Market Share Research Using Conjoint Analysis on Digital Cameras

Haodong Liu

Scecina Memorial High School, 46219 Indianapolis, Indiana, U.S.A.

ddhaodong@gmail.com

Keywords: Market, Conjoint, Share.

Abstract: This research conducts conjoint analysis market research study on a branded digital camera using programing

R. The aim is to predict market share (strictly share of preference as the model doesn't take into account

distribution or promotional effects). In conjoint analysis, customers are shown a variety of possible products

(or services) and asked to say which they prefer. By analyzing the preferences against the specification of the

products shown statistically, the underlying preferences can be worked out, so that preference for products

that were not tested can be evaluated (see conjoint design) to produce a conjoint analysis model to explore

different sets of preferences across the market as a whole. Using these preference values (utilities or part-

worths) from the conjoint research, a market model on customers’ preferences can be created based on what

drives customers' decisions. This allows businesses to model and test different product and service options to

evaluate likely market preferences and potential share, revenue and profit, all based on what customers really

value. In this project, a share of preference model is developed to improve the offering to customers and

estimate their effect on share to find out which options give the best return on investment.

1 INTRODUCTION

This research conducts conjoint analysis market

research study on a branded digital camera using

programing R. The aim is to predict market share

(strictly share of preference as the model doesn't take

into account distribution or promotional effects). In

conjoint analysis, customers are shown a variety of

possible products (or services) and asked to say which

they prefer. By analyzing the preferences against the

specification of the products shown statistically, the

underlying preferences can be worked out, so that

preference for products that were not tested can be

evaluated (see conjoint design) to produce a conjoint

analysis model to explore different sets of preferences

across the market as a whole. Using these preference

values (utilities or part-worths) from the conjoint

research, a market model on customers’ preferences

can be created based on what drives customers'

decisions. This allows businesses to model and test

different product and service options to evaluate

likely market preferences and potential share, revenue

and profit, all based on what customers really value.

In this project, a share of preference model is

developed to improve the offering to customers and

estimate their effect on share to find out which

options give the best return on investment.

2 CONJOINT DESIGN

A product or service area is described in terms of a

number of attributes. Based on the knowledge the

product category, product features and product

attributes, one design can be deployed by working

with the product manager in order to know what

parameters should be used. Attributes that affect

customers’ preference most significantly are price,

zoom, image quality, LCD screen size, and battery

life, which are all put into the model. This digital

camera study can be applied to any consumer product

because of the process would be exactly the same.

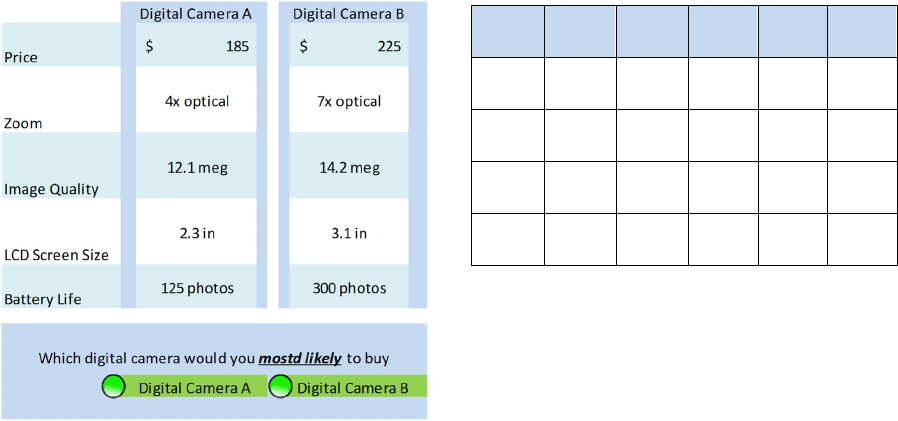

A digital camera may have attributes of zoom,

screen size, brand, price and so on. Each attribute can

then be broken down into a number of levels. For

instance, levels for zoom may be 4x optical, or 7x

optical. Using experimental design the attributes have

been used to develop 16 different types of camera (the

choice objects). For the sake of simplicity, the

attribute with a larger magnitude is denoted as +1

while the smaller one is -1. (See Appendix 1).

However, it is hard to determine which feature has

the greatest impact on customers’ preferences, and

what will the market share of a product with certain

features be. To answer this research question, the

following survey is conducted.

229

Since the analysis comes from the company’s

point of view, some combination does not make sense

for a company and therefore can be eliminated. (For

example, it is impossible for a company to sell goods

that have the best attribute with a lower price. This

means that the combination of -1,1,1,1,1 is impossible

and therefore it is not under the concern).

Participant would be shown a set of products,

prototypes, mock-ups, or pictures created from a

combination of levels from all or some of the

constituent attributes and asked to choose from, rank

or rate the products. Each example is similar enough

that consumers will see them as close substitutes, but

a unique combination of product features is made up

for a clear preference. The cameras were then

organized into 120 groups for customers to choose

from. (16*15/2) each pair of camera composes a

question in the survey looks like the table below.

Which camera a consumer would buy at the end

of day? What would the survey look like? To answer

above question, a comparison of a pair of cameras is

conducted to 200 responders like above.

For this model we had to simplify so that it fits on

the page. The data are made up and do not reflect any

real life situation.

3 DATA COLLECTION

Data for conjoint analysis are most commonly

gathered through a market research survey, although

conjoint analysis can also be applied to a carefully

designed configurator or data from an appropriately

design test market experiment. Market research rules

of thumb apply with regard to statistical sample size

and accuracy when designing conjoint analysis

interviews. The length of the research questionnaire

depends on the number of attributes to be assessed

and the method of conjoint analysis in use.

A typical Adaptive Conjoint questionnaire with

20-25 attributes may take more than 30 minutes to

complete. Choice based conjoint, by using a smaller

profile set distributed across the sample as a whole

may be completed in less than 15 minutes. Choice

exercises may be displayed as a store front type layout

or in some other simulated shopping environment.

200 people completed the survey, each made 120

choices. Then the total number of choices is 24,000.

An Excel spreadsheet is presented below with the

choice frequencies for each camera and each person.

Here is a peak of choices. An ordinal assumption is

made regarding the dependent variables:

Participant Camera1 Camera2 Camera3 Camera4 Camera5

1 15 9 14 6 12

2 13 12 14 8 14

3 13 11 12 12 10

4 14 13 6 5 13

4 ANALYSIS

Consumer psychologists have found that statistical

models such as dummy variable regression or

ANOVA very useful in conjoint analysis for multi-

attribute alternatives.

The task addressed is to model, fit, and if

successful, to predict the choices among alternatives.

Several abbreviations are used in the model, and they

are listed below:

DV = Choice frequency (sum across all people).

Dependent variable, this is the sum of all frequencies

across all people. For example, on camera 1, the sum

of all frequencies across all people, the value is 2146.

IV’s= Product attributes. Independent variable, this is

the Product attributes as Price, Zoom, Image Quality,

LCD Screen Size, Battery Life.

The Results is a simplified regression model that

helps predict the odds for consumer to choose a

specific product.

Seventh International Symposium on Business Modeling and Software Design

230

To evaluate the relative impact of all attributes,

we use the regression equation in R:

RegModel <- lm(ChoiceFrequency ~

Price+Zoom+Image.Quality+LCD.Screen.Siz

e+Battery.Life)

Predicted Frequency =

= 1500-347*Attribute1 + 257.7*Attribute2 +

321*Attribute3 + 121*Attribute4 + 283.1*Attribute5.

Coefficients Standard tStat

Errors

Intercept 1,500.00 5.05 297.17

Price -347.00 5.05 -68.75

Zoom 257.75 5.05 51.06

Img. Quality 321.38 5.05 63.67

LCD Scr. Size 121.00 5.05 23.97

Battery Life 283.13 5.05 56.09

R-squared =0.99, F-stat=3021

5 MODEL RESULT

People like to look for price, but not like to

compromise price for zoom. It means people like to

pay more for higher zoom. The results can be

summarized into two points.

1. All product features were considered by people

when they choose cameras.

2. If there is no major surprises, they preferred:

• Lower prices (negative coefficient)

• Large zooms (positive coefficient)

• Higher image quality (positive coefficient)

• Larger LCD screens (positive coefficient)

• Longer battery life (positive coefficient)

But price and image quality are most critical since

they have the highest coefficients in the model.

How do we use model results in the future

marketing? We can use this result to predict the

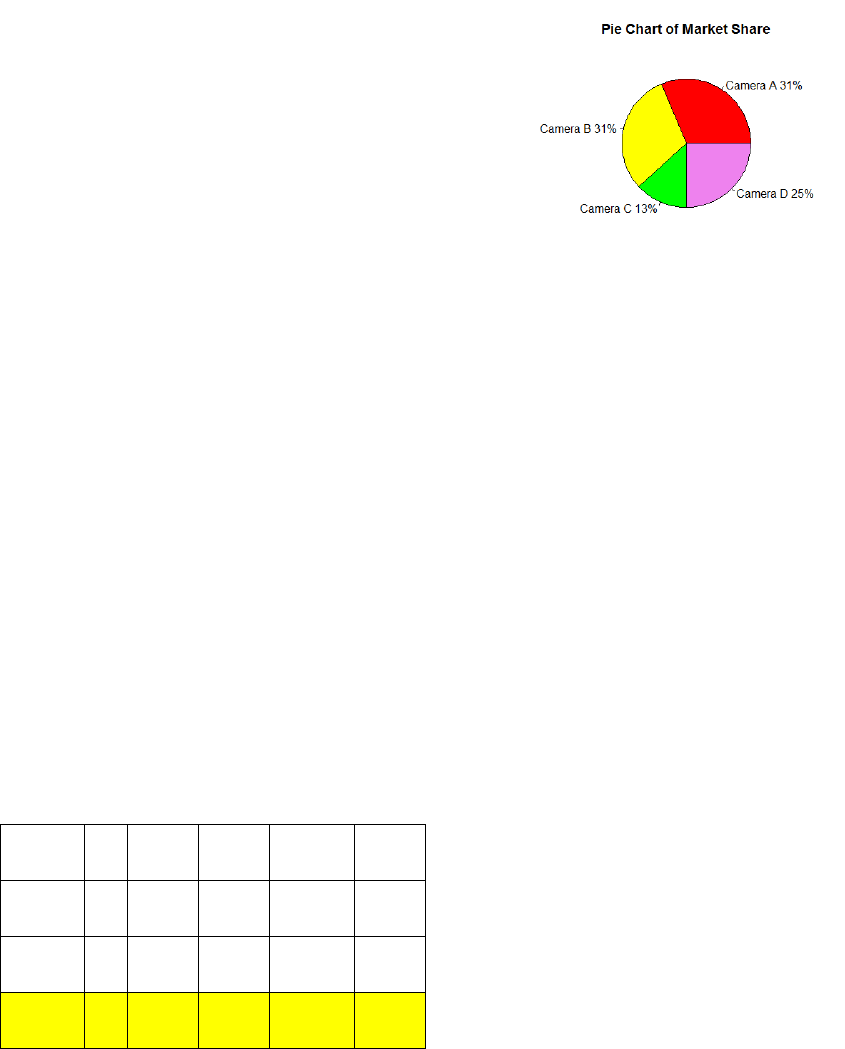

market share in the future. Here is an example:

Camera A: 185 7x zoom 12.1 mg 3.1 in LCD

300

photo

b

attery

Camera B: 225 7x zoom 14.2 mg 3.1 in LCD

300

photo

b

attery

Camera C: 225 7x zoom 12.1 mg 3.1 in LCD

125

photo

b

attery

Camera D: 185 4x zoom 14.2 mg 3.1 in LCD

125

photo

b

attery

If I want to introduce camera D, what would be

the market share be, comparing to other 3

competitors?

Using the model for the matrix of the example to

calculate the predicted frequencies, and look at the

proportions, and the proportion tells us the relative

preferences and shares of digital cameras in the

market.

6 DISCUSSION

Share in a market model is known as "Share of

Preference". This is the expected share if customers

knew all the information and all the products had the

same level of distribution. If prices and costs are

known, the model can be extended to include revenue

and profit potential.

Models can have extra parameters to take external

effects into account, so providing models that are

more closely related to reality reflects the real market.

A further element missing from this simple model is

the ability to look at different subgroups and

segments to see if a range of products could do better

than a single product in the market. Market models

are very valuable tools in the process of strategic

analysis.

Note that the ratings must reflect what your

customers perceive the position to be. Often

customers' perceptions do not reflect reality and so

changing the ratings on the attributes may be more

about communication than changing the actual

delivery. Often we find that simple service features

such as delivery, availability of help, keeping

promises and so on can have greater psychological

effects on customers, therefore have more significant

market effects than changing price or specific product

features. Market modeling, also known as a market

simulation, is one of the key strengths of Conjoint

Analysis.

There are other types of market models for other

types of trade-off research such as Pricing Research

Market Share Research Using Conjoint Analysis on Digital Cameras

231

or Brand-Price Trade Off Research. Models are a

major benefit of trade-off studies over other forms of

quantitative market research.

REFERENCES

Green, P. and Srinivasan, V. (1978) Conjoint analysis in

consumer research: Issues and outlook, Journal of

Consumer Research, vol 5, September 1978, pp 103–

123.

Marder, E. (1999) The Assumptions of Choice Modeling

Green, P. Carroll, J. and Goldberg, S. (1981) A general

approach to product design optimization via conjoint

analysis, Journal of Marketing, vol 43, summer 1981,

pp 17–35.

Richard T (2010). Journal of Choice Modelling, vol 3,pp

57–72.

Swait, Joffre (1998). "Combining sources of preference

data". Journal of Econometrics, vol 89: pp 197–221.

Luce, R. Duncan (1959). Conditional Logit analysis of

qualitative choice behavior. New York: John Wiley &

Sons.

Zarembka, Paul (1974). Frontiers in Econometrics. New

York: Academic Press. pp. 105–142.

APPENDIX

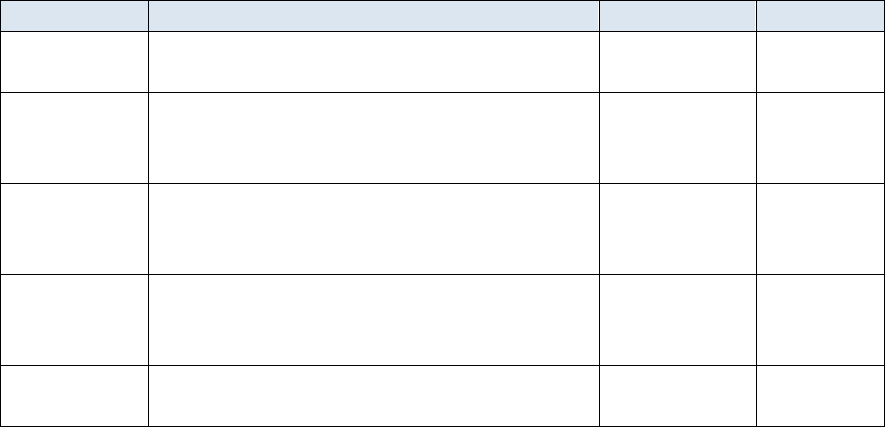

Attributes Description Level 1 (-1) Level2 (+1)

Price

The price indicates the amount you would pay for the camera in

your local shop.

$ 185 $ 225

Zoom

This is how much the camera can offer a 'close up' of what you are

looking at. A greater zoom indicates you can get a better 'close up'

image.

4x optical 7x optical

Image Q/ty

This is how detailed the picture is when stored by the camera. A

higher image quality indicates you can print a larger version of the

p

hoto.

12.1 meg 14.2 meg

LCD Scr. Size

This is the size of the LCD display on the back of the camera. A

larger LCD offers a better preview of you photo when you take it.

2.3 in 3.1 in

Battery Life

This is how many photos the camera can take before it needs to

have the battery re-charged.

125 photos 300 photos

Seventh International Symposium on Business Modeling and Software Design

232