Regulated and Regimented Interest in the Financial and Economy

System: Issues and Challenges

Hakimah Yaacob and Abdul Nasir bin Haji Abdul Rani

Universiti Islam Sultan Sharif Ali (UNISSA), Negara Brunei Darussalam

{hakimah.yaacob, nasir.rani}@unissa.edu.bn

Keywords: Regulated interest, standardisation, banking, compliance reporting, three-tier relationship.

Abstract: The imposition of interest began with standardization of banking principles issued by the Bank of International

Settlement (BIS). The main purpose of this paper is to provide a comprehensive review on the origin of interest

applied in the economic and financial system. The study employs library research consist of core principles

of Basel, policies imposed by BIS and local legislation of five countries. Based on an extensive reviews, the

paper claims that the origin of interest in the economy and financial systems began with standardisation. The

central banking contributes to the importation of the standards into the local financial system. The author

characterize responses to standardization as obligatory on local banks or financial systems that creates the

blooming of interest regime. The paper offers a holistic overview and proffer alternative solutions for free

interest in the economy and financial system. Further research of interest on the economic system resulted

from banking with interest can be analysed from the quantitative measures. Addressing the contextual root of

interest which is legally regulated will help the financial and economic system towards a free interest

economy.

1 INTRODUCTION

Regulated and legalised, these two words suffice to

ensure something is to be followed. The link between

interest rates and bank profitability are intactable in

order to evaluate the effect of the monetary policy

stance (BIS Working Papers No 514, 2015).

The earliest prohibition of interest was found in

the Vedic Text of ancient India (2000-1400BC).

Vasishta, a well known law maker of Hindu during

that time, made a special law which forbade the

higher castes of Brahmanas (priests) and Kshatriyas

(warriors) from being usurers or lenders at interest.

(V.Wayne, 1998) Among the Ancient Western

philosophers who condemned usury can be named

Plato, Aristotle, the two Catos, Cicero, Seneca and

Plutarch (V.Wayne, 1998). Other religions of Jews

and Islam prohibits any kind of interest or addition.

Some of the earliest prohibitions of usury are to be

found in the Old Testament, for example Leviticus

25:36–37: “Take thou no usury of him, or increase:

but fear thy God, that thy brother may live with

thee.… Thou shalt not give him thy money upon

usury, nor lend him thy victuals for increase”;

Deuteronomy 23:19: “Thou shalt not not lend upon

usury to thy brother; usury of money, usury of

victuals, usury of any thing that is lent upon usury”;

Deuteronomy 23:20: “Unto a stranger thou mayest

lend upon usury; but unto thy brother thou shalt not

lend upon usury; that the Lord thy God may bless thee

in all that thou settest thine hand to in the land whither

thou goest to possess it”; Exodus 22:25: “If thou lend

money to any of my people that is poor by thee, thou

shalt not be to him as an usurer, neither shalt thou lay

upon him usury” (Salin, 1971).

The prohibition of usury also can be found in the

Holy Qur’an, for example, al-Baqarah 2:275-276:

“Allah has permitted trading and forbidden usury.

Therefore, he who receives this admonition

(regarding the prohibition of usury) from his Lord,

and then gives up (taking usury), may keep his

previous gains (that he has taken before the

prohibition of usury) and it is for Allah to judge him.

But, those who revert to (taking usury), they shall be

among the people of the Fire, and they shall abide in

it forever. Allah deprives (the accumulation of wealth

through) usury of all blessings”; Ali ‘Imran 3:130: “O

believers! Devour not usury, doubling and redoubling

its rate many times, but remain conscious of Allah so

that yu shall prosper”; al-Rum 30:39: “And (know

that) what you give in usury, so that it may increase

10

Yaacob, H. and Rani, A.

Regulated and Regimented Interest in the Financial and Economy System: Issues and Challenges.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 10-16

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

in people’s property will not increase with Allah

(does not bring any good)”;

But this paper does not intend to explain the

prohibition of interest from religious nor

philosophical perspectives. This paper analyses the

imposition of interest in the banking system. We were

thought on how interest is to be managed, monetary

policy based on interest rate, discounted interest rate,

compunding interest and etc. Traditional models

emphasize the effects of monetary policy on the real

interest rate. However, we were not thought on the

origin of imposition of interest in the banking system.

This is where the so called claim on the fractional

reserve banking systems, money multiplication and

money supply being connected to the banking system.

What makes our banking system adopt the interest

based system? Despite of being prohibited by most of

the religion, interest still a good and viable option in

the monetary banking system. This paper claims that

the reason detre on the imposition of interest

undeniably backed by certain regulations and

standards (emphasise added).

The word interest and usury are interchangeably

used and it has been a long history. In his Theory of

Credit, Macleod describes: “A bank is therefore not

an office for “borrowing” and “lending” money, but

it is a Manufactory of Credit.”(Macleod,1905).

According to encyclopedia Britannica: “In old

English Law, the taking of any compensation

whatsoever was termed usury. With the expansion of

trade in the 13th century however, the demand for

credit increased, necessitating a modification in the

definition of the term. Usury then applied to

exorbitant or unconscionable interest rate. In 1545

England fixed a legal maximum interest; any amount

in excess of the maximum was usury. The practice of

setting a legal maximum on interest rate was later

followed by most states of the United States and most

other Western nations.” (Britannica, 2001)

The international financial regulation and

supervision have raised considerable scholarly

interest. One has to understand that the the beginning

of money standardisation began in 1944 resulted from

the Brettown Woods System. The Bretton Woods

Agreement remains an important part of world

financial history. The creation of the International

Monetary Fund (IMF) and valuation of gold and

foreign exchange rates remain important to this day.

The agreement also made currencies convertible for

trade and other current account transactions. Since the

collapse of the Bretton Woods System, IMF members

have been free to choose any form of exchange

arrangement they wish (except pegging their currency

to gold) and allows the currency to float freely,

pegging it to another currency or a basket of

currencies, adopting the currency of another country,

participating in a currency bloc, or forming part of a

monetary union. The Bretton Woods Agreement

resulted in the establishment of the IMF and the

World Bank in July 1944. The goal of the agreement

was to establish a framework for economic

cooperation and development that would lead to a

more stable and prosperous global economy. While

this goal remains central to both institutions, their

work is constantly evolving in response to new

economic developments and challenges.(IMF Fact

sheet, 2016) Unlike in the gold standard or Bretton

Woods, ‘modern’ money is not backed by or

redeemable for gold and hence the term fiat money.

This brings the issue of seigniorage, which is the

benefit one gets from the first use of fiat money, i.e.

the free purchasing power which new money, not

backed by gold or anything with intrinsic value,

carries with.(Mydin, 2002).It is submitted that the

authors are of the view that the usage of fiat money is

not a problem in the financial system. Comparing fiat

money with gold dinar is unjustifiable since fiat

money is being regulated by the authority of each

jurisdiction. People used gold and silver as main

currency of exchange previously due to its precious

values and unregulated. However, this statement need

to be said in subtle. The usage of fiat money however,

need to be free from any speculation and backed by

financial stability. Isues and challenges of regulated

and regimented interest is discussed in detail in below

contents.

2 METHODS

The study employs library research. Data collected

from the Standards and Policies of Bank of

International Settlement and the Central banks.

3 RESULTS

The findings shows that interest in the financial and

economic system originated from the standardisation.

The standards issued in policies have supported by

the Central Banks to materialise the implementation.

In addition non-compliance with the policies and

standards issued is subjected to non-compliance.

Regulated and Regimented Interest in the Financial and Economy System: Issues and Challenges

11

3.1 Evidences of the fractional reserve

banking system

According to Werner. R, the sequential introduction

of the incorrect fractional reserve and financial

intermediation theories of banking – leading the

student ever further away from the truth – was

intentional or not requires further research. Such

research should focus on the role of interested parties,

especially that of internationally active banks, central

banks and privately funded think tanks, in influencing

academic discourse. It is worrying, for instance, that

the topic of bank credit creation has been a virtual

taboo for the thousands of researchers of the world's

central banks during the past half century

(International Review of Financial Analysis, 2016).

The collapse of Bank Heuss Herstatt in 1974 was

a good bargaining factor to standardise the banking

practices in the world. The Basel Committee initially

named the Committee of Banking Regulations and

Supervisory Practices.(BIS, 2016) It was established

by the Central Bank Governors of the Group of Ten

(G10) countries at the end of 1974 in the aftermath of

serious disturbances in international currency and

banking markets (notably the failure of Bankhaus

Herstatt in West Germany). The Basel Committee on

Banking Supervision consists of senior

representatives of bank supervisory authorities and

central banks from Argentina, Australia, Belgium,

Brazil, Canada, China, France, Germany, Hong Kong

SAR, India, Indonesia, Italy, Japan, Korea,

Luxembourg, Mexico, the Netherlands, Russia, Saudi

Arabia, Singapore, South Africa, Spain, Sweden,

Switzerland, Turkey, the United Kingdom and the

United States.Since its inception, the Basel

Committee has expanded its membership from the

G10 to 45 institutions from 28 jurisdictions. Starting

with the Basel Concordat, first issued in 1975 and

revised several times since, the Committee has

established a series of international standards for bank

regulation, most notably its landmark publications of

the accords on capital adequacy which are commonly

known as Basel I, Basel II and, most recently, Basel

III. The Core Principles for Effective Banking

Supervision (Core Principles) are the de facto

minimum standard for sound prudential regulation

and supervision of banks and banking systems. The

minimum standards originally issued by the Basel

Committee on Banking Supervision in 1997, they are

used by countries as a benchmark for assessing the

quality of their supervisory systems and for

identifying future work to achieve a baseline level of

sound supervisory practices. The Core Principles are

also used by the IMF and the World Bank, in the

context of the Financial Sector Assessment

Programme (FSAP), to assess the effectiveness of

countries’ banking supervisory systems and

practices.(bis,2016) The revised Core Principles

define 29 principles that are needed for a supervisory

system to be effective. Those principles are broadly

categorised into two groups: the first group

(Principles 1 to 13) focus on powers, responsibilities

and functions of supervisors, while the second group

(Principles 14 to 29) focus on prudential regulations

and requirements for banks. The original Principle 1

has been divided into three separate principles, while

new principles related to corporate governance, and

disclosure and transparency, have been added. The

Core increased from 25 to 29 Principles (BIS, 2016).

Table 1 below shows the implementatation of

fractional reserve system as required under the

BCBS. Several jurisdictions were selected. The

Central Banks Acts were analysed from five (5)

jurisdictions. As shown in Table 1, the statutory

reserve is required by the Central Banks Acts of these

jurisdictions. The statutory reserve refers to the

fractional reserve requirement to be applied in the

banking system. Eventually, the “money multiplier”

demonstrates that a sum of money introduced into the

monetary system will increase the money supply by

more than its notional value.

Table 1: Banking Core Imposes the Fractional Reserve System in the Central Banks, sample of 5 jurisdictions. (Author’s own,

2017).

Banking Core

Principles

Singapore Law

Malaysian law

Brunei Law

Indonesian

law

Thailand law

BCP18: Problem

assets, provisions

and reserves

Banking Act 1999

Maintenance of reserve

fund

Sec 22.

maintain a reserve

Sec26(1) CBMA2009,

Conduct of monetary

Sec 40 AMBD

Order 2010

Art 10, Act

23/1999

Commercial

Banking Act

BE 2505

Section 11.

The above Table 1 may prove the Kamal Mydin

Meera’s theory that most all banks applies the

fractional reserve banking system including Islamic

banking (Mydin, 2016). This fractional Reserve is

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

12

determined by the central bank and is known as the

statutory reserve requirement (SRR). In Malaysia, as

of October 1, 2006 the SRR ratio as set by the Bank

Negara Malaysia was 4 percent of deposits. The

reserve requirement is the proportion of deposits

which the banking sector must keep as reserves to

fulfill withdrawal needs. Based on the above, it is

submitted that there is nothing wrong with the

reserve. We do not oppose to any idea of reservation

at the central banks for financial stability purposes.

However, we do object on taking and loaning it out

but at the same time, amount loaned is still considered

as assets and liabilty which is double entry. Ceteris

paribus this is interest. In most countries, Islamic

Banking and Finance too operates under this principle

(Mydin, 2009).

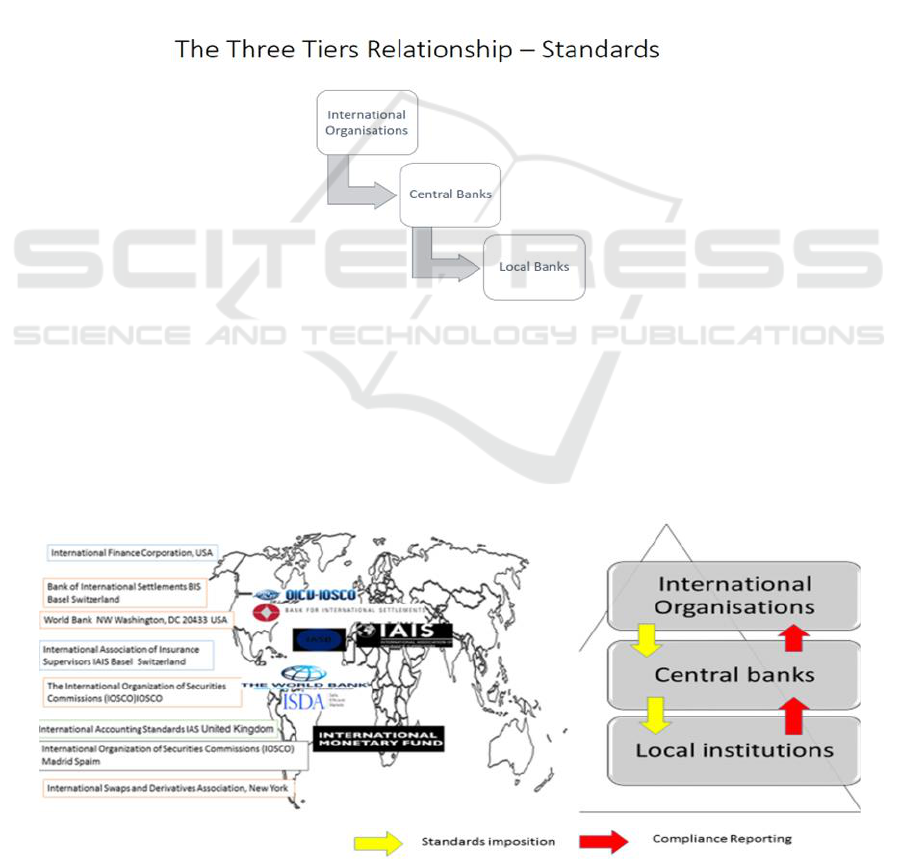

3.2 The Three Tier relationship

The relationship of how banking system works is best

demonstrated in below Figure 1. The incorporation of

standards issued by the international organisations

will be distributed to the Central banks. Central banks

will act as an agent to disseminate information,

standards, guidelines and any written directives from

the international organisations. Standardisation is

meant to create a harmonised practices in the

financial system. Undeniably standardisation is

needed towards globalisation.

Figure 1: The Three Tiers Relationship. Source: Author’s own (2017).

As can be seen from the Figure 1 above, the three

tiers relationship appears to have coherent effects of

standardisation and practices. Eventually all the local

institutions embed the same standards. By

incorporating the standards into the local jurisdictions

or local institutions, the monitoring and reviewing

processes requires compliance. These compliance

requirements demand large compliance towards the

standards.

Figure 2: Flow in Standards Imposition and Flow out Compliance Reporting. Source: Author’s own (2017).

Regulated and Regimented Interest in the Financial and Economy System: Issues and Challenges

13

Based on Figure 2 above, the Standards Basel Core

Principles states the Central Bank has to impose enalty for

non compliance of the Basel requirement. It is monitoreed

through the Financial Assesmenet Programme. The

assessment methodology can be used in multiple contexts:

(i) self-assessment performed by banking supervisors

themselves (ii) IMF and World Bank assessments of the

quality of supervisory systems, for example in the context

of FSAP; (iii) reviews conducted by private third parties

such as consulting firms; or (iv) peer review conducted, for

instance, within regional groupings of banking supervisors.

So far the assessment involving 150 countries. The Basel

Committee on Banking Supervision has issued guidelines

for performing self-assessments: Conducting a supervisory

selfassessment– practical application, Basel, April 2001.

The regular reports by the IMF and the World Bank on the

lessons drawn from assessment experiences as part of FSAP

exercises constitute a useful source of information which

has been used as an input to improve the Principles.

In order to achieve full objectivity, compliance

with the Core Principles is best assessed by suitably

qualified external parties consisting of two

individuals with strong supervisory backgrounds who

bring varied perspectives so as to provide checks and

balances; however, experience has shown that a

recent selfassessment is a highly useful input to an

outside party assessment.

a) A fair assessment of the banking supervisory

process cannot be performed without the

genuine cooperation of all relevant authorities.

b) The process of assessing each of the 29 Core

Principles requires a judgmental weighing of

numerous elements that only qualified assessors

with practical, relevant experience can provide.

c) The assessment requires some legal and

accounting expertise in the interpretation of

compliance with the Core Principles; these legal

and accounting interpretations must be in

relation to the legislative and accounting

structure of the relevant country.They may also

require the advice of additional legal and

accounting experts, which can be sought

subsequent to the on-site assessment.

d) The assessment must be comprehensive and in

sufficient depth to allow a judgment on whether

criteria are fulfilled in practice, not just in

theory. Laws and regulations need to be

sufficient in scope and depth, and be effectively

enforced and complied with. Their existence

alone does not provide enough indication that

the criteria are met (BIS,2016)

3.3 The problems in Islamic banking

operations

According to the World Bank Working Paper, in dual

financial systems with fairly developed conventional

money markets, Islamic banks evolve in an interest

rate dominant environment. Due to arbitrage between

conventional and Islamic financial systems, there

tends to be spillovers from conventional interest rates

to Islamic banks funding costs, to returns of Profit-

Sharing Investment Accounts (PSIAs) as well as to

costs of Islamic credit (Methodology of Assessment

on BCBS, www.bis.com, 2017). In most jurisdictions

that applies dual banking systems, there is often no

Islamic finance equivalent to money market or

government securities yield curves that can serve as

references to price Islamic banks credit. As a result,

some Islamic banks tend to rely on conventional

interest rates to price their Murabahah and Ijarah

contracts.(Mariam El Hamiani Khatat IMF Working

Paper, 2016).

3.4 Banking Models

As pointed by Werner (2014), there are three banking

models currently being adopted. The Fractional

reserve banking system establishes money creation

and multiplier that evantualy leads to interest. The

Keynes' theory in his Treaty mentions as follows; “A

banker is in possession of resources which he can

lend or invest equal to a large proportion (nearly

90%) of the deposits standing to the credit of his

depositors. In so far as his deposits are Savings

deposits, he is acting merely as an intermediary for

the transfer of loan-capital. In so far as they are Cash

deposits, he is acting both as a provider of money for

his depositors, and also as a provider of resources for

his borrowing-customers. Thus the modern banker

performs two distinct sets of services. He supplies a

substitute for State Money by acting as a clearing-

house and transferring current payments backwards

and forwards between his different customers by

means of book-entries on the credit and debit sides.

But he is also acting as a middleman in respect of a

particular type of lending, receiving deposits from the

public which he employs in purchasing securities, or

in making loans to industry and trade mainly to meet

demands for working capital. This duality of function

is the clue to many difficulties in the modern theory of

money and credit and the source of some serious

confusions of thought.” (Keynes, John Maynard,

1930). The financial intermediation theory includes

the ‘credit view’ in macroeconomics, proposing a

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

14

‘bank lending channel’ of monetary transmission and

according to Goodhart (1989):

“‘Intermediation’ generally refers to the

interposition of a financial institution in the process

of transferring funds between ultimate savers and

ultimate borrowers. … Disintermediation is then said

to occur when some intervention, usually by

government agencies for the purpose of controlling,

or regulating, the growth of financial intermediaries,

lessens their advantages in the provision of financial

services, and drives financial transfers and business

into other channels. … An example of this is to be

found when onerous reserve requirements on banks

lead them to raise the margin (the spread) between

deposit and lending rates, in order to maintain their

profitability, so much that the more credit-worthy

borrowers are induced to raise short-term funds

directly from savers, for example, in the commercial

paper market” (p. 144)(Goddhart,1989)

The three banking models as suggested by

Werner associated with interest. Surviving in this

conundrum, this may cause furore to Islamc banking

system. As opposed to the nature of Islamic banking

being the proprietor in every transaction, financial

intermediary is a big no for Islamic banking. Riding

on the fractional reserve banking system for long time

may defeat the upholding principles of shariah. As a

corollary, the three models promotes interest which is

not viable for islamic banking models.

3.5 The accounting standards

Charging interest on a loan principal is anathema in

Islamic banking. AAOIFI appears to agree that

recognition of profit is related to the repayment

period, and under its Financial Accounting Standard

(FAS) No. 2, Murabaha and Murabaha to the

Purchase Orderer. Under IAS 18, Revenue, when

there is a difference between the fair value and the

nominal amount of consideration the difference (i.e.

is recognised as interest revenue using the effective

interest method under IAS 39, Financial Instruments:

Recognition & Measurement. The effective interest

method amortises the cost of the financial asset and

allocates the interest income over the relevant period

based on the effective interest rate. The financial

reporting and accounting standards being regulated

under the International Acounting Standards Board

imposes interest calculation on reporting side. The

accounting standards of AAIOFI which prohibits

interest is claim to be incompatible with the current

sale based transaction. The problems not only in sale

based contract but also other contract such as ijarah,

wakalah, musharakah and mudharabah. There will be

extended consequences in the taxation system as well.

By adopting the International Accounting Standards,

the system of reporting and accounting are still ceteris

paribus interest.

4 FINDINGS AND CONCLUSION

Based on the above, interest was regulated and

regimented through standardisation. Indeed the

monitoring on compliance requires strict adherence to

the policy established. In a dual banking system, it is

proposed that the Central Banks provides pure

alternatives models for Islamic banking to detach

from the fractional reserves or the full reserves. To

adopt the financial intermediary models seems to

strayed from the real economic activities of Islamic

banking. Islamic banking acts as proprietor in every

transaction. Impossible for them to adopt the financial

intermediary models. A true banking model for

Islamic banks that free from multiplier, money begets

money, imposition of interest, compounding interest,

etc. this looks like easier said than done.

However, based on the above observation it is not

impossible for the banking system to be detached

from the interest based system. In dealing with

monetary policy, it is submitted that the increase and

decrease of interest rate will act as pain killer to the

grave desease. Infact more harm will be caused to the

public and not the main financial players. The

increase of interest rate may only harm the public.

Extended consequences will cause damage to the

societal values, the money created and multiplied

from the financial players. The control of money

supply should involve the financial players not

merely increasing the Statutory Reserve. The non-

desciscendum from the current avalanche may cause

difficulties for Islamic banking. However, continue

living in the current conundrum, may brings harm. It

is timely for Islamic banking to be detached from the

fractional reserve system, full reserve nor financial

intermediary models. To achieve this objective, a

concerted effort from the central banks are pivotal.

Being regulated under the regimented interest rulings

may cause harm to Islamic banking in future.

REFERENCES

A short review of the historical critique of usury Wayne

A.M. Visser and Alastair M^plntosh Accounting,

Business and Financial History, Volume 8, Number 2,

p176

Annual Report BIBD 2012-2017.

Regulated and Regimented Interest in the Financial and Economy System: Issues and Challenges

15

Diamond, Douglas W., & Rajan, Raghuram G. (2001,

June). Banks, short-term debt and financial crises:

Theory, policy implications and applications. Carnegie-

Rochester Conference Series on Public Policy, Vol.

54(1).(pp.37–71). Elsevier.

Douglas, C. H. (1924). Social Credit. London: Eyre &

Spottiswoode.

Eatwell, John, Milgate, Murray, & Newman, Peter (Eds.).

(1989). The New Palgrave Money. Basingstoke:

Macmillan.

Fama, Eugene (1985). What's different about banks?

Journal of Monetary Economics, 15(1985), 29–39.

Gertler, M., & Kiyotaki, N. (2011). Financial

intermediation and credit policy in business cycle

analysis. In B. Friedman, & M. Woodford (Eds.),

Goodfriend, Marvin (1991, Jan/Febb). Money, credit,

banking, and payments system policy. Economic

Review. Federal Reserve Bank of Richmond, 7–23.

Goodhart, C. A. E. (1989). Disintermediation. In John

Eatwell, Murray Milgate, & Peter Newman (Eds.), The

new Palgrave money. Basingstoke: Macmillan.

Gorton, Gary, & Pennacchi, George (1990, Mar.). Financial

intermediaries and liquidity creation. The Journal of

Finance, 45(1), 49–71.

Hellwig, Martin (1977). A model of borrowing and lending

with bankruptcy. Econometrica, 45, 1879–1906.

Hellwig, Martin (1991). Banking, financial intermediation

and corporate finance. In Alberto Giovannini, & Colin

Mayer (Eds.), European Financial

Integration.Cambridge:Cambridge University Press.

Hellwig, Martin F. (2000). Financial intermediation with

risk aversion. Review of Economic Studies, 67(4),

719–742.

Hoshi, Takeo, & Kashyap, Anil K. (2004). Japan's financial

crisis and economic stagnation.

International Review of Financial Analysis 36 (2014) 1–19

Keynes, John Maynard (1930).

ATreatiseonMoney.London: Macmillan&Co.

Khafif Ali, Al Milkiyyah fi al Shariah Islamiya wa

Muqaranatiha bil Kawanin al Arabia,Dar Al Nahda al

Arabia, Beirut, 1990.

Mariam El Hamiani Khatat IMF Working Paper, Monetary

Policy in the Presence of Islamic Banking Authorized

for distribution by Ghiath Shabsigh March 2016

Meera, Ahamed Kameel Mydin & Moussa Larbani (2006),

"Seigniorage of Fiat Money and the Maqasid al-

Shari’ah:The Compatibility of the Gold Dinar with the

Maqasid, Humanomics, Vol. 22, No.2, 2006, pp. 84-

97.

Meera, Ahamed Kameel Mydin (2002). The Islamic Gold

Dinar. Subang Jaya, Malaysia:Pelanduk Publications.

Meera, Ahamed Kameel Mydin (2004). The Theft of

Nations. Subang Jaya, Malaysia:Pelanduk Publications.

Meera, Ahamed Kameel Mydin and Moussa Larbani

(2006). “The Seigniorage of Fiat Money and the

Maqasid al-Shari’ah: The Unattainableness of the

Maqasid”.Humanomics, Vol.22 No. 1, pp17-33.

Montias, John Michael (1976), The Structure of Economic

Systems, New Haven: Yale University Press.

Policy document of Bank of International Settlement, Basel

Committee on Banking Core Supervision, available at

www.bis.org.

Policy document of International Associate of Insurance

Supervisors (IAIS), available at www.iais.org

Policy Document of International Chamber of Commerce

(ICC) on Uniform Credit and Practices (UCP600)

available at www.icc.org.

Policy Document of International Organisation of

Securities Commission (IOSCO) policy documents

available at www.iosco.org

Salin (n 2) 193; Gamoran “The Biblical law against loan on

interest” 1971 J of Near Eastern Studies 127-128.

Adopted from JJ Henning, The mediaeval contractum

trinius and the law of partnership, Fundamina 2007

Volume 13 Issue 2, available at

uir.unisa.ac.za/bitstream/.../Fundamina%20Final%

20Henning %2030% 20Nov.pdf.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

16