Choosing the Best Investment for Muslims According to Shariah

Dina Fitrisia Septiarini and Dian Fillianti

Islamic Economics Departement, Airlangga University, Surabaya, Indonesia

dina.fitrisia@gmail.com

Keywords: Investment, Islamic Stock, Kruskal-Wallis Test.

Abstract: Investment is owning one or more assets and usually long term with the hope of gaining profit in the future.

The return earned must be proportional to the risk of losses on assets. That is, the higher the risk of assets the

higher the expected return of the asset. The purpose of this study is to determine the difference of rate of risk

on Islamic stock, Islamic mutual fund, sukuk, 3 months of mudharabah deposit, gold, and property period

2008-2016. It uses quantitative approach by using Kruskal-Wallis test. The sample collecting method used is

purposive sampling. This study used secondary data that was collected from official websites of Indonesia

Stock Exchange, PT BNP Paribas, Indosat Ooredoo, Bank Syariah Mandiri, Price Gold, and Residential

Property Price Index on Makassar. Data used was historical data. The result Kruskal-Wallis test show that

there was significant difference of rate of risk on Islamic Stock, Islamic Mutual Fund, Sukuk, Mudharabah

deposit, Gold and Property. The result of this study proved that Islamic Stock is better than another type of

investments.

1 INTRODUCTION

The development of Islamic finance institutions in

Indonesia is also the development of various sharia

investments. Caliph Umar once told the Muslims

saying: "Whoever has the money, wants him to invest

it and anyone who owns the land wants him to plant

it” (Hidayat, 2011:24). The foundation is to extend

us to meet the wealth and use it in investing. But the

wealth must be accounted to Allah SWT listed in the

Qur'an Saba’:39 which reads:

Qul ‘Inna Robbī Yabsutūr-Rizqo Liman Yasyā‘u

Min ’Ibādihī Wayaqdiru Lahū. Wamā ‘Anfaqtum-

Min Syai‘in Fahuwwa Yukhlifuhū. Wahuwa

Khoyrūr-Rōziqīna.

“Say: Indeed, my Lord extends provision for

whom he wills of his servants and restricts (it) for

him. But whatever thing you spend (in his cause), He

will compensate it and He is the best of providers.

(QS. 34:39, Departemen Agama RI, 1971:690).

According to Al-Mahali (2000: 273), the above

verse explains that everyone gives sustenance to his

family that is sustenance from Allah SWT. That is,

every addition of wealth is always dependent on the

will of Allah SWT, so what one gets is a result of

pleasure given by Allah SWT.

The research used quantitative approach. The

variables used are return, risk, and coefficient of

variation.

1.1 Type and source of data

Type of data in this research is secondary data. The

source of data that can be accessed by www.idx.co.id,

PT BNP Paribas, sukuk, www.goldprice.org,

www.syariahmandiri.co.id, www.bi.co.id, several

other litelature sources related to this research. It

make purposive sampling, that analyzed for nine

years, so the total data in this research was 54 data

data (Indonesia Stock Exchange, 2017), (Gold Price,

2017), (PT. Bank Syariah Mandiri, 2017), (Bank

Indonesia, 2017).

1.2 Operational definition

Rate of risk is a measure of the relative deviation of a

distribution as the standard deviation ratio with the

estimated value for the value of the distribution. It

data can be obtained from the expected return and risk

in quarterly investment instrument period 2008-2016

using data ratio and it is time series.

96

Septiarini, D. and Fillianti, D.

Choosing the Best Investment for Muslims According to Shariah.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 96-99

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 LITERATURE REVIEW

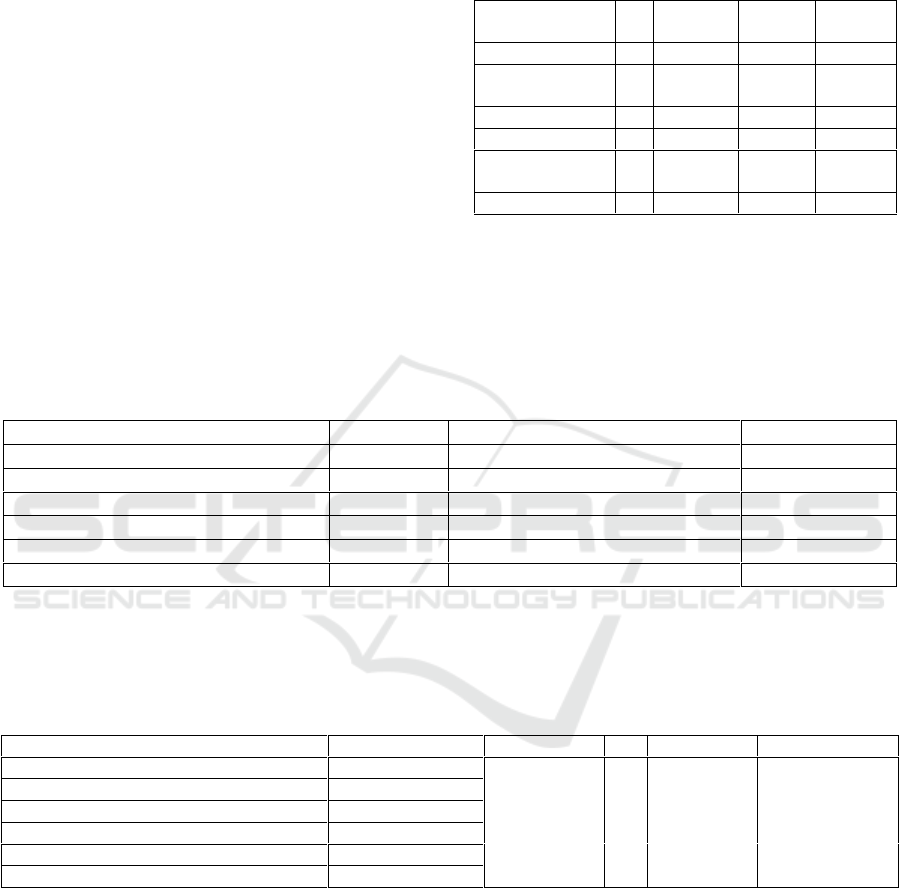

Table 1: Difference between Islamic Stock, Islamic Mutual Fund, Sukuk Ijarah, Gold, Mudharabah deposit, and Property.

Islamic Stock

Islamic Mutual Fund

Sukuk Ijarah

Gold

Mudha-rabah

deposit

Pro-perty

Inclusion of

Company

Systematic risk and

un-systematic risk

Certificate of

ownership proof

Wealth

Preser-

vation

Saving

Immobi-lity

No

Yes

3 years

No

3,6,12 month

No

Divdends

NAV

Payable monthly

interest on deposits

Profit

rising

price

Profit Sharing

Profit rising price

Can be traded

Can be traded

Can’t, redemption

option

Can be

traded

Can’t be traded

Can be traded

No

No

No

No

Max 2 Bilion

No

* More literature

The objective of all investment is capital gain,

which is the positive difference between selling price

and purchase price of the issuer because the company

earns a profit (Samsul, 2006: 160). If there are two

investments which have the same rate of return but

different rate of risks, then the investors prefer the

lower risk investment. Similarly, with the same rate

of return risk, investors prefer the investment with

higher risk that will face the same crisis. However,

when encountering two investments that have rate of

return equal to the rate of risk, it should be calculated

the result of each investment.

E(Ri)

Securities Market

Line (SML)

Beta

0 1,0

Figure 1: Trade off Return and Risk.

Yusoff, et.al (2010), investments on commercial

properties are more attractive compared to investment

on banking Institutions. Mensi, et.al (2015), GCC

stock market and global investors can realize both

risk diversification benefits and downside risk

reductions during tranquil and downturn periods by

including gold or Dow Jones Islamic Wold Emerging

Market (DJIWEM) in their portfolios but not the T-

bills. Mansor and Ishaq (2011), Islamic mutual fund

portfolios were dependent on the market portfolio of

which the former portfolio was closely mirrored to

the market movement in relation to the latter

portofolio.

Here is the model of the return realized, expected

return, risk, and coefficient of variation equation of

each investment instrument:

1. Return Realized

R

I

=

2. Expected Return

E(Ri) =

∑

3. Risk

σ =

[

(

R − E(Ri)

)

]

n − 1

4. Coefficient of Variation

CV =

( )

3 METHOD, RESULTS AND

DISCUSSION

3.1 Research Methodology

The research used quantitative approach. The

variables used are return, risk, and coefficient of

variation.

3.1.1 Type and Source of Data

Type of data in this research is secondary data. The

sources of data that can be accessed are

www.idx.co.id, PT BNP Paribas, sukuk,

www.goldprice.org, www.syariahmandiri.co.id,

www.bi.co.id, several other litelature sources related

R

BR

Choosing the Best Investment for Muslims According to Shariah

97

to this research. These data make purposive sampling,

that is analyzed for nine years, so the total data in this

research was 54 data (Indonesia Stock Exchange,

2017), (Gold Price, 2017), (PT. Bank Syariah

Mandiri, 2017), (Bank Indonesia, 2017).

3.1.2 Operational Definition

Rate of risk is a measure of the relative deviation of a

distribution as the standard deviation ratio with the

estimated value for distribution value. The data can

be obtained from the expected return and risk in

quarterly investment instrument period 2008-2016

using data ratio and it is time series.

3.2 Results

Non-probability sampling method with purposive

sampling category between JII, NAV per unit BNP

Paribas Pesona Syariah, profit’s sukuk Ijarah Indosat

IV Seri B, gold price, mudharabah deposit with 3

months rate of return, and residential property price

index (RPPI).

Table 2: Descriptive Statistic Rate of Risk.

Investment

Instrument

N

Min

Max

Mean

JII

9

-52,846

1,295

-6,616

Islamic Mutual

Fund

9

-3,577

18,078

3,061

Sukuk

9

0,000

0,000

0,000

Gold

9

-12,065

2,172

-0,406

Mudharabah

deposit

9

0,021

0,081

0,046

Property

9

0,271

1,579

0,693

*Data processed

The result of calculation above, the smaller the

rate of risk, indicates smaller risk and greater

expected return from investment. The statement

refers to JII which is the most profitable investment

choice.

Table 3: Kolmogorov Smirnov Normality Test.

Investment Instrument

Significant

Explain

Examination

JII

0,001

Not Distributed Normaly

Kruskal-Wallis

Islamic Mutual Fund

0,001

Not Distributed Normaly

Kruskal-Wallis

Sukuk

0,000

Not Distributed Normaly

Kruskal-Wallis

Gold

0,001

Not Distributed Normaly

Kruskal-Wallis

Mudharabah deposit

0,200

Distributed Normaly

ANOVA

Property

0,200

Distributed Normaly

ANOVA

*Processed Data

The table shows not normally distributed test

result, except Mudharabah deposits and property. It

can be concluded that further risk testing need to use

Kruskal-Wallis test.

Table 4. Kruskal-Wallis Test.

Investment Instrument

Mean Rank

Chi-Square

Df

Significant

Explain

JII

23,44

16,492

5

0,006

H

0

is rejected

Islamic Mutual Fund

34,56

Sukuk

13,00

Gold

36,33

Mudharabah deposit

22,00

Property

35,67

*Processed data

The applied significance level is 0,05 which is

greater than the risk level of 0,006. This suggests that

there are significant differences (H0 rejected). The

decision can be seen from the value of bigger

statistical calculation and statistical table

(16,492>11,070).

3.3 Discussion

Comparison of Rate of Return on Islamic Stock,

Islamic Mutual Fund, Sukuk, Gold, Mudharabah

Deposit, and Property Period 2008-2016

There is a significant difference in investment

instruments in according with the above statement

that Islamic stocks are at risk both systematically and

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

98

systematically without any intervention from

investment managers (Tandelilin, 2010: 104).

In Islamic mutual funds, the risk that occurs in

NAV is influenced by the price of securities that are

arranged in its portfolio (decreasing unit value) and

liquidity risk that can complicate the company's

management in providing its fund (Achsein,

2000:82).

There are risks that must be faced on Sukuk

Investment, one of themn is the risk of sharia

compliance (Wahid, 2010:296). The risk is due to

differences in understanding relating to fiqh and

affect the implemented sukuk contract.

According to Oei (2009:65) gold, which is likely

to experience a decline in prices, potentially in the

case of theft, there will be potentially different price

between the selling price and the purchased price.

Based on Financial Authorities Regulation

Number 65/POJK.03/2016 clause 1 number 15 which

states that rate of return risk is a risk due to changes

in the yield rate received by the bank from funds

channeling from costumers, that may affect the third

party’s behavior.

The requirement of property investment is to have

a considerable initial capital. It also requires

maintenance costs. It will take a considerable amount

of time to gain a profit from reselling the investment.

(Salim, 2011:6).

4 CONCLUSIONS

There were significant difference between rate of risk

of islamic stock, islamic mutual fund, sukuk, gold,

mudharabah deposit, and property. The significant

rate is 0.05.

Based on the average results in terms of rate of

risk, Islamic stock is the best investment instrument

among gold, Islamic mutual funds, sukuk, deposit,

and property.

Using Kruskal-Wallis test, it can be concluded

that rate of risk in Islamic stock, Islamic mutual fund,

sukuk, gold, mudharabah deposit, and property is

different from each other (H

0

rejected).

REFERENCES

Achsien, Iggi H. 2000. Investasi Syariah di Pasar Modal,

Menggagas Konsep dan Praktek Manajemen

Portofolio Syariah. The First Edition, Jakarta: PT.

Gramedia Utama.

Al-Mahali, Imam Jalaluddin dan Imam Jalaluddin As-

Suyutti. 2000. Tafsir Jalalain. Jilid 1. Bandung: Sinar

Baru Algensindo.

Bank Indonesia. (2017, August 24). Retrieved from Bank

Sentral Republik Indonesia:

https://www.bi.go.id/id/Default.aspx.

Departemen Agama RI. 1971. Al-Qur’an dan Terjemahnya.

Jakarta: Yayasan Penyelenggara

Penterjemah/Penafsiran Al-Qur’an.

Gold Price. (2017, August 26). Retrieved from Gold Price

.Org: https://goldprice.org/.

Hidayat, Taufik. 2011. Kaya Sekarang Juga! Cara Pintar

Investasi Emas & Dinar. The First Edition. Jakarta:

Mediakita.

Indonesia Stock Exchange. (2017, August 26). Retrieved

from Bursa Efek Indonesia: www.idx.co.id.

Mansor, Fadillah and M. Ishaq Bhatti. 2011. Risk and

Return Analysis on Performance of the

Islamic mutual funds: Evidence from Malaysia. Global

Economy and Finance Journal.

4 (1): 19.

Mensi, Walid, et.al. 2015. Are Sharia Stocks, Gold and U.S.

Treasuries Hedges and Safe Havens for the Oil-Based

GCC Markets?. Emerging Markets Review. 24: 101.

Oei, Istijanto. 2009. Kiat Investasi Valas, Emas, Saham.

Jakarta: PT Gramedia Pustaka Utama.

PT. Bank Syariah Mandiri. (2017, August 31). Retrieved

from Mandiri Syariah:

https://www.syariahmandiri.co.id/.

Salim, Joko. 2011. 108 Tanya Jawab Investasi & Bisnis

Properti Kupas Tuntas Strategi Sukses & Pintar

Berinvestasi. Jakarta: Transmedia Pustaka.

Samsul, Mohamad. 2006. Pasar Modal dan Manajemen

Portofolio. Jakarta: Erlangga.

Wahid, Nazaruddin Abdul. 2010. Sukuk: Memahami &

Membedah Obligasi pada Perbankan Syariah.

Yogyakarta: A-Ruzz Media.

Tandelilin, Eduardus. 2010. Portofolio dan Investasi Teori

dan Aplikasi. The First Edition. Yogyakarta: Kanisius.

Yusoff, Wan Zahri Wan, et.al. 2010. A Study of Return on

Investment for Commercial Property

In Johore State, Malaysia. Construction, Building and

Real Estate Research Conference of RICS. (Online)

www.researchgate.net accessed on September 12,

2017.

Choosing the Best Investment for Muslims According to Shariah

99