An Industry-focused Advertising Model

A. Murray

Department of Applied Mathematics, The University of Western Ontario, 1151 Richmond St. North, London, Canada

Keywords:

Optimal Control, Advertising, Stochastic Optimal Control, Mathematical Modelling.

Abstract:

In this paper a model is created that may be effectively used to determine the optimal spending trajectory for

an advertising campaign. Given a sufficient data set, all parameters present in the model should be easily

determinable, or at least accurately approximated, and justifications are given for the form of all parts of the

model. Finally, the solution to both the deterministic and stochastic versions of the model are given.

1 INTRODUCTION

The problem of predicting whether an ad campaign

will ultimately be successful is an important prob-

lem that is difficult to solve. Several models have al-

ready been proposed such as the Sethi model (Sethi,

1983) and the older Vidale-Wolfe advertising model

(Vidale and Wolfe, 1957). However, all advertising

models thus far have been purely theoretical and have

had limited applicability due to their assumptions and

simplifications. Justifications for each feature of the

new model come from a large data set provided by

a corporation that is actively engaged in numerous

advertising campaigns, however it has not been pre-

sented here due to confidentality issues.

Since (Gould, 1970) it has become standard prac-

tice to assume that the function relating market share

to advertising effort is concave. Indeed, it would

be unreasonable to assume differently as that would

imply that there would not be a diminished effect

from each additional advertisement. However, the

exact nature of the relationship between advertising

effort and market share is often quite difficult to de-

termine due to the inherent variance in this type of

data. Typically there is so much variance that almost

any concave function would model the relationship

quite well. Lewis and Rao (Lewis and Rao, shed)

demonstrate the difficulty in simply proving that a

given advertising campaign yielded a positive return

on investment, let alone the relationship between ad-

vertising spending and the resulting growth in market

share. Thus, a quadratic relationship between market

share and advertising expenditure is assumed since a

quadratic form yields a very simple form for the opti-

mal control. The purpose of the new model is to max-

imize long-term profit, however future profits must be

”discounted” due to the role that re-investment and in-

flation play. This effect is incorporated into the model

by multiplying the profit at time t by e

−δt

, where δ

is the rate at which the profit is discounted over time.

Thus the long-term profit can be described according

to the following function:

P =

∞

∑

0

(mx

t

−u

2

t

)e

−δt

. (1)

Where x

t

is the market share at time t, m is the rev-

enue per unit of market share, and u

t

is the advertising

effort at time t.

As in the Sethi model, x

t

is normalized by the mar-

ket share, however unlike the Sethi model the size

of the market does not remain constant. Instead, it

is assumed that the market size changes according to

the predefined function M

t

. Modelling market growth

and decline is a separate problem and no attempt to

do so is undertaken in this paper. The dynamics of

the market share are modelled as a discrete version of

those found in Equation 5 of (Murray and MacIsaac,

2015). A discrete model is used since firms cannot

feasibly control their advertising expenditure in real

time but only for periods of time with granularity

on the order of months, days, hours, etc. Equation

2 gives the deterministic version of the function de-

scribing the dynamics of the state equation where ρ

is the effectiveness of advertising, and D is the rate at

which market share decays (assumed to be linear for

simplicity).

x

t+1

−x

t

= ρu

t

√

M

t

−x

t

+ r(x

t

)(M

t

−x

t

) −Dx

t

, (2)

where 0 ≤ x

t

≤ M

t

. It is known that the function

describing the decay of the market share is concave

Murray, A.

An Industry-focused Advertising Model.

DOI: 10.5220/0005653300870091

In Proceedings of 5th the International Conference on Operations Research and Enterprise Systems (ICORES 2016), pages 87-91

ISBN: 978-989-758-171-7

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

87

however a quadratic relationship (−

Dx

2

2

) once again

results in the simplest optimal control. The growth

due to ranking, r(x

t

) is defined as follows:

r(x

t

) =

r

k

, if x

t

≥ T

k

,

. . .

r

1

, if T

2

> x

t

≥ T

1

,

0, otherwise

which captures the effect that ranking systems have

on market share growth. Each T

i

is the market share

threshold to enter into the i

th

ranking tier. As the mar-

ket share grows, so too will the ranking and likewise

a higher ranking spurs more growth. For more in-

formation on the dynamics of the ranking system see

(Murray and MacIsaac, 2015). In equation 1 it has

been assumed that the rankings are in a state of equi-

librium and thus have taken it to only be dependent

on the market share. In general, the advertising rate

of each company will affect their rankings and thus

affect the rankings of other firms as well. For more

research on the optimization of advertising revenue in

a system with many competing firms see (Fruchter,

1999), (Horsky, 1988) and (Erickson, 1995).

2 DETERMINISTIC SOLUTION

The current value Hamiltonian from equations 1 and

2 is

H = mx

t

−u

2

t

+λ(ρu

t

√

M

t

−x

t

+r(x

t

)(M

t

−x

t

)−Dx

t

),

(3)

which is almost identical to what is seen in the Sethi

model. Indeed, the optimal control takes a similar

form to that of the Sethi model:

u

∗

(x) =

λρ

√

M −x

2

. (4)

If we attempt to derive λ while taking r to depend

on x then the solution becomes intractable. However,

by Bellman’s Optimality Principle (Bellman, 1957),

each sub-path of an optimal path must be optimal.

Thus, for each interval where r is constant a solution

may be obtained. By solving equation 5, for a par-

ticular value of r, we can determine the current value

adjoint variable λ

t

.

λ

t+1

−λ

t

=

−dH

dx

= −m+λ

D + δ + r +

ρu

∗

2

√

M −x

.

(5)

When equation 4 is substituted into equation 5 we get:

λ

t+1

−λ

t

=

−dH

dx

= −m + λ

D + δ + r +

ρ

2

λ

4

,

(6)

which is a Ricatti Equation. The optimal path will re-

quire λ(0) = lim

t→∞

λ

t

. The optimal long term equi-

librium of λ

t

can be determined by setting λ

t+1

−λ

t

=

0 and solving for λ

t

in equation 6. The solution to

which is

lim

t→∞

λ

t

=

−2(D + r + δ −A))

ρ

2

(7)

where A =

p

2mρ

2

+ (r + D + δ)

2

. Solving equation

6 with the initial condition λ(0) = lim

t→∞

λ

t

yields

λ

t

=

−2(D + r + δ −A)

ρ

2

. (8)

If equation 2 is evaluated with the lambda obtained in

equation 8 then we get

x

t+1

−x

t

=

λρ

2

(M −x

t

)

2

+ r(M −x

t

) −Dx

t

. (9)

The solution of equation 9 with initial condition

x(0) = x

0

is

x

t

= (x

0

−

M(λρ

2

+ 2r)

B

)e

−Bt

2

+

M(λρ

2

+ 2r)

B

. (10)

For a particular value of r where B = 2D + λρ

2

+ 2r.

The full, piece-wise optimal path of x

t

is given by

x

t

=

x

t

|

r=r

k

, if x

−1

(T

k

) ≤t

. . .

x

t

|

r=r

1

, if x

−1

(T

1

) ≤t < x

−1

(T

2

)

x

t

|

r=0

, otherwise

If equation 8 is substituted into equation 4 then the

following optimal feedback control is obtained:

u∗

t

=

−(D + r + δ −A)

√

M −x

t

ρ

. (11)

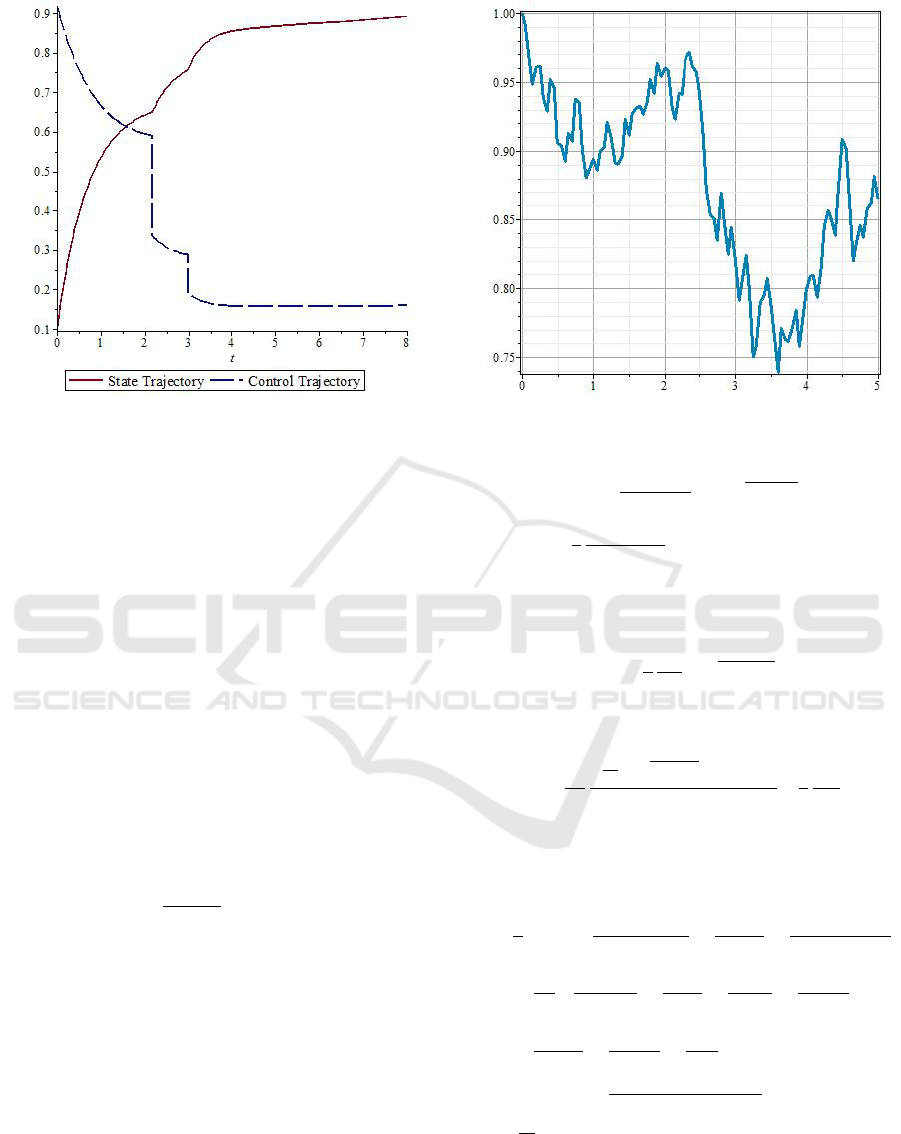

Figure 1 illustrates how the state and control func-

tions change when ranking is introduced. The dra-

matic decreases in the optimal advertising rate are due

to each changes in ranking.

The y-axis for x(t) is market share and the y-axis

for u(t) is measured in arbitrary cost units. The mar-

ket in Figure 1 is being modelled as growing linearly

at a very slow rate, but is still visible in the upward

bend in the optimal state and control functions.

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

88

Figure 1: Comparison of x(t) and u(t) in the deterministic

case.

3 STOCHASTIC SOLUTION

A major departure from previous advertising models

is made by incorportating dynamics into the effective-

ness of advertising. While the effectiveness, ρ is tra-

ditionally treated as a constant it will be assumed that

ρ evolves randomly through time according to a white

noise process w(ρ

t

). Doing so takes into account ef-

fects like competing ads, changing ad ”creatives” and

other phenomenon that may impact how receptive an

audience is to a given ad campaign. It should be

noted that multiple competing firms would be more

accurately modelled by a many-player game theoretic

approach as seen in (Prasad and Sethi, 2004). The

stochastic model that will be used is similar to Equa-

tion 2,

x

t+1

−x

t

= ρ

t

u

t

√

M

t

−x

t

+ r(x

t

)(M

t

−x

t

) −Dx

t

,

(12)

however it includes the following dynamics:

ρ

t+1

−ρ

t

= w(ρ

t

). (13)

Where ρ(0) = ρ

0

and as in Section 1, 0 ≤ x

t

≤ M

t

∀t

and x(0) = x

0

. Again we seek to maximize equation

1 but first we solve for the Value function V (x

t

, ρ

t

).

Note that we need not make restrictions on the parity

of ρ

t

and indeed, a negative value for advertising ef-

fectiveness could be interpreted as a poor public view

of the firm and/or its products. Shown in Figure 2 is a

sample path for how ρ

t

may vary over time.

By (Bensoussan, 1982) the current-value function

for this problem satisfies the following HJB equation:

Figure 2: A sample path for the advertising effectiveness

over time.

δV (x

t

, ρ

t

) = max

u

t

∂V (x

t

, ρ

t

)

∂x

t

(ρ

t

u

t

√

M

t

−x

t

−Dx

t

+ r)+

1

2

∂

2

V (x

t

, ρ

t

)

∂ρ

2

t

w

2

(ρ

t

) + mx

t

−u

2

t

.

(14)

It can be easily verified that the optimal control for

this case is:

u

t

∗ =

1

2

∂V

∂x

t

ρ

t

√

M

t

−x

t

. (15)

Substituting equation 15 into equation 14 yields

δV = mx

t

+

∂V

∂x

t

∂V

∂x

t

ρ

2

t

√

M

t

−x

t

−Dx

t

+ r

4

+

1

2

∂

2

V

∂ρ

2

t

w

2

(ρ

t

).

(16)

The details of the solution to equation 16 are left out

for the sake of brevity, however the result is

V =

1

δ

mx

t

+

G

2

t

(M

t

−x

t

)

4ρ

2

t

−

G

t

Dx

t

ρ

2

t

+

G

t

r(M

t

−x

t

)

ρ

2

t

+

σ

2

2

−2m

2

x

t

H

3

t

−

6mx

t

ρ

2

t

H

t

+

6G

t

x

t

ρ

4

t

+

2m

2

ρ

t

δH

2

t

−

5G

t

m

ρ

3

t

δH

t

−

G

t

m

2

ρ

t

δH

3

t

+

3G

2

t

ρ

5

t

δ

(17)

where G

t

= 2(

p

(δ + D + r)

2

+ mρ

2

t

−δ −D −r) and

H

t

=

G

t

2

+ δ + D + r. Inserting equation 17 into equa-

tion 15 yields the optimal feedback control for the

stochastic problem as shown in equation 18.

An Industry-focused Advertising Model

89

u

t

∗ =

1

2δ

m −

G

2

t

4ρ

2

t

−

G

t

D

ρ

2

t

−

G

t

r

ρ

2

t

+ σ

2

3G

t

ρ

4

t

−

m

2

H

3

t

−

3m

ρ

2

t

H

t

ρ

t

√

M

t

−x

t

(18)

Figure 3 is a sample path for the stochastic optimal

feedback control using the advertising effectiveness

path seen in Figure 2.

Figure 3: A sample path for optimal advertising spending

over time.

4 CONCLUSION

Both the deterministic and stochastic problems have

been solved and although the form of the optimal

control in the stochastic case is quite complex, it is

still straight-forward to implement computationally,

allowing advertisers to automate their spending on as

granular a level as is feasible. Shown below is a com-

parison of the controls for the stochastic versions of

the Sethi model and the model presented in this pa-

per.

Although the discrete nature of the model does not

impact the form of the optimal control, it has been

formulated in this way to be more immediately ap-

plicable to problems in industry. As Figure 4 illus-

trates, the ranking plays a large part in the difference

between the new and old forms of the optimal control.

A more subtle difference comes from the non-

constant size of the market. In Figures 1, 3 and 4

the market was assumed to slightly grow at a constant

rate. This is most noticeable in the tail of the functions

shown in Figure 1, however Figure 5 exaggerates the

growth to demostrate the impact that a non-constant

Figure 4: Sample paths for optimal advertising spending

over time under the Sethi model (upper path) and new

model (lower path).

Figure 5: Sample paths for optimal advertising spending

over time under the Sethi model and new model where the

new model assumes a large linear growth in the market over

time.

market has on the optimal control. In well-established

industries the non-constant market will not likely play

a very big part in determining the advertising budget.

However, if the market is either quickly exanding or

quickly diminishing then this must be taken into ac-

count when determining the advertising strategy and

the models presented in this paper dictate such a strat-

egy.

The models presented in this paper could be ex-

tended to allow for interactions between advertisers,

although the budgets and spending of competing ad-

vertisers is not typically known and thus such an ex-

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

90

tension would serve as a largely theoretical exercise.

However, Chintagunta and Vilcassim (Chintagunta

and Vilcassim, 1992) show that if each player only

has knowledge of the past strategies of their opponent

then the resulting optimal control formulation more

closely aligns with what is empirically observed. Fur-

thermore, the interaction between advertising and the

market could be explored. If the market is defined as

the set of people who would be willing to purchase the

product then for nascent industries the market would

be quite small, but could be expanded through adver-

tising efforts.

REFERENCES

Bellman, R. (1957). Dynamic Programming. Princeton

University Press.

Bensoussan, A. (1982). Stochastic Control by Functional

Analysis Methods. North-Holland Publishing, New

York.

Chintagunta, P. and Vilcassim, N. (1992). An empirical

investigation of advertising strategies in a dynamic

duopoly. Management Science, 38:1230–1244.

Erickson, G. (1995). Advertising strategies in a dynamic

oligopoly. Journal of Marketing Research, 32:23–237.

Fruchter, G. (1999). The many-player advertising game.

Management Science, 45:1609–1611.

Gould, J. (1970). Diffusion processes and optimal advertis-

ing policy.

Horsky, D. (1988). Dynamic advertising strategies of com-

peting durable good producers. Marketing Science,

7:356–367.

Lewis, R. and Rao, J. (accepted, soon to be published). On

the near impossibility of measuring the returns to ad-

vertising. Quarterly Journal of Economics.

Murray, A. and MacIsaac, A. (2015). Extension of the sethi

model to the advertising of digital products. In SIAM

CT15, Control & its Applications.

Prasad, A. and Sethi, S. (2004). Competitive advertising

under uncertainty: A stochastic differential game ap-

proach. Journal of Optimization Theory and Applica-

tions, 123:163–185.

Sethi, S. (1983). Deterministic and stochastic optimization

of a dynamic advertising model. Optimal Control and

Applications, 4:179–184.

Vidale, M. and Wolfe, H. (1957). An operations-research

study of sales response to advertising. Operations Re-

search, 5:370–381.

An Industry-focused Advertising Model

91