Intellectual Capital in Baitul Maal Wa Tamwil

Erik Sopian, Elis Mediawati and Aneu Cakhyaneu

Ilmu Ekonomi dan Keuangan Islam, Universitas Pendidikan Indonesia, Jl. Dr. Setiabudhi No. 229, Bandung, Indonesia

eriksopian95@student.upi.edu, {elis.mediawati, aneufpeb}@upi.edu

Keywords: Baitul Maal Wa Tamwil (BMT), Intellectual Capital and Return on Asset (ROA).

Abstract: This study to determine the description of Intellectual Capital value and its effect on profitability which is

measured by using Return On Asset (ROA) ratio. This research is based on the phenomenon of Baitul Maal

Wa Tamwil (BMT) occurrence among many people, but the newly emerging BMT can not survive in this

financial institution business which eventually will be collapse (bankrupt). The research method used is

descriptive and verifikatif. The object of this study was conducted in five BMTs that are still active in West

Bandung regency. This research uses secondary data type, the data is the result of the annual Members

Meeting report from year 2010 - 2016, obtained from Cooperation Office and UMKM Regency of West

Bandung. Data analysis technique used in this research is multivariate regression model for panel data. The

results showed that the three elements of Intellectual Capital which are Value Added Capital Asset (VACA)

have a positive and significant effect on profitability, Value Added Human Capital (VAHU), positively and

significantly influence to profitability, Structure Capital Value Added (STVA) profitability and simultaneous

test results of VACA, VAHU, STVA have a positive and significant effect on profitability. Implication of this

research as evaluation to increase added value for BMT which was produced through Capital Asset, Human

Capital and Capital Structure to achieving BMT’s goal.

1 INTRODUCTION

The development of BMT in Indonesia from year to

year has been increasing, from 3,200 BMTs in 2006

(Sakti, 2013), became 5,500 BMTs in the end of 2015

which are spread in all over Indonesia

(republika.go.id). But the increase of BMTS is only

written in data, because the reality tells the otherwise.

Due to the hardship of islamic financial institution

business which is being excecuted, some BMTs

couldn'tt survive and they began to collapse

(Sumiyanto, 2008).

We know there is no doubt that one of the causes

of how vulnerable the BMT will be collapse, is

because the amount of profit / income-received is not

like we expected. Based on the results of pre-

research, conducted on five BMTs located in West

Bandung regency, the financial statements of 2016

which is shown the BMT category based on the

calculation of ROA (Return on Asset), explain that

BMT Dana Ukhuwah, followed by BMT Mustama,

they are in unhealthy category while BMT el Dana

Manfaat, BMT Rabbani and BMT Al-Qinan are in

very unhealthy category.

Table 1: The Value of BMT’s ROA in West Bandung

regency.

ROA

Assessment

Criteria

Name BMT

Dana-

Ukhu-wah

Mustama

El Dana

Manfaat

Rabbani

Al-Qinan

≥ 10 (Healthy)

≤ 7 -9.9% (Fit)

≤ 3 to 6.99%

(less healthy)

≤ 1 - 2.99%

(Unhealthy)

1.4%

1.2%

<1% (Sick)

0.85%

0.71%

0.17%

2 LITERATURE REVIEW

Intellectual Capital is defined as knowledge resources

in the form of employees, customers, processes or

technologies that companies use in the process of

creating the value for the company (Ulum, 2009).

Intellectual Capital has three component first

Capital Asset, Capital assets is the capital that

company has, whose function is to support the entire

operations of the company. Second Human Capital,

Human capital is the lifeblood of intellectual

capital as a source of innovation, improvisation,

knowledge, skills and competencies within an

Sopian, E., Mediawati, E. and Cakhyaneu, A.

Intellectual Capital in Baitul Maal Wa Tamwil.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 773-776

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

773

organization or company. However, this component

is difficult to measure. Third Capital Sturcture,,

Capital structural relates to the mechanisms and

organizational structures that help support employees

in improving optimally the intellectual performance

or overall business performance.

3 METHODOLOGY

This research was conducted on BMT financial

institutions in West Bandung, there are BMT Dana

Ukhuwah, BMT Mustama, BMT El Dana Manfaat,

BMT Rabbani and BMT Al-Qinan. The data used in

this study are the financial statements of the years

2010-2016. Method used in this research is

descriptive and verification. Analysis of the data in

this study used test analysis through multiple

regression of panel data.

4 RESULTS

Based on calculations results and the category of

Intellectual Capital will be presented as follows:

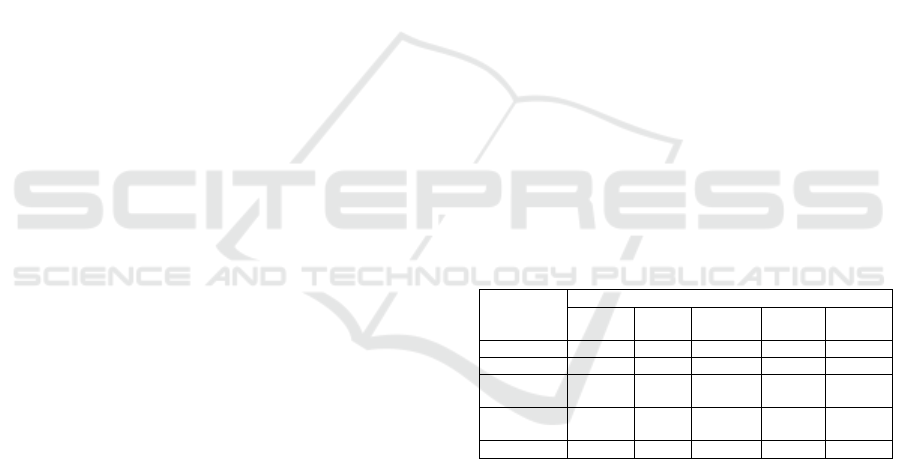

Figure 1: Results of BMT VAIC calculation in West

Bandung regency.

The average of VAIC in those five BMTs is 1.49

which means that on a Bad Performers category.

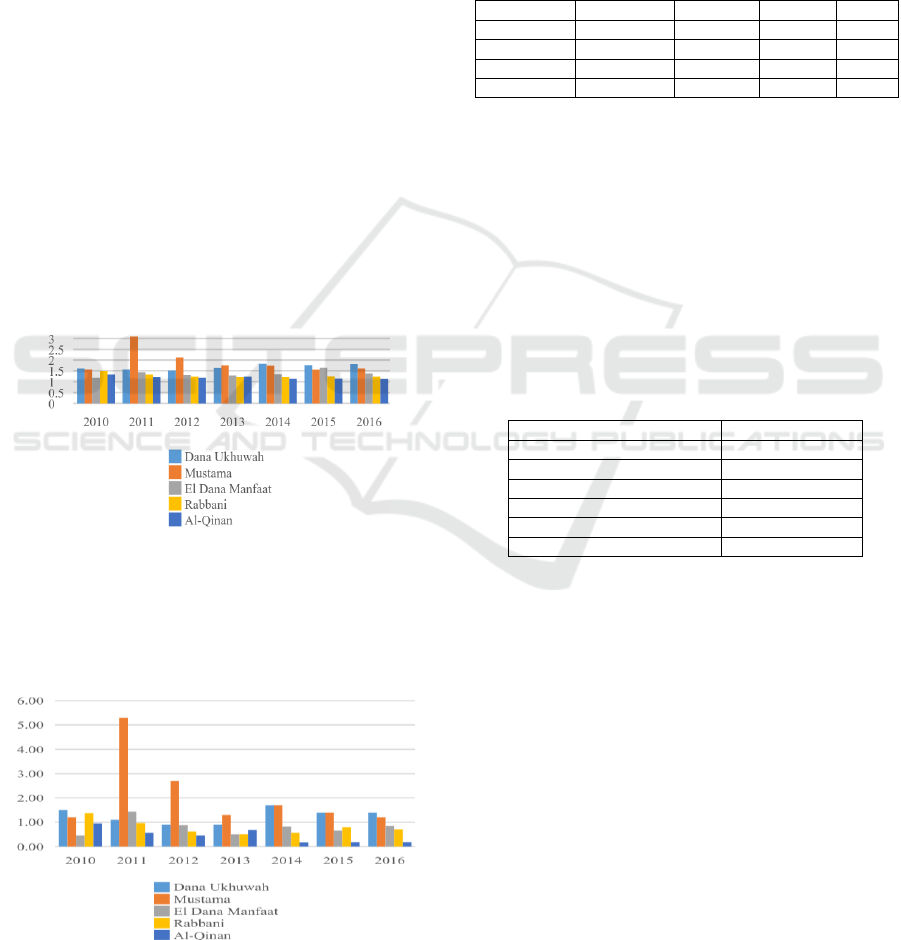

The value based on the calculation of ROA and

categories will be presented as follows:

Figure 2: The result of the calculation of VAIC in West

Bandung regency BMT.

The average of ROA from those five BMTs in

West Bandung Regency is 1.09 then this include into

the category of "Unfair".

In this study before determining the model that

used for research, we determine the best model

through chow test and LM test. Based on the results,

the best model used for this research is the Common

Model-effect, while the results of the Common-effect

model are as follows:

Table 2: Common-effect model Test Result.

From Table 2 it can be concluded that:

VACA (X

1it)

at significance level of 5% t

count

>

t

table

is 5,892274 > 2.03693, then H

0

is

rejected. That

means VACA influence the ROA positively and

significantly. VAHU (X

2it)

at significance level of 5%

t

>

t

table

is 2.648840 > 2.03693, then H

0

is

rejected. That

means VAHU influence the ROA positively and

significantly. STVA (X

3it)

at significance level of 5%

t > t

table

is 3.626740 > 2.03693.

As for the F test (simultaneously), the result of

using Eviews 9 application are as follows:

Table 3: The Results of F Test (simultaneously).

R-squared

0.942718

Adjusted R-squared

0.937174

S.E. of regression

0.225209

Sum squared resid

1.572295

Log likelihood

4.636359

F-statistic

170.0603

Prob(F-statistic)

0.000000

Based on table 3 F

count

is 170.0603

then the value

of F

table

with

5% significance level. So the result states

that F

count

>

F

table

(170.0603> 2.911334) so the

conclusion is VACA, VAHU, STVA together

(simultaneously) influence the ROA.

The result shows that the Capital Asset Value

Added (VACA) influences the profitability. In the

theory of Resource Based Theory (RBT), companies

must be able to utilize the resources in the form of

Tangible Assets and Intangible Asset so that the

results will be in accordance with the utilization of

resources owned by the company.

The results are supported by research of Faza

(2014), and Kartika and Hartane (2012) which shows

that VACA effect on profitability. The results also

support the research that has been described by Ulum

(2009) stated that the Intellectual Capital does not

only affect the company's performance for the year,

Variable

Coefficient

Std. Error

t-Statistic

Prob.

C

-2.370356

0.695927

-3.406041

0.0018

VACA

7.462430

1.266477

5.892274

0.0000

VAHU

1.798612

0.679019

2.648840

0.0126

STVA

3.478533

0.959135

3.626740

0.0010

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

774

even the Intellectual Capital can also predict future

financial performance.

VAHU, in this case is human resources

(employee), has a very important role in a company.

Employees become the determining factor in the

success of the company, as employees become single

element that operate everything to run the company's

operations.

The results are also supported by research of Dian

(2012), Nike (2013) which states VAHU effect on

profitability but in contrast with Antung (2014)

research, VAHU no significant effect on the

explained that the companies surveyed use spending

on personnel costs too extravagant but had no impact

on the value added to increase profits, so in this case

BMT in West Bandung regency has been able to

regulate the amount of expenditure for the needs of

employees

The utilization of Structure Capital is what makes

the modern and traditional business different. There

was the difference between the purchase price and the

selling price, profit is the primary value of success in

business. But now that can not be a benchmark, since

the creation of the intangibles value such as

stakeholders that will either make a firm or

developed.

The results showed that Capital Structure Value

Added (STVA) affect the profitability. This is

supported by Dian (2012) and Nike (2013) researches

which state STVA effect on profitability. The results

of different studies which is conducted by Chen et al.

(2005) who did the research in Taiwan company,

shows that STVA no significant effect on profitability

due to the tangible assets, in this case VACA

dominates to create profits for the company but the

impact of STVA in his study had no significant

impact.

Intellectual Capital is a combination of VACA,

VAHU and STVA components. The results showed

that the Capital Asset Value Added (VACA), Value

Added Human Capital (VAHU) and Capital Structure

Value Added (STVA) together effect on profitability.

The results are supported by Kalkana (2014) and

Reza (2015) research which states VACA, VAHU

and STVA jointly effect on profitability.

Resource Based Theory in the previous chapter

outlined the importance of utilization the intangible

or tangible resource to achieve company’

expectations. BMT in West Bandung regency, in this

case, has proven that the Intellectual Capital in a

company has a good impact and a significant

contribution by adding the value, so it is necessary to

take specific evaluation of BMT especially in order to

increase the elements which are associated. So in the

end when the value of Intellectual Capital increases,

the profitability of the company will also be increased

in accordance with the results of this study.

5 CONCLUSIONS

The value of Intellectual Capital owned by BMT

located in West Bandung regency, are included into

the category of “Bad” Performance. .Level of

profitability measured by using Return on Assets

owned by BMT located in West Bandung regency

included into the category of "unhealthy". VACA has

an influence in increasing the Return on Assets,

VAHU has an influence in increasing the Return on

Assets, STVA has an influence in increasing the

Return on Assets and VACA, VAHU, STVA are

together (simultaneously) have the effect of

increasing the Return on Assets.

REFERENCES

Antung, N. A., 2014. The Influence of Intellectual Capital

on Profitability (Study on Financial Institution).

Journal of business and finance. Vol 4 No. 1.

Chen, M. C., Cheng, S. J., Hwang, Y., 2005. AnEmpirical

Investigation of the relationship between Intellectual

Capital and Firm's Market Value and Finalcial

Performance. Journal of Intellectual Capital. Vol. 6

No. 2.

Candrasari, N. 2013. The Influence of Intellectual Capital

on Coorporate Performance (Study of Jakarta Islamic

Index (JII) coorporates, 2007-2012).

Dian, I., 2012. The Influence of Intellectual Capital and

Earnings Per Share On Manufacturing Company.

Faza, M. F., 2014. Influence Intellectual Capital On

Profitability, Productivity, and Corporate Values The

Banking Companies Listed in Indonesia Stock

Exchange (BEI). EKBISI. Vol. VIII, No. 2.

Kalkana, A., 2014. The impacts of Intellectual Capital,

innovation and organizational strategy on firm

performance. Procedia - Social and Behavioral

Sciences. 150 (2014).

Kartika, H., 2013. Effect of Intellectual Capital on ynag

Profitability Banking Companies Listed in Indonesia

Stock Exchange in the Year of 2007-2011.

Nike, C., 2013. Effect of Intellectual Capital on

Performance Company. Empirical Study on Enterprises

Jakarta Islamic Index (JII). 2007-2012.

Reza, G., 2015. Influence Intellectual Capital To

Profitability Manufacturing Companies Listed in

Indonesia Stock Exchange. Journal of Economics and

Business Islam. Vol. IX,1.

Sakti, A. 2013. Mapping Of Conditions and Potential of

BMT Partnership to Expand the Market and Linkage of

Islamic Banking Services to the Micro Enterprises.

Intellectual Capital in Baitul Maal Wa Tamwil

775

Sumiyanto, A., 2008. BMT Towards Modern Cooperative,

PT. ISES Consulting Indonesia. Yogyakarta. pp. 154-

180.

Ulum, I., 2009. Intellectual Capital; Concepts and

Empirical Study, PT. Graha Science. Yogyakarta. pp.

20-86.

Republika, 2017. [Online] available at:

Republika.go.id/12/7/2017

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

776