Mobile App Usability Index (MAUI) for Improving Mobile Banking

Adoption

Lalit Mohan

1,2

, Neeraj Mathur

1

and Y. Raghu Reddy

1

1

Software Engineering Research Center, International Institute of Information Technology, Hyderabad (IIIT-H), India

2

Institute for Development & Research in Banking Technology (IDRBT), Hyderabad, India

Keywords: Mobile App Usability, Mobile Banking in India, Usability, Error Handling.

Abstract: India has 790+ million active mobile connections and 80.57 million smartphone users. However, as per

Reserve Bank of India, the number of transactions performed using smartphone based mobile banking

applicationsis less than 12% of the overall banking transactions. One of the major reasons for such low

numbers is the usability of the mobile banking app. In this paper, we focus on usability issues related

tomobile banking apps and propose a Mobile App Usability Index (MAUI) for enhancing the usability of a

mobile banking app. The proposed Index has been validatedwith mobile banking channel managers, chief

information security officers, etc.

1 INTRODUCTION

India has 1.26+ Billion people and about 70% of

them are mobile users(Conn. B, 2014). The

smartphone adoption is approximately 22% of

overall mobile phones in India. With the rapid

growth rate of 186% the market share of

smartphones is expected to be at 32% by the year

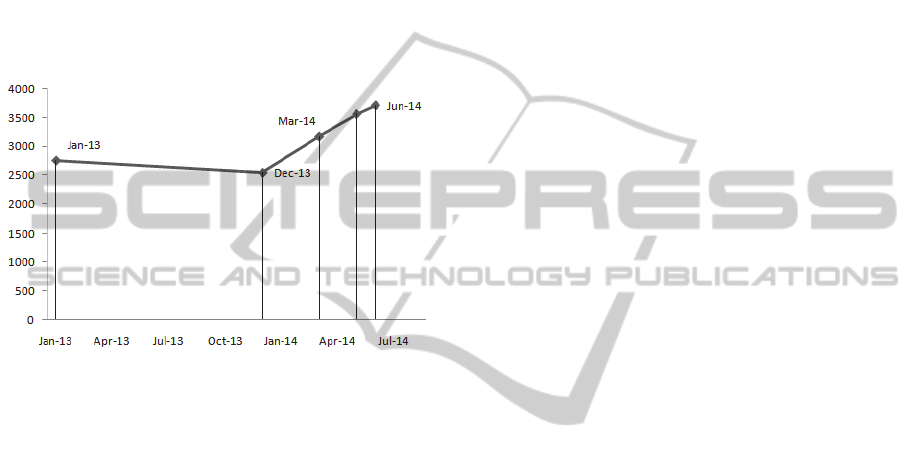

2017 as shown in Figure 1(Statista, 2014). From a

general market perspective, decreasing smartphone

prices, growing younger population in India and

improving technology awareness are some of the

reasons for the growth of smartphone adoption. With

240+ million (Conn. B, 2014)Internet users in India,

it is estimated that 60% of them access Internet over

mobile devices.

Figure 1: Share of smartphone usage in India (Statista,

2014).

The increasing usage of Internet on smartphones

provides opportunities to banks for improved

adoption of mobile banking. In India, about 89

banks provide mobile app banking services to their

customers(List of Banks permitted to provide

Mobile Banking, 2014). A report published by the

Reserve Bank of India (RBI) suggests that a mobile

banking transaction costs just 2% of the cost of a

branch transaction, one-tenth of the cost of an ATM

transaction and half the cost of Internet banking

transaction. In other words, the transaction cost of

mobile banking is much lower than any other

delivery channel in the bank(R.Khan, 2012). This

indicates that there are huge opportunities for

improved adoption of mobile app banking of banks

in India. Customers perform mobile banking using

mobile apps, browsers on the mobile devices,

Unstructured Supplementary Service Data (USSD),

Short Message Service (SMS), Near Field

Communication (NFC), mobile wallets, etc. Mobile

banking usingmobile apps compared to mobile

websites.Mobile banking is relatively easy to use for

frequent and repeated transaction as the navigation

can be menu driven. This conclusion can be

intuitively made from increasing transaction count

shown in figure 2.The number of mobile banking

transactions in Jan’13 was about 9.5 million with an

average transaction amount of INR 2,758 whereas

the number of transactions in Jun’14 was about 10.7

million with an average transaction amount of INR

3,715 (Banks wise volumes in ECS/NEFT/RTGS/

313

Mohan L., Mathur N. and Reddy Y..

Mobile App Usability Index (MAUI) for Improving Mobile Banking Adoption.

DOI: 10.5220/0005363003130320

In Proceedings of the 10th International Conference on Evaluation of Novel Approaches to Software Engineering (ENASE-2015), pages 313-320

ISBN: 978-989-758-100-7

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

Mobile Transaction, 2014).

Although there is an increase in the average

transaction amount, there are opportunities for

improving the adoption of mobile app banking.

Currently, the number of mobile banking app

transactions is only about 1.3 transactions per

smartphone per month. It has to be noted from the

various RBI reports that there are some

large/medium sized public sector banks having

millions of customers with less than 100 mobile

banking transactions per month (Banks wise

volumes in ECS/NEFT/RTGS/ Mobile Transaction,

2014).

Figure 2: Improved Adoption.

If the number of transactions grows to 3 per

smartphone-per month for paying utility bills,

mobile top-ups, card payments and other regular

monthly usage needs, it can decrease the transaction

cost for banks, thereby aiding banks in redirecting

investments in other requisite areas. Also, the small

cooperative banks (Banks wise volumes in

ECS/NEFT/RTGS/ Mobile Transaction, 2014),

eager to expand business are directly adopting

mobile banking instead of starting with traditional

Internet banking portals for desktops.

The major reasonsfor lesser adoption of mobile

banking appscan be listed as: Information security,

Network connectivity and Usability. With improving

data connectivity (3G and 4G), and with stricter

banking security guidelinesissued by RBI, Network

connectivity and Information Security are currently

being addressed at various levels. However,

usability parametersfor mobile app based banking is

not given due importance either by the RBI or by the

Bureau of Indian Standards (BIS). BIS is the

national standards body of the government of India

and responsible for standardization efforts.

In this paper, we propose usability parameters

specific to mobile banking applications. We

performed a thorough study of the various issues

concerning the usability aspects and proposed

parameters that can potentially beadopted by the

BIS.

The major contributions of this paper are:

An index named Mobile App Usability Index

(MAUI) that can guide banks to improve

usability of their mobile banking apps thereby

increasing adoption rates.

Fine-grained parameters based on the broad

factors like time taken to complete a task, user

interface display, and error handling.

Validation of the proposed parameters and

index with mobile banking channel managers

(business and IT), chief information security

officers and also with the mobile app customer

base.

2 MOBILE BANKING APP

USABILITY CHALLENGES

A survey with a sample of 1434 participants with

diverse backgrounds (Chief Information Security

Officers of the banks, Mobile Banking Channel

Managers and smartphone users - working women

and men from Information Technology (IT) and

Non-IT companies, homemakers, retired staff of

public sector firms, etc.) was conducted using

WhatsApp, Facebook, LinkedIn, emails and face-to-

face interactions to understand the usability related

challenges of mobile banking. The participants of

the survey were aware that the authorswere

involvedin banking technology research and hence

gave feedback with an expectation for improvement

of mobile banking adoption. Additionally, a total of

26,131 comments posted by mobile banking app

users on Google play store since Jan 2014

wereanalysed.

We used Google playstore’s public API to fetch

comments of major mobile banking apps

(public/private).We performedsentiments analysis of

the user comments to understand theirsatisfaction

level with mobile banking apps. We used

RapidMiner tool for sentimental analysis initially

but realized that it was a “golden hammer” and not

necessary for the type of analysis we needed. We

later resorted to using a simple likert scale (1 to 4)

and assessed the positive and negative sentiments of

the users.

The typical usability challenges in mobile

banking apps can be summarized by some of the

comments received during the survey:

“Simplify apps with inbuilt tamper free security

ENASE2015-10thInternationalConferenceonEvaluationofNovelSoftwareApproachestoSoftwareEngineering

314

rather answering questions start use of digital

signatures assigned to individuals”

“User friendly app which would not be difficult to

navigate even when network speed is not great”

“Taking least and only required inputs.. For any

operation on mobile banking app..Building trust in

users to adopt mobile banking/marketing providing

security pin generator token/device..even to

farmers..and rest of the banking should be carried

out with dtmf/sms based inputs..as these are the

easiest to use.. any person can easily adopt

it..Separate/dedicated communication channels via

service providers should be opened with highest

security measures”

Some common comments from Google play

store were:

“Screen flickering and UI goes blank sometime”

“Application tends to take much more time then

compared to other competitive bank, on 2G it tends

to hang does not show proper error messages.”

“Screen with poor UI and color combinations. Less

user friendly.”

From the survey and user comments analysis,

there was a clear correlation perceived by the users

between usability issues and reliability. For

example, if the app had difficult activation process,

customers lost interest in the app and stated that the

mobile banking app was not reliable. On the

contrary some other mobile banking apps had a

strong positive sentiment and customers were

satisfied with the app. The survey results concur

with our supposition that better usability leads to

better adoption and in turn better revenues for the

banks.

3 USABILITY MEASUREMENT

Usability is captured as a set of non-functional

requirements in software engineering practices. The

user interface designer develops wireframes and

mock-ups based on the requirements and available

organization standards. In our interaction with the

Indian banks’ mobile banking teams, werealized that

most of them do not have specific personnel playing

the role of user interface designers. Business Analyst

or technology teams develop mock-ups or screen

designs. In some cases, the interfaces were

developed directly without business team/user

involvement.

To understand the usability requirements and

factors to measure usability, some of the widely

adopted mobile banking apps of major banks (Wells

Fargo, Bank of America, Barclays Bank, Citi Bank,

and JP Morgan Chase Bank) and Mobile Wallets

(Square, Starbucks, PayPal, mPay, etc.) were

installed and the usability factors were studied.

As there are no BIS guidelines or assessment

factorson usability of mobile applications,the

Human Computer Interface and the User experience

guidelines for mobile devices available from Apple

for iOS(iOS Human Interface Guidelines,2014),

Google for Android (Mobile App Design from

Android,2014) and Microsoft for Windows

Mobile(Usability Guidelines,2014)were

studied.Majority of banking apps run on these

platforms, hence it covered the entire gamut of

mobile banking apps. Also, the usability models

suggested by Nielsen and Norman group (Mobile

website and application usability) and, People at the

Centre of Mobile Application Development

(PACMAD) model (Harrison, R Flood and Duce

D,2013; Bostr F, 2008 and Seongil L, 2008)were

studied. In addition, the five human computer

interface laws were analysed:(1) Miller's law of

STM (short term memory)(Miller, 1965), (2) Fitts'

Law(Fitts. P, 1954), (3) Hick Hyman Law(Rosati L,

2013), (4) Power law of practice(Newell A and

Rosenbloom P S, 1993), and (5) Zipf law(Apitz, G.,

Guimbretière, F. and Zhai, S.,2008). The main

reason to study these laws was to get a grasp of the

human aspects of remembrance, time taken to make

a decision based on the available choices and user

expectations on keeping most frequently used as the

first option as they have an impact on user

perception on usability.

The ISO 9241 manual on “Ergonomics of

Human System Interaction – Guidance on World

Wide User Interfaces”(Ergonomics of Human

System Interaction)was studied. However, the

guidelines proposed were generic to web

applications rather than mobile apps interfaces.

Like most other non-functional requirements,

measuring usability is challenging. In our work,

usability is measured based on the following factors:

(1) Time taken to complete task. Intuitively this

can be a measure as the number of clicks.

(2) User interface display parameters. This refers to

the font, colours, etc.

(3) Error handling. This focuses on the error

messages and the techniques to handle them.

The authors are associated with banking technology

arm of RBI and have a working relationship with

several mobile banking channel managers and

MobileAppUsabilityIndex(MAUI)forImprovingMobileBankingAdoption

315

information security officers of the banks. The

suggested parameters and index has been validated

via a survey of the mobile banking channel

managers, information security officers of the banks,

some user interface designers and importantly

mobile app banking users.

A thorough validation of the parameters can be

done after the mobile banking apps are developed

using the proposed parameters. This can be done via

usability testing of the developed mobile banking

apps. Instead ofwaiting for the development of the

apps, we have chosen heuristic approach in this

paper to validate the proposed parameters. Our

thought stems from the recommendations provided

by the Nielsen Norman group (NN/g) (Mobile

Website and Application Usability), a leading

organization that specializes in usability research on

heuristics based approach for validating the usability

parameters.

4 RECOMMENDATIONS FOR

IMPROVING USABILITY

Several researchers and organizations have provided

usability recommendations for web applications.

Some of the banks,westudied seemed to use these

recommendations for developing their mobile

banking applications. It is imperative that banks did

not develop the user interface of mobile banking

apps similar to internet banking sites as the display

screens, network connection and user attention span

are all different from a desktop/laptop usage. The

user interfaces of smartphones vary from 2” to 7”,

this adds to the challenges of developing user

interfaces for consistent usability experience.

As the saying goes, “what gets measured gets

managed”. After the adoption of the proposed

parameters, a lab can be set-up for usability testing

of mobile apps using Userzoom, Loop, Magitest, etc.

for testing.

We recommend a heuristic based evaluation

method that computes an index score called MAUI

(Mobile AppUsability Index). MAUI can be used

for measuring the effectiveness of implementation

of Usability parameters for bank’s mobile app. The

parameters mentioned in this paper are for the

following factors:

(1) Time taken to complete task

(2) User interface display

(3) Error handling

4.1 Time Taken to Complete Task

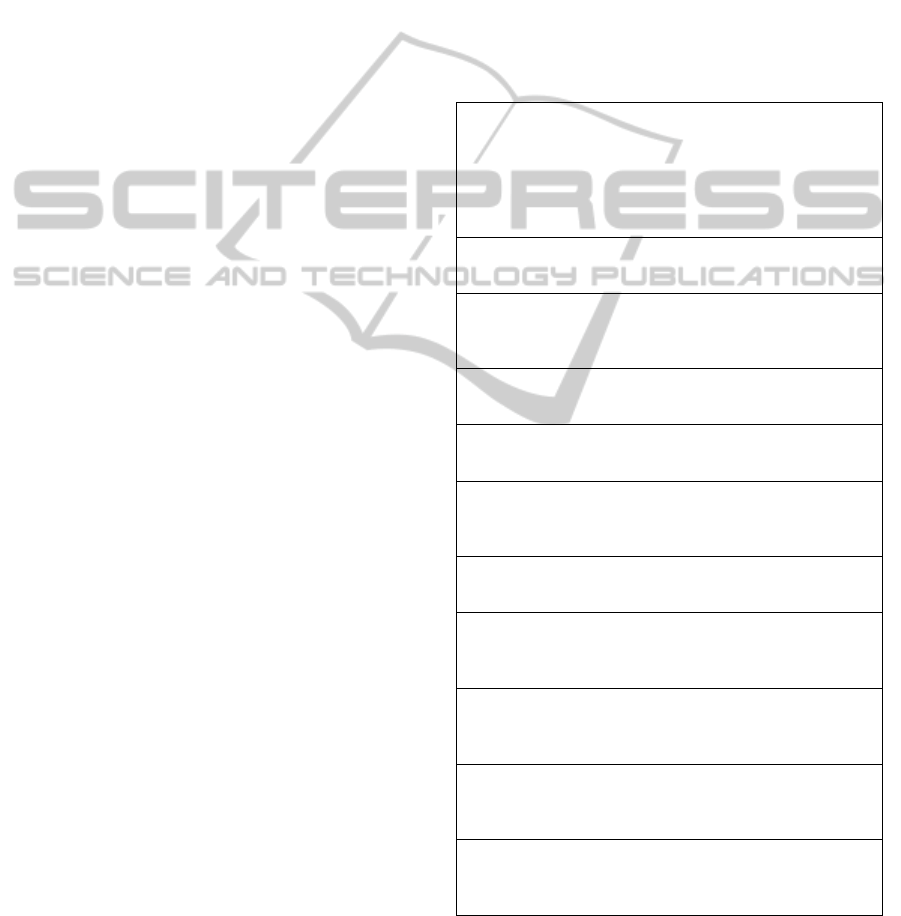

Table 1 mentions the usability parameters for time

taken to complete a specific task. A task is

considered as specific action that needs to be

completed to satisfy certain set of requirements. For

example, adding beneficiary account, performing

money transfer, making chequebook request,

navigating through the screens, etc. are tasks that

need to be completed. The time taken to complete

the task is measured using specific number of clicks

needed on the mobile phone to complete it.

Table 1: Time taken to complete task.

A1 - Account summary (using SIM, IMEI and other device

information without disclosing any Personally identifiable

information), nearest ATM/Branch, and contact

information of call centre (with option of click to call)

should be available without login using account number

and password

A2 - Maximum five fields should be sought from the

customers while completing a form in the screen

A3 - Screen navigation should start with more familiar

fields(amount to transfer/deposit, deposit period,

beneficiary name, account number, IFSC code, etc.)

A4 - Based on user’s previous actions, there should be an

option to set user/default favorites

A5- Breadcrumbs should be available to keep users

informed on the navigation

A6 - Labels of the fields should be in layman languageand

unambiguous for customer rather using bank specific

terminology

A7 - The option for “Select All” or “Delete All” should be

removed

A8 - Banking operation that started on a desktop, branch or

ATM should continue over the mobile app without keying

in data again

A9 - Mobile app registration should not require going to

bank branch and can be loaded from authorized app stores.

The registration should be free of any SMS charges

A10 - Sensitive information as date of birth, customer

account number that are already known should not be

requested in the app

A11 - Related fields should be grouped together(for

example, beneficiary, user account details, etc.).

Alsoknown fields should be pre-populated

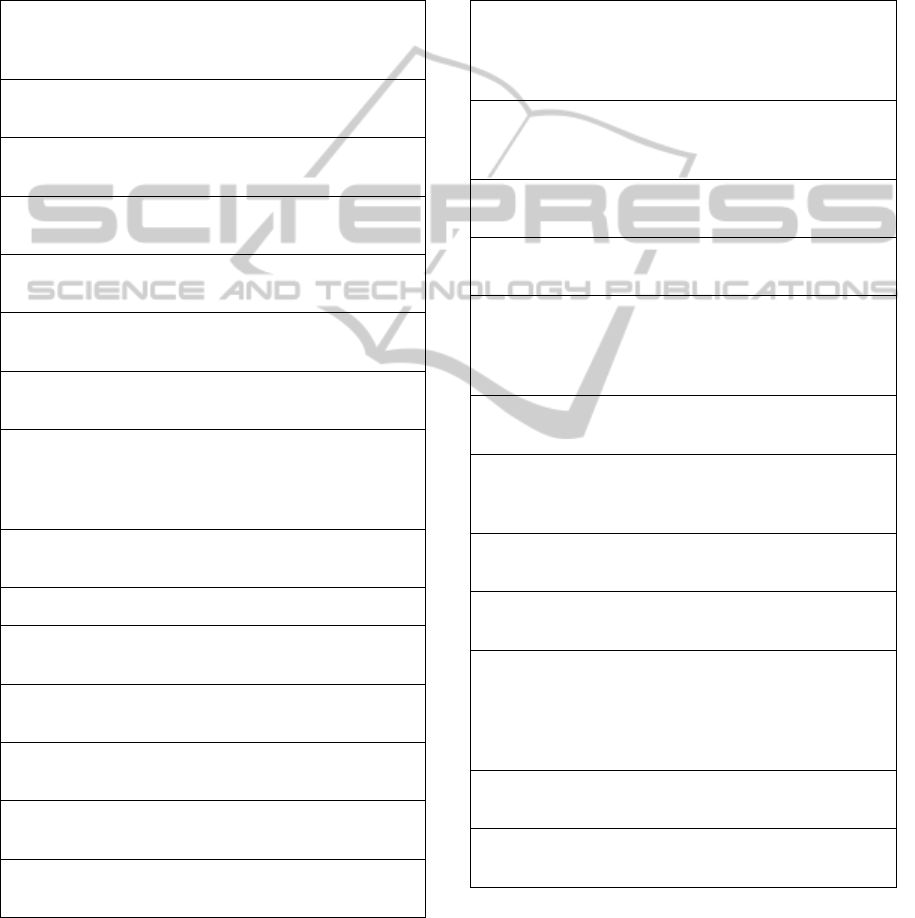

4.2 User Interface Display Parameters

The font size/type, display colours, controls size and

ENASE2015-10thInternationalConferenceonEvaluationofNovelSoftwareApproachestoSoftwareEngineering

316

labels can change the user perception on the app.

Though each individual has their own liking for a

colour, font and other display parameters, the

implementation of suggested parameterscan enrich

user experience with respect to the interface of the

mobile banking app. Table 2 provides the

parameters for user interface display.

Table 2: User interface display parameters.

B1 - Colour combination in foreground and background

should be consistent across screens and contrasting

without any gradient/progressing colours

B2 - Text information should be in mixed/sentence case

instead of upper case

B3 - Avoid pagination, vertical scrolling and horizontal

scrolling

B4 - Text in text boxes should be in single line and not

spread across multiple lines

B5 - Measures for size of button, textbox and other

controls relative to screen size instead of pixels

B6 - There should be bank logo, title page and frame on

every screen

B7 - White spacing between fields should be sufficient

to view labels without overlapping

B8 - Language used should be simple and consistent

with no long sentences and paragraphs in the screens.

Having local languages based on user preference would

be highly beneficial for users

B9 - There should be clear character spacing avoiding

any overlaps

B10 - Bold text should be used sparingly

B11 - The alignment of fields (left for text fields and

right for numbers) should be consistent

B12 - There should be left navigation available for

moving between menu options

B13 - There should not be any drag and drop based

features

B14 - The image icons should be tested for varying

resolutions (ldpi, mdpi, etc) and different OS

B15 - Apps should be built using HTML5 for

consistent look

4.3 Error Handling

As the mobile phone screens are smaller in size than

desktops and the user attention for detail on smaller

screens is difficult. It is important that apps are more

thoroughly tested for various screens and device

types and performance for various connectivity

options. It is important that appropriate error

messages are informed early rather later and thus

reducing the call or other modes of escalationsto

bank’s operations team.

Table 3: Error handling.

C1 - System messages should be classified as

Information (with text in Green/Blue color), Warning

(with text in Yellow color) and Error (with text in Red

color)

C2 - If a particular mobile device is not supported, an

error message should be displayed instead of allowing

the user to install and then showing an error message

C3 - Error messages while filling a form should be

displayed next to the fields and button

C4 - The message should provide the reason for error

and suggests the next possible action

C5 - Application should maintain user action

persistence and recovery from abrupt exits (network

connection lost, session timeout, battery down, memory

shortage, etc.)

C6 - System messages should be configurable values

rather hardcoded for change at a later point of time

C7 - Language of the error message should be in

layman languageand easy to understand and avoid

displaying any bank specific error messages

C8 - Error messages while loading a page should be at

the top of the screen

C9 - The help icon should always be available and

contextual to the screen

C10 - The app should be tested for varying network

bandwidth, device models (make and screen size),

flip/bump, back button and other buttons on the device,

stylus, trackball/pad, swipe operations, screen rotation,

Mobile Keys, Battery consumption and memory usage

C11 - The app should have an option for user to report

the error

C12 - The version updates should be done on regular

basis and ensured to keep past favorites intact

4.4 Evaluating Usability Parameters

Implementation

Some of the usability parameters listed are

applicable for web banking applications as well.

MobileAppUsabilityIndex(MAUI)forImprovingMobileBankingAdoption

317

Parameters A2-A6 and A11 suggested for “time

taken to complete task”, B2 suggested for “user

interface display” and C1, C3, C4 and C6-C9

suggested for “error handling” are more relevant for

mobile banking interfaces.

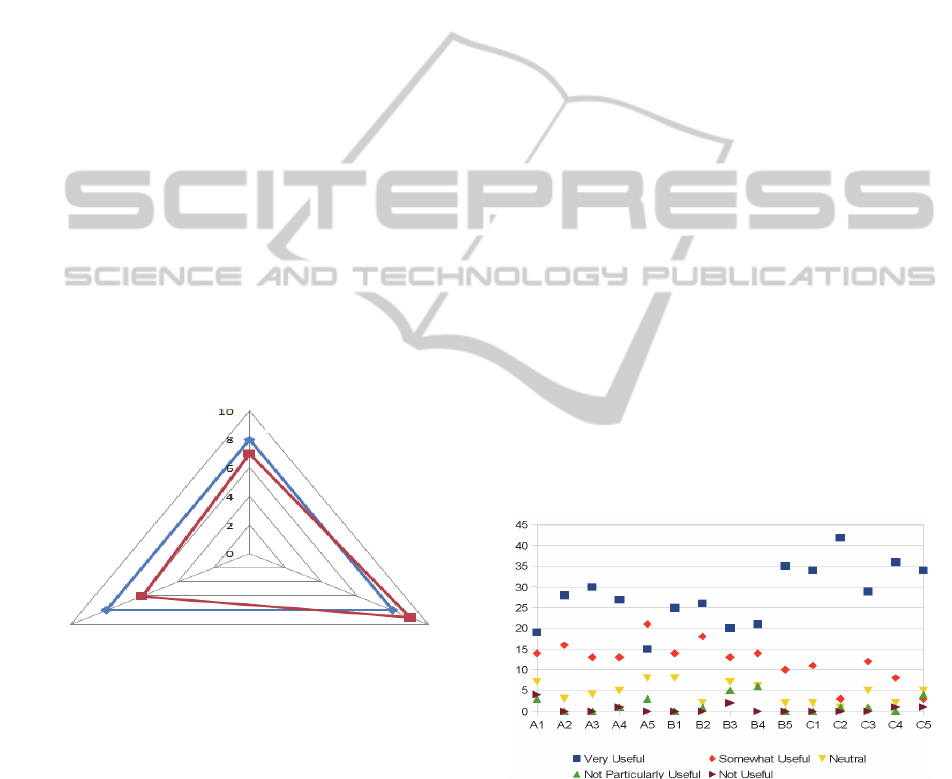

Based on the response to the recommendations,

the banks should scale the implementation of

usability parametersusing the spider diagram as

shown in Figure 3. In the figure the darker line

represents a reference benchmark and grey line is

the MAUI values of a banking app. MAUI value can

be computed as:

MAUI = (P

c

/P

n

) * scale

(1)

where P

c

is the number of conformed parameters, P

n

is the total number of parameters used for assessing

usability. In our paper, for sake of simplicity, MAUI

is measured on a scale of 1-10, 10 being the highest

and 1 being the least. Since the goal is to provide a

basis for standardizing usability rather than measure

the relative importance of one parameter over

another, each recommendation parameter is treated

equally by assigning one point each (at times this

may be context driven and relative weights may be

assigned to each parameter) and measured against a

scaling factor.

Figure 3: MAUI parameters.

For example, if there are 15 parameters and about 11

parameters are met by the bank, the index can be

calculated as (11/15) * 10 giving a value of 7.3. The

score on time taken to complete task, user interface

display parameters and error handling are plotted on

a spider diagram shown in Figure 3.

The figure shows a benchmark/desirable score

for each of the axis as 8.0. We believe that a

threshold value of 8.0 provides a reasonable

assurance that the mobile banking app provides good

to very good user experience. Precise benchmark

values and assessment agencies/organizations to

assess the conformance can be established once the

rate of adoption of mobile banking apps shows a

steady increase. In addition, conformance of

parameters can also be further broken down into

multiple levels rather than the binary value of “Yes”

or “No” shown in this paper.

5 APPLICABILITY OF

RECOMMENDATIONS

The applicability of MAUI is validated through a

survey conducted (Google report on the Mobile App

Usability survey, 2014) with Chief Information

Security officers to ensure that the suggested

usability parameters have reasonable security.

Mobile banking channel managers having

responsibility of running mobile banking business,

technology managers from the banks and IT services

industry involved in the development of mobile apps

for the banks also participated in the survey. As the

survey participants consisted ofsenior decision-

making personnelin the banks and other relevant

organizations, a detailed survey could have taken

away their interest to participate. Hence a short

survey for first five key parameters from Table 1, 2

and 3 for each of the focus areas (time taken to

complete task, display parameters and error

handling) was conducted.There were 51 respondents

in total. The responses of the survey are shown in

Figure 4.

Figure 4: Responses to MAUI survey.

We used Likert scale (Very Useful - 5, Somewhat

Useful - 4, Neutral - 3, Not Particularly Useful - 2

and Not Useful - 1) to capture the response on the

various parameters. The average score is 4.39/5, the

lowest scores are 3.87 and 3.94 and the highest are

4.83 and 4.7. The summary of responses is shown in

Figure 6 and the detailed view of results is available

at (Google report on the Mobile App Usability

Error handling

User interface

display

Time taken to

complete task

ENASE2015-10thInternationalConferenceonEvaluationofNovelSoftwareApproachestoSoftwareEngineering

318

survey, 2014).

Following were some of the comments from

respondents.

“it will be really helpful as some of the banks have

really good mobile banking apps, while others don't

have that good apps. So if it is standardized then

user experience will be good”

“These will definitely increase the user experience.

Consistency in colors and font will increase

usability.”

“This Mobile Banking App Usability parameters if

adopted ,it will be very useful for the users. All these

parameters are really very useful & helpful for

mobile banking users in terms of saving time and

ease of operations.”

“Yes these would be very useful. Especially some

sort of intelligence from the app with regards to

error handling and saving the favourite activities of

the user.”

“These features may provide ease of operation to

customers. Uniformity across all banks would also

be helpful for customers.”

“Good initiative to improve mobile banking”

Some additional comments to enhance/modify the

suggested parameters were also provided:

“Vertical scrolling is good but not the horizontal

scrolling”

“The first question: ‘Account summary without

login’ may not be good idea”

Overall, the survey respondents seemed to agree the

need for such parameters. Some of the comments

specifically seemed to point out that the parameters

can in fact be applied to most Human Computer

Interfaces. Also, there were some comments from

respondents to ensure security was not compromised

while improving mobile banking app usability.

6 CONCLUSIONS

MAUI guides banks to improve usability and

thereby increase adoption rates. Banks could use

MAUI for baselining the currently deployed app and

increase the adoption with an improved MAUI and

perform the cost benefit analysis. These parameters

will be shared with RBI and BIS for establishing

usability standards for mobile apps. The MAUI will

further be refined to take the following aspects into

consideration:

Rather than binary conformance value,

levels of conformance will be introduced.

International leading mobile banking

applications will be studied and an

appropriate threshold MAUI value will be

established.

By further refining MAUI, we plan to build asemi-

automated tool to measure MAUI.

The accessibility requirements for different age

groups and differently abled people would also be

part of the future scope for further improving mobile

banking apps adoption.Improving usability is a

constant journey with changing customer

experiences and technology innovation, hence, it is

recommended for banks to review the usability

requirements on a yearly basis monitoring the

feedback on app stores and the customer queries

being handled by bank operations team. The MAUI

could be extended to apps that banks are planning to

deploy for internal stakeholders and also for any

organization building mobile apps for enterprise

needs. Better usability of mobile apps improves

customer loyalty and hence customer stickiness to

the bank.

ACKNOWLEDGEMENTS

We thank Mobile Banking users, the mobile channel

managers and chief information security officers for

responding to the survey and providing their views

on the usability parameters.

REFERENCES

Apitz, G., Guimbretière, F. and Zhai, S.

(2008).Foundations for designing and evaluating user

interfaces based on the crossing paradigm. ACM

Transactions on Computer Human Interaction, 17(2).

Bostr, F. (2008). Capricorn - an intelligent user interface

for mobile widgets. In: 10th international conference

on Human computer interaction with mobile devices

and services. ACM.

Conn, B. (2014). The evolution of Mobile Marketing in

India: Current Trends and Best Practices. IAMAI

Mobile Marketing Summit report.

Developer.apple.com, (2014). iOS Human Interface

Guidelines: Designing for iOS. (online) Available at:

https://developer.apple.com/library/ios/documentation/

userexperience/conceptual/mobilehig/ (Accessed: 28

Nov. 2014).

Developer.android.com, (2014). Mobile App Design from

Android. (online) Available at: https://developer.

android.com/design/material/index.html (Accessed: 28

MobileAppUsabilityIndex(MAUI)forImprovingMobileBankingAdoption

319

Nov. 2014).

Docs.google.com, (2014). Google report on the Mobile

App Usability survey. (online) Available at:

https://docs.google.com/forms/d/1ZYAOQF2sAAEw

YR26bbp8B3_vCZaJMtaKVUaWQK3ULZU/viewan

alytics (Accessed: 28 Nov. 2014).

Ergonomics of Human System Interaction – Guidance on

World Wide User Interfaces. (2011). ISO 9241-151:

ISO/TC 159/SC.

Fitts, P. (1954). The information capacity of the human

motor system in controlling the amplitude of

movement. Journal of Experimental Psychology,

47(6), pp.381-391.

Harrison, R., Flood, D. and Duce, D. (2013). Usability of

mobile applications: literature review and rationale for

a new usability model. J Interact Sci, 1(1), p.1.

Miller, G. (1965). The magical number seven, plus or

minus two.Psychological Review 63 (2): 81-97, 1956.

Msdn.microsoft.com, (2014). Usability Guidelines.

(online) Available at: http://msdn.microsoft.com/en-

us/library/bb158578.aspx (Accessed: 28 Nov. 2014).

Newell, A., and Rosenbloom, P. S. (1993). Mechanisms of

skill acquisition and the law of practice.In J. R.

Anderson (Ed.), Cognitive skills and their acquisition

(pp. 1-55). Hillsdale, NJ: Erlbaum.

Nielsen Norman Group. Mobile Website and Application

Usability | Nielsen Norman Group Report.

R. Khan, H. (2012). Customizing mobile banking in India:

issues & challenges. In: FICCI-IBA (FIBAC) 2012

Conference on-“Sustainable excellence through

customer engagement, employee engagement and right

use of technology”.

RBI, (October 2014)List of Banks permitted to provide

Mobile Banking Service in India - Report from

Reserve Bank of India (2014) (Online) available

at:http://www.rbi.org.in/scripts/bs_viewcontent.aspx?I

d=2463 (Accessed: 28 Nov. 2014).

Banks wise volumes in

ECS/NEFT/RTGS/MobileTransaction- Report from

Reserve Bank of India (2014). (Online) Available

at:http://www.rbi.org.in/scripts/NEFTView.aspx

(Accessed: 28 Nov. 2014).

Rosati, L (2013). How to design interfaces for choice:

Hick- Hyman law and classification for information

architecture. In Slavic, A.; Salah, A.; Davies, C.

Classification and visualization: interfaces to

knowledge: proceedings of the International UDC

Seminar. The Hague, The Netherlands. pp. 125–138,

Seongil, L. (2009). Mobile Internet Services from

Consumers’ Perspectives. International Journal of

Human- Computer Interaction, 25(5).

Statista, (2014). India: mobile phone internet user

penetration 2012-2018 | Statistic. (online) Available

at: http://www.statista.com/statistics/309019/india-

mobile-phone-internet-user-penetration/ (Accessed: 28

Nov. 2014).

ENASE2015-10thInternationalConferenceonEvaluationofNovelSoftwareApproachestoSoftwareEngineering

320