Ensuring Blood is Available When it is Needed Most

Nigel M. Clay, John W. Hearne, Babak Abbasi and Andrew Eberhard

School of Mathematics and Geospatial Science, RMIT University, Bourke Street, Melbourne, Australia

1 STAGE OF THE RESEARCH

This research is in the first year of a three to four

year program. An initial review of the literature has

been undertaken and, as this document will show, an

approach is proposed to address the research ques-

tions. Some initial work has commenced using this

approach but much more will be required for comple-

tion.

2 OUTLINE OF OBJECTIVES

There are several objectives of this research:

• To establish a mathematical basis for the variance

seen in real blood inventory data;

• To develop a blood inventory simulation model

which incorporates this mathematical basis;

• To compare the outcome of the simulation model

with competing models of blood inventory;

• To use the model to analyse the impact of alter-

native blood inventory policies on the supply of

blood.

3 RESEARCH PROBLEM

Past research conducted into the management and be-

haviour of blood inventories relies on distributional

assumptions regarding the supply and demand for

blood which tend to underestimate the true variation

in inventory volumes. This may lead to the underesti-

mation of blood shortages and outdates and/or give a

false sense of security to inventory managers. This re-

search will address this issue from a mathematical and

modelling perspective and will use the results to ex-

amine the impact of alternative blood inventory poli-

cies.

It is hypothesised that variation in blood invento-

ries arises from two canonical sources. Firstly, the

process of donation, storage, hospital orders, supply

and transfusion consists of delays at several points.

These delays can cause system oscillation and insta-

bility as a result of small changes in demand with-

out the presence of stochastic variation in demand and

supply.

The second source of variation is the stochastic

nature of demand and supply themselves. When con-

sidered together with the first source of volatility the

total variation in the system may be amplified.

It is believed that a model incorporating both of

these sources of variation will exhibit the degree of

volatility seen in the real data. Such a model could

then be used to optimise inventory decisions or test

the behaviour of the inventory to potential changes in

blood storage, donor behaviour and so forth.

4 STATE OF THE ART

4.1 Early Work

The science of inventory management can be traced

back to 1913 when the first derivation of the economic

order quantity was given (Harris, 1913). This initial

work went substantially unchanged until 1951 when

an optimal solution to the (s, S) inventory policy was

presented (Arrow et al., 1951).

This seminal work assumed that the commodity

could be re-ordered at specific intervals and incorpo-

rated uncertainty in demand. The inventory manager

chooses two values, S and s, where S > s. If the inven-

tory on hand, y

t

, at time t is less than s then the inven-

tory manager orders S−y

t

of the commodity from the

supplier to meet future demand. The problem faced

by the inventory manager is to choose suitable val-

ues of S and s that are optimal in the sense that they

minimise the combined cost of holding the stock and

placing an order. Arrow et al. provided an optimal

solution to this problem.

However, other inventory policies could also be

used by an inventory manager. Instead of an (s, S)

policy a manager could take other approaches. For ex-

ample, he could replace the commodity as soon as it

was ordered, he could make few but large orders or he

3

M. Clay N., Hearne J., Abbasi B. and Eberhard A..

Ensuring Blood is Available When it is Needed Most.

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

could make frequent small orders. How could a man-

ager be certain that choosing an optimal (s, S) policy

was superior to these alternatives? It turns out that

where demand is uncertain the optimal (s, S) policy

is optimal over any alternative inventory policy that

could be adopted (Scarf, 1960) although the proof was

not available until several years after the paper from

Arrow et.al.

4.2 Perishable Inventory

Some commodities have a fixed life span. We might

immediately think of such things as milk, eggs, bread

and so on but there are other examples: photographic

material, chemical weapons in a store, some short half

life radioactive items. If demand were known with

certainty for these then it would be easy to order in

such a way that the commodity never perishes. The

combination of demand uncertainty and a perishable

(fixed-lifetime) commodity is a more challenging one

than one where the demand is uncertain but the com-

modity has an infinite lifetime.

This forces us to confront not just the optimal or-

der polices in the face of uncertain demand but the

optimal issuing policies as well. The two ends of the

continuum for these are first in first out (FIFO) and

last in first out (LIFO). It seems fairly intuitive that a

FIFO policy is optimal for such inventories and early

proofs for some simple cases were provided in 1958

(Derman and Klein, 1958) while other cases were ad-

dressed later (Pierskalla and Roach, 1972).

The optimal ordering policies for perishable in-

ventories with uncertain demand were investigated

by both Steven Nahmias (Nahmias, 1975) and Brant

Fries (Fries, 1975). These researchers independently

derived the optimal inventory policy for this case. For

this case the inventory manager need only determine

the optimal quantity S of the commodity to hold. As

soon as the inventory falls below this value it is op-

timal to order replacement from the supplier. This is

known as the (S − 1, S) inventory policy.

4.3 Blood Inventories

Blood inventories are a subclass of perishable inven-

tory. These differ as, in addition to demand, the sup-

ply of blood and blood products is also stochastic.

The earliest relevant work on blood inventories ap-

plied known industrial inventory models to the prob-

lem (Millard, 1959). Two measures of blood in-

ventory performance were suggested: probability of

shortage and expected outdates. These measures are

still vitally important today. A limitation of this early

research is that it assumed that variation in both de-

mand and supply of blood is attributed to a Poisson

process. Other early work also tends to continue the

use of the a Poisson process for the supply of blood

(Elston and Pickrel, 1963; Prastacos, 1984), how-

ever differing assumptions have been applied to the

demand for blood. These have variously been neg-

ative binomial (Elston and Pickrel, 1963), modified

log normal (Prastacos, 1984) and batch Poisson (Goh

et al., 1993). More recently independent Poisson, or

related, processes have been used to model both sup-

ply and demand (Blake and Hardy, 2014; Abouee-

Mehrizi et al., 2014; Abbasi and Seidmann, 2014).

It is natural to ask how well these assumptions

match data collected from real blood banks. In their

paper, Blake and Hardy give us data from two Cana-

dian blood banks. A comparison is made between the

observed mean and standard deviation of empirical

aggregate inventory data and results obtained by sim-

ulation. While the means are approximately equal, it

is clear that the standard deviations do not match. Site

A, for example, has a mean of 8,197.54 and a standard

deviation of 1,204.15. The simulation for this site is

approximately equal in the mean but the standard de-

viation is 433.10. The real standard deviation is 2.8

times larger. Their assumption of a zero inflated Pois-

son process for supply and demand gives a simulation

which underestimates the true variance of the aggre-

gate inventory.

In a separate example it was shown (Atkinson

et al., 2012) that a simulation of blood bank dona-

tions and hospital transfusions required a coefficient

of variation of 1.32 to minimise the sum of squared

deviations between the empirical and simulated data.

This would not be the case if the donations and trans-

fusions resulted from a Poisson process.

Consideration of the appropriate donation and

transfusion distributions is important as shortages and

outdates occur in the tails of these distributions rather

than at the mean. Underestimation of the standard de-

viation would tend to underestimate the occurrence of

these events.

5 METHODOLOGY

The approach used in this research will set up a math-

ematical framework for modelling of blood inven-

tories. This will include learnings from a system

dynamics approach to modelling blood inventory in

which it is shown that the system itself contains feed-

back loops and delays which can cause volatility in

the donation rate and inventory levels without having

to assume exogenous sources of variation.

ICORES2015-DoctoralConsortium

4

5.1 Mathematical Framework

At the current stage of research this is only partly

worked out. We use the following notation:

• Capital letters refer to random variables

• Lowercase letters refer to a realisation of a ran-

dom variable or to scalars

• Bold case denote vectors and matrices

• The transpose of a vector or matrix is denoted by

the superscript

|

• Lowercase greeks denote probability density

functions

• Uppercase greeks denote cumulative density

functions.

• Subscripts refer to a property of a variable or func-

tion such as time or dimension.

At a given time t a region contains a total of N

t

ac-

tive blood donors. Not all of these blood donors are

available to donate at time t as some of them have

given blood in the last k days and some have an ap-

pointment to give blood that has not transpired at time

t. Denote by V

t

= {V

1

,V

2

, . . . ,V

k

} the number of un-

available donors where V

i

is the number of donors that

are ineligible to give blood for i days. This allows us

to obtain the number of unavailable donors as V

t

· 1

|

k

.

Where 1

k

is the unit sum vector of dimension k. De-

note P

t−1

as the number of donors that have made an

appointment but have not yet given blood. So, at time

t the total number of donors that are willing to make

an appointment to give blood is given by:

A

t

= N

t

− V

t

· 1

|

k

− P

t−1

(1)

Available donors will make an appointment to do-

nate blood over the interval (t,t + s] with the unknown

probability distribution Φ

t

(s) =

R

s

0

φ(x)dx. The inter-

val s should be defined as to avoid overlaps. Usually it

makes sense to define s = 1 since we are dealing with

single calendar days. Since the population consists of

only those donors that are active (we ignore donors

that might die or leave the system) we can state that

Φ

t

(∞) = 1. We define D

t

as the number of available

donors at time t that will make an appointment. Note

that:

D

t

=

A

t

∑

j=1

(T

j

< t + s) (2)

where T

j

> t is the time that donor j will make an

appointment to give blood.

(T

j

< t + s) =

1 w.p. Φ

t

(s)

0 w.p. 1 − Φ

t

(s)

(3)

It follows that the probability density function

ρ

t

(D

t

= d

t

| A

t

, Φ

t

(s)) of the number of donors that

will make and appointment over the period (t, t + s] is

given by:

A

t

d

t

Φ

t

(s)

d

t

[1 − Φ

t

(s)]

A

t

−d

t

(4)

Each of the d

t

donors will make an appointment

where the next available slot that does not exceed the

capacity of the donor centre is allocated to them. We

assume that the donor centre has a capacity of c ap-

pointment spots. At the beginning of day t there are

P

t−1

≥ 0 donors that have made an appointment but

have not given blood. The number of donors with an

appointment on day t is therefore B

t

= min(c, P

t−1

).

So we have

P

t

= P

t−1

− B

t

+ D

t

(5)

There is a chance that not all of these appointments

will be kept. We denote θ as the probability that a

donor breaks their appointment. This allows us to de-

fine the number of units of blood donated U on day

t as U

t

= B

t

− G

t

where G

t

is the number of donors

breaking their appointment on day t. Since U

t

≥ 0

it follows that 0 ≤ G

t

≤ B

t

. The probability density

function ξ(U

t

= u

t

| θ, B

t

) of the number of units of

blood donated on day t will be given by:

ξ(U

t

= u

t

| θ, B

t

= b

t

) =

b

t

u

t

θ

b

t

−u

t

(1 − θ)

u

t

(6)

Donors breaking their appointments G

t

= B

t

−U

t

re-

turn to the pool of available donors. Those that give

blood are removed from the available donors for k

days. So, at the beginning of day t + 1 the vector of

unavailable donors is:

V

t+1

= V

t

M + U

t

(7)

where U

t

=

{

0, 0, . . . ,U

t

}

and is of dimension k and

M is a k × k matrix such that:

M =

0 0 0 ··· 0 0 0

1 0 0 ··· 0 0 0

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

0 0 0 ··· 1 0 0

0 0 0 ··· 0 1 0

(8)

The updated number of available donors at time t + 1

is given by:

A

t+1

= A

t

− D

t

+ G

t

+ V

t

· π

|

k

(9)

where π

k

=

{

1, 0, ··· , 0

}

is of dimension k.

This framework is incomplete at this stage. It

is still necessary to develop it further to include the

markovian state transitions for the number of donors

that have made an appointment, the ageing of blood

inventory, the supply of blood to hospitals and the

subsequent transfusion of that blood. These addi-

tional components will form part of this research.

EnsuringBloodisAvailableWhenitisNeededMost

5

5.2 A System Dynamics View of Blood

Inventory

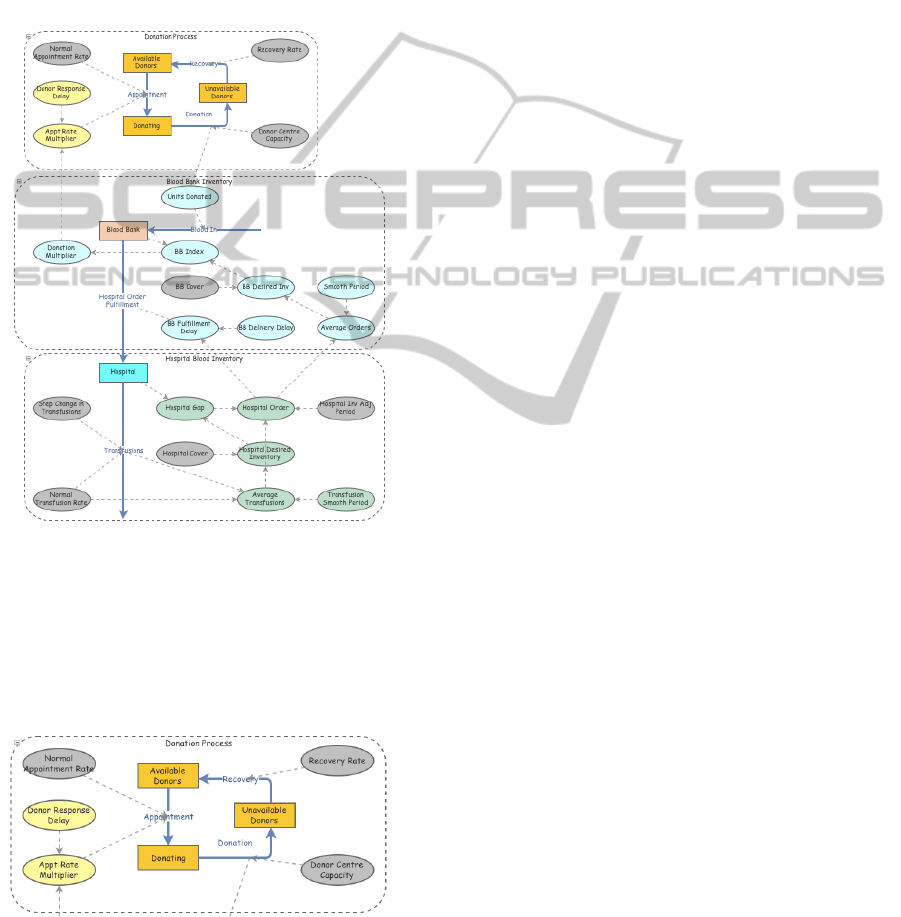

Insight Maker (Fortmann-Roe, 2014) was used to

build a simple model of blood donor, blood bank and

hospital interaction. This model, seen in figure 1 be-

low, is split into three main areas. The donation pro-

cess is captured in the top section of the model, the

blood bank in the middle section and the hospital in

the lower section.

Figure 1: A simple System Dynamics model of a blood in-

ventory built in Insight Maker.

Before we consider the behaviour of the whole

system we consider just the top section of the model

shown below in figure 2 which is concerned with the

donor base. This section will be also be used to de-

scribe the meaning of the various components.

Figure 2: The donor population model in Insight Maker.

Donors move between three states. These are rep-

resented by the three orange rectangular boxes. In

system dynamics parlance these are termed stocks.

A donor will either be available for donation, have

made an appointment to donate or has already do-

nated and is in an 84 day long recovery period. An

available donor will make an appointment to donate

blood. This will cause them to flow along the blue ar-

row from the available donor stock to to the donating

stock. Once blood is taken this donor will then flow

along the blue arrow into the unavailable donors stock

where he will remain for 84 days before recovering

and flowing back into the available state. The quan-

tity of 84 days is analogous to the parameter k given in

section 5.1 above. At the beginning of the simulation

this donor population is divided so that 6 donors are

in the process of donating blood, 504 are available to

give blood and 504 have given blood in the previous

84 days so they are unavailable. The sum of these val-

ues analogous to N

t

. The number of available donors

is analogous to A

t

, the number donating is analagous

to P

t−1

and the number of unavailable donors is anal-

ogous to V

t

· 1

|

k

.

It is no coincidence that these initial values have

been chosen. Since the recovery rate and the normal

appointment rate (represented by pale grey ovals) are

both set at 1/84 the system will remain in equilibrium

with the integer values of the stocks preserved. When

the appointment rate differs from the recovery rate the

system will attempt to converge on a new equilibrium

which is likely to be non-integer valued. In reality

donors are not divisible, but this has been set up to

demonstrate the system behaviour rather than repre-

sent it accurately. Given this motivation, non-integer

values of donors are acceptable.

The pale yellow ovals capture two important prop-

erties of the donation process. The oval marked ‘Appt

Rate Multiplier’ can vary in response to requests from

the blood bank for more or less donations. Such re-

quests are not addressed immediately by the donor

base. Donors take time to respond. The pale yellow

oval marked ‘Donor Response Delay’ captures the ex-

tent of this delay.

Dotted arrows show the direction of influence in

the model. For example, the normal appointment rate

is a factor which determines the number of available

donors which make an appointment. The dotted rect-

angle which surrounds the donation process allows

it to be treated as a single object when building the

model. It has no bearing on the outcome.

The appointment rate multiplier allows the actual

appointment rate to be responsive to the request for

donations made by the blood bank. If we were to as-

sume that there was a request to double the amount of

blood needed for a period of 30 days it can be seen

that the system attempts to reach a new equilibrium

to meet the increased requirement and attempts to re-

ICORES2015-DoctoralConsortium

6

vert to the original level when the requirement ceases.

Convergence to a new equilibrium does not happen

straight away. If the actual appointment rate is chang-

ing constantly in response ot blood bank requirements

the system cannot settle into an equilibrium state.

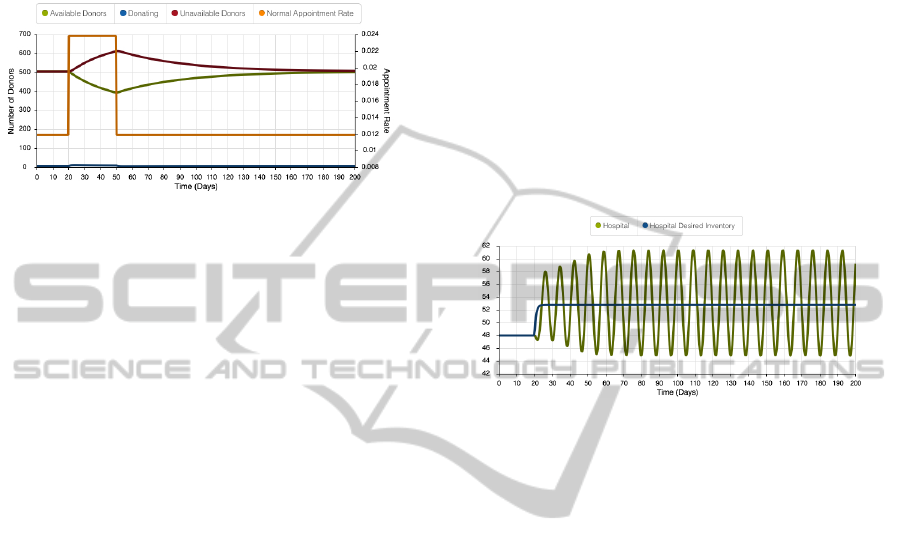

Figure 3: The response of the donor model to a doubling

of the appointment rate for a period of 30 simulation days.

The orange line is plotted using the second Y-axis and rep-

resents a doubling of the appointment rate for a period of

30 days. The green line shows how the number of avail-

able donors falls when the request for additional donations

is made and how it then rises once the request returns to

the initial level. The purple line also shows the comple-

ment of this in the number of unavailable donors. The blue

line shows the number of donors that have made an appoint-

ment.

The use of the three donor states give this model

some similarities to the mathematical framework dis-

cussed earlier. The transition of unavailable donors

to available donors does not account for this in quite

the same way, but it does capture the salient features.

Similar simplifications are present elsewhere in the

model as the intent is to give insight into the behaviour

of the system rather than simulate it exactly.

Now we consider the behaviour of the entire sys-

tem in response to a very small change in transfusions.

The system is in equilibrium until simulation day 20,

at which point the transfusion rate increases by just

10%. Eventually this small increase will cause the

hospital to re-evaluate its desired inventory level. In

turn this will increase the size of the order the hospital

places with the blood bank. In the Australian system,

a hospital may place an order in the morning and re-

ceive it from the blood bank in the afternoon of the

same day. However, there is a larger, notional period

of time between the recognition of a new order level

and when the order is finally made available within its

inventory. In the example we use here this has been

set to 2 days.

When the blood bank starts to notice orders of a

higher level being made it will re-evaluate its desired

inventory level and request additional donations to

meet the increased demand. Donors cannot respond

instantly to the blood bank’s request. They take time

to respond to the request, but ultimately more donors

will make an appointment to give blood. In this exam-

ple we have assumed that it takes 7 days for donors to

respond to a request for more blood. If the number of

appointments exceeds the capacity of the donor centre

surplus donors are moved into the next day. This al-

lows the number of donors with appointment to back-

log should they exceed the capacity of the donor cen-

tre.

Figures 4 to 7 show how these two delays cause

the system to become unstable. The hospital is able

to adjust its desired inventory level quite quickly to

the new requirement. However figure 4 shows that

the actual quantity of blood stored in the hospital’s

inventory begins to oscillate with a frequency of ap-

proximately 7 days.

Figure 4: Response of the hospital inventory to a small in-

crease in transfusion rate. The blue line is the hospital’s

desired inventory level. This moves up solely in response

to the increased level of transfusion. The green line shows

how the actual inventory held in the hospital begins to os-

cillate in response to the increased demand level.

In figure 5 we see that the desired blood bank in-

ventory also begins to oscillate in sympathy with the

hospital inventory. This is because the desired inven-

tory level of the blood bank is driven by the orders

being placed by the hospital. In order to respond to

this the blood bank requests a change in the number

of donations being made. These new donations do not

appear in the system straight away. The actual inven-

tory held by the blood bank becomes quite erratic but

does eventually settle into more consistent oscillatory

behaviour.

The request for additional blood results in more

donors making an appointment. The number of ap-

pointments that can be dealt with though is limited

by the capacity of the donor centre. In figure 6 we

see that this initial increase in donations increases the

number of donors that are unavailable resulting in a

subsequent decrease in donations as the number avail-

able to donate falls. This causes some initial insta-

bility in the donor population which does eventually

settle down but continues to have some small oscilla-

tions.

Oscillations also appear in the units of blood that

are used to fulfil hospital orders. That is because the

order quantities themselves are oscillating. However,

EnsuringBloodisAvailableWhenitisNeededMost

7

Figure 5: Response of the blood bank inventory to a small

increase in the transfusion rate. The green line shows an

oscillation in the blood bank’s desired inventory level. This

is sympathetic to hospital orders for blood. The actual in-

ventory level held by the blood bank, shown by the blue

line, becomes erratic as it is now subject to both the delay

present in the hospital inventory system and the delay in the

response of donors to requests for more blood.

Figure 6: Response of the donor population to a small in-

crease in the number of transfusions. The blue line de-

scribes the number of donors that are waiting to give blood

after having made and appointment. The green line is the

number of donors that are available to make appointments

and the purple line is the number of unavailable donors.

we see in figure 7 that the compounding effect of os-

cillation and delays causes the number of units do-

nated to behave quite erratically. It is also apparent

that the quantity of units donated is limited by the ca-

pacity of the donor centre as we see a plateau from

simulation day 25 to simulation day 40. During this

time appointments were backlogging in the donating

stock.

Figure 7: The number of donations made and the number

of units of blood supplied in fulfilment of hospital orders.

The green line represents hospital orders being fulfilled by

the blood bank. This oscillates in sympathy with hospital

orders but incorporate a delay of 2 days. The blue line is

the number of units of blood donated. This is quite erratic

and has plateaus where the number of appointments exceed

the capacity of the donor centre.

This simple model exhibits behaviour that is

volatile without the need to introduce any stochastic

variables at all. This is consistent with the hypoth-

esis stated in section 3. The potential remains to add

stochastic variables to the model, but leaving them out

gives great insight into the system dynamics making

it difficult to ignore in any mathematical framework

for blood inventories.

5.3 Approach

It is hoped that the simple model shown in the previ-

ous section demonstrates the behaviour that a blood

inventory system is capable of as a result of a very

small change in the number of units of blood trans-

fused. In reality both transfusions of blood and dona-

tions made are stochastic and this has motivated re-

searchers to consider approaches based on stochastic

processes to model the behaviour of these inventories.

However, current and past research has not consid-

ered that a system dynamics view might explain why

real blood inventories exhibit more volatility than that

seen in simulations. This volatility arises because of

delays in the feedback loops inherent the blood inven-

tory system. There are delays when a hospital makes

an order and when that order arrives from the blood

bank. There are delays when the blood bank requests

additional donations. These delays interact with each

other to produce oscillation and instability.

As an analogy, consider what would happen if

there was a material delay between when you turn the

steering wheel of your car and when the car actually

started to turn. The delayed response of the vehicle

and the subsequent feedback you get as you look at

the road ahead would lead to a never ending process

of correction and overcorrection. This is what appears

to be happening with blood inventories. Incorporation

of system dynamics concepts into the mathematical

framework of blood inventories will allow this gap to

be addressed as it is both the stochastic nature of sup-

ply and demand and the structure of the blood inven-

tory system which interact to cause greater volatility

than would otherwise be expected.

6 EXPECTED OUTCOME

Building a model of blood inventories that can cap-

ture realistic dynamics of the blood inventory system

will engender improvements in the management of

blood inventories. Further, it will inform policy mak-

ers as to effective strategies to ensure that shortages

and outdates of blood are minimised. Better models

ICORES2015-DoctoralConsortium

8

will help to ensure that blood is available when it is

needed most.

REFERENCES

Abbasi, B. and Seidmann, A. (2014). Reducing the shelf

life of perishable items with stochastic replenishment

in a two-echelon inventory system. Technical report,

Simon School Working Paper No. FR 14-08.

Abouee-Mehrizi, H., Baron, O., Berman, O., and

Sarhangian, V. (2014). Allocation policies in blood

transfusion. Working Paper.

Arrow, K. J., Harris, T., and Marschak, J. (1951). Optimal

inventory policy. Econometrica, 19(3):250–272.

Atkinson, M., Fontaine, M., Goodnough, L., and Wein, L.

(2012). A novel allocation strategy for blood trans-

fusions: Investigating the tradeoff between the age

and availability of transfused blood. Transfusion,

52(1):108–117.

Blake, J. T. and Hardy, M. (2014). A generic modelling

framework to evaluate network blood management

policies: The canadian blood services experience. Op-

erations Research for Health Care, 3(3):116–128.

Derman, C. and Klein, M. (1958). Inventory depletion man-

agement. Management Science, 4(4):450–456.

Elston, R. C. and Pickrel, J. C. (1963). A statistical ap-

proach to ordering and usage policies for a hospital

blood bank*. Transfusion, 3(1):41–47.

Fortmann-Roe, S. (2014). Insight maker: A general-

purpose tool for web-based modeling & simulation.

Simulation Modelling Practice and Theory, 47(0):28–

45.

Fries, B. E. (1975). Optimal order policy for a perishable

commodity with fixed lifetime. Operations Research,

23:46–61.

Goh, C.-H., Greenberg, B., and Matsuo, H. (1993). Per-

ishable inventory systems with batch demand and ar-

rivals. Operations Research Letters, 13(1):1–8.

Harris, F. W. (1990 [Reprinted from 1913]). How

many parts to make at once. Operations Research,

38(6):947–950.

Millard, D. W. (1959). Industrial inventory models as ap-

plied to the problem of inventorying whole blood.

Nahmias, S. (1975). Optimal ordering policies for per-

ishable inventory-ii.Operations Research, 23(4):735–

749.

Pierskalla, W. P. and Roach, C. D. (1972). Optimal issuing

policies for perishable inventory. Management Sci-

ence, 18(11):603–614.

Prastacos, G. P. (1984). Blood inventory management: An

overview of theory and practice. Management Sci-

ence, 30(7):777–800.

Scarf, H. (1960). The optimality of (s, S) policies in the

dynamic inventory problem. In KJ Arrow, S. Karlin,

P. S., editor, Mathematical Methods in the Social Sci-

ence. Stanford University Press, Stanford.

EnsuringBloodisAvailableWhenitisNeededMost

9