Factor Analysis of Constraints in Financial Feasibility for Results on

Sharia Banks

Nizar Alam Hamdani

1

, Arif Budiraharja

2

, Toto Susanto

2

, and Didit Supriyadi

2

1

Universitas Garut, Garut, Indonesia

2

Universitas Pendidikan Indonesia, Bandung, Indonesia

nizar_hamdani@uniga.ac.id, arief.bjbs@gmail.com, totosusantobj@yahoo.com

Keywords: Islamic Banking, public awareness, human resources.

Abstract: The development of Islamic banking has always shown positive trends. This can be seen in the annual increase

in its assets and market shares. However, in national banking scale, this does not seem to affect national

banking assets at all. This is due to the fact that the asset value and market share of Islamic banking are

relatively small. This is very ironic considering the majority of Indonesia's population is Muslim. The small

market share indicates that there are many Muslims who have become customers of Islamic banks. The data

were analyzed using exploratory factor analysis. The number of samples were 76 customers of 8 branches

BJB Syariah, selected using the proportional simple random sampling. The results showed that what affected

Islamic banking market share was the following factors: marketing, government policies, literacy and human

resources. Other research findings that Islamic banks need to raise public awareness about Islamic products

because they are not well-informed about Islamic products. And just as important as marketing is human

resources. Without improvement in literacy, market share will not grow.

1 INTRODUCTION

Banks are profit-oriented business entities. Marketing

activities are indispensable to meet what the

customers need and want. Therefore, banks need to

do their marketing activities in an integrated manner

and continue to carry out market research to figure out

what their customers really want and need. According

to Utama (2016), the emergence of sharia banking is

particularly because the way the society see and do

things in their business activities is influenced by the

Islamic teachings.

The growth of sharia banking makes the

competition among sharia banks tighter than ever,

resulting in a damage in a bank’s competitive

advantage. Therefore, a bank must make unremitting

renewal efforts to become a major player in its

segment. That way, a bank can remain the customers’

main preference. An Islamic bank is demanded to

have a reliable marketing system and not to rely on

emotional mass only. The marketing process of

Islamic banking is essentially the same as that of the

conventional banking in that it begins with the

customers’ need analysis (Ahmad Azrin Adnan,

2013). Some studies have reported that marketing

affects a product, image, and service, which in turn

will shape consumer perception (Doraisamy,

Shanmugam, & Raman, 2011). Awan and Azhar

(2014) explain that internal and external marketing

affects consumer attitude.

The Islamic banking market share has only

reached 4.87% of the total national banking market

share, lower than the minimum target of 5% (OJK,

2016). Nowadays, Islamic banking market in

Indonesia is very potential; however, due to the low

sharia financial inclusion, not many people have used

sharia finance products just yet. This is a serious

challenge for the Islamic banking (Sumut Invest,

2017). Meanwhile, Yuliani’s (2016) study suggests

that the forecasting value of Islamic banking assets in

December 2016 was IDR 341,614 billion or 5.01% of

the national banking forecasting value of IDR

6,816,388 billion in the same period. The

development of sharia banking in Indonesia is far

behind that in Malaysia despite the fact that Indonesia

enjoys its status as a country with the largest Muslim

population in the world. Today’s market share of

sharia banking in Malaysia is around 40-50%, and

that in Indonesia is only 4.86% (Bm & Uddin, 2016).

The society are not well-informed that Islamic

banks are managed differently from the conventional

banks. Islamic banks offer profit sharing and interest-

free partnership system to make it conform to the

Islamic teachings. Syarif (2012) suggests that Islamic

Hamdani, N., Budiraharja, A., Susanto, T. and Supriyadi, D.

Factor Analysis of Constraints in Financial Feasibility for Results on Sharia Banks.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 261-266

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

261

banks need to socialize their innovations and

reinforce their human resources and Islamic banking

system.

Promotion in the perspective of Islam is to

honestly inform about a product of service to the

potential customers. In this regard, Islam strongly

forbids us to provide false information to deceive the

potential customers. A hadith mentions: “Ibnu Umar

said: “I’ve been deceived in the buying of this,”

complained a man to the Prophet. The Prophet said,

“Tell them not to deceive! (Narrated by Bukhari).

2 LITERATURE REVIEW

Marketing is an organization and a process of

creating, communicating, and providing value to the

customers and establishing a long-term and

sustainable relationship with the customers (Kotler,

Philip dan Keller, 2012). Every function of

management contribute in its own way to the

drafting of strategy at different levels. Marketing is

a function with the largest contacts with the external

environments over which the corporation has only

little control. Thus, marketing plays an important

role in the strategic planning (Fejza & Asllani,

2013). In penetrating and seizing a market, a

businessman should also take into account internal

and external factors. The marketing mix has been

defined as the set of marketing tools that a company

uses to pursue its marketing objectives in the target

(Kotler, Philip, & Keller, 2012).The company's

profile depends entirely on the ability of the

management to understand the marketing mix in

question. Shuhaimi’s (2012) study suggests that the

marketing mix through 5 Ps model plays an

important role in the development of Islamic

banking. Mohammad’s (2015) study investigated the

application of 7 PS; i.e., promotion, price, people,

product, place, process and physical evidence, in

banking system. The result revealed that process was

the most important factor, and price was the least

influential factor. This goes to say that the customers

prefer a simple, understandable and quick process in

conducting banking transactions. Meanwhile,

Phillips and Peterson (2004) put forward the

importance of making differentiation in order for the

product/service to be acceptable by the customers

and to have competitive advantage.

Ismal’s (2010) survey on Islamic banking

depositors in Java, Sumatera, and Kalimantan

revealed that 77.7% of the total respondents show

respects towards Islamic banking instruments, 58.8%

understood Islamic financial instruments, and only

27.7% participated in the Islamic financial

instruments. It was also revealed that there were three

types of depositors: sharia-driven, profit-driven, and

transaction-driven depositors. The sharia-driven

depositors refer to the customers who choose Islamic

banks for their Islamic principles and will never

choose conventional banks. The profit-driven

depositors are indifferent between sharia and

conventional banks; they only take profit into their

account. The transaction-driven depositors are those

who use sharia banking service for transactional

purposes. The sharia-driven depositors were 56.8% of

the total respondents, 27% were profit-driven

depositors, and the last 16.2% were transaction-

driven depositors.

It was then concluded that the majority of

depositors were sharia-driven. They chose Islamic

banks because of their product conformity to the

Islamic teachings and fatwa of Indonesian Ulema

Council (MUI) (Shuhaimi, 2012). This confirms

other studies that customers chose Islamic banks due

to religious reasons. Their preference was also

influenced by Islamic financial literacy (Haque,

Osman, & Ismail, 2009; Tara, Irshad, Khan, &

Rizwan, 2014).

A survey conducted by the Financial Services

Authority (OJK, 2016) revealed that in Indonesia the

Islamic financial literacy was only 11.06 % and

Islamic banking literacy was 66.3%. This low level of

Islamic financial literacy greatly affected the

preference for Islamic banks. According to Azmi and

Chong (2014), financial literacy is necessary to

understand Islamic banking products and services.

Abdullah and Anderson (2015) suggest that financial

literacy is shaped by the following factors: views on

banking product, views on Islamic banking product,

parents’ influence on Islamic financial product and

services, factors determining investment in securities,

views on conventional banking product, attitude on

personal financial management, influence of personal

financial management, knowledge on wealth

planning and management, and attitude on Islamic

financial product and services.

Like in Malaysia, the Iranian government fully

supports Islamic banking by ratifying the Law for

Usury-Free Banking in August 1983. This law

requires banks in Iran within three years to adjust

thoroughly their business activities to the principles

of sharia and turn the outstanding interest-based

deposits into interest-free deposits within a year

(Parveen, Zadeh, & Muzakkirsyed). Islamic banking

in Iran and Malaysia enjoys a rapid growth due to

their government full support; not only can it compete

with conventional banking, but also becomes the

global first and second greatest sharia banking

respectively. While in Turkey and Sudan whose

government only gives lukewarm support, the

progress of sharia banking is not so significant.

Indonesian government must learn from other

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

262

successful countries in developing sharia banking

networks. State-owned enterprises (BUMN) also

encouraged to invest in the sharia banking. Based on

Roadmap of Indonesian Islamic Banking 2015-2019,

there are 41 programs to boost the development of

Islamic banks in Indonesia (OJK, 2016). In this

regard, Sari, Bahari and Hamat (2016) explain in their

report the influence of government and political

issues on the evolution of Islamic banking in

Indonesia.

3 RESEARCH METHODOLOGY

This study was conducted using an exploratory

approach; i.e., by exploring dominant factors that

shaped market share of Islamic banking. The primary

data were qualitative statements of Islamic bank

customers in Indonesia, but then quantified using five

point Likert scale.

This report discusses factors affecting Islamic

banking market share including promotion, product,

service, price, process, external environment, human

resources, and fatwa of Indonesian Ulema Council

(MUI).

The data were collected through observation,

interview, and questionnaire. The samples were 76

customers of BJB Syariah. The collected data were

analyzed using confirmatory factor analysis by means

of SPSS.

4 RESULTS AND DISCUSSION

The results of the survey data analysis are as follows:

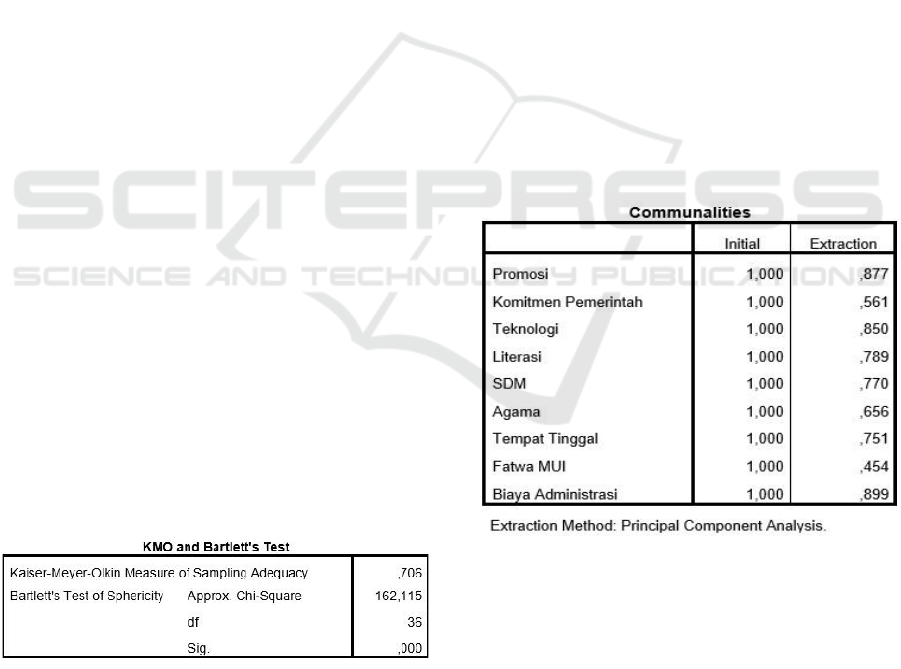

The result of KMO and Bartlett's test revealed that

the sampling adequacy was 0.706. Since it was higher

than 0.5, further test can be proceeded.

The result of correlation test between independent

variables in the output of KMO and Bartlett’s test is:

Table 1: KMO and Bartlett’s Test.

It could then be said that further test could be

proceeded. The correlation between independent

variables can be seen in the table of Anti-Image

Matrices. What should be paid attention to is MSA

(Measure of Sampling Adequacy) score. The MSA

score range is 0 to 1 with the following conditions:

1. MSA = 1, variables can be correctly predicted

by other variables.

2. MSA > 0.5, variables can still be predicted and

further analysis can be proceeded.

3. MSA < 0.5, variables cannot be predicted and

further analysis is not possible.

The results of MSA using SPSS are as follows:

1. Promotion 0.507 > 0.5

2. Government Commitment 0.631 > 0.5

3. Technology 0.821 > 0.5

4. Literacy 0.595 > 0.5

5. Human Resources 0.833 > 0.5

6. Religion 0.834 > 0.5

7. Residency 0.619 > 0.5

8. Fatwa of Indonesian Ulema Council (MUI)

0.869 > 0.5

9. Administration Cost 0.546 > 0.5

It could be then concluded that all variables could

further be analyzed since their scores were higher

than 0.5.

The next step is grouping these independent

variables into one or more factors. This is to describe

how these factors can explain the independent

variables. Therefore, it should be referred to the table

of Communalities below:

Table 2: Communalities.

The results show that the factors can explain the

promotion variable by 0.877 or 87.5%, the

government variable by 56.1%, the technology

variable by 85%, the literacy variable by 78.9%, the

human resources variable by 77%, the religion

variable by 65.6%, the residency variable by 75.1%,

the variable of fatwa of MUI by 45.4%, and the

administration cost variable by 89.9%. Since the

average explanation is above 50%, the factors were

determined.

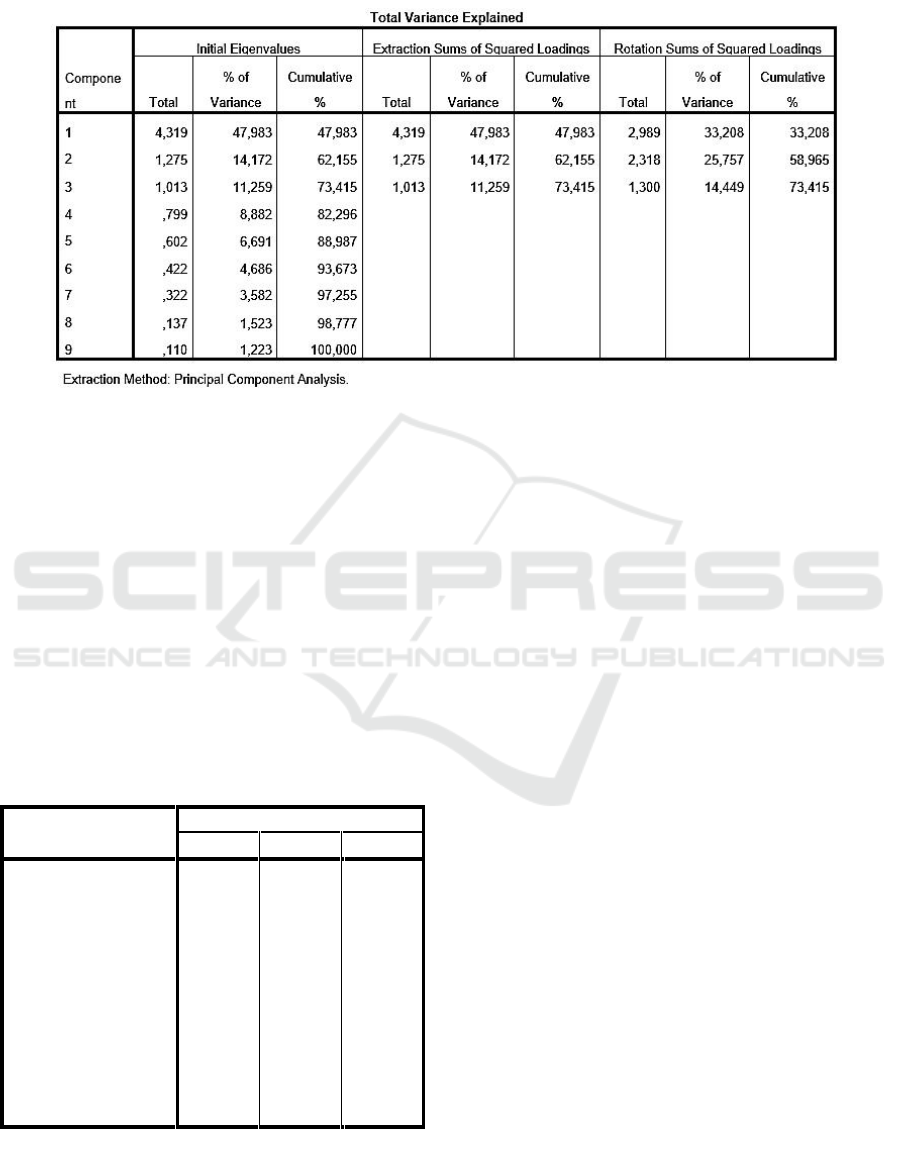

Table of Total Variance Explained shows

how may factors that can be established.

Factor Analysis of Constraints in Financial Feasibility for Results on Sharia Banks

263

Table 3: Total Variance Explained.

Based on the above calculation, the Component

ranging from 1 to 9 represents all independent

variables. In the Initial Eigenvalues column, the score

was set to 1. The variance can be explained by Factor

1 by 4.319/9 x 100% = 47.988, by Factor 2 by 1.275/9

x 100% = 14.166, and by Factor 3 by 1.013/9* x

100% = 11.255. The three factors combined can

explain the independent variables by 47.988% +

14.166% + 11.255% = 73.409%. Since the

Eigenvalues was set to 1, the total score taken was

that above 1; i.e., Components 1, 2, and 3.

Afterward, which variable that would go

into which factor was determined by referring to the

table of Component Matrix below:

Table 4: ComponenMatrix.

Table of Component Matrix

a

Component

1

2

3

Promotion

.711

.606

-.061

Government

Commitment

.655

-.144

-.334

Technology

.919

-.069

.017

Literacy

.604

.639

.127

Human Resources

.867

.128

-.047

Religion

.688

-.268

-.333

Residency

.679

-.497

.208

Fatwa of Indonesian

Ulema Council (MUI)

-.567

.353

.086

Administration

Cost

.409

-.120

.847

Extraction Method: Principal Component Analysis.

a. 3 components extracted.

Based on the above table, the correlations

between independent variables with the factors to be

formed are:

1. Promotion: Factor 1 correlation 0.11; Factor 2

correlation 0.606; Factor 3 correlation -0.061

2. Government Commitment: Factor 1 correlation

0.655; Factor 2 correlation -1.44; Factor 3

correlation -0.334

3. Technology: Factor 1 correlation 0.919; Factor

2 correlation 0.069; Factor 3 correlation 0.017

4. Literacy: Factor 1 correlation 0.604; Factor 2

correlation 0.639; Factor 3 correlation 0.127

5. Human Resources: Factor 1 correlation 0.867;

Factor 2 correlation 0.128; Factor 3 correlation

-0.047

6. Religion: Factor 1 correlation 0.688; Factor 2

correlation -0.268; Factor 3 correlation -0.333

7. Residency: Factor 1 correlation 0.679; Factor 2

correlation -0.497; Factor 3 correlation 0.208

8. Fatwa of MUI: Factor 1 correlation -0.561;

Factor 2 correlation 0.353; Factor 3 correlation

0.086

9. Administration cost: Factor 1 correlation 0.409;

Factor 2 correlation -0.120; Factor 3 correlation

0.847

Table of Rotated Component Matrix below shows

which variable goes to which factors.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

264

Table 5: Rotated Component Matrix.

The input of a variable into a particular factor was

determined by the correlation coefficient between the

variable and factor in question. And it was obtained

the following:

1. Factor 1: Government Commitment,

Technology, Religion, Residency, Fatwa of

MUI

2. Factor 2: Promotion, Literacy, Human

Resources, and

3. Factor 3: Administration Cost

Refer to the table of Component Transformation

Matrix below to conduct a test at the final step and to

determine the factor.

Table 6: Component Transformation Matrix.

Based on the above calculation, it could be

concluded that the correlation coefficients of Factor

1, Factor 2, and Factor 3 were 0.758, 0.810, and 0.929

respectively. Each of these scores implies a strong

correlation because they are higher than 0.5.

Thus, Factor 1, Factor 2, and Factor 3 can be said to

summarize the nine independent variables.

Factor 1 comprised the variables of government

commitment, technology, religion, residency, and

fatwa of MUI that could be characterized as the

external driving factors. Factor 2 represented the

variables of promotion, literacy, and human resources

that could be characterized as the corporate capability

factors. And Factor 3 represented the administration

cost variable that could be characterized as the

operational technical factor.

Thus, these factors can be summarized as follows:

1. Factor 1 is called the external driving factor

2. Factor 2 is called the corporate capability factor

3. Factor 3 is called operational technical factor

5 CONCLUSION

The following factors affected BJB Syariah market

share: promotion, government commitment,

technology, human resources, religion, residency,

fatwa of Indonesian Ulema Council (MUI). Having

been rotated, these factors were categorized into

three: Factor 1: government commitment,

technology, religion, residency, fatwa of MUI, Factor

2: promotion, literacy, human resources, and Factor

3: administration cost. Factor 1 is then called the

external driving factor (that affects the market share),

Factor 2 is called the corporate capability factor, and

Factor 3 is called the operational technical factor.

REFERENCES

Ahmad Azrin Adnan. 2013. Theoretical Framework for

Islamic Marketing : Do We Need a New Paradigm?

International Journal of Business and Social Science,

4(7), 157–165.

Bm, H., Uddin, M. A. 2016. Does Islamic bank financing

lead to economic growth: An empirical analysis for

Malaysia. Munich Personal RePEc Archive. Munich.

https://doi.org/10.5897/JAERD12.088

Doraisamy, B., Shanmugam, A., Raman, R. 2011. A Study

on Consumers’ Preferences of Islamic Banking

Products and Services in Sungai Petani. Academic

Research International, 1(3), 284–295.

Fejza, E., Asllani, A. 2013. the Importance of Marketing in

Helping Companies With Their Growth Strategies : the

Case of Food Industry in Kosovo. European Scientific

Journal, 9(16), 326–335.

Haque, A., Osman, J., Ismail, A. Z. H. 2009. Factor

influences selection of Islamic banking: A study on

Malaysian customer preferences. American Journal of

Applied Sciences, 6(5), 922–928.

https://doi.org/10.3844/ajas.2009.922.928

Kotler, Philip dan Keller, K. L. 2012. Marketing

Management (14th ed.). New Jersey: Pearson.

OJK. (2016). Metadata Statistik Perbankan Syariah.

Departemen Perizinan dan Informasi Perbankan.

Jakarta, I.

Parveen, T., Zadeh, E. L., Muzakkirsyed, A. 2015.

Evolution of Islamic Banking in IRAN: Prospects and

Problems. IOSR Journal of Business and Management

Ver. II, 17(9), 2319–7668.

https://doi.org/10.9790/487X-17926166

Shuhaimi, M. 2012. Islamic Perspective on Marketing Mix

Mohd. Shuhaimi bin Haji Ishak. International Journal

Of Business and Management Studies, 4(2), 121–131.

Factor Analysis of Constraints in Financial Feasibility for Results on Sharia Banks

265

Sumut Invest. 2017, April. OJK:Aset dan Pangsa Pasar

Kecil, Perbankan Syariah Belum Optimal. Referensi

Bisnis Sumatera. Sumatera.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

266