An Artificial Stock Market with Interactions Network and Mimetic

Agents

Sadek Benhammada

1

, Frédéric Amblard

2

and Salim Chikhi

1

1

MISC Laboratory, University of Constantine 2, Constantine, Algeria

2

UMR 5505 CNRS-IRIT, Université Toulouse 1 Capitole, Toulouse, France

Keywords: Agent-based Models, Computational Economics, Artificial Stock Markets, Social Networks, Mimetism.

Abstract: Agent-based artificial stock markets attracted much attention over the last years, and many models have

been proposed. However, among them, few models take into account the social interactions and mimicking

behaviour of traders, while the economic literature describes investors on financial markets as influenced by

decisions of their peers and explains that this mimicking behaviour has a decisive impact on price dynamics

and market stability. In this paper we propose a continuous double auction model of financial market,

populated by heterogeneous traders who interact through a social network of influence. Traders use different

investment strategies, namely: fundamentalists who make a decisions based on the fundamental value of

assets; hybrids who are initially fundamentalists, but switch to a speculative strategy when they detect an

uptrend in prices; noise traders who don’t have sufficient information to take rational decisions, and finally

mimetic traders who imitate the decisions of their mentors on the interactions network. An experimental

design is performed to show the feasibility and utility of the proposed model.

1 INTRODUCTION

In financial market, traders can be influenced by

decisions of their peers. This phenomenon is called

herd (or mimetic) behaviour, and attracted much

attention for several decades. The reason for this

interest is that mimicking behaviour has a decisive

impact on price dynamics, and it might offer an

explanation of excessive volatility and creation of

bubbles (e.g. (Manahov, 2013) and (Chang, 2014)).

In the literature we distinguish three main

reasons for mimicking behaviour to occur in

financial markets, i.e., when a decision of an

investor can be influenced by observing the actions

of other investors: (1) incomplete information, (2)

concern for reputation and (3) compensation

structures (Bikhchandani, 2000).

The information based models, such as in

(Banerjee, 1992) and (Scharfstein, 1990 assume that

individuals have private (but imperfect) information

about the course of action, they can also observe

each other’s actions but not the private information

or signals that each player receives. Investors may

consider optimal to follow the behaviour of the

preceding individual disregarding his own

information. Other models such as in (Chang, 2014),

are based on herding caused by compensation. In

fact, performance evaluation of a fund manager that

invests for his employers is often based on relative

(not absolute) performance, i.e., his compensation

increases with his own performance, and decreases

if he produces a performance below than other fund

managers. This leads him to conform his investment

decisions to those of other professionals, more than

he would if he was acting on his own account. Also,

reputational concerns of fund managers can also

provide a motivation to be mimetic. Indeed, when

managers take the same decisions, even if the result

of the investment is poor, observers may conclude

that there is a high probability that managers are of

good quality and that the bad result is accidental.

Thus, many proposed models are based on

reputation concerns (Scharfstein, 1990).

However, it is difficult to test those theoretical

models directly (Manahov, 2013), because it is

difficult to access at a time t to private information

of traders, their investment strategies and

interactions among them. Therefore, it is difficult to

determine whether traders make similar decisions as

they neglect their own information and imitate

others, or because they have access to the same

information they use to make their decisions.

390

Benhammada S., Amblard F. and Chikhi S.

An Artificial Stock Market with Interactions Network and Mimetic Agents.

DOI: 10.5220/0006118803900397

In Proceedings of the 9th International Conference on Agents and Artificial Intelligence (ICAART 2017), pages 390-397

ISBN: 978-989-758-220-2

Copyright

c

2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

To overcome this problem, we can use artificial

stock markets (ASM) which are computer models of

real stock markets; they are based on modelling

market actors by agents, and supposed have the

essential properties of real financial markets with the

aim of reproducing analyse or understand the

dynamics of stock markets, and this by computing

experiences (Derveeuw, 2007). In literature, there is

a little work that uses ASMs to study the

phenomenon of mimicking behaviour on financial

markets. In (Manahov, 2013), we propose the study

of herd behaviour through the use of an artificial

financial market, where the market is populated by

agents who are with learning behaviour represented

by the genetic programming algorithm. Therefore, as

in real markets, authors use statistical measures of

price series generated by the experiments to quantify

mimicking behaviour on the market. This limits the

ability of the model to study the phenomenon.

In this paper we propose a continuous double

auction ASM with heterogeneous traders. The

proposed ASM is populated by heterogeneous

traders which are bound by interaction network.

Traders use different investment strategies, among

them, the mimetic traders which are able to imitate

the decisions of their successors in the interactions

network. To test the model we perform a series of

experiments, and we analyse their results.

This paper is organized as follows. Section 2

presents a description of the proposed model, in

section 3 we perform a series of experiments and we

discuss the results. Finally, Section 4 concludes and

outlines open research directions.

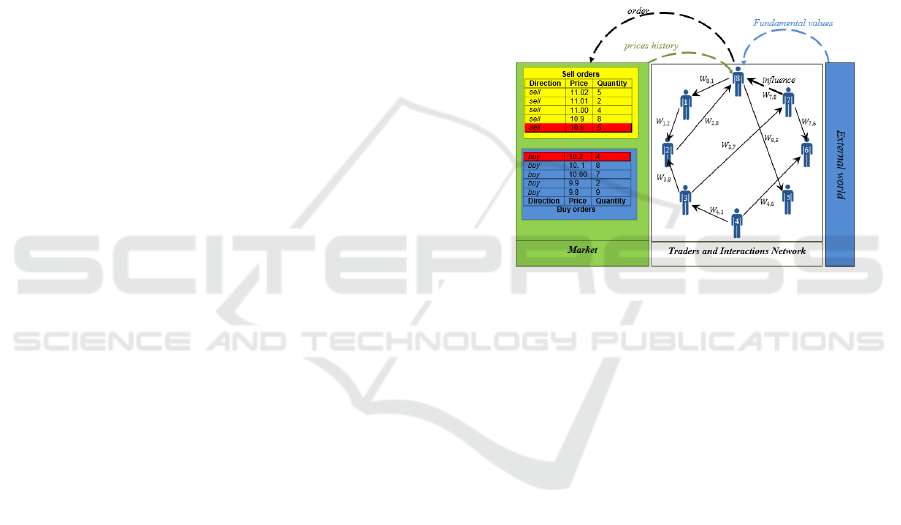

2 STRUCTURE OF THE ASM

In this section we introduce a continuous double

auction model with heterogeneous traders. The

proposed ASM has four main components (see

Figure 1): (i) Market which allows buyers and

sellers to exchange assets; (ii) Traders who exchange

assets in the market; (iii) External-world that is the

source of information used by traders to estimate the

fundamental value of assets; and (iv) social network

that allows traders to interact and learn about the

decisions of their predecessors.

2.1 The Market

The role of Market is to receive and process orders

placed by traders. An order submitted by one trader

is described by a direction (buy or sell), a quantity of

assets to buy or sell, and a quoted price. The quoted

price of a buy (sell) order is the maximum

(minimum) limit price above (under) which the

order should not be executed. Unexecuted orders are

placed in the order book. The order book is

described by two lists, the list of buy orders, and the

list of sell orders. The list of buy orders is arranged

in decreasing order of prices, while the list of sell

orders is arranged in increasing order. If a submitted

order finds a matching order of the opposite side in

the book, a trade is generated. When a trade is

generated, the Market deletes satisfied orders from

the order book, an orders can be satisfied completely

or partially (depending on quantity), if order is

satisfied partially, the unsatisfied order part is

replaced in the book.

Figure 1: The structure of an artificial stock market.

2.2 External World

The fundamental value of the asset is the expected

discounted sum of its future dividends. It represents

the true value of asset. To estimate it, analysts use

information of external world, such as balance sheet

of company and overall state of the economy.

The role of External world is to generate the

signal representing the fundamental value of asset

that will be received by traders with an error margin.

We will use two jump processes to simulate

fundamental values. To generate fundamental value

without trend, we use the following process:

( + 1)= () +

(1)

Where

∽(0,) is a white noise from a

normal distribution with mean 0 and variance

= 1.

To have an uptrend of prices over a period, and

stimulate speculative behaviour of hybrid agents

(see section 3.4), we will generate a fundamental

value with increasing trend during the first

transactions, and without trend (equation 1) during

the rest of simulation. To generate a fundamental

An Artificial Stock Market with Interactions Network and Mimetic Agents

391

value with increasing trend we use the following

process:

(

+ 1

)

=

(

)

++

(2)

>0 is a positive constant.

2.3 Interactions Network

To study the mimicking behaviour, we need to

model the social network of interactions of traders in

the market, through which, they can access to

actions of each other, and eventually imitate them.

Thus, the interactions network is represented by

a directed graph, where the nodes represent the

traders, while edges represent the interactions among

them. The interactions are assumed unidirectional

(i.e., agent j-th influences agent i-th, but the reverse

isn't necessarily correct). Interactions are

characterized by a weight

,

, assumed a positive

real number, and it represents the degree of

confidence of trader i, in the decisions of trader j.

To produce a realistic social network, we use the

“small-world” model of Watts-and-Strogatz (Watts,

1998). Creating a Watts-Strogatz network is carried

out at two steps:

(1) Create a ring network with N nodes; each

node is connected to the same number k of nearest

neighbours in the two sides.

(2) Remove each edge with uniform probability

p and rewire it to one of nodes that are chosen

uniformly at random.

2.4 Traders

The market is populated by traders who exchange

(buy and sell) assets. According to the used strategy

to make decision, we use different types of traders:

2.4.1 Noise Traders

Noise traders represent traders who don’t have

sufficient access to information and/ or don’t have

sufficient competence to use information in decision

making. So, he makes a decision to submit a buy

order, a sell order or wait with corresponding

probabilities

,

and

.

2.4.2 Fundamentalist Traders

Fundamentalists estimate the fundamental value of

the asset with a small error margin, and use it to

make decisions. Thus, to make a decision, a

fundamental trader i estimates a fundamental value

() and compares it with current price in

Market(). If

(

)

<

(), trader i considers

that assets are undervalued, and so decides to submit

a buy order. If

(

)

>

(), he consider that asset

is overestimated and he place a sell order.

2.4.3 Hybrid Traders

Hybrid traders are initially fundamentalists, but can

switch to the speculative behaviour when they detect

a sufficient uptrend in prices history and sufficient

liquidity.

A hybrid trader i stand initially in fundamental

strategy. It has a desire D

(t) to become speculative,

initialized by InitD

. It continuously observes prices

trend using moving average (equation 3) (Martinez,

2009) and market liquidity with Effective Spread

(ES

(

t

)

) (Bessembinder, 2009) (equation 4).

(

,

)

=

(

)

∑

()

∑

()

(3)

t is the current time and L is a period length.

(

)

=

(

)

(

)

(

)

(4)

(

)

is the last price of asset at time t,

(

)

is

the estimated fundamental value by trader i at time t.

Once it observes a sufficient uptrend

(

(

,

)

>ℎ

) associated with sufficient

liquidity (

(

)

<ℎ

), it can switch to technical

behaviour with a probability proportional to its

desire

(). If it persists in fundamentalist

behavior, it increases his desire of speculation

( + 1) as follows:

(

+1

)

=

(

)

+

(5)

When trader i adopts technical (speculative)

strategy, he continuously observes prices trend and

market liquidity. If price tends to decline

(

(

,

)

<−ℎ

) or market liquidity is

insufficient (

(

)

≥ℎ

), it return to the

fundamental strategy.

2.4.4 Mimetic Traders

Mimetic traders represent traders who consider that

their own information is incomplete to making

decision, and take their decision by imitating others.

A mimetic trader i can access to actions of its

successors in the interaction network (see section

3.3), thus, to make a decision, mimetic trader i

imitates the last decision of one of its successor’s j.

Imitated successor j is chosen using roulette-wheel

selection, i.e., proportionally to the weights of

interactions

,

which represents the degree of

confidence of trader i in decisions of his successor j

ICAART 2017 - 9th International Conference on Agents and Artificial Intelligence

392

(see Figure 2.). Mimetic trader has a learning

mechanism for updating weights of its interactions

(see Figure 3); the aim is to foster imitation of

predecessors who are able to make correct decisions

based on the analysis of the price trend. Thus, each

mimetic trader keeps the list

of

imitated decisions, to be able to evaluate them later,

and thus updates the weights of its interactions with

the imitated successors according to this evaluation.

Figure 2: Make a decision algorithm of mimetic trader.

An imitated decision can be described as a triplet

=(

,

,

) , while:

is the type of

imitated decision (buy or sell),

the time when

decision is imitated, and

the imitated

successor. To update the weights of interactions with

imitated successors at time t, a mimetic trader i filter

a list of evaluable decisions

(). An

imitated decision is considered evaluable if the time

since its imitation is greater than or equal to a

duration Δ

:

(

)

=

∈

(

)|

−

≥Δ

}

Mimetic trader i retains for each interaction with

trader j a value

,

that we call absolute weight;

,

is used to calculate the interaction weight

W

,

with a sigmoid function as follows:

,

=

∗

,

(6)

a, r are positive real.

Sigmoid function aims to obtain a weight with a

quite slow slope in the beginning, followed by

acceleration, and finally slows down and approaches

(

).

Figure 3: Algorithm for updating interactions weights.

3 EXPERIMENTS & DISCUSSION

We designed a model to study mimicking behaviour

in stock markets. As mentioned in the introduction,

herd behaviour has an important effect on asset

prices in stock markets; it is considered as the first

explanation of the phenomenon of speculative

bubble formation ((Orléan, 1989) and (Chang,

2014)). However, does the model give realistic

prices dynamics? Also, are the mimetic traders

designed able to cause mimetic contagion, and

reproduce a realistic speculative bubble such as

indicated in theoretical assumptions?

3.1 Metrics and Tools

To test the model, we will perform experiments and

analyse the output price series, and the evolution of

the state of traders and interactions network. In order

to verify whether prices dynamics of our model are

realists, we analyse statistic properties (mean,

median, minimum, maximum, kurtosis and

skewness) and we compare it with them of real price

series. To see the formation of realistic bubbles, we

observe measures introduced in experimental

economics literature to analyse bubbles magnitude,

which are the following:

(1) Relative Deviation (RD), is the average deviation

of prices from fundamental value relative to the

average fundamental value (Stöckl, 2010).

=

∑

(

)

()

(7)

Algorithm Make a decision

Parameters:

: The last decision tacked by trader i.

: The last decision tacked by trader j.

,

: Weight of interaction between mimic trader i

and imitated successor.

: Strategy of trader i.

: Strategy of trader j.

Output:

Decision (buy, sell)

Select one successor j of trader i using roulette-wheel,

proportionate to the weights of interactions

,

.

=

=

if (

=)

return buy order

else (

=)

return sell order

end i

f

Algorithm Update Interactions Weights

Parameters:

(

)

: List of evaluable decisions

,

: Weight of interaction with imitated

,

: Absolut weight of interaction between

mimic trader and imitated successor

: Rate used to update

,

.

: Threshold used to determine if price has significantly

increased or decreased.

←(

(

)

−

(

−

)

)/

(

−

)

for each ∈

(

)

:

if (

=)

if ( > ):

,

←

,

+

|

|

;

else :

,

←

,

−

|

|

;

else /* (

=)*/

if ( < −):

,

←

,

+

|

|

;

else:

,

←

,

−

|

|

;

,

=

1+

∗

,

delete decision from

(

)

end for

An Artificial Stock Market with Interactions Network and Mimetic Agents

393

(2) Boom Duration, which equals the greatest

number of consecutive periods when prices

increase relatively to fundamental value

(Füllbrunn, 2012).

(3) Bust Duration which is the greatest number of

consecutive periods when prices decrease

relatively to fundamental value (Füllbrunn,

2012).

(4) Positive Deviation (PD), a deviation of the price

from the fundamental value if prices are above

(below) fundamental value (Füllbrunn, 2012).

=

∑|

(

)

−()

|

()()

(8)

(5) Negative Deviation (ND), defined as deviation of

the price from the fundamental value if prices are

below fundamental value (Füllbrunn, 2012).

=

∑|

(

)

−()

|

(

)

<()

(9)

A bubble is characterized as (1) the positive

Relative Deviation (RD is not below or at zero), (2)

long Boom Duration and short Burst Duration

(Boom> Burst), and (3) high Positive Deviation and

low Negative Deviation (PD>ND) (Füllbrunn,

2012). Thus, to verify these properties, we will test

the corresponding null hypothesis (i.e. (1) ≤ 0,

(2) ≤ , and (3) ≤ ).

Also, given that the decisions of a mimetic trader

are imitations of their successors, and that the choice

of successor to imitate depends on the weights of its

interactions with him (see Figure 2) thus, to be able

to measure the influence of each type of traders on

decisions of mimetic traders, we measure the

average of interactions weights with each type of

traders as follow:

Let

,

,…,

weights of interactions

where: (1) predecessor is mimetic trader, (2)

successor is a trader of type which can be Noise,

Fundamentalist, Hybrid, or Mimic, i.e. ∈

,,,

}

. is the traders number of the type .

=

∑

(10)

Thus, there will be four weight averages:

,

,

and

.

Also, to better understand prices dynamic and

trader’s behaviour, we will interest to the strategies

used by traders to make a decisions on the market.

For fundamentalist and noise traders, the strategy is

obviously fundamentalist and noise respectively. For

hybrid traders, strategy is the one used to take the

last decision (technical or fundamentalist). For

mimetic trader, strategy is the one used by imitated

trader to make imitated decision (see Figure 2).

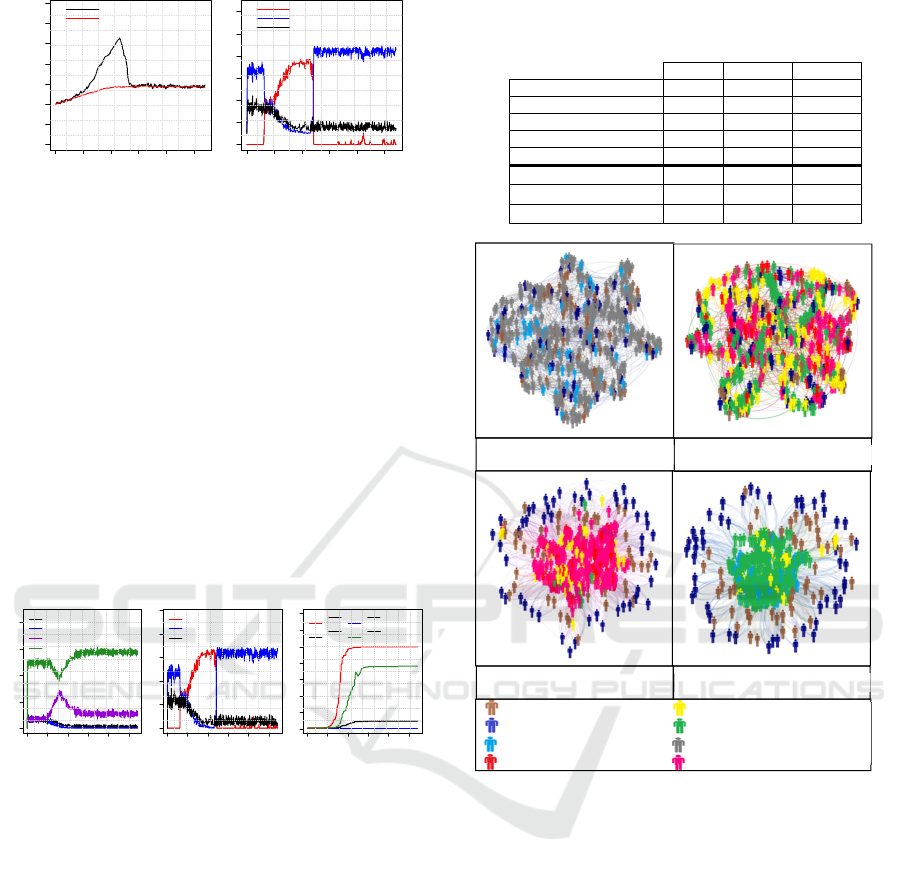

Finally, we will use social networking

visualization tools to visualize the evolution of the

interactions of traders and their strategies.

3.2 Experimental Settings

Table 1 shows values for general model parameters

of all performed experiments. Given the large

number of model parameters, we content with relate

only general parameters of the experiments, namely

general parameters of market which have the same

values in all experiments, and the same for the

parameters of generated fundamental values. What

will change in performed experiments are the

proportions of different types of traders, except the

noise traders that are set at 10% in all experiments,

and whose role is to ensure market liquidity

(Kobayashi, 2007). First, we test model with

fundamentalists trading (EXP.1), after we will

introduce hybrid traders (EXP.2). Finally, we

introduce the mimetic traders in EXP.3. The aim is

to show that mimetic traders are able to cause a

mimetic contagion of speculative behaviour and a

deviation of prices from the fundamental value, in

the same way as hybrid traders.

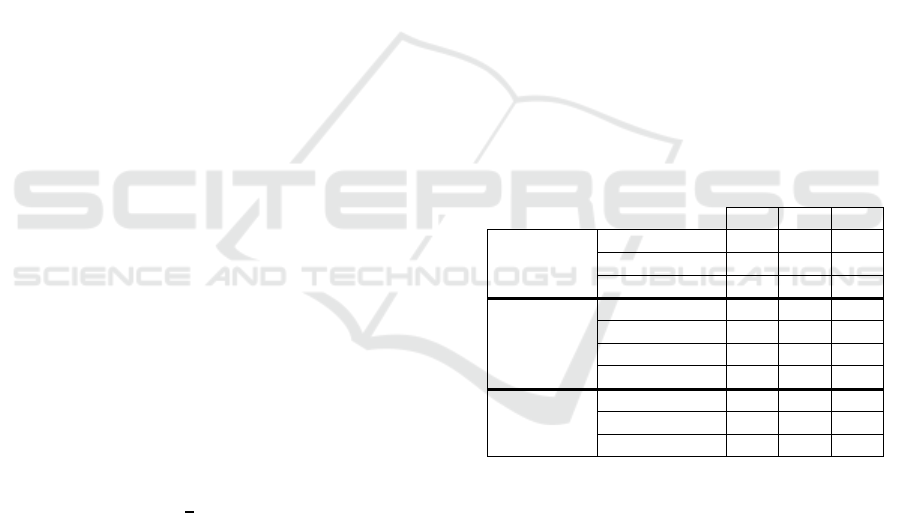

Table 1: Experimental design.

EXP.1 EXP.2 EXP.3

General

parameters of

Market

Nbr. of transactions 2000 2000 2000

Number of traders 500 500 500

Open price 1000 1000 1000

Proportions of

traders

Noise traders 10% 10% 10%

Fundamental traders 90% 10% 10%

Hybrid traders 0% 80% 10%

Mimetic traders 0% 0% 70%

Parameters of

generated

fundamental

values

Initial FV 1000 1000 1000

b (eq. 2) 0,5 0,5 0,5

n (section 2.2) 500 500 500

3.3 Analyse of Results

First, we will observe the statistical properties of the

experiments and compared with two real price series

(FTSE100 index and Barclays bank’s (Martinez,

2009)). Table 2 shows that price series generated by

our model have statistical properties that are close to

the real series. For example, it has been found in real

financial market, that prices series exhibit a kurtosis

larger than three, which indicate a leptokurtic

distribution of return. This phenomenon is known as

fat tails (Martinez, 2009). Thus, as real series, the

series generated by experiments have a kurtosis

larger than three, and so exhibit a phenomenon of fat

tails.

ICAART 2017 - 9th International Conference on Agents and Artificial Intelligence

394

After having presented the statistical properties

of performed experiments, now we will analyse and

discuss results of each experiment regarding the

dynamics of prices and its relationship with the

behaviour of traders.

Table 2: Statistical properties of log return in performed

experiments.

Mean Median Min. Max. Kurtosis Skewness

FTSE100

-0,00003 0 -0,059 0,059 5,138 -0,130

Barclays

0,00020 0 -0,090 0,094 4,626 0,113

EXP.1

0,00017 0 -0,067 0,078 5,208 0,219

EXP.2

0,0003 0 -0,035 0,041 9,509 0,586

EXP.3

0,00019 0 -0,035 0,045 4,133 0,460

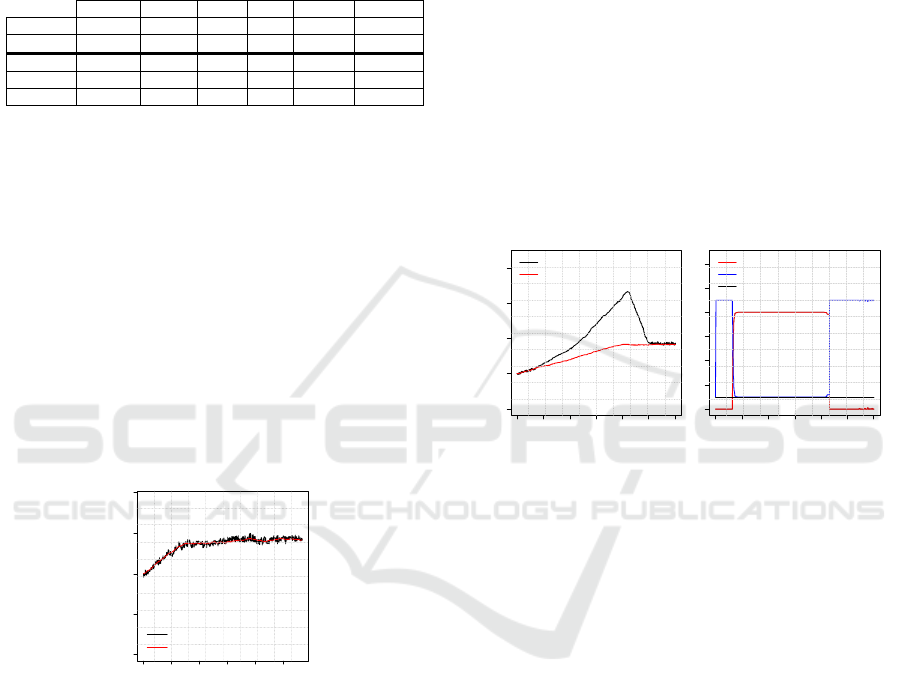

3.3.1 Fundamental Trading

In order to analyse prices dynamics with

fundamentalist traders, we perform EXP.1, with

population composed from 90% of fundamentalists

and 10% of noises (see Table 1). We can see in

Figure 4 that prices fluctuate around the fundamental

value. In Table 3 RD=0.001 is close to 0, also, the

test doesn’t reject a null hypothesis that

≤ 0,

which confirm that prices follow closely

fundamental value (Füllbrunn, 2012). In fact,

fundamentalist traders which represent the majority

of traders submit orders with prices close to

fundamental value, and thus prevent the deviation of

prices from the fundamental.

Figure 4: Evolution of prices and FV in EXP.1.

3.3.2 Introduction of Hybrid Traders

We will observe price dynamics in the presence of

hybrids that can switch between fundamentalist and

speculative strategies. Are they able to cause a

deviation of prices and the formation of bubble by

their speculative behaviour as stated in the

literature?

In EXP.2 when population of traders is

composed from 80% of hybrids and 10% of

fundamentalists, we can see in Figure 5(a) the

deviation of prices from fundamental value that

takes the form of a bubble followed by a crash, also,

the three null hypotheses was rejected, which

indicates a deviation of prices from fundamental

value with the magnitude of a bubble. In fact

RD=0,194 is positive (see Table 3), which indicate

that asset is overvalued. Also, Boom is higher than

Burst and both durations are significantly higher

compared to the number of periods (150). ND=2k

isn’t significant regarding PD=1043k, which

confirms a positive deviation of prices from

fundamental values. A formation of bubble in EXP.2

can explain by the behaviour of hybrid traders which

represent a majority in population. In fact, the

switching of hybrid traders to technical strategy (see

Figure 5(b)) led to a boom phase when prices

increase and deviate from fundamental value, then

return to the fundamentalist behaviour led to a burst

phase when prices decrease and remain close to

fundamental values.

Figure 5: Evolution of prices and the number of traders by

strategies in EXP.2.

3.3.3 Introduction of Mimetic Traders

We will observe price dynamics in the presence of

mimetic traders (section 2.4.4), to see if their

mimetism will lead to diffusion of speculative

behaviour in the market, and formation of bubbles,

such as reported in the literature (e.g. (Orléan, 1989)

and (Chang, 2014)).

In EXP.3 when population of traders is

composed from 70% of mimetic traders and 10% of

noises, fundamentalists and hybrid traders. We can

see in Table 3 that RD=

0,123 is significantly positive

and the same for Boom and Burst duration, which

indicates a significant deviation of price from

fundamental value. The test reject the three null

hypothesis which indicate that a deviation of prices

from fundamental values has the magnitude of

speculative bubble (Figure 6(a)) such as in EXP.2

when population is composed from 80% of hybrids.

0 2000 4000 6000 8000 10000

0 500 1000 1500 2000

Time

Prices/Fund. values

Prices

Fund. values

0 2000 4000 6000 8000 12000

0 1000 2000 3000 4000

Time

Prices/Fund. values

Prices

Fund. values

(a) Prices and Fund. values

0 2000 4000 6000 8000 1200

0

0 100 200 300 400 500 600

Time

Traders by strategy

(b) Traders by strategies

Technicals

Fundamentalists

Noises

An Artificial Stock Market with Interactions Network and Mimetic Agents

395

Figure: 6 Evolution of prices and the number of traders by

strategies in EXP.3.

Figure 6 (b) represents the number of traders for

each strategy as function of time. We can see that

the majority of trader’s deviate to speculative

strategy during the period when prices increase, in

fact, 10% of hybrid traders switch to speculative

behaviour due to the uptrend in prices, and then the

vast majority of mimetic imitate speculative

decisions of hybrids, and thus become speculators as

can be seen in

Figure 7

(a) and

Figure 7

(b).

Figure 7

(c) shows that the weights average of mimetic

interactions with hybrids

and mimetic

are

largely greater than those of fundamentalists

and

noises

. This indicates that mimetic traders tend

to imitate hybrids or other mimetic traders.

Figure 7: Evolution of mimetic traders by (a) trader types

(b) strategies, and (c) weight averages of interactions with

mimetic traders in EXP.3.

In other word, speculative behaviour first

contaminates mimetic traders that interact with

hybrid traders, and then gradually contaminates

other mimetic traders which don’t interact directly

with the hybrids. This corresponds exactly to the

mimetic contagion, which causes the phenomenon of

the bubble as described in the literature (e.g.

(Orléan, 1989) and (Chang, 2014)).

Finally, for better understand the behaviour of

traders, and interactions between them, we have

used Gephi tool (Bastian, 2009) to visualize a

traders, their types and investment strategies, and

their interactions in different periods of simulation.

Figure 8 present visualizations of traders and

their interactions in 4 key periods of experiments

EXP.3. A stickman represents a trader; colours

represent their investment strategies. To visualize

Table 3: Means of observed bubble measures, and test of

null hypothesis significance in performed experiments. (*)

indicates that null hypothesis is rejected.

EXP.1 EXP.2 EXP.3

B

oom 241 30

B

urs

t

221 12

R

D 0

,

001 0

,

194 0

,

123

PD 20

k

1043

k

471

k

ND 17 k 2 k 7 k

H0 : ≤ 0

p

>0,05

p

<0,05*

p

<0,05*

H0 : ≤

p>0,05 p<0,05* p<0,05*

H0 : ≤

p>0,05 p<0,05* p<0,05*

Figure 8: Visualization of traders and their interactions

network in EXP.3.

interactions network, we applied the Force Atlas

algorithm, which pulls together nodes connected

with strong interactions, while repelling away all

other nodes. This provides a much more readable

representation of the graph.

Before the start of the simulation, we can see

that the market is populated by a majority of mimics

(grey stickman), with 10% noises (brown stickman),

10% of fundamentalists (blue stickman), and 10% of

hybrids, initially use fundamentalist strategy (sky

blue stickman).

After 300 transactions, all hybrid traders chose

speculative strategy (in red), when mimetic traders

are divided between fundamental strategy (in green),

speculative strategy (in violet) and noise decision (in

yellow). They haven’t preference for a particular

strategy.

0 2000 4000 6000 8000

0 500 1500 2500 3500

Time

Prices/Fund. values

Prices

Fund. values

(a) Prices and Fund. values

0 2000 4000 6000 8000

0 100 200 300 400 500 600

Time

Traders by strateg

y

(b) Traders by strategies

Technicals

Fundamentalists

Noises

0 2000 4000 6000 8000

0 100 200 300 400

Time

Mimics by type o

f

traders

(a) Mimics by imitated traders

Nois es

Fundamentalists

Hybrids

Mim ic s

0 2000 4000 6000 8000

0 100 200 300 400 500

Time

Mimics by strategy

(b) Mimics by strategies

Technical strategy

Fundamental strategy

Nois e strategy

0 2000 4000 6000 8000

0 20 40 60 80 100 120 140

Time

Average Weights

(c) Evolution of average weights

W

M

H

W

M

N

W

M

F

W

M

M

Noise trader

Fundamentalist trader

Hybrid with fundamental strategy

H

y

brid with s

p

eculative strate

gy

In the beginning (time 0)

After 300 transactions (time 1879)

After 500 transactions (time 4219) After 800 transactions (time 5041)

Mimetic with noise strategy

Mimetic with fundamental strategy

Mimetic without strategy

Mimetic with s

p

eculative strate

gy

ICAART 2017 - 9th International Conference on Agents and Artificial Intelligence

396

After 500 transactions, the mimetic approach

each other, and with hybrid traders, indicating a high

weights of interactions between them. Thus, the

majority of mimetic traders imitate speculative

decisions of hybrids, which leads to the formation of

a bubble.

After 800 transactions, mimetic traders always

have strong interactions between them and with

hybrid traders, the majority of mimetic traders

switch to fundamentalist behaviour with hybrids,

which causes the crash.

4 CONCLUSIONS

In this paper we introduced an agent based model of

double auction market with heterogeneous traders

and a social network of interactions. The market is

populated by different types of traders, namely, (1)

noise traders which represent misinformed traders in

the market, (2) fundamental traders which make

their decisions based on their estimate of the

fundamental value, (3) hybrids which represent

traders able to switch to speculative behaviour when

they detect an uptrend in prices, and finally, (4)

mimetic traders which take decisions by imitating

their successors in interactions network.

To test the model, we conducted a series of

experiments and compared statistical properties of

generated prices series with those of real market, and

also, we tested theoretical assumptions which

consider mimetic traders as the first explanation of

the phenomena of speculative bubble. Experiments

have shown that prices series generated have statistic

properties close to those of real prices series. Also,

results of experiments support theoretical

assumption concerning the important role of

mimicking behaviour as an explanation of excess

volatility and bubbles formation. In fact, when

market is populated by a majority of mimetic

traders, they choose to imitate speculative decisions,

resulting in price volatility and the formation of a

bubble.

The proposed model provides access to all the

information concerning the decisions of traders, their

strategies and their interactions; this will have to

provide a more efficient way to study the mimicking

behaviour and its role on financial markets.

Regarding the perspective, we will improve the

model through the development of agents that better

simulate the behaviour of traders in real markets.

REFERENCES

Bikhchandani, S., & Sharma, S. (2000). Herd behaviour in

financial markets. IMF Economic Review, 47(3), 279-

310.

Banerjee, A. V. (1992). A simple model of herd behavior.

The Quarterly Journal of Economics, 797-817.

Scharfstein, D. S., & Stein, J. C. (1990). Herd behaviour

and investment. The American Economic Review, 465-

479.

Derveeuw, J., Beaufils, B., Mathieu, P., & Brandouy, O.

(2007). Testing double auction as a component within

a generic market model architecture. In Artificial

Markets Modeling (pp. 47-61). Springer Berlin

Heidelberg.

Orléan, A. (1989). Mimetic contagion and speculative

bubbles. Theory and Decision, 27(1-2), 63-92.

Martinez-Jaramillo, S., & Tsang, E. P. (2009). An

heterogeneous, endogenous and coevolutionary GP-

based financial market. IEEE Transactions on

Evolutionary Computation, 13(1), 33-55.

Bessembinder, H., & Venkataraman, K. (2009). Bid-ask

spreads: Measuring trade execution costs in financial

markets. Encyclopedia of Quantitative Finance.

Füllbrunn, S., & Neugebauer, T. (2012). Margin Trading

Bans in Experimental Asset Markets. Jena Economic

Research Paper, 58.

Stöckl, T., Huber, J., & Kirchler, M. (2010). Bubble

measures in experimental asset markets. Experimental

Economics, 13(3), 284-298.

Bastian, M., Heymann, S., & Jacomy, M. (2009). Gephi:

an open source software for exploring and

manipulating networks. ICWSM, 8, 361-362.

Chang, S. K. (2014). Herd behavior, bubbles and social

interactions in financial markets. Studies in Nonlinear

Dynamics and Econometrics, 18(1), 89-101.

Watts, D. J., & Strogatz, S. H. (1998). Collective

dynamics of ‘small-world’networks. nature,

393(6684), 440-442.

Kobayashi, S., & Hashimoto, T. (2007). Analysis of

Random Agents for Improving Market Liquidity

Using Artificial Stock Market. In Proceedings of The

Fourth Conference of The European Social Simulation

Association (ESSA 4th’07) (pp. 315-317).

Manahov, V., & Hudson, R. (2013). Herd behaviour

experimental testing in laboratory artificial stock

market settings. Behavioural foundations of stylised

facts of financial returns. Physica A: Statistical

Mechanics and its Applications, 392

(19), 4351-4372.

An Artificial Stock Market with Interactions Network and Mimetic Agents

397