Governance and Trust in Zakat Institution

Erika Takidah and Ajeng Pratiwi

Accounting Education Department, Faculty of Economics, Universitas Negeri Jakarta Indonesia, Jakarta, Indonesia

erikatakidah@unj.ac.id, ajengpratiwi14.ap@gmail.com

Keywords: Governance, Accountability, Transparency, Sharia Compliance, Trust, Zakat Institution.

Abstract: As one of the five basic pillars in Islam, zakat is an obligatory upon every adult, mentally stable,and

financially-able moslem. As a result, millions of moslems donate their zakat through zakat institusions. In the

management of zakat funds, it is very to obtain the trust from the zakat payers (muzakki). This paper seeks to

explore the zakat payers perception of governance and and its effect to the trust in a zakat institution.

Perception of accountability, transparency and sharia compliance represents the governance of Badan Amil

Zakat Nasional (Baznas), as a zakat management institution. The survey method was applied in this research

and with quantitative approach. The paper examines relation among accountability, transparency, sharia

compliance and 100 zakat payers’ trust in Baznas. The result of this research showed that the accountability,

transparency and sharia compliance influenced a muzakki’s trust in Baznas. Sharia compliance performs the

strongest influence on trust among the studied variables. The paper relies heavily depend on a muzakki

perception of Governance and Trust. Selection of limited indicators for this research may affect the results of

the study. This paper highlights the need of an increasing trust through relevant disclosure of accountability,

transparency and shariah compliance information to build a muzakki perception based on the annual report of

zakat institution.

1 INTRODUCTION

As the largest moslem country Indonesia has huge

potential of zakat therefore the responsibility of

paying zakat is part of worship and duties on each

moslem. The research results of Badan Amil Zakat

Nasional (BAZNAS) in 2015 stated that the potential

of zakat in Indonesia reached Rp 442 trillion or

equivalent to 3.4 percent of Indonesia's Gross

Domestic Product (GDP). But in fact, the zakat that is

absorbed and managed by zakat management

institution until 2016 reaches only Rp 4.4 trillion or

one percent of its potential. This shows that Muslims

currently have less interest to pay zakat in zakat

management institutions.

The development of zakat management

institutions has not been accompanied by the

increasing interest of the community to pay zakat in

zakat management institution. The cause is

optimalisation of zakat institution and public trust to

zakat management institution is still low. Muzakki

trust is very influential to zakat collection targets. The

creation of muzakki trust, is expected to increase

muzakki both in terms of quantitative and qualitative,

so that zakat collection targets are achieved.

Furthermore, muzakki trust will also lead to the

purpose of zakat management, namely community

empowerment and poverty alleviation.

Regard to zakat institution confidence issues,

there are several factors that are considered on

muzakki trust. The first factor is accountability. The

management of zakat, infaq, and shadaqah are

considered to have weaknesses in aspects of public

accountability, accountability, transparency, and

institutional arrangement (Shabri, 2014) . That is why

the government issued Undang-Undang No. 23

Tahun 2011 on the Management of Zakat. The current

phenomenon, the issue of accountability and

transparency is still the main problem that

overwhelms most of the zakat management

institutions in Indonesia, whether managed by the

government or private.

The second factor that affects trust is transparency

or openness. The phenomenon that often happens

people have doubts to pay their zakat through zakat

management institution because it is considered less

transparent. Therefore, transparency of financial

statements, management and attitudes is important to

increase the trust of muzakki to zakat management

institution (Mukhlis and Beik, 2013).

870

Takidah, E. and Pratiwi, A.

Governance and Trust in Zakat Institution.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 870-875

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

The third factor affecting trust is sharia

compliance. Sharia compliance has become one of

the important pillars in the development of sharia

institutions (Sulaiman and Jamil, 2015). Violation of

sharia compliance can occur due to weak supervision

will adversely affect the image and credibility of

sharia institutions, thus reducing public confidence.

The fourth factor affecting muzakki's trust is

honesty and integrity. Integrity is an element of

character that underlies the emergence of professional

recognition. Integrity requires an Amil Zakat to be

honest and objective without having to sacrifice the

secrets of muzakki or mustahik.

The last factor is professionalism. The

professionalism of zakat management institution

requires a management organization that is filled by

people who have the capacity, both managerial and

scientific understanding of religious scholarship

(Abdullah, 2010). In addition, management

professionalism also needs to base itself on a good

governance system as it has become a demand for the

implementation of today's public governance

management.

In accordance with the mandate of the Undang-

undang to become a professional institution, zakat

management institutions must have competence,

totality in work, get payment (wages), always want to

learn, awareness that all behavior and actions have

social and religious responsibility. Through such a

competent institution, zakat will be channeled

appropriately and will influence the public trust.

1.1 Trust in Zakat Institution

Luarn and Lin (Ferrinadewi, 2008) define trust is a

specific belief in integrity (honesty of trustworthy

parties and ability to keep promises), benevolence

(thoughtfulness and motivation believed to act in the

interests of trust them), competency (ability of the

trusted party to carry out the trusting needs) and

predictability (consistency of the behavior of the

trusted party).

According to Mayer and Davis (1999), the three

dimensions of the trustee arise from the ten existing

literature: ability, virtue, and integrity. This is

reinforced by Gefen and Silver's theory that the belief

dimension consists of: (1) Competence, the company

has the ability to deliver its promises to clients; (2)

Integrity, a company acts in a consistent, reliable, and

honest manner when delivering on its commitment;

(3) Kindness, a core company in the right place and

putting the client's attention above his or her interests.

Muhammad and Saad (2016) examined the

reliability and validity of trust’s dimensions namely;

public governance’s quality, quality of zakat

distribution, zakat service quality and perceived

board capital. The result shows that all the constructs

are reliable measured of trust toward intention to pay

zakat in Kano Nigeria

Ghazali et al. (2016) The commitment-trust

theory is utilized as the underpinning theory. An

extensive literature review found that shared values,

communication, non-opportunistic behavior and

perception on distribution are the potential factors

that influence trust towards zakat institution.

1.2 Accountability and Trust in Zakat

Institution

Barlow explains that accountability means an

obligation to present and report all acts and activities

performed in accordance with the mandate / mandate

that it carries on to a higher party or superior.

Strengthening the definition of accountability is also

put forward by Patricia Douglas, the accountability of

an organization implies (a) the availability of

information about decisions / policies and actions

taken during the operation, (b) asking external parties

to review the information, and (c) taking corrective

action if needed.

In the shariah accounting point of view, Tapanjeh

(2009) defines that: Accountability is an attempt to

generate correct, fair and transparent disclosures. The

accountability of the disclosure is done first is for

God. The fundamental concept of Islamic

accountability is believing that all resources are

available to individuals in the form of trust.

Therefore, correct disclosure of financial facts, and

accurate information must be freely available to the

user.

Islamic accountability framework in the zakat

funds management (Saad et al., 2014) accountability

in the zakat fund management is driven by the Islamic

foundation, which cannot be separated from the

Islamic teachings and pathways. For this reason, the

zakat contribution is essential, which all the Muslims

have to abide by, through the shadowing of the

intangible relations within the human beings i.e.

Muslims and submission to Allah

The four main dimensions of accountability are

strategic accountability, fiduciary accountability,

financial accountability and procedural

accountability. (1) Strategic accountability is

associated with the core objectives, the disclosures

include: organizational intentions, that is, their vision

and mission; actions, that is, activities and programs

to fulfill their intentions; and results that measure the

impact of their actions and the extent to which their

Governance and Trust in Zakat Institution

871

intentions have been achieved. (2) Fiduciary

accountability emphasizes honesty and compliance,

and at operational levels, governance and control. (3)

Financial accountability is concerned with their

financial outlook and the main trends and factors

underlying their financial development (Dhanani and

Connolly, 2012). Hence the researchers assume that

the accountability as apart of governance, ia a factor

to build the muzakki trust towards zakat institution.

Therefore, the following hypothesis is formed as

below.

H1: Accountability should have a significant

positive relationship with muzakki trust in zakat

institution

2 LITERATURE REVIEW

2.1 Transparency and Trust in Zakat

Institution

According to Andrianto (2007), public transparency

is a genuine, thorough disclosure, and provides a

place for the active participation of all levels of

society in the process of managing public resources.

Any policy issued by the organizer must be openly

accessible by allowing sufficient space for the public

to participate widely in it. Muhammad (2006), all

Zakat Institution has implemented public

accountability in the framework of transparency of

zakat fund management in various forms such as

preparing routine reports to muzakki, bulletins, and

publications in the mass media.

Komite Nasional Kebijakan Governance

(KNKG) 2005 define transparency is a condition

where the institution provides material and relevant

information in a way that is easily accessible and

understood by stakeholders. Meanwhile, according to

the National Committee on Governance, the

managers are obliged to carry out the principle of

openness in the decision process and in conveying

information. Openness in conveying information

means that the information submitted must be

complete, correct and timely to all stakeholders.

Indicators of transparency are formulated using

several expert theories, the principle of transparency

are: (1) Availability of adequate information on every

process of formulation and implementation of public

policy; (2) Access to ready, accessible, free and

timely information.

Meanwhile Krina (2008) revealed, transparency

indicators are: (1) Provision of clear information on

responsibilities; (2) Establish a grievance mechanism

in the event of any breach or demand for payment of

bribes; (3) Ease of access to information; (4)

Increasing the flow of information through

cooperation with mass media and non-government

institutions.

According to Kamil and Ahmad (2002), Distrust

toward zakat institution, especially in term of

transparency and ineffeciency in zakat distribution

management. In congruence with above discussion, it

is assumed that trnparency in zakat institution will

determine muzakki trust. Thus proposed hypothesis

is:

H2: Transparency should have a significant

positive relationship with muzaki trust in zakat

institution.

2.2 Shariah Compliance and Zakat

Institution

Shariah Compliance Shariah compliance is the ability

to follow Islamic sharia law. The meaning of Islamic

law here is Al Qur'an and Al-Hadist which is a

guideline for Muslims. One of the fundamental

aspects that differentiates the sharia and conventional

financial industry is the compliance with sharia

principles (sharia compliance). One of the legal

aspects of the sharia financial industry is the

regulation of sharia compliance Yudha and Roby

(2016). Shariah compliance is an important part for

sharia financial industry in terms of management and

operational. This is supported by the existence of

Sharia Supervisory Board for every shariah-based

financial institution.

Performance of Shariah compliance, legality and

institutional measured six measures covering aspects

related to the Sharia Supervisory Council (SSC),

Vision and Mission, Organizational Structure,

Employee Education Level, Regular Training

Program, and the percentage of fulltime employees

Shabri (2014)

The supervision of sharia by the Sharia

Supervisory Board (SSC) is an inseparable part of

Shariah compliance. In this context, the regulation of

sharia supervision, of course, includes the existence

of a sharia board, which is an important part of the

framework of regulatory rules as sharia compliance.

Based on the above-mentioned thinking, the study

related to shariah supervisory institutions in sharia

financial institutions, it is important to do. Wahab and

Rahman (2011) argued that in the case of zakat

institutions in a Muslim country like Malaysia, good

governance is important since it may contribute

towards efficiency and effectiveness in zakat funds.

Closer examination of the various governance

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

872

mechanisms is important because zakat institutions

control significant financial resources.

Consistent with the above argument, it is expected

that a high level of shariah compliance would

contribute to a greater trust in zakat institution.

Therefore, the following hypotheses is offered :

H3: Shariah compliance should have a significant

positive relationship with muzaki trust in zakat

institution.

3 METHODOLOGY

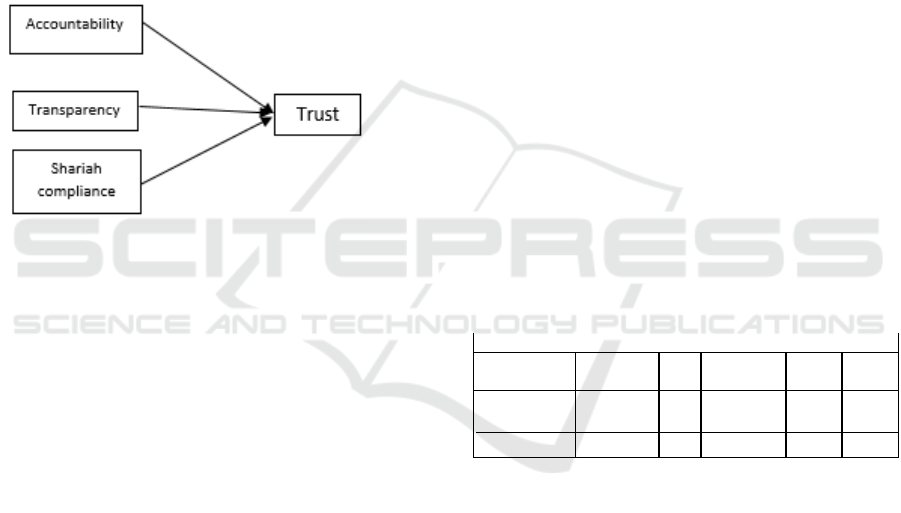

Based on the review literature and previous research

results the conceptual model in this study is shown in

Figure 1.

Figure 1: Conceptual model.

The model postulates that picture above shows

that trust in zakat institution is influenced by

governance: Accountability, Transparency and

Shariah compliance. The framework also postulates

that the independent variable are expected to have a

direct positive influence on the dependent variable of

this paper. This means that the greater accountability,

transparency and shariah compliance, the higher the

trust of muzakki in zakat institutions and vice versa.

The object of this research is the Badan Amil

Zakat Nasional (BAZNAS) Jakarta. The method used

in this research is survey method. The population in

this study is all muzakki paying zakat in BAZNAS

which amounted to 11,779 people. The sample in this

research is 100 samples with sampling technique is

purposive sampling. Sample criteria in this research

are; (1) Muzakki BAZNAS domiciled in Jakarta; (2)

Has been registered as Muzakki within a minimum

period of 5 years; (3) Has paid zakat to BAZNAS

more than 5 times; (4) Not including muzakki

affected by autodebet salary or working in an agency

that has partnered with BAZNAS through zakat

payroll system.

Data collection was done by distributing

questionnaires to the respondents. The questionnaire

consisted of 4 variables, namely 1) a confidence

variable with 14 statement items, 2) shariah

compliance variables with 8 statement items, 3)

accountability variables with 16 statement items, 4)

transparency variables with 11 statement items. The

scale used is Likert scale with answer range 1 to 5.

Data analysis method used in this research consisted

of classical assumption test and hypothesis test.

4 RESULTS AND DISCUSSION

Based on table 1, the results showed a high and

positive significant correlation between all constructs

of governance (accountability, transparency and

shariah compliance) and muzakki trust. coefficient

value F equal to 95,576> F table 3.09 and significance

number 0,000 <0,05. From these results can be said

that accountability, transparency and shariah

compliance were perceived as important to the trust

in zakat institution. This is consistent with prior zakat

literature (Ghazali, 2016; Wahab and Rahman,2011)

and also with the governance studies (Wahab and

Rahman, 2011; Mukhlis and Beik 2013).

The framework also proposes a positive

relationship between the independent and dependent

variables such relationship is also supported by other

scholars (Hasanah, 2013; Muhammad and Jaffri,

2016).

Tabel 1: F test.

ANOVA

a

Model

Sum of

Squares

Df

Mean

Square

F

Sig.

Regression

3375,596

3

1125,199

95,576

,000

b

Residual

1130,194

96

11,773

Total

4505,790

99

a. Dependent Variable: Trust

b. Predictors: (Constant), Accountability, Transparency and

Shariah Compliance

As summarized at table 2, relationship between

trust and governance as follow :

Influence of accountability on trust;

The value of the obtained path coefficient is

positive at 0.302 and the significance value of

0.001 (0.001 <0.005);

The effect of transparency on trust;

The value of the obtained path coefficient is

positive at 0.297 and the significance value of

0,000 (0.000 <0.005);

Effect of Shariah compliance on trust;

The value of path coefficient obtained is

positive equal to 0.369 and significance value

of 0,000 (0.000 <0.005).

Governance and Trust in Zakat Institution

873

From these results it can be answer all of research

Hypothesis: H1 accepted cause of accountability has

a direct and significant influence on trust. H2

accepted because transparency has a direct and

significant influence on trust. H3 can be accepted

because that the shariah compliance has a positive

and significant impact on trust. This result also

consistent with Zainal et al. (2016), Kamil and

Ahmad (2002) that Accountability, Transparency and

Shariah Compliance has a positive and significant

correlation with muzakki trust.

Tabel 2: T test.

Coefficients

a

Model

Unstandardized

Coefficients

Standardized

Coefficients

T

Sig.

B

Std.

Error

Beta

(Constant)

4,431

3,108

1,426

,157

Accountability

,271

,082

,302

3,305

,001

Transparency

,284

,073

,297

3,874

,000

Shariah

Compliance

,857

,180

,369

4,763

,000

a. Dependent Variable: Trust

Tabel 3: Determination Coefficient.

Model Summary

Model

R

R Square

Adjusted R

Square

Std. Error of the

Estimate

1

,866

a

,749

,741

3,431

a. Predictors: (Constant), Accountability, Transparency and

Shariah Compliance

Table 3 showed that the overall explanatory factor

of muzakki trust in zakat institution were statistically

significant at 5% significant level with adjusted R-

squared off 74,1% Hence with this condition it

revealed that the independent explains 74.1% of the

variance muzakki trust. This finding concurred with

Zainal (2016) study where stakeholder trust influence

by governance.

5 CONCLUSIONS

The results of data analysis and discussion can be

concluded that governance which represented by

accountability, transparency and shariah compliance

has a significant effect on muzakki trust in zakat

management institution. The highest influence

coefficient (dominant) on trust among variables is

sharia compliance. The issue of zakat management is

argued in this paper as closely related to the

governance relationships in the zakat institution.

Differ from western understanding over

accountability transparencies and shariah

compliances, Islamic governance framework

proposed and analyzed here provides a broad and

integrated understanding over the governance in

zakat fund management that can help the relevant

parties to manage the zakat fund more effectively and

efficiently.

REFERENCES

Abdullah, R. B., 2010. Zakat Management In Brunei

Darussalam : A Case Study Zakat Management In

Brunei Darussalam : A Case Study Rose binti Abdullah.

Seventh International Conference.

Dhanani, A., Connolly, C., 2012. Discharging not‐for‐profit

accountability: UK charities and public discourse.

Accounting, Auditing and Accountability Journal. Vol.

25 Issue: 7, pp.1140-1169.

Andrianto, N., 2007. Good e-Government: Transparansi

dan Akuntabilitas Publik Melalui e-Government, Bayu

Media. Malang.

Ferrinadewi, E., 2008. Merek dan Psikologi Konsumen,

Graha Ilmu. Yogyakarta.

Ghazali, M. Z., Saad, R. A. J., Wahab, M. S. A., 2016. A

Conceptual Framework for Examining Trust towards

Zakat Institution International Journal of Economics

and Financial Issues. Special Issue for International

Soft Science Conference (ISSC 2016). 6(S7) 98-102.

11-13 April 2016, Universiti Utara Malaysia, Malaysia.

Hasanah, N., 2013 Analisis Pengaruh Layanan Lembaga

Amil Zakat Terhadap Kepercayaan Muzakki (Studi

Pada Lembaga Amil Zakat Dompet Dhuafa

Yogyakarta), Repository UGM. Yogyakarta.

Kamil, M. I., Ahmad, M. A., 2002, Peranan sikap dalam

gelagat kepatuhan zakat pendapatan gaji. Analisis. 9 (1-

2), 171-191.

Krina, 2008. Indikator dan Alat Ukur Prinsip Akuntabilitas,

Transparansi, dan Partisipasi, Sekretariat Good Public

Governance, Badan Perencanaan Pembangunan

Nasional. Jakarta.

Mayer, R. C., Davis, J. H., 1999. The effect of the

performance appraisal system on trust for management:

A field quasi-experiment. Journal of Applied

Psychology. Vol 84 No. 1, pp. 123-136.

Mukhlis, A., Beik, I. S., 2013. Analisis Faktor-faktor yang

Memengaruhi Tingkat Kepatuhan Membayar Zakat:

Studi Kasus Kabupaten Bogor. Jurnal Al-Muzara’ah. I

(1), 83–106.

Muhammad, R., 2006. Akuntabilitas Keuangan pada

Organisasi Pengelola Zakat (OPZ) di Daerah Istimewa

Yogyakarta. Jurnal Akuntansi dan Investasi. Vol. 7 No.

1, hal: 34-55.

Noman, A., 2003. Imperatives of Financial Innovations For

Islamic Banks. International Journal of Islamic

Financial Services. Vol. 3.

Muhammad, S. A., Jaffri, S. R. A., 2016. Determinants of

Trust on Zakat Institutions and its Dimensions on

Intention to Pay Zakat: A Pilot Study. Journal of

Advanced Research in Business and Management

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

874

Studies. ISSN (online): 2462-1935 | Vol. 3, No. 1. Pages

40-46.

Saad, R. A. J., Aziz, N. M. A., Sawandi, N., 2014. Islamic

Accountability Framework in the Zakat Funds

Management. Procedia - Social and Behavioral

Sciences. 164 (August), 508–515.

Shabri, H., (2014). Performance Comparison Amil Zakat

Institutions Managed By The Government And Private

Organization In West Sumatra Province, 103–117.

Sulaiman, H., Jamil, N., 2015. Information security

governance model to enhance zakat information

management in Malaysian zakat institutions.

Conference Proceedings - 6th International Conference

on Information Technology and Multimedia at

UNITEN: Cultivating Creativity and Enabling

Technology Through the Internet of Things, ICIMU

2014.

Tapanjeh, 2009. Corporate Governance from The Islamic

Perspective: A Comparative analyse with OECD

Principles Critical Perspectives on Accounting.

Elsevier- Critical Perspectives on Accounting.

Undang-Undang No. 23, 2011. Tentang Pengelolaan Zakat.

Wahab, A. N., Rahman, A. A. R., 2011. A framework to

analyse the efficiency and governance of zakat

institutions. Journal of Islamic Accounting and

Business Research. 2 (1), 43-62.

Yudha, A. N., Roby, C., 2016. Manajemen Pelayanan

Pemberdayaan Anak Yatim pada Lembaga Amil Zakat

Yatim Mandiri di Surabaya. Al Tijarah. Vol. 2, No. 1.

Zainal, H., Azizi, A. B., Ram, A. J. S., 2016. Reputation,

Satisfaction of Zaka Distributuin and Service Quality as

Determinant of Stake Holder Trus in Zakat Institution.

International Journal of Economics and FInancia

Issues. 2016 6(S7).

Governance and Trust in Zakat Institution

875