbooks in operations research/management

science also discuss a newsvendor problem; e.g.,

Chapter 10 in (Silver et al., 1998), Chapter 11 in (Ca-

chon and Terwiesch, 2009) and Chapter 5 in (Nah-

mias, 2009). In the standard newsvendor model, the

total expected cost is shown to be convex, whereas

ours is not convex, because the daily transportation

rail cost is based on the number of containers actu-

ally used, not the demand actually served, as in the

standard newsvendor model.

A newsvendor model with standard-sized contain-

ers is studied in e.g., (Pantumsinchai and Knowles,

1991) and (Yin and Kim, 2012). Quantity discount

pricing is offered to the shipper. In these papers, if a

larger container is used, the per-unit rate is cheaper.

Nevertheless, their transportation costs are based on

the volume actually shipped, not the number of con-

tainers as in ours. Although we do not have quantity

discount as in theirs, we have a fixed upfront payment

and variable transportation costs. They do not have an

upfront payment or a secondary transportation option.

Our contract scheme is related to returns policies

or buyback contracts in the newsvendor setting. In

our model, the total payment from the shipper to the

rail companyconsists of two parts, namely the upfront

payment proportional to the number of reserved bo-

gies, and the variable payment proportional to the ac-

tual number of bogies actually used. In the newsven-

dor model in which a supplier and a buyer enter into

a buyback contract, the buyer who places an order

quantity of x pays wx to the supplier, where w is the

per-unit wholesale price. After demand D material-

izes, the supplier buys back all unsold units from the

buyer at a per-unit buyback price b. The net payment

from the buyer to the supplier is

wx− b(x− D)

+

= (w− b)x+ bmin(x,D)

where (t)

+

= max(t,0) denotes the positive part of a

real number t. The payment under the buyback con-

tract can be viewed as two parts, namely the “upfront”

payment, (w− b)x, proportional to the committed or-

der quantity and the variable payment, bmin(x,D),

proportional to the actual sales. The order quantity

in the newsvendor model is analogous to the num-

ber of reserved bogies in ours, and the actual sales

to the actual number of bogies actually used. Lit-

erature on buyback contracts in the newsvendor set-

ting is extensive; see reviews in (Cachon, 2003) and

(Lariviere, 1999). Ours differs from the buyback con-

tract, because our variable payment is not linear on

the actual volume shipped via rail but on the actual

number of bogies used. For each realization of de-

mand D = d, the variable payment bmin(x,d) in the

buyback contract is continuous piecewise linear func-

tion in d, whereas our payment is not linear, not con-

tinuous in d and has some jumps.

Demands in the newsvendor model and ours are

perishable. In our model, demand to transport gaso-

line must be met on daily basis. The rail company can

segment customers, e.g., by freight types. Different

freight types can be changed at different prices. The

rail company is interested in maximizing revenue be-

cause variable costs are small, compared to the fixed

sunk cost of acquiring rail cars. Rail freight is a prime

candidate for perishable-asset revenue management

(RM) techniques. However, papers on railway RM

are quite limited, compared to those in “traditional”

RM industries, e.g., airline, hotel and car rental. Rail-

way RM papers include, e.g., (Armstrong and Meiss-

ner, 2010) and (Kraft et al., 2000).

The rest of the paper is organized as follows: Sec-

tions 1 and 2 give an introduction and a formulation

of the problem. We provide an analysis and a numer-

ical example in Section 3. Section 4 contains a short

summary and a few future research directions.

2 FORMULATION

Throughout this article, let Z

+

denote the set of non-

negative integers, and R

+

the set of nonnegative real

numbers.

Consider a shipper who needs to transport fuel

(e.g., diesel and gasoline) daily using either road or

rail. Let D

i

be a random demand (volume in liters)

for transport on day i for each i = 1,2,...,n, where n

is the length of the planning horizon. Prior to the start

of the planning horizon, the shipper and the rail com-

pany establish a long-term contract: The rail company

guarantees to provide up to y ∈ Z

+

bogies on each day

throughout the planning horizon, and the shipper pays

an upfront of

˜

fy where

˜

f is the per-bogie upfront fee.

The upfront payment is collected at the beginning of

the planning horizon.

Throughout the planning horizon, the shipper also

pays an additional transportation cost, which is lin-

early proportional to the number of tanks actually

used on that day. Let κ be the capacity of the tank

(in liters). For day i = 1,2, ..., n, the number of tanks

actually used by the shipper is

Z

i

= min(y,⌈D

i

/κ⌉) (1)

=

(

y if y ≤ ⌈D

i

/κ⌉

⌈D

i

/κ⌉ if y > ⌈D

i

/κ⌉.

(2)

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

238

=

(

y if D

i

≥ κy

⌈D

i

/κ⌉ if D

i

< κy.

(3)

To ship total volume of D

i

liters, we need ⌈D

i

/κ⌉

tanks. (We divide the total demand by the tank capac-

ity and round up to its ceiling, because the number of

tanks has to be an integer.) However, the rail company

provides up to the number of reserved bogies y. One

tank needs one bogie. Hence, the number of tanks

actually used is the minimum of these two quanti-

ties. Detailed explanation is as follows: Suppose the

demand is larger than the total capacity of reserved

bogies (D

i

> κy). The number of reserved bogie is

less than or equal to the number of tanks actually re-

quired to accommodate all demand (y ≤ ⌈D

i

/κ⌉) All

reserved bogies are used; this corresponds to the up-

per case in (2) and (3). On the other hand, suppose

that the demand is less than the capacity of reserved

bogies (D

i

< κy). We do not need to use all bogies

(y > ⌈D

i

/κ⌉), and only ⌈D

i

/κ⌉ is actually needed to

carry all demand D

i

. This corresponds to the lower

case in (2) and (3).

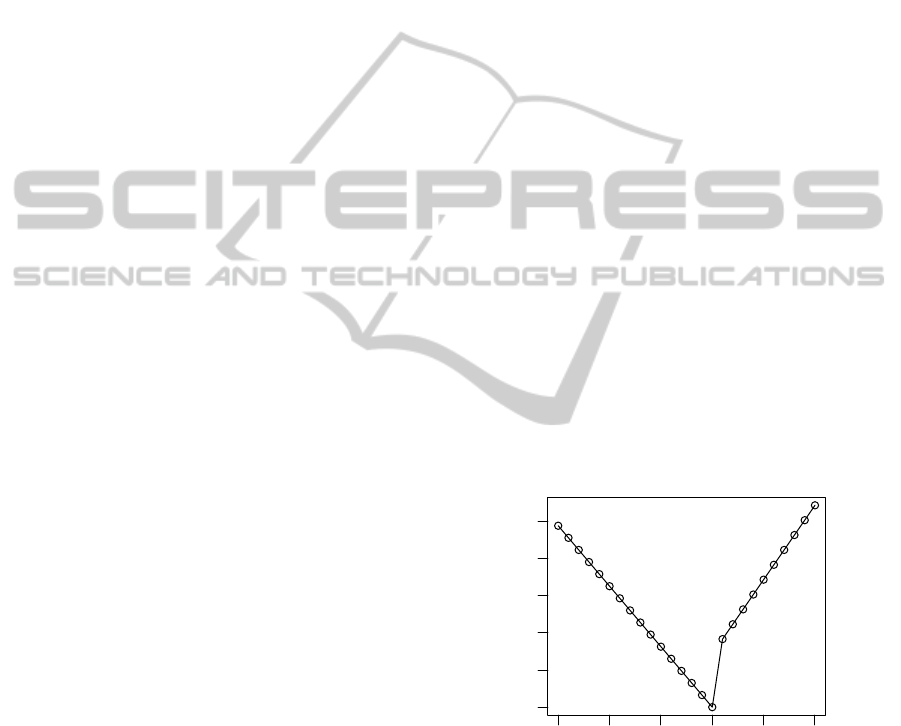

0e+00 1e+05 2e+05 3e+05 4e+05 5e+05

0 5 10 15

y

D

i

/κ

⌈D

i

/κ⌉

Z

i

Z

i

D

i

Figure 1: Number of bogies actually used Z

i

=

min(y, ⌈D

i

/κ⌉) versus demand, D

i

.

Figure 1 shows the number of bogies actually

used, when demand ranges from 0 up to 500000 given

that capacity is κ = 30000 and the number of reserved

bogies is y = 12 (shown in the horizontal dashed-

dotted line). The number of bogies needed for all

demand is ⌈D

i

/κ⌉, the stepwise nondecreasing func-

tion shown in the dotted line. (The quantity inside

the ceiling D

i

/κ is a linear increasing function shown

in the dashed line.) The solid line in Figure 1 is the

number of bogies actually used, Z

i

= min(y,⌈D

i

/κ⌉)

as in (1). (In fact, two bogies are often fitted to each

carriage train at the two ends. By “one bogie,” we ac-

tually mean one pair of bogies. Furthermore, we do

not consider a double-stack car/well wagon.)

The additional payment of gZ

i

is transferred to

the rail company, where the per-liter rail contract rate

is r, and the per-tank transportation fee is g = rκ. If

demand exceeds the total volume of tanks initially

reserved upfront, κy, then the excess (D

i

− κy)

+

is

transported by the trucking company at a per-liter

rate t, where 0 < r < t. The expected total transporta-

tion cost incurred by the shipper is

ψ(y) =

˜

fy+ E

n

∑

i=1

gmin(y,⌈D

i

/κ⌉) + t(D

i

− κy)

+

= E

n

∑

i=1

fy+ gmin(y,⌈D

i

/κ⌉) + t(D

i

− κy)

+

(4)

where f =

˜

f/n the upfront payment fee per day.

Inside the square brackets in (4), the first term is the

fixed cost of reserving y bogies, whereas the second

and third terms are the random transportation costs by

a train and a truck, respectively. Note that (4) is also

valid at y = 0: If we do not use rail and use only truck,

then the expected cost is ψ(0) = t

∑

n

i=1

E[D

i

], the per-

unit truck cost times the expected total demand.

The shipper’s problem is to determine y ∈ Z

+

the

number of bogies to reserve upfront at the beginning

of the planning horizon. The trade-offs are obvious:

The shipper must commit y before daily demand is

materialized. If y is larger than the number of bogies

actually needed on that day Z

i

, no refund in provided

for unused bogies, and the shipper pays too much up-

front. On the other hand, if y < Z

i

, the excess vol-

ume needs to be transported by truck, whose per-liter

freight rate is more expensive. A firm commitment is

hedged against demand uncertainty; this is similar to

the newsvendor problem.

Despite some similarity, our payment does differ

from that in the newsvendor model. In the standard

newsvendor problem, the objective function is based

on the demand actually served, min(x,D), where D

is a random demand and x is the order quantity.

If the daily payment to the rail company were lin-

early proportional to daily volume actually shipped,

then the standard newsvendor problem would be ap-

plied directly. Nevertheless, the daily payment to the

rail company is linearly proportion to the total vol-

ume of tanks actually used, κmin(y,⌈D

i

/κ⌉), which

is greater than or equal to the total volume actually

shipped, min(κy,D

i

). Then,

gmin(y,⌈D

i

/κ⌉) = r{κmin(y,⌈D

i

/κ⌉)}

≥ rκmin(y,D

i

/κ) = r[min(κy,D

i

)].

(5)

The left-hand-side (LHS) can be viewed as the freight

rate times the total volume of tanks, whereas the right-

hand-side (RHS) is the freight rate times the total vol-

ume actually carried in the tanks. The total volume

NewsvendorModelinRailContracttoTransportGasolineinThailand

239

of tanks (LHS), the term inside the curly brackets,

is at least the total volume actually carried (RHS),

the term inside the square brackets. Our scheme im-

plies higher payment to the rail company, compared to

other schemes based on the volume actually shipped.

In the analysis below, we will show that, because of

this payment scheme, the expected cost is not convex,

whereas that in the newsvendor model is convex.

3 ANALYSIS

Assume that the vector of daily demands

D

1

,D

2

,...,D

n

are independent and identically

distributed R

+

-valued random variables. Let F be the

common distribution and D the random variable with

such distribution, i.e., the random daily demand. Let

¯

F be the complementarycumulativedistribution func-

tion; i.e.,

¯

F(t) = P(D > t) = 1−P(D ≤ t) = 1−F(t).

Let F

−1

denote the quantile function. Define the

first-order loss function of D as L(x) = E[(D−x)

+

] =

R

∞

x

¯

F(u)du. Also define the limited expected

value as LEV(x) = E[min(x,D)] =

R

x

0

¯

F(u)du. For

well-known continuous distributions (e.g., lognor-

mal, gamma, Weibull, beta), the formulas for the

limited expected value and the loss function are

readily available. Furthermore, if an expression

for L(x) = E[(D − x)

+

] is available, then we can

easily obtain a formula for LEV(x) = E[min(x,D)]

by using E[min(x,D)] = E[D] − E[(D− x)

+

].

Define the expected daily cost, if the number of

reserved bogies is y, as follows:

π(y) = fy+ gE[min(y, ⌈D/κ⌉)] + tE[(D− κy)

+

]

(6)

= fy+ g

y−1

∑

i=0

¯

F(iκ) + t

Z

∞

κy

¯

F(u)du. (7)

Then, the total expected cost over n day is

ψ(y) = nπ(y) (8)

since the expectation of the sum of random variables

is the sum of the expected values. [Derivation of (7) is

provided in Appendix.] Henceforth, we focus on the

expected daily cost. Note that expression (7) provides

an easy way to evaluate π(y): The last term E[(D−

x)

+

] =

R

∞

x

¯

F(u)du where x = κy is the first-order loss

function of D.

Proposition 1 characterizes an optimal solu-

tion y

∗

= argmin π(y) when demand is deterministic;

specifically, P(D = d) = 1. Proofs of all propositions

are given in Appendix.

Proposition 1. Suppose f ≤ (t − r)κ.

1. If d < ( f + g)/t, y

∗

= 0, and only truck is used.

2. If ( f + g)/t ≤ d ≤ κ, y

∗

= 1, only train is used.

3. If d > κ, both train and truck are used, and

y

∗

= argmin{π(⌊d/κ⌋),π(⌈d/κ⌉)}.

Suppose f > (t − r)κ. Then, y

∗

= 0 and only truck is

used.

The results in Proposition 1 make sense economically.

If the fixed upfront is very large (i.e., f > (t − r)κ),

then we use only truck. On the other hand, suppose

that the fixed upfront is not that large. Then we have

to take into account the size of demand. If demand is

smaller than the cutoff ( f + g)/t, we use only truck

to avoid paying upfront. If demand is larger than the

cutoff and less than the bogie capacity, then it is opti-

mal to reserve only one bogie, and no truck is needed,

because all demands can be put into one bogie. If de-

mand is larger than the bogie capacity, then we use

both truck and train.

For shorthand, denote ∆(y) = π(y+ 1) − π(y). If

the expected daily cost were convex, then we could

easily derive an optimality condition,

argminπ(y) = argmin

y∈Z

+

{∆(y) ≥ 0}. (9)

Unfortunately, π(y) is not convex: Figure 2

shows π(y), with constant demand P(D = d) = 1

where d = 458000, κ = 30000, r = 0.3691, t = 0.49,

f = 2000.

0 5 10 15 20 25

200000 210000 220000

y

π(y)

Figure 2: Expected daily cost π(y) is not convex on Z

+

.

There are two kinks at ⌊d/κ⌋ = 15 and ⌈d/κ⌉ =

16.

Henceforth, we consider the problem with random

demand. In Proposition 2 we identify a condition un-

der which the optimality condition (9) holds, and pro-

vide a closed-form optimal expression for the num-

ber of reserved bogies, which minimizes the expected

daily cost. Let ζ denote a density function of F.

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

240

Proposition 2. Assume that

κζ(κy)

F(κ(y+ 1)) − F(κy)

≤

t

r

(10)

for all y ∈ Z

+

.

1. The expected cost π(y) is unimodal and attains its

minimum at y

∗

= argmin

y∈Z

+

{∆(y) ≥ 0} where

∆(y) = f + rκ

¯

F(κy) − t

Z

κ(y+1)

κy

¯

F(u)du. (11)

Furthermore, if f ≥ κ(t − r), then π(y) attains its

minimum at y

∗

= 0.

2. The optimal number of reserved bogies increases

if one or more of the following conditions hold:

(i) the fixed upfront payment f decreases; (ii) the

rail freight rate r decreases; (iii) the truck freight

rate t increases.

If the fixed upfront payment is sufficiently large, e.g.,

at least κ(t − r), then the shipper should not use rail

service; all daily demand should be accommodated by

truck. Part 2 also gives a sensitivity analysis with re-

spect to a change in a contract parameter. The results

make economically sense.

To find an optimal solution using (11) in Propo-

sition 2, we need to be able to evaluate the definite

integral

R

κ(y+1)

κy

¯

F(u)du. This can be written as the

difference of the two loss functions

Z

κ(y+1)

κy

¯

F(u)du =

Z

∞

κy

¯

F(u)du −

Z

∞

κ(y+1)

¯

F(u)du

= L(κy) − L(κ(y+ 1)).

Alternatively, it can be computed as the difference of

the two limited expected values

Z

κ(y+1)

κy

¯

F(u)du =

Z

κ(y+1)

0

¯

F(u)du −

Z

κy

0

¯

F(u)du

= LEV(κ(y+ 1)) − LEV(κy).

As previously mentioned, a closed-form expression

for either loss function or limited expected value can

be found in standard probability and statistics text-

books. A numerical example, which describes how

to find an optimal solution, is given in at the end of

this section.

Although the expected cost π(y) is not convex, it

is unimodal, and an optimal solution can be found an-

alytically, when condition (10) holds. We argue that

this condition is not very restrictive. Recall that the

cumulative distribution function is the area under the

density curve: F(t) =

R

t

0

ζ(u)du. Then,

F(κ(y+ 1)) − F(κy) ≈ κζ(κy). (12)

In (12), the LHS is the area under the density curve

from t

1

= κy to t

2

= κ(y+ 1), whereas the RHS is the

area of the rectangle with height equal to density at t

1

,

ζ(κy), and width equal to the length of interval [t

1

,t

2

],

κ. With this approximation, condition (10) becomes

1 ≈

κζ(κy)

F(κ(y+ 1)) − F(κy)

≤

t

r

.

In our model, the truck rate is strictly greater than the

rail rate, t > r; so condition (10) usually holds.

We now turn our attention to a heuristic solution.

We approximate the expected daily cost by removing

the ceiling function in (6):

ν(y) = fy+ gE[min(y,D/κ)] + tE[(D − κy)

+

]

= fy+ rE[min(κy,D)] + tE[(D− κy)

+

].

The approximated cost ν(y) differs from the exact

cost π(y) only on the second term: In ν(y), the cost

charged by the rail company is based on the total

volume actually shipped, whereas in π(y) it is based

on the total volume of tanks actually used; see (5).

Clearly, the approximated cost is a lower bound on

the exact cost, by the definition of the ceiling func-

tion. The approximated cost ν(y) is continuously dif-

ferentiable, and a one-line formula for a minimizer is

derived in Proposition 3.

Proposition 3. If f < κ(t −r), then the approximated

cost ν(y) is convex and attains its minimum at

y

a

=

1

κ

F

−1

1−

f/κ

t − r

. (13)

We refer to 1 − f/[κ(t − r)] as the critical ratio.

Recall that in the newsvendor model with overage

c

o

and underage c

u

, the optimal order quantity is

F

−1

(c

u

/(c

u

+ c

o

)) where F is the demand distribu-

tion, and c

u

/(c

u

+ c

o

) is the so-called critical ratio.

In analogous, the overage is f/κ, the per-liter cost

of reserving too much and some bogies are not used.

The underage occurs if we do not reserve enough bo-

gies and need to use both road and rail; so the per-

liter underage is t − r − f/κ. The underage can be

viewed as the incremental per-liter cost if truck is

used. Specifically, it is t − (r+ f/κ), the per-liter cost

by truck t minus the per-liter cost by rail, which is

the sum of the per-liter freight rate and the per-liter

upfront (r+ f/κ).

Our heuristic solution is to reserve

y

∗

a

=

(

⌈y

a

⌉ if π(⌈y

a

⌉) ≥ π(⌊y

a

⌋)

⌊y

a

⌋ otherwise

Our heuristic solution requires evaluation of the ex-

pected daily cost function π(y) and compares the ex-

pected values at the floor and ceiling.

In practice, the per-liter rates by train and truck, r

and t, may depend on daily crude oil or gas price;

NewsvendorModelinRailContracttoTransportGasolineinThailand

241

they may be random when the contract is signed, and

their values are realized daily. Then, the expected to-

tal cost (4) becomes

E

n

∑

i=1

fy+ κR

i

min(y,⌈D

i

/κ⌉) + T

i

(D

i

− κy)

+

where R

i

and T

i

are per-liter rates by train and truck

on day i, respectively. We further assume that the

per-liter rates are independently and identically dis-

tributed and that they are independent of demands.

Our formulation and analysis remain valid, if we now

interpret r = E[R

1

] and t = E[T

1

] as the expected per-

liter rates by train and truck, respectively.

Suppose that the expected per-liter rates are ex-

ogenously specified. Assume that the shipper makes

decision according to (13). If the rail company wants

to allocate exactly y

u

∈ Z

+

bogies to the shipper, then

the daily upfront payment should be

f = κ(t − r)[1− F(y

u

κ)]. (14)

We obtain (14) simply by solving (13) for the fixed

upfront f.

NUMERICAL EXAMPLE

Consider one of the biggest petroleum companies

in Thailand, who wants to transport hi-speed diesel

from Saraburee province in the central region to Phare

province in the northern region. Two modes of trans-

portation are available: 1) road, service offered by a

3PL trucking company, and 2) rail from Baan Pok Pak

station in Saraburee to Denchai station in Phare, ser-

vice offered by State Railway of Thailand. The dis-

tance is about 500 kilometers. Either truck or train

can make a round trip within a single day.

The 310-day demands in year 2013 are collected,

and its histogram is shown in Figure 3. We fit a log-

normal distribution with parameters µ = 12.756 and

σ = 0.488. (These parameters are obtained using a

fitdistr

command in R.) The corresponding den-

sity is superimposed over the histogram in Figure 3.

The daily demand has mean

E[D] = exp(µ+ σ

2

/2) = 390456.6 liters

and standard deviation

p

var(D) =

q

exp(2µ+ σ

2

)(exp(σ

2

) − 1)

= 202470.4 liters.

The coefficient of variation is 0.52; in words, the stan-

dard deviation is about half of the mean. The capac-

ity of a tank is κ = 33000 liters. The rail per-liter

rate is r = 0.3169 Thai Baht (THB), the per-tank cost

is g = rκ = 10457.7, and the truck per-liter rate is

t = 0.49 THB.

Daily volume

Density

0 400000 800000 1200000

0.0e+00 1.5e−06 3.0e−06

Figure 3: Histogram of daily demand.

Assume that one year has n = 310 days. It follows

from Proposition 2 Part 1 that if the fixed daily upfront

is greater than κ(t−r) = 5712.3 THB (or equivalently

the fixed upfront is

˜

f = nf = 1770813 THB per bogie

per year), then the shipper would not use rail service

at all.

Suppose that the daily upfront is f = 1000 THB.

For the given daily demand distribution, we choose

the maximum number of reserved bogies to be y

m

=

60; this y

m

is sufficient to accommodate daily demand

roughly 99.99 percent of the time. We can verify that

condition (10) holds for each y = 1,2,...,y

m

; see Fig-

ure 4.

0 10 20 30 40 50 60

0.0 0.2 0.4 0.6 0.8 1.0

LHS of (10)

y

Figure 4: Sufficient condition is verified: LHS values of

(10) are at most t/r = 1.54622.

Then, we can use (11) to find an optimal solu-

tion. The difference ∆(y) is evaluated for each y =

1,2, ...,y

m

; see last column in Table 1.

The first y at which the difference is nonnegative

is y

∗

= argmin{∆(y) ≥ 0} = 16. The optimal solu-

tion given in Proposition 2 requires the shipper to re-

serve y

∗

= 16 bogies.

At the optimal solution, on each day the expected

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

242

Table 1: Expected daily total cost π(y), rail

cost gE[min(y,⌈D/κ⌉)], truck cost tE[(D − κy)

+

],

upfront fy, and ∆(y).

y upfront cost.truck cost.rail π(y) ∆(y)

1 1000 175153.72 11457.70 186611.42 -4711.08

2 2000 158984.94 22915.39 181900.33 -4683.55

3 3000 142847.23 34369.55 177216.78 -4556.35

4 4000 126886.69 45773.75 172660.44 -4281.27

5 5000 111398.11 56981.05 168379.17 -3874.89

6 6000 96736.04 67768.24 164504.28 -3386.85

7 7000 83204.85 77912.57 161117.42 -2868.02

8 8000 71000.09 87249.31 158249.40 -2357.12

9 9000 60201.56 95690.71 155892.28 -1878.85

10 10000 50794.65 103218.78 154013.43 -1446.41

11 11000 42699.89 109867.13 152567.02 -1064.89

12 12000 35800.17 115701.96 151502.13 -734.20

13 13000 29961.64 120806.28 150767.93 -451.25

14 14000 25047.97 125268.71 150316.67 -211.43

15 15000 20929.22 129176.03 150105.24 -9.58

16 16000 17486.66 132609.00 150095.66 159.44

17 17000 14614.86 135640.24 150255.10 300.46

18 18000 12222.10 138333.46 150555.56 417.82

19 19000 10229.71 140743.67 150973.38 515.31

20 20000 8570.95 142917.74 151488.69 596.23

21 21000 7189.66 144895.26 152084.92 663.35

22 22000 6038.81 146709.45 152748.26 719.02

23 23000 5079.23 148388.06 153467.29 765.22

24 24000 4278.37 149954.13 154232.51 803.57

25 25000 3609.24 151426.84 155036.08 835.43

26 26000 3049.47 152822.04 155871.51 861.93

27 27000 2580.58 154152.87 156733.45 883.99

28 28000 2187.26 155430.18 157617.44 902.38

29 29000 1856.85 156662.98 158519.83 917.73

30 30000 1578.88 157858.68 159437.56 930.56

31 31000 1344.66 159023.46 160368.12 941.29

32 32000 1147.00 160162.41 161309.41 950.29

33 33000 979.94 161279.76 162259.71 957.85

34 34000 838.53 162379.03 163217.55 964.20

35 35000 718.62 163463.12 164181.75 969.54

36 36000 616.81 164534.48 165151.29 974.05

37 37000 530.21 165595.13 166125.34 977.86

38 38000 456.45 166646.75 167103.20 981.08

39 39000 393.53 167690.75 168084.28 983.81

40 40000 339.77 168728.32 169068.09 986.12

41 41000 293.77 169760.44 170054.21 988.09

42 42000 254.35 170787.94 171042.29 989.76

43 43000 220.53 171811.53 172032.06 991.19

44 44000 191.45 172831.79 173023.24 992.40

45 45000 166.44 173849.21 174015.64 993.44

46 46000 144.88 174864.21 175009.09 994.33

47 47000 126.27 175877.15 176003.42 995.10

48 48000 110.19 176888.32 176998.51 995.75

49 49000 96.28 177897.99 177994.26 996.31

50 50000 84.23 178906.35 178990.58 996.80

51 51000 73.77 179913.60 179987.37 997.21

52 52000 64.69 180919.90 180984.59 997.57

53 53000 56.79 181925.37 181982.16 997.88

54 54000 49.91 182930.14 182980.04 998.15

55 55000 43.91 183934.29 183978.20 998.39

56 56000 38.68 184937.91 184976.58 998.59

57 57000 34.10 185941.07 185975.17 998.76

58 58000 30.10 186943.83 186973.93 998.92

59 59000 26.60 187946.25 187972.85 999.05

60 60000 23.52 188948.37 188971.90

number of tanks actually used is E[min(y

∗

,⌈D/κ⌉)] =

11.15, and the expected total volume of tanks

is κE[min(y

∗

,⌈D/κ⌉)] = 367950, whereas the ex-

pected total volume actually shipped via rail is

E[min(κy

∗

,D)] = 354769.5, and the expected volume

shipped via road is E[(D− κy

∗

)

+

] = 35687.

Alternatively, the optimal solution can be found

via enumeration. In addition to ∆(y), Table 1 shows

the expected total daily cost π(y) along with its com-

ponents, namely the expected rail cost, expected truck

cost, and the upfront payment.

0 10 20 30 40 50 60

0 50000 100000 150000

y

cost

upfront

cost.truck

cost.rail

π(y)

Figure 5: Expected total cost as function of number of bo-

gies.

These costs are plotted in Figure 5. The lowest

point of the expected total cost occurs at y

∗

= 16.

If one did not take into account any cost pa-

rameters and ignored demand uncertainty, then one

could estimate the number of reserved bogies by di-

viding the daily mean demand by the tank capacity

and rounding up, ⌈E[D]/κ⌉ = ⌈11.84⌉ = 12, and the

expected volume shipped via road would be E[(D −

12κ)

+

] = 73061.58, an increase of 105% from that

using the optimal solution. Note that the optimal so-

lution y

∗

is larger than the mean demand divided by

capacity: The number of reserved bogies would be

less than the optimal solution by 25%. The expected

additional cost if one did not use an optimal solution

would be π(12) − π(y

∗

) = 151502 − 150096 = 1406

THB per day, or equivalently (310)(1406) = 435860

THB per year.

To find a heuristic solution, we compute the criti-

cal ratio 1− f/[κ(t− r)] = 0.8259; the corresponding

quantile divided by the capacity is y

a

= 16.59. Since

π(16) = 150096 < 150255 = π(17), from our heuris-

tic the number of reserved bogies y

∗

a

= 16. At this

particular problem instance, the heuristic solution is

exactly equal to the optimal solution. To evaluate per-

NewsvendorModelinRailContracttoTransportGasolineinThailand

243

formance of our heuristic approach, more numerical

examples can be conducted in the future.

Suppose that the rail company can allocate at most

y

u

= 7 bogies on this leg (origin-destination pair).

Further assume that the shipper makes decision ac-

cording to (13). Then, the rail company should offer

a daily upfront payment of at least (14), which is equal

to 4553.78 THB, or equivalently

˜

f = 1411669 THB

per bogie per year.

Throughout our numerical example, the LEV

function is used extensively to evaluate ∆(y) and

π(y). For the lognormal distribution with parame-

ters µ and σ, the LEV function is

E[min(D,x)] = exp(µ+ σ

2

/2)Φ

log(x) − µ− σ

2

σ

+ x

h

Φ

log(x) − µ

σ

i

where Φ is the cumulative distribution function of the

standard normal distribution. All calculations in our

numerical example are done in R. (For instance, R

command for the cumulative distribution function of

lognormal is

plnorm

and that of normal is

pnorm

.)

4 CONCLUSION

In summary, we formulate a newsvendor model in

which the shipper determines how many bogies to

be reserved before random daily demand is materi-

alized. If the number of reserved bogies is very large,

we may end up paying a large upfront fee for unused

bogies. On the other hand, if we reserve not enough

bogies, we incur a large transportation cost via truck.

We want to determine an optimal number of bogies

to reserve in order to minimize the expected cost. In

the analysis, we show that under certain condition, the

expected cost is unimodal and a closed-form optimal

solution is derived. An easy-to-implement heuristic

solution is also proposed. Some sensitivity analysis is

provided: The number of reserved bogies decreases,

if the upfront payment increases, or the rail freight

rate increases, or the truck freight rate decreases. In

the numerical example, we show that the optimal so-

lution and the heuristic solution coincide. Further-

more, if we did not take into account of demand un-

certainty as in our model, then the number of reserved

bogies could differ from the optimal solution by 25%

and would result in a significant increase in trans-

portation cost.

Some future research directions are identified be-

low. Recall that, in the analysis, we assume demands

are independent and identically distributed. Note that

the expected total cost (4) can be written as

ψ(y) = E[

n

∑

i=1

ψ

i

(y)] =

n

∑

i=1

E[ψ

i

(y)] (15)

where ψ

i

(y) is the random cost on day i

ψ

i

(y) = fy+ gmin(y,⌈D

i

/κ⌉) + t(D

i

− κy)

+

.

Equation (15) always holds (whether or not demands

are independent) since the expectation of the sum of

random variables is equal to the sum of the expecta-

tion. If demands are not independent but identically

distributed, then all of our results remain unchanged,

because ψ(y) = nE[ψ

1

(y)] as in (8), and we can focus

on the expected daily cost, E[ψ

1

(y)] = π(y) in (6).

However, if demands are not identically distributed,

then we cannot minimize each term E[ψ

i

(y)] sepa-

rately: We need to minimize the total expected cost

∑

n

i=1

[ψ

i

(y)]. Cases when demands are nonstationary

(i.e., neither independent nor identically distributed)

would be an interesting research extension.

Recall that our model considers a contract prob-

lem on a single leg in the railroad network. One ex-

tension would be to study a contract to transport gaso-

line over the entire railroad network. Furthermore,

for each leg, there may be multiple types of contain-

ers, depending on their capacities. The upfront fee

depends on the container type, and the per-container

charge depends on the container capacity and the dis-

tance between an origin and a destination.

Another interesting extension is a railroad’s con-

tract design problem. Our model allows the shipper

to choose the number of bogies to be reserved. In the

contract design problem, we would allow the railroad

company to choose the parameters of the contract,

e.g., the upfrontpayment and the per-containerfreight

charge. The contract design problem can be modeled

using a game-theoretical framework. We hope to pur-

sue these or related problems in the future.

ACKNOWLEDGEMENTS

The problem was materialized after some discussions

with Mr. Apichat Gunthathong, our part-time master

student who has been working at the petroleum com-

pany (in the numerical example) for 12 years. His

independent project, a part of requirement for a mas-

ter degree in logistics management at the school, was

related to our model.

REFERENCES

Armstrong, A. and Meissner, J. (2010). Railway revenue

managment: Overview and models. Working paper

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

244

(available at http://www.meiss.com), Lancaster Uni-

versity Management School.

Cachon, G. (2003). Supply chain coordination with con-

tracts. In de Kok, A. and Graves, S., editors, Hand-

books in Operations Research and Management Sci-

ence: Supply Chain Management. Elsevier, Amster-

dam.

Cachon, G. and Terwiesch, C. (2009). Matching Supply

with Demand: An Introduction to Operations Man-

agement. MccGraw-Hill, New York.

Energy Information Administration (EIA) (2008). Motor

gasoline consumption 2008: A historical perspective

and short-term projections. Retrieved August 2, 2014

from www.eia.gov/forecasts/steo/special/pdf/.

Khouja, M. (1999). The signle-period (news-vendor) prob-

lem: Literature review and suggestions for future re-

search. Omega, 27(5):537–553.

Kraft, E., Srika, B., and Phillips, R. (2000). Revenue

management in railroad applications. Transportation

Quarterly, 54(1):157–176.

Lariviere, M. (1999). Supply chain contracting and coordi-

nation with stochastic demand. In Tayur, S., Gane-

shan, R., and Magazine, M., editors, Quantitative

Models for Supply Chain Management. Kluwer Aca-

demic Publishers, Boston.

Nahmias, S. (2009). Production and Operations Research.

McGraw-Hill, Inc., New York.

Organization of the Petroleum Exporting Countries (OPEC)

(2013). World oil outlook 2013. Retrieved August 2,

2014 from

www.opec.org

.

Pantumsinchai, P. and Knowles, T. (1991). Standard con-

tainer size discounts and the single-period inventory

problem. Decision Sciences, 22(3):612–619.

Qin, Y., Wang, R., Vakharia, A., Chen, Y., and Seref, M.

(2011). The newsvendor problem: Review and direc-

tions for future research. European Journal of Opera-

tional Research, 213(2):361–374.

Silver, E., Pyke, D., and Peterson, R. (1998). Inventory

Management and Production Planning and Schedul-

ing. John Wiley & Sons, Inc., New York.

Yin, M. and Kim, K. (2012). Quantity discount pricing

for container transportation services by shipping lines.

Computers & Industrial Engineering, 63(1):313–322.

APPENDIX

Derivation of (7)

For shorthand, denote M = ⌈D/κ⌉. Since D is a non-

negative random variable with distribution F, M is a

Z

+

-valued random variable. The cumulative distribu-

tion function of M is as follows: For any t ∈ R

+

P(M ≤ t) = P(⌈D/κ⌉ ≤ ⌊t⌋)

= P(D/κ ≤ ⌊t⌋)

= F(⌊t⌋κ).

We use the tail-sum formula for expectation:

E[min(t,M)] =

∞

∑

j=0

P(min(t,M) > j)

=

⌊t⌋−1

∑

j=0

P(M > j)

=

⌊t⌋−1

∑

j=0

¯

F( jκ).

The finite sum in the second term in (7) is obtained.

The last term is the first-order loss function of D.

Proof of Proposition 1

Proof. For shorthand, let

˜

π(y) = [ f − (t − r)κ]y+ td

ˆ

π(y) = f y + g⌈d/κ⌉.

Given that demand is constant and equal to d, the

daily cost (6) becomes

π(y) = fy+ gmin(y, ⌈d/κ⌉) + t(d − κy)

+

=

(

fy+ gy+ t(d − κy) ify = 0, 1,2,..., ⌊d/κ⌋

fy+ g⌈d/κ⌉ if y = ⌈ d/κ⌉,. ..

=

(

˜

π(y) if y = 0,1, 2,.. .,⌊d/κ⌋

ˆ

π(y) if y = ⌈d/κ⌉,⌈d/κ⌉ + 1, ...

In particular, if d < κ,

π(0) = td

π(y) = fy+ g if y = 1, 2,...

Since both

˜

π(y) and

ˆ

π(y) are linear, π(y) is a piece-

wise linear function. Note that

ˆ

π(y) is strictly increas-

ing since f > 0. Let y

∗

= argmin π(y).

Suppose f > (t − r)κ. Both

˜

π and

ˆ

π are increas-

ing functions, so y

∗

= 0. In words, if the fixed upfront

is sufficiently large, we use only truck and do not re-

serve any bogies (y

∗

= 0).

Suppose f ≤ (t −r)κ. That is, ( f + g)/t ≤ κ since

g = rκ.

1. If d < ( f +g)/t, then in this case d < κ and π(0) =

td ≤ ( f + g) = π(1), so y

∗

= 0, and we use only

truck.

2. If ( f +g)/t ≤ d < κ, then π(0) > π(1), so y

∗

= 1;

i.e., we reserve one bogie. Since demand does not

exceed capacity, one bogie is enough to accom-

modate entire demand; we do not need any truck.

3. If d ≥ κ, then π(y) is linearly decreasing up

to ⌊d/κ⌋ and increasing from ⌈ d/κ⌉. Specifi-

cally, the coefficient of y in

˜

π(y) is negative when

f ≤ (t − r)κ, so

˜

π(y) is linearly decreasing and

NewsvendorModelinRailContracttoTransportGasolineinThailand

245

minimized at ⌊d/κ⌋. Since

ˆ

π(y) is increasing, it is

minimized at ⌈d/κ⌉. Thus, the global minimizer

is argmax{

ˆ

π(⌈d/κ⌉),

˜

π(⌊d/κ⌋)}.

Proof of Proposition 2

Proof. From (7) we have that

∆(y) = f + g

¯

F(κy) − t

Z

κ(y+1)

κy

¯

F(u)du,

and

∆

′

(y) = −κgζ(κy) + κt[F(κ(y+ 1))− F(κy)].

Recall g = rκ. If (10) holds, then ∆

′

(y) ≥ 0, or equiva-

lently ∆(y) is increasing; thus, the expected cost func-

tion π(y) is unimodal. Let y

∗

= argmin

y∈Z

+

{∆(y) ≥

0}. Then, π(y) switches from decreasing to increas-

ing at y

∗

; hence, π(y) attains its minimum at y

∗

.

Finally, note that

∆(0) = f + κr −t

Z

κ

0

¯

F(u)du ≥ f − κ(t − r)

since 0 ≤

¯

F(u) ≤ 1. If f ≥ κ(t − r), ∆(0) ≥ 0; π(y)

is increasing on Z

+

and is, thus, minimized at y

∗

=

0. Part 2 follows from (11) and the fact that ∆(y) is

increasing.

Proof of Proposition 3

Proof. For convenient let x = κy and define

ξ(x) = ( f/κ)x+ rE[min(x,D)] +tE[(D− x)

+

]

Then, argminν(y) = (argminξ(x))/κ since ν(y) =

ξ(x). After some simplifications, we get

ξ(x) = ( f/κ)x+ rE[D] + (t− r)E[(D− x)

+

].

The first and second derivatives with respect to x are

ξ

′

(x) = f/κ − (t − r)

¯

F(x)

ξ

′′

(x) = (t − r)F

′

(x) = (t − r)ζ(x) ≥ 0

respectively. The approximated cost function ξ(x) is

convex. If f < κ(t − r), then the optimality condi-

tion is that ξ

′

(x) = 0; i.e., x = F

−1

(1− f/[κ(t − r)])

and (13) follows immediately.

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

246