The Mediating Role of Perceived Benefits upon SMEs’ Satisfaction

towards Islamic Microfinance Institutions

Muhamad Abduh

1

and Nur Jamaludin

2

1

School of Business and Economics, Universiti Brunei Darussalam, Jalan Tungku Link, Gadong, Brunei Darussalam

2

Department of Economics, International Islamic University Malaysia, Kuala Lumpur, Malaysia

muhamad.abduh@ubd.edu.bn

Keywords: Islamic microfinance, Indonesia, Service quality, Carter model, SMEs.

Abstract: This study is aimed at investigating the relationship between Islamic microfinance institutions service quality

and the satisfaction of small and microenterprises in Indonesia by using perceived benefits as mediating

variable. Primary data are collected from 454 small and microenterprises (SME) located in West Java

Province and the CARTER Model is adopted to test the satisfaction of small and microenterprises upon the

services provided by their patronized Islamic microfinance institutions. By using the structural equation

model, the finding confirms that perceived benefits fully mediate the relationship between service quality of

Islamic microfinance institutions and small and microenterprises’ satisfaction.

1 INTRODUCTION

Abduh (2013) investigated the prioritizing issues in

Islamic economics and finance (IEF) by using

analytical hierarchy process and found that area of

zakat-waqaf and poverty alleviation is considered as

the most important area followed by monetary system

including Islamic currency. Despite the large number

of studies done in Islamic banking, the respondents

have considered that the area is not able to answer or

give solution to the current problem of poverty in

Muslim society.

Nowadays, microfinance is believed as one of the

most significant tools to narrow the income

distribution gap among the people and eventually to

alleviate poverty. It is a new initiative which is

acclaimed to bring a new paradigm of economic

development which is not only focusing on growth

but also on equality and quality of the development.

However, the implementation of riba-based loans and

other non-Islamic approaches in conventional

microfinance institutions avoids many Muslim SME

entrepreneurs to go for its products and services.

Masyita and Ahmed (2011) reported that the

demand for Islamic microfinance institutions’

(IMFIs) services is very high in Muslim majority

developing countries like Indonesia, Bangladesh, and

Pakistan despite the fact that most of the IMFIs are

informal institutions. In Indonesia, the IMFIs are part

of its microfinance system since 1990, when the first

Islamic cooperative of Baitul Maal wat-Tamwil

(BMT) was established. It was established in order to

provide Muslim SME owners with shariah

compliance financial products and services. Masyita

and Ahmed (2011) also reported that as many as 72%

people live in Muslim countries do not use formal

financial services in fulfilling their needs, and thus the

existence of IMFIs is very helpful for them, especially

the lower income group.

However, despite all the advantages offered by

IMFIs to the SME owners, there still barriers in the

market between the two stakeholders in Indonesia.

Among the identified barriers is the high transaction

cost charged by IMFIs. The reason is that the IMFIs

are not only channeling funds and do the monitoring,

administrating, and collecting the payment, but also

guiding and nurturing their customers on how to

improve their economic situation. Moreover, the

absence of physical collateral, which pushes IMFIs to

face more probability of credit default risks than the

conventional microfinance has increased the

transaction costs of IMFIs. Nevertheless, one of the

reasons why IMFIs are still growing is because the

transaction costs are still below the cost demanded by

banks. Table 1 shows the development of BMT as the

dominant IMFIs in Indonesia from 1990 to 2013,

which is very impressive in terms of the number.

712

Abduh, M. and Jamaludin, N.

The Mediating Role of Perceived Benefits upon SMEs’ Satisfaction towards Islamic Microfinance Institutions.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 712-717

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

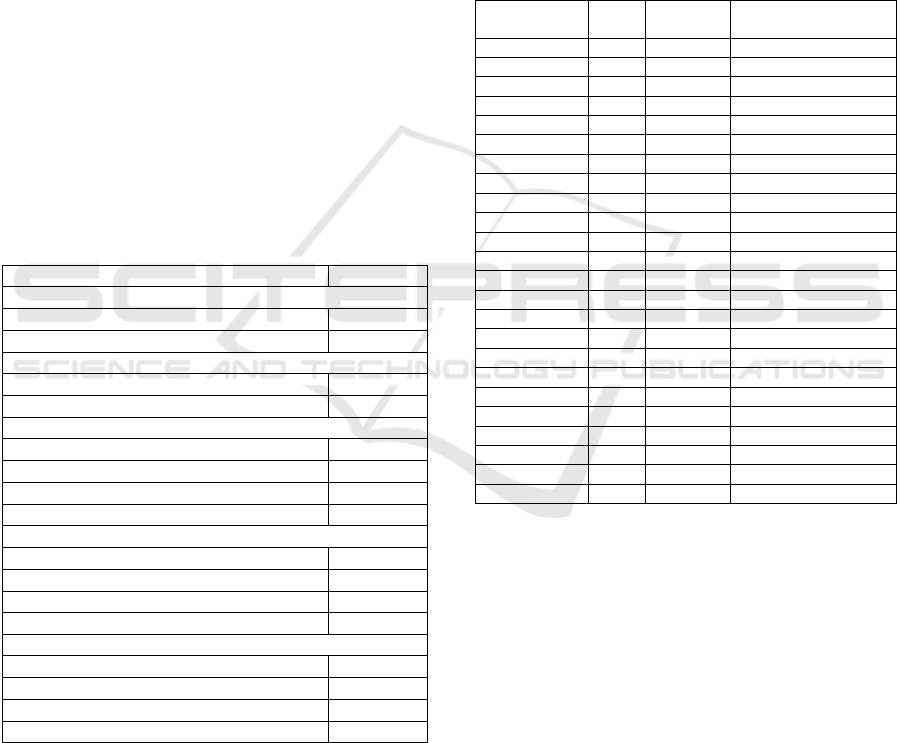

Table 1: The Development of IMFIs in Indonesia from

1990 to 2013.

Year

Number of BMT

1990-1995

300

1996

700

1997

1501

1998

2470

2000

2938

2001

3,037

2003

2,856

2012

3900

2013

7500

With the big number of IMFIs and other

microfinance institutions in Indonesia, IMFIs have to

compete with not only other IMFIs but also with other

major financial institutions such conventional

microfinance institutions, banks, and leasing

companies. In this competitive market, it is vital for

the IMFIs to enhance its quality of services in order

to maintain the existing customers and attract more in

the future.

2 LITERATURE REVIEW

2.1 The Role of IMFIs

Many have said that commercial banking has failed

to provide financial services to the poor and catering

market at micro level. As a consequence,

microfinance, especially IMFIs, had emerged as an

economic development institution that has a

competitive advantage to serve financial needs of the

lower income groups in the society. Al-Harran (2000)

explained that among the purpose of the

establishment of IMFIs is to create financial services

that can be accessed by the non-bankable people and

to improve their economic performance.

In the case of Indonesia, BMT was established in

order to empower Muslim small and micro-

entrepreneurs and to enhance the welfare of the

general Muslim. In addition, BMT was set to provide

Muslim with shariah compliance methods of

financing and fostering productive businesses in

order to increase job opportunities that can help

government to reduce the unemployment rate.

BMT as the dominant IMFIs were proven to be

able to improve business performance of SMEs

effectively. Using 60 BMTs and 204 SMEs located in

Central Java as research samples, Hadisumarto and

Ismail (2010) reported that the business performances

of SMEs including its business income, profit, and

assets, had improved significantly after they joined

and received financing from the BMT.

2.2 Service Quality of IMFIs

Excellent service quality is believed could retain the

existing customers and at the same time attracting

new customers as the words-of-mouth impact from

the satisfied consumers. For financial institutions,

quality service is about meeting the requirement and

needs of their customers and the delivery of

customers’ expectation. Abduh and Othman (2014)

argued that in today’s global economy, quality is a

survival factor for organization because of the

shifting in the world economy from a production-led

philosophy to a customer focused approach. In other

words, the ability of delivering customer service

would determine the effectiveness of a firm.

Parasuraman et al. (1985) identified 10

dimensions of service quality in financial industry as

follows: reliability, responsiveness, competence,

access, courtesy, communication, credibility,

security, competence, understanding, and tangibles

which later on simplified into 5 dimensions which are

reliability, responsiveness, assurance, empathy, and

tangibles. Othman and Owen (2001) expanded the

SERVQUAL model of Parasuraman et al. (1985) by

adding compliance dimension as one item regarding

to measurement of Islamic financial institution. This

indicator tried to measure the shariah compliancy of

services provided by Islamic financial institutions.

Items included in this dimension are: operational of

the institution refers to Islamic teaching; no interest

in deposit and financing; and services and products

offered are not against sharia law. This model is

known as CARTER Model.

Fararah and Al-Swidi (2013) is among the first

paper evaluated the service quality of IMFIs using

CARTER model. The study was aimed to examine

the relationship between service quality, perceived

benefits and satisfaction. The finding had shown that

there is a positive and significant impact of the

perceived benefits on the satisfaction level of SME

owners towards IMFIs service quality at 1 percent

level of significance. The study has also revealed that

the relationship between service quality and

satisfaction of IMFIs customer is also positive and

significant.

Although there is no study yet that discuss the

factors influence SME owners in Indonesia to choose

IMFIs, study in Islamic banking such as Abduh

(2011) have shown that customers in Indonesia had

perceived sharia compliance and assurance as the

most important dimension in choosing the Bank.

The Mediating Role of Perceived Benefits upon SMEs’ Satisfaction towards Islamic Microfinance Institutions

713

2.3 Customer Satisfaction and Loyalty

Abduh et al. (2012) explained that customer

satisfaction is a measure of how organization’s total

product performs in relation to a set of customers’

requirements. Therefore, in the industry of financial

services, financial institutions should be more

focusing on increasing customer satisfaction to retain

them by improving the service quality level of their

institution.

Levesque and McDougall (1996) posit that

satisfied customer leads to the higher profit of the

organization, therefore customer satisfaction

becomes one of the most important elements in the

successfulness of the business. In addition, the

positive effect of customer satisfaction is the

enhancement in customers’ trust and loyalty, and

eventually will improve the profit of the organization.

Therefore, it is a strategic issue for the organizations

to increase customer satisfaction and maintain their

loyalty which indirectly if will give impact upon the

economic returns, i.e. profitability, market share, and

return on investment (Anderson et al., 1994).

2.4 Perceived Benefits

Perceived benefit refers to the perception of the

positive consequences that are caused by a specific

action. Services providers could lose their customers

if customers perceive no benefit or a little benefit will

be obtained from the programs (services or products),

likewise the customers would be motivated to give

their loyalty if they perceive more benefits would be

obtained from the programs and it surely increases the

relationship between them and the providers.

2.5 Research Hypotheses

The determination of customers satisfaction on

Islamic banking products and services have been

broadly examined by many researchers both in

Muslim and non-Muslim countries. In contrast,

research on Islamic Microfinance regarding the issue

of customer satisfaction is still rare. The proposed

research hypotheses to be tested in this study as

follow:

H1: Service quality has a positive and significant

effect on the satisfaction of SME owners;

H2: Service quality has a positive significant

effect on perceived benefits of SME owners;

H3: Perceived benefits have a positive and

significant effect on the satisfaction of SME

owners;

H4: Perceived benefits mediate the relationship

between service quality and SME Owners’

satisfaction upon IMFIs performance.

3 DATA AND METHODOLOGY

3.1 Data

The data are obtained through a survey in November

2014 using structured questionnaire consisting of four

parts i.e. demographic, service quality, perceived

benefits, and customer satisfaction. The respondents

are SMEs owners and the scope are the Province of

Jakarta, West Java, and Banten. A total of 454 units

of questionnaires were received and analyzed for this

research.

3.2 Structural Equation Model

Confirmatory factor analysis (CFA) is a type of SEM

analysis that deals specifically with measurement

models; that is, the relationships between observed

measures or indicators and latent variables or factors.

In confirmatory factor model approach, we choose to

statistically test the significance of a hypothesized

factor model in order to know whether the sample of

data confirms the model or not. The sample data that

fits the model confirms the validity of the

hypothesized model. This is primarily the rationale

for CFA.

The validity of measurement model is based on

the acceptance of the model goodness-of-fit alongside

with specific proof of construct validity which is the

degree to which data collection methods properly

measure what they were intended to measure. To

fulfill the validity and reliability procedures,

convergent validity and items reliability (Cronbach’s

alpha) will be carried out.

Figure 1: Model proposed and tested in this study.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

714

Numerous of indices will be used in this study to

assess the goodness of fit between the model and the

sample of data. These indices include: Chi-

square/dfχ2, Comparative Fit Index (CFA), Root

Mean Square Error of Approximation (RMSEA), and

Normed Fit Index (NFI).

4 FINDINGS AND DISCUSSION

4.1 Demography

The demography of the respondents of this study is

reported in Table 2. The figures indicate that 56.8%

of the respondents are male and 43.2% female, with

most of them are married (85%). In term of education,

most of the respondents are graduated from Senior

High School, only 25.6% were graduated from

colleges. The majority of respondents are in the group

age of 31 – 40 years followed by 21 – 30 years

(27.8%). With regard to their income, 49.1% are in

the group of $80-$215 per month, followed by the

group of $250-$415.

Table 2: Demographic information of the respondents.

Variables

%

Gender

Male

56.8%

Female

43.2%

Marital Status

Single

15.0%

Married

85.0%

Age

Below 20 years old

1.3%

21-30

27.8%

31-40

55.9%

41 +

15.0%

Background of Education

Primary School

4.2%

Junior High School

13.0%

Senior High School

57.3%

Diploma/University

25.6%

Monthly Income

Below Rp 1 million ($80)

9.9%

≥ Rp 1 Mill. - Rp 3 mill. ($80-$215)

49.1%

>Rp 3 Mill. - Rp 5 mill. ($250-$415)

32.4%

>Rp 5 Mill. ($415)

8.6%

4.2 Convergent Validity

The significant factor loadings indicate convergent

validity. According to Barclay (1995), the ideal

degree of standardized factor loading should be .70

and above. However, .60 is still accepted by many

researchers.

Table 3 shows that all of the items have a good

value in which all factor loadings have a sufficient

score requirement. The highest convergent validity is

accounted by the item SC3 which is refers to

“products accepted by Islamic Law” with score of

0.934, and followed by the item CS41 which is refers

to “It is Very satisfied with personal” with score of

0.926. Overall, the values exceed 0.6 and many are

more than 0.7 and 0.8; it shows evidence that the

model provides a good validity.

Table 3: Standardized factor loadings of construct items.

Observed

Variables

Factors

Standardized Factor

Loading

SC3

<---

SCOM

0.934

SC2

<---

SCOM

0.866

SC1

<---

SCOM

0.888

As9

<---

ASSUR

0.753

As6

<---

ASSUR

0.669

As7

<---

ASSUR

0.677

Re13

<---

RELI

0.737

Re12

<---

RELI

0.806

Re11

<---

RELI

0.720

Ta19

<---

TANG

0.756

Ta18

<---

TANG

0.865

Ta16

<---

TANG

0.653

Em29

<---

EMPA

0.734

Em26

<---

EMPA

0.639

Em24

<---

EMPA

0.763

Res32

<---

RESP

0.962

Res31

<---

RESP

0.566

Res30

<---

RESP

0.568

CS40

<---

CS

0.517

CS41

<---

CS

0.926

CS42

<---

CS

0.840

PB33

<---

PB

0.746

PB37

<---

PB

0.679

PB35

<---

PB

0.726

Note: SCOM = Shariah compliance; ASSUR = assurance; RELI =

reliability; TANG = tangible; EMPA = empathy; RESP =

responsiveness; CS = Customer satisfaction; and PB = perceived

benefits.

4.3 Reliability Test

Cronbach’s Alpha is the common measure of internal

consistency (reliability). The value of Cronbach’s

alpha should be greater than minimum standard of 0.7

(Nunnelly, 1978). The results of this study showed a

good estimate of internal consistency for all latent

variables under investigation. The values of

Cronbach’s alpha shown in Table 4 below ranges

between .767and .858 for each latent variable in the

proposed model except for the variable of

Responsiveness which shows .676 for its Cronbach’s

Alpha value.

The Mediating Role of Perceived Benefits upon SMEs’ Satisfaction towards Islamic Microfinance Institutions

715

4.4 Assessing the Measurement Model

The findings show that almost all factor loadings

were respectively strong and all statically significant,

but the model showed unsatisfactory for some test

indices. The fit indices for the sample are: chi-square

to degrees of freedom (χ²/df) = 6.982, CFI = 0.658,

NFI = 0.623, IFI = 0.659, TLI = 0.636 and RMSEA =

0.11.

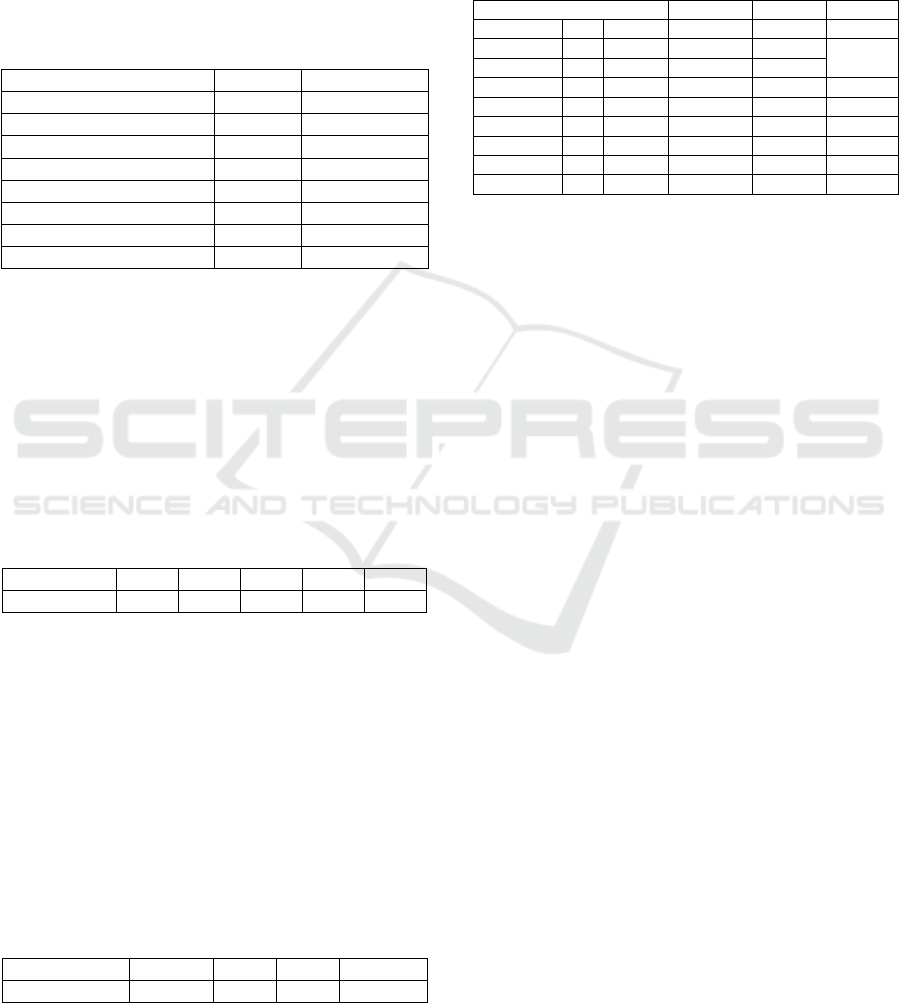

Table 4: Cronbach’s alpha reliability test.

Latent Variables

No. Items

Cronbach's α

Sharia Compliances (SCOM)

3

0.858

Assurance (ASSUR)

3

0.786

Reliability (RELI)

3

0.848

Tangible (TANG)

3

0.794

Empathy (EMPA)

3

0.762

Responsiveness (RESP)

3

0.676

Perceived Benefits (PB)

3

0.767

Customer Satisfaction (CS)

3

0.815

Model re-specification is aimed at improving the

original model into a better goodness of fit.

According to Hu and Bentler (1999), if CFI and NFI

scores are greater than .90 and the Root mean square

error of approximation (RMSEA) value is less than

.08, then the indices show a good model fit. Table 5

shows the goodness-of-fit statistics of the model and

the statistics after the modification of the model show

significant improvement with CMIN/DF is 2.143 and

other indices are greater than 0.90.

Table 5: Baseline comparisons of the modified model.

Model

NFI

RFI

IFI

TLI

CFI

Default model

0.942

0.916

0.968

0.953

0.968

As suggested by Steiger and Lind (1980), the

RMSEA score 0.05 and below shows the good fit of

the model tested. Table 6 shows that the RMSEA

value of our hypothesized model is 0.05, with the

90% confidence interval ranging from 0.044 to 0.057

and the p value of this test of closeness of fit equal to

0.468. This means that we have 90% confidentiality

to conclude that the RMSEA in the population with

the bound area 0.044 to 0.057 as a good precise

degree. Theoretically, this result indicates that the

model is fit and thus the proper interpretation would

not likely to be spurious.

Table 6: RMSEA of the modified model.

Model

RMSEA

LO90

HI90

PCLOSE

Default model

0.05

0.044

0.057

0.468

4.5 The Relationship among Variables

Table 7 provides the standardized regression

estimates I which shows the direction and the

magnitude of the investigated relationships in the full

model.

Table 7: Standardized regression estimate I.

Relationship Direction

Est. (B)

P-value

R

2

PB

SQ

0.658

***

0.433

CS

SQ

0.039

0.501

0.328

CS

PB

0.546

***

ASSUR

SQ

0.884

***

0.782

SCOM

SQ

0.578

0.334

RELI

SQ

0.764

***

0.583

TANG

SQ

1.027

***

0.550

EMPA

SQ

0.728

***

0.530

RESP

SQ

0.619

***

0.384

Interestingly, this study provides no evidence to

show that service quality has a significant influence

upon customer satisfactions (p-value .501). However,

it does have a significant influence upon perceived

benefits and perceived benefits significantly

influence the customer satisfaction. Therefore, there

is a strong indication that the relationship between

service quality and customer satisfaction in the

Islamic microfinancing industry in Indonesia is fully

mediated by the perceived benefits of the customers.

The findings support hypotheses 1 and 3, and

rejecting hypothesis 2.

Table 7 also provides the information of

regression weight between service quality to the first-

order factor of service quality or CARTER

(Compliances, Assurance, Reliability, Tangibility,

Empathy, and Responsiveness). The statistics

displayed in Table 7 are showing that significant

relationship exist among them which means that

between first order CFA and its second order is a

good-fit model.

4.6 Mediation Analysis

To assess the mediating role of perceived benefits in

between service quality and customer satisfaction of

SMEs’ owners upon the performance of Islamic

Microfinance Institutions, the non-mediated model

will also be run in order to compare the direct and

indirect effects. In this way, the role of perceived

benefits in mediating service quality towards

customer satisfaction can be identified.

When both independent and mediating variable

appear in the model, the relationship between

independent and dependent variable is no longer

significant, with the strongest demonstration of

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

716

mediation occurring when the direct independent

variable to dependent variable path is zero.

Table 8: Standardized regression estimate II.

Relationship Direction

Est. (B)

P-value

CS

SQ

0.350

***

Table 8 of the standardized regression estimate for

the model without perceived benefits variable and

Figure 2 for the model with perceived benefits

variable are showing that the perceived benefits

variable is successfully demonstrating a full

mediation role. This supports hypothesis 4 of this

study.

Figure 2: Testing the mediating role of PB.

5 CONCLUSIONS

With the increasing popularity of Islamic

microfinance institutions (IMFIs) in Indonesia, many

Muslim SME owners are moving from conventional

MFIs to IMFIs. This study is aimed at examining the

role of perceived benefits in mediating the

relationship between service quality and customer

satisfaction, in the case of Islamic microfinance

institutions in Indonesia.

The findings have shown that SMEs owners’

perceived benefits upon taking financing from IMFIs

has had improved their satisfaction upon the IMFIs

service quality performances. In other words,

perceived benefits significantly mediating the

relationship between service quality and customer

satisfaction.

REFERENCES

Abduh, M., 2011. Islamic Banking Service Quality and

Withdrawal Risk: The Indonesian Experience.

International Journal of Excellence in Islamic Banking

and Finance. Vol. 1, No. 2, pp. 1-15.

Abduh, M., 2013. Prioritizing Issues in Islamic Economics

and Finance. Middle-East Journal of Scientific

Research. Vol. 15 No.11, pp. 1594-1598.

Abduh, M., Kassim, S. H., Dahari, Z., 2012. Customer

Satisfaction and Switching Behavior in Islamic

Banking: Evidence from Indonesia. School of Doctoral

Studies (Europian Union) Journal. Vol. 4, pp. 209-215.

Abduh, M., Othman, A. M., 2014. Service Quality

Evaluation of Islamic Banks in UAE: An Importance-

Performance Analysis Approach. Journal of Islamic

Economics, Banking and Finance. Vol. 10 No. 2, pp.

103-113.

Al-Harran, S., 2000. Islamic Finance: The Experience of

the Sudanese Islamic bank in partnership financing as

a tool for rural development among Small farmer in

Sudan, Unpublished Ph. D thesis, Durham University.

Anderson, E. W., Fornell, C., Lehmann, D. R., 1994.

Customer satisfaction, market share and profitability:

Findings from Sweden. Journal of Marketing. Vol. 58

No. 3, pp. 3-56.

Barclay, D. C., 1995. The partial least squares (PLS)

approach to causal modelling: personal computer

adoption and use as an illustration, Technology Studies

Press. London,

1st

edition.

Fararah, F. S., Al-Swidi, A. K., 2013. The role of the

perceived benefits on the relationship between service

quality and customer satisfaction: a study on the Islamic

microfinance and SMEs in Yemen using PLS approach.

Asian Social Science. Vol. 9 No. 10, pp. 18-36.

Hadisumarto, W. M. C., Ismail, A. G., 2010. Improving the

effectiveness of Islamic micro-financing: learning from

BMT experience. Humanomics. Vol. 26 No. 1, pp. 65-

75.

Hu, L., Bentler, P. M., 1999. Cut off criteria for fit indexes

in covariance structure analysis: conventional criteria

versus new alternatives. Structural Equation Modeling.

A Multidisciplinary Journal. Vol. 6, pp. 1-55.

Levesque, T., McDougall, G. H. G., 1996. Determinants of

customer satisfaction in retail banking. International

Journal of Bank Marketing. Vol. 14 No. 7, pp. 12-20.

Masyita, D., Ahmed, H., 2011. Why is growth of Islamic

microfinance lower than conventional? A comparative

study of the preferences and perceptions of the clients

of Islamic and conventional microfinance institutions in

Indonesia. Paper presented in 8th International

Conference on Islamic Economics and Finance. Doha.

Nunnelly, J. C., 1978. Psychometric Theory, McGraw Hill.

USA,

2nd

edition.

Othman, A., Owen, L., 2001. Adopting and measuring

customer service quality (SQ) in Islamic bank: a case

study in Kuwait finance house. International Journal of

Islamic Financial Service. Vol. 3, No. 1, pp. 1-26.

Parasuraman, A., Zeithaml, V. A., Berry, L. L., 1985. A

conceptual model of service quality and its implication

for future research. The Journal of Marketing. Vol. 49

No. 4, pp. 41-50.

Steiger, J.H., Lind, J.C., 1980. Statistically-based tests for

the number of common factors. Paper presented at the

annual Spring Meeting of the Psychometric Society in

Iowa City. May 30, 1980.

The Mediating Role of Perceived Benefits upon SMEs’ Satisfaction towards Islamic Microfinance Institutions

717