The Importance of Islamic Microfinance Model as a Mean to

Alleviate Fisherman Poverty in Pangandaran

A. Jajang W. Mahri, Neni Sri Wulandari and Mumuh Muhammad

Islamic Economics and Finance Study Program, Universitas Pendidikan Indonesia, Jl. Dr. Setiabudhi No. 229 Kota

Bandung

ajajangwmahri@upi.edu

Keywords: Fisherman, Islamic Microfinance, Poverty.

Abstract: The background of this research is poverty problem that have happened to traditional fisherman in Indonesia.

Pangandaran is one of the districs in Indonesia which is still having problem in fisherman poverty. Based on

previous research that fisherman poverty problem is caused by various factors like biological, technological,

sosio-economic. Meanwhile, one of the types of sosio-economic problem is limited access to financial

institution because the fisehrman is party who is susceptible to bad credit. This research uses mix method with

using quantitative and qualitative approach. Qualitative approach uses descriptive analysis, whereas

quantitative approach uses mann-whitney u test, OLS and logit regression. The result of the study in the first

step shows that fisherman poverty in Pangandaran is influenced strongly by family burden and financial access

toward financial institution. On the other hand, the total of family labour and family burden influence income

fisherman per capita. Meanwhile, there is significant difference between fisherman income who has an access

and not. The research planning for the next will be focused on the design of the Islamic microfinance model

and testing such Islamic mirofinance model to fisherman in Pangandaran.

1 INTRODUCTION

Indonesia has 11 potential sectors in maritim. The

amount of economic potential in maritim about US$

1.2 triliun per year. Job opportunities provided by this

sector reaching 40 million people. Then, if able to

optimize this maritim potential, unemployment and

povert problem automatically will be eradicated

(Nugroho, 2014).

However, it is ironic to see a fact that fishermen

in Indonesia is a subsistence sector that shackled by

the poverty problem. Fisherman's welfare level is

generally lower than those who work not as

fishermen. The data shows that the average

fisherman's expenditure is only about IDR 561,000

per month, lower than those who are not fisherman

with an average of IDR 744,000 per month. If

reviewed further, the problem of fishermen that

trapped in the poverty is caused by not having

adequate access to education and health, and also

difficulty in obtaining access to credit as most of

banks assume that loans to fisherman is at high risk

(Central Bureau of Statistics, 2013; Survey of

Demography Institution of North Sulawesi (2014) in

Harmadi, 2014).

West Java as the third province that has the great

number of fishermen still has problem in poverty.

Study conducted by Muflikhati et al. (2010)

concluded that using poverty indicator from World

Bank (1$ US /day) that the number of poor fisherman

in West Java at the rate of 45,7 %.

This study wil be focused on sosio-economic

problem that faced by fisherman itself. Islamic

microfinance model, can simply be defined as a

model of microfinance that can provide facilities or

microfinance products for people who are in unlucky

condition according to Islamic principles. Access to

microfinance institution become so important for

poor fisherman. Rahman (2010) concluded that

microfinance programs based on Islamic principles or

called by Islamic microfinance had improved life

standard for rural society. Poverty upon fisherman in

north and south beach area in West Java indicated by

limited access to financial institution, because

fisherman is one of the parties who is at high risk

credit

.

One of the policies that have been done before by

the government in Indonesia as an effort to alleviate

poverty on fisherman is in the form of direct

asssistance or fishing equipment that can be used to

756

Mahri, A., Wulandari, N. and Muhammad, M.

The Importance of Islamic Microfinance Model as a Mean to Alleviate Fisherman Poverty in Pangandaran.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 756-762

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

get fishs. On the other hand, microfinance model

throughout the time used by only small and medium

entreprises. Therefore, this study will explore as to

how the fisherman as poor one can get access to

financial institution in the model of Islamic

microfinance which consistently will lift fisherman’s

life standard. However, for the first step of this study

will analyze factors influencing fisherman poverty in

Pangandaran, and also will analyze how fisherman

get access to financial institution.

2 LITERATURE REVIEW

In this part will be flattened as to the concept of

Islamic microfinance, the relationship between

Islamic microfinance and poverty alleviation and also

previous study that related to.

2.1 Concept of Islamic Microfinance

Microfinance is program that give small loan to the

poorest to do business as mean to get an income to

fulfil their basic needs and family (Rahman, 2010).

Therefore, in 2005 world bank has stated that in 2005

as year of microfinance to campaign and extend

poverty alleviation.

Grameen Bank is great model for microfinance in

Bangladesh that conduct programs successfully,

where Muhammad Yunus as the founder of Grameen

Bank got nobel prize for reconcilement category in

2006. Muhammad Yunus tried to expose capitalism

logic in banking practice. Capitalism clearly has born

discrimination to the poor. The syllogism of banking

capitalism of the strict premises as follows (i) Bank

has to get profit without differentiating rich and poor

people,(ii) Credit that given in great amounts and not

reached by poor people, (iii) therefore, irrational if

bank can give micro credit. The conclusion is

rationally bank will not take sides for poor people

(Wahid, 2014).

In practice, Gramen Bank pioneered by

Muhammad Yunus in Bangladesh is not an Islamic

financial institution, it means that bank still uses

interest in providing financing to the poor. Therefore,

there is a deep cares of conventional microfinance

practices from Islamic perspective, as shown by

Wilson (2007) that extending materialism and rural

society consumerism and urban slums can damage

social cohesion and frustrated in the long run.

Ahmed (2002) recorded some differences

between conventional microfinance and Islamic

microfinance as follows:

Table 1: Differences between Conventional and Islamic

Microfinance.

Conventional Islamic

Liablities

(Source of Funds)

External funds, savings

of clients

External funds, savings

of clients, Islamic

charitable sources

Assets (Mode of

Financin

g)

Interest-based Islamic financial

instrument

Financing the

Poorest

Poorest are left out Poorest can be included

by integrating zakah

with microfinancin

g

Funds Transfe

r

Cash

g

iven Good transferre

d

Deduction of

Inception of

Contract

Part of the funds

deducted at inception

No deductions at

inception

Group Target Women Family

Objective of

Tar

g

etin

g

Woman

Empowerment of

Women

Availability of ease

Liability of the

Loan (When given

to women

)

Recipient Recipient and spouse

Work incentive of

em

p

lo

y

ees

Monetary Monetary and religous

Dealing with

Default

Group/centre pressure

and threats

Group/center/spouse

guarantee, and Islamic

ethics

Social

Development

Pro

g

ra

m

Secular (or un-Islamic

behavioral, ethical, and

social develo

p

ment

)

Religious (includes

behavior, ethics, and

social

)

Source: Ahmed (2002)

2.2 Islamic Microfinance and Poverty

Alleviation

Generally, the framework of Islamic microfinance in

poverty alleviation as follows:

Figure 1: Conceptual Framework of Microcredit

Programmes in Poverty Alleviation (Rahman, 2010).

Some previous studies showed that Islamic

microfinance model can be one of the instruments in

poverty alleviation as stated by Rahman (2010) who

concluded that Islamic microfinance program has lift

life standard or rural sosio-economic. With using

1020 farmer household in rural as research sample

and econometric model, this study concluded that

household income, productivity and job opportunity

increase significantly. On the other hand, Islamic

The Importance of Islamic Microfinance Model as a Mean to Alleviate Fisherman Poverty in Pangandaran

757

microfinance program has increased spirituality with

indicator diligence in worship. Finally, Islamic

microfinance appears as a mean to boost economic

activities more ethics in poverty alleviation.

The other study which relates to support this study

is study conducted by Durrani (2011) using 100

sample of poor people in Pakistan. That study

analyzed that microfinance is important element

strategically and effectively in eradicating poverty.

Meanwhile, sosio-economic factors that concidered

in this study are reparation of life style, acomodation

standard, income, life standard, purchasing power,

expansion of business facility, good entrepreneur and

technology. The study results showed that effective

access and providing microfinance may help poor

people to smooth consumption, risk management,

step by step in asset holding, developing micro-

business, improving productivity capacity, and

enjoying life quality.

Beside that, Aslaam (2014) counducted empirical

study in Pakistan. Respondent in this study is client

and employee of Islamic microfinance in ten district

in Pakistan. The total of respondent is 120. This study

used Chi-Square test to analyze the data. The results

concluded that Islamic microfinance has played role

in improving life standard, income per capita,

education level, ethics value, profitability,

sustainability, infrastructure condition, job vacancy,

and able to lead inflation and income inequalty.

2.3 Fisherman Poverty in Indonesia

The study conducted by Agunggunanto (2011) using

OLS regression and logit regression showed some

conclusions as folllows having experience as

fisherman directly and indirectly influence output of

catching fish and get implication to fisherman

income. On the other hand, total of family burden, use

of technology, boot ownership, and cooperation

assistance (dummy variabel) as factors influencing

fisherman income and poverty in Demak, Central

Java.

Another study conducted by Hamdani and

Wulandini (2013) summarized that factors

influencing traditional fisherman poverty in Muncar

subdistrict are low education, productivity, fisherman

behavioral and habitual in using income which is less

intention for future needs, capital ownership, use of

technology and it is not financial institution yet which

has role in serving fisherman needs, distributing fish

and facilitating fisherman needs.

Then, there is also previous study that related to

this study by Muflikhati et al. (2010) who conducted

research in four subdistrict in beach area West Java,

they are Gebang subdsitrict (Cirebon) Kandanghaur

subdistrict (Indramayu) as representative for north

beach area, and also Pelabuhanratu subdistrict

(Sukabumi) and Pangandaran subdistrict (Ciamis) as

representative for south beach area. Using sample 276

family. The result of study implied that if using

economic measure, so fisherman family is more

prosperity than non fisherman family. On the

contrary, if prosperity is measured by lot of

dimension, so fisherman family is lower than non.

Generally, factors influencing prosperity are familiy

burden, education, asset, income, and expenditure per

capita.

Based on literature review toward previous

empirical studies regarding poverty alleviaton

especially in fisherman poverty known that is still

limited related to model of

Islamic Microfinance.

Whereas, if this model is developed will able to help

life quality for fisherman particularly for those who

are a muslim. Besides that, Islamic microfiance

model will give financial access coincide with moral

injection in economic activities.

3 METHODOLOGY

Method used in this study is mixed methods or

combination method. This research method is method

which is based on pragmatism philosophy (composite

positivism and postpotivism) (Sugiyono, 2011).

Qualitative analysis uses descriptive study. Whereas,

quantitative method that used is diferrence test,,OLS

regression and logit regression.

Menawhile, the proposed hypotheisis for

difference test as follows:

Ha: There is difference average income

between fisherman who has access to

financial institution and not.

Ho: There is difference average income

between fisherman who has access to

financial institution and not.

In this study for OLS regression model as follows:

Log Y =

+

+

+

+

+

+

+

+

(1)

Explanation:

Log Y : Log fisherman income per capita (IDR)

: Intercept

..

: Parameter coeficient

: error

X1 : Age (year)

X2: Education (in dummy, 1 = non elementary,

and 0 = elementary)

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

758

X3 : Duration of becoming fisherman (year)

X4 : Family burden (person)

X5 : Family labor (person)

X6: Boat ownership (in dummy, 1 = one’s own,

and 0 = other)

X7: Access to the Financial Sector (in dummy

form, 1 = Access, and 0 = No Access)

Whereas, regression logit (binary) model

proposed as follows:

=

+

+

+

+

+

+

+

+

Explanation:

: Poverty Probability

1 = Poor dan 0 = Non-Poor

Subject of this study is fishermen in Pangandaran

West Java. The total of sample for this study is 100

fishermen with using purposive sampling.

4 DISCUSSION AND

CONCLUSIONS

Based on data processing from fishermen, only 83

quisionares of 100 that can be accepted to analyze.

The following are the results:

4.1 Demography Condition of

Fisherman in Pangandaran

Most of the people living around Pangandaran beach

work as fishermen. To fulfil life needs, they have to

come to sea every day in the hope of getting a lot of

fish for sale. However, the income of the fisherman is

very dependent on the nature or weather conditions

and the availability of fish in the sea, when the

weather does not support for fishing or going to sea

then the fishermen will be difficult to fulfil their daily

needs. Such condition vulnerable cause poverty

among fishermen.

Table 2: Demography Condition of Fisherman in

Pangandaran.

No. Variable Interval Average

1. A

g

e 17-60 Year 40 Yea

r

2.

Education Elementary –

Hi

g

h School

Elementary

3.

Duration of Becoming

Fisherman

1-42 Year 19 Year

4. Famil

y

burden 0-6 Person 3 Person

5. Famil

y

labo

r

0-4 Person 1 Person

If the level of welfare is measured by a larger

dimension such as access to education, then the

welfare of the fisherman is in low condition. The level

of education has become one of the factors that

caused the fishermen community in Pangandaran to

be poor. Fisherman at Pangandaran is unlikely to find

a better job with low education condition. When

working as a fisherman is temporarily unavailable,

then fisherman will work as pedicab driver or

constructon worker.

The low level of fishermen education in

Pangandaran does not necessarily make the fishermen

are not experts in mastering the techniques of fishing.

Fishing skills are done through the process of

socialization and enculturation from generation to

generation.

4.2 Sosio-Economic Condition of

Fisherman in Pangandaran

To know the condition of fisherman poverty

materially in Pangandaran, the indicator used from

the Central Bureau of Statistics. The poverty line

according to Central Bureau of Statistics (BPS) for

2017 is IDR 361.496,00 / capita / month.

The following are data of poor and non-poor

fishermen based on poverty line indicators issued by

the Central Bureau of Statistics (BPS):

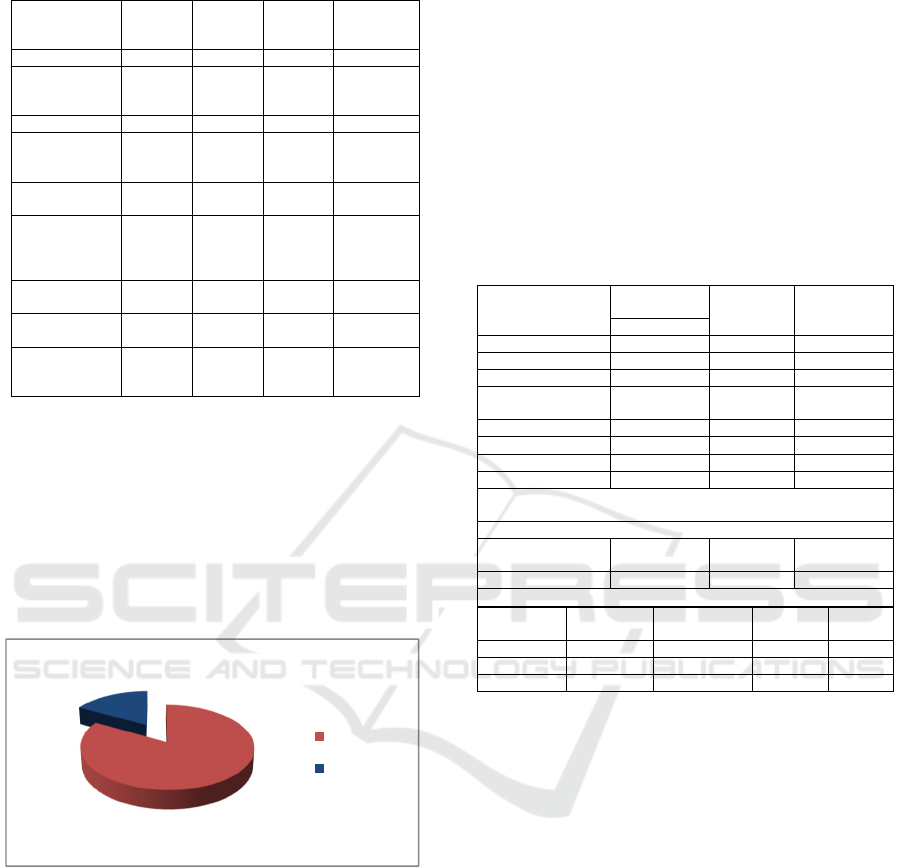

Figure 2:

Percentage of Fisherman Poverty.

Fisherman in poor condition means that income per

income below Rp 361.496,00 / month.

The level of morality is one of the factors causing

one's poverty level. Study conducted by Rahman

(2010) Revealed that moral and ecthics influence

positively to household income. Therefore, it is

important to analyze the spiritual level of fishermen

in Pangandaran. Here is the level of religiosity or

spiritual fisherman based on data in the field:

25%

75%

Poor

Non-Poor

The Importance of Islamic Microfinance Model as a Mean to Alleviate Fisherman Poverty in Pangandaran

759

Table 3: Religiousity Level of Fisherman in Pangandaran.

Statements

Regular

10 (0)

Very

often

6 (4)

Very

rare

4 (6)

Not at all

0 (10)

Sa

y

in

g

p

ra

y

e

r

19 40 24 0

Know hoe to

recite the Holy

Qur’an

3 26 50 4

Fastin

g

17 53 13 0

Inviting

towards Islamic

activities

6 10 58 9

Involvement

with dowr

y

3 0 3 77

Wife and

daughter

(Wearing

Hizab)

24 20 22 17

Not involve

with interest

17 14 20 32

Misunderstandi

n

g

with Wife

2 1 44 36

Involvement

with social

activities

23 30 30 0

Note: Figure in the parentheses are the score for dowry,

interest, and misunderstanding with wife.

Based on the data above, it can be determined

whether the spiritual condition of the fisherman is

poor or not. Rahman (2010) explained that if the score

of each respondent is below 70% then it can be

categorized as someone experiencing poor spiritual.

Here is the level of religiosity among fishermen:

Figure 3:

Percentage of Fisherman Religiosity.

The spiritual poverty level of fishermen in

Pangandaran can be reflected from their bad habits

such as gambling. Moreover, Majority of fishermen

leave the obligations of Islamic teaching is caused by

their condition is always in sea. Such conditions make

some fishermen as a barrier to worship. Therefore, it

can be concluded that the poor condition of the

spiritual can bring negative or bad behavior that will

impact to the difficulty of fishermen to get out of the

poverty line

.

4.3 Factors influencing Fisherman

Poverty and Income in

Pangandaran

To analyze the factors affecting fisherman poverty

and income in Pangandaran is conducted by two

testing approach namely OLS regression and logit

regression.

The following is the OLS tests for factors

affecting fisherman income per capita in

Pangandaran:

Table 7: OLS Regression Test.

Model

Standardized

Coefficients

t Sig.

Beta

(

Constant

)

21,401 ,000

X1 Age -,026 -,189 ,851

X2 Education ,038 ,349 ,728

X3 Duration of

b

ecomin

g

fisherman

,006 ,045 ,964

X4 Famil

y

Burden -,380 -3,224 ,002*

X5 Famil

y

Labo

r

,298 2,468 ,016*

X6 Boat Ownershi

p

,081 ,712 ,478

X7 Financial Access ,134 1,176 ,243

Dependent Variable: Log_Income

*Si

g

nificant at 5%

Model Summar

y

R R Square

Adjusted R

Square

Std. Error of

the Estimate

,421

a

,178 ,101 ,50649

ANOVA

b

Model

Sum of

S

q

uares

Mean

S

q

uare

F Sig.

Re

g

ression 4,154 ,593 2,313 ,034

Residual 19,240 ,257

Total 23,394

Based on regression output that partially family

burden and family labor affecting income per capita.

The regression coefficient for family burden shows

negative result, it explaines that the more family

burden, the lower fisherman income per capita. This

is in accordance with the theory and concept that

have been developed by Rahman (2010) and

Agunggunanto (2011) . Meanwhile, the regression

coefficient for family labor shows positive result, it

reveal that if there is family member who work, it will

increase fisherman income per capita.

R-Square or coefficient of determination for this

test is 17.8% which reveal that independent variables

are able to explaine dependent variable up to 17.8%.

While for 82.2% is explained by other variables

outside the study. Meanwhile, simultanously in this

model influencing toward dependent variable or

fisherman income per capita.

The second test is logit regression which used to

know factors infleuncing fisherman poverty in

Pangandaran. The following is logit regression ouput:

83%

17%

Poor

Non-Poor

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

760

Table 8: Logit Regression Test.

Variables in the E

q

uation

B S.E. Wald Sig.

X1 A

g

e ,012 ,034 ,117 ,732

X2 Education -,327 ,598 ,299 ,585

X3 Duration of

b

ecomin

g

fisherman

,004 ,035 ,011 ,918

X4 Famil

y

Burden ,604 ,250 5,817 ,016*

X5 Famil

y

Labo

r

-,746 ,484 2,376 ,123

X6 Boat Ownershi

p

,088 ,590 ,022 ,881

X7 Financial Access -1,074 ,620 2,998 ,083**

Constant -2,185 1,388 2,479 ,115

Logit Regression Model: dependent variabel (1= poor, 0= non-poor)

*Si

g

nificant at 5%, **si

g

nificant at 10%

Model Summar

y

-2 Log likelihood Cox & Snell R Square

Nagelkerke

R S

q

uare

84,319

a

,109 ,161

Based on the test results can be concluded that the

factors influencing fisherman poverty in Pangandaran

are family burden as stated by Agunggunanto (2011)

and financial access as stated by Rahman (2010).

Independent variables simultanously explain poverty

up to 10.9%. While, and 80.1% is explained by

others. Therefore, one of the proper efforts to create

fisherman prosperity is to motivate fisherman to have

access to financial instituion.

4.4 Financial Access of Fisherman in

Pangandaran

Fisherman is a job that depends on the condition of

nature. When the season to go to sea is famine, then

the fisherman will have difficulty in earning income.

Meanwhile, the needs of fisherman's life must still be

fulfilled. The following is mechanism of financial

acces for fisherman as mean to fulfil the nedds:

4.4.1 Rich Fisherman (juragan)

The easiest way to get a loan of money is through rich

fisherman or usually called by boss. Fishermen who

have not received the results can borrow money first

to the rich fishermen (juragan). Furthermore the

fisherman will pay for it when the season went to sea

through wages received from skipper. Usually loan

from juragan to fisherman without using interest.

4.4.2 Usurer

Another way to get loan easily is through usurer. In

Pangandaran, usurer is still widely found. Loan

system thorugh this scheme is required to pay interest.

4.4.3 Cooperative

Not all fishermen in Pangandaran are members of the

cooperative. So that only members of the cooperative

who get a loan facility. However, not all members of

the cooperative know that cooperative has a role to

lend money. Therefore, this cooperative is not

optimal in empowering fisherman in Pangandaran.

4.4.4 Bank

The loan facility that became a fisherman's faovorit is

a credit / loan provided by bank BRI through its

program namely Kredit Usaha Rakyat (KUR). But,

this loan is not given to all fishermen, there is special

requirement. On the other hand, this intitution is

required fisherman to pay interest.

4.5 Analysis of Differences for

Fisherman Income based on

Financial Access

Based on normality test using Kolmogorov-Smirnov

getting sig. value at 0,000. That value is less than

alpha 5%. Therefore, H

A

is accepted and H

0

is

refused . That means fisherman income is not normal

distribution. Because of that data is not normal, then

will use statistics with Mann-Whitney U test.

Table 10: Mann-Whitney U test.

Ranks

Financial N Mean Ran

k

Sum of Ranks

Income Non-Access 44 36,18 1592,00

Access 39 48,56 1894,00

Total 83

Test Statistics

Income

Mann-Whitne

y

U 602,000

Wilcoxon

W

1592,000

Z -2,338

As

y

m

p

. Si

g

.

(

2-tailed

)

,019*

Based on the results in the ranks table shows that

groups of fishermen who have access to financial

institutions up to 44 people. While those who do not

have access to finance amounted to 39 people. Based

on these results can be seen that almost 50% of the

total of fishermen who become respondents do not

have access to finance, especially to financial

institutions. Furthermore, in the table of statistical

tests can be seen that the significance value is at 0,019

less than alpha 5%. (0,019 < 0,05). This explaines that

there is differences between fisherman who has

access to financial institution and not. In another

words, that access to financial institution could

increase fisherman income.

The Importance of Islamic Microfinance Model as a Mean to Alleviate Fisherman Poverty in Pangandaran

761

Thereby, one of efforts in increasing fisherman

prosperous is through getting access to financial

institution. Islamic microfinance can become

instrument in alleviating poverty. Islamic

microfinance model will help to improving life

quality particularly for those who are a muslim

materially and spiritually. Islamic microfinance will

also lead fisherman with moral injection as mean to

create good behvior and ethics in doing economic

activities. Therefore, it is needed to create Islamic

microfinance model as a mean to alleviate fisherman

poverty in Pangandaran.

REFERENCES

Agunggunanto, E. Y., 2011. Analisis Kemiskinan dan

Pendapatan Keluarga Nelayan Kasus di Kecamatan

Wedung Kabupaten Demak, Jawa Tengah, Indonesia.

Jurnal Dinamika Ekonomi Pembangunan. 1(1), pp 50-

58.

Ahmed, H., 2002. Financing Micro Enterprises: An

Analytical Study of Islamic Microfinance Institutions.

Journal of Islamic Economic Studies. 9 (2), pp. 27-63.

Aslaam, M. N., 2014. Role of Islamic Microfinance in

Poverty Alleviation in Pakistan: An Empirical

Approach. International Journal of Academic Research

in Accounting, Finance and Management Sciences. 4

(4), pp.143–152.

Central Bureau of Statistics, 2013. Central Bureau of

Statistics, (online) available at: www.bps.go.id.

Durrani, M. K. K., 2011. Role of Micro Finance in

Reducing Poverty: A Look at Social and Economic

Factors. International Journal of Business and Social

Science. 2 (21).

Hamdani, H., Wulandini, K., 2013. Faktor Penyebab

Kemiskinan Tradisional, Universitas Jember. Jember,

Artikel Penelitian Mahasiswa 2013.

Harmadi, S. H. B., 2014. Nelayan Kita, Kompas. Retrieved

July 15, 2016, from: http://nasional.kompas.com,

September 19, 2014.

Muflikhati, I., Hartoyo, H., Sumarwan, U., Fahrudin, A.,

Puspitawati, H., 2009. Kondisi Sosial Ekonomi Dan

Tingkat Kesejahteraan Keluarga: Kasus Di Wilayah

Pesisir Jawa Barat. Jurnal Ilmu Keluarga & Konsumen.

3(1), 1-10.

Nugroho, J., 2014. Indonesia Punya 11 Sektor Potensial

Kelautan, Antara Sumbar. Retrieived July 15, 2016,

from: http://www.antarasumbar.com, Agustus 14,

2014.

Rahman, A. R. A., 2010. Islamic Microfinance: An Ethical

Alternative to Poverty Alleviation. Humanomics. 26

(4), pp. 284 – 295.

Rahman, M. M., 2010. Islamic Microfinance Programme

And Its Impact On Rural Poverty Alleviation. The

International Journal of Banking and Finance. 7(1), pp.

119-138.

Sugiyono, 2011. Metode Penelitian Kombinasi (Mixed

Methods), Alfabeta. Bandung.

Wahid, N., 2014. Keuangan Inklusif Membongkar

Hegemoni Keuangan Peran Kredit Usaha Rakyat

Dalam Menurunkan Kemiskinan dan Pengangguran,

PT. Gramedia. Jakarta.

Wilson, R., 2007. Making Development Assistance

Sustainable Through Islamic Microfinance

, IIUM

International Conference on Islamic Banking and

Finance. Kuala Lumpur.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

762