Energy Flexibility Potential of Industrial Processes in the Regulating

Power Market

Zheng Ma, Henrik Tønder Aabjerg Friis,

Christopher Gravers Mostrup and Bo Nørregaard Jørgensen

SDU Center for Energy Informatics, University of Southern Denmark, Campusvej 55, 5230, Odense, Denmark

Keywords: Energy Flexibility, Electricity Flexibility, Regulating Power Market, Industrial Processes.

Abstract: Demand response is generally considered necessary for efficiently upholding grid balance with the increased

intermittent production from renewable energy sources. Demand response is acknowledged to enhance the

use of more renewable energy friendly technologies, such as heat pumps, electric vehicles, and electric heating

in replacement of conventional technologies. To enable the use of demand response, the consumers must have

economical and practical incentives without loss of convenience. This study aims to investigate the demand-

response market potential of a flexible industrial process in the current electricity market structure. The Danish

West regulating power market is selected in this study with an ideal process simulation of an industrial roller

press. By analysing market data, the value of flexible electricity consumption by the roller press in the

regulating power market is demonstrated by an ideal process simulation.

1 INTRODUCTION

Denmark has established ambitious goals for

independence of fossil fuels towards 2050 (Danish

Government, 2011; DK Energy Agreement, 2012)

These goals imply a 12% reduction of gross energy

consumption in 2020 in comparison to 2006; a share

of 35% renewable energy in 2020; and 50% wind

energy in Danish electricity consumption in 2020.

This means that wind energy will cover more than 50

% of the total electricity consumption in 2020. A goal

that is almost reached, since wind power in 2015

covered around 42% of the total electricity

consumption (Energinet, 2017). Furthermore,

electricity and heat production must come from only

renewable energy sources in 2035. These are all

milestones toward the end goal in 2050, where all

energy is provided by renewable energy sources.

Traditionally, fossil-fuelled centralized and

decentralized power plants covered the electricity

production. The electricity production from fossil-

fuelled power plants is easy to regulate compared to

the consumption. The production and consumption

must always be in balance to ensure a stable and

functioning grid. However, when large amounts of

renewable energy sources (wind and solar) are

integrated into the electricity system, irregular

production fluctuations will emerge. With

fluctuations for both the production and consumption,

challenges arise since electricity is usually produced

according to the consumption demand. Hence, with

the increase in renewable energy sources, it will be

increasingly difficult to maintain and control the

balance between electricity production and

consumption.

There are different ways to deal with the above-

mentioned problem. However, the transition of the

electricity system requires large investments. One

approach is to expand the capacity of traditional

power plants to ensure balance in the electricity

system by having the necessary reserve capacity

disposable. According to the report ‘Smart Grid in

Denmark’ (Energinet and Danish Energy

Association, 2014), this approach requires a

socioeconomic investment of approximately 7.7

billion DKK, without yielding any additional benefits

for Denmark.

Another approach is to implement an intelligent

and flexible electricity system, a so-called Smart

Grid, which enables flexible consumption.

Establishing the Smart Grid requires a socioeconomic

investment of approximately 9.8 billion, according to

the report. The investment includes distribution grid

upgrading, equipment for metering, and control and

automation of consumptions. However, the

investment in a Smart Grid yields a benefit for

Ma, Z., Friis, H., Mostrup, C. and Jørgensen, B.

Energy Flexibility Potential of Industrial Processes in the Regulating Power Market.

DOI: 10.5220/0006380201090115

In Proceedings of the 6th International Conference on Smart Cities and Green ICT Systems (SMARTGREENS 2017), pages 109-115

ISBN: 978-989-758-241-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

109

Denmark of approximately 8.2 billion DKK, hence

the total net cost will be around 1.6 billion DKK.

The socioeconomic benefits are divided into

different categories. The first benefit is that

consumers shift their electricity consumptions

according to the electricity price. Thereby it can

reduce the socioeconomic cost of electricity

generation. The second benefit is that the electricity

consumption of consumers will be more easily

manageable, which makes it possible to implement

energy saving and demand response solutions. This

saves society the alternate capital cost that would

otherwise be required if these solutions were not

implemented. The third benefit is that the cost of

ancillary services can be reduced by allowing more

providers with lower costs access to the regulating

power market. The last benefit is especially

interesting in regards to demand-side flexibility.

The electricity price will to a greater extend

depend on the supply, thus a behavioural change in

the consumption patterns is expected to happen.

However, according to the current market rules, only

electricity consumers with large consumption can

participate in the market for ancillary services.

Therefore, a new market player is needed. This new

market player, the energy service aggregator, bundles

small and medium sized consumers to represent one

large consumption unit in the market. This allows

more demand-side flexibility to participate in the

regulating power market.

This paper aims to investigate the energy

flexibility potential of industrial processes available

to energy service aggregators for providing demand

response services and its impact on market

exploitation. A comprehensive review of applications

of demand response in the industrial sector is

provided in (Shoreha et al., 2016). The dominant

electricity consuming processes and equipment in the

industrial sector include machine drives, electrical

heating, and electro-chemical processes (Samad and

Kiliccote, 2012). The example that we consider in this

paper belongs to the category of machine drives. The

Danish DK-West regulating power market is selected

for simulating the energy flexibility of an ideal

process exemplified by an industrial roller press.

2 BACKGROUND

The Danish electricity grid is divided in two areas,

DK-West (Jutland and Funen) and DK-East

(Zealand). Additionally, the electricity grid is divided

into production, transmission, distribution, and

consumption (shown in figure 1).

The overall electricity market consists of a wholesale

market, retail market, and a regulating power market

for ancillary services.

Figure 1: Overview of the Danish transmission and

distribution grid (Clear Creek Networks, 2016).

2.1 The Wholesale Market

Wholesale trade of electricity in Denmark occurs

primarily as either bilateral trade directly between

buyer and seller or through the common Nordic

electricity market - Nord Pool. In the day-ahead

market (Elspot market), the electricity is traded the

day before the hour of operation. A smaller part of the

wholesale trade occur in the intraday market (Elbas

market), with trade up to one hour before the

operation hour. The day-ahead market is the major

electricity market, where 70 % of the total electricity

consumption in the Nordic countries is traded

(Energinet, 2013). The day-ahead market is the most

dominant factor for the electricity price formation of

public available prices in the wholesale market.

The volume traded in the intraday market is

significantly smaller compared to the day-ahead

market. In 2015, the total volume traded in the

intraday market in Denmark was 1.97 TWh,

compared to 56.25 TWh in the day-ahead market.

However, the standard deviation of the average

electricity prices in the intraday market in 2015 was

105.79 DKK/MWh with a mean value of 141.06

DKK/MWh, compared with a standard deviation of

84.21 DKK/MWh in the day-ahead market

(Energinet, 2016a). The high standard deviation in the

intraday market indicates a potential for trading of

energy flexibility in the intraday market. However,

the profit that can be made here is smaller than in the

SMARTGREENS 2017 - 6th International Conference on Smart Cities and Green ICT Systems

110

regulating power market.

2.2 The Regulating Power Market

After the intraday market has close, the Transmission

Service Operator (TSO) will account for all

imbalances in the grid. The TSO buys regulating

power from balance responsible parties, who have

registered offers for up and down regulation with a

given capacity (MW) and price (DKK/MW).

Regulation is considered from the perspective of the

production, meaning up regulation will increase the

supply, whereas down regulation will decrease the

supply. Manual reserves are traded in the Nordic

regulating power market - the Nordic Operational

Information System (NOIS).

The volume that is traded in the regulating power

market is lower than the amount in the intraday

market. The total amount of traded up and down

regulation in Denmark in 2015 was 0.44 TWh. By

comparing up and down regulation with the total

electricity consumption in Denmark, there are no

unambiguous tendencies during the past five years

(Energinet, 2016a). A detailed description of

ancillary services is provided in (Biegela et al., 2014;

Lund et al., 2015).

3 FLEXIBILITY POTENTIAL

With the increased capacity of renewable energy

sources in the future, the electricity grid must undergo

modifications for a continuous effective use of these

resources. One very important modification is support

for demand response in the demand side. In this

section, the estimation of the flexibility potential is

simulated using several scenarios. The potential of

increasing and decreasing the consumption, as result

of changing the production in certain periods, is

referred to as flexibility potential.

3.1 Case Selection

One of the leading supplier companies within the

cement industry, KHD Humboldt Wedag, is selected

for the flexibility potential simulation. In order for a

process to deliver all flexibility demands, it must

fulfil the two following requirements:

Turn on and off instantaneously or within very

short notice.

The discontinuous operation must not affect the

quality of the product from the process.

The roller presses of KHD Humboldt Wedag

seem suitable for the simulation. According to the

datasheet (KHD Humboldt Wedag, 2016), they have

a variety of roller presses with different pressing

forces and power consumptions. Since the pressing

forces are not important for the simulation, the roller

press with the highest power consumption (6000 kW)

is chosen.

3.2 Simulation Initialisation

The market data from 2015 is selected in this study

for the simulations. The regulating power market

volumes and prices (DK-West), as well as intraday

prices, are obtained from Energinet.dk (Energinet,

2016b), whereas Nord Pool Spot (Nord Pool Spot,

2016) is used for the intraday volumes.

Firstly, the required capacity is found that meets

all up and down regulations in the different markets

and areas. To find this, the maximum value of the up

regulation and the minimum value of the down

regulation (it is negative in the statistics) necessary at

any given hour during the simulation year (2015)

must be located.

The maximum amount of up regulation at any

given time during 2015 was 638.9 MW, whereas it

was -572.0 MW for down regulation. Since the

required up regulation is larger than the required

down regulation, the process capacity in the

simulation is chosen as 638.9 MW. Since each roller

press has a power consumption of 6 MW, a capacity

of 642 MW (107 units) must be installed to cover all

regulation requirements at all times in this simulation.

This is not a realistic number of units in a real life

scenario; however, it is used here as it suffices to

demonstrate the concept.

It is assumed that the roller press adds value to the

materials by pulverising it, which will further on be

referred to as ‘Process Income’ DKK/MW. Since this

value is not known, different scenarios for ‘Process

Incomes’ will be simulated. It is not given that the

process can deliver regulation whenever it is required.

If the process is running in the given hour, it will only

be able to deliver up regulation within that hour and

not down regulation. On the other hand, if the process

is turned off within that hour, it can only provide

down regulation.

To determine whether the process is turned on or

off, an evaluation of the ‘Process Income’, the hourly

spot price, and the electricity taxes must be done.

Figure 2 shows the spot price (incl. electricity

taxes) for an arbitrary selected day, January1

st

, 2015

and a ‘Process Income’ of 150 DKK/MW. The spot

price itself fluctuates throughout the day, whereas the

‘Process Income’ is constant. The electricity taxes in

the considered market, i.e., Denmark, relates directly

Energy Flexibility Potential of Industrial Processes in the Regulating Power Market

111

to the consumed amount of electricity. In the period

where the spot price with taxes is below the ‘Process

Income’, it is profitable to have the roller presses

running. However, when the spot price with taxes

exceeds the ‘Process Income’, it is no longer

profitable to have the roller presses turned on, and

they will therefore be turned off.

Figure 2: Example of the ON / OFF for the ideal process.

The process is ON below the constant line.

3.3 Down Regulation

An IF (condition) function is designed in this study to

determine whether alterations should be made to the

‘Initial Running Schedule’. The IF function is

described below, where, if all the following

conditions are met, the process will be turned on:

Down regulation is needed.

The process is turned off in the ‘Initial Running

Schedule’.

The income for providing down regulation and

‘Process Income’ exceeds the electricity taxes.

The income for providing down regulation

(referred to as ‘Income Down Regulation’) is

calculated as the product of the amount of units

activated to provide the down regulation, the

balancing power price for down regulation, and the

power consumption of each unit (e.g. 6 MW for the

roller press).

There is an electricity cost associated with

providing down regulation (consisting of taxes only).

However, the electricity taxes always exceed the

‘Income Down Regulation’, resulting in an economic

loss for providing down regulation if it is not for the

‘Process Income’. From the companies’ point of view

(the companies owning the roller presses), they can

receive cheap electricity for running their processes

when providing down regulation. Hence, instead of

keeping the roller presses turned off, it can become

profitable to turn them on.

If the ‘Income Down Regulation’ is calculated as

the difference between the payment for providing

down regulation and the electricity taxes, the profit of

the down regulation in all markets would be zero or

negative. This would provide an inaccurate picture of

the value of providing down regulation in each

market, as cheaper electricity from providing down

regulation does hold a significant production value,

especially if the ‘Process Income’ is high. For this

reason, the ‘Income Down Regulation’ is calculated

including the ‘Process Income’, but without taking

any additional expenses for providing down

regulation into consideration. The purpose of the

simulations are to estimate the value of flexible

consumption, and not including both the electricity

taxes and ‘Process Income’ into the calculations for

‘Income Down Regulation’ would give a wrong

picture of the real value in the electricity markets.

However, not all units will be activated when

supplying down regulation. If there is a need for e.g.

88.3 MW of down regulation in a certain hour, only

14 units will turn on. This provides 84.0 MW of down

regulation, whereas the last 4.3 MW should be

supplied from elsewhere. It is obvious that, more

down regulation can be supplied by the processes

with smaller units (e.g. 1 MW instead of 6 MW).

There are occasions where there is a need for

down regulation in a market, but it is not supplied by

the processes. This is due to that conditions are not

met. This lost potential for down regulation (referred

to as ‘Lost Regulation Income’) is heavily influenced

by the ‘Process Income’, which is why the

simulations are made for different values of ‘Process

Income’. The evaluation of different ‘Process

Incomes’ shows a big flexibility potential in the

market.

3.4 Up Regulation

For the up regulation market, the same procedure

applies in this study. A similar IF (condition) function

is made. The processes are turned off if the following

conditions are met:

Up regulation is needed.

The process is turned on in the ‘Initial Running

Schedule’.

The income for providing up regulation exceeds

the ‘Process Profit’ (which is the difference

between ‘Process Income’ and electricity costs,

i.e., spot price and taxes).

If the conditions are met, only the amount of units

required to cover the up regulation are turned off. The

remaining units continue to run. As in the simulation

for down regulation, there also remains a rest for up

regulating power, which cannot be covered by the

processes. This is either because the unit is turned off

in the ‘Initial Running Schedule’, it is more profitable

to keep the processes running and not provide up

regulation, or because the required up regulation is

SMARTGREENS 2017 - 6th International Conference on Smart Cities and Green ICT Systems

112

not divisible by 6 MW.

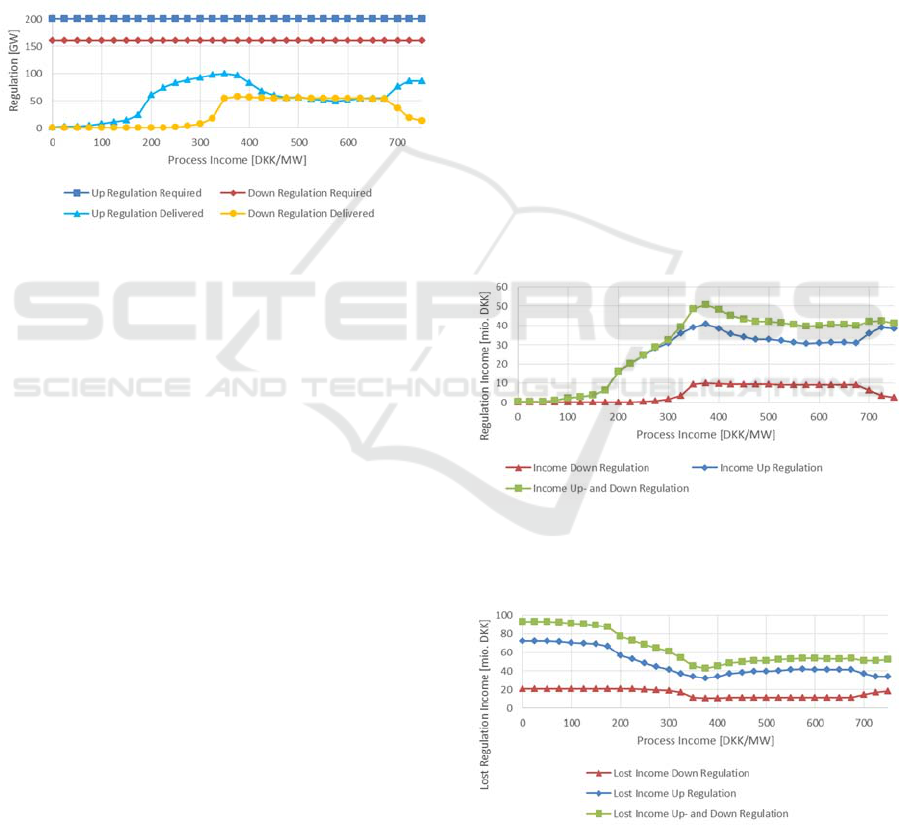

3.5 Simulation Results

The results for the DK-West regulating power market

can be seen in Figure 3. Figure 3 shows that the

maximum up regulation can be delivered at a Process

Income of 350 DKK/MW. As for down regulation,

the maximum amount is delivered at 375 DKK/MW.

Furthermore, the total amount of regulating power

(both up and down) that can be delivered is 154.1

GW, out of 359.6 GW, at ‘Process Income’ 350 and

375 DKK/MW.

Figure 3: The flexibility potential of the 6 MW ideal process

simulations for data from the DK-West Regulating Power

Market.

This means that around 43 % of the total regulating

power needed throughout the year can be delivered,

when using roller presses of 6 MW. However, this is

an ideal scenario and illustrates the total potential of

flexible consumption within the current regulating

power market. The remaining 57 % must come from

other sources, such as power generation or other types

of demand response.

The figure also shows that it is not profitable to

provide either up or down regulating power for low

value of ‘Process Income’ (e.g. 0-150 DKK/MW).

The electricity taxes were 498 DKK/MW, which

means that the balancing power price needs to be high

for it to be profitable to provide down regulating

power. The graph for ‘Down Regulation Delivered’

shows that the balancing power price does not

compensate for the high electricity taxes. Only a

small amount of down regulating power was

delivered until the ‘Process Income’ reached 350

DKK/MW. From this point, the down regulation

delivered was almost constant until the ‘Process

Income’ reached 675 DKK/MW afterwards it slowly

decreased. The reason for this plateau of constant

‘Down Regulation Delivered’ between 375-675

DKK/MW is due to the electricity taxes. The

electricity taxes make a restriction to the amount of

down regulating power that can be delivered by the

ideal process.

The reason why ‘Up Regulation Delivered’ is also

small at low values of ‘Process Income’ is indirectly

caused by the electricity taxes. The electricity taxes

have huge impact on the ‘Initial Running Schedule’

resulting in the processes being turned off at most

occasions. However, as the ‘Process Income’

increases, the processes are turned on more often in

the ‘Initial Running Schedule’. Since it is only

possible to provide up regulation when the processes

are already on, this can cause the increasing amount

of ‘Up Regulation Delivered’. At ‘Process Income’

375 DKK/MW, the ‘Up Regulation Delivered’ starts

to decline, because the income for providing up

regulation (referred to ‘Income Up Regulation’) no

longer exceeds the ‘Process Income’, and it is more

profitable to keep the processes running instead of

turning them off to provide the up regulation. The ‘Up

Regulation Delivered’ remains almost constant until

the ‘Process Income’ is as high as 675 DKK/MW.

The ‘Process Income’ is so high that the processes

keep on almost all the time in the ‘Initial Running

Schedule’. It allows much more up regulating power

and much less down regulating power to be delivered.

Figure 4: The total regulation income of the 6 MW ideal

process simulations for data from the DK-West Regulating

Power Market.

Figure 5: The lost regulation income of the 6 MW ideal

process simulations for data from the DK-West Regulating

Power Market.

Energy Flexibility Potential of Industrial Processes in the Regulating Power Market

113

Figure 4 shows the total income for both up and down

regulation is highest (50.6 million DKK), when the

regulation potential is at its maximum, at a ‘Process

Income’ of 375 DKK/MW.

Unsurprisingly, as figure 5 shows the ‘Lost

Income Up and Down Regulation’ (defined as the

‘The Lost Regulation Income’) is at its lowest when

the ‘Process Income’ is 375 DKK/MW. It is because

the total regulating power and the income are at the

peak point.

In this study, a roller press of 6 MW has been used

in the simulation. In theory, it should be possible to

increase the amount of regulation capacity delivered

by using more but smaller processes. The smallest

roller press in the datasheet (KHD Humboldt Wedag,

2016) is 280 kW. It is possible to alter the power

consumption of the ideal process to study how it can

affect the amount of regulation provided. Replacing

the 6 MW roller press with a 280 kW roller press in

the simulation looks almost identical to the 6 MW

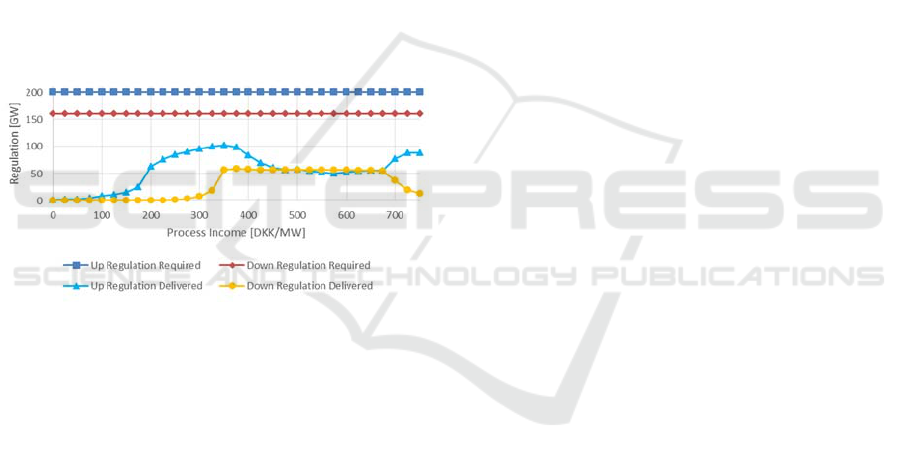

process, as shown in figure 6.

Figure 6: The flexibility potential of the 280 kW ideal

process simulations for data from the DK-West Regulating

Power Market.

The total amount of regulation delivered is 158.3

GW, instead of 154.1 GW, which constitutes 44 % of

the regulation required in 2015. It is only an increase

of 4.2 GW of regulation delivered, but it illustrates

the principle that more regulation can be delivered

with more but smaller processes. The optimal values

for the ’Process Income’ are the same as with the 6

MW process, but the ’Regulation Income’ has

increased from 50.6 to 51.7 million DKK. However,

it is questionable if this relatively small increase in

profit is enough to justify the additional cost and

effort of aggregating and administrating smaller

loads.

4 DISCUSSION

The simulation in this study is based on an ideal

process of the roller press of 6 MW, which is able to

deliver both up and down regulation instantaneously

without affecting the quality of the product from the

process. In the simulation, the ideal process can

deliver all required regulating power and the results

are the ’best-case scenario’. The ideal process is

associated with a ‘Process Income’. Different values

of ‘Process Income’ were simulated, to compensate

for the fact that the ‘Process Income’ for the roller

press process is unknown. By changing the ‘Process

Income’ in the simulation makes it possible to

evaluate, if an industrial process is likely to be

profitable for providing demand response in the

regulating power market.

This study takes the DK-West regulating power

market as example, because the balance responsible

parties are charged for their imbalance, and this is the

business potential for aggregators to enter the market

for regulating power. Meanwhile, more regulating

power is traded in the DK-West, due to the fluctuating

production from a large installed capacity of wind

turbines.

The roller press has functioned as the ideal

process for the simulation in the study. However, it is

an ideal scenario and the results would be naturally

difficult to achieve in practice, because the majority

of industrial processes link to certain operation hours

during a working day. In addition, some industrial

processes like the use of artificial lighting in

commercial greenhouses depend on external factors

like the weather forecast, and the decision to turn the

processes on or off requires more consideration than

just the ‘Process Income’ (Zheng and Jørgensen,

2016). Other examples of flexible consumption are

given in (Biegela et al., 2014). Here the examples of

households, supermarket refrigeration systems, and

Battery storage are used. The first two examples

address intrinsic flexibility in thermal capacity, and

the second electrical storage. Other examples on

energy storage technologies, including services

provide by electrical vehicles, are given in (Lund et

al., 2015). The case of compressed air for

manufacturing processes is considered in (Beier et al.,

2015). Our example differs from this previous work

in the field by focusing on flexibility provided by a

mechanical production process based on machine

drives.

5 CONCLUSIONS

To leverage the imbalance between supply and

demand in an electrical grid with a large penetration

of fluctuating renewable energy sources, there is a

SMARTGREENS 2017 - 6th International Conference on Smart Cities and Green ICT Systems

114

need for marketization of energy flexibility in the

demand side. Due to a larger amount of power being

traded in the intraday market, the total value of energy

flexibility in the intraday market is much higher

compared to the regulating power market. However,

due to market regulations the value of trading energy

flexibility is higher per unit in the regulating power

market compared to the intraday market. It means that

consumers can gain more income by delivering

energy flexibility into the regulating power market.

It is demonstrated that the ideal process is able to

deliver both up and down regulation, depending on

whether it is initially turned on or off and according

to the expenses of electricity taxes. An economic

statement of an aggregation company is not assessed

in this study, and it would be too complex to specify

actual expenses and determine how an aggregator can

regulate its income. An economic statement of

individual consumers is also out of the scope for this

study.

This study only addresses industries with a high

potential for delivering energy flexibility through

simple processes based on machine drives. To limit

the scope, small electricity loads related to industrial

site personnel, such as lighting, cooling, heating,

ventilation, and office equipment, are not considered

in this study, since the incentive of aggregating small

loads to perform demand response appears to be too

small compared to the impact on user inconvenience.

REFERENCES

Biegela, B., Westenholzb, M., Hansenc, L.H., Stoustrupa,

J., Andersena, P., Harbod S. 2014. Integration of

flexible consumers in the ancillary service markets. In

Energy, Volume 67, 479–489.

Beier, J., Thiede, S., Herrmann, C. 2015. Increasing Energy

Flexibility of Manufacturing Systems through Flexible

Compressed Air Generation. In Procedia CIRP,

Volume 37, 18-23.

Clear Creek Networks. 2016. Back to the Basics: The

Electrical Grid and The Substation. http://

www.clearcreeknetworks.com/2014/05/02/electricalgri

ds-101-an-introduction-to-utilities/

Danish Government. 2011. Energy Strategy 2050 – from

coal, oil and gas to green energy.

DK Energy Agreement. 2012.

Energinet.dk. 2017. http://energinet.dk/DA/El/Nyheder/

Sider/ Dansk-vind stroem-slaar-igen-rekord-42-

procent.aspx.

Energinet.dk & Danish Energy Association. 2014. Smart

grid in Denmark. Technical report.

Energinet.dk. 2013. Elmarkedet i danmark. Technical

report.

Energinet.dk. 2016a. Virksomheden. http://energinet.dk/

DA/OM-S/Omvirksomheden/Sider/ default.aspx.

Energinet.dk. 2016b. Udtræk af markedsdata. http://

energinet.dk/DA/El/Engrosmarked/Udtraek-af-

markedsdata/Sider/default.aspx.

KHD Humboldt Wedag. 2016. High Pressure Grinding

Roller Presses. Technical report.

Lund, P.D., Lindgren, J., Mikkola, J., Salpakari J. 2015.

Review of energy system flexibility measures to enable

high levels of variable renewable electricity. In

Renewable and Sustainable Energy Reviews, Volume

45, 785–807.

Nord Pool Spot. 2016. Historical Market Data.

http://nordpoolspot.com/historical-market-data.

Samad, T., Kiliccote, S. Smart grid technologies and

applications for the industrial sector. 2012. In Comput.

Chem. Eng. 47, 76–84.

Shoreha, M.H., Sianoa, P., Shafie-khaha, M., Loiab, V.,

Catalãoc, J.P.S. 2016. A survey of industrial

applications of Demand Response. In Electric Power

Systems Research, Volume 141, 31–49.

Zheng M., Jørgensen, B.N. 2016. Energy Flexibility of the

Commercial Greenhouse Growers: The Potential and

Benefits of Participating in the Electricity Market, In

proceedings of IEEE International Conference on

Sustainable Energy Technologies.

Energy Flexibility Potential of Industrial Processes in the Regulating Power Market

115