Risk Management, Bank Profitability and Non Performing Loan

Handiani Suciati and Mochamad Dzikri

Universitas Padjadjaran, Bandung, Indonesia

Keywords: Credit risk management, bank profitability, non-performing loan.

Abstract: Risk management has an important role for supporting good corporate governance and for any business going

concern, moreover under the rapid changes of business complexity and economic condition. Bank,

specifically, as a business whose rely heavily on public trust, need to have a reliable risk management. The

purpose of this study was to analyze the impact of credit risk management on bank profitability, with non-

performing loan as an intervening variable in banking industry. This research use descriptive analysis method,

with cross sectional and time series analysis. 20 bank was selected as the sample of this research, based on

the purposive sampling method. We found evidence that credit risk management and non-performing loan

has a significant impact on bank profitability. Bank management need to have a good credit risk management

as it will improve non-performing loan, which eventually will improve bank profitability.

1 INTRODUCTION

Globalization has a significant impact on business

activities, with free transfer of capital, goods, and

services across national frontiers. It has increased the

number and the complexity of transactions, which

made banking industry always developed their

business activities, to meet the business needs.

However this brought additional cost for banking

industry, as it will increase the banking industry risk.

Banking industry activities closely related with many

risks, such as market risk, operational risk, reputation

risk, liquidity risk, credit risk and so on.

Banking is an industry whose business rely

heavily on public trust. Bank need to raise fund from

public, in order to be able to distribute fund to the

debtor, as a loan, which eventually will provide a

profit for the bank. Bank is an industry which quit

heavily regulated by government authority, as bank

rising a fund from public, so government need to

protect the public interest. Therefor bank need to have

a proper and reliable risk management, so it could

manage risk effectively, specifically credit risk, it

could comply with regulations and could maintain

public trust. Bank will prone to many risks that it need

to have an effective risk management. The failure in

detecting and managing bank risk will cause a

contraction on bank activities, decrease the output

and will impact state economic condition (Joseph et

al., 2012)

In the other hand, the awareness of how important

it is, for a business not to pursue profit merely, but to

prioritize the business going concern itself, has risen

the need for every entity to apply good corporate

governance in conducting their business activities.

The implementation of good corporate governance is

influenced by many factors, such as having a sound

risk management, as an example.

Patricio (2005) study proved that the increasing of

bankruptcy cases around the world has induced the

urgency of improving the credit risk management,

which is related with the asset’s variability of cash

flow as an important indicator of bank financial

failure. Ghozali (2007) study proved that the

implementation of bank risk management increase

the shareholder value, providing management with

information regarding the loss possibility which

allow them to improve the decision making method

and process. It is also used to measure bank’s

performance more accurately and also to develop a

sound risk management infrastructure thus improve

bank competitiveness.

The US subprime mortgage crisis, in 2008 started

with default payment of property credit with

subprime mortgage scheme, which could not been

paid by the debtor due to the high interest rate and the

downfall of property price itself. It boost the number

of non-performing loan with worldwide pervasive

impact including Indonesia.

The implementation of bank risk management in

Indonesia is stipulated in Peraturan Bank Indonesia

286

Suciati, H. and Dzikri, M.

Risk Management, Bank Profitability and Non Performing Loan.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 286-290

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Nomor 5/8/PBI/2003. Bank conducting their

operational activities based on prudence principles,

specifically in deciding credit approval so it could

minimize the non-performing loan. Bank will

evaluate the potential debtor based on several

criterions, which is known as 6 C; debtor’s character,

capital, collateral, condition, capacity and constraint

(Veithzal, 2006).

Non-performing loan is the debtor failureness to

repay its debt at the specific period, based on the

agreement. The existence of non-performing loan will

influence the bank’s profitability and bank credit risk.

Lower non-performing loan, implies less bank credit

risk. In Indonesia, Bank Indonesia regulation Nomor

15/2/PBI/2013, stated the ratio of bank’s non-

performing loan is 5%. Bank’s profitability reflects

bank ability to obtain profit, it is also as a

measurement of management effectiveness

(Wiagustini, 2010:76). Profitability could be

measured by return on asset (ROA), which emphasize

the company’s ability to generate earning from its

operational activity. Higher ROA, implies higher

Banks’s profitability thus better asset utilization by

management (Lukman, 2009:118).

Previous study regarding bank’s credit risk

management, non-performing loan and profitability

shown various result. Nawaz et al (2012) study

proved that credit risk management impact bank’s

performance significantly; Li (2014) study proved

that credit risk management has a positive influence

on bank’s profitability. However, Kithinji (2010)

found that bank profitability is not influence by bank

credit risk management.

Study on non-performing loan and profitability

conducted by George et al. (2012); Han & Young

(2012) shown that non-performing loan has a

negative impact on ROA, significantly. On the

contrary with the result of study conducted by Zha &

Hui (2012).

2 METHODS

The purpose of this research is to study the influence

credit risk management on bank’s profitability with

non-performing loan as an intervening variable.

To achieve that, we use descriptive analysis

method, with cross sectional and time series analysis.

The variables involved in this study are:

credit risk management (as independent

variable),

bank’s profitability (as dependent variable) and

Non-performing loan (as an intervening

variable).

The measurement of each variable, is provided in

table 1, below.

Table 1: Operational variable and measurement

Variable

Definition

Indicator

Measur

ement

scale

X, Credit

risk

manageme

nt

implementa

tion (SEBI

No

13/24/DPN

P)

Credit risk

management in

providing loan

Self-assessment

matrix of the

implementation

quality of credit

risk

management.

Grade 1: Strong

Grade 2:

Satisfactory

Grade 3: Fair

Grade 4:

Marginal

Grade 5:

Unsatisfactory

ordinal

Z, Non

performing

loan

(Nawaz et

al., 2012)

Credit which

collectability

included in

trouble

criterion:

special mention,

substandard,

doubtful and

bad

NPL Ratio =

(The amount of

credit under

trouble criterion

: the credit total

amount) x

100%

Ratio

Y,

profitability

rate (Gizaw

et al., 2014)

Ratio to

measure

management

ability to

generate profit

Return On

Asset =

(Net income :

total asset) x

100%

Ratio

Conventional bank (non-Sariah bank) are used as

the subject in this research. Sample selection

conducted based on non-probability sampling-

purposive sampling, which selected based on several

criterion (Sekaran, 2011).

Table 2: Purposive sampling criterion

Number

Criteria

Amount

1

Conventional bank issued annual

report 2012-2014

119

2

Conventional bank which are not

listed in Indonesia Stock Exchanges

during 2012-2014

(77)

3

Conventional bank did not provide

risk profile and risk management

report related with the assessment

of the quality of risk management

implementation in 2012 -2014

annual report.

(37)

4

Conventional bank fulfil the

criterions

20

5

Conventional Bank data used as the

sample for 2012-2014

60

Risk Management, Bank Profitability and Non Performing Loan

287

At the end this research use 60 samples, as an

observation. These samples are taken from 20

selected conventional bank which then being

observed for 3 years (2012 – 2014).

Hypotheses being tested in this study are:

Ho

1 :

β

1

> 0 “there is no negative influence

between credit risk management and

non-performing loan”

Ha

1 :

β

1

< 0 "there is negative influence between

credit risk management and non-

performing loan”

Ho

2 :

β

2

> 0 “there is no negative influence

between non-performing loan and

bank profitability”

Ha

2

: β

2

< 0 “there is negative influence between

non-performing loan and bank

profitability”

Ho

3 :

β

3

< 0 “there is no positive influence

between credit risk management and

bank profitability”

Ha

3 :

β

3

> 0 “there is no positive influence

between credit risk management and

bank profitability”

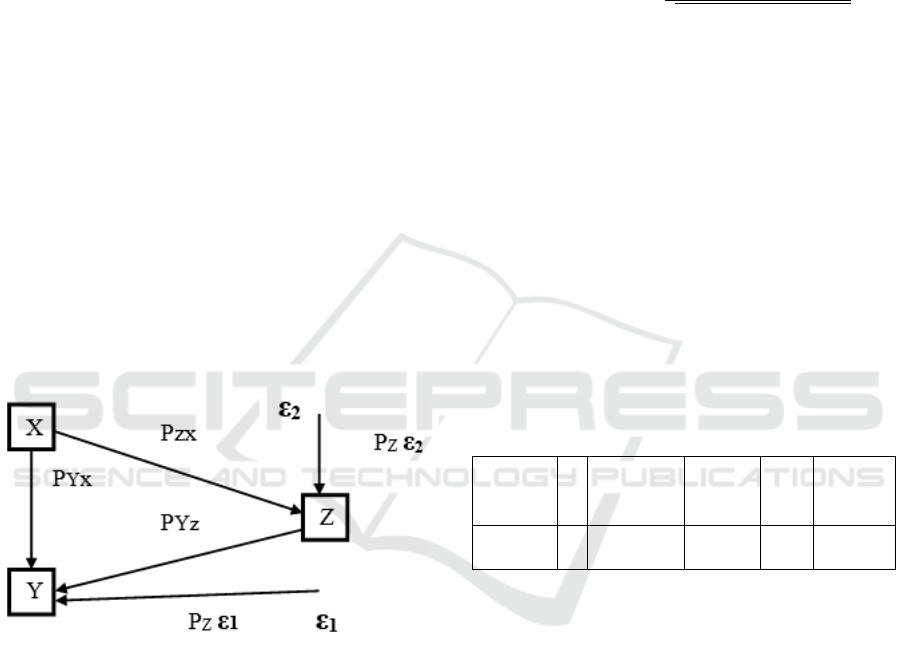

This research is using path analysis to analyze the

data, as described in figure 2.

Figure 1: Path analysis diagram

The structural equation for the figure above are:

Z = P

ZX

+

ε

2

Y = P

YX

+ P

YZ

+ ε

1

Where as:

X = credit risk management

Y = profitability

Z = non-performing loan

ε

1

= other variable influencing Y

ε

2

= other variable influencing Z

P

YX

= Path coefficient, X influence on Y

P

ZX

= Path coefficient, X influence on Z

P

YZ

= Path coefficient, Z influence on Y

P

Y

ε

1

= Path coefficient, ε

1

influence on Y

P

Z

ε

2

= Path coefficient, ε

2

influence on Z

We conducted several test including normality,

multicollinearity, heteroscedasticity and

autocorrelation test, followed by the F and t test.

In conducting the path analysis, we applied

several steps, as described below:

1. Correlation analysis, to analyze the

dependencies between variables, which

determine using this model :

R

xy

=

nΣxy−(Σx)(Σy)

√

(nΣx

2

−

(

Σx

)

2

)(nΣy

2

− Σ

(

y

)

²

R

2

/ KP = r² x 100%

Where as:

R

xy

= correlation coefficient

N = sample size

x = independent variable value

y = dependent variable value

KP = determination coefficient

2. Regression analysis

3. Influence calculation

We conducted one side test, using α 5 %.

3 RESULTS

Table 3 displays the descriptive statistic of credit risk

management qualities.

Table 3: Credit risk management descriptive statistic

N

Minimum

Maximum

Mean

Std.

Deviation

X

60

1.00

3.00

2.1167

.55515

Valid N

(listwise)

60

The average score for the quality of credit risk

management from the sample in this research is

2.1667, which shown adequate level. The maximum

score 3 shown that the worst self-assessment on the

quality of credit risk management is in fair level. The

minimum score 1 shown that the best self-assessment

on the quality of credit risk management is in strong

level. With 0.55515 standard deviation, it shown the

deviation and score variability of the quality of credit

risk management is quite low.

The descriptive statistic for profitability shown

average score 2.1558 %, which implies the average

profitability of conventional bank during the research

period is 2.1558 %, with 5.15 % as a maximum score

and -1.58 % as the minimum score. Standard

deviation score 1.20474, shown the deviation and

score variability of the profitability is quite low.

The non-performing loan descriptive statistic

shown average score 2,2642 %, which is quite below

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

288

the maximum score 5%. The maximum NPL in this

research is 9,95 %, with 0,21% as the minimum score.

With 1.71488 standard deviation, it shown the

deviation and score variability of non-performing

loan is quite low.

3.1 Path Analysis Substructure 1

Path analysis on substructure 1, analyze the influence

of credit risk management on NPL. Using SPSS we

found the value of coefficient correlation or R 0.495,

which shown quite strong correlation between

variable based on Guildford criterion. The coefficient

determination is 24.5 %, which implies that credit risk

management contribute 24,5 % influence on NPL.

The rest 75,5 % shown the contribution of other factor

on NPL.

Table 4: Test result on path coefficient simulant regression

Model

Sum of

squares

df

Mean

square

F

Sig

1 Regression

42.557

1

42.557

18.849

0,000

a

Residual

130.952

58

2.258

Total

173.509

59

a. Predictors (constant), X

b. Dependent variable: Z

From table 4, we can see that F-stat (18,849) >

F.table (2.769431), which implies reject Ho. It means

that credit risk management has a significant

influence on non-performing loan.

Table 5: Test result on path coefficient partial regression

Unstandardized

Coefficients

Standardi

zed

Coefficie

nts

T

Sig

Model

B

Std. Error

Beta

1 (Constant)

4.591

0.570

8.054

0.000

X

-0.988

0.228

-.0495

-4.342

0.000

a. dependent variable: Z

From table 5, we can see credit risk management

t score is -4.342 which is lower than t table -2.002465,

therefor we reject Ho, and so we conclude that credit

risk management has significant negative influence

on non-performing loan.

3.2 Path Analysis Substructure 2

Path analysis on substructure 2, analyze the influence

of credit risk management (X), non-performing loan

(Z) on profitability (Z).

Table 6: Coefficient Correlation

Model Summary

Model

R

R Square

Adjusted

R

Standard Error of The

Estimate

1

0.735

a

0.539

0.523

0.83176

a. Predictors: (constant), Z, X

From table 6, we know the coefficient correlation

(R) is 0,735, which based on Guildford criterion

indicating there is strong correlation between

independent and dependent variables,

simultaneously.

Based on calculation, the determination

coefficient is 53,9%, which shown credit risk

management and non-performing loan together, have

53,9% influence on profitability, while the rest 46,1%

is influenced by other factors which not being study

in this research. The simulant test on substructure 2

found that F-stat is 33,388 which is higher than

F.tabel, 2.769431. It mean the Ho is being rejected,

which implies credit risk management and non-

performing loan, together, have significant influence

on profitability.

As for the next test, we did the partial test to

analyze which variable has an influence on

profitability.

Table 7: Regression on partial path coefficient

Unstandardized

Coefficients

Standardized

Coefficients

t

Sig

Model

B

Std. Error

Beta

1 (Constant)

1.208

0.459

2.630

0.011

X

0.658

0.145

0.469

4.538

0.000

Z

-0.266

0.073

-0.378

-3.657

0.001

a. dependent variable: Y

From table 7, we know that the path coefficient is

0.469 for credit risk management and for non-

performing loan is -0.378. The NPL partially has

negative significant influence on profitability, as the t

count (-3.657) is less than t table (-2.002465). In

means we reject Ho for the second hypothesis.

The test on third hypothesis shown that t count is

4.538 > t table 2.002465, therefor Ho is being

rejected, with conclusion that partially credit risk

management has positive, significant influence on

profitability.

From calculation we also found that the direct

effect between X and Y (P

yx)

is 0,469, the indirect

effect of X on Y through Z is 0,187. Therefor the total

effect is 0.656.

Risk Management, Bank Profitability and Non Performing Loan

289

4 CONCLUSIONS

The research shown that credit risk management and

NPL has significant influence on profitability, both

contributes 53,9 % influence on profitability.

Therefor bank management need to implement a

sound and effective credit risk management in order

to improve bank’s performance, to be able to protect

investor interest and the most important one is to

prevent the banking crisis, which will have a

pervasive impact.

Bank need to be equipped with comprehensive

credit risk management which allow management to

identify, measure, supervise and control the credit

risk.

We found that credit risk management has a

negative significant influence on non-performing

loan. Applying a sound credit risk management is a

must for banking industry, as it will decrease the non-

performing loan.

This study also show that nonperforming loan has

a negative significant influence on profitability. It

means that the increased in nonperforming loan, due

the poor bank credit quality, will resulted in a loss

from bank’s operational activity.

The research shown that credit risk management

has a positive, significant influence on profitability.

An effective credit risk management will support the

achievement of bank profit, thus will increase its

profitability.

REFERENCES

Bank Indonesia. 2011. Lampiran Surat Edaran Bank

Indonesia Nomor 13/24/DPNP Tentang Pedoman

Standar Penerapan Manajemen Risiko, 25 Ok-tober

2011.

____- Peraturan Bank Indonesia Nomor 11/25/PBI/2009

tentang Perubahan atas Peraturan Bank Indonesia

5/8/pbi/2003 tentang Penerapan Manajemen Risiko

bagi Bank Umum.

____2013. Peraturan Bank Indonesia Nomor

15/2/PBI/2013 tentang Penetapan Status dan Tindak

Lanjut Pengawasan Bank Umum Kon-vensional, 20

Mei 2013

George, G., Enock, Barrack Otieno Ouma, and Jane

Nasimiyu Were. 2012. "Effect of Financial Risk on

Profitability of Sugar Firm in Kenya." European

Journal of Business and Management ISSN 2222-1905

(paper) ISSN 2222-2839 (online) Vol. No.5, No.3.

Gizaw, Milion, Matewos Kebede, and Sujata Selvaraj. "The

Impact of Credit Risk on Profitability Performance of

Commercial Banks in Ethiopia." African Journal of

Business Manajemen ISSN 1993-8233 (ISSN 1993-

8233) vol 9(2) (2014): 59-66.

Li, Fan, and Yizun Zou. 2014. The Impact of Credit Risk

Management on Profitability of Commercial Banks.

Han, Xiaoxiao, and Ji-Young Seo. "Influential Factors in

Lending and Profitability in Commercial Chinese

Banks." African Journal of Business Management

ISSN 1993-8233 Vol.6 (32) (2012): Pp. 10041-10049.

Imam, Ghozali. 2007. Manajemen Risiko Perbankan.

Semarang: BPUNDIP.

Joseph, Mabvure Tendai. 2012. "Non Performing Loans in

Commercial Banks: A Case of CBZ Bank Limited in

Zimbabwe." Interdiciplinary Journal of Contemporary

Research in Business Vol.4(7).

Kithinji, A. M. Credit risk management and profita-bility of

commercial banks in Kenya, 2010. School of Business,

University of Nairobi, Nairobi.

Lukman, Dendawijaya. 2009. Manajemen Perbankan.

Jakarta: PT Raja Ghalia Indonesia.

Nawaz, Muhammad. 2012. "Credit Risk and The

Performance of Nigerian Banks." Interdiciplinary

Journal of Contemporary Research in Business. Vol. 4.

Patricio, A. P., and A. P. I. Vong. "Credit Risk Assessment

in The Macau Banking Sector." Euro Asian Journal of

Management Vol 15 (2005): 113-124.

Sekaran, U., 2011. Research Method for Business:

Metodologi Penelitian untuk Bisnis Jilid 2. Jakarta:

Salemba Empat.

Veithzal, Rivai. 2006. Credit Management Handbook.

Jakarta: PT Raja Grafindo Persada.

Wiagustini, Ni Luh Putu. 2010. Dasar-Dasar Manajemen

Keuangan. Denpasar: Universitas Udayana.

www.bi.go.id

www.idx.com

Zha, Suvita, and Xiaofeng Hui. 2012. "A Comparison of

Financial Performance of Commercial Banks: A Case

Study of Nepal." African Journal of Business

Management ISSN 1993-8233 Vol. 6(25) (2012):

Pp.7601-7611.

Sistem Pendidikan Nasional 2003

Slameto. 2003. Belajar dan Faktorfaktor yang

Mempengaruhinya. Jakarta: Rineka Cipta.

Sudarmanto,Y,B. 2003. Tuntutan Metodologi Belajar.

Jakarta: PT.Gramedia Widiasaran Indonesia

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

290