Daily Equity Returns and Price Limit in China's Stock Market

Yuan Yirui

National Research Institute for Rural Elechrification, 122 Xueyuan Road, Hangzhou, China

yryuan@hrcshp.org

Keywords: Price Limit, Volatility, Normal Distribution.

Abstract: The purpose of this paper is to get a conclusion whether the price limits have C-H effects on return series on

limit-hitting days in China. I compare the volatilities between the non-limiting return series and return series

with price limit. ‘Estimating the effect of price limits on limit-hitting days’ is the main reference published

in 2005 by Chung Jeff and Li Gan. The model I use is normal distribution.

1 INTRODUCTION

Price limit is an established amount in which a price

may increase or decrease in any single trading day

from the previous day’s settlement price. It limits the

extent that how far the price can move up or down.

The purpose of Price limits is to control price

fluctuation and make an orderly market. Price limit

has two effects: ceiling effect, C-H effect. As I will

use return series instead of only limit-hitting days’

returns, there is no ceiling effect. The C-H effect is

called cooling-off and heating-up effect. It assumes

that price limit may cool off or heat up price

behavior. If it has effect, I can use price limit as a

tool to achieve certain purposes.

Around half of the world’s stock exchanges use

price limit tool. For example, In China, Stock

exchange limit the price changes to 10% in mid-

1997, but now the price limits decline to 5%. We

can see that price limits will also change according

to the economy status.

There are many references I can use. In the paper

used as the main reference, the main conclusion is

that price limit will have some cooling off effect in

normal iid distribution. But the effect is not

significant in mixture normal distribution. The

model I use is the one introduced in the reference. In

‘Price limit performance: Evidence from the Tokyo

Stock Exchange’, there are three hypothesis of

effect: volatility spillover hypothesis (prevent price

change and immediate correction), delayed price

discovery hypothesis (the block on price may force

stock to discover until next trading day), trading

interference hypothesis (people want to sell or buy at

equilibrium price and they will wait). They use daily

stock price data of four years. In the first hypothesis,

they use a 21-day event window, day -10 to +10.

Day 0 represents the limit-hit day. Then they

calculate volatility of each day for the 21-day period

surrounding the event day 0. However, the empirical

results show: volatility returns to normal level not

that quickly; price still change and even more

frequently; trading volume is larger than before. As

a conclusion, none of them established. Price limits

almost have no effect.

In ‘Price limits and volatility: a new approach

and some new empirical evidence from the Tokyo

stock exchange’, it examines Day-of-the-week effect

of limit hits which is first introduced ever. They use

the data from DataStream. It uses EGARCH model

which allows for the information asymmetry and

parameters to be negative. When seasonally

occurred price limit days is associated with

seasonally occurred high stock returns, it means that

price limit hits are not due to noise trading entirely.

It also shows that high volatility exists when there

are high price limit hits; low volatility exists when

there are low price limit hits.

In ‘The impact of trading halts on liquidity and

price volatility: evidence from the Australian stock

exchange’, it examines the behavior of liquidity and

volatility around trading halts. There contains four

hypothesis: Trading volume for halted stocks is

abnormally high immediately after a trading halt;

Price volatility is also abnormally high after a

trading halt; bid-ask spreads are abnormally wide;

Market depth at the best-quotes is abnormally low

immediately after a trading halt. In order to observe

the behavior of both liquidity and volatility, they set

up a natural experiment: there are two identical

11

Yirui Y.

Daily Equity Returns and Price Limit in China’s Stock Market.

DOI: 10.5220/0006018200110014

In Proceedings of the Information Science and Management Engineer ing III (ISME 2015), pages 11-14

ISBN: 978-989-758-163-2

Copyright

c

2015 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

11

firms: one has trading halts, another don’t have.

They want to know the trading behavior after trading

halts by releasing good news and bad news. The

result is that trading behaviors act more abnormally

when bad news are released than good news.

In ‘Characteristics of stocks that frequently hit

price limits: empirical evidence from Taiwan and

Thailand’, They find that volatile stocks, actively

traded stocks and small market capitalization stocks

hit price limits more often than other stocks. The

stocks are all from Taiwan Stock Exchange and the

Stock Exchange of Thailand. It calculates the

number of limit hits by using year, month, day-of-

the week and industry categories. The purpose of

this paper is to find out that if some certain stocks

with certain characteristics hit limits more often than

others. They do this kind of research because that

this area is underdeveloped right now. It examines

four possible factors: beta, residual risk, trading

volume, firm size and the book-to-market value of

equity. Then it calculates the autocorrelation

between limit-hits and the four factors.

In ‘Using American Depository Receipts to

identify the effect of price limits’, it use a natural

experiment: same stock is traded in two different

exchanges. One has price limit and the other does

not have. In this way, we can observe the effect of

price limit very clearly. The conclusion of this paper

stands for the point that price limit does not have

significant effect on means nor variances.

There are some other related literatures I have

not mentioned here, but I will give reference

information at the end of the whole project. To sum

up, most supported opinion in previous years is that

price limits have cooling-off effect. But most recent

empirical work shows that the effect turns to be

heating-up. I will do this empirical work according

to Chinese recent information and status.

The paper is organized as follows: The Data and

Model will be included in Section 2. I will estimate

stocks using normal distribution model in Section 3.

Section 4 will be the conclusion.

2 DATA AND MODEL

The data is from ‘Wind information’. It contains

four stocks from 09/02/2011 to 09/03/2012. We get

the daily stock prices and returns from ‘Wind’.

Next, I calculate the adjusted stock return and use

the +5% and -5% as the upper and down limits and

find out how many times of limit hits. Then I divide

the sample into many subsamples, named Sj, which

contains j+1 day. S0 means there is no limit-hitting

day, and S1 means there is one limit-hitting day and

contains next day just after the hitting day. For

example, there is a return series (0,1,0,1,1,0,1,1,1,0).

0 represents that price doesn’t hit the limit and 1

represents that price dose hit the limit. 1 belongs to

S0 because there is no price limit hits. And 2and3

belong to S1. 4,5 and 6 belong to S2. If there is no

limit hits, I will just use the return data, but if the

return hits the limit, I will use the average return of

this day and next trading day as the adjusted return

of both of them. And sometimes they just hit the

limit in continuous days. The adjusted return will be

the average return of these limit-hitting returns and

the following day’s return. Now I have the adjusted

data.

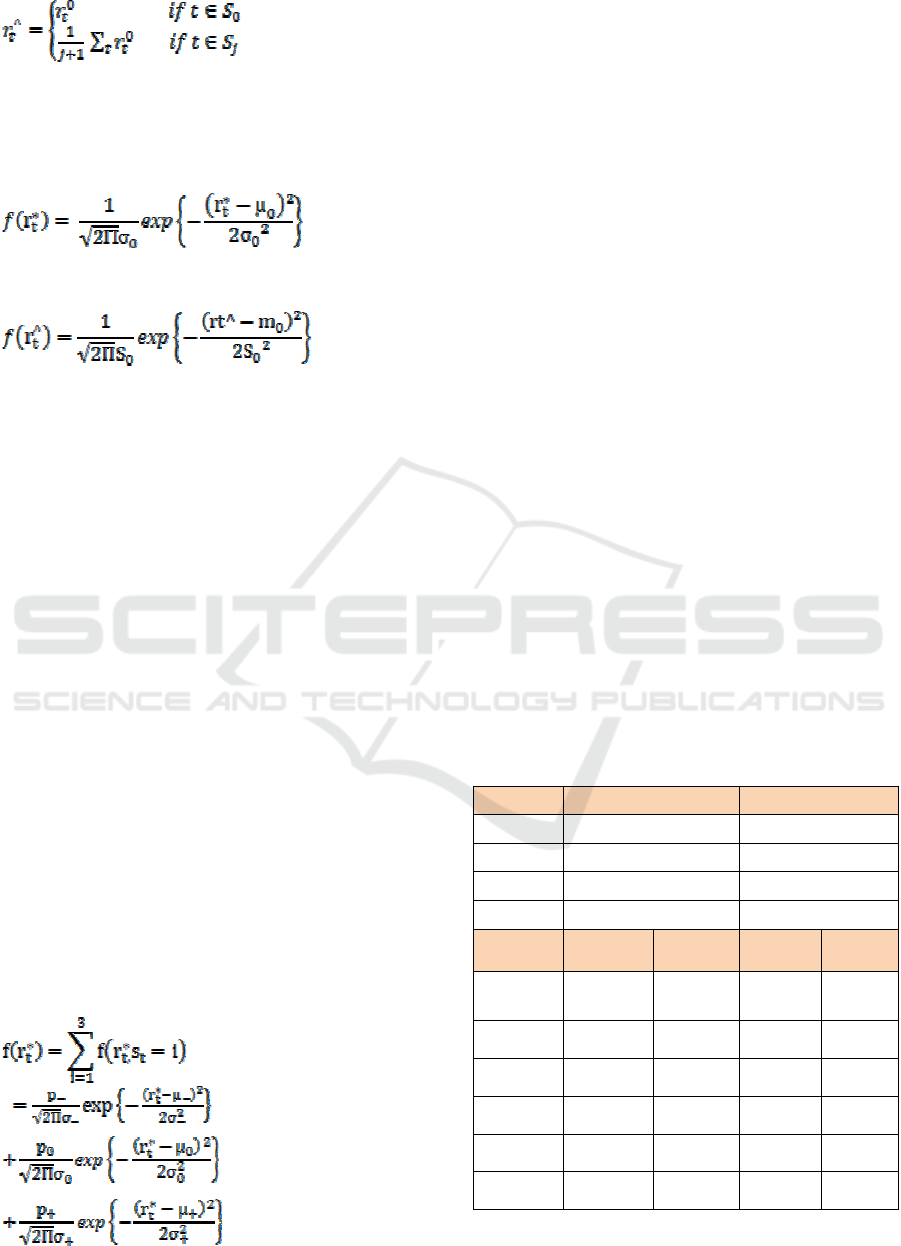

Table 1: Days that limits are hit.

Sheng run Gan hua Sih uan Guo yao

Up

limit

hits

32 14 13 17

Down

limit

his

23 11 12 11

Total

limit

his

55 25 25 28

There are enough limit hits for me to do the

research and observe the effect of price limits. In

this way, the stock price returns to the equilibrium

on j+1 day and I can get rid of ceiling effect. In this

paper, the purpose is to observe if the price limit has

effect on volatility of stock prices.

Table 2: Frequency of limit hits in continuous days.

Continuous days of limit hits

0 1495

1 111

2 15

3 5

4 2

Total trading days 1628

Percentage of limit hit days 8.17%

rt*means an unobserved return series assuming no

price limit. rt means unobserved return series

assuming only the C-H effect. rt^ will be estimated

rt and rt0 will be the observed return series.

ISME 2015 - Information Science and Management Engineering III

12

ISME 2015 - International Conference on Information System and Management Engineering

12

(1)

I use normal distribution to do the research. The

hypothesis is that price limit has a significant effect

on mean and volatility of stock returns.

The model is:

(2)

Now rewrite the function:

(3)

2.1 When the State S Is S

-

, It Means

that Return Hits the Down Limit

m

0

=µ

0

+γ (4)

s

0

2

=σ

0

2

(1+ζ

-

)*(1+j) (5)

2.2 When the State S Is S+, It Means

that Return Hits the Upper Limit

m

0

=µ

0

+γ (6)

s

0

2

=σ

0

2

(1+ζ

-

)*(1+j) (7)

In this rewrite model, (γ-,γ+)and (ζ-,ζ+) two pairs

reflect the effect of price limits on stock returns. I

use the Normal Distribution to run the regression

and see if these parameters are significant or not. If

the (γ-,γ+) are significant, it means that price limits

have effect on mean value. If the (ζ-,ζ+) are

significant, it means that price limits have effect on

variance.

All these parameters are not significant. This

means that price limits barely have. effect on mean

and variance under Normal Distribution Model.

Mixture Normal Distribution Model:

(8)

In this paper, I only use normal density to

estimate stock returns to see if the volatilities

between non-limiting returns and adjusted returns

with price limits change after limit-hitting days.

Mixture Normal Distribution can be used when price

limits are not reached consecutively on more than

one day. It is more difficult.

2.3 MLE Estimates and Effect of Price

Limits

In order to get the conclusion of the effect of price

limits on limit-hitting days, I use Maximum

Likelihood Estimation, which has been introduced in

previous part. Now I use ‘R’ program to do the

estimation. The detailed estimation results are listed

in table 3. I estimated six parameters: mean,

variance, mean effect +, mean effect -, variance

effect + and variance effect -. If I use gragh to

explain the main idea, it would be that observed data

obeys the Normal density and the adjusted data can

be drawd with fatter tails. First, I calculate the mean

and variance of observed stock returns and their

standard error . Second, I estimate the six variables

and their standard errors of adjusted data which

contains price limits. If the parameters are

significant, it means that they should be added into

the model and it also means that price limits have

effect on mean and variance. Third, I can get the

effect by using the formula introduced below. In this

way, the effect of price limits can be calculated and I

can make our conclusion depending on the result.

Table 3: Result of MLE.

mean variance

Shengrun -2.07e-03(1.87e-03) 7.24e-04(8.20e-05)

Ganhua -7.85e-04(1.18e-03) 4.95e-04(5.15e-05)

Sihuan -2.15e-04(4.4e-04) 1.31e-03(5.57e-05)

Guoyao -4.17e-04(4.4e-04) 1.08e-03(4.63e-05)

Stock Shengrun Ganhua Sihuan Guoyao

µ mean -3.7e-03

(2.1e-03)

-8.33e-04

(1.15e-03)

-1.87e-04

(1.37e-03)

-4.7e-04

(1.1e-03)

σ2 variance

7.0e-04

(1.1e-04)

4.78e-04

(5.34e-05)

4.46e-04

(6.4e-05)

4.4e-04

(5.2e-05)

γ-

mean effect

-0.033

(3.7e-03)

-0.0278

(3.4e-03)

-0.032

(2.2e-03)

-0.032

(2.5e-03)

γ+

mean effect

0.042

(2.7e-03)

0.031

(2.8e-03)

0.026

(3.3e-03)

0.027

(1.9e-03)

ζ-

var effect

-0.81

(0.052)

-0.81

(6.37e-02)

-0.94

(0.02)

-0.87

(0.039)

ζ+

var effect

-0.92

(0.020)

-0.86

(4.32e-02)

-0.78

(0.069)

-0.92

(0.020)

Daily Equity Returns and Price Limit in China's Stock Market

13

Daily Equity Returns and Price Limit in China’s Stock Market

13

The data in the brackets is standard error which can

be compared with the p-value to figure out whether

the variable is significant or not. I can conclude from

table 3 that ‘variance effect ‘ is significant. So it

means that price limits have a negative effect on

variance. This is so called cooling-off effect.

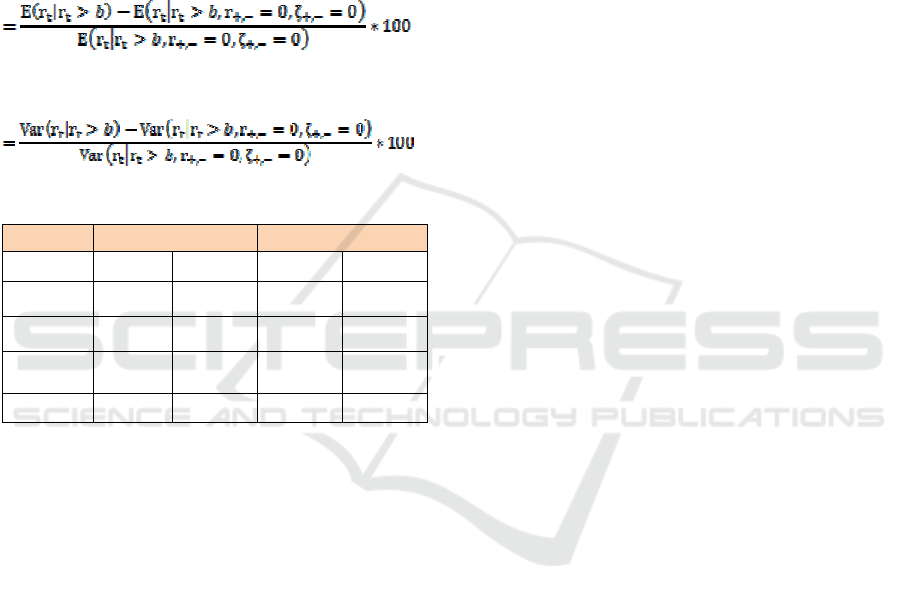

Now I want to know what the particular extent of

effect is. The effect of price limits is the percentage

change of both mean and variance when price hits

the limits.

Mean effect

Variance effect

Table 4: Effect of price limits on limit-hitting days.

Mean Variance

+ - + -

Shengrun 42% 26% -95% -51%

Ganhua 73% 35% -93% -55%

Sihuan 83% 57% -90% -86%

Guoyao 75% 74% -98% -69%

From table 4, we can see that the effects of price

limits in four stocks are similar. Also, it is apparent

that price limits have a positive effect on mean and a

negative effect on variance. This is so called

cooling-off effect which means volatility declines

after price limit hitting days. According to the result,

we can conclude that price limits have cooling-off

effect when using Normal density.

3 CONCLUSION

The main target of this paper is to see whether price

limits have effect or not. As we all know, price

limits have two effects: ceiling effect and C-H

effect. In this paper I only focus on C-H effect.

The sample is divided into many subsamples Sj,

which contains j+1 days. J represents days that hit

price limits. Then take the average of j days’ high

returns and next trading day’s return as the new

returns for j+1 days. The new returns will be the

sample used in the model. Through this way, all

subsamples will not have any ceiling effect. The data

is four ST stocks’ returns. The model I use is

Normal density. After MLE estimation, the results

show that price limits have some cooling-off effect.

Variance declines after price limits are set.

REFERENCES

Chung Jeff and Li Gan, 2005, Estimating the effect of

price limits on limit-hitting days, the econometric

journal Vol.8, No.1

Kenneth A. Kim and S. Ghon Rhee, 1997, Price limit

performance: Evidence from the Tokyo Stock

Exchange, the journal of finance. Vol.LII, No2

Haitham Nobanee, Wasim K. AlShattarat, Ayman E.

Haddad and Maryam AlHajjar, 2010, Price limits and

volatility: a new approach and some new empirical

evidence from the Tokyo stock exchange,

International Research Journal of Finance and

Economics 1450-2887

Alex Frino, Steven Lecce and Reuben Segara, 2011, The

impact of trading halts on liquidity and price

volatility: evidence from the Australian stock

exchange, Pacific-Basin Finance Journal, Volumn 19,

issue 3

Kenneth A. Kim and Piman Limpaphayom, 2000,

Characteristics of stocks that frequently hit price

limits: empirical evidence from Taiwan and Thailand,

Journal of Financial Markets, 315-332

Li Gan and Dong Li, 2001, Using American Depository

Receipts to identify the effect of price limits

ISME 2015 - Information Science and Management Engineering III

14

ISME 2015 - International Conference on Information System and Management Engineering

14