Bonus Share Issues and Announcement Effect in Indonesia Stock

Exchange

Ani Pinayani

Universitas Pendidikan Indonesia, Jl. Dr. Setiabudhi 229, Bandung, Indonesia

ani_pinayani@yahoo.co.id

Keywords: Bonus Share, Trading Volume, Stock Return.

Abstract: The purpose of this study is to find out the bonus effect of stock announcement events on stock trading volume

and stock returns in Indonesia Stock Exchange (IDX). The research method used in this study is event study.

The research population consisted of companies that made the announcement of bonus shares for the period

January 2001 - January 2013, the research sample was selected from 23 companies by using purposive

sampling technique. Data analysis techniques to test the hypothesis using t-test with One-Sample Test, Paired-

Sample Test and One-Way Anova Test. The result of the research shows that (1) The announcement of

bonus shares has no effect the stock trading volume; (2) The announcement of bonus shares has

no effect the stock returns; (3) The average value of trading volume of shares prior to the announcement

of bonus shares is equal to after the announcement of bonus shares; (4) The average return value of shares

prior to the announcement of bonus shares is equal to after the announcement of bonus shares; (5) The average

value of stock trading volume is relatively the same among each industry sector that has announced bonus

shares; (6) The average value of stock returns is relatively the same among each industry sector that has

announced bonus shares.

1 INTRODUCTION

The results of research in Australian, Indian, Chinese,

USA and Indonesia capital markets show some

differences or gaps of research results, among others,

the announcement of bonus shares supports signaling

hypothesis means that the announcement of bonus

shares shows a positive and significant price reaction

by market participants (Balachandran and Tanner,

2001; Lukose and Rao, 2002). While the results of

research Miller and Rock (1985), Mishra (2005),

Suganda (2007) showed that the distribution of bonus

shares provide a negative signal. This indicates that

the publication of bonus shares is considered as an

anticipative measure against the company's bad cash

flow. The announcement of bonus shares based on the

theory described by Miller and Modigliani (1961)

shows that the company does not receive cash flow so

that the company's financial position remains or does

not change.

The results of Barnes and Ma (2002) research on

the influence of bonus stocks on market reaction in

China are counter to Miller and Modigliani theory

(1961) the companies that distribute bonus shares

with small ratios do not affect shareholder wealth

while companies that distribute bonus shares with

medium and large are tend to increase shareholder

wealth.

The results of Ardiansyah’s research (2002)

showed a significant difference between stock trading

volume before and after the announcement of bonus

shares. The market responded negatively to the

announcement of bonus shares indicated by the

average trading volume of shares before the

announcement is greater than the average trading

volume of shares after the announcement of bonus

shares. In the manufacturing industry, the market

does not react to the announcement of bonus shares,

while in the non-manufacturing industry, the market

responds to the announcement negatively and

significantly. Based on the pre-crisis period of 1993-

1997, the market did not react to the announcement

of bonus shares, while in the company that announced

bonus shares in the crisis (1997-1999), the market

showed a significant negative reaction.

The results of Lasrado and Rao research (2009)

show that firms that distribute bonus shares with a

1:1 ratio are significantly reacted by market

participants, while the ratio is 1:2, 2:1, and otherwise

has no significant difference before and after the

announcement of bonus shares.

Pinayani, A.

Bonus Share Issues and Announcement Effect in Indonesia Stock Exchange.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 105-109

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

105

Signaling hypothesis explains that the

announcement of bonus shares is a positive signal

which is given by management to the public because

the company is considered to have good prospects in

the future (Megginson, 1997). Investors gave a

positive response to the announcement of this bonus

stock with the expectation of a larger return in the

future. There are controversy between the theory with

the results of the research mentioned above, the writer

are interested in conducting further analysis of the

effect of the announcement of bonus shares made by

the company against the capital market reaction,

especially against Volume of stock trading and stock

return on Indonesia Stock Exchange.

Corporate action by sharing bonus shares will

create different interpretations for each market

participant. Bonus share distribution announcements

can have both positive and negative information. The

positive content of information occurs when investors

respond to the information as a good signal because it

assumes that a company with good prospects is able

to distribute bonus shares to its shareholders.

Negative information content occurs because

investors think that companies are not able to

distribute bonuses in the form of cash due to financial

problems which is facing by the company. Corporate

action is the activity of issuers that affected the

number of shares in circulation and the stock price in

the market (Basir and Fakhrudin, 2005).

The purpose of this research is to know (1) The

effect of bonus stock announcement on stock trading

volume and return value of shares in the company that

make announcement of bonus shares during the event

period; (2) The average difference between the stock

trading volume before and after the announcement of

bonus shares; (3) The average difference between

stock returns before and after the announcement of

bonus shares; (4) The differences in the average value

of trading volume of shares of each industry sector

during the period of bonus stock announcement

events; (5) Differences in the average return value of

shares of each industry sector during the period of

bonus stock announcement events.

2 METHODS

The method used in this research is Event Study.

Testing information content is purposed to see the

reaction of an event. If the announcement contains

any information, then the market will react at the time

the announcement is received. Market reaction is

indicated by changes in stock prices. Investors always

use the benchmark return is the comparison between

the current stock price with the previous stock price.

Especially in the event study that studies the specific

event, the benchmark used is the abnormal return.

The population in this study is a company listed on

the Indonesia Stock Exchange which made the

announcement of bonus shares for observation period

from January 2001 to January 2013 as many as 42

companies. Samples of 23 companies were selected

using Purposive Sampling technique. This research

data is secondary data from IDX statistics, daily stock

price list from www.yahoofinance.com, corporate

action schedule from www.ksei.co.id. Data analysis

techniques to test the hypothesis using t-test One-

Sample Test, t-test Paired-Sample Test, and One-

Way Anova Test.

Based on theoretical framework, hypothesis in

this research are as follows:

1. The announcement of bonus shares influences the

stock trading volume.

2. The announcement of bonus shares affect the

stock return.

3. There is an average difference between the stock

trading volume before and after the bonus stock

announcement event.

4. There is an average difference between stock

returns before and after the announcement of

bonus shares.

5. There is a difference in the average value of trading

volume of shares of each industry sector that

announces bonus shares.

6. There is a difference in the average value of stock

returns from each industry sector that announces

bonus shares.

3 RESULTS AND DISCUSSION

3.1 Results Study

The object of this research is a company listed on the

Indonesia Stock Exchange and announcement of

bonus shares during the observation period from

January 2001 to January 2013 of 42 companies.

Based on sample selection which refers to Purposive

Sampling technique, 23 companies are selected as

sample because there are companies that do not meet

the criteria.

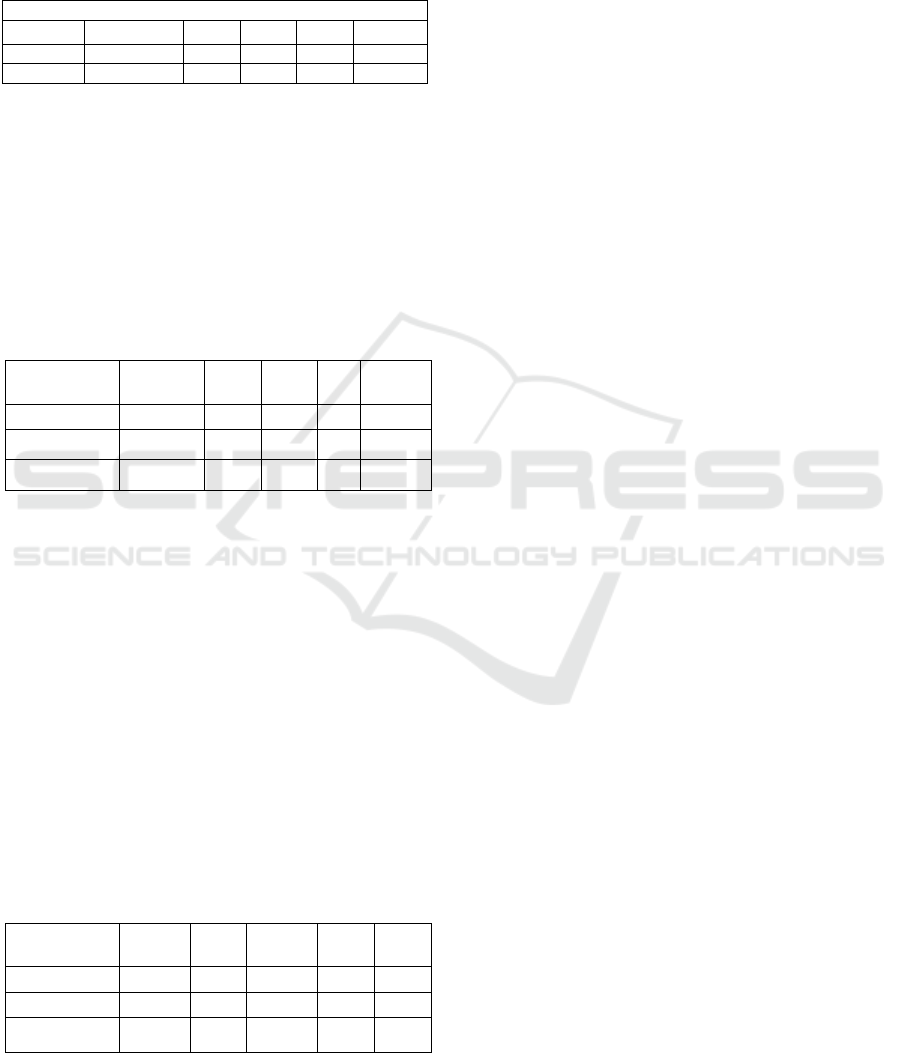

Results of hypothesis testing 1 and 2 in Table 1

obtained the value of t -1.119 and -.512 with

significance levels .275 and .614 ( > .05) hypothesis

testing results are not significant meaning the

Table 1: One-Sample Test Trade Volume and Stock Return

t

df

Sig.

Trade Volume

-1.119

22

.275

Stock Return

-.512

22

.614

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

106

Information content in the announcement of

bonus shares has no effect on stock trading volume

and stock returns.

Table 2: Paired Samples Test Trade Volume and Stock

Return

Paired Differences

Mean

SD

t

df

Sig.

Volume

-7.07 E-2

.339

-1.00

22

.328

Return

-1.2 E-3

.049

-.119

22

.906

Results of hypothesis 3 testing in Table 2 obtained

the value of t - 1,000 and the level of significance .328

(> .05). Hypothesis testing is not significant means

there is no difference in average trading volume of

stock before and after the event of bonus stock

announcement. Result of hypothesis test 4 is obtained

t -0,0119 and significance level of .906 (> .05)

means there is no difference of stock return average

before and after bonus bonus announcement event.

Table 3: Anova Trade Volume among Industry Sectors

TVA Saham

Sum of

Squares

df

Mean

Square

F

Sig.

Between Groups

4.543

6

.757

.995

.428

Within Groups

257.109

338

.761

Total

261.652

344

The result of hypothesis testing of 5 in Table 3

obtained the value of F - .995 and significance level

of .428 (> .05), hypothesis test result is not significant

mean that the average value of trading volume of

shares for the seven industrial sectors is identical or

no significant difference The average value of stock

trading volume among the seven industry sectors that

make bonus share announcements.

Results of hypothesis testing 6 in Table 4

obtained value 1.919 and significance level .077 (>

.05), the results of hypothesis testing does not

significantly mean the average value of stock returns

for the seven industrial sectors is identical or no

significant difference in the mean value of return

shares among the seven industry groups announcing

bonus shares.

Table 4: Anova Return Stocks among Industry Sectors

Return Saham

Sum of

Squares

df

Mean

Square

F

Sig.

Between Groups

.010

6

.002

1.919

.077

Within Groups

.304

338

.001

Total

.314

344

3.2 Discussion

The results of hypothesis testing 1 shows that the

information content in the announcement of bonus

shares has no effect on stock trading volume activity.

Although judging from the average trading volume of

stocks rose and gave a positive signal.

The results of this study do not match the results

of Balachandran and Tanner (2001) research, Lukose

and Rao (2002) that support signaling hyphothesis

that bonus stock announcements show positive and

significant price reactions around the time of

announcements, bonus stock announcements bring

good information to the market.

The results of hypothesis 2 testing shows that the

information content in the announcement of bonus

shares has no effect on the returns. The result of the

average of abnormal return of stock has increased

during the observation period.

The results of this study were counter productive with

Balachandran and Tanner (2001), but in accordance

with Miller and Rock (1985), Mishra (2005) and

Suganda (2007) found that bonus share distribution

gave negative signals. When a company announces

bonus shares, it does not actually change shareholder

value. The announcement of bonus shares based on

the theory described by Miller and Modigliani (1961)

shows that the company does not receive cash flow so

that the company's financial position remains or does

not change. Companies that announce bonus shares

based on this theory are rated negatively by the

public. This indicates that the publication of bonus

shares is considered as an anticipatory action against

the company's bad cash flow.

The result of hypothesis test 3 shows that there is

no difference of average stock trading volume before

and after bonus stock announcement event. This

happens because of the anticipated bonus

announcement event bonus shares by investors.

The results of this study are counter to the results of

Balachandran and Tanner (2001) research, Lukose

and Rao (2002) that support signaling hyphothesis

that bonus stock announcements show a positive and

significant price reaction around the time of the

announcement, bonus stock announcements bringing

good information to the market. Results of this study

also counter with the study Ardiansyah (2002) who

found a significant difference between stock trading

volume before and after the announcement of bonus

shares.

Result of hypothesis 4 test shows that there is no

difference of stock return average between before and

after bonus share announcement event. This happens

because of the investor has anticipated the bonus

Bonus Share Issues and Announcement Effect in Indonesia Stock Exchange

107

shares announcement event. Results of this study are

appropriate and support the research of Miller and

Rock (1985) that the distribution of bonus shares

gives a negative signal. When a company announces

bonus shares, it does not actually change shareholder

value. The announcement of bonus shares based on

the theory described by Miller and Modigliani (1961)

shows that the company does not receive cash flow so

that the company's financial position remains or does

not change. Companies that announce bonus shares

based on this theory are rated negatively by the

public. This indicates that the publication of bonus

shares is considered as an anticipatory action against

the company's bad cash flow. This research is in

accordance with the research of Lasrado and Rao

(2009) found that firms that distributed bonus shares

with a 1: 2, 2: 1 ratio did not have significant

differences before and after the announcement of

bonus shares, while companies that distributed bonus

shares with 1: 1 ratio reacted Significant by market

participants.

Results of hypothesis testing 5 shows that the

average value of stock trading volume is relatively the

same for the seven industrial sectors or there is no

significant difference average value of stock trading

volume among the seven industry sectors that make

the announcement of bonus shares. Results of this

study counter the results of research Balachandran

and Tanner (2001) that supports signaling

hyphothesis that bonus stock announcements show a

positive and significant price reaction around the time

of the announcement, bonus stock announcements

bring good information to the market, bonus stock

announcements bring good information to the market.

The study was conducted in the Australian Capital

Market with a sample of financial firms, non-

financial and mining companies 1992-2000.The

results of this study also counter with the study

Ardiansyah (2002) who found a significant difference

between stock trading volume before and after the

announcement of bonus shares. The market

responded negatively to the announcement of bonus

shares indicated by the average trading volume of

shares before the announcement is greater than the

average trading volume of shares after the

announcement of bonus shares. Results of this study

are in accordance with Ardiansyah (2002) especially

in the manufacturing industry, the market does not

react to the announcement of bonus shares, while in

the non-manufacturing industry, the market responds

to the announcement negatively and significantly.

Results of hypothesis testing 6 indicate that the

average value of stock return is relatively the same for

the seven industry sectors or there is no significant

difference in average stock value among the seven

industry groups that make bonus share

announcements. Results of this study were counter to

the results of Balachandran and Tanner (2001)

research that supported signaling hyphothesis that

bonus stock announcements showed a positive and

significant price reaction around the time of the

announcement, bonus stock announcements brings

good information to the market. The existence of a

positive abnormal return is only for non-financial

companies and mining in contaminated or

uncontaminated conditions. Results of this study fit

and support the research of Ardiansyah (2002) found

that in the manufacturing industry, the market does

not react to the announcement of bonus shares, while

in the non-manufacturing industry, the market

responds to the announcement negatively and

significantly.

4 CONCLUSIONS

The result of the research shows that (1) The

announcement of bonus shares has no effect on stock

trading volume; (2) The announcement of bonus

shares has no effect the stock returns; (3) The

average value of trading volume of shares prior to the

announcement of bonus shares is equal to after the

announcement of bonus shares; (4) The average

return value of shares prior to the announcement of

bonus shares is equal to after the announcement of

bonus shares; (5) The average value of stock trading

volume is relatively the same among each industry

sector that has announced bonus shares; (6) The

average value of stock returns is relatively the same

among each industry sector that has announced bonus

shares.

Based on the limitations of this study, for further

research it is advisable: (1) Extend the observation

period, the longer the observation period, the more

number of companies will be used as research

samples; (2) Group companies that make bonus share

announcements with companies that do not perform

stock splits to compare, in order to more clearly

illustrate the effect of bonus share announcement

decisions; (3) In subsequent research research can be

extended by using research for similar industries only

because similar industries have more similar

properties; (4) Using control variables by dividing the

two economic conditions the pre-crisis period 2007

and the crisis after 2007.

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

108

REFERENCES

Balachandran, B. dan Tanner, S., 2001. Bonus Share Issues

and Announcement Effect: Australian Evidence. Social

Science Research Network Electronic Paper

Collection.

Balachandran, B., 2004. Further evidence on the

announcement effect of bonus shares in an imputation

tax setting. Global Finance Journal, Volume 15, Issue

2, August 2004, Pages 147-170

Barnes, M and Ma, S., 2002. The Behavior of China’s Stock

Prices in Response to The Proposal and The Approval

of Bonus Issues. Journal of Accounting Research.

Basir, Saleh dan Hendy M. Fakhrudin., 2005. Aksi

Korporasi. Jakarta: Salemba Empat.

Darmadji, T. & Fakhruddin, H.M., 2001. Pasar Modal di

Indonesia: Pendekatan Tanya Jawab. Edisi Pertama.

Salemba Empat, Jakarta.

Jones, C.P., 1996. Investment Analysis and Management.

Fifth Edition. Canada: John Wiley & Sons Inc.

Khan Fakru.Y. & Thoufiqulla, 2013. An Analysis of Bonus

Share Issued and its Impact on Share price with

Reference to NSE Listed Stocks in India. Acme

Intellects International Journal of Research in

Management. Vol- 4 No. 4 Oct 2013

Lasrado, C. and Rao, T.V. Narasimha., 2009. Analysis of

Stock Price Behavior around Bonus Issue: A Test of

Semi-Strong Efficiency of Indian Capital Market.

Bhavan International Journal of Business, 3,18-31

Lukose P. J., Jijo and Narayan Rao S., 2002. Does Bonus

Issue Signal Superior Profitability? A Study of The

BSE Listed Firms. Social Science Research Network

Electronic Paper Collection.

Megginson, William L., 1997. Corporate Finance Theory.

Addison-Wesley Educational Publishers Inc.

Miller, M.H. & F. Modigliani., 1961. Dividend Policy,

Growth and the Valuation of Share. Journal of

Business, 34.

Miller, M and Rock, K., 1985. Dividen Policy Under

Asymetric Information. Journal of Finance, 40.

Mishra, A.K., 2005. An Empirical Analysis of Market

Reaction Around the Bonus Issues in India. The ICFAI

Journal of Applied Finance, 11, 21-39.

Pradhan, S.K., Kasilingam, R., 2014. Impact of Bonus

Announcements on Share Price: Evidence from

Bombay Stock Exchange. Pacific Business Review

International. Volume 7, Issue 6, December 2014

Sharmila R, Nanjundaraj P.A., Thiyagarajan. R, 2015.

Volatility of Stock prices around Bonus share

Announcements. International Journal of Applied

Research 2015; 1(7): 701-706

Suganda, R., 2007. Kandungan Informasi Pengumuman

Saham Bonus: Studi Empiris di Bursa Efek Jakarta.

Tesis, Universitas Gajah Mada, Yogyakarta.

Bonus Share Issues and Announcement Effect in Indonesia Stock Exchange

109