Potential Informal Workers Participation for Health Insurance in

Surabaya City

Rachmawati Maulidhina

Faculty of Public Health, Airlangga University, Dr. Ir. H. Soekarno St., Mulyorejo- Surabaya, Indonesia

rmaulidhina@gmail.com

Keywords: Health insurance, Informal workers, Participation, Health care, Ability, Willingness.

Abstract: Informal workers are the largest group of workers in East Java, with the total number of informal workers in

East Java being twice the number of formal workers, which is about 12 million people. The Indonesian

government itself has handed over the affairs of the workers’ security guarantees to BPJS Ketenagakerjaan

(Employment). Until now, the number of participants in BPJS Ketenagakerjaan (Employment) in East Java

from the informal sector has only reached about 100,000 people. This study aims to describe the financial

capacity of the informal workers to participate in health insurance in Surabaya. The method used is

analytical descriptive based on the secondary data of the national employment survey and the Central

Bureau of Statistics (BPS). The results of the study show that informal workers have the ability to pay

health insurance premiums because the public is able to finance their non-essential needs, and there has

been an allocation of funds for health services. The willingness variable is generated because the workers

are willing to make payments when there is an adjustment required between the premium with the

expenditure of income and the complete health service. There are some actions that still need to be

developed; socialisation, motivating the informal workers group to save money and government/cross-

sector involvement.

1 INTRODUCTION

Health is a human right which in Indonesia has been

regulated in the constitution since 1945 and must

ensure the fulfilment of health for the entire

population of Indonesia without exception. Based on

these basic regulations, health development has

become a part of national development as an effort

to create better public health.

In order to realise the success of health

development, in 2004 the government issued the

National Act No. 40 on the National Health

Insurance System (SJSN). This regulation stipulates

that the entire population is obliged to be a

participant of social security, namely the National

Health Insurance (JKN) through a Social Security

Administration Agency (BPJS). This, in its

implementation, uses the principle of social

insurance involving compulsory membership, the

amount of premium based on the amount of income

and all members getting health services the same

(Social Security Agency, 2004). Furthermore in

2011, the government issued Law Number 24 that

stipulates that the National Health Insurance to be

held by BPJS consists of BPJS Health and

Employment (Social Security Agency, 2011).

The emergence of regulations related to social

security in the field of health requires a

comprehensive reform, even while the conditions of

the implementation of the existing regulations are

still partial and overlapping. The scope of the

program is not comprehensive and the benefits have

not been felt by the community (Thabrany, 2005).

The constraints result in low public participation in

the JKN program, based on the data from the Social

Security Administering Agency (BPJS) Health.

Until March 17

th

, 2017, JKN-KIS participants have

reached a total of 175 million people from several

segments of the membership which is only 70% of

the total population of Indonesia. The same

condition is shown from the data from BPJS

Employment up to June 2017; the number of

participants has only reached 23.3 million people.

Meanwhile, the total workforce in Indonesia is 130

million people and 50 million are workers in the

formal sector. The remaining 80 million workers are

in the informal sector. While in Surabaya, based on

data from the BPJS Employment branch Surabaya

100

Maulidhina, R.

Potential Informal Workers Participation for Health Insurance in Surabaya City.

In Proceedings of the 4th Annual Meeting of the Indonesian Health Economics Association (INAHEA 2017), pages 100-104

ISBN: 978-989-758-335-3

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

mentioned informal workers who have not joined for

811,789 people.

The low workers' participation is a problem that

needs to be solved immediately. However, the

ability and willingness of the informal sector

workers in Surabaya to be a participant of the JKN

needs to be further investigated as an effort to

increase their participation and the success of the

JKN program and universal coverage.

2 METHOD

This study aims to describe the ability and

willingness of the health insurance financing in

relation to the informal workers in Surabaya. The

data has been obtained through a literature study and

the analysis of the survey data was sourced from the

National Labour Force Survey (Sakernas) and the

Central Bureau of Statistics (BPS). Literature studies

were conducted through the internet with book

reference materials, the publication of survey results

as well as documents related to the issues discussed.

This study is an analysis of the number and

percentage of participation of the public health

insurance to do with informal workers, their income

and expenses and property ownership as a variable

that can measure the ability of the workers to pay the

premiums/health insurance contributions each

month.

The analysis in this study began by describing

the number of workers in the informal sector based

on the survey data from the Central Statistics

Agency (BPS). Based on the type of work that will

be conducted, an analysis of the health insurance

financing capability based on income and the

expenditure of the informal workers will be

conducted and the fulfilment of basic needs

according to Maslow's theory will also be looked in

to. Meanwhile, in order to describe the willingness

of the informal workers, an analysis based on the

results of the interviews conducted with 3

respondents who were informal workers who have

incomes at different levels (namely income workers

with one month less than the expenditure in another

month, the income of the same month as the

spending in one month and workers with an income

more than their spending in a month) have been

conducted. The sampling technique used is non-

probability sampling, so it does not use the principle

of probability theory. The basis of the determination

is certain considerations of the researcher and the

purpose of the study. The descriptive data analysis

was based on the interviews in the field to determine

the worker’s willingness combined with the results

of the literature study to determine the ability of the

informal workers in Surabaya to finance their health

insurance.

3 RESULTS

3.1 Number and Distribution of Informal

Workers

Based on the official statistics – the data published

by the provincial statistics centre of East Java

(Badan Pusat Statistik) on May 6

th

, 2013 - it shows

that the main job of the majority of the population of

the East Java province is agriculture that is made up

of 7.38 million people or 38.25% of the total number

of workers. The second position followed by the

trade sector amounted to 4.01 million people, or

20.78%, while the industrial sector occupies third

place. Surabaya is the capital of the East Java

province with the densest population and the highest

number of labourers, both indigenous and made up

of other urban residents working in Surabaya. In

accordance with the statistical data of the National

Social and Healthcare for employees (BPJS

Ketenagakerjaan), Surabaya shows that the number

of workers in Surabaya reached 1.475 million people

with the number of informal workers being 811

thousand people. Both of these data sets present that

the economic system in Indonesia is dominated by

the informal sector.

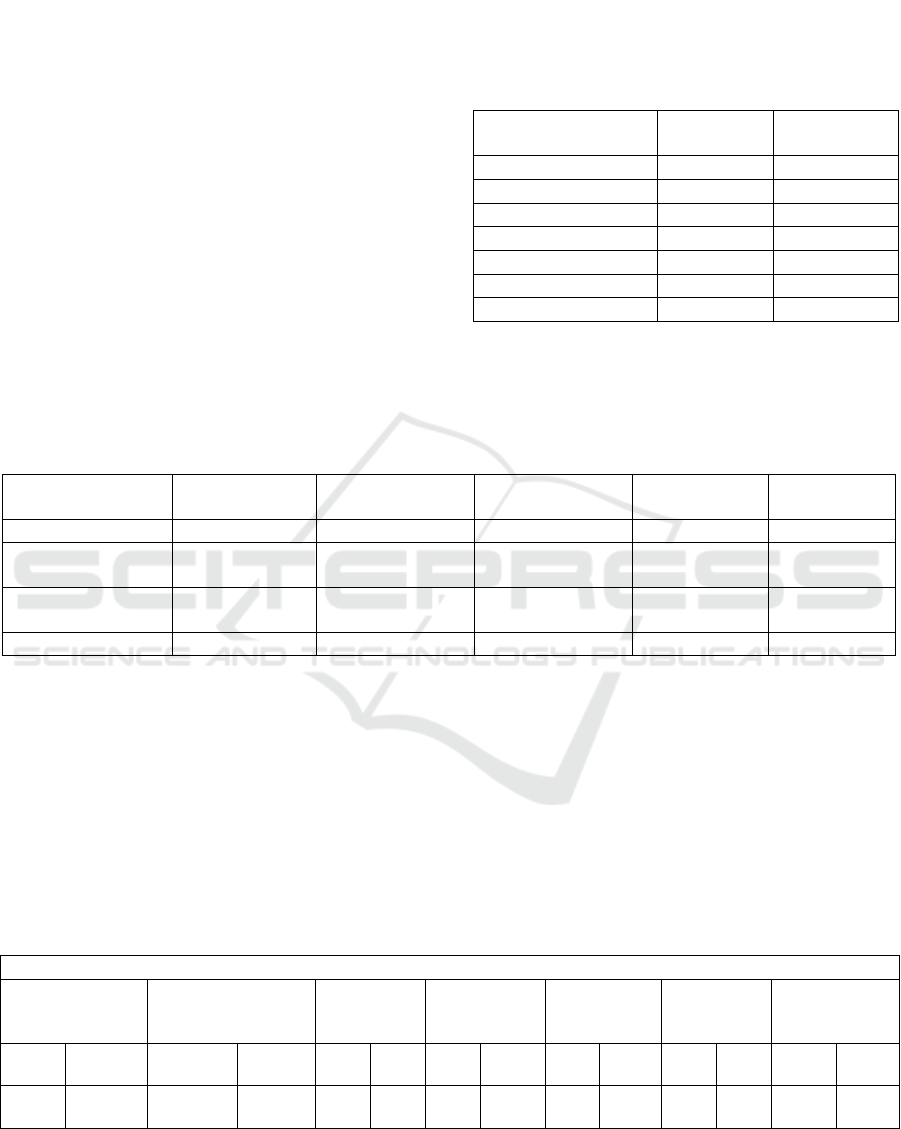

Table 1: Informal Workers by Occupation

Job

Frequency

Percentage

Seller

51

34.0

Pedicab Driver

38

25.3

Other

22

14.7

Driver

12

8.0

Coolie

10

6.7

Construction

9

6.0

Employee/Labour

4

2.7

Small Shop

4

2.7

Total

150

100.0

Source: Informal Sector Research Results Surabaya,

2011 at Prioris Law journal, Vol. 3 No. 3, Year 2013

Based on the table above, the seller has the

highest proportion making up 34% out of the total

150 respondents of the research. This high number is

supported by data published by BPS that is

Distribution of the Gross Regional Domestic

Product of Surabaya at the Current Market Prices by

Potential Informal Workers Participation for Health Insurance in Surabaya City

101

Industry of Surabaya Municipalit, 2010-2016 shows

that the largest percentage of the contributors come

Wholesale and Retail Trade; Repair of Motor

Vehicles and Motorcycles that equal to 27.59% out

of the total 100% GRDP Surabaya in 2016

3.2 Income and Expenditure Informal

Workers

Based on previous research conducted in 2011, with

a total of 151 respondents, the data was obtained and

deployed in accordance with the table below.

In the table below, it can be seen that the level of

the majority of the revenue obtained is to the amount

of IDR 500,000 - <IDR 1,000,000 per month at

37%. 21.9% of the total respondents have an income

of between IDR 1,000,000 - <IDR 1,500,000. The

above data is supported by the results of the

measurements of the average monthly income of

informal workers based on the Survey of the Labour

Force Situation in East Java in 2016, which showed

the following results

Table 2: Informal Workers Monthly Revenue

Revenue (thousands

rupiah)

Frequency

Presentation

<500

31

20,5

500 - <1.000

56

37,1

1.000 - <1.500

33

21,9

1.500 - <2.000

7

4,6

2.000 - <2.500

10

6,3

>2.500

14

9,3

Total

151

100,0

.

Table 3: Average of Employee/Labourer and Casual Employee’s Net Wage/Salary (Rupiahs) per Month by

Main Employment Status, 2012 ‐ 2016 (Urban)

Main Employment

Status

August 2012

August 2013

August 2014

August 2015

August 2016

Employee

1.3807. 907

1.650.568

1.721.697

1.859.531

2.222.655

Casual Employee in

Agriculture

460.372

614.475

749.300

714.195

1.058.372

Casual Employee in

Non-Agriculture

776.029

859.065

1.124.2333

1.320.533

1.434.695

Total

1.243.519

1.506.270

1.584.979

1.717.744

2.041.037

Based on the above data, it can be seen that the

income of informal workers is still below the

workers in a company or in the formal sector and is

still around > IDR 1,000,000 until 2016, although

this has since increased. Net income or the wages

earned by workers will certainly be used

subsequently for the purposes for themselves and

their families. Comparisons between income and

expenditure on food and non-food items would

indicate the ability of the informal workers to pay

the premiums/health insurance contributions. The

National Economic Social Survey 2012-2013 found

that the average spending of the people of Surabaya

totalled IDR 1,042,088 in 2013 with details of the

expenditure on food needs being IDR 429,746 and

IDR 612,342 on non-food. Non-food expenditure

has been listed in the following table.

Table 4: Type of Non-Food Expenditure

Type of Non-Food Expenditure

Housing And

Household

Facilities

Miscellaneous Goods

& Services (including

Health and Education)

Clothes.

Footwear &

Headgear

Durable Goods

Tax &

Insurance

Party &

Ceremony

Total

2012

2013

2012

2013

2012

2013

2012

2013

2012

2013

2012

2013

2012

2013

252.507

261.534

200.920

230.780

15.502

31.891

57.251

45.820

37.514

23.110

28.199

19.207

591.893

612.342

Source: Social Survey 2012-2013 National economic

INAHEA 2017 - 4th Annual Meeting of the Indonesian Health Economics Association

102

4 DISCUSSION

Health insurance owned by each individual becomes

a necessity if the individual feels that there is the

need. Some theories put forward state that according

to Anderson, there are five factors that influence the

demand for health services, namely: 1) perception;

2) the actual demand (hope, the assurance, previous

experiences, customs, religion); 3) the ability to pay;

4) the motivation to obtain health services and the 5)

environment (availability of health care facilities).

The ability to pay on points to three is affected by

income and the expenditure of each individual or

family (Anderson, 1973).

Based on Table 2 and Table 3, the data shows

that every year, there is an increase in revenue for

informal workers. In 2011, the data showed that the

majority of respondents had an income between IDR

500.000 - < IDR. 1,000,000 (Triyono, et al, 2013)

while the data of the average income of urban

informal workers each month in 2016 reached IDR

1,058,372 for informal workers in the agriculture

sector and IDR 1,434,695 for non-agricultural

informal workers (Central Bureau of Statistic of East

Java, 2016).

The increase is an improvement not

only for private people but also for the economic

conditions in Indonesia.

However, income earned does not necessarily

become a reference point because of the other needs

that must be met. The survey results indicated that

the average public expenditure in Surabaya in 2013

reached IDR 1,042,088, with spending on food

needs being IDR 429,746 and IDR 612,342 on non-

food. When adjusted for, the average income in

2013 for informal workers amounted to IDR

859,065, so it can be seen that there is a considerable

margin between revenue and expenditure (BPS,

2014; BPS. 2014).

The ability to pay the dues is a subjective

assessment based on assumptions about how the

person pays. Some references say that the amount of

expenditures to revenues affects the ability of the

individual to pay the health insurance dues, whereas

in the survey it was stated that in this type of

spending on non-food is a kind of "Miscellaneous

goods and services including the health and

education” (Noormalasari, et al, 2015) so people are

able to allocate its income aside for a month for their

health insurance premium. This statement can be

supported by their ability to meet the needs of non-

food items that aren’t essential, as the demand for

health services falls in to this category. Exceptions

may occur if the individual's income is low or below

the minimum wage or with the family expenses

exceeding 75% of the revenue. This group can be

helped by the government because of the

beneficiaries allied with the health services.

Society's ability to pay dues does not necessarily

make them decide to follow the health insurance

plan, but the willingness to pay does affect it.

In interviews with the three respondents with

different incomes, the results concerned some of the

factors influencing them such as the level of

education. With a low-income, the respondents have

not yet been exposed to the information related to

both health and employment insurance. For the

respondents with medium and high incomes, it was

found that they had not received information on the

clear benefits that would come from following the

health insurance plan.

The high-income respondents chose to follow

private health insurance. This statement is consistent

with the studies conducted in 2011 that resulted in

54 % of informal sector workers being educated to

elementary school (SD) level. The lower education

levels of informal sector workers is a potential

obstacle in the implementation of social security.

This is due to the lack of access to various programs

relating to labour, because they are poorly educated

and also from poor communities. The condition

causes them to lack knowledge and not be able

contribute to the work performed so easily.

The second factor is that the health services

guaranteed are incomplete and the administration is

convoluted. The demand from all three of the

respondents indicated that the respondents wanted

the amounts of fees to be in accordance with their

respective revenue. A person's motivation to have

health insurance can be caused by an adverse health

status known as an endogenous factor. Efforts to

increase JKN access will be more effective if JKN

accommodates consumer preferences (Hidayat,

2008).

Other factors which affect the willingness to pay

health insurance contributions is income per month,

so big contribution rates should be adjusted by the

amount of income per month. In the study conducted

in 2010 in Semarang, it was stated that the amount

of rupiah to be issued should be in accordance with

the services provided, but a barrier occurs when

there is a family of more than 4 people because the

ability to pay has decreased. There is then the need

for assistance and the responsibility of the

government to step up in this regard (Djuhaeni,

2010).

Potential Informal Workers Participation for Health Insurance in Surabaya City

103

5 CONCLUSIONS

In the survey, the results indicated that the average

public expenditure in Surabaya in 2013 reached IDR

1,042,088 with spending on food needs being IDR

429,746 and IDR 612,342 on non-food. When

adjusted for the average income in 2013 of informal

workers amounting to IDR 859,065, it can be seen

there is a considerable margin between revenue and

expenditure. However, non-food expenditure has

covered the need for health care services so then the

informal workers should be able to pay the fees for

their health insurance. This statement can be

supported by their ability to meet the needs of non-

food items that aren’t essential, while the demand

for health services is essential. All of the interview

respondents were willing to pay the insurance

premiums for the services to be acquired.

From the reviews that have been conducted, it

was found that the government should subsidise the

cost to society of the informal sector workers

considering that their income is not fixed. In

addition, the dissemination of information is

important so that the informal workers who actually

can afford to pay the fee are not reluctant to join the

health insurance plan because they understand and

know the benefits that come from the insurance. To

realise the increase in the participation of informal

workers to become active participants requires the

involvement of various institutions and sectors such

as the labour department and the health department

so that it will not only be the formal sector workers

who could benefit from health insurance.

REFERENCES

Act. Year 2004, on National Social Security System

(SJSN). Social Security Administering Body (BPJS).

40.

Act. Year 2011 on the Social Security Administering

Agency (BPJS). Yogyakarta: Pustaka Mahardika. 24.

Anderson JG. 1973. Health services utilization: framework

and review. Health services research. 8 (3).

Badan Pusat Statistik of Surabaya. Average Per Capita

Monthly Expenditure (Rp.) By Expenditure Type,

2012-2013. National Socio-economic Survey Results.

[online] 2012-2013. Available from URL:

https://surabayakota.bps.go.id/linkTableStatis/view/id/

478.

Badan Pusat Statistik of Surabaya. Average Non-Food Per

Capita Monthly Expenditure (Rp.) By Non-Food

Expenditure, 2012-2013. National Socio-economic

Survey Results. [online] 2012-2013. Available from

URL:

https://surabayakota.bps.go.id/linkTableStatis/view/id/

478.

Badan Pusat Statistik of Surabaya.

Distribution of GRDP at Current Market Prices by

Industry of Surabaya Municipality, 2010-2016

(percent). [online] 2016. Available from URL:

https://surabayakota.bps.go.id/statictable/2017/07/05/5

43/distribusi-pdrb-kota-surabaya-atas-dasar-harga-

berlaku-menurut-lapangan-usaha-2010-2016-persen-

.html

Central Bureau of Statistics of East Java. 2016. Labor

Force Situation in East Java. Surabaya: BPS -

Statistics of East Java

Djuhaeni H. 2010. Potential Towards the Implementation

of Public Participation in the framework of the

Universal Health Insurance Coverage in Bandung.

Journal of Health Care. 13 (03)

Dong H, Kouyate B, Cairns J, Sauerborn R. 2005.

Inequality in willingness to pay for community based

health insurance, Health Policy. 72: 149-56.

Hidayat, B. 2008. Modeling The Demand for Health Care

Given Insurance: Notes For Researcher. Journal of

Health Services Management. 11: 58-65

Noormalasari W, Nuryadi N, Sandra C. 2015. Ability to

Pay National Health Insurance Fee for Fishermen in

Jember District (Ability to Pay The Premium Of

National Health Insurance For Fisherman in Jember).

Health Library. Jan 17; 3 (1): 147-54.

Thabrany H. 2005 Health Funding and Alternative

Mobilization of Health Funds in Indonesia. Jakarta:

PT Raja Grafindo Persada.

Triyono T, Soewartoyo S. 2013. Constraints of Social

Security Program Participation of Workers in the

Informal Sector: A Case Study in Surabaya. Prioris

Law Journal. Dec 6; 3 (3).

INAHEA 2017 - 4th Annual Meeting of the Indonesian Health Economics Association

104