Bayesian Inventory Planning with Imperfect Demand Estimation

in Online Flash Sale

Ted Tao Yuan

1

, Michelle Cai

2

and Daniel Kao

2

1

Vipshop US, 2550 North First Street, Suite 300, San Jose, CA 94131, U.S.A.

2

Guangzhou VIP Information Technology Co., Ltd, 20 Huahai Road, Liwan District, Guangzhou, China

Keywords: Newsvendor Model, Flash Sale, eCommerce, Machine Learning, Bayesian Inference, Stochastic Model

Applications in Inventory Management and Automation.

Abstract: Daily deal, or flash sale, websites offer limited quantity of selected brands and products for a short period of

time. The idea is that short-term sales event of branded products drives consumer interest. Flash sale sites like

vip.com negotiate great deals from various vendors on a limited quantity of selected products. In operation,

all merchandises need to be allocated to regional warehouses before a short-term sales event starts. The variety

and quantity of merchandises change significantly from one sales event to another. Unsold items are typically

shipped back to vendors after the sales event ends. In this paper, we discuss the design and implementation

of a regional warehouse merchandise allocation model and strategy to maximize sales conversion rate. Our

work reveals the uniqueness of inventory planning of flash sale and its similarity to that of general online

retailers. Our machine learning prediction models and Bayesian Updating strategy are highly valuable to the

improvement of regional warehouse efficiency and customer experience in dealing with highly volatile flash

sale inventory.

1 INTRODUCTION

Online ecommerce retailers usually make their

product offerings available with plenty of inventory

for customers. In the business model, supply quantity

and price of a product can be adjusted according to

demand from buyers over time, such that it operates

according to the law of demand. In many cases,

demand curve

(O'Sullivan and Sheffrin, 2005) can be

constructed from user behavioural and transaction

data available at different price points. The variety

and quantity of products of online retailers are

typically maintained at certain levels from time to

time based on demand and price predictions.

Flash sale, also known as deal-of-the-day, is a

recently popular ecommerce model with time- and

quantity-limited offerings of discounted

merchandises. The flash sale business model is built

on short-term shallow inventory with limited quantity

of branded products at highly discounted prices. The

limited availability and ever-changing conglomerate

of selected merchandises daily on display at a flash

sale site, which is partitioned by geographic regions

in the discussion, makes it difficult to accurately

predict demand needed for the site’s day-to-day

operation from merchandise selection to online

display ranking and inventory planning. For example,

before a scheduled sales event starts, what

merchandises from vendors to be included in the

event? How to pre-distribute tens of thousands of

selected SKUs (stock keeping unit, a distinct item for

sale), each with small or fixed available quantity, to

N regional warehouses, such that it reduces operation

cost, maximizes overall sales conversion rate (max

profit for the business) and at same time achieves best

user experience by shipping from a warehouse closest

to a buyer?

In this paper, we present a study on flash sale

regional inventory planning based on machine

learning (ML) statistical demand estimation, as well

as an enhancement strategy using Bayesian Updating

(

DeGroot and Schervish, 2002) that can take the ML

estimate with a prior. The Bayesian Updating

estimate may have bigger impact to the merchandise

allocation among regional warehouses than the ML

model estimates on flash sale’s constantly changing

inventory. Discussion of flash sale inventory

challenges in business operations can be found in a

recent article (Savino, 2011).

Yuan, T., Cai, M. and Kao, D.

Bayesian Inventory Planning with Imperfect Demand Estimation in Online Flash Sale.

DOI: 10.5220/0005632303430348

In Proceedings of 5th the International Conference on Operations Research and Enterprise Systems (ICORES 2016), pages 343-348

ISBN: 978-989-758-171-7

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

343

2 DEMAND ESTIMATION

One of the ecommerce business key performance

indices is to maximize sales conversion rate of

merchandise on site. The conversion rate can be

measured by the quantity sold divided by total

quantity available for a SKU during a sales event. It

can be affected by many business processes, from

product selection to its ranked display on site, and to

the timely delivery to customers. All else being equal,

how can we improve overall sales conversion rate by

improving regional merchandise distribution

planning? Specifically, given some quantity of a SKU

that we may have limited past sales knowledge, we

need to determine the quantity allocation ratio for pre-

distribution of the merchandise to each regional

warehouse.

Although flash sale is unique in its business

operation, merchandise sell-or-not is inherently

determined by the quality of a product and demand

and display ranking factors such as brand recognition,

fashion, price discount, seasonality, color, size

preference by region, etc. To determine regional

quantity allocation ratio based on the demand

estimation of sales of merchandise, we built ML

models to predict the regional demand for a SKU.

There has been a large literature on multi-echelon

distribution systems and inventory allocation (

Ghiani

et al., 2004). In our distribution configuration, we

assume overall supply is given and must be pre-

distributed to customer-facing regional warehouses

(fulfilment centers) before a flash sale event starts.

Due to the short period of a flash sale and business

policy, transferring merchandises between regional

distribution warehouses, or warehouse serving

customers in a different region, is typically not

allowed.

2.1 Newsvendor Model

Newsvendor, or newsboy or single-period

(Stevenson, 2009) or perishable (Malakooti, 2013),

model can be traced back to a paper (Edgeworth,

1888) where Edgeworth used central limit theorem to

estimate the optimal cash reserves to satisfy random

withdrawals from depositors.

In the Newsvendor model (Arrow et al., 1951) of

inventory optimization, it concerns how many copies

of the day's paper to stock in the face of uncertain

demand and knowing that unsold copies will be

worthless at the end of the day. The optimal solution

is to statistically balance the cost of being

understocked (a loss of sale) with inventory cost of

being overstocked. By and large, this simple model is

applicable to retail inventory management (Gallego et

al., 1993). We can develop business specific supply

and demand estimation to plug into the model.

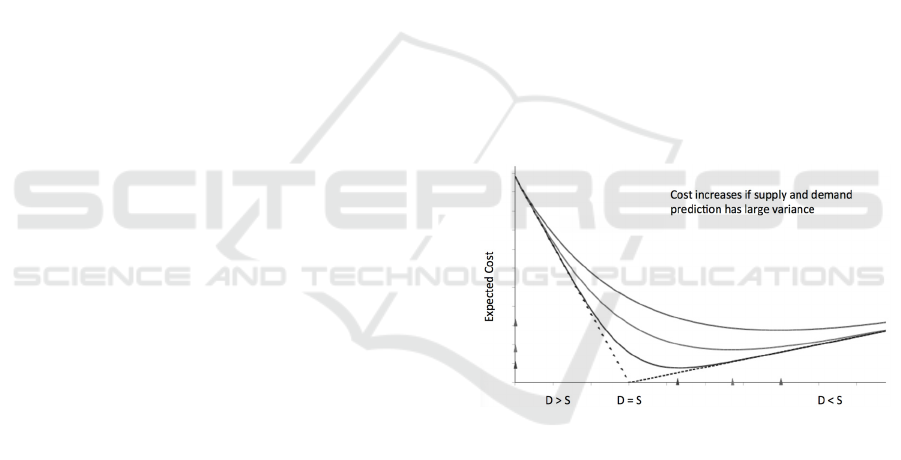

Figure 1 shows that the uncertainty around the

minimum cost in the Newsvendor model is greatly

affected by the variance of the underlying demand

and supply estimation. The decreasing linear dotted

line at left represents the cost of sales loss due to

understock when demand is greater than supply, the

increasing linear dotted line at right represents

inventory cost due to overstock when demand is less

than supply. When demand equals supply, there is no

sales loss or leftovers and the cost is zero. These are

the cases when the demand and supply are estimated

accurately without uncertainty. The three curves

show the minimum costs under uncertainty due to the

fluctuation of demand and supply. The lowest curve

is when the demand and supply fluctuation variance

is low, and the top curve is when variance is high. We

see as demand and supply variance gets higher, both

the expected minimum cost and the “safety” stock

level increase, and the cost function becomes much

more flat. In other words, the impact of the optimal

solution to business diminishes fast if the demand and

supply estimation has large statistical variance.

Figure 1: Cost under uncertain demand (D) and supply (S).

In flash sale, it usually acquires fixed quantity of each

SKU for a short-term sales event. It boils down to

stochastic demand estimation at each regional

warehouse based on historical sales and viewing

records if exist, and from aggregated statistics of sales

of similar merchandise or product category,

seasonality, regional discriminative factors such as

size, color, fashion, etc.

Among many choices, we choose to train non-

linear, non-parameterized machine learning models

using gradient boosted decision trees (GBDT)

(Friedman, 1999) to predict demand and regional

warehouse merchandise allocation ratio based on past

sales and sales proportion ratio in the regions. Our

training datasets are typically in the size of millions

with features extracted from brand, product and

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

344

recent sale transaction databases in the Chinese

market. We discuss two ML models that are tightly

correlated with slightly different business and

operation interests.

2.2 ML Model to Predict Regional

Warehouse Allocation Ratio of a

SKU

In the model, we try to infer a SKU’s sales proportion

ratio at a regional warehouse from historical sales

data. The sales proportion ratio is the sold quantity at

a regional warehouse divided by the total sales across

all regions. The machine-learning model

(GBDT_ALR) is summarized in the following

relation,

sales proportion ratio: y = function(

region, brand, product sales history, product

attributes, clicks and views, …)

with function f estimated by regression to minimize a

loss function ψy,fx,

argmin

,

,

We plan to use the inferred sales proportion ratio

as the guidance to merchandise allocation among

different regions.

We used GBM package in R to train the GBDT

model. The training set consists of millions of

randomly selected samples from the past sales

records, and the target is computed from the past sales

proportion ratio at regional distribution centers. It is

noted that we favor samples with larger sales quantity

and repeated sales that have less variance, and

samples with overall uniform sales conversion rates

across warehouses for SKUs. We gave them higher

sample weights in GBDT model training. We

adjusted the learn rate (shrinkage factor) and number

of decision trees to generate the best training result.

In offline test validation, the model gives us

overall 80% accuracy when we compare predicted

sold quantity with actual sales in our test data set. It

reveals for flash sale, in clothing, shoes and

accessories for example, the most important factors

are brand recognition, size differential by region (i.e.,

northern prefers larger sizes, southern prefers

smaller), and product category overall sales rate etc.

Figure 2 is a density plot of the difference (x-axis)

between the predicted sales proportion ratio and

actual SKU allocation ratio. The SKU allocation ratio

is simply the percentage of the merchandise that we

pre-distributed to the region. The distribution is

generally in a Gaussian form, which tells us our

distribution allocation ratio did generally agree with

sales proportion ratio. It has room to improve as it

slightly weighted to the left (overstocked), had small

tail on the right (understocked), also a sizeable sigma

(~0.25).

Figure 2: Prediction vs actual allocation ratio.

When applied to production, we more focused on

sales loss due to the misplacement of goods, i.e.,

overstock one region, understock others. To minimize

sales loss, business usually sets portion of the total

supply of a SKU under the ML pre-distribution tests.

For that matter, we have two measures for each test,

a “call-back” rate which is defined as the percentage

of the pre-distributed goods that did not sell and had

to be shipped back and returned to vendors, and a

sales coverage rate which is defined as the percentage

of the pre-distributed and sold goods among all sold

goods for a brand. In our environment, logistics sets

priority and requires the call-back rate to be less than

10%. After the call-back rate meets the requirement,

we can gradually increase the pre-distributed portion

to increase the sales coverage rate. In our tests, the

sales coverage rate can be anywhere from 15% to

100% for various brands.

2.3 ML Model to Predict Sales

Conversion Rate of a SKU

As conversion rate is the main business interest, we

also built a GBDT model to predict sales conversion

rate (GBDT_SCR). The goal is to learn the following

relationship,

sales conversion rate: y = function(

region, brand, product sales history, product

attributes, clicks and views, …)

where function f is estimated using the R/GBM

package.

Bayesian Inventory Planning with Imperfect Demand Estimation in Online Flash Sale

345

The regional sales conversion rate of a SKU

equals to the sold quantity divided by quantity

available to sell in the regional warehouse. The model

prediction can also be used to guide SKU’s allocation

so that more items are pre-stocked to a regional

warehouse with higher predicted sale probability.

Usage of the conversion rate prediction model in

merchandise allocation will be discussed in section 3.

The training data set can be assembled in pretty

much the same way as the GBDT_ALR model with

similar features except the target values. We have

tuned the training parameters such as learn rate,

number of trees as well as distributions (Gaussian for

regression and Bernoulli for classification) in the

GBDT algorithm to achieve best training result. The

classifier model has an AUC value 0.84 with the test

data set. As the model is equivalent to learning an

item’s probability of sale in a region, it reveals a

different set of important factors from the sales

proportion ratio model.

2.4 Comparison of the GBDT Models

Table 1 lists the variables of each model in each

column sorted by importance,

Table 1: Top important factors.

Sales Allocation Model

(GBDT_ALR)

Sales Conversion Model

(GBDT_SCR)

Warehouse region ID Brand name

Brand name Last time sale quantity

Brand regional past sales

proportion

Last three month SKU

sale quantity

Total stock quantity Last three month product

sale quantity

Similar size item regional

sales proportion

Total stock quantity

… …

3 BAYESIAN UPDATING

The ML model GBDT_ALR discussed above gives

us a fairly good estimation to determine item pre-

distribution allocation ratio based on sales proportion

ratio for goods with larger quantity of items and

repeated sales. However, major portion of our daily

flash sale merchandise SKUs are either newly arrivals

and/or with small total available quantity (typically <

10) from various vendors. If evenly distributed to

warehouses, it is normal that there can be only 1 or 2

items per SKU available for each regional warehouse.

In such cases, the training dataset samples have much

larger variance on the target labels and certain sales

features, and the model was not optimally trained

with lower statistical confidence on the major portion

of the inventory.

In some way, it can be related to the well-known

Bullwhip/Forrester effect (Hau et al., 1997) that exists

in supply chain management systems. Seasonality,

product life cycle and pure demand uncertainty all

contribute.

With the imperfect demand estimation and other

business specific requirements, we sometimes take

subjective human intervention by injecting rules to

enhance the prediction results. We are also

continuously exploring new factors that can further

improve the precision of the models.

The main issue here is the lack of, or short demand

history for many SKUs. Statistically, it is not proper

to assume one-time sold-out of 1 or 2 items at one

warehouse implies 100% sales conversion rate during

next sales time or at higher inventory levels. The

randomness of sales seems impacting more on the

GBDT_ALR sales proportion model. This leads us to

consider other ways to enhance the ML prediction

models, specifically the Bayesian Updating (Gelman

et al., 2003) approach.

3.1 Bayesian Updating

We believe demand estimation D can be measured by

observed sales quantity. Assuming we have N=3

regional merchandise distribution warehouses, the

total demand estimation D of a SKU is the sum of the

demand estimation in each region D(i),

D = D

1

+ D

2

+ D

3

= S(1) *

p

(1) + S(2) *

p

(2)+S(3)*

p

(3)

(1)

where S(i) is the item’s allocated quantity in region i,

p(i) is the item’s sales conversion rate in the region.

The total quantity of a SKU available for sell is S

= S(1) + S(2) + S(3). The overall sales conversion rate

of the SKU across all regions is

p=

D

S

=

S

1

S

*p

1

+

S

2

S

*p

2

+

S

3

S

*p

3

=r

1

*p

1

+r

2

*p

2

+r

3

*p

3

= r

i

*p(i)

N

i=1

where r(i) = S(i)/S is the SKU’s allocation ratio in

region i, and

∑

r

i

=1

N

i=1

. r(i) is used in the pre-

distribution planning to determine the stock quantity

at the regional warehouse. The overall sales

conversion rate of a flash sale is the weighted average

of all its SKUs’ sales conversion rates.

We can interpret r(i) as the probability of a SKU

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

346

item being distributed to region i. and p(i) as the

probability that it will be sold in the region. From

Bayes’ theorem

(Gelman et al., 2003), the probability

of a SKU being allocated to region i knowing its

probability of being sold in the region is

|

|

∗

∑

∗

(2)

This provides us the formula to compute future

warehouse allocation ratio for the SKU with updated

knowledge of sales conversion rate and prior

warehouse inventory level. The updated conversion

rate knowledge can be acquired either through online

monitoring and measurement of the actual sales, or

from the GBDT_SCR conversion rate model

described in section 2.3 based on past online sales

data.

3.2 Inventory Planning and Online

Monitoring

As Bayesian, we could start with equal distribution

among warehouses. We can have better estimation

given the ML sales conversion model. To illustrate,

lets say our initial sales conversion rate estimates

from the GBDT_SCR model output are

1

0,

2

80%

3

30%

If we assume equal prior, from Bayes’ theorem,

1

0%,

2

73%

3

27%

With minor rounding and human judgment in reality,

we would choose a SKU’s warehouse allocation ratio

for the 3 regions as

1

5%,

2

70%

3

25%

We would have a forecast estimate of the SKU’s

overall sales conversion rate as p =

∑

r

i

*pi =

63.5% with this allocation.

After the sales event starts, lets say we measure

the actual sales conversion rate at the end of day 1 in

each region of the SKU as

1

0%,

2

90%

3

20%

We can update the SKU’s sales conversion estimate

as p' =

∑

r

i

*p'i = 68%. We can continuously

update and monitor the SKU’s overall conversion rate

p", p''', … with new regional sales measurements at

the end of day 2, 3, and so on.

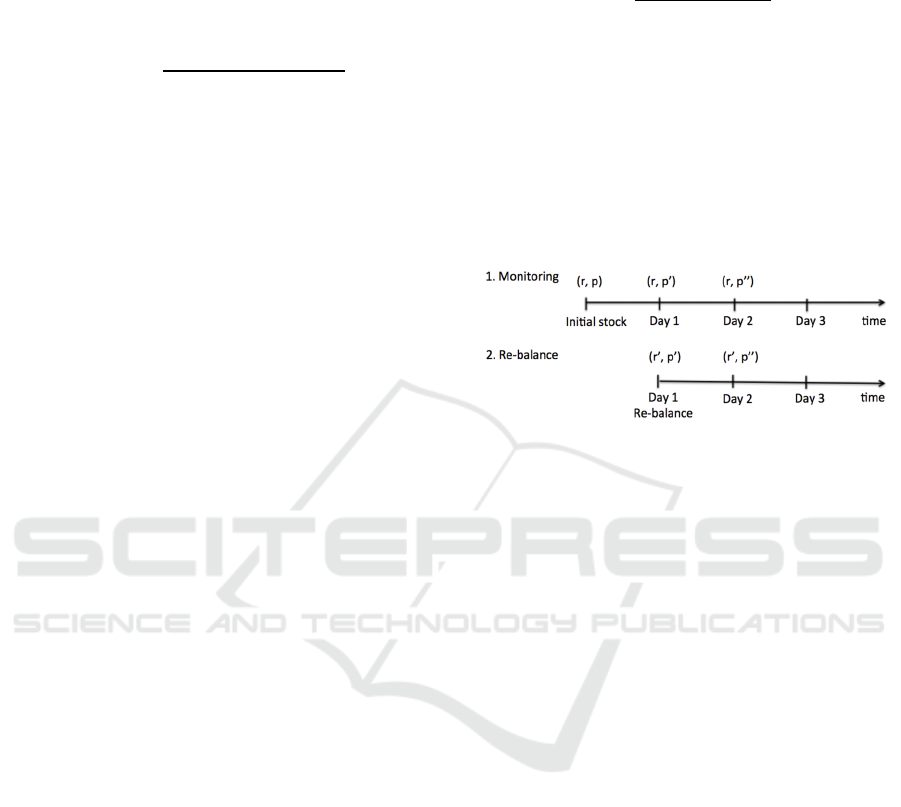

3.3 Inventory Stock Re-balance

For some merchandises, if the inventory can be

replenished or adjusted among warehouses, knowing

the actual p'(i) at the end of day 1, we can update the

warehouse allocation ratio for the SKU in region i

using

∗′

∑

∗′

(3)

where p

'

i

p

i

|

r

i

is the newly observed sales

conversion rate given warehouse allocation according

to r(i). With the above p'(i) measurement values, it

yields a new inventory allocation ratio for the SKU as

r’

1

0,r’

2

93%andr’

3

7%

If we can re-balance the inventory among warehouses

according to the new values, our overall conversion

rate expectation for the SKU will be p" =

∑

r'

i

*p'i

= 85% based on the new sales rate data.

Figure 3: Monitoring and updates over time.

It is noted that the inventory monitoring and replenish

strategy discussed here are not something new.

Similar computations can be found in various

Bayesian applications and in general literature (Pearl,

1994).

3.4 Relationship with the ML Models

The Bayesian Updating strategy can be very useful

for flash sale regional warehouse pre-allocation with

limited inventory if we do not have an accurate

estimate of either sales proportion rate or allocation

ratio for major portion of the merchandises. The

GBDT_SCR model prediction can be used with prior

information to compute the warehouse allocation

ratio in the Bayesian Updating computation.

It is noted that if the sales conversion estimation

is accurate and consistent, meaning p'(i) = p(i),

Bayesian Updating generates the same allocation

result as before.

4 CONCLUSIONS

In flash sale, business usually acquires sufficient

quantity of merchandises that are aimed to sell out in

every sales event. We can design a merchandise

allocation robot for regional warehouses knowing

total available quantity of a SKU before the sales

event starts. The robot comprises of two components,

Bayesian Inventory Planning with Imperfect Demand Estimation in Online Flash Sale

347

a ML model prediction that computes a SKU’s

regional allocation ratio and sales conversion

probability, and a Bayesian Updating allocation

calculator that utilizes ML sales conversion model

prediction with known allocation prior. We showed

that we can forecast, monitor and improve overall

sales conversion rate progressively.

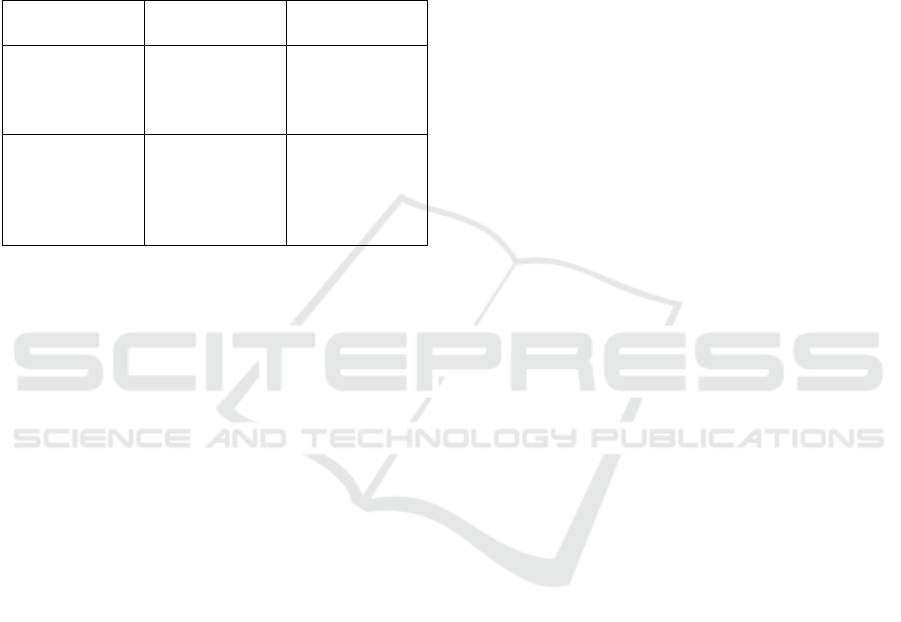

The effectiveness of the two components is

summarized in Table 2.

Table 2: Model Effectiveness.

GBDT Model Bayesian

Updating

SKUs with

repeated or

large quantity

sales

GBDT_ALR

has low

variance, higher

precision

If prediction is

accurate, trivial

operation, no or

less effect

SKUs with

shallow

quantity, short

or no past sales

GBDT_ALR

has high

variance, noisy

and lower

precision

Use

GBDT_SCR

with prior, more

effective

ACKNOWLEDGEMENTS

We thank vip.com for the continuous support.

REFERENCES

O'Sullivan, A. and Sheffrin, S., 2005. Economics:

Principles in Action. Prentice Hall.

DeGroot, M. and Schervish, M., 2002. Probability and

Statistics (third ed.). Addison-Wesley.

Savino, J., 2011. Inventory to Support Flash Sales

Environments, MultiChannel Merchant (available at

http://multichannelmerchant.com/opsandfulfillment/inv

entory-to-support-flash-sales-environments-02022011/).

Ghiani, G., Laporte G., Musmanno R., 2004. Introduction

to Logistics Systems Planning and Control. John Wiley

& Sons.

Stevenson, W. J., 2009. Operations Management (10th

edition). McGraw-Hill Education.

Malakooti, Behnam, 2013. Operations and Production

Systems with Multiple Objectives. John Wiley & Sons.

Edgeworth, F., 1888. The Mathematical Theory of

Banking. J. Royal Statistical Society. 51,113-127.

Arrow, K., Harris, T., Marshak, J., 1951. Optimal Inventory

Policy, Econometrica.

Gallego, G. and I. Moon, 1993. The Distribution Free

Newsboy Problem: Review and Extensions. Journal of

Operational Research Society. 44, 825-834.

Friedman, J., 1999. Greedy Function Approximation: A

Gradient Boosting Machine. (available at http://www-

stat.stanford.edu/~jhf/ftp/trebst.pdf)

Hau L. Lee, V. Padmanabhan, and Seungjin Whang, 1997.

Information distortion in a supply chain: The bullwhip

effect. Mangement Science, 43(4):546–558, Apr. 1997.

Gelman, A., Carlin, J., Stern, H., Rubin, D., 2003. Bayesian

Data Analysis, Chapman and Hall/CRC, 2

nd

edition.

Pearl, J., 1994. A probablistic calculus of actions.

Proceedings of the Tenth Conference on Uncertainty in

Artificial Intelligence, Seattle. Morgan Kaufmann,

454–462.

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

348