The Importance of Financial Educations against Financial Stability

through Banking Sector and Higher Education in Indonesia

Aniek Hindrayani and Khresna Bayu Sangka

Sebelas Maret University, Indonesia

Keywords: Financial education, curriculum development, banking.

Abstract: Lacking of institutions collaboration and coordination between their financial educations’ stakeholders in

Indonesia during past years has become the major deficiency factor of financial literacy. This condition is

getting worse due to the insufficient higher education curriculum. The aim of this study is identifying how

the financial education program overcome this gap to create the financial stability and economic welfare. By

employing secondary data from Indonesian Statistical Bureau and Indonesian Central Bank, we analyzed with

descriptive statistics. This study found that deeper understanding on financial education is very important to

be improved especially for the national curriculum development that should be applied in higher education

which is collaborating with banking sector.

1 INTRODUCTION

The effects of financial crisis which suffered by

various nations in in the last decades has affected in

economic sector and many other sectors, while to

restore the economic condition would takes between

510 years’ time. One of the critical factor which

caused the financial crisis and the economic downturn

is the ignorance of financial literacy from the start,

starting from education sector. Furthermore, the lack

of protection of consumer finances in banking

industry has also triggered the crisis. The results of a

survey in Hungary on students who studied finance in

the faculty of economics shown that less than 50% of

respondents who know the financial literacy well

(Kovacs and Tertak, 2016). In Indonesia, banking

industry is lacks of an adequate, comprehensive,

integrated and properly planned education program to

build public understanding of finance and banking in

particular (Wibowo, 2013; Anonym, 2014;

Tambunan, 2015; and Kovacs and Tertak, 2016). The

relationships between banks and the universities

much more on the business site rather than on

education.

This study would like to identify how the financial

education program to overcome this gap and create

the financial stability and moreover for economic

welfare. To restore economic conditions and growth

requires an integrated strategy among various

stakeholders. The ultimate goal of financial education

is financial wellbeing. To achieve the objectives of

this study, we employ secondary data from

Indonesian Statistical Bureau (BPS) and Indonesian

Central Bank (BI).

Descriptive statistics method has been used to

analyze the data. The result of this study showed the

it is critical need to improve knowledge more on

finance education which could be developed in the

curriculum and implemented policy in the university

or higher degree education sector by incorporating a

collaboration between the commercial bank.

The following sections describe the literature

reviews, methods, discussion, and conclusion.

2 LITERATURE REVIEW

2.1 Financial Education

The concept of financial education explains that a

person's general knowledge of finance, for example,

knowledge of financial products, the financial sector,

and financial behavior can help to create the country's

economic stability (Hasting, et.al., 2013) Lack of

public knowledge about finance can be the cause of

unnatural economic behavior, such as

overproduction, excessive consumption, and

unnatural currency movements abroad (Wibowo,

2013). This factors could trigger the economic

conditions to fluctuate unpredictably.

110

Hindrayani, A. and Sangka, K.

The Importance of Financial Educations against Financial Stability through Banking Sector and Higher Education in Indonesia.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 110-115

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Financial knowledge will develop financial

behavior that is influenced by individual characters

such as personality into financial ability, so that in the

future will form a financial wellbeing. According to

the Consumer Financial Protection Bureau (2015),

financial wellbeing supported by financial ability

encompasses how to make financial decision, how to

process financial information to financial decision,

and how to execute financial decision.

Five major social group that had been identified

for education activities as stated by OECD (2013) are

as follows: (1) school children, (2) students, (3)

professional, (4) economic institution, and (5) other

group (including housewives and informal sectors)

There are several parties of National Strategy on

Financial Education which are responsible to to

organize and to create people’s awareness of financial

education. This strategy is an approach to (1)

recognises the importance of financial education, (2)

creating collaboration between stakeholders, (3)

establishing roadmap of finance stability in the period

of time, and (4) as a guidance for individual to apply

financial education strategy (OECD, 2013). National

Strategy on Financial Education describes as follows.

Financial education for public implies three

indicators, (1) improve awareness, (2) behavioral

changes, and (3) bank minded society. Banks as

financial intermediaries serve to maintain financial

stability and promote economic growth.

2.2 Financial Stability

Financial system stability is a condition in which

economic mechanisms in pricing, allocation of funds

and risk management function well and support

economic growth

(http://www.bi.go.id/id/perbankan/ssk/ikhtisar/defini

si/Contents/Default.aspx). While the instability of the

financial system is triggered by various causes and

turmoil, the market failure, which can be sourced

from external (international) and internal (domestic).

The financial system itself is accompanied by other

activities such as credit risk, liquidity risk, market risk

and operational risk.

The financial system supposed to be stable if: (1)

the monetary policy transmission is functioning

normally, (2) the function of banks and other financial

instruments as intermediary proceeds accordingly, (3)

public confidence in the financial system, and (5)

systemic crises can be addressed properly

(http://www.bi.go.id/id/perbankan/ssk/ikhtisar/penti

ngnya/Contents/Default.aspx)

Central Bank plays an important role on

implementing financial education program to five

major social groups (OECD, 2013). For school

children and students, central bank implemented

through the curriculum. Content of curriculum should

be supported with the learning tools, as mini bank,

student cards, and interactive games related with the

products of the bank.

According to the Indonesian Banking

Architecture, financial education increased through

financial literacy and consumer protection to enhance

financial stability. Increasing financial literacy should

be able to manage financial better, protect from unfair

practices of financial institutions, and self-reliance

when involving in financial activities

(http://www.bi.go.id/id/perbankan/arsitektur/Content

s/Default.aspx).

3 METHODS

3.1 Data

This study used secondary data sourced from BPS

and BI. In addition, data also obtained from university

websites that been used to identified the curriculum

containing financial education in the economics and

business department. BPS data was included national

income in various sectors, particularly financial and

insurance activities. The BI was employed to identify

data included the results of a consumer confidence

survey of future financial developments and the

position of public savings in commercial banks and

rural banks by ownership structure.

3.2 Sample

Sample of data was defined by Gross Domestic

Products (GDP), consumer confidence survey,

number of banks, and the curriculum. GDP seen from

the amount of contribution to GDP by industry.

Industry is grouped into 11 groups, while the data

collection period is 2011-2016. Survey data to the

consumer confidence using April 2017 data, on

society's expectation of the next economic condition.

Moreover, this study was also incorporate banks’ data

development as financial intermediary number from

year of 2012-2016.

The curriculum data drawn randomly which was

representative of the University throughout

Indonesia. The sample of the university included

Gadjah Mada University (UGM), Indonesia

University (UI), and Hassanudin University

(UNHAS) with the range of courses included in

finance education at Economic Science Program.

The Importance of Financial Educations against Financial Stability through Banking Sector and Higher Education in Indonesia

111

3.3 Data Analysis

Data analysis used statistic descriptive. The amount

of contribution to GDP by industry drawn by

percentage of each industry to the GDP. Outstanding

of private deposits showed by trend in the last 7 years.

While university curriculum showed by the table of

distribution of subject related with finance education

on undergraduate curriculum.

4 RESULTS AND DISCUSSION

In this section describes the data analysis supported

the purpose of the study, analyses how much the

contribution of the financial sector of industry to the

GDP, then identify the predictions of public

confidence in the development of financial condition

for the future. The predictions of public confidence in

the future would be supported by the ability of the

public to preserve funds in the bank. Data on the

number of banks and the number of colleges

represents the many opportunities of cooperation

between banks and universities to implement finance

education well.

4.1 National Income

Description of contribution in each industry sector

can be seen in the following table.

Table 1: Contribution of GDP by Industry (%)

Industry

2012

2013

2014

2015

2016

Agriculture,

Forestry and

Fishing

13.37

13.36

13.34

13.49

13.45

Mining and

Quarrying

11.61

11.01

9.83

7.65

7.21

Manufacturing

21.45

21.03

21.08

20.97

20.51

Electricity and

Gas

1.11

1.03

1.09

0.14

1.15

Water supply,

Sewage, Waste

Management and

Remediation

Activities

0.08

0.08

0.07

0.07

0.07

Construction

9.35

0.49

9.86

10.21

10.38

Wholesale and

Retail Trade,

Repair of Motor

Vehicles and

Motorcycles

13.21

13.21

13.43

13.31

3.19

Table 1. Cont.

Transportation

and Storage

3.63

3.93

4.42

5.02

5.22

Accommodation

and Food Service

Activities

2.93

3.03

3.04

2.96

2.92

Information and

Communication

3.61

3.57

3.5

3.52

3.62

Financial and

Insurance

Activities

3.72

3.88

3.86

4.3

4.2

Real Estate

Activities

2.76

2.77

2.79

2.84

2.81

Business

Activities

1.48

1.51

1.57

1.65

1.71

Public

Administration

and Defense;

Compulsory

Social Security

3.95

3.9

3.83

3.9

3.86

Education

3.14

3.22

3.23

3.36

3.37

Human Health

and Social Work

Activities

1

1.01

1.03

1.07

1.07

Other Services

Activities

1.42

1.47

1.55

1.65

1.71

Source: bps.go.id

From Table 1 above, the contribution of Financial and

Insurance Activities is not stable, with the range from

3.72% to 4.2%. This contribution is much lower than

industry of Agriculture, Forestry and Fishing, Mining and

Quarrying, Manufacturing, and Wholesale and Retail

Trade, Repair of Motor Vehicles and Motorcycles. As an

industry sector that serves to maintain monetary stability,

its role has not been optimal.

4.2 Prediction of public confidence

The results of consumer surveys indicate that people remain

optimistic about the financial condition of the next period,

considering from income expectations, expectations of job

availability, and expectations of business activities as

mentioned at Bank Indonesia website:

(http://www.bi.go.id/id/publikasi/survei/konsumen/Docum

ents/SK%20April%202017.pdf)

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

112

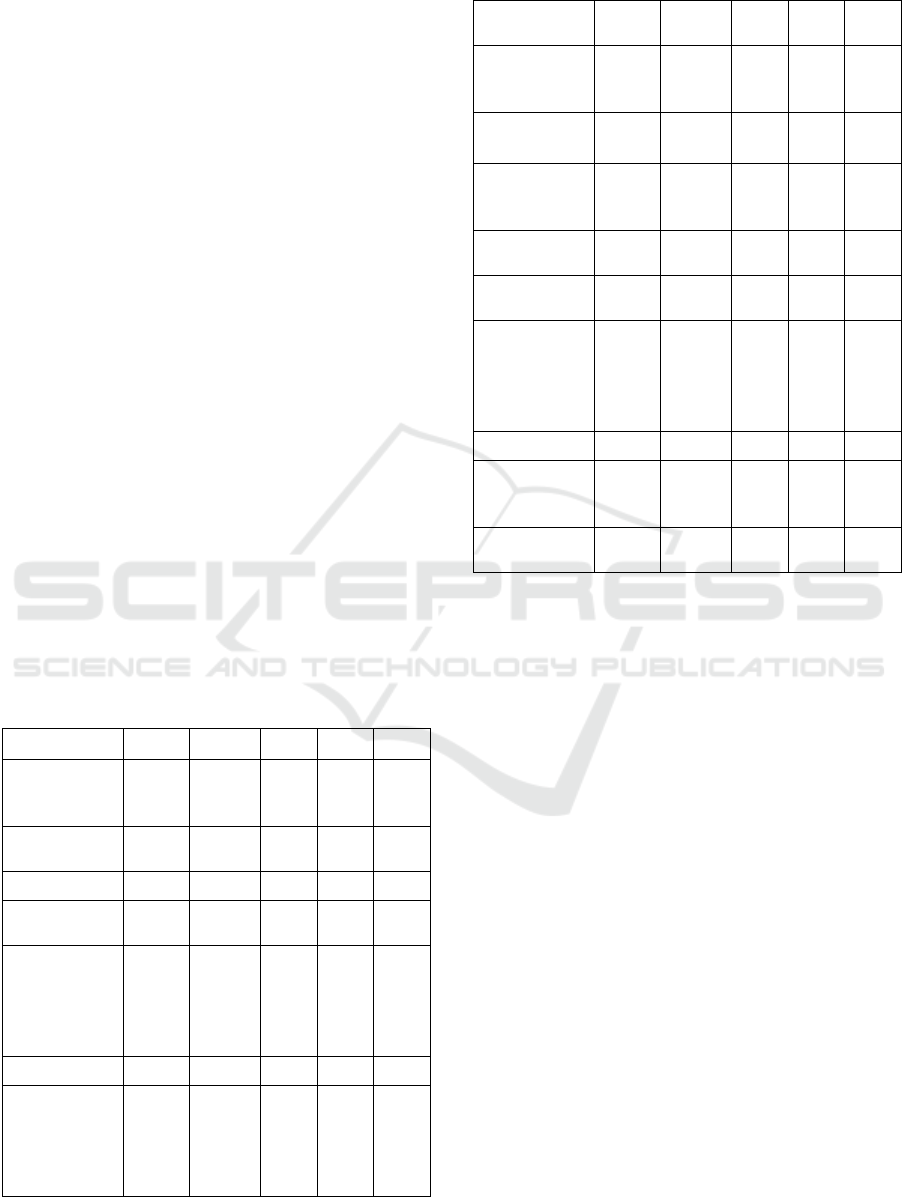

Figure 1: Developments in consumer expectations index

(Source: www.bi.go.id, data processed)

From Figure 1, people tend to be optimistic about the

upcoming financial condition, this indicate public

confidence in the country's financial stability tends to

increase.

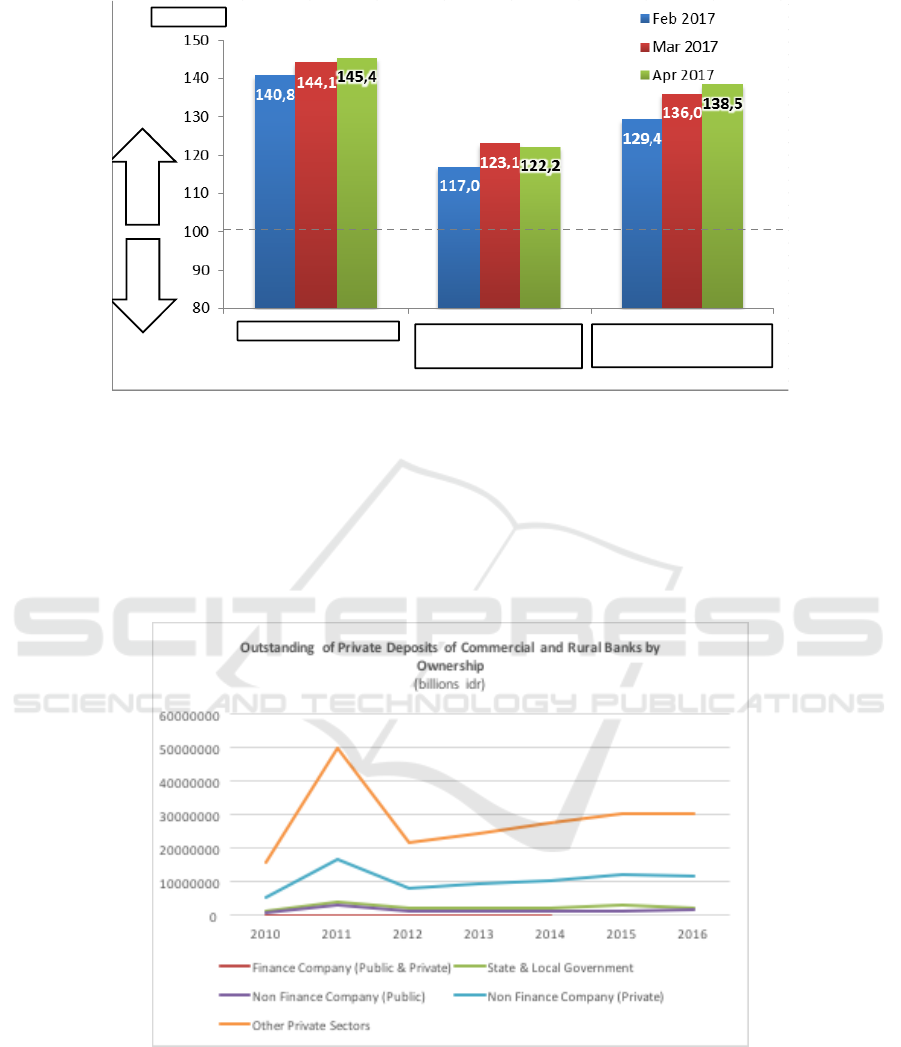

4.3 Outstanding of Private Deposits

The number of bank in Indonesia has reach 120 commercial

banks and 1837 rural banks. Outstanding of private deposits

of commercial and rural banks by ownership figured

bellow.

Figure 2: Outstanding of Private Deposits of Commercial and Rural Banks by Ownership (www. bi.go.id, data processed)

From figure 2, other private sector has a tendency to

save more money to the bank than with the others sector

Other private sector includes foundations, social

institutions, civic organizations, cooperation, and

individual, which is not for profit sector. There was still

many chance to enhance business sector to reap sustainable

economic conditions.

4.4 University Curriculum

Indonesia has reach 78 state universities and hundreds

private universities (snmptn.ac.id), and most of them has

index

IncomeExpectations

ExpectationsofJob

Availability

ExpectationsofBusiness

Activities

OPTIM

ISM

PESIM

ISM

The Importance of Financial Educations against Financial Stability through Banking Sector and Higher Education in Indonesia

113

economic department, which are studying economics to

understand and develop finance education from the

faculty’s curriculum. Data of curriculums were employed

from universities which had Economic and Business

Faculty, state universities were represented by UGM, UI,

and UNHAS. The subject of the study could be seen on the

following table.

Table 2: Subjects Related with Finance Education

No

Subject

1

Accounting Introduction 1

2

Accounting Introduction 2

3

Monetary Economics 1

4

Monetary Economics 2

5

Workshop / Seminar on Monetary Economics

6

Financial Management 1

7

Financial Management 2

8

Portfolio Theory and Analysis

9

Public sector accounting

10

Banks and Financial Institutions

11

Centralized Bank

12

Economics of Finance

13

Sharia Economics

14

State and Local Finance

15

Monetary Policy in Development

Source: University website, processed

From Table 2 above, Gadjah Mada University has

63.2%, Indonesia University has 21%, and

Hassanuddin University has 15.79% of the subjects

related with Finance Education. On average, it is only

33.33% subjects related with Finance Education in

Economic Science Department curriculum.

5 CONCLUSIONS

Education institution, especially higher degree

institution such as university, take a vital position in

enhancing the better financial literacy among

Indonesian. Surprisingly, there are no specific

regulation in how the curriculum should incorporate

accordingly in higher education program. As this

study aims to identify how the financial education

program overcome the gap between deficiency factor

of financial literacy and the financial stability and

economic welfare in Indonesia. Lacking of public

knowledge of financial literacy in the long run caused

people not having good economic behavior, thus

exacerbating the country's economic condition.

Furthermore, the finding also showed the lack of

institutions collaboration and coordination between

their financial educations’ stakeholders. This

condition is getting worse due to the insufficient

higher education curriculum. It is very important to

improve deeper understanding on financial education

especially for the national curriculum development

and applying in higher education which is

collaborating with banking sector to optimize the

bonding between those parties

As there are 120 commercial banks and 1837 rural

bank, there are many chances and opportunities to

develop collaboration between the universities or

higher degree institutions to increase finance

education to a perceived level. Certainly from the

applied curriculum in which runs in economic and

business faculty or related department is easier to

achieve rather than any other faculties. So it is

important to create an initiating program between

higher education institution and banking sector

trough financial education and counselling or the

other interactive programs such as game based or

event based program which will increase students’

awareness and initiative to learn and knowing more

about related issues. It also can be used to get proper

and match inputs for curriculum development.

Furthermore it will improve the financial managerial

skills, attitude and behavior amongst the higher

educations’ members.

REFERENCES

Anonym. 2012. Financial Education in Indonesia

Experiences and Evaluation. Bank Indonesia: Banking

Research and Regulation Directorate

_______. 2013. Advancing National Strategies for Fi-

nancial Education. A Joint Publication by Rus-sia’s

G20 Presidency and the OECD

_______. 2014. Booklet Keuangan Inklusif. Departemen

Pengembangan Akses Keuangan dan UMKM Bank

Indonesia.

_______. 2015. Financial well-being: The goal of fi-

nancial education. Consumer Financial Protec-tion

Bureau.

_______. 2015. National Strategies for Financial Edu-

cation. OECD/INFE Policy Handbook.

Atkinson, A. and F. Messy. 2013. “Promoting Financial

Inclusion through Financial Education: OECD/INFE

Evidence, Policies and Practice”, OECD Working

Papers on Finance, Insurance and Private Pensions,

No. 34, OECD. Publishing.

http://dx.doi.org/10.1787/5k3xz6m88smp-en

Faboyede, Olusola Samuel, Ben-Caleb, Egbide, Oyewo,

Babajide and Faboyede, Adekem. 2015. Financial

Literacy Education: Key to Poverty Alleviation and

National Development in Nige-ria. European Journal

Accounting Auditing and Finance Research. Vol.3,

No.1, pp.20-29.

Haffar, Warren and Crenshaw, Sandra. 2012. The Faces of

Peace: NGOs, Global Education, and Univer-sity

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

114

Curricula. Peace Research, Vol. 44/45, No. 2/1, pp.

193-209.

Hans H. Jenny. 1979. Institutional Financial Assess-ment:

Methodology and Meaning. Research in Higher

Education, Vol. 10, No. 1, AIR Forum Issue, pp. 59-70.

http://www.jstor.org/stable/40195302

http://www.bi.go.id/id/perbankan/ikhtisar/lembaga/Conten

ts/Default.aspx

http://www.bi.go.id/id/publikasi/survei/konsumen/Docum

ents/SK%20April%202017.pdf

https://web.snmptn.ac.id/ptn

https://www.bps.go.id/

Justine S. Hastings, Brigitte C. Madrian, and William L.

Skimmyhorn 2013. Financial Literacy, Financial

Education and Economic Outcomes. Annu Rev

Econom. (2013) May 1; 5: 347–373.

doi:10.1146/annurev-economics-082312-125807.

Klapper, Leora; Lusardi, Annamaria and Panos, A.

Georgios. 2012. Financial Literacy and the Fi-nancial

Crisis. Network for Studies on Pensions, Aging and

Retirement Discussion Paper.

Kovács, Levente and Terták, Elemér 2016. Financial

Literacy (Panacea or placebo? – A Central Eu-ropean

Perspective). Verlag Dashöfer, vyda-vateľstvo s.r.o.,

Železničiarska 13 Bratislava 814 99 Slovakia

Purtell, M. Robert and Fossett, W. James. 2010. Beyond

Budgeting: Public-Service Financial Education in the

21st Century. Journal of Public Affairs Education, Vol.

16, No. 1, pp. 95-110.

Tambunan, Tulus. 2014. Financial Education: Indonesian

Experience. Financial Access and SME Development

Department Bank Indonesia. JSFA-ADBI-IMF Joint

Conference.

______________. 2015. Financial Inclusion, Finan-cial

Education, and Financial Regulation: A Sto-ry from

Indonesia. ADBI Working Paper Series. No. 535. June.

Wibowo, Pungky P. 2013. Financial Education for Fi-

nancial Inclusion: Indonesia Perspec-tive. Department

of Banking Research and Regulation Bank Indonesia.

Wicaksono, Y. Teguh and Friawan Deni. 2011. Recent

Developments in Higher Education in Indone-sia:

Issues and challenges. ANU Press.

http://www.jstor.org/stable/j.ctt24h3c0.11

The Importance of Financial Educations against Financial Stability through Banking Sector and Higher Education in Indonesia

115