Research on Oil Flow Embodied in Export Trade of China

Keqiang Guo and Baosheng Zhang

School of Business Administration, China University of Petroleum, Fuxue Road 18, Changping, 102249 Beijing, China

guokeqiang@aliyun.com, bshshysh@cup.edu.cn

Keywords: Embodied Oil Flow, Export Trade, Input-Output Model, Structure Decomposition Analysis, China.

Abstract: In the past 20 years, China “leaked out” a large number of oil through exporting different kinds of products.

The amount and the pathway of oil flow embodied in China’s export trade are calculated by using the Input

Output Model and the Structure Decomposition Analysis. The total exported embodied oil has grown from

5 206 × 10

4

ton in 1997 to 15 547 × 10

4

ton in 2010, which account for a large percent of China’s domestic

oil consumption. The export scale effect is always the major part of positive promotion, while the

technology effect is the major part of negative influence. The export structure has lesser impacts, comparing

with the other two effects. The scale effect of Manufacture of equipment is the largest source for the

increment of exported embodied oil.

1 INTRODUCTION

After the accession to the World Trade Organization

(WTO), China’s integration with the global

economy has contributed to sustained growth in

international trade. Both its exports and imports

have grown faster during the past dozen years, while

China’s trade surplus increased dramatically.

Although this trend was affected by the international

financial crisis, the Chinese government has made

some plans recently to promote the economic

prosperity, including “the Silk Road Economic Belt

and the 21st-Century Maritime Silk Road” and

“Made in China 2025”, and so forth. Under these

background, China’s export trade will keep on

developing predictably. On one hand, the huge trade

surplus has brought China a great amount of foreign

exchange reserve; on the other hand, it also cost

China significant volumes of oil (X. Tang, B. Zhang,

L. Feng,2012), because all goods and services

produced in an economy are directly and/or

indirectly associated with oil use (G. Machado, R.

Schaeffer, and E. Worrell, 2001)

The debate on the impacts of international trade

on energy flow is not new. Many researchers have

studied the embodied energy imports or exports for a

number of countries and regions, such as, China, the

United Kingdom, and the United States, and so on.

These studies show that there are a lot of energy

flow embodied in the international trade, which is

not often considered and still not sufficiently clear.

China’s oil supply highly dependent on import,

and the gap between its consumption and production

has been increasing quickly. At the same time, with

the continued growth of international trade, China

are “leaking” a large number of oil through

exporting different kinds of products. It is significant

and urgent to answer the questions including, but are

not limited to: How many embodied oil are

exported? Which export sectors are most oil-

consuming? What is the major driving force factors

of the increase for the embodied oil export? The

aims of this paper focus on calculating the amount

and the pathway of oil flow embodied in China’s

export trade by using the Input Output Model and

the Structure Decomposition Analysis. The study

hopefully offer consultations for the development

and management of China’s international trade.

2 METHODOLOGY AND DATA

2.1 Basic Input Output Model

The Input-Output Analysis was firstly developed by

Leontief in the 1930s, which has been widely used

for analyzing the economic relationship of linkages

between different sectors. The basic Input Output

Model can be expressed as equation (1):

1

XAXY IAY

(1)

443

Zhang B. and Guo K.

Research on Oil Flow Embodied in Export Trade of China.

DOI: 10.5220/0006028204430447

In Proceedings of the Information Science and Management Engineering III (ISME 2015), pages 443-447

ISBN: 978-989-758-163-2

Copyright

c

2015 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

443

Where, X and Y represent exogenous and

endogenous accounts respectively, I is identity

matrix, and A is the technical coefficient matrix that

can be expressed as equation (2):

ij

nn

Aa

(2)

Where, i = (1, n); j = (1, n); n is the count of sectors

in an economy system; a

ij

is the technical

coefficient, also called as direct consumption

coefficient, which can be expressed as equation (3):

ij

ij

j

x

a

x

(3)

Where, x

ij

is marked as sector j’s use of products

from sector i; and x

j

is marked as the total output of

sector j. The matrix (I-A)

-1

is often called Leontief

Inverse Matrix.

Another important conception in the basic Input

Output Model is complete consumption coefficient,

denoted by b

ij

, which measures how much direct and

indirect output from sector i will be used in sector j’s

one unit worth of value of final output. It can be

expressed as equation (4):

()

ij ij ik kj

k

ba ba

(4)

Where, k means the middle sector. If the complete

consumption coefficient matrix is set as B, i.e. B = (

b

ij

)

n×n

, the equation (4) can be solved and transferred

to equation (5):

1

()BIA I

(5)

2.2 Exported Embodied Oil Model

Based on the basic Input Output Model, the model

for calculating oil flow embodied in international

trade can be established as equation (6):

1

n

ii

i

E

OeoV

(6)

Where, EO is the amount of embodied oil in

international trade; eo

i

is the amount of embodied oil

in one unit worth of value of product i, i.e. embodied

oil intensity; V

i

is the total value of product i in

import or export trade.

Before calculation the technical coefficient

matrix A should be modified to eliminate the

influence of the processing and manufacturing trade,

for example, some products are made by imported

semi-finished products and be exported again after

assembled. Firstly, A can be distinguished to two

parts: the imported middle products part A

m

and the

domestic middle products part A

d

, i.e. A = A

m

+ A

d

.

Secondly, the import coefficient matrix M are set to

establish equation (7):

()

m

d

AMA

A

IMA

(7)

Where, M is a diagonal matrix that can measures the

dependence of sector i on the imported middle

products, and the element of the diagonal matrix,

marked as m

ii

, can be expressed as equation (8):

/( )

ii i i i i

mimXimex

(8)

Where, X

i

is total output value of sector i, im

i

is the

total import value of sector i and ex

i

is the total

export value of sector i. It is assumed in this analysis

that the share of imported products in every sector

are same. Finally, the model of calculating exported

oil flow embodied in international trade can be

expressed as equation (9):

1

1

()

n

d

ex i i

i

EO eo I A ex

(9)

2.3 Structure Decomposition Analysis

Based on the exported embodied oil model, the

structure decomposition analysis can be continued:

firstly, set t

i

= eo

i

(I – A

d

)

-1

, which is complete oil

consumption of sector i; secondly, set s

i

= ex

i

/ EX,

where ex

i

is the total export value of sector i as

mentioned above, EX is the total export value of the

country, and, so, s

i

is the share of sector i’s export

value on the total export of the country. Then, the

exported embodied oil of sector i can be transferred

to equation (10):

exi i i

EO t s EX

(10)

The amount of exported embodied oil are divided by

this equation into three parts: the complete oil

consumption coefficient, the structure of export and

the scale of export, which are called the technology

effect, the structure effect and the scale effect. The

change of the exported embodied oil from time t1 to

time t2 can be expressed as equation (11):

21

22 2 11 1

tt

tt t tt t

exi exi exi i i i i

EO EO EO t s EX t s EX

(11)

Equation (11) can be solved by using the

Logarithmic Mean Divisia Index (LMDI) method.

The solution are shown as equation (12):

ISME 2015 - Information Science and Management Engineering III

444

ISME 2015 - International Conference on Information System and Management Engineering

444

21

21

21

21

21 2 1

21

21

21

(, )ln(/)

(,)ln(/)

(, )ln( /)

(,)( )/ln(

tt

tt

tt

tt

tt t t t

eff eff eff

exi exi exi i i

eff t t

i exi exi i i

eff t t

i exi exi i i

eff t t

exi exi

exi exi exi exi exi

EO EO EO t s EX

t L EO EO t t

sLEOEO ss

EX L EO EO EX EX

LEO EO EO EO EO

21

/)

t

exi

E

O

(12)

Where,

eff

i

t ,

eff

i

s and

eff

EX mean the influence

effects of the change from technology, the structure

of export and the scale of export.

2.4 Data

The oil consumption and the total output value of

every industries, the technical coefficient matrix A

between all industries and the import and export

value of every industries are need to calculate the

embodied oil flow. The data above are available

from China’s statistical yearbooks and China’s Input

Output tables (1997, 2002 and 2007 are original

tables, 2000, 2005 and 2010 are extended tables)

that both released by the National Bureau of

Statistics of China. Classification of industries are

different between the two data sources, so it should

be modified for consistency. Fifteen industry sectors

are used in this study, as shown in Table 1.

Table 1: Modified Industry Sectors of China.

N

O. Industry Sector

1 Agriculture

2 Mining

3 Manufacture of food, beverages and tobacco

4

Manufacture of textile, wearing apparel, footwear, caps,

leather, fur, feather and related products

5 Other Manufacture

6 Production and supply of power, heat and water

7 Processing of petroleum

8 Chemical industry

9 Manufacture of non-metallic mineral products

10 Manufacture of metal products

11 Manufacture of equipment

12 Construction

13 Transportation, Postal, Telecommunication services

14 Wholesale and retail trades, Hotels and catering services

15 Real estate, Banking and insurance and other services

3 RESULTS AND ANALYSIS

3.1 Amount of Exported Embodied Oil

According to the model built above and annual data,

the amount of oil embodied in China’s export trade

of every industry sectors are calculated as shown in

Table 2. The total consumption of oil in China (DC,

Domestic Consumption) and the proportion of

exported embodied oil on DC are also displayed.

Table 2: Exported embodied oil and the share on domestic

consumption of sectors. The No. from 1 to 15 represent 15

industry sectors mentioned in Table 1. Unit: 10

4

Ton.

No. 1997 2000 2002 2005 2007 2010

1 49 745 62 49 41 48

2 237 242 234 199 111 72

3 93 111 114 144 141 155

4 508 6214 954 1197 1422 1389

5 243 226 428 590 591 649

6 16 0 13 13 11 10

7 712 525 784 1539 1196 1180

8 674 844 1232 1592 2011 2352

9 101 125 138 202 234 319

10 416 556 639 1030 1506 1084

11 1119 1704 2674 4142 4499 5389

12 8 9 36 38 62 131

13 249 275 652 1049 1212 1146

14 245 282 316 609 396 465

15 537 569 600 858 1061 1158

Total 5206 6164 8877 13250 14493 15547

DC 17367 21232 22541 30086 34032 42875

Share 30% 29% 39% 44% 43% 36%

Two sectors, No. 11 (Manufacture of equipment)

and No. 8 (Chemical industry), are the first and

second largest sources of exported embodied oil. In

2010, the amount of exported embodied oil of the

two sectors account for about 50% in total. There is

a clear increase trend of exported embodied oil for

the sector of Manufacture of equipment, and the

total increase rate between 1997 and 2010 is 382%,

which is larger than any other sectors.

It also can be seen from Table 2 that both the

total domestic consumption of oil and exported

embodied oil have massive growth from 1997 to

2010. The growth rate of exported embodied oil is

199%, which is larger than that of domestic

consumption (147%). In recent years, the percentage

of exported embodied oil is around 40%, which

means there are about 40% of China’s oil

consumption per year are contributed to other

countries through international trade. But the trend

has revealed a clear decline trend after 2005.

3.2 Influence Factors of Embodied Oil

Influence factors of the increase for exported

embodied oil are analyzed by using the Structure

Decomposition Analysis method. The results of the

analysis on embodied oil between 1997-2000, 2000-

2002, 2002-2005, 2005-2007 and 2007-2010 are

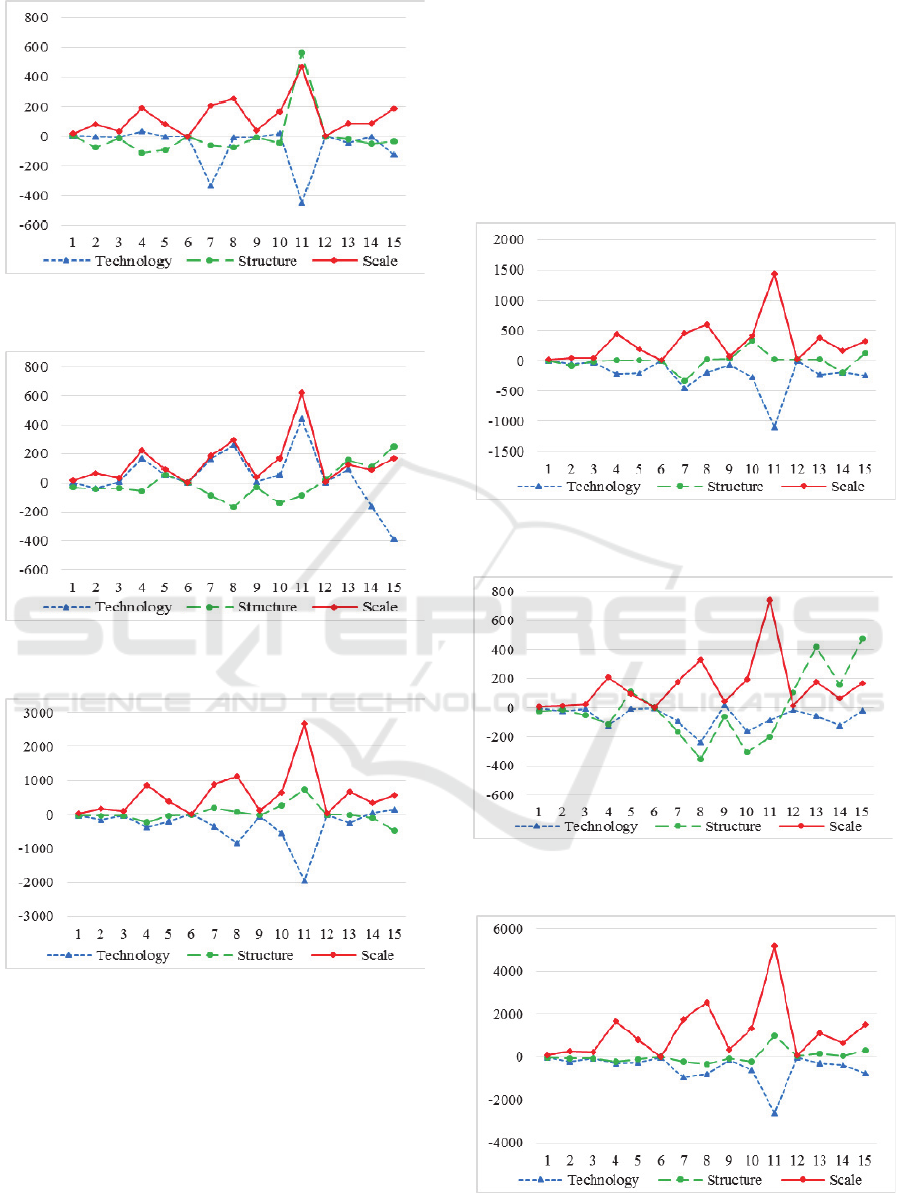

displayed in Figure 1-5.

Research on Oil Flow Embodied in Export Trade of China

445

Research on Oil Flow Embodied in Export Trade of China

445

Figure 1: Influence factors of the change on exported

embodied oil between 1997 and 2000. Unit: 10

4

Ton.

Figure 2: Influence factors of the change on exported

embodied oil between 2000 and 2002. Unit: 10

4

Ton.

Figure 3: Influence factors of the change on exported

embodied oil between 2002 and 2005. Unit: 10

4

Ton.

The change on the amount of embodied oil in

international trade are derived from combined action

of three effects. It can be seen from Figure 1-5 that

the export scale effect is always the major part of

positive promotion, while the technology effect is

the major part of negative influence. The only

exception of the technology effect appeared at the

change from 2000 to 2002. The export structure has

lesser impacts, comparing with the other two effects.

The industry sectors of No.1 Agriculture, No.3

Manufacture of food, beverages and tobacco, No. 6

Production and supply of power, heat and water, No.

9 Manufacture of non-metallic mineral products and

No. 12 Construction export pretty small amount of

oil embodied in international trade. The reason is all

of these sectors are low energy consuming or have

very small value of exports because their own

industrial characteristics.

Figure 4: Influence factors of the change on exported

embodied oil between.2005 and 2007. Unit: 10

4

Ton.

Figure 5: Influence factors of the change on exported

embodied oil between 2007 and 2010. Unit: 10

4

Ton.

Figure 6: Influence factors of the change on exported

embodied oil between 1997 and 2010. Unit: 10

4

Ton.

ISME 2015 - Information Science and Management Engineering III

446

ISME 2015 - International Conference on Information System and Management Engineering

446

The total Influence factors of the change on

exported embodied oil between 1997 and 2010 are

also calculated, as shown in Figure 6. The scale

effect of Manufacture of equipment is the largest

source for the increment of exported embodied oil,

even its technology effect also is the largest. Which

is in line with the result in Table 2.

4 CONCLUSIONS

The amount and the pathway of oil flow embodied

in China’s export trade are calculated by using the

Input Output Model, the Structure Decomposition

Analysis and China’s annual data (1997-2010).

The results show that, in the past 20 years,

Manufacture of equipment and Chemical industry

are the first and second largest sources of exported

embodied oil. The total exported embodied oil has

grown from 5 206 × 10

4

ton in 1997 to 15 547 × 10

4

ton in 2010, which account for a large percent of

China’s domestic oil consumption. The export scale

effect is always the major part of positive promotion,

while the technology effect is the major part of

negative influence. The export structure has lesser

impacts, comparing with the other two effects. The

scale effect of Manufacture of equipment is the

largest source for the increment of exported

embodied oil.

The oil flow embodied in international trade and

its influence factors should be considered during the

development and management in the future.

ACKNOWLEDGEMENTS

The authors would like to give many thanks to the

National Social Science Foundation of China (No.

13&ZD159) for sponsoring this research.

REFERENCES

X. Tang, B. Zhang, L. Feng, “Net oil exports embodied in

China’s international trade: An input–output analysis,”

Energy, vol. 48, no. 1, pp. 464–471, Dec. 2012.

G. Machado, R. Schaeffer, and E. Worrell, “Energy and

carbon embodied in the international trade of Brazil:

an input–output approach,” Ecol. Econ., vol. 39, no. 3,

pp. 409–424, Dec. 2001.

Research on Oil Flow Embodied in Export Trade of China

447

Research on Oil Flow Embodied in Export Trade of China

447