Credit Risk Management and Islamic Banking Performance

Evidence from Indonesia

Dedi Supiyadi

1

, Deddy Mulyadi

2

, Merry Fithriani

1

, Syaiful Syaiful

1

, Zulfikar Ikhsan

1

and Luthfi

Rahman

1

1

Universitas Pendidikan Indonesia, Jl. Dr. Setiabudhi 229, Bandung, Indonesia

2

STIA LAN Bandung, Jl. Cimandiri No. 34-38, Bandung, Indonesia

supiyadi@student.upi.edu, demul10@stialanbandung.ac.id

Keywords: Islamic Banking, ROE, Credit Risk, CAR, Bank Size, Liquidity Risk, Inflation.

Abstract: The growth of Islamic banking in Indonesia plays an important role for the economic growth, the growth of

Islamic banking itself is inseparable from the credit risk that determines the performance of the banking as a

whole. This study aims to determine the credit risk and performance of Islamic banking in Indonesia that are

listed in Indonesian Stock Exchange in 2007 – 2016. We use the secondary data obtained from the Indonesian

Stock Exchange and the annual reports and then we analyses the data by using multiple linear regressions.

The result of the study shows that performance of Islamic banks in Indonesia is influenced by Credit Risk,

Capital Adequacy Ratio, Company Size and Liquidity Risk. The study finds that credit risk and liquidity risk

have a positive effect while Capital Adequacy and firm size have a negative effect. Furthermore, the study

finds that inflation has insignificant effect on performance of Islamic banking in Indonesia. Based on the

studies, Islamic banks should increase the capital adequacy, and increase the company's assets through the

bond, increase the number of shares or other forms of financing. The need for external and internal monitoring

of debtor. Internal control is conducted by conducting intensive control over the process of disbursement of

credit funds. While the external control is done by monitoring and action the use of credit funds effectively

and efficiently by Islamic banking to customers. With the two aspects of control is expected to reduce the

credit risk of Islamic banking.

1 INTRODUCTION

Nowadays sharia banking is growing very fast in both

Muslim countries and non-Muslim countries (Azmi,

2017), with total assets of US $ 2,293 trillion,

consisting of 75% of Sharia Bank assets, 15% sukuk,

4% funding, 1% takaful and microfinance and 4%

other fields (GIFR, 2016). The banking system in

Indonesia is largely a conventional one that is not in

accordance with the Sharia principles. Indonesia as

the largest Muslim country in the world, requires a

banking system based on Sharia principles. Islamic

banking is an alternative one, where guarantee

interests free transactions and in accordance with

Islamic laws. Sharia is the origin and basis of Islamic

banking, and incorporates Islamic laws and

jurisprudence (Saiti et al., 2017). Based on statistical

data, the number of Islamic banks in Indonesia until

2016 were 199 banks consisting of 13 Islamic

Commercial Banks, 21 Islamic Business Units and

165 BPR sharia around Indonesia (OJK, 2016).

Competition in the financial industry and banking

in Indonesia is very tight, and the level of high

complexity, greatly affects the performance of banks

and increases the risk. Inadequate management,

insufficient lending to customers, and capital that

does not cover the risks faced by banks leads to a

decrease in bank performance. The decline in bank

performance can reduce the trust of society, investors,

business and government. The company must

perform an improvement. One indicator of Islamic

banking performance is profitability, and the higher

the level of profitability shows the best performance

of the banking.

The proxy used to measure profitability are ROE

(return on equity) and ROA (return on asset), these

ratios are the right to measure the performance of

Islamic banking. The performance of Islamic banking

will determine the sustainability of the company,

Supiyadi, D., Mulyadi, D., Fithriani, M., Syaiful, S., Ikhsan, Z. and Rahman, L.

Credit Risk Management and Islamic Banking Performance - Evidence from Indonesia.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 193-199

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

193

provide certainty to investors and provide shareholder

returns. Banking industry has an important role in

economic growth (Imran et al., 2012), both

conventional and Islamic banking have the same goal

that is seeking profit.

Study on commercial bank performance has been

largely done by previous researchers, but the study on

Islamic banks is still lack of literature, especially in

developing countries such as Indonesia; (Zarrouk et

al., 2016) found evidence that the profitability of

Islamic banks is largely determined by cost

effectiveness, asset quality and capital level, the study

also found that non-financial activities increase the

profitability of Islamic banks, no difference

determinant between conventional and Islamic

banks. According to (Ramlan and Sharrizat, 2016)

Islamic banks are more profitable than conventional

banks, and more efficient in managing credit risk,

bank size and customer growth are the most important

factors in improving banking performance (Hassan,

2009).

The study (Kayode et al., 2015) found that credit

risk negative effects on banking performance, the

proxy used is ROA, and increased credit risk reduces

profitability and decreases bank performance,

(Kodithuwakku, 2015) found that Loan provision to

Total Assets (LP/TL), Loan Provision to Non-

Performing Loans (LP/NPL), Loan Provision to Total

Assets (LP/TA) and Non-Performing Loans to Total

Loans (NPL/TL) significant effect on banking

performance.

According study (Alharthi, 2016), he found that

credit and capital risk affect profitability negatively

and significantly (ROA and NIM), Bank size

positively and significantly affects profitability (ROA

and NIM), while loan intensity (negative in case of

NIM), deposit ratio (positive), and foreign ownership

(negative) have no significant effect on profitability.

GDP macroeconomic variables are negatively and

significantly correlated with profitability (ROA and

NIM), as well as for market capitalization, except

NIM.

Based on the previous studies, the main objective

of this study was to analyze the impact of credit risk

and the factors affecting the performance of Islamic

Bank in Indonesia. The study is expected to

contribute to the enrichment of the literature to fill

Islamic Management, business & philanthropy

research gaps and as empirical evidence and reference

for further research.

2 METHODOLOGY

The method used in this research is explanatory

research. The sample in this research is 13 Islamic

Banks listed on Indonesia Stock Exchange (BEI)

from 2007-2016.

The sampling technique used is purposive

sampling, the criteria for selecting the sample under

study are as follows: (a) Firms must be Islamic

Banking (b) Firms must be listed in the Indonesia

Stock Exchange for the period of 2007- 2016, (c)

Firms must issue financial statements continuously

during the period of 2007-2016, (d) Firms have went

go public (e) Firms must report financial statements

with rupiah as a currency unit.

This study uses secondary data taken from

quarterly report from Indonesia Stock Exchange and

OJK. In this study the variable dependent is Banking

Performance measured by ROE (Return on Equity),

while the independent variable in this study is Credit

Risk as measured by Non Performing Financing

(NPL), Capital Adequacy (CAR) (Alshatti, 2016),

SIZE measure the total assets (Abiola and Olausi,

2014); (Ongore and Kusa, 2013); Liquidity Risk

measured by Cash & Cash Equivalent to Total Assets

(Almazari, 2014) and inflation (Zarrouk et al., 2016).

This study was adopted from the study (Ramlan

and Sharrizat, 2016), (Abiola and Olausi, 2014),

(Jara‐Bertin et al., 2014), (Idris et al., 2011), by

using multiple regression analysis technique, this

research done by using econometric equation as

follows:

= + + + +

+ + (1)

Where:

Y = Performance (ROE)

CR = Credit Risk (NPF)

CAR = Capital Adequacy Ratio

SIZE = Bank Size

LQR = Liquidity Risk

INF = Inflation

β

0

= Constanta

β

1

…β

n

= Regression Coefficient

ε = error

2.1 Conceptual Framework

Conceptual framework is theoretical concepts that

will be used as a reference in research, built from the

results of previous research. In this study, credit risk

(NPL), Capital Adequacy Ratio (CAR), Bank Size,

Liquidity Risk and Inflation Index as Independent

variable, and Return on Equity (ROE) as Dependent

variable.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

194

Figure 1. Conceptual Framework.

Based on the conceptual framework, the

hypothesis of this research is:

= There is a positive impact between Credit Risk

on Islamic Bank Profitability

= There is a positive impact between Capital

Adequacy Ratio on Islamic Bank Profitability

= There is a positive impact between SIZES on

Islamic Bank Profitability

= There is a positive impact between Liquidity

Risk on Islamic Bank Profitability

= There is a negative impact between Inflation on

Islamic Bank Profitability

3 RESULTS AND DISCUSSION

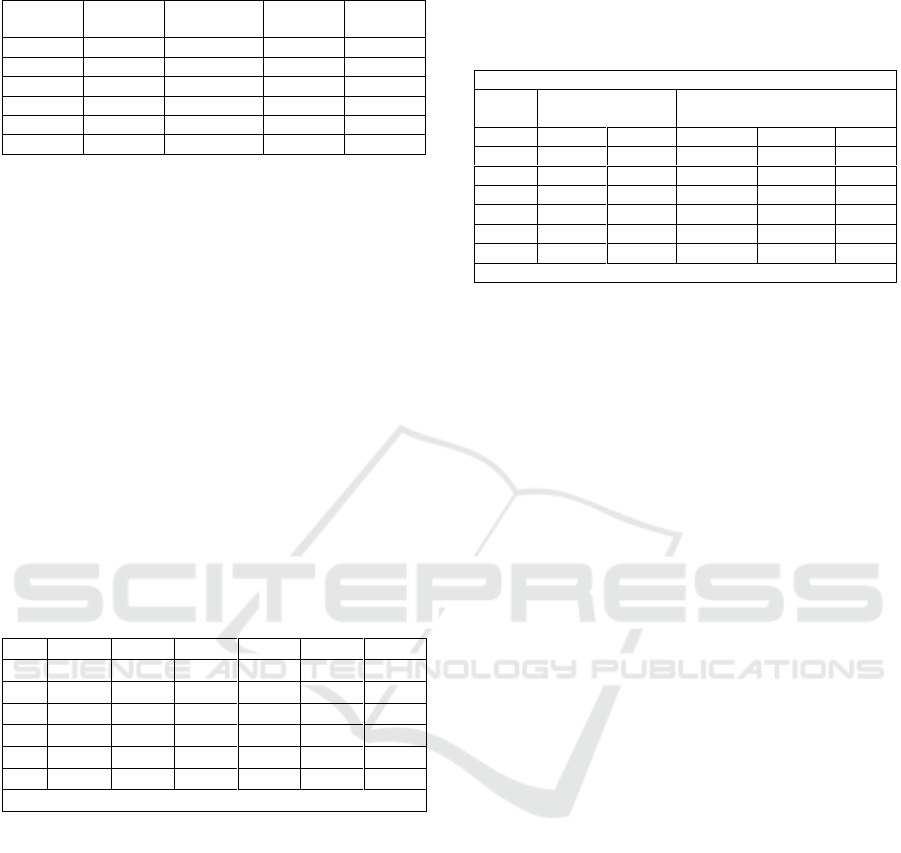

The assumption classic test is used to determine

whether the research model is feasible or not, which

is includes the test of normality, multicollinearity test,

and autocorrelation test. Normality test result in

Figure 2. The graph confirms that the regression

model obtained is normally distributed, where the

data distribution is around the diagonal line. The

results of multicollinearity test in Table 1. shows that

Credit Risk, CAR, Bank Size, Liquidity Risk and

Inflation variables have a tolerance value between

0.299 to 0.809 for all observation data, the value is

greater than 0.10 so it can be concluded that there is

no multicollinearity among independent variables,

this is reinforced by the value of VIF (variant inflation

factors) between 1.237 to 3.343, where the value is

less than 10, it can be stated that there is no

multicollinearity problem in the prediction model.

Autocorrelation test results in Table 6, Durbin

Watson value is 1.209, from the analysis results show

that the Durbin-Watson value is greater than the value

of dL is 1.235, thus there is no problem

autocorrelation. This study meets the classic

assumption, so it can be concluded that the research

free of multicollinearity and autocorrelation.

Table 1. Collinearity Statistics

Model

Collinearity Statistics

Tolerance

VIF

(Constant)

CR

.809

1.237

CAR

.450

2.221

SIZE

.299

3.343

INF

.741

1.350

LQR

.620

1.613

a. Dependent Variable: ROE

Descriptive statistical test is used to provide

general overview of each research variable as

describes in Table 2.

Figure 2. Normal P-P Plot.

Table 2 shows Descriptive statistic results. The

profitability of Islamic banks in Indonesia has a

minimum value of 0.05 and a maximum value of

0.54, the average profitability of Islamic banks is

0.196 or 19.6%, shows that the performance of

Islamic banks in Indonesia only 19.6% has not shown

maximum results, it effects on the performance of the

bank itself and for stakeholders. The average value of

liquidity risk of 0.15% means that Islamic banks in

Indonesia have low liquidity risk, liquid and very

healthy, thus Islamic banks in Indonesia have a very

good performance.

ROE

CR

CAR

SIZE

LQRISK

INF

Credit Risk Management and Islamic Banking Performance - Evidence from Indonesia

195

Table 2. Descriptive Statistic.

Minimum

Maximum

Mean

Std.

Deviation

CR

4.230

439.060

48.248

103.909

CAR

.110

.170

.144

.017

SIZE

117.000

169.000

153.550

13.739

INF

.03

.12

.059

.023

LQR

.000

.030

.015

.008

ROE

.050

.540

.196

.123

Inflation is a macroeconomic indicator that often

affects the economic performance, the result of the

study shows that the average inflation rate is 0.59%,

the condition of Indonesian economy with the

inflation rate in this study period does not affect the

performance of Islamic banks in Indonesia. The

average value of the bank size is 153.5%, which

means that Islamic banks in Indonesia have excellent

asset quality. The average value of CAR is 0.14%,

indicating that in order to maintain stability, Islamic

banks should be able to maintain capital adequacy of

0.14%, and otherwise it will affect overall banking

performance. The average value of credit risk shown

in the descriptive statistical analysis is 48.248%,

meaning that Islamic banks in Indonesia have a high

risk, but with high risk is directly proportional to the

level of banking performance, high risk high

profitability.

Table 3. Correlation Analysis.

CR

CAR

SIZE

INF

LQR

ROE

CR

1

.135

.126

-.224

.192

.093

CAR

.135

1

.706

**

.289

-.153

-.686

**

SIZE

.126

.706

**

1

.421

**

-.493

**

-.921

**

INF

-.224

.289

.421

**

1

-.224

-.422

**

LQR

.192

-.153

-.493

**

-.224

1

.608

**

ROE

.093

-.686

**

-.921

**

-.422

**

.608

**

1

**. Correlation is significant at the 0.01 level (2-tailed).

Table 3 shows the results of the correlation

analysis, finding two significant positive variables,

are Credit Risk and Liquidity, meaning that every 1%

increase in credit risk and liquidity risk will increase

Return on Equity by 0.093 (0.1%) and 0.608 (6.1%),

thus higher credit risk and liquidity risk will increase

the profitability of Islamic banks in Indonesia. CAR,

SIZE and Inflation show a significant negative

relationship, meaning that every 1% increase in CAR

will reduce profitability by 6.9%, as well as the bank

size each time the company expansion will reduce the

level of profitability because expansion requires a

large cost, for variable inflation as variables macro

economy also shows a negative relationship so that

every 1% inflation increase reduce the profitability of

Islamic banks by 4.2%, inflation reduces purchasing

power directly reduces the profitability of Islamic

Banks because customer more selective in fulfil its

needs only for most important needs.

Table 4. Regression Analysis.

Coefficients

a

Model

Unstandardized

Coefficients

Standard Coefficients

B

Std.Er

Beta

t

sig

(Cont)

1.331

.092

14.513

.000

CR

.000

.000

.177

3.243

.003

CAR

-1.159

.533

-.159

-2.174

.037

SIZE

-.007

.001

-.747

-8.330

.000

INF

.107

.306

.020

.348

.730

LQR

3.049

1.024

.186

2.979

.005

a. Dependent Variable: ROE

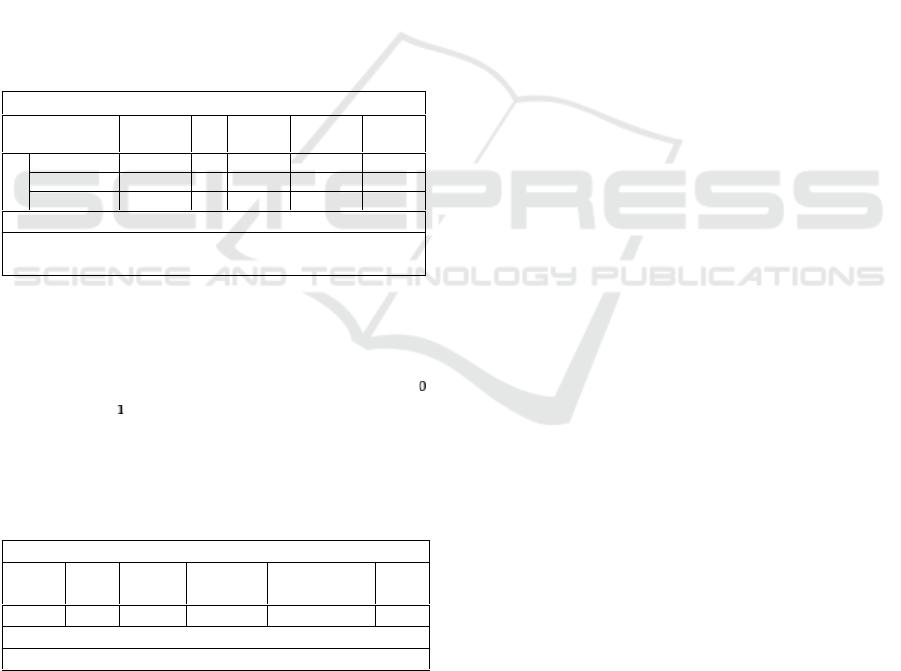

The results of a study of 12 Islamic banks in

Indonesia within the period of research from 2007 to

2016, found that credit risk significant positive effect

on profitability, the study support the previous study

conducted by (Abiola and Olausi, 2014),(Li and Zou,

2014), (MS and N, 2016), credit risk is the most

important factor to maintain the survival, growth and

bank performance. However, this study is in contrast

to research conducted by (Kayode et al., 2015);

(Kodithuwakku, 2015), (Alharthi, 2016) The results

of this study show that Islamic banking in Indonesia

has a high level of credit risk, therefore Islamic

banking needs to increase prudence in giving credit to

creditors, with five ways: Pricing the loan, Credit

Limits, Collateral or Security, Diversification, Credit

Credentials and Asset Securitization, by using 5C

approach are: Character, Capacity, Capital,

Condition, Collateral. (Heffernan, 2005). The high

credit risk is proportional to the magnitude of

profitability (MS and N, 2016).

Table 4 shows the capital strength and efficiency

of Islamic banks, found that CAR as an internal factor

affecting the profitability of Islamic banks in

Indonesia, the ROE is negatively influenced by the

CAR, this finding indicates that the level of capital

adequacy of banks is inadequate, thus negatively

affecting profitability, in other words banks with low

CAR are less profitable, these findings are in line with

previous studies by (Zarrouk et al., 2016).

Firm size describes company strength, and firm

size tends to generate high profitability (Hall and

Weiss, 1967). the study found that bank size had a

negative effect on profitability, this study contradicts

the study conducted by, (Hassan and Bashir, 2005),

(Alharthi, 2016), (Ben et al., 2017). This negative

influence indicates that large (small) banks tend to

earn large (small) profits, the study found that Islamic

banks in Indonesia are small banks, this finding may

also be caused by factors: bureaucracy, economic

conditions, politics and regulations in Indonesia

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

196

which is less support the development of Islamic

banks. The study support previous studies conducted

by (Sufian and Habibullah, 2009).

Profitability is very sensitive to macroeconomic

conditions, in general high economic growth, tend to

improve bank performance. An indicator of

macroeconomic conditions that has the possibility of

increasing profitability is inflation. High inflation

raises interest rates, with rising interest rates

increasing bank profitability, the study finds that

inflation does not significantly affect the profitability

of Islamic banks in Indonesia, these findings are in

line with research by (Sufian and Habibullah, 2009);

(Khediri and Khedhiri, 2009); (Zarrouk et al., 2016).

The results of the study found a significant

positive liquidity risk to profitability, these findings

show that Islamic banks in Indonesia have a good

liquidity risk that can improve profitability, these

findings are in line with the study (Bassey and Moses,

2015); (Almazari, 2014).

Table 5. ANOVA Test.

ANOVA

a

Model

Sum of

Squares

df

Mean

Square

F

Sig.

1

Regression

.544

5

.109

76.246

.000

b

Residual

.049

34

.001

Total

.593

39

a. Dependent Variable: ROE

b. Predictors: (Constant), LIQRisk, CAR, CRISK, INF,

SIZE

Anova test is used to test the influence model of

Liquidity Risk, CAR, CRISK, INF, SIZE variable to

ROE. Table 5 shows F value 75.246 with significance

level 0.05 obtained significant value 0.000, hence H

rejected and H accepted. It can be concluded that the

performance of Islamic Bank in Indonesia is

influenced by Credit Risk, Capital Adequacy Ratio,

Company Size, Liquidity and Inflation Rate.

Table 6. Determination Coefficient

Model Summary

b

Model

R

R

Square

Adjusted

R Square

Std. Error of

the Estimate

D-W

1

.958

a

.918

.906

.03780

1.209

a. Predictors: (Constant), LIQRisk, CAR, CRISK, INF, SIZE

b. Dependent Variable: ROE

The coefficient of determinant is used to explain

the control variable to the dependent variable. The

greater the coefficient of determinant the better the

ability of the independent variable to explain the

variable Return on Equity. The determinant

coefficient value (R Square) shown in table 6, is 0.918

or 91.80%, the result of analysis shows that control

variable Credit Risk, CAR, Size, Liquidity Risk and

Inflation Rate can explain as a factor affecting

profitability of Islamic Bank in Indonesia equal to

91.80% and 9.20% influenced by other factors.

4 CONCLUSIONS

Research on the profitability of Islamic banks has

become one of the topics of concern for researchers

in the world, especially after the global financial

crisis. This study aims to highlight the profitability

and factors affecting the performance of Islamic Bank

in Indonesia. The empirical findings show that the

profitability of Islamic banks in Indonesia is

significantly influenced by credit risk, capital

adequacy ratio, firm size and liquidity risk, but

inflation does not significantly affect the profitability

of Islamic banks in Indonesia. We found that credit

risk has a positive effect on the performance of

Islamic banks in Indonesia, therefore Islamic banking

needs to increase prudence in lending.

The results of the study found that CAR was

significantly negative to profitability, therefore

Islamic banks in Indonesia need to increase capital

adequacy in order to increase profitability, as well as

company size, the study found that firm size

significantly negative to profitability. Indonesia

Islamic banks has a very good liquidity risk level

which is indicated by the result of study, where

liquidity risk is significant positive to profitability.

Based on the studies, Islamic banks should

increase the capital adequacy, and increase the

company's assets through the bond, increase the

number of shares or other forms of financing. The

need for external and internal monitoring of debtor.

Internal control is conducted by conducting intensive

control over the process of disbursement of credit

funds. While the external control is done by

monitoring and action the use of credit funds

effectively and efficiently by Islamic banking to

customers. With the two aspects of control is

expected to reduce the credit risk of Islamic banking.

This study has limitations, for further research it

is recommended to include Islamic Rural

Development Banks (BPD) as the unit of analysis,

increasing the number of variables such as GDP,

government regulation or other relevant variables as

well as measuring the performance of Islamic banks

with ROA and NIM proxies to obtain comprehensive

results.

Credit Risk Management and Islamic Banking Performance - Evidence from Indonesia

197

REFERENCES

Abiola, I. and Olausi, A.S. (2014), “The Impact of Credit

Risk Management on The Commercial Banks

Performance in Nigeria”, International Journal of

Management and Sustainability, Vol. 3 No. 5, pp. 295–

306.

Alharthi, M. (2016), The Determinants of Efficiency,

Profitability and Stability in the Banking Sector: A

Comparative Study of Islamic, Conventional and

Socially Responsible Banks, Plymouth University,

Plymouth.

Almazari, A.A. (2014), “Impact of Internal Factors on Bank

Profitability : Comparative Study between Saudi

Arabia and Jordan”, Journal of Applied Finance &

Banking, Vol. 4 No. 1, pp. 125–140.

Alshatti, A.S. (2016), “Determinants of banks’ profitability

- The case of Jordan”, Investment Management and

Financial Innovations, Vol. 13 No. 1, pp. 84–91.

Azmi, M.A. and W. (2017), “Impact of Islamic Banking on

Economic Growth and Volatility: Evidence from the

OIC Member Countries”, Palgrave CIBFR Studies in

Islamic Finance, Springer International Publishing AG,

Gewerbestrasse 11, 6330 Cham, Switzerland, pp. 15–

32.

Bassey, G.E. and Moses, C.E. (2015), “Bank Profitability

and Liquidity Management : a Case Study of Selected

Nigerian Deposit Money Banks”, Bank Profitability

and Liquidity Management: A Case Study of Selected

Nigerian Deposit Money Banks, Vol. III No. 4, pp. 1–

24.

Ben, I., Mahdi, S. and Abbes, M.B. (2017), “Relationship

between Capital , Risk and Liquidity A comparative

study between Islamic and conventional banks in

MENA region”, Research in International Business

and Finance, Elsevier B.V., pp. 1–21.

GIFR. (2016), Islamic Finance: A Catalyst for Shared

Prosperity?, available at:https://doi.org/10.1596/978-

1-4648-0926-2.

Hall, M. and Weiss, L. (1967), “Firm Size and

Profitability”, Source: The Review of Economics and

Statistics, Vol. 49 No. 3, pp. 319–331.

Harianto, S. (2017), “Rasio Keuangan dan Pengaruhnya

Terhadap Profitabilitas Pada Bank Pembiayaan Rakyat

Syariah di Indonesia”, Vol. 7 No. April, pp. 41–48.

Haron, S. (1996), “The effects of management policy on the

performance of Islamic banks”, Asia Pacific Journal of

Management, Vol. 13 No. 2, pp. 63–76.

Hassan, A. (2009), “Risk management practices of Islamic

banks of Brunei Darussalam”, The Journal of Risk

Finance, Vol. 10 No. 1, pp. 23–37.

Hassan, M.K. and Bashir, A.-H.M. (2005), “Determinants

of Islamic Banking Profitability”, Islamic Perspectives

on Wealth Creation, Vol. 7, Edinburgh University

Press, pp. 118–140.

Heffernan, S. (2005), Modern Banking, Vol. 14, John Wiley

& Sons Ltd, The Atrium, Southern Gate, Chichester,

West Sussex PO19 8SQ, England.

Idris, R., et.al (2011), “Determinant of Islamic Banking

Institutions’ Profitability in Malaysia”, World Applied

Sciences JournalSpecial Issue on Bolstering Economic

Sustainability Bank Negara Malaysia, Vol. 12 No. 1,

pp. 1–7.

Imran, S., Ali, N., Quality, A., Employee, P.P., Efficiency,

E. and Interest, N. (2012), “A Study of Ten Indian

Commercial Bank ’ s Financial Performance using

CAMELS Methodology”, IMS Manthan, Vol. VII No.

1, pp. 1–14.

Jara‐Bertin, M., Arias Moya, J. and Rodríguez Perales, A.

(2014), “Determinants of bank performance: evidence

for Latin America”, Academia Revista

Latinoamericana de Administración, Vol. 27 No. 2, pp.

164–182.

Kayode, O.F., Obamuyi, T.M., Ayodeleowoputi, J. and

Ademolaadeyefa, F. (2015), “Credit Risk and Bank

Performance in Nigeria”, IOSR Journal of Economics

and Finance, Vol. 6 No. 2, pp. 21–28.

Khediri, K. Ben and Khedhiri, H. Ben. (2009),

“Determinants of Islamic bank profitability in the

MENA region”, International Journal of Monetary

Economics and Finance, Vol. 2 No. 3/4, pp. 409–426.

Kodithuwakku, M.S. (2015), “Impact of Credit Risk

Management on the Performance of Commercial Banks

in Sri Lanka”, International Journal of Scientific

Research and Innovative Technology, Vol. 2 No. 7, pp.

24–29.

Li, F. and Zou, Y. (2014), The Impact of Credit Risk

Management on Profitability of Commercial Banks: A

Study of Europe.

Mohammad, S. (2013), “Liquidity Risk Management in

Islamic Banks: A Survey”, Afro Eurasian Studies, Vol.

1 No. 1–2, pp. 215–230.

MS, S. and N, Z. (2016), “The Impact of Credit Risk on

Profitability of the Commercial Banks”, Journal of

Business & Financial Affairs, Vol. 5 No. 2, pp. 1–7.

OJK. (2016), The Sharia Indonesia Banking Statistic,

Jakarta.

Ongore, V.O. and Kusa, G.B. (2013), “Determinants of

Financial Performance of Commercial Banks in

Kenya”, International Journal of Economics and

Financial Issues, Vol. 3 No. 1, pp. 237–252.

Ramlan, H. and Sharrizat, M. (2016), “The Profitability of

Islamic and Conventional Bank : Case study in

Malaysia”, 7th International Economics & Business

Management Conference, Vol. 35, Elsevier B.V., pp.

359–367.

Saiti, B., Wahab, H.A. and Ahmad, K. (2017), “Contracts,

Structures, and Computation Mechanisms of Islamic

Bank Retail Financing Products: A Critical

Assessment”, Palgrave CIBFR Studies in Islamic

Finance, Springer International Publishing AG,

Switzerland, pp. 81–125.

Sufian, F. and Habibullah, M.S. (2009), “Determinants of

bank profitability in a developing economy: Empirical

evidence from Bangladesh”, Journal of Business

Economics and Management, Vol. 10 No. 3, pp. 207–

217.

Zarrouk, H., Jedidia, K. Ben and Moualhi, M. (2016), “Is

Islamic bank profitability driven by same forces as

conventional banks ?”, International Journal of Islamic

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

198

and Middle Eastern Finance and Management, Vol. 9

No. 1, pp. 46–65.

Credit Risk Management and Islamic Banking Performance - Evidence from Indonesia

199