Zakat Literacy among University Students and Factors Influenced It

Clarashinta Canggih, Rachma Indrarini and Prayudi Setiawan Prabowo

Islamic Economic Study, Economic Faculty, Universitas Negeri Surabaya, Surabaya, Indonesia

{clarashintacanggih, rachmaindrarini, prayudiprabowo}@unesa.ac.id

Keywords: Zakat Literacy, Islamic Economics Student, Age, Gender, Knowledge.

Abstract: Zakat is one of obligatory worship that could lessen economic disparity among people. However, there is

wide gap between potency and realization of zakat fund in Indonesia. One of the possible sources of the zakat

gap is the lack of zakat literacy in the society. This research aimed to identify zakat literacy of Islamic

Economics Students Universitas Negeri Surabaya (UNESA). Furthermore, it aimed to identify factors that

influenced zakat literacy. This research used descriptive approach through primary data collection from

questionnaire to understand the level of zakat literacy among Islamic Economics students and descriptive

quantitative approach to determine factors that influence zakat literacy level through regression analysis. The

participants of the research were 127 students. The result showed that the zakat literacy of Islamic Economics

student is on medium level. Furthermore, it showed that age and knowledge about zakat have significant

impact toward student zakat literacy level, while gender has no significant impact.

1 INTRODUCTION

Zakat is one of obligatory worship that has economic

impact in wealth distribution among people. It can

decrease economic gap within society, escalate

economic development as well as purchasing power

parity which could eradicate poverty (Canggih,

Fikriyah, Yasin, 2017; Syahrullah and Ulfah, 2016).

Zakat can be used as a solution to alleviate disparity

and poverty rate evenly through zakat management

by zakat institution in order to distribute it widely.

By its nature, zakat can be classified into two:

zakat fitrah and zakat maal. Zakat fitrah is a

compulsory payment that must be paid during

Ramadhan by each Muslim, whereas zakat maal is

obligatory for wealth acquired by Muslim. Abu Bakar

(2007) and Qardawi (1999) distinguish wealth

considered as zakat obligatory into traditional

perspective (agricultural, mineral resources, gold,

cash, revenue, and livestock) and modern perspective

(salary, income from asset, and marketable

securities).

Indonesia is a country with the biggest Muslim

population worldwide, around 87.5% (Kemenag,

2013). Hence, it is obvious that Indonesia zakat

potency is very big. PIRAC estimates that in 2004 the

amount of zakat potency in Indonesia reached IDR

6.132 trillion (Kurniawati, 2004). Firdaus, Beik,

Irawan, and Juanda (2012) explained that total

amount of Indonesia zakat potency, including

household salary, company revenue, and saving, is

IDR 217 trillion, equal to 3.4% Indonesia GDRP in

2010. Furthermore, Canggih, Fikriyah, Yasin (2017)

estimated the zakat potency, particularly zakat on

income, in Indonesia on 2015 around IDR 82 trillion.

However, there is wide gap between potency and

realization of zakat in Indonesia. The huge amount of

zakat potency is not within reach on zakat realization.

In 2011-2015, there were very wide gap between

potency and realization, particularly zakat on income,

the amount of zakat realization only reaches 1% of

total potency in the same period (Canggih, Fikriyah,

Yasin, 2017).

Khamis et all (2014) and Siswantoro and

Nurhayati (2012), mentioned that most of Muslim do

not really care, even neglect to pay, about zakat maal.

Somehow, it shows that almost half of Muslim in

Indonesia has less motivation to pay zakat (Mukhlis

and Beik, 2013). Furthermore, IMZ and PEBS

(2009), Infoz (2011), and Syahrullah and Ulfah

(2016) found that one of the factors that contributes

to gap of zakat potency and realization is the level of

understanding regarding zakat obligation is low. That

contrasts with the fact that Muslim population in

Indonesia is the majority. Besides, knowledge

religion, particularly about zakat, has been taught on

146

Canggih, C., Indrarini, R. and Prabowo, P.

Zakat Literacy among University Students and Factors Influenced It.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 146-150

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

the early age of children, which should result in

sufficient knowledge about zakat.

Kamus Besar Bahasa Indonesia defined literacy as

quality or ability to understand letter including ability

to read and write (KBBI, 2016). However, literacy

particularly concern on individual ability to

understand and recognize ideas that visually

delivered. There are many researches about literacy,

either financial or media. Nidar and Bestari (2012)

defined personal financial literacy as a competency to

know, understand, and evaluate information about

personal finance.

However, there is no research about zakat literacy

so far. Thus, zakat literacy can be defined as

individual ability to know and understand about zakat

from its definition, type, and zakat management

institution. In simple way, zakat literacy can be

grouped into three groups, basic knowledge about

zakat, zakat calculation, and zakat payment method.

Zakat knowledge comprises of definition of zakat,

types of zakat, time of zakat payment, percentage of

zakat payment. Zakat calculation covers rules to

calculate several types of zakat. Zakat payment

method encompasses identification of zakat

institution (OPZ), payment method, OPZ program,

OPZ right and obligation.

Furthermore, there is no measurement regarding

zakat literacy level. However, there are several

classifications of financial literacy level from

literatures that can be used to classify zakat literacy

level. The Financial Services Authority (OJK)

(2013), classified financial literacy level, particularly

Indonesian, from Financial Literacy Survey 2013 into

four categories namely (1) well literate (21.84%), (2)

sufficient literate (75.69%), (3) less literate (2.06%),

(4) not literate (0.41%). The first category shows

sufficient knowledge and trust about financial

institution and financial services product, includes

features, benefit, risk, right and obligation about

financial product and services, as well as ability to use

financial product and services. The second category

shows sufficient knowledge and trust about financial

institution and financial services product, includes

features, benefit, risk, right and obligation about

financial product and services. The third category

shows knowledge about financial institution and

financial services product. The fourth category shows

no knowledge and trust about financial institution and

financial services product, as well as no ability to

utilize financial services product.

Danes and Hira (1987) and Volpe, Chen, and

Pavlicko (1996) classified financial literacy level into

three category namely (1) more than 80%, (2) 60% to

79%, and (3) below 60%. The first category

represents a relatively high level of financial

knowledge. The second category represents a

medium level of financial knowledge. The third

category represents a relatively low level of financial

knowledge. This classification is formed from the

percentage of respondent correct answer from series

of question about financial literacy.

Several studies about financial literacy among

young people and students show that students lack

knowledge about finance (Chen and Volpe, 1998),

financial literacy level of students are considerably

low (Beal and Delpachitra, 2003), young people has

low financial literacy (Lusardi, Mitchell, and Curto,

2010), comes within the low category, and therefore

needs to be improved (Nidar and Bestari, 2012),

Factors that influence financial literacy can be

categorized as demographic/personal (Chen and

Volpe 1998; Worthington 2006; Beal and Delpachitra

2003), social and economic characteristics

(Worthington, 2006), financial experience (Peng,

Bartholomae, Fox, and Cravener, 2007), level of

education (Lusardi, Mitchell, and Curto, 2010; Nidar

and Bestari, 2012; Sarigul, 2014), economic

condition (Worthington, 2006), and family

characteristics (Lusardi, Mitchell, and Curto, 2010).

The factors that are analyzed are demographic

characteristics, and level of education.

The elements categorized as demographic

characteristics are gender (Beal and Delpachitra,

2003; Chen & Volpe, 1998; Worthington, 2006;

Lusardi, Mitchell, and Curto, 2010), age

(Worthington, 2006; Nidar and Bestari, 2012), and

class rank or level of education in university (Nidar

and Bestari, 2012; Sarigul, 2014).

So far, researches about zakat are talking about

factors that affected obedience of zakat payer, zakat

management by zakat institution (UPZ), and intention

of muzakki to pay zakat. There is no research about

zakat literacy to identify the level of zakat knowledge

and understanding of people, particularly zakat payer.

Hence, this paper aims to measure the level of zakat

literacy of people, especially student of Islamic

Economic Program Universitas Negeri Surabaya.

Furthermore, this paper wants to probe about factors

that influenced literacy level such as gender, age, and

knowledge about zakat (class rank in university).

2 METHODS

This research used descriptive quantitative approach,

to understand the zakat literacy level among Islamic

Economics student as well as to determine the factors

that influenced zakat literacy level. The survey was

Zakat Literacy among University Students and Factors Influenced It

147

located at Faculty of Economics, Universitas Negeri

Surabaya, in the Islamic Economic Studies Program.

The population of this study was class of 2014, 2015,

and 2015. Data was taking through questionnaire.

Number of sample were 127 respondents, consist

of 48 male and 79 female. In terms of age, there were

1 respondent of 17 years old, 19 respondents of 18

years old, 47 respondents of 19 years old, 40

respondents of 20 years old, 19 respondents of 21

years old and 1 respondent of 22 years old. As for

knowledge variable, 31 respondents have taken the

course of Zakat Management, while 96 respondents

have not taken the course of Zakat Management.

Level of zakat literacy was defined from

descriptive approach, from data tabulation. As to

understand the factors that influenced zakat literacy

level, descriptive quantitative approach was used. It

used dummy variable regression, to find the factors

that possibly have influence to zakat literacy. The

model is used to accommodate the existence of

qualitative variables. The independent variables

consist of gender, knowledge, and age. Gender

variable consisting of male and female, the variable

of knowledge consist of have taken zakat

management course and have not taken zakat

management course, and age variable. While the

dependent variable, the financial literacy variable,

was derived from the score of the correct answer from

the questionnaire distributed.

Here is the regression model with the dummy

variable used in this study:

𝑌

𝑖

= 𝛽

0

+ 𝛽

1

𝐷

1

+ 𝛽

2

𝐷

2

+ 𝛽

3

𝑋

𝑖

(1)

Where: Y

i

= Zakat Literacy Level

X

i

= Age

D

1

= 1 if Male

= 0 if Female

D

2

= 1 if have taken Zakat Management

Course

= 0 if have not taken Zakat Management

Course

Hypothesis to be answered in this research is there

is an effect of independent variable to its dependent

variable.

3 RESULTS AND DISCUSSIONS

From data tabulation of primary data collection

through questionnaire that has been collected, it was

grouped in accordance to Danes and Hira (1987) and

Volpe, Chen, and Pavlicko (1996) criteria regarding

literacy level. Hence, the zakat literacy level of

Islamic Economics students of UNESA can be

described on table 1.

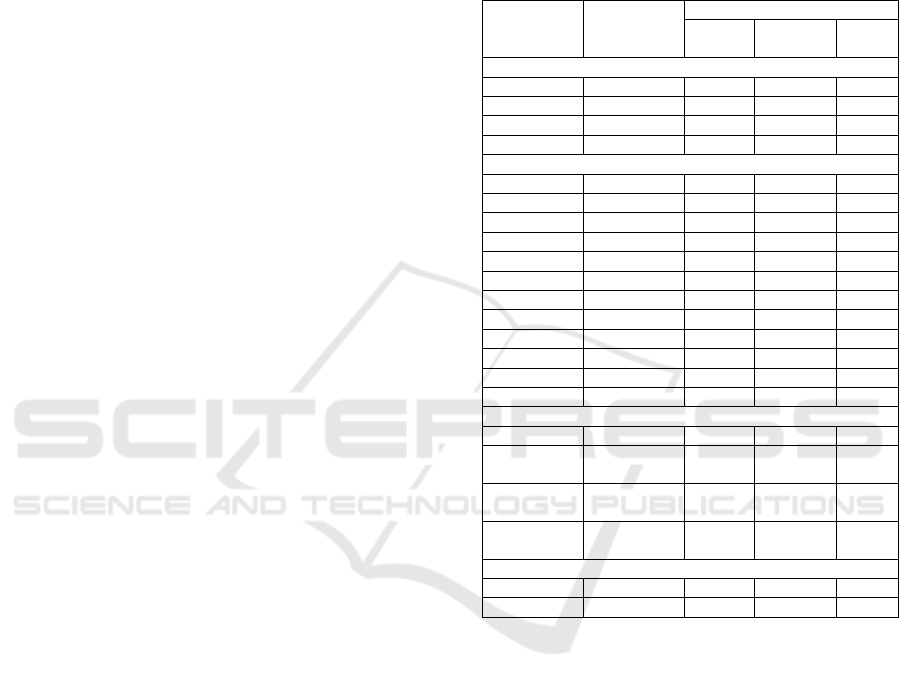

Table 1: Zakat Literacy Level of Islamic Economics

Student

Variable

Number

and

Percentage

Zakat Literacy Level

Low

Level

Medium

Level

High

Level

Gender

Male

Number

22

16

10

Percentage

17%

13%

8%

Female

Number

24

47

8

Percentage

19%

37%

6%

Age

17

Number

0

1

0

Percentage

0%

1%

0%

18

Number

4

11

4

Percentage

3%

9%

3%

19

Number

20

21

6

Percentage

16%

17%

5%

20

Number

17

18

5

Percentage

13%

14%

4%

21

Number

5

11

3

Percentage

4%

9%

2%

22

Number

0

1

0

Percentage

0%

1%

0%

Knowledge

Have Taken

Number

6

18

7

Zakat

Subject

Percentage

5%

14%

6%

Have not

Taken

Number

40

45

11

Zakat

Subject

Percentage

31%

35%

9%

Overall

Number

46

66

15

Percentage

36%

52%

12%

From table 1, it can be seen that zakat literacy of

Islamic Economics students can be classified into

three levels namely low level, medium level, and high

level. Overall the zakat literacy level of Islamic

Economics student is on medium level (52%). Only

12% of the student has high level of zakat literacy.

However, 36% of the student has low level of zakat

literacy.

It shows that most of the Islamic Economics

students already have sufficient knowledge regarding

zakat. Nevertheless, some of the students need more

assistance to enhance their zakat literacy level

through enrollment on zakat subject.

Regression result of the factors that influence

zakat literacy level can be seen on Figure 1.

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

148

Figure 1: Regression result of zakat literacy

influenced factor

From figure 1 it can be seen that gender variable

are not significant as explainers in the model. Gender

variable has no significant impact towards student’s

zakat literacy level. Meanwhile, age and knowledge

variables are significant as explainers in the model at

the 5% level and the 1% level. Both variables have

significant impact towards student’s zakat literacy.

However, age and knowledge variable have

different impact based on the coefficient generated.

Age negatively affect zakat literacy level, the older

the age, the lower the zakat literacy level. On the

contrary, knowledge has positive effect to zakat

literacy level. The higher the class levels of the

student, the higher the zakat literacy level.

This result provides that both age and knowledge

have significant impat on zakat literacy. It is

corresponds with Lusardi, Mitchell, and Curto

(2010), Nidar and Bestari (2012), and Sarigȕl (2014),

that socio-demographic, level of education, and

student characteristics have significant impact on

financial literacy.

4 CONCLUSIONS

From the data processing, it is found that the level of

zakat literacy among Islamic Economics student

comes within moderate level. The gender variable

cannot be used as the measurement parameter. Age

and knowledge variables can be used to explain the

existing model. Age negatively affects zakat literacy

level, and knowledge positively affects zakat literacy

level. The impact of age variable toward zakat

literacy level can be described that the increase of age

of 1 unit can reduce the value of zakat literacy of

3.5939 units. While the magnitude of the effect of

knowledge variables on the value of zakat literacy can

be illustrated that by taking the course of Zakat

Management can increase the zakat literacy level.

REFERENCES

Abu Bakar, Nur Barizah. 2007. Study Guide: Zakat

Accounting Concepts and Application. Kuala Lumpur:

Wise Words Publishing.

Al Qardawi, Y., 1999. Fiqh Zakat: A Comparative Study

of Zakah, Regulations and Philosophy in the Light of

Qur'an and Sunnah. Translated by Monzer Kahf, 1.

Beal, DJ Delpachitra, SB. 2003. Financial literacy among

Australian university students. Economic Papers, 22,

65-78.

Canggih, Clarashinta, Fikriyah, Khusnul, Yasin, Ach. 2017.

Potensi dan Realisasi Dana Zakat Indonesia. Al-Uqud:

Journal of Islamic Economic, 1(1), 14-26. Available at:

http://journal.unesa.ac.id/index.php/jie/issue/view/32

Chen, H, Volpe, RP. 1998. An Analysis of Personal

Financial Literacy Among College Students. Financial

Services Review, 72(2), 107-128.

Danes, Sharon M and Hira, Tahira K. 1987. Money

Management Knowledge of College Students. Journal

of Student Financial Aid: Volume 17: Iss, 1 Article 1.

Available at

http://publications.nasfaa.org/jsfa/vol17/iss1/1

Firdaus, Muhammad, Beik, Irfan Syauqi, Juanda,

Bambang. 2012. Economic Estimation and

Determinations of Zakat Potential in Indonesia. IRTI

Working Paper Series No. 1433-07. Jeddah: IRTI

Indonesia Magnificence of Zakat (IMZ) dan PEBS, (2009).

Indonesia Zakat and Development Report 2009: Zakat

dan Era Pembangunan: Era Baru Zakat Menuju

Kesejahteraan Ummat. Indonesia Zakat &

Development Report. Jakarta.

Infoz. 2011. Perlu definisi Kontekstual Mustahik. edisi 13

Tahun 6 Juli-Agustus 2011

KBBI. 2016. Pengertian Literasi. Available at

www.kbbi.web.id

Kemenag. 2013. Jumlah Penduduk Menurut Agama.

Available at: http://data.kemenag.go.id/#

Kurniawati. 2004. Kedermawanan kaum Muslimin: potensi

dan realita zakat masyarakat di Indonesia. Jakarta:

Piramedia (PIRAC)

Khamis, M.R., Mohd, R., Salleh, A.M., Nawi, A.S. 2014.

Do Religious Practices Influence Compliance

Behaviour of Business Zakat among SMEs?, Journal of

Emerging Economies and Islamic Research, 2 (2), 1-16

Lusardi, Annamaria, Mitchell, Olivia S, Curto Vilsa. 2010.

Financial literacy among the young: Evidence and

implications for consumer policy. CFS Working Paper

No 2010/09. Available at: http//nbn-

resolving.de/urn:nbn:de:hebis:30-78626/

Mukhlis,A., Beik, Irfan Syauqi. 2013. Analisis Faktor-

faktor yang Memengaruhi Tingkat Kepatuhan

Membayar Zakat: Studi Kasus Kabupaten Bogor.

Jurnal al-Muzara’ah, Vol I, No. 1, 2013, 83-106

Nidar, Sulaeman Rahman, Bestari, Sandi. 2012. Personal

Financial Literacy Among University Students (Case

Study at Padjadjaran University Students, Bandung,

Indonesia). World Journal of Social Sciences, Vol. 2.

No. 4. July 2012. Pp. 162 – 171.

Zakat Literacy among University Students and Factors Influenced It

149

Peng, Tzu-Chin Martina, Bartholomae, S, Fox, JJ, and

Cravener, G. 2007. The Impact of Personal Finance

Education Delivered in High School and College

Courses. J Fam Econ Iss 28:265–284.

Sarigul, Hasmet. 2014. A Survey of Financial Literacy

Among University Students. Journal of Accounting and

Finance, October 2014, 207-224

Siswantoro, D. and Nurhayati, (2012), “Factors Affecting

Concern about Zakat as a Tax Deduction in Indonesia”,

International Journal of Management Business

Research, 2 (4), 293- 312

Syahrullah, Maria Ulfah. 2016. Response of Indonesian

Academicians toward Factors Influencing the Payment

of Zakat on Employment Income. Research on

Humanities and Social Sciences Vol.6, No.10, 87-94

The Financial Services Authority (OJK). 2013. Literasi

keuangan. Available at:

http://www.ojk.go.id/id/kanal/edukasi-dan-

perlindungan-konsumen/Pages/Literasi-

Keuangan.aspx diakses pada:

Volpe, Ronald P, Chen, Haiyang and Pavlicko, Joseph J.

1996. Personal Investment Literacy Among College

Students. Financial Practice and Education –

Fall/Winter: 88-94

Worthington, AC. 2006. Predicting financial literacy in

Australia, Financial Services Review, 15(1), Spring

2006, 59-79

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

150