Literacy of Islamic Banking Products

Survey on Members of Islamic Mass Organization in Bandung City

Husniati Husniati

1

, A. Jajang W. Mahri

2

, and Rida Rosida

3

Universitas Pendidikan Indonesia, Bandung, Indonesia

husniati13@student.upi.edu, {ajajangwmahri, rida.rosida}@upi.edu

Keywords: Islamic Mass Organization, Saving and Islamic Banking.

Abstract: The majority of Indonesian people are Muslim and there are many Islamic Mass Organizations. However,

this potential can not help the development of Islamic Banking in Indonesia, as evidenced by the Islamic

banking market share growth in 2016 only reached 4.8% has not been able to reach the expected 20%. Besides,

the use of Islamic banking among the Ulama, kyai, society around the pesantren and the perpetrators of Islamic

mass organizations are still very few that only reached 37%. The problem is due to the understanding of ulama

about the operational of Islamic banking is still low, they only know the theory based on Al-qur'an and Hadith.

Therefore, ulama difficult to communicate about Islamic banking to the public. The purpose of this study to

find out how the general description of the literacy of Islamic banking products among members of the Islamic

Mass Organization in Bandung City.This research method using quantitative descriptive approach to describe

the characteristics of respondents and knowledge variables Islamic banking products. The sample used in this

research is the Islamic mass organization Nahdlatul Ulama, Muhammadiyah and Persatuan Islam. The results

of this study indicate that knowledge of Islamic banking products in the category enough.

1 INTRODUCTION

As well as phenomena in other Muslim countries,

Islamic banking in Indonesia has also recorded

progressive developments. Caused by "the

overwhelming majority of Muslims are 87.1% of

government support, banking regulations, and the

role of ulama, Muslim scholars and Islamic mass

organizations" (Ismal, (2011:2). But the market share

of Islamic banking in 2016 just 4.81%, has not

reached the expected 20%. The cause of market share

is still low according to Sari, Bahari, & Hamat,

(2013:129) that "the cause of the small market share

of Islamic banking in Indonesia is the lack of the role

of Islamic scholars and organizations in Indonesia".

The problem in line with the research of Noor

(2012) and Wartoyo (2014) about pesantren society

(ulama, kiai, santri and surrounding community)

using Islamic banks is still small, with result can be

seen as follows:

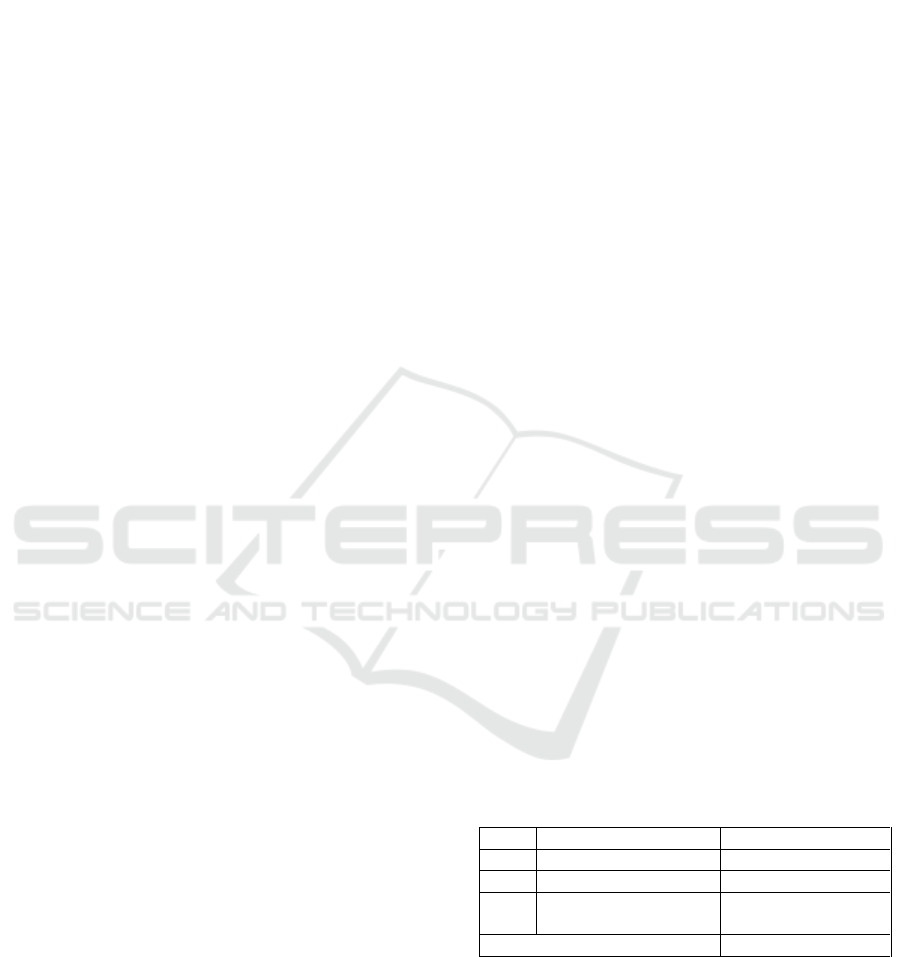

Figure 1: Pesantren Community using Islamic bank.

Based on Figure 1, the research result of Noor

(2012) of Islamic boarding school using Islamic bank

only reaches 31% meaning that not yet using Islamic

bank as much as 69%. In line with research Wartoyo

(2014) using Islamic banks as much as 43% means

that have not used as much as 57%. Though the target

respondents have been or are studying the chapter

mu'amalah in the study of yellow books, but still

many who have not used Islamic banks. In line with

research Herinza (2013:93) namely "NU Islamic

Society and Muhammadiyah Islamic banking

perception only know the theory based on Alqur'an

and Hadist, so they do not understand the operational

93

211

13

17

Using Islamic Banks

Not Using Islamic Banks

Research of Wartoyo (2014) in City and District

Cirebon

Research of Noor (2012) In DKI Jakarta

256

Husniati, H., Mahri, A. and Rosida, R.

Literacy of Islamic Banking Products - Survey on Members of Islamic Mass Organization in Bandung City.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 256-260

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

of Islamic banks". Machmud & Rukmana, (2010:71)

"The level of Ulama understanding about the

opersional of Islamic banks is still minimal so that

ulama are difficult to communicate to the public". In

line with the study according to Abdullah &

Anderson (2015:9) that public knowledge assumes

there is no distinction between Islamic banking

products and conventional bank products. Therefore,

there are still few users of Islamic banking so market

share is still low.

The large number of Islamic mass organizations

should be able to inflate Islamic banking, but in

reality it has not been able to develop Islamic

banking. Number of Islamic Organizations in the city

of Bandung until reaching 21 Islamic Organizations,

if Islamic mass organizations that have a large

Regional Leaders, Branch Leaders, Regional Leaders

with so very many in number. Whereas the role of

activists in the field of Islam is very important so that

the Islamic community better understand how fiqh

muamalah one of them is Islamic banking world

(Isnurhadi, 2014).

The purpose of this study to find out how the

general description of the literacy of Islamic banking

products among members of the Islamic Mass

Organization in Bandung City.

2 LITERATURE REVIEW

Acording to the opinion of Rusdianto & Ibrahim

(2016) and Huston (2010:304) “Financial literacy is

the ability to use knowledge and skills to

managefinancial resources effectively for lifetime

financial security”. Financial literature occurs when

an individual has a set of skills and abilities that

enable the person to utilize the resources available to

achieve the goal. The definition of financial literacy

according to Mason & Wilson (Krishna, Rofaida, &

Sari, 2010: 64) is "one's ability to obtain, understand,

and evaluate relevant information for decision

making by understanding the financial consequences

it brings." Stating that financial knowledge is an

which is inseparable dimension of financial literacy,

but can not describe one's financial literacy. Financial

literacy has additional application dimensions that

imply that one must have the ability and confidence

to use his financial knowledge to make decisions

(Huston, 2010).

The study on Islamic financial literacy can be

considered as a new concept being brought into the

area of financial literacy. Due to its novelty, there is

currently no commonly accepted meaning of Islamic

financial literacy (Abdullah M. , 2014). However, it

should be noted that there are certain elements in the

existing constructs used to assess financial literacy

which are not compatible with the underlying

philosophy of Islamic finance such as the interest

element. Indeed, there is a crucial need to develop the

constructs for assessing Islamic financial literacy.

Thus, this study attempt to fill this void by developing

the appropriate constructs for Islamic financial

literacy (Rahim, Rashid, & Hamed, 2016).

3 METHODOLOGY

This research is using quantitative descriptive

method. The object of this research is Islamic mass

organization in Bandung. Population Organization of

Islam in Bandung there are 21 groups. Sampling with

sample method of non-probability sampling with

sampling type used is purposive sampling with

judgment sampling technique and quota sampling.

The criteria of the Islamic Mass Organization

determined in this study are the three largest Islamic

Islamic mass organizations in Bandung. According to

the Kementrian Agama Jawa Barat (2010), Persis

(2015), and NU (2015), the three largest cities in

Bandung are seen from the number of Heads of

branch offices. Having many branches in Bandung

City, so that has many manager and members.

Besides Having a lot of boarding schools, teachers or

boarding board is part of the members of the Islamic

Mass Organization. Based on these criteria and

opinions, then obtained sample of Islamic Mass

Organizations that meet these criteria are:

1) Nahdatul Ulama (NU)

2) Muhammadiyah

3) Persatuan Islam (Persis)

Table 1: Samples of Members of Islamic Organizations in

Bandung.

No

Nama Ormas Islam

Jumlah Sampel

1

Nahdatul Ulama (NU)

50

2

Muhammadiyah

50

3

Persatuan Islam

(Persis)

50

Jumlah

150

4 RESULTS

Based on the results of research in the field, known

general description of the characteristics of

respondents are as follows:

Literacy of Islamic Banking Products - Survey on Members of Islamic Mass Organization in Bandung City

257

Table 2: Characteristics of Respondents by Position in Islamic Mass Organizations.

No

The Name of The Islamic

Mass Organization

Position

Amount

Member

Management

1

NU

39

11

50

2

Muhammadiyah

32

18

50

3

Persis

26

24

50

Total

97

53

150

The result above that is in Table 2 that in every

Islamic Mass Ogranization many respondents as

members, because it is more number of members in

comparison with management. While management

consists of various positions that are becoming

chairman, deputy, secretary, treasurer, economic

field, education, human resources and others both in

branch, regional and regional levels.

Ownership of savings accounts are do not have,

only conventional / Islamic only and having both,

with the following result:

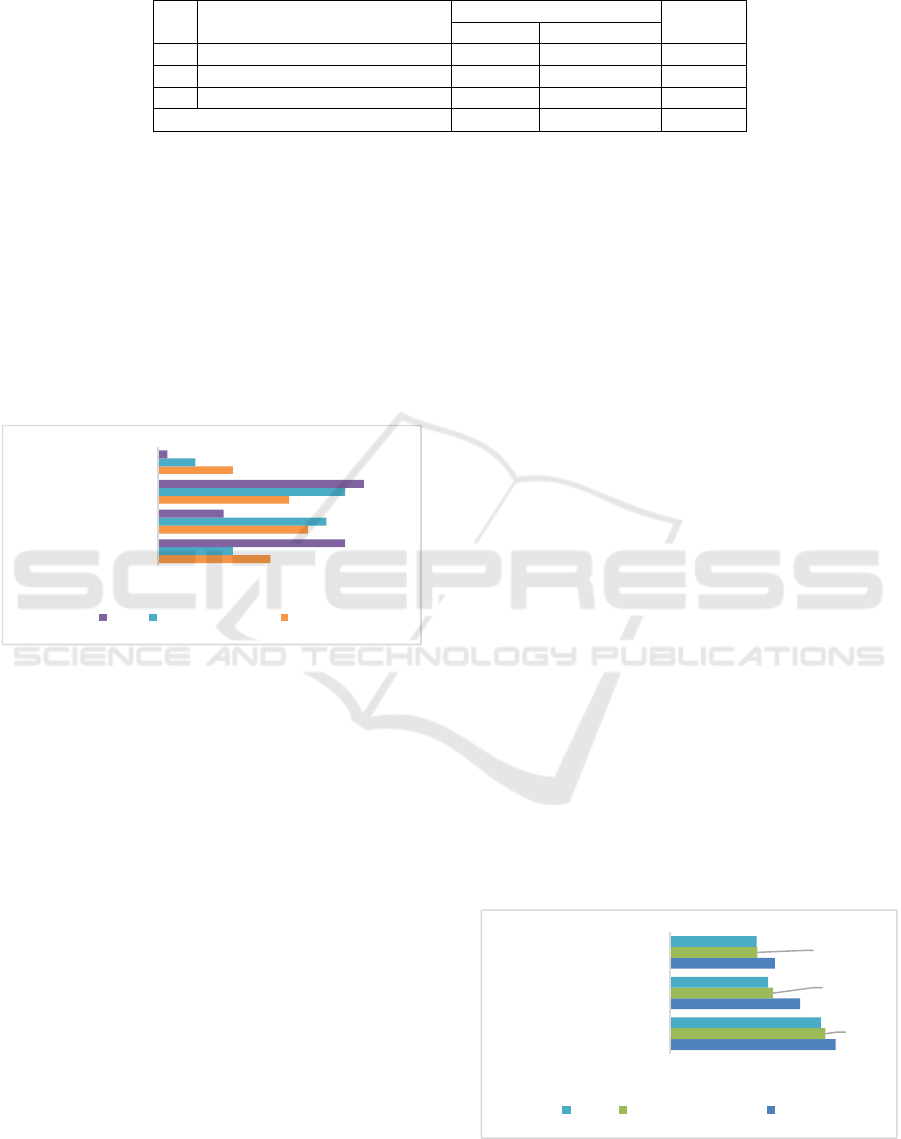

Figure 2: Ownership of savings account.

Research on the ownership of savings accounts

based on Figure 2 shows that conventional savings

ownership is more widely used in the NU and

Muhammadiyah Islamic Mass Organizations,

whereas in the Islamic Mass Organizations Persis

more are using Islamic banks. NU Islamic Mass

Organizations have not used many Islamic banks

since there are not many who cooperate with the

Islamic Mass Organization, many still do not

understand Islamic banks, do not know the difference

between Islamic banks and conventional banks.

While the use of Islamic banks because of institutions

that require and from savings hajj. The view of NU

Islamic Mass Organization against savings and the

danger of riba, that riba has indeed been prohibited

and explained in the Qur'an or hadith. But if we save

in a conventional bank is not the intention to get

interest then it is allowed. So with so few who use

Islamic banks in NU Islamic Mass Organization.

Islamic Mass Organizations Muhammadiyah the

use of Islamic banks is less than conventional banks,

but the difference is small. If in this Muhammadiyah

Islamic Mass Organizationis already a lot of

cooperation with Islamic banks so many are using it.

But they are also working with conventional banks so

the use of the bank is almost balanced. Basically they

also do not really know the difference Islamic

banking system and conventional, visible glance is

still the same. The view of the Muhammadiyah

Islamic Mass Organization against saving in Islamic

banks and conventional as well as views on riba, they

say that the ror interest is haram and the use of the

bank will get its reward from Allah swt. They prefer

to use Islamic banks and they expect more and more

to use Islamic banks. However, because of the need

for easier transactions then many are also using

conventional banks.

Islamic Mass Organizations Persis are more likely

to use Islamic banks because they have cooperated

with Islamic banks. They are convinced that riba is

haram, once haram remains haram. Then they also

still see that Islamic banks are still many

shortcomings, so there is the possibility there is still

riba. But they know that not all of them can be directly

according to Islam but must be gradual, therefore it is

better to choose the less mudharat. However,

basically if there is another solution from the bank

then they choose not to use Islamic banks. Therefore,

leaving the bank will be better and far away from riba.

It can also be seen from the results of many Islamic

Mass Organizations Perisis that do not use any bank.

Yet they continue to support Islamic banks, but much

has to be fixed. General overview literacy of Islamic

banking products variable are as follows:

Figure 3: Recapitulation of response each Islamic Mass

Organization variable literacy of Islamic banking products.

72.50

57

46

68

45

38.29

66

43

38

- 20.00 40.00 60.00 80.00

Product confidence

Products as a benefit tool

Knowledge of the types

of products

NU Muhammadiyah Persis

12

16

14

8

8

18

20

4

20

7

22

1

0 5 10 15 20 25

Conventional dan…

Islamic

Conventional

Do Not Have

NU Muhammadiyah Persis

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

258

Table 2: Category variable literacy of Islamic banking

products.

Range

Category

1,00-2,00

Very Low

2,01-4,00

Low

4,01-6,00

Medium

6,01-8,00

High

8,01-10,00

Very High

When seen from Figure 3, which is seen in this

indicator is the indicator of knowledge about this type

of product Islamic Mass Organization many

answered the average on the low category. Questions

in this indicator are, understanding, terms of contract

and legal requirements. In this indicator is more to the

theory of banking products, so the answer is not a lot

of good. The Islamic Mass Organization, does not

know much about the mechanisms in Islamic banking

and the science of Fiqh muamalah is also still low. In

the process of study about fiqh muamalah it self is

still rare, so the result is also low. However, of the

three Islamic Mass Organizations are the best answer

is from Persis. Because, Persis use of Islamic banks

and the number of management more than others, so

the knowledge is better than other Islamic Mass

Organizations.

Then on the product indicator as a set of benefits

in Figure 3 with result at the category is moderate.

Because, the Islamic Mass Organizations know

enough about the benefits derived from Islamic

banking products. Each make a savings account or

financing will explain the benefits that will be

obtained, so the possibility of higher knowledge.

Therefore, Persis is more knowledgeable about the

benefits of its products than any other Islamic Mass

Organization.

Furthermore, from the third indicator of product

confidence, with the results can be seen from Figure

3 where the product beliefs are in accordance with the

rules of Islamic and avoid the dangers of riba, the

literacy of Islamic Mass Organizations in the high

category. Because the discussion ever studied at the

recitation / study routine every Islamic Islamic Mass

Organization. In muamalah study more often

discussed only about the dangers of riba compared

with others, so that knowledge is high on this

indicator. In this Indicator it is also Persis higher than

other Islamic Mass Organizations, due to the more

frequent review of riba compared with others. In

addition, more management so the respondents so

that the knowledge is higher than the members.

Overall in one variabel literasi of Islamic banking

products that the Islamic NU Muslim Mass

Organization has an average of 49, then

Muhammadiyah for 50.43 and for Persis is 58.5. If the

overall average of the Islamic Islamic Mass

Organization is equal to 52.64, that is, the value is in

medium / enough category.

5 CONCLUSION

The results of research and discussion in the previous

chapter, So it can be concluded that the literacy of

Islamic Mass Organization about Islamic banking

products as a whole is in the medium category, either

Islamic Mass Organization NU, Muhammadiyah or

Persis. While each indicator is, the first indicator of

knowledge of the types of products found in low

kateogri for NU Muslim Mass Organization and

Muhammdiyah while Persis in the medium category.

Then on the second indicator is the product as a

benefit device is in the medium category in all the

Islamic Mass Organization. Lastly on the product

confidence indocator is in the high category in all

Islamic Mass Organizations.

REFERENCES

Abdullah, M. 2014. Financial literacy: An exploratory

review of the literature and future research. Journal of

Emerging Economies and Islamic Research, II(3), 1-7.

Abdullah, M. A., Anderson, A. 2015. Islamic Financial

Literasi among Bankers in Kuala Lumpur. Journal of

Emerging Economies and Islamic Research, III(2), 1-

16.

Herinza, R. 2013. Persepsi Ulama Terhadap Pelaksanaan

Perbankan Syariah di Kabupaten Kudus. Universitas

Negeri Semarang: Skripsi.

Huston, S. J. 2010. Measuring financial literacy. Journal of

Consumer Affairs, XLIV(2), 296-316.

Ismal, R. 2011. Islamic Banking in Indonesia: Lesson

Learned. Kertas Kerja dalam Multiyear Expert Meeting

on Services, Development and Trade: The Regulatory

and Institutional Dimension. United Nations

Conference on Trade and Development (UNCTAD),

(pp. 1-14). Geneva.

Isnurhadi. 2014. Pentingnya Pemahaman Tentang

Keuangan dan Perbankan Syariah dalam Rangka

Mu'amalah yang Berdasarkan Syariah Islam. Orasi

Ilmiah, 1-25.

Kementrian Agama Jawa Barat. 2010. Ormas Islam.

Retrieved Maret 20, 2017,, from

jabar.kemenag.go.id/file/dokumen/alamatormas.pdf

Machmud, A., Rukmana. 2010. Bank Syariah. Jakarta:

Erlangga.

Noor, F. 2012. Preferensi Masyarakat Pesantren Terhadap

Bank Syariah (Studi Kasus DKI Jakarta). TAZKIA

Islamic Business and Finance Review, 65-79.

Literacy of Islamic Banking Products - Survey on Members of Islamic Mass Organization in Bandung City

259

NU. 2015. Jaringan. Retrieved November 5, 2017, from

http://www.nu.or.id/about/jaringan.

Persis. 2015. Dekade Sunda dan Persis. Retrieved

November 5, 2017, from http://persis.or.id/dekade-

sunda-dan-persis/

Rahim, S. H., Rashid, R. A., Hamed, A. B. 2016. Faktor

Analysis of Islamic Financial Literacy and Its

Determinan: A Pilot Study. The European Proceedings

of Social & Behavioural Sciences EpSBS, (pp. 413-

418).

Rusdianto, H., Ibrahim, C. 2016. Pengaruh Produk Bank

Syariah Terhadap Minat Menabung Dengan Persepsi

Masyarakat Sebagai Variabel Moderating Di Pati.

Equilibrium, IV(1), 43-61.

Sari, M. D., Bahari, Z., Hamat, Z. 2013. Perkembangan

Perbanakn Syariah di Indonesia: Suatu Tinjauan. Jurnal

Aplikasi Bisnis, III(2), 120-138.

Wartoyo. 2014. Persepsi Dan Respon Pesantren Terhadap

Implementasi Ekonomi Islam. Retrieved from Portal

Garuda:

http://download.portalgaruda.org/article.php?article=4

47042&val=9458&title=Persepsi%20dan%20respon%

20pesantren%20%20terhadap%20implementasi%20ek

onomi%20islam.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

260