Direct Debit Frauds: A Novel Detection Approach

Gaetano Papale

1

, Luigi Sgaglione

1

, Gianfranco Cerullo

1

, Giovanni Mazzeo

1

,

Pasquale Starace

1

and Ferdinando Campanile

2

1

Department of Engineering, University of Naples “Parthenope”, Naples, Italy

2

Sync Lab S.r.l., Naples, Italy

Keywords: Data Fusion, Real-time Correlation, Data Analytics.

Abstract: Single Euro Payments Area (SEPA) is an initiative of the European banking industry aiming at making all

electronic payments across the Euro area as easy as domestic payments currently are. One of the payment

schemes defined by the SEPA mandate is the SEPA Direct Debit (SDD) that allows a creditor (biller) to

collect directly funds from a debtor’s (payer’s) account. It is apparent that the use of this standard scheme

facilitates the access to new markets by enterprises and public administrations and allows for a substantial

cost reduction. However, the other side of the coin is represented by the security issues concerning this type

of electronic payments. A study conducted by Center of Economics and Business Research (CEBR) of

Britain showed that from 2006 to 2010 the Direct Debit frauds have increased of 288%. In this paper a

comprehensive analysis of real SDD data provided by the EU FP7 LeanBigData project is performed. The

results of this data analysis will conduct to define emerging attack patterns that can be execute against SDD

and the related effective detection criteria. All the work aims at inspire the design of a security system

supporting analysts to detect Direct Debit frauds.

1 INTRODUCTION

Payment systems are in rapidly evolution. And so

are payment frauds. Whenever a new payment

method is introduced, the fraudsters try to take

advantage of loopholes and security vulnerabilities

that each novel system brings with it. European

Union has developed the Single Euro Payment Area

(SEPA), where 500 million of citizens, businesses

and the European Public Administrations can make

and receive over 100 billion no-cash payments every

year (EPC, 2002). SEPA Direct Debit (SDD) is a

service that allows consumers to make in euro

payments using a single bank account and a single

set of instructions. A common standard, if on one

hand translates into efficiency gains for businesses

and public administrations, facilitating access to new

markets and reducing costs, on the other hand, the

simplification of the payment process increases the

risks for the users. The SDD service is not free from

cybercrime attacks. A study conducted by Center of

Economics and Business Research (CEBR) of

Britain, on behalf of Liverpool Insurance Company,

showed that from 2006 to 2010 the Direct Debit

frauds have increased of 288%, with an expected

growth of 57% for the next three years (FINEXTRA,

2010). The magnitude of these evidences is related

to the lack of knowledge on the part of financial

institutions with respect to the types of threats that

an attacker can implement. The paper is organized as

follows: Section 2 presents the works found in

literature that approached to the issues in SDD

payments and electronics ones; in Section 3 an in-

depth analysis of the SEPA standard and an accurate

description of the phases to set-up a Direct Debit

transaction is presented. Particular emphasis is given

to the almost absence of security mechanisms that a

financial institution puts in place to protect his users

from unauthorized or fraudulent SDDs. Section 4,

starting from the information reported in the

previous sections, analyzes the vulnerabilities of the

SDD process due to the adoption of Creditor

Mandate Flow Model (CMF). Section 5 proposes a

categorization, in four misuse cases, of attacks that a

fraudster can execute against an unaware SDD’s

user. To this aim, we have analyzed over than 2TB

of real SDD data, provided within the framework of

EU FP7 European LeanBigData project. Section 6

380

Papale, G., Sgaglione, L., Cerullo, G., Mazzeo, G., Starace, P. and Campanile, F.

Direct Debit Frauds: A Novel Detection Approach.

In Proceedings of the 6th International Conference on Cloud Computing and Services Science (CLOSER 2016) - Volume 1, pages 380-387

ISBN: 978-989-758-182-3

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

outlines effective detection criteria to the previously

identified attack patterns and finally, Section 7

shows future research directions.

2 RELATED WORK

Direct Debit frauds are a modern topic in the

scientific community and, at the beginning of our

work, we were aware that no literature concerning

this argument was available. However, several are

the publications relating the detection of threats

against other forms of electronic payment. In

(D’Antonio, 2015) (Coppolino, 2015) authors

describe the advanced cyber threats, specifically

targeted to financial institutions and propose an

approach based on combining multiple and

heterogeneous data to detect frauds against a Mobile

Money Transfer (MMT). The research presented in

(Raj, 2011), denotes that in real life fraudulent

transactions are scattered with genuine transactions

and simple pattern matching techniques are not often

sufficient to detect those frauds accurately. The

work presents a survey of various techniques (Data

mining, Fuzzy logic, Machine learning...) used in

credit card fraud detection. (Patidar, 2011) shows

that the frauds tend to be perpetrated to certain

patterns and the use of Neural Network to detect

fraudulent transactions is presented. The paper

(Duman, 2011) suggests a novel combination of the

two well-known meta-heuristic approaches, namely

the genetic algorithms and the scatter search to

detecting credit card frauds. The method is applied

to real data and very successful results are obtained

compared to current practice. The research presented

in (Allison, 2005) proposes an analysis of the

identity theft and the related crimes.

3 SEPA DIRECT DEBIT

TRANSACTIONS

SEPA is the area where citizens, businesses,

governments and other economic actors can make

and receive euro payments. The jurisdiction of the

SEPA scope currently consists of the 28 EU

Member States (List, 2015), the members of

European Free Trade Association-EFTA (Iceland,

Liechtenstein, Norway and Switzerland), plus

Monaco and San Marino. The goal of the SEPA

project includes the development of financial

instruments, standards, procedures and

infrastructures to enable economies of scale. This

paper is focused on SEPA Direct Debit transactions

(SDDs), one of the services provided by SEPA.

Typical examples of SDD transactions are services

that require recursive payments such as pay per view

TV, gym subscription and energy distribution. The

actors involved in an SDD transaction are:

Creditor

In the SEPA Direct Debit (SDD) schema is the

person or company who has a credit that will be

satisfied by collecting funds from the Debtor’s bank

account through an SDD transaction.

Debtor

In the SEPA Direct Debit (SDD) schema is the

person or company who has a debit that satisfies by

providing funds from his/her bank account to the

Creditor’s bank account by means of an SDD

transaction.

Creditor’s and Debtor’s banks

They represent the respective banks of Creditor and

Debtor.

When a Creditor must draw funds from another

person’s bank account, to set up the process, he/she

has to acquire an SDD mandate from Debtor and

advise his/her bank about it. During each

transaction, the Creditor sends a direct debit request

(with information about the amount of the

transaction) to his/her bank that will start the process

to request the specified amount from Debtor’s bank

account. The Debtor must provide only the signature

of the mandate, but has no prior acknowledgement

about the direct debit being in charge to his/her bank

account. Usually, the Creditor sends a receipt to the

Debtor by using a best effort service, so no

guarantee about delivery time and delivery itself is

provided. In this process, the Debtor will have

knowledge of an unauthorized direct debit only

when the funds have already been withdrawn and

after reception of his/her bank statement. This of

course exposes the Debtor to a large number of

possible frauds. For these reasons, with SEPA, in

case of unauthorized transactions due to errors or

frauds, a Debtor can request refund until 8 weeks

from the SDD deadline or 13 months in case of an

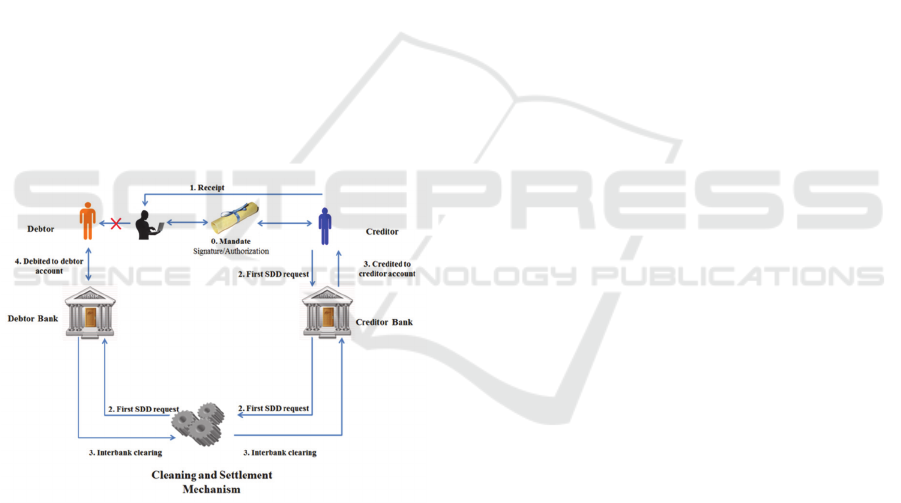

unauthorized SDD. The SDD process (Figure 1 ) is

characterized by the following steps:

Acquisition

1) The mandate is signed by the Debtor and is

notified to the Creditor Bank.

Validation

1) The Creditor Bank sends a validation request for

the received mandate to the Debtor Bank.

2) The Debtor Bank receives the validation request

and returns its validation.

Direct Debit Frauds: A Novel Detection Approach

381

SDD request

1) The Creditor generates a receipt at least 14

working days before its deadline.

2) The Creditor sends an SDD request to its bank (at

least 11 working days before in case of first SDD

request, 9 for subsequent requests).

3) The Creditor Bank sends an SDD request to the

Debtor Bank which checks the correctness of the

request and if no problem occurred, the bank debits

the SDD on Debtor's account.

Interbank Clearing

1) The Debtor Bank communicates the result of

SDD request to the Creditor Bank.

2) In case of positive response, the Creditor Bank

credits the amount of the transaction on Creditor’s

account.

The standard adopted by SEPA to compose SDD

requests is the ISO 20022 (Goswell, 2006), a multi-

part International Standard performed by ISO

Technical Committee TC68 Financial Services. It

defines a modelling methodology to capture in a

syntax-independent way financial business areas,

business transactions, and associated message flows.

Also, it sets a central dictionary of business items

used in financial communications and fixes a set of

XML and ASN.1 design rules to convert the

message models into XML or ASN.1 schemas,

whenever the use of ISO 20022 XML or ASN.1-

based syntax is preferred. In Italy, from the 1st of

February 2014, domestic credit transfers, banking

and postal direct debits (RIDs) were replaced by the

corresponding SEPA instruments. In particular, for

the SDD request, the “CBIBdySDDReq.00.01.00”

standard which is provided by the Interbank

Corporate Banking (CBI) consortium is used.

Figure 1: SEPA Direct Debit process.

In Listing 1 an excerpt of real SDD data is shown.

<Cdtr>

<Nm>Cred_Name Cred_Surname </Nm>

<PstlAdr>

<TwnNm>Cred_Town</TwnNm>

<Ctry>Cred_Country</Ctry>

<AdrLine>Cred_Addr</AdrLine>

</PstlAdr>

<Id>ITXXX100000857072000YYY</Id>

</Cdtr>

<CdtrAcct>

<Id>

<IBAN>IT58Z0000000001000000000884</IBAN>

</Id>

</CdtrAcct>

<Dbtr>

<Nm>Deb_Name Deb_Surname </Nm>

<PstlAdr>

<TwnNm>Deb_Town</TwnNm>

<Ctry>Deb_Country</Ctry>

<AdrLine>Deb_Addr</AdrLine>

</PstlAdr>

<Id>AAABBB88A08B777R</Id>

</Dbtr>

<DbtrAcct>

<Id>

<IBAN>IT48Y0000000001000000000884</IBAN>

</Id>

</DbtrAcct>

<RmtInf>

<Ustrd>Gym Subscription</Ustrd>

</RmtInf>

Listing 1: Excerpt of SDD data in ISO 20022 format.

It contains the information of Creditor and Debtor.

Within the <Cdtr> tag, the “Id” field represents the

Creditor Identifier (CI, 2015) on 23 digits.

In particular, from digit 8 to digit 23 is defined

the VAT number of the company. An analogous

structure is used for the Debtor, but the “Id” field is

on 16 digits and represents the fiscal code of the

user. In the real data that we have analyzed, every

ISO 20022 xml file contains a trace of purpose of

the transaction (i.e. gym or pay-tv subscription)

within the field “Ustrd”.

4 ISSUES IN SEPA

TRANSACTIONS

The SEPA Direct Debit transactions, as any other

form of electronic payment, are not immune from

attacks of fraudsters. At the basis of each SDD fraud

there is the “Identity Theft”, of either the Debtor's

identity or the Creditor’s identity. Identity Theft is a

relatively new phenomenon for which there is no

universally recognized definition, but overall can be

defined as a crime where someone:

“knowingly transfers, possesses, or uses, without

lawful authority, a means of identification of another

DataDiversityConvergence 2016 - Workshop on Towards Convergence of Big Data, SQL, NoSQL, NewSQL, Data streaming/CEP, OLTP

and OLAP

382

person with the intent to commit, or to aid or abet,

or in connection with, any unlawful activity that

constitutes a violation law ..." (Finklea, 2010).

The major weakness of the SEPA Direct Debit

process is at the beginning of the procedure, in

particular during the phase of signing the mandate.

In fact, as shown in Figure 2, a fraudster can

authorize the SDD mandate in place of the Debtor.

This illegal activity, also known as “Mandate

Fraud”, allows benefiting products or services

without paying for it, while the Debtor will

recognize the fraud after the direct debit was

performed. The management of the mandate can

follow two different models:

CMF – Creditor driven Mandate Flow

DMF – Debtor driven Mandate Flow

CMF provides that the mandate is stored with the

Creditor and it is the unique model in four European

countries (Germany, Spain, Netherland and UK).

DMF, unlike the previous, provides that the mandate

stays with the Debtor’s bank and is adopted in

Finland, Greece, Malta, Slovenia, Slovakia,

Hungary, Latvia and Lithuania. In Italy and in the

remaining countries of SEPA area, CMF and DMF

coexist, but the European Policy Centre (EPC) has

Figure 2: Mandate Fraud.

unilaterally decided that the SEPA model would be

based on CMF. The same European Consumer’s

Organization (BEUC), through a letter to the

members of European Parliament (MEPs) dated 25

January 2010, has raised the issue by defining

SEPA’s Creditor Mandate Flow Model (CMF)

“massively open to fraud”. With the CMF model,

the consumer’s bank (i.e. Debtor’s bank) does not

have control over the mandate, so the risk of fraud is

higher (BEUC, 2011). This model prevents the

Debtor’s Bank from intervening once a payment has

left an account, with the consequence that the

Creditor is in full control of the transaction.

Furthermore, the reduced amount of information

required to activate a transaction, allows even to the

less savvy criminals to perpetrate a fraud. The

precondition of an SDD fraud is an identity theft.

There are different techniques to steal personal

information of the victim, as reported in (Pardede,

2013), several that don’t need high technical

expertise (i.e. Dumpster Diving) and other more

sophisticated (i.e. Spoofing and Phishing).

5 FOUR MISUSE CASES

In this section will be described four misuse cases in

the SDD transactions. The classification was

conducted in order to develop, in future, a support

system to recognize SDD frauds with a high

detection rate and a low occurrence of false-

positives. To categorize the frauds, we have

examined a huge amount of real data. This data have

been obtained within the LeanBigData project

(Project, 2014). LeanBigData is an European project

that has as goal the building of an ultra-scalable and

ultra-efficient integrated big data platform

addressing important open issues in financial, cloud

data and social media big data analytics. Over than 2

TB of data transactions properly anonymized have

been analyzed and, from the observation of different

attack patterns, we have extracted four misuse cases.

The misuse cases will be schematized with

indications about the actors involved in the fraud,

the preconditions to execute it, a description of the

misuse case and the fraudster’s goal. To allow a

better understanding of the misuse cases, it is

appropriate to divide the services that can be

connected to an SDD transaction into two

categories:

Location-unbound

Location-bound

The “location-unbound” category identifies services

that can be provided at any location and therefore do

not require the physical presence of the Debtor (e.g.

pay-per-view, smartphone fee) while, the term

“location-bound” indicates all services necessarily

provided at a specific place and requiring the

physical presence of the user at a specific place, for

example a gym subscription.

Misuse Case 1: Location-unbound Service Fraud

Actors: Debtor, Creditor and Fraudster.

Objective: The goal of the Fraudster is to

perpetrate an identity fraud against the Debtor to

Direct Debit Frauds: A Novel Detection Approach

383

benefit of a “location-unbound” service, without

paying for it.

Preconditions:

1)The Fraudster steals Debtor’s identity.

2)The Fraudster signs a mandate for a location-

unbound" service instead of the legitimate user.

Description:

1)The Fraudster, impersonating a Debtor, requests a

direct debit on the Debtor’s account for a “location-

unbound” service.

2)The Fraudster, to activate the SDD process, signs

the mandate with the stolen identity of the Debtor.

3)The Debtor’s bank, once verified the correctness

of the data into SDDs, transfer the cost of the service

from Debtor’s account.

Misuse Case 2: Location-bound Service Fraud

Actors: Debtor, Creditor and Fraudster.

Objective: The goal of the Fraudster is to

perpetrate an identity fraud against the Debtor to

benefit of a “location-bound” service, without

paying for it.

Preconditions:

1)The Fraudster steals Debtor’s identity.

2)The Fraudster signs a mandate for a “location-

bound" service instead of the legitimate user.

Description:

1)The Fraudster steals the identity of a Debtor and,

by using such identity, requests a payment for a

“location-bound” service to the unaware Debtor.

2)The Fraudster, to activate the SDD transaction,

signs the mandate with the stolen identity of the

Debtor.

3)The “location-bound” service provided by real

Creditor has a location of use very far from usually

places visited/lived by the Debtor.

4)The Debtor’s bank, that has the duty of checking

only the correctness of format and data into the SDD

request, validates the transaction.

Misuse Case 3: Fake Company Fraud

Actors: Debtor and Fraudster.

Objective: The goal of the Fraudster is to

perpetrate an identity fraud against the Debtor,

without provide to him/her any “location-bound” or

“location-unbound” service.

Preconditions:

1) Fraudster and Creditor is the same actor.

2) The Fraudster steals Debtor’s identity.

3) The Fraudster signs a mandate for a service

instead of legitimate user.

Description:

1) A fake company, registered as biller for SDDs,

requires a direct debit for a service to an unaware

Debtor.

2)The Fraudster, to activate the SDD transaction,

signs the mandate with the stolen identity of the

Debtor.

3) The Debtor’s bank, that is not able to verify the

reliability of Creditor, accepts the SDDs.

Misuse Case 4: Cloning Company Fraud

Actors: Debtor and Fraudster.

Objective: The goal of the Fraudster is to

activate a direct debit on the Debtor’s account for a

“location-unbound” service regularly subscribed by

Debtor, but that will not provide.

Preconditions:

1) Fraudster and Creditor is the same actor.

2)The Fraudster contacts the Debtor and obtains

“legally” his/her identity.

3)The Debtor authorizes the mandate for the service.

Description:

1)The Fraudster, using a company name slightly

different from another well-known by the Debtor,

contacts the Debtor and proposes to him/her the

subscription for an “unbound” service.

2)The Debtor is interested to the service, subscribes

it and provides its personal and banking details.

3)The Debtor’s bank, given that the cloning

company is registered as a biller and the mandate is

properly signed, activates the fund transfer.

4)The Debtor will be aware of the fraud only when

after several days the service still has been not

provided (within the account statement there is not

anything of irregular).

6 A MULTI SENSORS

APPROACH TO RECOGNIZE

FRAUDOLENT

TRANSACTIONS

In the last years, despite the recommendations by the

part of European Banking Committee (EBC) to

improve the security of SDD payment process, the

financial institutes have not yet put in place valuable

solutions to recognize fraudulent transactions. The

banking fraud detection systems currently have low

performance because they separately control only

the format correctness of the direct debit requests

and the data therein specified. The multi sensors

approach proposed in this work, is driven by the

Joint Directors Laboratories (JDL) Data Fusion

model (Blash, 2013) and involving its Source

Preprocessing, Object Refinement and Situation

Refinement levels. In order to discern a malicious

operation from a legitimate one, is necessary

DataDiversityConvergence 2016 - Workshop on Towards Convergence of Big Data, SQL, NoSQL, NewSQL, Data streaming/CEP, OLTP

and OLAP

384

categorizing each incoming SDD for topic and

collect, within of a profile, more information as

possible on Debtor and Creditor. Finally, through

several detection criteria targeted on the misuse

cases previously analyzed, both SDDs and users data

will be focused to extract the evidence of an SSD

fraud. The Data Fusion process will be operated by

using a generalization of the Bayesian theory, such

as the Dempster-Shafer theory of Evidence

(Dempster, 1968). Figure 3 shows the high level

architecture that aims at develop a multi sensor

decision supports system which by the data gathered

by multiple data sources (i.e. Social Networks data,

SDD raw data, third party services...), will provide a

measure of likelihood of an ongoing Direct Debit

fraud.

Figure 3: Decision Supports System Global Architecture.

The above architecture consists of the main

following blocks:

SDD Topic categorization

It is the module responsible of the classification of

each incoming SDD to a topic of interest. It operates

on raw SDD data and performs a data filtering step

to extract the Creditor information. This data will be

used as input for third party services (i.e. Registro

delle Imprese and Agenzia delle Entrate websites) to

retrieve the working sector, such as the topic, of the

Creditor.

Profile

It is a centralized database that stores in real-time the

profile of each Debtor and in the specific his/her

personal data, banking account information,

addresses and interests. For the definition of the

Debtor’s interests, once obtained the user’s

authorization, tools that perform machine learning,

text analysis and natural language processing have

been used. These receive a text in input - e.g.

Facebook posts, tweets, hashtags - and execute an

automatic classification in categories. Also, the

profile contains a table with the information related

to the Creditors (i.e. venues and working sector)

which the Debtor has made business.

Detection Criteria

The Detection Criteria allow to evaluate the

deviation between the context of the SDD operation

and the ideal profile of the Debtor. From a careful

analysis of the attack patterns described at previous

section and, observing the typologies of services

involved, the preconditions and the modus operandi

of cyber criminals, the following criteria have been

defined:

1) Geographic Incoherence

The “Geographic Incoherence” criterion is

applicable to the SDDs that involving the fruition of

“location-bound” services. This criterion measures

the coherence between the known Debtor’s

addresses (i.e. residence address, job address and

other addresses communicated from Debtor to the

bank) and the location of use of the service. One

parameter to take into account for evaluating a

location of service as plausible is the distance in

kilometre from the Debtor’s addresses. The criterion

integrates the Google Maps Geocoding API

(Google, 2016) to converting addresses in

geographic coordinates and calculating the distance

between two geographic points.

2) Interests Incoherence

The “Interests Incoherence” criterion can be used to

recognize suspicious SDDs both for “location-

bound” and “location-unbound” services. It aims at

measuring the match between the topic of the

transaction and the Debtor’s interests. The criterion,

through the exploitation of Dempster-Shafer theory

and using Sentiment analysis techniques, evaluates

the evidence that Debtor’s interest is close to topic

of service.

3) Creditor Reliability

The “Creditor Reliability” criterion, by the use of

third party services (i.e. Registro delle Imprese and

Agenzia delle Entrate websites), allows to identify if

a company is real or not. Of course, for a company

does not inscribed to the "Registro delle Imprese",

the criterion will raise an alert.

4) Frequency Incoherence

A direct debit is a service typically used to perform

recursive payments. That means observing of an

account should highlight periodicity of payments of

the same nature. The presence of spurious payments

or a suspect increasing of the number of

transactions, could be index of malicious operations.

Each one of the described criteria produces as

outcome an indicator that summarizes the evidence

Direct Debit Frauds: A Novel Detection Approach

385

of an ongoing fraud as defined by the Basic

Probability Assignment (BPA) of Dempster-Shafer

theory. All the BPAs will be in turn focused using

the Dempster’s rule of combination. In this way,

more criteria can be combined for the same

transaction to increase the fraud detection rate and

reduce the false alarms. For instance, in an

attempting of "Location-bound Service Fraud" the

isolated use of the “Geographic Incoherence”

criterion could conduct to evaluate a transaction as

genuine. Adding also the “Interests Incoherence"

criterion, and evaluated that the Debtor is totally

unclosed to the transaction's topic, a warning will be

raised.

Table 1: Application of Detection Criteria.

Misuse

Cases

vs

Detection

Criteria

Geo.

Incoh.

Interests

Incoh.

Freq.

Incoh.

Credit.

Reliab.

Misuse

Case 1

Misuse

Case 2

Misuse

Case 3

Misuse

Case 4

Table 1 shows how the proposed Detection Criteria

can be used to recognize the misuse cases described

at Sec.5.

7 CONCLUSIONS

In this paper we discussed of the new SEPA Direct

Debit standard adopted by the European Union to

transfer funds within its economic area. From an in

depth study of the Direct Debit process, many safety

risks for user’s money emerged. In this context, only

a strong understanding of the fraud strategies can

indicate the best countermeasures. Our work,

starting from real SDDs data, presented an analysis

of emerging attack patterns against Direct Debit

transactions, it has categorized them in misuse cases

and defined four Detection Criteria. The

classification is been conducted in order to ensure a

high detection rate and a low occurrence of false-

positives. Our goal is to develop a tool that

recognizes possible ongoing attacks through real

time analysis (Ficco, 2011) (Romano, 2010) and the

continuous monitoring of the SDDs data flow

(Cicotti, 2015) (Cicotti, 2012). Such a tool will

provide a support service, by means of the Software

as a Service (SaaS) paradigm (Ficco M, 2012)

(Ficco, 2012), to the fraud analyst. The tool will be

also provided with a powerful Human Machine

Interface (HMI) specifically designed to support Big

Data analytics for fraud detection (Coppolino,

2015).

ACKNOWLEDGEMENTS

The research leading to these results has received

funding from European Commission within the

context of Seventh Framework Programme

(FP7/2007-2013) for research, technological

development and demonstration under Grant

Agreement No. 619606 (Ultra-Scalable and Ultra-

Efficient Integrated and Visual Big Data Analytics,

LeanBigData Project). It has been also partially

supported by the “Embedded Systems in critical

domains” POR Project (CUP B25B09000100007)

funded by the Campania region in the context of the

POR Campania FSE 2007-2013, Asse IV and Asse

V and by the TENACE PRIN Project (n.

20103P34XC) funded by the Italian Ministry of

Education, University and Research.

REFERENCES

Allison, S. e. a., 2005. Exploring the crime of identity

theft: Prevalence, clearance rates, and victim/offender

characteristics. Journal of Criminal Justice, pp. 19-29.

BEUC, 2011. Establishing technical requirements for

credit transfers and direct debits in euro. (Online)

Available at: http://www.beuc.eu/publications/ 2011-

00202-01-e.pdf [Accessed 24 October 2015].

Blash, E. e. a., 2013. Revisting theJDL model for

information exploitation. In: Information Fusion, 16th

International Conference on., IEEE.

CI, 2015. Creditor Identifier Overview. (Online)

Available at: http://www.europeanpaymentscouncil

.eu/index.cfm/ [Accessed 23 October 2015].

Cicotti, G. C. L. a. a., 2012. QoS monitoring in a cloud

services environment: the SRT-15 approach. In: Euro-

Par 2011: Parallel Processing Workshops. Springer

Berlin Heidelberg, pp. 15-24.

Cicotti, G. e. a., 2015. How to monitor QoS in cloud

infrastructures: the QoSMONaaS approach.,

International Journal of Computational Science and

Engineering, 11(1), pp. 29-45.

Coppolino, L. e. a., 2015. Use of the Dempster-Shafer

Theory for Fraud Detection: The Mobile Money

Transfer Case Study. Intelligent Distributed

Computing VIII. Springer, p. 465–474..

DataDiversityConvergence 2016 - Workshop on Towards Convergence of Big Data, SQL, NoSQL, NewSQL, Data streaming/CEP, OLTP

and OLAP

386

Coppolino, L. e. a., 2015. Effective Visualization of a Big

Data Banking Application. In: Intelligent Interactive

Multimedia Systems and Services, Springer, pp. 57-68.

D’Antonio, e. a., 2015. Use of the Dempster–Shafer

theory to detect account takeovers in mobile money

transfer services. Journal of Ambient Intelligence and

Humanized Computing, DOI:10.1007/s12 652–015–

0276–9., p. 1–10.

Dempster, A., 1968. A generalization of bayesian

inference. Journal of the Royal Statistical Society,

Volume Series B (Methodological), pp. 205-247.

Duman, E. a. O. M. H., 2011. Detecting credit card fraud

by genetic algorithm and scatter search. Expert

Systems with Applications, 38(10).

EPC, 2002. Euroland: Our Single Euro Payment Area!.

(Online) Available at: http://www.europeanpayments

council.eu/index.cfm/knowledge-bank/epc-documents/

euroland-our-single-payment-area/sepa-whitepaper-05

20021pdf/ (Accessed 15 January 2016).

Ficco, M. e. a., 2011. An event correlation approach for

fault diagnosis in SCADA infrastruc-tures. In:

Proceedings of the 13th European Workshop on

Dependable Computing. s.l.:ACM, pp. 15-20.

Ficco, M. and Rak, M., 2012. Intrusion tolerance as a

service: a SLA-based solution. Porto, Portugal, 2nd

Int. Conf. on Cloud Computing and Services Science

(CLOSER 2012).

Ficco, M. and Rak. M., 2012. Intrusion tolerance in cloud

applications: the mosaic approach. Palermo, Italy, 6th

Int. Conf. on Complex, Intelligent, and Software

Intensive Systems (CISIS 2012).

FINEXTRA, 2010. Direct debit fraud at an all-time high;

Bacs challenges figures. (Online) Available at:

http://www.finextra.com/news/fullstory. aspx?news

itemid=22028 [Accessed 11 January 2016].

Finklea, M., 2010. Identity theft: Trends and issues.

DIANE Publishing.

Google inc., Google Maps Geocoding API. (Online)

Available at: https://developers.google.com/maps/

documentation/geocoding/intro [Accessed 18 January

2016].

Goswell, S., 2006. Iso 20022: The implications for

payments processing and requirements for its

successful use. Journal of Payments Strategy &

Systems, 1(1), pp. 42-50.

List, 2015. Epc List of SEPA Scheme Countries. [Online]

Available at: http://www.europeanpaymentscouncil

.eu/index.cfm/knowledge-bank/epc-documents/epc-list

-of-sepa-scheme-countries/epc409-09-epc-list-of-sepa-

scheme-countries-v21-june-2015pdf/ [Accessed 22

October 2015].

Pardede, M. e. a., 2013. E-fraud, Taxonomy on Methods

of Attacks, Prevention, Detection, Investigation,

Prosecution and Restitution.

Patidar, R. e. a., 2011. Credit Card Fraud Detection Using

Neural Network. International Journal of Soft

Computing and Engineering (IJSCE) ISSN, p. 2231–

2307.

Project, 2014. Ultra-Scalable and Ultra-Efficient

Integrated and Visual Big Data Analytics. (Online)

Available at: http://leanbigdata.eu/ [Accessed 12

January 2016].

Raj, S e. a., 2011. Analysis on credit card fraud detection

methods. Computer, Communication and Electrical

Technology (ICCCET), 2011 International Conference

on., pp. 152-156.

Romano, L. e. a., 2010. An intrusion detection system for

critical information infrastructures using wireless

sensor network technologies. In: Critical

Infrastructure (CRIS), 2010 5th International

Conference on., IEEE, pp. 1-8.

Direct Debit Frauds: A Novel Detection Approach

387