Time Series Forecasting using Clustering with Periodic Pattern

Jan Kostrzewa

Instytut Podstaw Informatyki Polskiej Akademii Nauk, ul. Jana Kazimierza 5, 01-248 Warszawa, Poland

Keywords:

Time Series, Forecasting, Data Mining, Subseries, Clustering, Periodic Pattern.

Abstract:

Time series forecasting have attracted a great deal of attention from various research communities. One of

the method which improves accuracy of forecasting is time series clustering. The contribution of this work

is a new method of clustering which relies on finding periodic pattern by splitting the time series into two

subsequences (clusters) with lower potential error of prediction then whole series. Having such subsequences

we predict their values separately with methods customized to the specificities of the subsequences and then

merge results according to the pattern and obtain prediction of original time series. In order to check efficiency

of our approach we perform analysis of various artificial data sets. We also present a real data set for which

application of our approach gives more then 300% improvement in accuracy of prediction. We show that in

artificially created series we obtain even more pronounced accuracy improvement. Additionally our approach

can be use to noise filtering. In our work we consider noise of a periodic repetitive pattern and we present

simulation where we find correct series from data where 50% of elements is random noise.

1 INTRODUCTION

Time series forecasting is rich and dynamically grow-

ing science field and its methods applied in numer-

ous areas such as medicine, economics, finance, engi-

neering and many other crucial fields [(Huanmei Wu,

2005),(Zhang, 2007),(Zhang, 2003),(Tong, 1983)].

Currently there are many popular and well developed

methods of time series forecasting such as ARIMA

models, Neural Networks or Fuzzy Cognitive Maps

[(S. Makridakis, 1997) (J. Han, 2003) (Song and

Miao, 2010) ]. Clustering is process of grouping into

one clusters ”by some natural criterion of similarity”

(Duda and Hart, 1973). This vague definition is one

of the reason why there are so many different cluster-

ing algorithms (Estivill-Castro, 2002). Although dif-

ferent clustering methods group elements according

to completely different criterions of similarity there

always has to be mathematically defined similarity

measurement metric. Every algorithm using this met-

ric groups together elements which are closer to each

other then those in other clusters. Classical example

of time series clustering’s usage is classification based

on ECG of a particular patient into cluster of nor-

mal or dysfunctional ECG. Other type of time series

clustering is presented in partition methods such SAX

algorithm (Jessica Lin, 2007). Goal of that type of

algorithms is discretization of numerical data which

shows some features of and compress data at the same

time. However using knowledge gained by clustering

into time series forecasting is very limited. This re-

sults from the simple fact that even if we are able to

group elements into clusters with specific forecasting

properties we do not know to which clusters future el-

ements would belong to.

We would like to bypass this problem and present

usage of time series clustering for time series fore-

casting. Our assumption is that there exist such peri-

odic pattern in time series based on which we are able

to create subsequence with much lower potential error

of prediction then whole series. Elements which are

not included in chosen subsequence are grouped in

second subsequence. Due to the periodicity of the pat-

tern we can assume to which cluster future elements

should belong to. Because of that we are able to pre-

dict values of every subsequence separately and then

merge them according to periodic pattern to get pre-

diction of original series X. Main problem with that

idea is that number of possible periodic patterns in-

crease exponentially according to time series length.

This means that in practise evaluating potential er-

ror for every periodic pattern is impossible but using

our approach we can find proposal of best pattern in

reachable time.

This paper is organized as fallows. Section 2 re-

views related work. The proposed approach is de-

scribed with in detail in section 3. Simulations of

different series are presented in section 5. In section

Kostrzewa, J..

Time Series Forecasting using Clustering with Periodic Pattern.

In Proceedings of the 7th Inter national Joint Conference on Computational Intelligence (IJCCI 2015) - Volume 3: NCTA, pages 85-92

ISBN: 978-989-758-157-1

Copyright

c

2015 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

85

4 we estimate complexity of our approach overhead

according to time series length. The last section 6

concludes the paper.

2 RELATED WORKS

In book ”Data Mining: Concepts and Techniques,

Morgan Kaufmann.” (J. Han, 2001) are discussed five

major categories of clustering: partitioning methods

(for example k-mean algorithm (MacQueen, 1967)

), hierarchical methods (for example Chameleon al-

gorithm (G. Karypis, 1999)), density based methods

(for example DBSCAN algorithm (M. Ester, 1996)

), grid-based methods (for example STING algorithm

(W. Wang, 1997)) and model-based methods (for ex-

ample AutoClass algorithm (P. Cheeseman, 1996)).

Main property for all of these categories is grouping

into one cluster elements from one interval in contrast

to our approach which groups into one clusters ele-

ments scattered across the whole time series. Other

type of clustering is Hybrid Dimensionality Reduc-

tion and Extended Hybrid Dimensionality Reduction

[(Moon S, 2012) (S. Uma, 2012)]. These method con-

sists of clustering of all elements with specific type

of value. Algorithm can group into one clusters ele-

ments scatter across a whole time series hover it does

not suggest pattern. Because of that we are not able

to assume to which cluster future elements should be-

long to, which is a significant difference between our

approach and the methods described above.

3 THE PROPOSED APPROACH

Main idea of our approach is to find a pattern S which

is periodic binary vector and according to it split-

ting time series X into two subsequences (clusters) X

1

and its complement X

0

. After that we use prediction

methods on X

1

subsequence and X

0

separately. Then

we merge results according to S pattern and get pre-

diction of original time series. As measurement of

error we use mean square error (MSE).

MSE =

1

n

n

∑

i=1

(y − ˆy)

2

(1)

Where n is number of all predicted values, y is real

value and ˆy is predicted value. MSE can be treated as

similarity measure according to which we group ele-

ments into clusters. Because every element belongs to

exactly one subsequence we can say that our approach

use strict partitioning clustering. In order to describe

our approach with more details we split algorithm to

simple functions and describe them separately.

3.1 Create Corresponding Subsequence

We have time series X = (x

1

,x

2

,...,x

n

) and binary

vector S = (b

1

,b

2

,..., b

n

). We create subseries

X

1

= (x

1

1

,x

1

2

,..., x

1

j

) which contains all elements x

i

such that corresponding b is equal to 1. Analogously

we create subseries X

0

which contains all elements x

i

such that corresponding b is equal to 0. For example:

X = (x

1

,x

2

,..., x

n

), S = (1, 1,0, 0,1,1,0,0...0,0,1)

X

1

= (x

1

,x

2

,x

5

,x

6

,.., x

n

), X

0

= (x

3

,x

4

...x

n−2

,x

n−1

)

3.2 Extend Binary Vector

The first step needed to extend binary vector is cre-

ation of vector dictionary. A pseudo-code definition

of creating vector dictionary is given in Table 1.

create dictionary: gets binary vector S which we

would like to extend. Initially we set variable d to

1 and create empty dictionary set. We create vector

which is interval of length d +1 starting from first po-

sition. We check if dictionary contains vector which

is coincides our vector on first d position but differs

on last d +1 position. If such vector occurs that means

that our dictionary words are too short to predict un-

equivocally binary vector S so we clear dictionary, in-

crease d by 1 and repeat whole process from the first

position. Else if dictionary does not contain the vector

we add it to the dictionary. Then we increase interval

starting position by 1 and repeat the whole process till

end of the interval do not exceed end of the S vector.

The function returns the dictionary when end of the

interval exceeds end of the S vector .

When we have the dictionary we can start extend-

ing S vector. A pseudo-code definition of extending

binary vector is given in Table 2.

extend binary vector: gets binary vector S which

we would like to extend and expected length value.

Thanks to function create dictionary we have dictio-

nary for binary vector S. Let d be length of every

vector in that dictionary and n be the length of S vec-

tor. In dictionary we try to find such vector which on

every position but the last is equal to S(b

n−d+2

...b

n

).

If there is no such vector we extend S by random bi-

nary number. Otherwise we extend S by last value of

the vector found in dictionary. We repeat this process

till S length reach expected new length.

3.3 Find Proposition of Best Pattern S

We have to find such binary vector which:

1. Splits vector X into subsequences X

1

and its com-

plement X

0

such that MSE of that subsequences

would be lower then MSE of time series X.

NCTA 2015 - 7th International Conference on Neural Computation Theory and Applications

86

FUNCTION create_dictionary(S)

d=1

dict = []

i=1

WHILE i<=(size(S)-d)

window = S(i:i+d)

IF ismember(window(1:end-1),dict(1:end-1)

&& !ismember(window,dict) )

size_of_window=size_of_window+1

i=1

dict = []

ELSE

dict = dict.add_new_row(window)

ENDIF

i = i+1

ENDWHILE

RETURN dict

Figure 1: Pseudo-code of algorithm which creates vector

dictionary for pattern S.

FUNCTION extend_binary_vector(S,new_length)

dict = create_dictionary(S)

i = size(S)-length_of_row(dict)+1

WHILE length(S)<new_length

small_win = S(i:i+length_of_row(dict)-1)

index =

index_of_element(small_win,dict(:,1:end-1) )

IF index>0

S.add(dict.elementAt(index).elementAt(end))

ELSE

S.add(randomly_0_or_1())

ENDIF

i = i+1

ENDWHILE

RETURN S

Figure 2: Pseudo-code of algorithm which extends binary

vector to length c.

2. contains regularity such that it is possible to pre-

dict correctly new values of binary vector.

A pseudo-code definition of an algorithm for finding

proposal of the best pattern binary vector is given in

Table 3.

f ind best subsequence: gets time series and arbi-

trary chosen constants c and multiplicity number k.

Then we create all possible different binary vectors of

length c such that 1s are on at least d

c

2

e positions. We

save these vectors as rows of matrix S. This means

that S has m rows where for odd c we get m = 2

c−1

and for even c we get m = 2

c−1

+

1

2

c

c/2

. For every

i − th row of S matrix we create vector X

1

i

as it was

described at Section 3.1. Every subsequence X

1

i

is

splitted in such a way that 0.7 of that series is train set

X

1

i

train

and 0.3 is test set X

1

i

test

where 0.7 and 0.3 are ar-

bitrary chosen constants. Then by using arbitrary cho-

sen prediction method we calculate MSE of predic-

FUNCTION find_best_subsequence(time_series,c,k)

S = cob(c)//cob returns all binary combinations

//of length c with 1 on at least c/2 positions

FOR i=1;i++;i<=number_of_rows(S)

X1(i,:)=create_subseq(S(i,:),time_series)

Xtrain=X1(1:0.7*size(X))

Xtest =X1(0.7*size(X):end)

MSE = chosen_prediction_method(Xtrain,Xtest)

S(i,end+1) = MSE

ENDFOR

S = sort_ascendning_by_last_column(S)

S = S(1:ceiling(end/k),:)

WHILE c<size(time_series)

c=k*c

IF c>size(time_series)

c = size(time_series)

ENDIF

FOR j=1;j++;j<number_of_rows(S)

S(j,:)=extend_binary_vector(S(j,:),c)

X(j,:)=create_subseq(S(j,:),time_series)

Xtrain=X(1:0.7*size(X))

Xtest=X(0.7*size(X):end)

MSE=any_prediction_method(Xtrain,Xtest)

S(j,end+1) = MSE

ENDFOR

S = sort_ascendning_by_last_column(S)

S = S(1:ceiling(end/k),:)

ENDWHILE

//return S with lowest MSE

RETURN S(1,:)

Figure 3: Pseudo-code of algorithm which finds proposition

of best subsequence.

tion. It is worth noting that we can create m processes

and calculate MSE for vectors X

1

1

,X

1

2

,..., X

1

m

paral-

lel. Parallel computing in practise can significantly

decrease computational time. The number of possible

S subsequences increase exponentially according to c

number. This is why it is the most time consuming

part of the algorithm.

In this part of the algorithm we have set of pairs

(S

1

,MSE

1

),(S

2

,MSE

2

), (S

3

,MSE

3

)...(S

m

,MSE

m

).

Then we reject all S rows but d

1

k

e of the rows with

the lowest MSE. We extend rows of S using function

extend binary vector (refer to pseudo-code in Table

2) to get binary vectors with length k · c. Now we

have set S

1

,S

2

,..., S

d

1

k

e

where every row S has length

k · c. For every row S

i

we create vectors X

1

i

as it was

described in section 3.1. We repeat process of calcu-

lating MSE, selection and extending S rows length

while its length does not exceed training set length.

As the result we return row S with corresponding

lowest MSE.

Time Series Forecasting using Clustering with Periodic Pattern

87

3.4 Time Series Forecasting

In order to predict value of x

t+1

we predict value of

b

t+1

in S series (refer to pseudo-code in Table 2).

Then if b

t+1

= 1 we take prediction x

1

t+1

calculated

on subsequence X

1

otherwise we choose prediction

x

0

k+1

calculated on subsequence X

0

, where X

0

is com-

plementary subsequence X

1

to X.

4 COMPLEXITY OF PROPOSED

APPROACH

Our goal is to prove that clustering with our approach

has time complexity equal to O(log

n

k

MSE(n)) where

MSE is arbitrary chosen prediction function, k is con-

stant multiplicity parameter and n is length of series.

We assume that prediction function has complexity

not less than O(n). Firstly we determine complexities

of every part of the algorithm.

4.1 Time Complexity of the Algorithm

Which Creates Corresponding

Subsequence

Algorithm which creates vector X

1

and X

0

from orig-

nal series using pattern S is described in the section

3.1. Complexity of that algorithm is O(n).

4.2 Time Complexity of the Algorithm

Which Extends Binary Vector

Algorithm which extends binary vector (refer to

pseudo-code in Table 2) contains two parts. Firstly

we have to create vector dictionary which is able

to extend binary sequence. We notice that maximal

number of vectors in dictionary cannot be larger than

2

d

where d is the vector length. However, at the same

time dictionary cannot contain more then c elements

where c is the length of the vector on which we

build dictionary. Due to that we can say that in every

step dictionary length is not larger that min(2

d

,c).

Moreover we know that algorithm will produce not

more that c such dictionaries. We know that number

of operation is equal to

c

∑

i=1

min(2

d

,c) ∗ c < c

2

(2)

so we can say that time complexity of that algo-

rithm is O(c

2

). Another part of the algorithm is ex-

tending binary vector using created dictionary. What

is important we create dictionary only once and then

we use it during whole process of clustering. Find-

ing proper vector in dictionary costs not more than

O(log

2

c). This is why extending binary vector by n

elements cost O(nlog

2

c).

4.3 Time Complexity of the Algorithm

Which Finds Best Pattern S

Algorithm which finds best pattern S is described in

subsection 3.3. We choose some arbitrary length of

the first subsequence c and multiplicity parameter k.

We start with subsequence of length c and then in ev-

ery step we extend this subsequence k times. Also we

remove all S proposals but d

1

k

e with the lowest corre-

sponding MSE. Number of operations can be approx-

imated by:

(3)

2

c−1

MSE(c) + 2

c−1

c

2

+ clog

2

(c)

+ d

1

k

e2

c−1

MSE(kc) + kclog

2

(c)

+ d(

1

k

)

2

e2

c−1

MSE(k

2

c) + k

2

clog

2

(c)

+ ... + d(

1

k

)

log

n/c

k

e2

c−1

MSE(n)

which is equal to

2

c−1

c

2

+

log

n/c

k

∑

i=0

d(

1

k

)

i

e2

c−1

(MSE(k

i

c)+ k

i

clog

2

c) (4)

where 2

c−1

is number of all proposals of S pro-

posed in the first step, c

2

is maximal cost for creation

binary vector dictionary (refer to Section 4.2), log

n/c

k

is the maximal number of steps after which length

of S reaches n, MSE(k

i

c) is cost of approximation

prediction error on every step for every S proposal,

k

i

clog

2

c is cost of extending binary vector S k times.

Taking into account this equation we can say that

number of operation in our approach is definitely

smaller than

2

c

c

2

+ log

n/c

k

(2

c

)(MSE(n) + (nlog

2

c)) (5)

After taking into consideration that complexity of

MSE(n) is not less than O(n) and omitting constants

we can say that complexity of our approach according

to n is equal to:

O(log

n

k

MSE(n)) (6)

On the contrary, the time complexity according to

c is equal to:

O(2

c

) (7)

NCTA 2015 - 7th International Conference on Neural Computation Theory and Applications

88

Figure 4: IceTargets series plot.

It is worth noticing that algorithm can be processed

in parallel and consequently that time calculation in

practise can decrease significantly.

5 SIMULATIONS

In order to check efficiency of our approach we made

several simulations. In our simulations we used neu-

ral networks with hidden layer and delay equal to

2 (refer to diagram on Figure 5). As a neural net-

work training method we used Levenberg-Marquardt

backpropagation algorithm [(Marquardt, 1963)]. in

comparative simulation we used neural networks with

the same structure, training rate, training method and

number of iteration as in our approach. The only

difference was that neural networks in our approach

were trained on subsequences chosen by our algo-

rithm where neural network used in comparative sim-

ulation was trained on whole training set. In every

simulation as a constant c number we used 12 and

as multiplicity parameter k we used 2. In order to

avoid random bias we repeated every simulation 10

times and used mean values. We also used IceTargets

data which contains a time series of 219 scalar val-

ues representing measurements of global ice volume

over the last 440,000 years (see Figure 4). Time series

is available at (http://lib.stat.cmu.edu/datasets/, ) or in

the standard Matlab library as ice dataset.

5.1 IceTargets with Random Noise

We modified IceTargets series by adding random

numbers generated from uniform distribution on -

1.81 to 2.12. Where -1.81 is minimum value

from IceTargets series and 2.12 is maximum value

from IceTargets series. Random number occurrence

scheme is as fallow:

X = (rand(1),IceTargets(1),rand(2),IceTargets(2),

rand(3), ... IceTargets(219),rand(220))

Our approach finds vector S = (0,1, 0,1, ...,1, 0)

which is correct pattern and splits time series accord-

Figure 5: Diagram of neural network used in simulations.

ing to it (refer to Table 1). Due to that neural net-

works separately predicts IceTargets series and ran-

dom noise. Our approach has mean MSE equal to

0.62 where neural network trained on whole set gives

MSE equal to 0.93. The results are presented in Table

2.

5.2 Cosinus with IceTargets

We created time series by merging cosinus and

IceTargets time series using pattern:

X = (cos(0.1), IceTargets(1) , cos(0.2),

cos(0.3), IceTargets(2), IceTargets(3), cos(0.4),

IceTargets(4) , cos(0.5), cos(0.6), IceTargets(5),

IceTargets(6) ...)

So pattern could be described by vector

S = (101100101100101100101100...)

Our approach finds correct pattern which splits time

series into proper subsequences (refer to Table 1).

Neural networks trained on subsequences give mean

MSE equal to 0,0170 where neural network trained

on whole training set gives MSE equal to 0,5144

(refer to Table 2).

5.3 Quarterly Australian Gross Farm

Product

In this simulation we used real statistic data of

Quarterly Australian Gross Farm Product $m

1989/90 prices. Time series is build from 135

data points represented values measured between

September 1959 and March 1993. Data is available

at (https://datamarket.com/data/set/22xn/quarterly-

australian-gross-farm-product-m-198990-prices-sep-

59-mar 93#!ds=22xn&display=line, ). The data

was rescaled to 0-1 range. One of the proposed

subsequence is presented on table 1. Average value

of MSE of this time series forecasting calculated

using our approach was equal to 0,007 when average

value of MSE achieved by single neural network was

equal to 0,0211 (refer to Table 2).

Time Series Forecasting using Clustering with Periodic Pattern

89

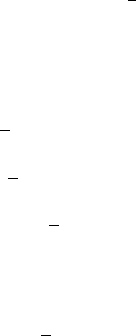

Table 1: Table which presents on different time series plots of subsequences X

1

and X

2

after clustering with our approach.

Time series IceTargets with random noise

Pattern proposed by our approach: S = (101010101010101010101001...)

Time series Subsequence X0 found by our approach Subsequence X1 found by our approach

Time series Cosinus with IceTargets

Pattern proposed by our approach: S = (101100101100101100101100...)

Time series Subsequence X0 found by our approach Subsequence X1 found by our approach

Time series Quarterly˙Australian˙Gross˙Farm

Pattern proposed by our approach: S = (1011001100110011001100...)

Time series Subsequence X0 found by our approach Subsequence X1 found by our approach

Time series predicted with different methods

Pattern proposed by our approach: S = (110011001100110011001100...)

Time series Subsequence X0 found by our approach Subsequence X1 found by our approach

5.4 Series Predicted With Different

Methods

In all previous simulations we used our approach to

splitting time series into subsequences and then we

predict their values with the same method - neural

network. However, our approach gives a possibility

to use completely different methods of prediction to

each subsequence. Due to that we can choose differ-

ent methods according to specific prediction proper-

NCTA 2015 - 7th International Conference on Neural Computation Theory and Applications

90

Table 2: Comparisons with other methods for time series based on MSE.

IceTargets merged with noise IceTargets merged with cos QuarterlyGrossFarmProduct

Our approach 0,62 0,0170 0,007

Single Neural Network 0,93 0,5144 0,0211

Increase efficiency 1,5 times 30,25 times 3,014 times

ties of each subsequence and take advantage of both

methods. To show that it is possible we merged

two series with completely different prediction prop-

erties into one time series. We choose simple series

which grows linearly according to time and statistic

data IceTargets which expected value do not seems

to change in time. We merged them with the pattern:

X = (1, 2, IceTargets(1), IceTargets(2), 3, 4,

IceTargets(3), IceTargets(4), 5, 6, IceTargets(5),

IceTargets(6) ...)

Pattern is described with a vector

S = (110011001100110011001100...).

We use our approach which splits time series into two

subsequences (Please see table 1). To predict X1 we

use linear regression and to predict X0 we use neural

network. Thanks to that we use advanteges of both

methods and get MSE=0.0101. In case of using sin-

gle neural network method we get MSE = 2535.45

and when using only single linear regression MSE =

30.35 (refer to Table 3). Our approach provides the

prediction error over 250000 times smaller then us-

ing only neural network and 3000 times smaller then

using only linear regression.

Table 3: Comparison of MSE calculated with different

methods for the time series created by merging linear func-

tion and IceTarget.

Method Neural Linear Our

Network regression approach

MSE 2535.45 30.35 0,0101

6 CONCLUSIONS

In presented work, we proposed a novel method for

time series forecasting. Our approach is based on

splitting of the series into a subsequence and its com-

plement what can result in much lower potential pre-

diction error. Moreover, it allows application of dif-

ferent prediction methods to both subsequences and

therefore to combine their benefits. The proposed ap-

proach is not associated with any specific time series

forecasting method and can be applied as a generic

solution in time series preprocessing. Moreover we

show that our approach allows to noise filtering. In

order to validate the efficiency of the introduced so-

lution we conducted series of experiments. Obtained

results proved that using our approach results in sig-

nificant improvement of accuracy. Moreover we have

proven that generated overhead asymptotically is log-

arithmic with respect to time series length. Low com-

putation overhead caused by our approach suggests

that it can be useful regardless of the time series

length. Moreover algorithm can be processed parallel

and therefore we can decrease time of computation by

implementing it on multiple processors.

Our solution opens up broad prospects of further

work. First of all our approach use strict partition-

ing clustering where every element belongs to exactly

one cluster. Future research may design and examine

our approach with overlapping clustering where sin-

gle element may belong to many clusters. Efficiency

of our approach with such modification should be in-

vestigated on real data. Another open question is in-

fluence of choice of maximal searched pattern period

and minimal acceptable subseries length into our ap-

proach prediction efficiency. One of future area of re-

search could be also design and implementation auto-

mated method of selecting different prediction meth-

ods to proposed subseries.

REFERENCES

Duda, R. and Hart, P. (1973). Pattern classification and

scene analysis. In John Wiley and Sons, NY, USA,

1973.

Estivill-Castro, V. (20 June 2002). Why so many clus-

tering algorithms a position paper. In ACM

SIGKDD Explorations Newsletter 4 (1): 6575.

doi:10.1145/568574.568575.

G. Karypis, E.-H. Han, V. K. (1999). Chameleon: hierarchi-

cal clustering using dynamic modeling. In Computer

6875.

http://lib.stat.cmu.edu/datasets/.

https://datamarket.com/data/set/22xn/quarterly-australian-

gross-farm-product-m-198990-prices-sep-59-mar

93#!ds=22xn&display=line.

Huanmei Wu, Betty Salzberg, G. C. S.-S. B. J.-H. S. D. K.

(2005). Subsequence matching on structured time se-

ries data. In SIGMOD.

J. Han, M. K. (2001). Data mining: Concepts and tech-

niques, morgan kaufmann. In San Francisco, 2001

pp. 346389.

J. Han, M. K. (2003). Application of neural networks to

an emerging financial market: forecasting and trading

the taiwan stock index. In Computers & Operations

Research 30, pp. 901-923.

Time Series Forecasting using Clustering with Periodic Pattern

91

Jessica Lin, Eamonn Keogh, L. W. S. L. (2007). Experi-

encing sax: a novel symbolic representation of time

series. In Data Mining and Knowledge Discovery, Vol-

ume 15, Issue 2, pp 107-144.

M. Ester, H.-P. Kriegel, J. S. X. X. (1996). A density-

based algorithm for discovering clusters in large spa-

tial databases. In Proceedings of the 1996 Interna-

tional Conference on Knowledge Discovery and Data

Mining (KDD96).

MacQueen, J. (1967). Some methods for classification and

analysis of multivariate observations, in: L.m. lecam,

j. neyman (eds.). In Proceedings of the Fifth Berkeley

Symposium on Mathematical Statistics and Probabil-

ity, vol. 1, pp. 281297.

Marquardt, D. (June 1963). An algorithm for least-squares

estimation of nonlinear parameters. In SIAM Journal

on Applied Mathematics, Vol. 11, No. 2, pp. 431-441.

Moon S, Q. H. (2012). Hybrid dimensionality reduction

method based on support vector machine and inde-

pendent component analysis. In IEEE Trans Neu-

ral Netw Learn Syst. 2012 May;23(5):749-61. doi:

10.1109/TNNLS.2012.2189581.

P. Cheeseman, J. S. (1996). Sting: a statistical information

grid approach to spatial data mining. In Bayesian clas-

sification (AutoClass): theory and results, in: U.M.

Fayyard, G. Piatetsky-Shapiro, P. Smyth, R. Uthu-

rusamy (Eds.), Advances in Knowledge Discovery and

Data Mining, AAAI/MIT Press, Cambridge, MA.

S. Makridakis, S. Wheelwright, R. H. (1997). Forecasting:

Methods and applications. In Wiley.

S. Uma, A. C. (Jan 2012). Pattern recognition using en-

hanced non-linear time-series models for predicting

dynamic real-time decision making environments. In

Int. J. Business Information Systems, Vol. 11, Issue 1,

pp. 69-92.

Song, H. J., S. Z. Q. and Miao, C. Y. M. (2010). Fuzzy cog-

nitive map learning based on multi-objective particle

swarm optimization. In IEEE Transactions on Fuzzy

Volume 18 Issue 2 233-250. IEEE Press Piscataway.

Tong, H. (1983). Threshold models in non-linear time series

analysis. In Springer-Verlag.

W. Wang, J. Yang, R. M. R. (1997). Sting: a statistical

information grid approach to spatial data mining. In

Proceedings of the 1997 International Conference on

Very Large Data Base (VLDB97).

Zhang, G. (2003). Time series forecasting using a hybrid

arima and neural network model. In Neurocomputing

50 pages: 159-175.

Zhang, G. (2007). A neural network ensemble method with

jittered training data for time series forecasting. In

Information Sciences 177 pages: 5329-5346.

NCTA 2015 - 7th International Conference on Neural Computation Theory and Applications

92