Audit Fee and Multiple Large Shareholder on Audit Quality

R. Nelly Nur Apandi and Alfira Sofia

Universitas Pendidikan Indonesia, Jl. Dr Setiabudi 229, Bandung, Indonesia

{nelly.nna, alfira.sofia}@upi.edu

Keywords: Audit Fee, Multiple Large Shareholder and Audit Quality.

Abstract: Auditor is demanded for always being professional in his/her job, but it is undeniable that business side of

audit service has also been an important consideration for auditors in making contract with auditee. This

business side of audit service can trigger abnormal audit pricing. The higher of audit fee can cause

decreasing or increasing of audit quality. This study aims to observe the influence of audit fee on the audit

quality and to observe whether Multiple Large Shareholder is able to moderate the influence of audit fee on

the audit quality. Method used was descriptive quantitative method. The study was conducted to all non-

financial industrial companies registered in Indonesia stock exchange from 2014 to 2015. Result of the

study succeeds in indicating that audit fee has influence on audit quality and that Multiple Large

Shareholder does moderate the effect of audit fee on the audit quality.

1 INTRODUCTION

The increasing needs of audit service happens along

with the structural change of company’s ownership

that separate authority and responsibility between

the owner (stakeholder) and the management

(agent). The owner of company faces the possibility

of gaining inaccurate information from the

management due to conflict of interest in it, thus the

information cannot be used for making economic

decision appropriately (Jensen and Meckling, 1976).

In order to reduce the risk of information, it is

necessary to have quality audit service (Arens,

2014). To achieve high quality audit service, it is

necessary to have good planning, including

appropriate audit pricing (De Angelo, 1981a;

1981b). Auditor is demanded for always being

professional in his/her job, but it is undeniable that

business side of audit service has also been an

important consideration for auditors in making

contract with auditee (Tuanakotta, 2011; Apandi,

2016). Dominant consideration on business side and

ignoring the professionalism can encourage

abnormal audit pricing, and eventually will cause the

low audit quality.

Fitriany (2016) states that the abnormal fee audit

is the difference between the audit fee paid by the

client and the normal estimate of the audit fee.

Abnormal audit fee may occur under several

conditions; first, audit fee received by auditor is

lower than proper payment for the service in order to

achieve good audit quality (Blankley, 2012). This

occurs due to excessive discount of audit fee and it

may cause doubt on auditor’s capability in applying

accepted professional standard. Second, audit fee

received by the auditor is higher than proper

payment for the service by giving opinion warrant

according to auditee’s expectation (Choi, 2010;

Fitriany, 2016). Thus, the auditor will gain premium

audit fee by sacrificing his/her independency.

Economic dependence of auditor on client, so that

the audit contract on the next year will not be signed

over to other auditor, causes the auditor willing to

give opinion warrant more than what is expected by

auditee.

Previous researches regarding audit fee and audit

quality show different results. Researches conducted

by Hoitash (2007); Ettredge (2014) suggest that

abnormal audit fee or fee pressure can decrease the

audit quality. Kraub (2015); Fitriany (2016) suggest

that positive abnormal fee has negative effect on the

audit quality. Rahmina and Agoes (2014) by using

primary data in Indonesia proves that high audit fee

can increase audit quality because high audit fee is,

instead, considered to encourage the auditor to

provide more efforts in order to increase his/her

audit quality.

Upon the companies registered in Indonesia

stock exchange, demand the user of information on

audit report is getting higher, thus it encourages

Apandi, R. and Sofia, A.

Audit Fee and Multiple Large Shareholder on Audit Quality.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 375-379

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

375

auditor to improve his/her audit quality. This

increasing demand is an audit risk that must be faced

by auditors, and as compensation for the higher audit

risk, the audit fee determined will also increase. The

increasing of audit fee is considered to be able to

increase the audit quality. Audit quality will be

higher if there is strict control on operational

activities carried out by companies (Apandi, 2016).

Conflict of interest happening in the company does

not only occur between management and owner of

the company, but also there is conflict of interest

between majority owner of company and minority

owner of company. Company with multiple large

shareholder has greater control compared to

company without multiple large shareholder (Attig

et al., 2008).

Based on explanation above, it is necessary to

conduct a study to observe the influence of audit fee

on audit quality moderated by multiple large

shareholder. This research has contribution in

studying the effect of moderating by large

shareholders that has never been conducted by

previous researchers.

2 LITERATURE REVIEW

2.1 Influence of Audit Fee on Audit

Quality

Low audit fee causes auditor apt to shorten the

important audit procedure that can make auditor

giving wrong and misleading opinion to the reader

of financial report (Tuanakotta, 2011), whereas high

audit fee encourages auditor to improve his/her audit

quality (Rahmina and Agoes, 2014). This occurs

because of high audit fee reflects high audit risk and,

therefore, in order to decrease the audit risk,

allocation of more time and effort of the auditor is

needed. Thus, the increasing of audit fee can directly

affect better audit quality

The quality of the audit will largely depend on

the auditing process performed by the auditor. Audit

quality according to DeAngelo (1981b) is defined as

the auditor's ability to find any errors in the

accounting process undertaken by the audited

company. Various studies that correlate audit fees

with audit quality using audit quality proxies are

based on the level of earnings management

performed by companies reflected from

discretionary accruals as in the research undertaken

by Hoitash (2007); Kraub (2015); Fitriany (2016). A

high discretionary accrual will show the auditor's

willingness to accept accounting policies chosen by

management that are favorable to management so as

to produce unfair financial statements and mislead

readers of financial statements. The conclusion, the

higher value of discretionary accrual is lower the

audit quality

Researches by Rahmina and Agoes (2014) prove

that high audit fee can increase audit quality since

high audit fee is, instead, considered able to

encourage the auditor to provide more efforts in

order to improve his/her audit quality.

H1 = Audit Fee Has Positive Effect on Audit

Quality

2.2 Influence of Audit Fee on Audit

Quality Moderated by Multiple

Large Shareholder

Information asymmetry occurs not only between

management and owner of company, but the ability

for appropriation by majority shareholder upon

minority shareholder can cause information

asymmetry. Information asymmetry type one causes

management to be likely to carry out actions that

bring benefit for their own at the loss of owner of

company. In contrast, information asymmetry type

two causes majority shareholder to be likely to carry

out actions that bring benefit for their own at the loss

of minority shareholder.

In its practice, company is often owned by more

than one majority shareholder (Claessens, 2000).

This condition causes second and subsequent

majority shareholders having control right upon the

company equal to the first majority shareholder.

Control upon management actions is even greater

because there are two parties having strict control

upon the company. This condition will be different if

the ownership is only in the hand of one majority

shareholder, so that control function upon

management will be less strict (Gutierrez and Tribó,

2004; Amdouni and Boubaker, 2015).The existence

of second majority shareholder minimizes the

possibility of appropriation by the first majority

shareholder upon minority shareholder because,

indirectly, the second majority shareholder will also

have control upon operation of the company (Attig

et al., 2008).

The increasing control function can encourage

better quality of information in audit report due to

the increasing demand of accuracy in the financial

report faced by auditor in such condition. High audit

fee causes lower audit quality and the existence of

second majority shareholder can intensify the effect

of high audit fee on high audit quality.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

376

H2 = Multiple Large Shareholder Intensifies

Effect of Audit Fee on Audit Quality

3 METHODOLOGIES

This research uses descriptive quantitative method.

Population in this research is all non-financial

industrial companies registered in Indonesia stock

exchange. Sampling technique used is purposive

sampling with number of sample was 88 companies.

Data collected concerning audit quality derived from

financial report of the companies from 2014 to 2015

as available in the website of Indonesia capital

market. Whereas, data concerning audit fee and

multiple large shareholder is obtained from annual

report of the companies of the same period.

Data analysis technique used is Ordinary Least

Square (OLS).

Explanation:

QUALITY = Discressionary accrual jones

modified

FEE = Natural Logarithm of Audit

Fee

MLS = If the company has multiple

lar

g

e shareholder, value

g

iven

is 1, otherwise value given is

0

ASSET = Natural logarithm of total

asse

t

LIABILITIES = Natural logarithm of total

liabilities

LOSS = If the company hass loss,

value given is 1, otherwise

value

g

iven is 0

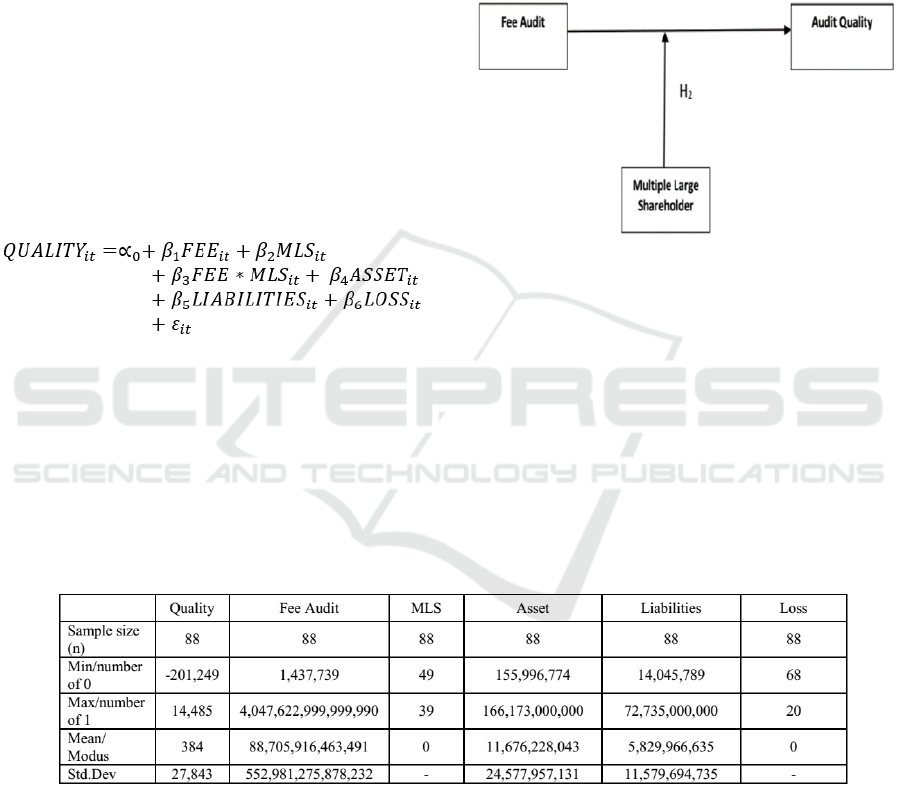

Figure 1: Paradigm of research.

4 RESULTS AND DISCUSSION

This study aims to examine the influence of audit fee

on audit quality moderated by multiple large

shareholder. Below is result of statistic description

of each variable.

Table 1: Variables descriptive analysis.

Based on table 1, it is obtained that min and max

values of audit fee are 1,437,739 and

4,047,622,999,999,990 respectively, with Mean

1.852.432. Whereas, min and max values of audit

quality are -201,249 and 14,485 respectively, with

Mean is 384. And, min and max values of multiple

large shareholder are 0 and 1 respectively, with

Modus is 0. The results above describe that the audit

fee in Indonesia is quite high, indicated by average

values of audit fee by which 60% (not tabulated) of

audit assignment is dominated by big four public

accountant firms. Companies in Indonesia are

generally concentrated in only one large shareholder.

Audit Fee and Multiple Large Shareholder on Audit Quality

377

Table 2: Results of regression model.

**α (0.05); ***α (0.01)

Based on table 2, from regression 1 (without

moderation variable) it is found that audit fee has

influence on audit quality. This can be seen from the

coefficient and prob value of less than 0.05, namely

-1719.346 (0.0085) ***each. This result of

regression shows that the higher the audit fee, the

lower the discretionary accrual. So, it can be

concluded that the higher of audit quality. Whereas,

from regression 2 (With control variables & without

moderating variable) it is found that audit fees have

an effect on audit quality. This can be seen from the

coefficient and prob value of less than 0.05, namely

-2569.821 (0.0001) ***each. The regression results

in model 3 (With moderating variable & without

control variables) also show consistent results that

audit fees have an effect on audit quality. This can

be seen from the coefficient and prob value of less

than 0.05, namely 3299.791 (0.0002) ***each.

The effect of moderation variable can be seen in

regression 4 (regression with moderation), that

multiple large shareholder can intensify the

influence of audit fee on audit quality with

significance level at *1%. This can be seen from the

coefficient and prob value of less than 0.01, namely

4079.491 (0.0004) ** each. Other variable with

influence on audit quality is Asset, with coefficient

and prob value of 15311.39 (0.0030) **, Liabilities

with coefficient and prob value -8946.297 (0.0422)

**, and Loss with coefficient and prob value -

24259.33 (0.0002) ***.

Result of this research is in line with previous

researches that associate audit fee and audit quality,

such as researches by Rahmina and Agoes (2014).

That proves a high audit fee can increase audit

quality. It can be seen from the lower discressionary

accrual values. This research also provides other

empirical evidence that multiple large shareholder

intensifies the influence of audit fee on audit quality.

Result of this study verifies that multiple large

shareholder can act as control in making quality

financial report. This control function by the

multiple large shareholder is equal to the control

function as described in the research concerning

influence of institutional ownership that can

moderate the effect of audit fee on audit quality such

as research by Kasai (2014).

5 CONCLUSIONS

Higher audit fee has effect on reduce discretionary

accrual. It seems that the higher audit fee has effect

on better audit quality. Improvement of audit quality

requires more commitment of auditing time and

resources from the auditors so that the audit fee

needed to be spent by the company is higher. This

research also verifies that the existence of multiple

large shareholder in a company can function as

control for management and other majority

shareholders. Thus, the multiple large shareholder

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

378

can intensify the positive effect of audit fee on audit

quality.

Result of this research can act as a reference

regarding literature that associate audit fee, multiple

large shareholder, and audit quality, which has never

been conducted before. This research is also

expected able to encourage companies to be more

transparent in disclosing the expenditure of audit fee

to prevent the occurrence of abnormal audit fee,

since there is relatively small number of company in

Indonesia willing to disclose it.

Using of secondary data concerning audit quality

measured by accrual discretionary model has several

weaknesses since the data obtained is the proxy of

financial report from companies audited and not

from auditor. Therefore, if there is secondary data

concerning auditor from the perspective of the

auditor itself, subsequent researches in the future can

exploit data regarding management of public

accountant firm or quality management of public

accountant firm.

REFERENCES

Arens, A., 2014. Auditing and Assurance Services an

Integrated Approach, Pearson.

Amdouni, S., Boubaker, S., 2015. Multiple Large

Shareholders and Owner-Manager Compensation:

Evidence from French Listed Firms. The Journal of

Applied Business Research, 31(3), 1119–1130.

Apandi, A., 2016. The Effect of Corporate Tax

Governance, Audit Quality and Tax Exposure on

Audit Fee for Companies Enlisted in Indonesia Stock

Exchange. Advances in Economics, Business and

Management Research, 15.

Attig, N., Guedhami, O., Mishra, D., 2008. Multiple large

shareholders, control contests, and implied cost of

equity. Journal of Corporate Finance, 14(5), 721–737.

DeAngelo, D. 1981a. Auditor Independent, Low Balling

and Disclosure Regulation. Journal of Accounting and

Economics 3, 113-127.

DeAngelo, D., 1981b. Auditor size and audit quality.

Journal of Accounting and Economics 3, 183-199.

Blankley, B., 2012. Abnormal Audit Fees and

Restatement. Auditing: A Journal of Practice &

Theory 31(1) 79-96.

Choi, C., 2010. Audit Office Size, Audit Quality and Audit

Pricing. Working Paper. Singapore Management

University

Claessens, C., 2000. The separation of ownership and

control in East Asian Corporations. Journal of

Financial Economics 58, 81-112.

Ettredge, E., 2014. Fee pressure and audit quality.

Accounting, Organizations and Society 39, 247–263.

Fitriany, F., 2016. Impact of Abnormal Audit Fee to Audit

Quality: Indonesian Case Study. American Journal of

Economic 6(1) 72-78.

Gutiérrez, M., Tribó, J. A., 2004. Private benefits

extraction in closely-held corporations: The case for

multiple large shareholders. Business Economics

Series 15, Working Paper 04-43, 126.

Hoitash, H., 2007. Auditor fees and audit quality.

Managerial Auditing Journal, 22(8) 761 – 786.

Jensen, J., Meckling, M., 1976. Theory of the Firm:

Managerial Behavior, Agency Costs and Ownership

Structure. Journal of Financial Economics V. 3, 4,

305-360.

Kraub, K., 2015. Abnormal Audit Fees and Audit Quality:

Initial Evidence from the German Audit Market.

Journal of Business Economics (JBE), 85(1) 45-84.

Kasai, K., 2014. Ownership Structure, Audit Fees, and

Audit Quality in Japan. Faculty of Economics. Shiga

University.

Tuanakotta, T., 2011. Berpikir Kritis Dalam Audit,

Salemba Empat.

Rahmina, R., Agoes, A., 2014. Influence of auditor

independence, audit tenure, and audit fee on audit

quality of members of capital market accountant

forum in Indonesia. Procedia - Social and Behavioral

Sciences 164, 324 – 331.

Audit Fee and Multiple Large Shareholder on Audit Quality

379