Early Warning System for Sharia Insurance Companies in Indonesia

and Malaysia at 2013-2015 periode

Sylva Alif Rusmita, Puji Sucia Sukmaningrum, and Zata Atikah Amani

Universitas Airlangga, Surabaya, Indonesia

sylvalifr@feb.unair.ac.id, puji_sucia@yahoo.com, zatatikah@gmail.com

Keywords: Comparison, Early Warning System, Islamic Insurance Indonesia and Malaysia.

Abstract: The purpose of this research is to know the health of Islamic insurance companies in Indonesia and Islamic

insurance companies in Malaysia using early warning system during the period of 2013-2015. Early warning

system is the measurement where those ratios will provide early warning. This research method uses

quantitative methods, and using sample of three Islamic insurance companies in Indonesia and eight Islamic

insurance companies in Malaysia. Assessment of financial performance using early warning system is

measured by the ratio of change of surplus ratio, underwriting ratio, incurred loss ratio, commission ratio,

management ratio, investment yield ratio, premium growth ratio, and retention ratio. The data used is

secondary data which is being collected of annual financial report from 2013-2015. The results show all of

the ratios on Islamic insurance companies in Indonesia and Malaysia in good health. But when viewed from

per ratio, health level in Islamic insurance companies in Malaysia is better than Islamic insurance companies

in Indonesia.

1 INTRODUCTION

Islamic Economics is a branch of science that

develops and grows to solve the economic problems

caused by greed and injustice. Here the Islamic

economy grows and comes to reach falah with

maslahah as a goal to avoid from harm.

The development of Islamic economics in

Indonesia develop rapidly since the monetary crisis in

1997 which have impacted on liqyuidity of

conventional bank. However, Bank Muamalat was

established in 1992 to survive when the crisis

occurred. Various Laws supporting the system of

Islamic finance institutions began to be made by

Government, such as Law Number 7 of 1992

concerning Banking as amended by Act Number 10

of 1998 and Act Number 23 of 1999 concerning Bank

Indonesia which at the same time received direct

support from the Indonesian Vice President Jusuf

Kalla.

The development of Takaful or Islamic Insurance

in Indonesia which is also involved in the

development of sharia banking industry has a positive

impact on the development of sharia insurance

industry in Indonesia. The development of Takaful

was driven by the demand of sharia banking which

requires insurance protection for every asset in

Islamic banks, such as the company's assets and third

party assets.

Insurance is one of the non-banking financial

institutions engaged in services which is also one of

the pillars that can promote economic growth in

Indonesia. On chapter 246 of the Code of Trade

Commercial Law which explains that insurance is an

agreement, whereby an insurer binds himself to an

insured with a premium to provide reimbursement to

him because of a loss, damage or loss of expected

profit, which he may suffer because of an event that

is not certain.

The explanation above also relates to the

definition of insurance in the business view which

explains that a company whose main business

receives or sells services, transfers risks from other

parties, and earns a share of risk among its customers

(Ali, 2004: 60).

Sula (2004: 33) defines takaful in the sense of

muamalah is mutually carrying risk among fellow

people, so that among others be the insurer of other

risks. Thus takaful is a shared responsibility between

the Muslims and in this case is aimed at helping, and

guaranteeing another Muslim in matters of

righteousness (Hasan, 2014: 19).

Rusmita, S., Sukmaningrum, P. and Amani, Z.

Early Warning System for Sharia Insurance Companies in Indonesia and Malaysia at 2013-2015 periode.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 135-140

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

135

The system implemented in this Takaful

insurance is based on ta’awun principle which is

helping each other in the good way of spending funds

tabarru 'or ibdah funds, donations, and charities

intended to bear the risk (Amrin, 2006: 5). It known

as sharing of risk on Takaful insurance, while

conventional insurance applied transfer of risk.

Table 1: Comparison of Total Assets for Sharia Insurance

in Indonesia and Malaysia in 2013 – 2015 (on trilion).

Sharia

Insurance

2013

2014

2015

Indonesia

Rp 16,66

Rp 22,36

Rp 26,52

Malaysia

Rp 65.171

Rp 70.812

Rp 76.930

Source: Indonesia Insurance Statistics by the Financial

Services Authority & Annual Report by Bank Negara

Malaysia (which has been reprocessed).

Based on data published by the Financial Services

Authority (OJK), the total number of sharia insurance

companies reached 8 units consisting of 5 units of

sharia life insurance, 3 units of general insurance

sharia, and 0 units of reinsurance sharia. The total

number of sharia business unit companies reaches 45

units consisting of 19 units of sharia insurance, 23

sharia general insurance and 3 units of Islamic

reinsurance with total assets reach Rp 26.52 trillion in

2015 or grow 18.6 percent from Rp 22, 36 trillion in

the past year. Based on the data, industry in the field

of services that is sharia insurance will continue to

grow rapidly can be one of the financial sector that

can also be interpreted as part of the main movement

of the Indonesian economy.

Based on the publication results from Bank

Negara Malaysia globally, takaful industry has grown

rapidly, it is because takaful industry appeals to both

Muslim and non-Muslim consumers. The Industry is

expected to grow by 15-20 percent per years with

total contribution estimated to reach USD 7.4 billion

of total assets of USD 16.1 billion by 2015, and

currently stands more than 110 takaful companies

around the world. It is also offset by Malaysia and

Indonesia which are the main markets in the

development of takaful insurance.

Based on data published by Bank Negara

Malaysia, total assets of sharia insurance in Malaysia

after converted to the Indonesian currency exchange

rate of Rp 3,113.17 per RM 1 amounting to Rp 76,930

trillion in 2015 with sharia life insurance assets

amounting to Rp 66,588 trillion while general

insurance assets of sharia amounting to Rp 10,342

trillion. Of the total assets increased by 8 percent from

Rp 70,812 trillion in 2014.

Although there is an increase in total assets of a

Takaful company but in financial matters is the most

important issue in supervising financial performance.

Especially the supervision of financial performance

of sharia insurance industry which has specific

criteria in its performance assessment, it is necessary

to have the provision of Early Warning System

(EWS) or an early warning system to solve problems

if they occur in the future.

Early Warning System or usually referred to as an

early warning system that aims to determine the

extent to which the financial health of a company.

Satria (1994: 5) describes the usefulness of the Early

Warning System (EWS), which states that:

In many countries EWS calculations are used to

help insurance commissioners measure financial

performance and assess the health of an insurance

company by detecting earlier impending insolvency

shortages, identifying firms that require more

rigorous monitoring and immediate attention , and

determine the level (grading) of insurance companies.

According to Satria (1994: 133) there are nine

important ratios that are often used in assessing the

financial performance based on the Early Warning

System (EWS), but in this study will use 8 ratios

including the Ratio of Surplus Change, Underwriting

Ratio, Claim Ratio, Management Cost Ratio,

Investment Return Ratio, Premium Growth Ratio,

and Own Retention Ratio.

The formulation of the problem in this study is

how the health of sharia insurance companies in

Indonesia with Malaysia using early warning system

during the study period 2013-2015?

The purpose of this study is to find out the health

of sharia insurance companies in Indonesia with

Malaysia using early warning system during the study

period 2013-2015

2 THEORY AND DEVELOPMENT

OF HYPOTHESIS

Sharia insurance or better known as takaful, at-ta'min,

and tadhamun are mutual efforts to protect and help

between a number of people or parties through

investment in the form of assets or tabarru 'funds and

provide a pattern of return to face certain risks

through akad sharia (Aziz, 2010: 190). Sula (2004:

33) defines takaful in the sense of muamalah is

mutually carrying risk among fellow people, so that

among others be the insurer of other risks.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

136

2.1 Sharia Insurance in Indonesia

The development of sharia insurance industry players

during the last five years can be classified according

to the form of the implementation of sharia business

activities, namely pure sharia (full fledge) and part of

sharia (Sharia unit) and described as sharia life

insurance company, insurance company.

Based on the growth of total assets of sharia

insurance industry in 2013 has grown in terms of

assets of 20.43 percent, in 2014 by 25.71 percent, in

2015 decreased increase of only 18.2 percent, and in

2016 increased growth again to 20.42 percent. If from

2013 to 2016, the total assets of the sharia insurance

industry experienced an average growth every year of

21.19 percent. This may reflect that the sharia

insurance industry continues to be in demand by the

public and is beginning to be trusted as a financial

institution that can be coupled with conventional

insurance that is better known to the public at large.

2.2 Sharia Insurance in Malaysia

The development of Takaful industry in Malaysia

began in the early 1980s inspired by the needs of the

Muslim community in Malaysia, which was later

used as an alternative to sharia-based for conventional

insurance, as well as complementing the operations

of sharia banks established in 1983.

The general insurance industry of sharia in

Malaysia has experienced remarkable growth since

more than 20 years ago. This is evidenced by the

increasing number of sharia general insurance

companies along with decent industrial performance

diakuin and a good progressive with a broad market

structure and a variety of products provided by

general insurance operators of sharia. Although sharia

general insurance is formed early and leads from

sharia life insurance from total contribution since the

beginning of the Malaysian sharia insurance but

nowadays sharia insurance has more than 71 percent

of total contribution obtained from sharia insurance

industry in Malaysia (Bank Negara Malaysia, 2004 ).

2.3 Early Warning System Analysis

Early Warning System (EWS) using a series of test

ratios (test ratios) applied to the financial statements

of general insurance companies to measure the

company's financial capabilities and performance.

There are 8 important ratios used to measure financial

performance According to Satria (1994: 67-72). They

are surplus ratio, underwriting ratio, claim ratio,

growth ratio of premiums, commission ratio, cost

management, ratio investment, premium growth

ratio, and retention ratio

3 RESEARCH METHOD

The research is using quantitative approach.

Analytical technique used is descriptive statistic, that

is statistic technique used to analyze data by

describing data which have been collected before

(Anshori and Iswati, 2009: 116)

3.1 Operational Definition

The operational definition contains explanations /

specifications of the variables that have been

identified, the measurement of variables, and the

scale / size used. he operational definitions of the

variables used in this study are surplus ratio,

underwriting ratio, claim expenses ratio, ROI,

Growth ratio premium.

3.2 Data

In this study used the type of quantitative data in the

form of secondary data. Secondary data is primary

data that has been processed further and presented by

primary data collector or by other party and usually

presented in the form of table or diagram (Siagian and

Sugiarto, 2006: 17). Where the data comes from the

company's financial report downloaded on the official

website of the Takaful company. Secondary data used

in the form of annual financial statements from each

website of Sharia Insurance in Indonesia and sharia

insurance in Malaysia period 2013-2015

3.3 Sample

In this research, sampling technique used is purposive

sampling. Anshori and Iswati (2009: 105), stated that

purposive sampling is a technique of determining

samples with certain considerations

The sample used is a full sharia insurance

company in Indonesia registered in the Financial

Services Authority prior to 2013 and a full sharia

insurance company in Malaysia registered with Bank

Negara Malaysia and publishes and publishes its

annual financial report for the period 2013-2015

through each insurance company sharia. Total sample

from Sharia Insurance Indonesia are three companies

and Sharia Insurance Malaysia are ten companies.

Early Warning System for Sharia Insurance Companies in Indonesia and Malaysia at 2013-2015 periode

137

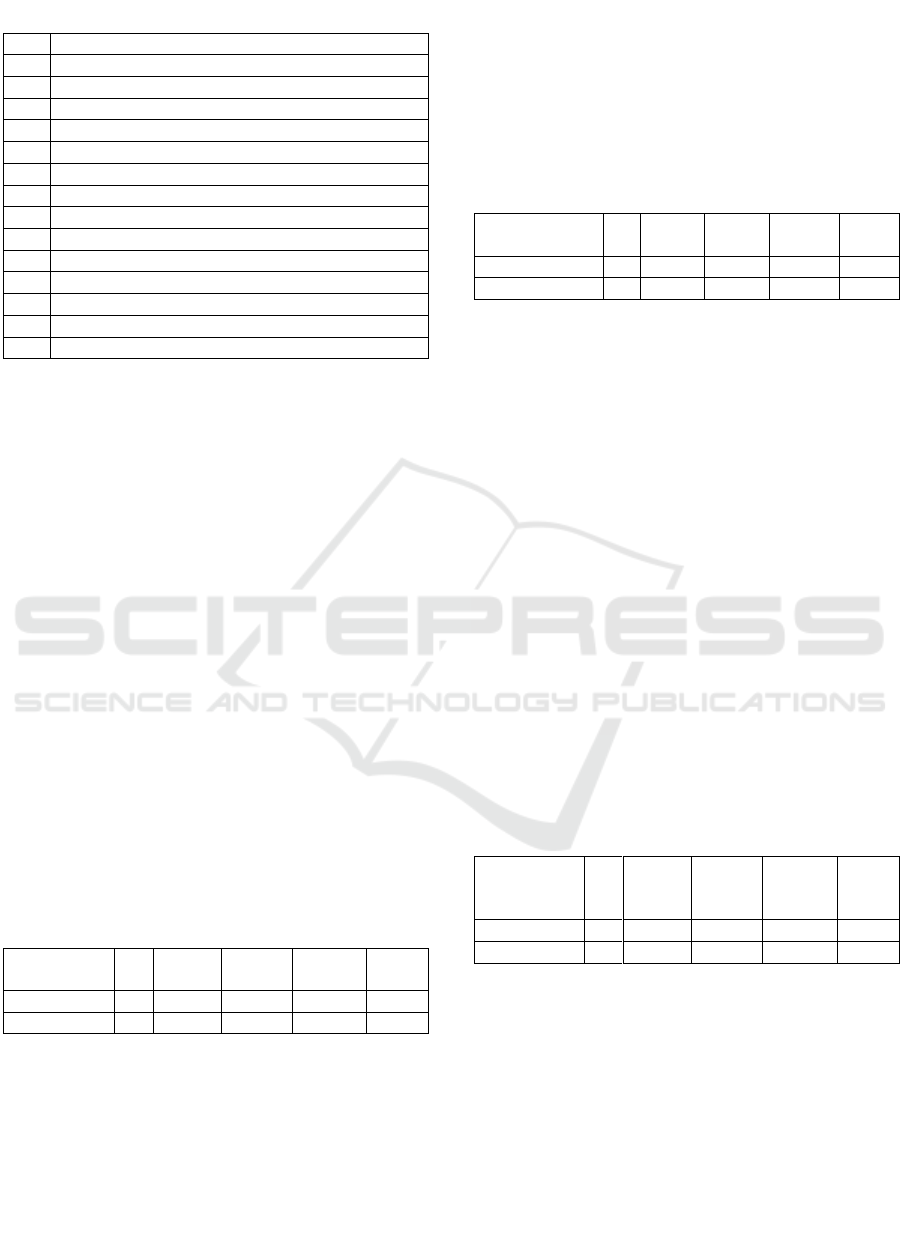

Table 2: Reseach Sampling.

Sharia Insurance in Indonesia

1

PT Asuransi Takaful Keluarga

2

PT Asuransi Jiwa Sharia Al-Amin

3

PT Asuransi Jiwa Takaful Umum

Sharia Insurance in Malaysia

1

AmMetLife Takaful Berhad

2

Etiqa Takaful Berhad

3

Great Eastern Takaful Berhad

4

Hong Leong MSIG Takaful Berhad

5

HSBC Amanah Takaful (Malaysia) Berhad

6

Zurich Takaful Malaysia Berhad

7

Prudential BSN Takaful Berhad

8

Sun Life Malaysia Berhad

9

Syarikat Takaful Malaysia Berhad

10

Takaful Ikhlas Berhad

3.4 Analysis Technique

Data analysis techniques in quantitative research

using statistical analysis. Data analysis in this

research uses two stages namely descriptive statistics.

Descriptive statistics present the mean, the lowest

(minimum), and the highest (maximum) values of the

ratios tested: Surplus Change Rate, Underwriting

Ratio, Claim Load Ratio, Commission Ratio,

Management Cost Ratio, Return Ratio Investment,

Premium Growth Ratio, and Own Retention Ratio of

Takaful insurance that is sampled during the period

2013-2015. Descriptive statistics in this study using

Ms. Excel 2013.

4 RESULTS AND DISCUSSION

Based on data analysis the result of this research are:

4.1 Sharia Surplus Ratio

Table 3: EWS Calculation Result on Sharia Surplus Ratio

Changes in Indonesia and Malaysia.

Surplus

Ratio

N

Min

Max

Mean

Std.

Dev

Indonesia

9

0,00

0,30

0,03

0,10

Malaysia

9

0,00

0,00

0,00

0,00

Source: Result of Data Processing.

Sharia Insurance in Indonesia has a better financial

performance when compared with Sharia Insurance

in Malaysia. Sharia Insurance in Indonesia has the

highest Surplus Ratio Change Rate on descriptive

statistic analysis for the average value and maximum

value. Sharia Insurance in Indonesia has an average

of 0, 03 or 3% with the highest ratio of 0,30 or 30%

and the lowest ratio of 0%. While the average

Malaysia Sharia insurance surplus ratio is 0, 00 or 0%

with the highest ratio of 0,00 or 0% and the lowest

0%.

4.2 Underwriting Ratio Description

Table 4: EWS Calculation Result on Sharia Insurance

Underwriting Ratios in Indonesia and Malaysia

Underwriting

Ratio

N

Min

Max

Mean

Std.

Dev

Indonesia

9

-0,01

0,22

0,14

0,06

Malaysia

9

-0,21

0,04

-0,06

0,09

Source: Result of Data Processing.

Financial performance of Sharia Insurance in

Indonesia and Sharia Insurance Malaysia in the

period 2013-2015 based on Underwriting Ratio show

that Sharia Insurance in Indonesia has an average of

0.14 or 14% with the highest ratio of 0,22 or 22% and

the lowest ratio of -0.01 or -1%. On the other hand,

the average underwriting ratio of Sharia Insurance in

Malaysia is -0.06 or -6% with the highest ratio of 0.04

or 4% and the lowest being -0.21 or -21%. So, Sharia

Insurance both countries in good condition, but

Shariah Insurance Malaysia has better financial

performance compared to Sharia Insurance Indonesia

because Sharia Insurance in Malaysia has the lowest

Underwriting Ratio value. It can be concluded that

Sharia Insurance in Malaysia has a good assessment

in the determination of the contribution given to

customers of sharia insurance.

4.3 Description of Claim Expense Ratio

Table 5: EWS Calculation Result on Sharia Insurance

Claim Expense Ratio in Indonesia and Malaysia

Claim

Expense

Ratio

N

Min

Max

Mean

Std.

Dev

Indonesia

9

0,29

0,88

0,50

0,20

Malaysia

9

0,01

0,53

0,31

0,19

Source: Result of Data Processing.

Sharia Insurance in both countries has good

performance, but Sharia Insurance in Malaysia has

better financial performance compared to Sharia

Insurance in Indonesia. It is because Sharia Insurance

in Malaysia has the lowest Claim Ratio Rate. Based

on the Claim Expense Ratio, Sharia Insurance in

Indonesia has an average of 0, 50 or 50% with the

lowest ratio of 0, 29 or 29% and the highest ratio of

0.88 or 88%. While Sharia Insurance Claim Expense

Ratio in Malaysia is 0,31 or 31% with the lowest 0,

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

138

01 or 1% and the highest ratio of 0, 53 or 53%. So it

can be concluded that Sharia Insurance in Malaysia

has a good assessment in underwriting and risk

closing process

4.4 Description of Commission Ratio

Table 6: EWS Calculation Result on Ratio of Sharia

Insurance Commission in Indonesia and Malaysia

Commission

Ratio

N

Min

Max

Mean

Std.

Dev

Indonesia

9

0,06

0,47

0,30

0,13

Malaysia

9

0,21

6,15

2,02

2,62

Source: Result of Data Processing.

Based on the Commission Ratio, Sharia Insurance in

Indonesia has an average of 0, 30 or 30% with the

lowest ratio of 0, 06 or 6% and the highest ratio of 0,

47 or 47%. While, Sharia Insurance Commission in

Malaysia amounted to 2, 02 or 202% with the lowest

0, 21 or 21% and the highest ratio of 6, 15 or 615%.

This illustrates that in the year Sharia Insurance in

Indonesia and Asuransi Sharia in Malaysia have a

good financial performance. However, here Sharia

Insurance in Indonesia has a better financial

performance. Since the Commission Ratio can be

used as a benchmark in determining the acquisition

cost incurred by the company in each industry, where

the cost of acquisition in the Malaysian Sharia

Insurance industry is high, it will be very influential

in the Commission Ratio

4.5 Descriptions of Cost Management

Ratio

Table 7: EWS Calculation Result on Sharia Insurance Cost

Management Ratio in Indonesia and Malaysia

Cost

Management

Ratio

N

Min

Max

Mean

Std.

Dev

Indonesia

9

0,38

0,97

0,78

0.22

Malaysia

9

0,63

17,72

4,88

6,65

Source: Result of Data Processing.

The Management Cost Ratio, Sharia Insurance in

Indonesia has an average of 0.78 or 78% with the

lowest ratio of 0.38 or 38% and the highest ratio of

0.97 or 97%. While, the average Sharia Insurance

Management Cost Ratio in Malaysia is 4,88 or 488%

with the lowest 0, 63 or 63% and the highest ratio of

17.72 or 1772%. This illustrates that in the year

Sharia Insurance in Indonesia and Sharia Insurance in

Malaysia have a good financial performance. Sharia

Insurance in Indonesia has the lowest Ratio

Management Cost, because sharia insurance in

Indonesia is starting to grow so the management costs

incurred are not too high than in Malaysia

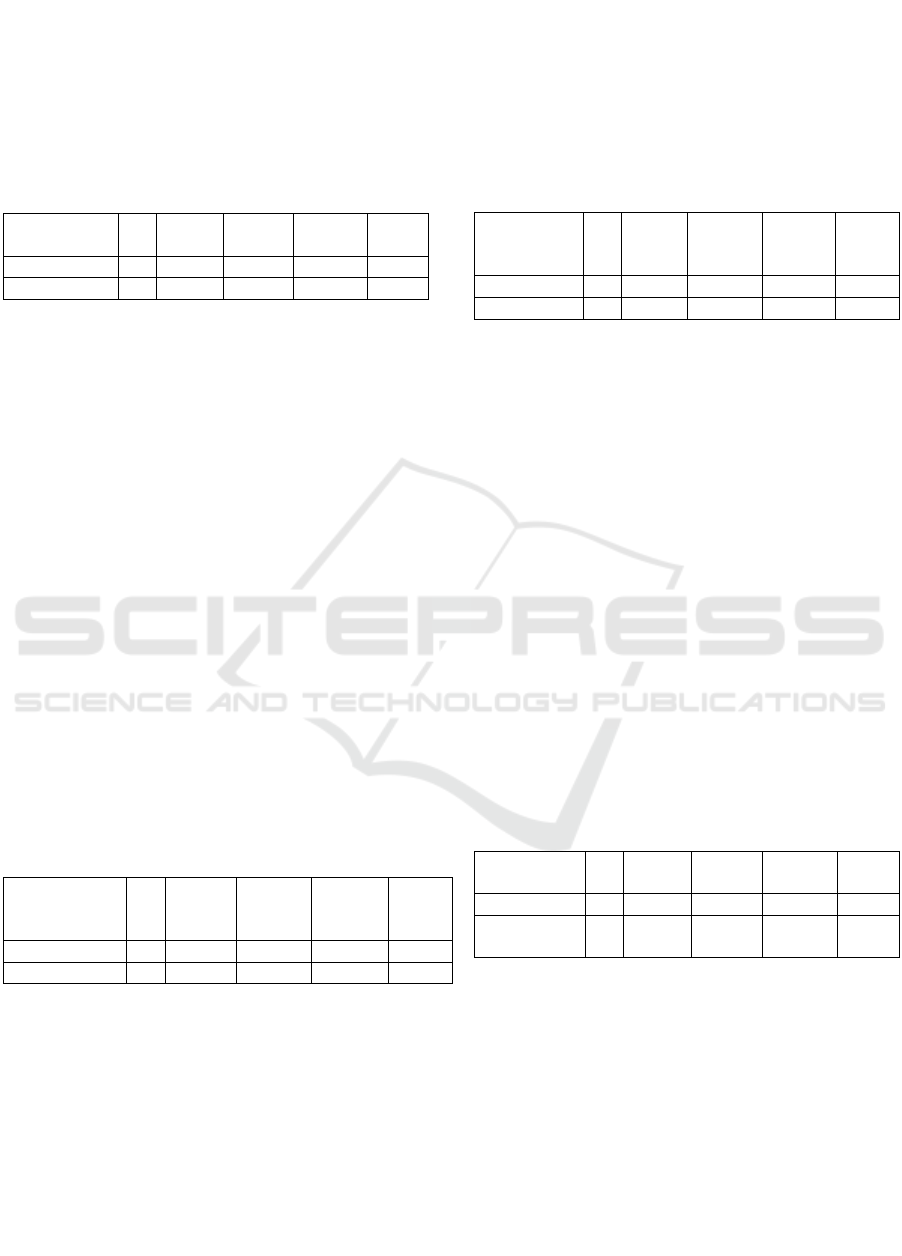

4.6 Premium Growth Ratio

Table 8: EWS Calculation Result on Sharia Insurance

Premium Growth Ratio in Indonesia and Malaysia

Premium

Growth

Ratio

N

Min

Max

Mean

Std.

Dev

Indonesia

9

-0,07

0,28

0,01

0.11

Malaysia

9

-0,21

101,84

11,61

33,84

Source: Result of Data Processing.

Sharia Insurance in Indonesia has an average of 0.01

or 1% with the highest ratio of 0, 28 or 0, 28% and

the lowest ratio is -0, 07 or -7%. While, the average

Ratio of Growth Insurance Premium Sharia in

Malaysia amounted to 11,61 or 1161% with the

highest ratio of 101,84 and the lowest ratio -0.21 or -

21%. Sharia Insurance in Malaysia has a better

financial performance when compared with Sharia

Insurance in Indonesia due to Sharia Insurance in

Malaysia have in the Ratio of Premium Growth more

sustainable than Sharia Insurance in Indonesia. The

shariah insurance premium in Malaysia has increased

every years where the factors that influence are the

level of education, the level of awareness of citizens

and government regulations which require citizens to

have sharia insurance.

4.7 Retention Ratio

Table 9: EWS Calculation Result on Sharia Insurance

Retention Ratio in Indonesia and Malaysia

Ratio

Retention

N

Min

Max

Mean

Std.

Dev

Indonesia

9

0,27

0,42

0,37

0.05

Malaysia

9

0,10

0,69

0,44

0.20

Source: Result of Data Processing.

Sharia insurance in malaysia has a healthier financial

performance when compared to sharia insurance in

indonesia due to sharia insurance in Malaysia

increase in own retention ratio higher than sharia

insurance in Indonesia. The reasons that affect the

level of own retention ratio is the ability to deal with

the risks. Sharia Insurance in Malaysia is prefer to use

reinsurance to protect their contribution received

Early Warning System for Sharia Insurance Companies in Indonesia and Malaysia at 2013-2015 periode

139

5 CONCLUSION

Based on the results of the financial performance

assessment using the ratio of Early Warning System,

on the Ratio of Surplus Change, Commission Ratio,

and Management Cost Ratio Sharia Insurance in

Indonesia has better financial performance than

Sharia Insurance in Malaysia. While Islamic

Insurance in Malaysia has better financial

performance than Sharia Insurance in Indonesia when

on Underwriting Ratio, Claims Expense Ratio,

Surplus Growth Ratio, and Own Retention Ratio. On

the other site, this research also found that external

factors influence the financial performance such as

the awareness and knowledge of Indonesian citizens

about how importance the insurance, second is

government regulations that support the sharia

insurance itself. Third is the level of public health to

every citizen in Indonesia as well as in Malaysia, and

many others factors.

REFERENCES

Ali, Hasan AM. 2004. Asuransi dalam Perspektif Hukum

Islam: Suatu Tinjauan Analisis Historis, Teoritis, &

Praktis. Jakarta: Kencana

Amrin, Abdullah. 2006. Asuransi Syairah: Keberadaan

dan Kelebihannya di Tengah Asuransi Konvensional.

Jakarta: Elex Media Komputindo

Anshori, Musclich dan Iswati, Sri. 2009. Buku Ajar

Metodologi Penelitian Kuantitatif. Surabaya: Pusat

Penerbitan dan Percetakan UNAIR (AUP)

Asuransi Jiwa Sharia Al-Amin. 2013. Laporan Keuangan

Tahunan 2012. (www.alamin-insurance.com diakses 8

Maret 2017)

Asuransi Takaful Keluarga. 2013-2015. Laporan Keuangan

Tahunan 2012. (www.takaful.co.id diakses 8 Maret

2017)

Asuransi Takaful Umum. 2013. Laporan Keuangan

Tahunan 2012. (www.takafulumum.co.id diakses 8

Maret 2017)

Aziz, Dahlan Abdul, et al. 2010. Ensiklopedi Hukum Islam.

Jakarta: Ichtiar Baru

Bank Negara Malaysia. 2004. Malaysian Takaful Industry

1984-2004. (www.bnm.gov.my diakses 20 Januari

2017)

Etiqa Takaful. 2013. Annual Financial Statement 2012.

(www.etiqa.com.my diakses 8 Maret 2017)

Great Eastern. 2013. Annual Financial Statement 2012.

(www.greateasterntakaful.com diakses 8 Maret 2017)

Hasan, Nurul Ichsan. 2014. Pengantar Asuransi Sharia.

Jakarta: Referensi (Gaung Persada Press Group)

Hong Leong MSIG Takaful. 2013. Annual Financial

Statement 2012. (www.hlmtakaful.com.my diakses 8

Maret 2017)

HSBC Amanah Takaful. 2013. Annual Financial Statement

2012. (www.takaful.hsbcamanah.com.my diakses 8

Maret 2017)

Otoritas Jasa Keuangan. 2016. Daftar Perusahaan Asuransi

Jiwa Syariah. (www.ojk.go.id diakses tanggal 7 Oktober

2016)

Prudential BSN Takaful. 2013. Annual Financial Statement

2012. (www.prubsn.com.my diakses 8 Maret 2017)

Satria, Salusra. 1994. Pengukuran Kinerja Keuangan

Perusahaan Asuransi Kerugian di Indonesia. Jakarta:

Lembaga Penerbit Fakultas Ekonomi Universitas

Indonesia

Siagian, Dergibson dan Sugiarto. 2006. Metode Statistik

Untuk Bisnis dan Ekonomi. Jakarta: PT Gramedia

Pustaka Utama

Sula, Muhammad Syakir. 2004. Asuransi Sharia (Life and

General) Konsep dan Sistem Operasional. Jakarta:

Gema Insani

Sun Life Takaful. 2013. Annual Financial Statement 2012.

(www.sunlifemalaysia.com diakses 7 Maret 2017)

Takaful Ikhlas. 2013. Annual Financial Statement 2012.

(www.takaful-ikhlas.com.my diakses 8 Maret 2017)

(www.takaful-ikhlas.com.my diakses 8 Maret 2017)

Takaful Malaysia. 2013. Annual Financial Statement 2012.

(www.takaful-malaysia.com.my diakses 8 Maret 2017)

Zurich Takaful. 2013. Annual Financial Statement 2012.

(www.zurich.com.my diakses 8 Maret 2017)

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

140