The Relationship of Order of Entry and Business Performance

Moderated by Market Place Factors

Satria Tirtayasa

University of Muhammadiyah Sumatera Utara

Keywords: Relationship, order, entry, business, performance, market.

Abstract: It has been recognized that the changes in business environment have an impact on business performance.

The changes create an opportunity for the firms to become the pioneer or follower in achieving higher business

performance. Prior studies about order of entry and business performance were done either in fully developed

or developed economic settings. None has taken place in an emerging or developing economic, particularly

Indonesia. Indonesian textile industry is one of the important economic sector in the nation development.

Thus, this study intends to examine the relationship between order of entry and business performance.

Furthermore, this study also investigate the moderating role of market place factors. Data were collected

through mail survey and personal interviews addressed to 110 CEOs. The research hypotheses were tested by

using Hierarchical Regression Analysis (HRA). The study generates three major findings. Firstly, the research

proves that there are significant differences between pioneer and early follower on business performance and

indicate that pioneer performs better than early follower in achieving a high level of business performance.

Secondly, the research found that there is a positive relationship between order of entry and business

performance. Thirdly, the research found that market place factors positive and significant influence the

relationshif of order of entry and business performance.

1 INTRODUCTION

The increasing competitive intensity in the domestic

and global arena has forced all type of businesses to

maintain their sustainable competitive advantage. A

competitive firm can be established if the

organisations can anticipate the customer’s desire

(needs and wants) and deliver superior customer

value more effectively and efficiently than their

competitors (Day, 1990; Narver and Slater, 1994;

Webster, 1988).Changes in the business environment

such as changes in technology and customer needs

also give an impact on competitive advantage. Thus,

the business may anticipate these conditions for

creating an opportunity for the firms to be the first

mover (Lieberman and Montgomery 1988). The first

firm to enter the market for specific products or

services, is commonly believed to accrue long-term

competitive advantages. These advantages are

thought to derive directly from the firm’s competitive

headstart over rivals and to result in dominant and

stable market positions. Order of entry into a market

and market share is believed to causally related

(Urban and Star, 1991).

On average, first movers have higher market share

than early followers. In turn they have higher market

share than later entries. Accordingly, companies are

often encouraged to pursue pre-emptive strategies to

achieve first-mover status (Miller, William, and

Robert, 1989). On the contrary, if a late mover uses

product/strategy innovation it would have a chance to

overtake the pioneer if the latter were to make mistake

(Carpenter and Nakamoto, 1989; Shankar, Carpenter,

and Krisnamurthi, 1998).

Studies about order of entry in Indonesian textile

industry need to be conducted because they contribute

to the country’s revenue and this industry also shows

expansion although the competitive intensity and

environment changes reveal high turbulence (as

impact of the economic crisis ).Based on the BPS (

Statistic Central Bureau), Total export achievement in

2011 was about US$ 7.3 billion and in the 2013 about

US$ 7.8 billion. This export achievement still need to

increase because almost fulfill the target export in

2015 about US$ 12 - 15 billion. Meanwhile, the

growth of textiles commodities reveals positive

growth such as fibers commodity and yarn

commodity, but for several commodities such as

fabrict, garments carpet and others shows negative

550

Tirtayasa, S.

The Relationship of Order of Entry and Business Performance Moderated by Market Place Factors.

DOI: 10.5220/0010046305500557

In Proceedings of the 3rd International Conference of Computer, Environment, Agriculture, Social Science, Health Science, Engineering and Technology (ICEST 2018), pages 550-557

ISBN: 978-989-758-496-1

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

growth. Based on the problem aboved, the research

problem that could arise is “does the combination of

firm timing decision with other market place factors

condition drive business performance ?”.

2 RESEARCH QUESTIONS

Based on the problem statement and importance of

this research, the following research questions are

required to be addressed :

1 To what extent is the different of order of entry

on business performance ?

2 To what extent does order of entry influence

business performance ?

3 Does the interaction between order of entry and

market place factors effect business

performance ?

3 LITERATURE REVIEW

3.1 Order of Entry of Business

According to PIMS the order of entry is defined as the

first time a business enters the market. Robinson

andFornell (1985) define order of entry as a

categorical measure that classifies a business as a

market pioneer, an early follower, or a late entrant.

Szymanski, Troy, and Bharadwaj (1995), assume that

order of entry is the first mover entering the market

under ideal conditions. It executes error-free entry

strategies.

3.2 Pioneer and Entry Follower

PIMS defines market pioneer as “ one of the pioneers

in developing such as product or service”.

Meanwhile, Robinson and Fornell (1985) defines first

mover as “one of the pioneers in the first developing

such as products or services”. This means that the first

mover may or may not be the first to enter a market.

It is only perceived that as being one of the first few

firms. Robinson, et al. (1992) are also define that

‘first entrant’ as the first business to develop products

and services.

3.3 Early Follower

The definition of early follower is very limited, for

most of the previous research did not give a clear

definition. Karakaya and Stahl (1989) define that

‘early follower’ as the business that develops the

products and services after the first firm enters the

market with a new product.

3.4 Business Performance

Green, Barclay, and Ryans (1995) define

performance as the degree of market success attained

by a product at the market maturity or at the point

where product market boundaries change.Most of

literature divides business performance into two

dimensions. They are financial measurement (such as

: profitability and market share) and non financial

measurement (such as consumer satisfaction).

3.5 Order f Entry and Market Share

However it is still important to study relationship

between order of entry and business performance

variables because these two concepts are considered

to be causally related (Urban and Star 1991).Parry

and Bass (1990) have studied 593 consumer goods

business and 1287 industrial goods business and their

findings are as follows : 1.The followers were

obtained low market shares than pioneer. 2.The

pioneers have shared advantage depends on industry

type (concentrated, non concentrated and end user

purchase amounts.

Robinson, et al. (1992) have studied Industrial

goods and consumer goods. The researchers have

used the following categories : the first entrant market

pioneers, other market pioneers, early followers, and

late entrants. The research findings are as follows

:Market pioneers do not tend to benefit from

acquisition entry and increasing finance skills

significantly increases the probability of being a first

entrant and of being another market pioneer.Robinson

and Huff (1994) have studied data by covering 95

observations in 34 product categories of frequently

purchased consumer goods. The results is the pioneer

market share reward show an increase when lead time

is increased. Srinivasan and Murthi (1996) have

analyzed managerial skills in determining the first

mover market share advantages. The sample consistof

236 business unit from PIMS data base. The findings

are as follows : the difference in the RME (relative

marketing efficiency) scores between the pioneers

and late entrants is significant and the difference in

Relative production efficiency (RPE) score between

pioneers and early followers and late entrant are

significant.Shankar et.al (1998) have analyzed 13

brands from two categories of ethical drugs in U.S.

market during the 1970s and 1980s. The findings of

the research are : a) The pioneer has higher potential

markets than non innovative late mover and the

The Relationship of Order of Entry and Business Performance Moderated by Market Place Factors

551

pioneer grows faster than many non innovative late

movers.b) Innovative late entry can produce an

advantage relative to pioneering.

3.6 Moderators Effect of Market Place

Slater and Narver (1994) studied about competitive

environment moderate the market orientation

performance relationship. The finding is : market

turbulent have significant relationship with ROA,

technology turbulent have significant relationship

with sales growth, competitive intensity was found no

moderating effect of the market orientation

relationship with market performance.Moreover, Adu

and Kwaku (1997) researched about market

orientation and performance upon small business

performance. They found that a moderating influence

of market growth with sales growth are the

performance measure.Geiger and Hoffan (1998)

studied that 55 firms have diversification business

outside of regulated environment. The findings are as

follows: regulatory environment was positively

related to performance. Furthermore, Langerak, et al.

(1998), investigated about an exploratory results on

the attendants and consequences of green marketing.

They found that the regulatory and institutional

intensity is significantly and positively related to

green marketing.

4 HYPOTHESES

DEVELOPMENT

4.1 Order of Entry and Business

Performance

In order to determine whether the findings established

are suitable and relevant to the theoretical framework,

this research uses previous evidence to develop

hypotheses. In previous studies, the relationship

between order of entry and business performance

revealed an equivocal result. For instance, Flaterty

(1983) states that there is a small simple correlation

between order of entry and market share. Meanwhile,

most of finding mention the order of entry as having

significant effects on business performance

(Robinson and Fornell, 1985; Urban, Carter, Gaskin

and Zofia, 1986; Lambkin, 1988; Carpenter and

Nakamoto, 1989, and Michell, 1991. On the contrary,

(Freshtman, 1990) has found that there is no

relationship between order of entry with business

performance. However, many authors have found that

pioneer organizations have high performance (

examples are to be found in Robinson, Claes, and

Sulivasan, 1992; Mascarenhas, 1992; Kalyanaram

and Kardes, 1992; and Lattin and Brown, 1994;

Robinson and Huff, 1994 ). Findings also appear in

the writings of other authors where early entry beat

pioneers to have high market share, for instance :

Shankar, Carpenter and Krishnamurthi, 1998;

Carpenter and Sawhney, 1996. Based on the

equivocal findings above, the hypotheses can be seen

in figure 1. The following hypotheses will be

examined :

H1: There is significant difference between

pioneer and early follower on market share

H2: There is positive relationship between order

of entry and market share

4.2 Moderator Effect of Market Place

Factors with Order of Entry and

Business Performance

The four contextual variables outlined in Kohli and

Jaworski (1990) who discussed market place factors

that moderate the market orientation-performance

relationship and were subsequently tested by Slater

and Narver (1994) and Kwaku (1997) are employed

in this research. They contain market turbulence,

technology turbulence, competitive intensity, and

market growth. Furthermore, another market place

factors moderator is government regulation.

Government regulation has been studied by Geiger

and Hoffan (1998), and Langerak, et al. (1998). The

moderator effect of each dimension are described in

figure 1. The rationality of each dimension are as

follows :

4.2.1 Market Turbulence

It is expected that market turbulence will moderate

the order of entry-business performance relationship.

For instance, the ability to adapt and respond to the

evolving needs of customers is critical for business

success in constantly changing business environment.

Szymanski, et al. (1995) have suggested that in a

stable environment where customer types and

preferences do not change frequently over time,

pioneers are expected to have limited impact on

performance. Meanwhile, in unstable markets, the

late entrants may take away the pioneer’s market

share when serving market. The hypotheses are as

follows :

H3: The extent of market turbulence positively

moderates the relationship between order of entry and

market share

ICEST 2018 - 3rd International Conference of Computer, Environment, Agriculture, Social Science, Health Science, Engineering and

Technology

552

4.2.2 Technological Turbulence

Szymanski, et al. (1995) state that the greater the rate

of technological change, the greater the advantages to

late entrants. Access to newer technologies may offer

later entrants the opportunity to overcome the

negative experiences of the pioneer and learn from

the advantages enjoyed by the pioneer. For the first

mover, investments in existing technologies could

become a barrier to exit.

On the contrary, businesses which operate by

using stable technologies need to rely on market

orientation to a greater degree to obtain a competitive

edge because technology does not provide such

leverage (Bennet and Cooper, 1981). The hypotheses

suggest that:

H4: The extent of technology turbulence

positively moderates the relationship between order

of entry and market share

4.2.3 Market Growth Rate

Szymanski, et al. (1995) have stated that the market

share would be lower for pioneering firms competing

in a high growth markets. High growth markets, with

their higher margins and growing demand, are

expected to attract more entrants. All else being

equal, the combined market share of all firms (= 100

%) competing in higher growth markets is likely to be

dispersed over a larger number of firms. On contrary,

in a stable economy, the pioneer firms is tend to

maintain their performance, because the opportunity

for late entrants to enter to the market is limited

because of the impact of lower demand. The

hypotheses are as follows :

H5: The extent of market growth rate positively

moderates the relationship between order of entry and

market share

4.2.4 Competitive Intensity

In a very competitive market place, customers are

more likely to be faced with several different

alternatives to fulfiltheir needs and wants. In such

environment, there is a tendency for the firms to

become more sensitive and responsive to the changed

needs of customers in their business environments

(Lusch and Lacziniak, 1987). Hence, late entrant

firms have an opportunity to surpass the pioneer

firm’s performance. On contrary, businesses with

stable competitive intensity give an opportunity for

pioneer to maintain their performance, because

consumers do not have any alternative to fulfil their

wants. The hypotheses are :

H6 : The extent of competitive intensity positively

moderates the relationship between order of entry and

market share

Based on the above discussion, a research

framework has been developed (see figure 1).

Figure 1. Reseach Framework

5 METHODOLOGY

The study employed the survey method using a

structured mail questionnaire (Sekaran, 2003). This is

the most appropriate method for drawing responses

when geographical dispersion is large, such as the

case of indonesia (Sekaran, 2003). The survey

questionnaire gathered information on Company

Characteristic, Market Palce factors, and Business

performance. The twenty four items to measuring the

extent of mark place factors were adopted from Kohli

and Jaworski (1993) and the responses were elicited

on a 5 point of scale ranging from ‘1’ strongly

disagree to ‘7’ strongly agree. The responses of 4

items measuring business performance was elicited

on a 5 point of scale ranging from ‘1’ very low to ‘7’

very high. Percentage of sales groth ver a five-year

period was used as an indicator of the business

performance. Measurement of performance was

based on perceived values rather than objective

values. A total 110 questionnaires were collected

from respondents of large textiles companies listed in

the Indonesia Manufacturing Directory released by

central Bureau Statistics (Biro Statistik) 2016. The

data collection spanned the period from February

2015 to the end April 2016.

5.1 Population and Sample

Based on BPS sources the amount of population of

textile industry at Jakarta-Bogor –Bekasi

(Jabotabek)- Indonesia are 210 textiles companies.

Moreover, The researcher chooses large textile

organizations as the population because they have

their own marketing divisions that always control the

The Relationship of Order of Entry and Business Performance Moderated by Market Place Factors

553

marketing strategies and adapt market place factors as

well (purposive sampling) The sample size are 110

companies.

5.2 Data Collection

The questionnaire uses the Indonesian Language for

the research conducted in Indonesia because the

respondents would be able to comprehend the

contents The. responses on the company surveys are

high. A total of 110 questionnaires were sent to the

firms.

5.3 Data Collection

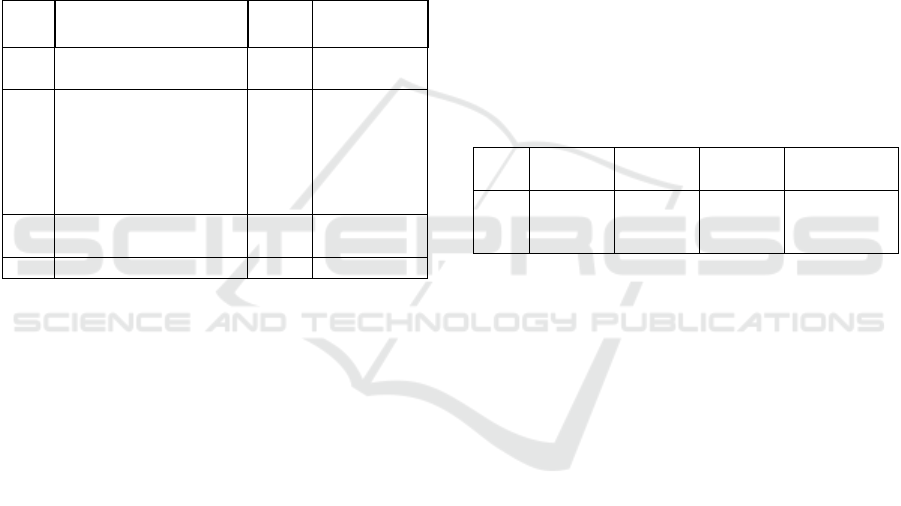

Table 1 Test Reliability For Each Variables

No. Variables Items Cronbach

Alpha

A. A. Market

Place Factors

1

2

3

4

- Market turbulence

- Technological

Turbulence

- Market Growth

Rate

- Market Intensit

y

4

4

2

4

0.6960

0.7202

0.600

0.6337

B. B. Business

Performance

1 - Market share 3 0.8990

5.4 Statistical Methods

To test the influence of the moderator variables

(market place factors) on order of entry and business

performance, the researcher uses a hierarchical

regression analysis (HRA) with the following

equations.

(1) Y = 0 + 1OE

(2) Y = 0 + 1OE +2MPF

(3) Y = 0 + 1OE +2MPF + 3OEMPF

Where :

Y = Business performance (market share )

C. OE = Order of entry

MPF = Market place factors (market turbulence,

technology turbulence, government, market growth

rate, competitive intensity, and regulation)

OEMPF= interaction between order of entry and

market place factors.

5.5 Data Checking

In order to check as to whether the data has fulfilled

the assumptions of multiple regression analysis,

which can be seen from normality of the error term

distribution, the linearity between variables, constant

variance of the error term and multicolinearity. After

checking the data can be concluded that all data fulfill

the assumptions of regression analysis.

6 FINDINGS

6.1 Differences between Order of Entry

and Business Performance

The difference between order of entry and business

performance. The result reveals that there are

significant differences between pioneer and early

follower in achieving market share (significant-t

0.000). Pioneer has a mean score of 3.729 and early

follower has mean score of 3.125. It indicates that

pioneer has the ability to enhance their performance

better than early follower (see Table 1)

Table 2 Differences Order of Entry and Business

Performance

No. Variable Sample Mean

Score

Significant-t

1 Market

share

Pioneer

Early

Followe

r

3.7297

3.1250

0.000

0.000

6.2.1 Market Turbulence

When market turbulence is introduced as a moderating

factor, the regression analyses results show R²

increase significant from .091 to .167 or R² changes

.076 and significant F change 0.02 or it is significant

at 10 percent level. The results indicate that 16.7

percent of market share performance could be

explained by order of entry and market turbulence.

Based on partial regression, the coefficient regression

shows the contribution of market turbulence as

moderator effect is significant (0.463) and significant-

t .002 or significant at 5 percent level (see table 6.8).

Furthermore, by introducing the interaction effect

between order of entry and market turbulence, the

regression analysis shows significant as R² increase

significant from 0.167 to 0.207 or R² changes .040 and

significant F changes .024 or it is significant is at 5

percent level. It indicates that 20.7 percent of market

share performance could explain the interaction order

of entry and market turbulence. Partial regression,

coefficient shows 0.00844 and significant-t .024 or

significant at 5 percent level. It can be concluded that

contribution of market turbulence factor in equation is

quite strong for interaction role, and hypothesis is

accepted (see table 2).

ICEST 2018 - 3rd International Conference of Computer, Environment, Agriculture, Social Science, Health Science, Engineering and

Technology

554

6.2.2 Technology Turbulence

When technology turbulence is introduced as

moderator factor the R² increases from .091 to .118 or

R² changes .0027 and is significant at 10 percent level

or significant F changes by .074. Partial regression

shows .233 and the coefficient is significant at 10

percent level or significant-t show .074 (see table 3).

When order of entry and technology turbulence

interact, R² increases from .118 to .177 or R² changes

.059 and significant at 5 percent level or significant F

changes to .007. Partial regression coefficient is 0.105

and significant-t of .007 or significant at 5 percent

level (see table 3). Conversely, from the regression

analysis above, it could be stated that technology

turbulence has a strong contribution toward the

interaction role, and hypothesis is accepted(see table

3).

6.2.3 Market Growth Rate

By proposing market growth rate as a moderating

factor, the R² increases significant from .091 to .373

or R² changes .281 and significant at 1 percent level

or significant F changes of .000. Partial regression

shows .475. The coefficient is significant at 1 percent

level or significant-t .000 (see table 4). In addition,

after introducing the interaction between order of

entry and market growth rate , R² increases from .373

to .414 or R² changes .042 and is significant at 5

percent level or significant F changes .008. Partial

regression coefficient is 0.0892 and significant-t of

.008 or is significant at 5 percent level,

thushypothesis is accepted(see table 4).

6.2.4 Competitive Intensity

When competitive intensity was tested as moderator

factor R² increases from .091 to .114 or R² changes

.023 and significant F changes =.103 or significant at

10 percent level. Partial regression coefficient shows

.290 and significant-t .103 or not significant at 10

percent level (see 5). It can be concluded that there is

no moderator role for competitive intensity.

By testing the interaction between order of entry

and competitive intensity, the interaction effect is

found significant as R² increases from .114 to .154 or

R² changes .040 and significant F changes = .029 or

is significant at 5 percent level. Partial regression

coefficient is .00991 and significant-t .029 or is

significant at 5 percent level (see table 5). This

regression means that interaction between order of

entry and competitive intensity can contribute

forward a interaction role, hypothesis is acceptedsee

table 5.

7 DISCUSSION

The evidence shows that there are differences

between pioneer and early follower. Pioneer performs

better in achieving market share than early follower.

Furthermore, the evidence reveals that there is a

positive relationship between order of entry and

business performance. The findings is supported

byMiller, et.all, 1989 and Urban and Star, 1991,

where they stated that first movers company have

higher market share than early followers.

Secondly, hierarchy regression test found that all

dimensions of market place factors positively

moderate the relationship between order of entry and

market share.The findings also supported by Kohli

and Jaworski,1993, Narver and Slater,1994,Adu, A.

&Kwaku 1997, Hoffman and Geiger, 1998, where

they found thatthe greater extent of technology

turbulence, market growth rate, and government

regulation could made more highest the relationship

of order of entry and business performance (market

share

REFERENCES

Adu, A. &Kwaku (1997). Market orientation and

Performance: Do the Findings Establised in Large

Firms Hold in the Small Business Sector ? Journal of

Euro marketing, New York, Vol.6, l 1-26.

Emory, C. W. & Cooper, D.R. (1995).Business Research

Methods, Fifth Edition, Richard D. Irwin, Inc.

Fershtman, C., Mahajan, V. & Muller, E. (1990).Market

Share Pioneering Advantage: a Theoretical Approach,

Management Science, 36 (August), 900-918.

Fornell, C., Robinson, W.T. &Wernerfelt, B.

(1985).Consumption Experience And Sales Promotion

Expenditure, Management Science, Vol.31, No.9,

September, 1084-1105.

Flaherty, M. T. (1983). Market Share, Technology

Leadership, and Competition in International

Semiconductor Markets, In Research on Technological

Innovation, Management and Policy, R .Rosenbloom,

ed. Greenwhich, CT: JAI Press Inc., 69-102.

Geiger, S. W. & Hoffman, J. J. (1998).The Impact of the

Regulatory Environment and Corporate Level

Diversification on Firm Performance, Journal of

Managerial Issues; Pittsburg; Winter.

Gregory, V.S., Carpenter, G. S. &Krishnamurti, L.

(1998).Late Mover Advantage: How Innovative Late

Entrants Outsell Pioneers, Journal of marketing

Research, Chicago, 35 (February), 54-70.

Jaworski, B. J. &Kohli, A.K. (1993). Market Orientation:

Antecedents and Consequences, Journal of Marketing ,

July, 53-70.

Kardes, F. R. &Kalyanaram, G. (1992).Order of Entry

Effect on Consumer Memory and Judgment: an

The Relationship of Order of Entry and Business Performance Moderated by Market Place Factors

555

Information Integration Perspective, Journal of

Marketing Research, XXIX (August), 343-357.

Kerlinger, F.N. (1986). Foundations of Behavioral

Research, Fort Worth, TX : Holt, Reinhart and

Winston.

Kohli, A. K. &Jaworski, B. J. (1990). Market

Orientation:The Construct, Research Propositions, and

Managerial Implications, Journal of Marketing, Vol.54

(April),1-18.

Lambkin, M. (1988).Order of Entry and Performance in

new Markets, Strategic Management Journal, 9, 127-

140.

Lieberman. M. B. & Montgomery, D. B. (1988). First

Mover Advantages, Strategic Management Journal, 9,

41-58.

Mitchell, W. (1991).Dual Clocks: Entry Order Influence on

Incumbent and Newcomer Market Share and Survival

When Specialized Assets Retain Their Value, Strategic

Management Journal, 12 (March) 85-100.

Nerver, J. C. & Stanley, F. S. (1990). The Effect of a Market

orientation on Business Profitability, Journal of

Marketing, 5 (October), 20-35.

Parry, M. & Frank, M.B. (1990).When to Lead or Follow

?it Depends, Marketing Letters, 1 (November), 187-

198.

Robinson, W. T., Fornell, C. & Sullivan, M. (1992).Are

Market Pioneer Intrinsically Stronger Than Later

Entrants ? Strategic Management Journal, 13, 609-624.

Robinson, W.T. & Huff, L. C. (1994). The Impact of Lead

Time and Years of Competitive Rivalry on Pioneer

Market Share Advantages, Management Science, 40

(October), 1370-1377.

Robinson, W.T. (1988). Sources of Market Pioneer

Advantages: The case of Industrial Goods Industries,

Journal of Marketing Research XXV (February), 87-94.

Robinson, W. T. and Fornell, C. (1985).Source of Market

Pioneer Advantages in Consumer Goods Industries,

Journal of Marketing Research, August, 305-317.

Sekaran, U. (1992). Research Methods for Business : A

SkillBuilding Approach, Second edition, Jhon Wiley &

Sons, Inc.

Slater, S. F. &Narver, J. C. (1994).Does Competitive

Environment Moderate The market Orientation-

Performance Relationship ?, Journal of Marketing,

January, (46-55).

Srinivasan, K. (1988). Pioneering Versus Early Following

in New Product Markets,” unpublished PhD

dissertation, University of California, Los Angeles.

Shankar, V., Carpenter, G.S. &Krishnamurthi, L.

(1998).Late Mover Advantage: How Innovative Late

Entrants Outsell Pioneers, Journal of Marketing

Research, February, (1-14).

Szymanski, D. M., Troy, L. C. &Bharadwaj, S. G.

(1995).Order of Entry and Business Performance: An

Empirical Synthesis and Reexamination, Journal of

Marketing, 59 (October) 17-33

APPENDIX

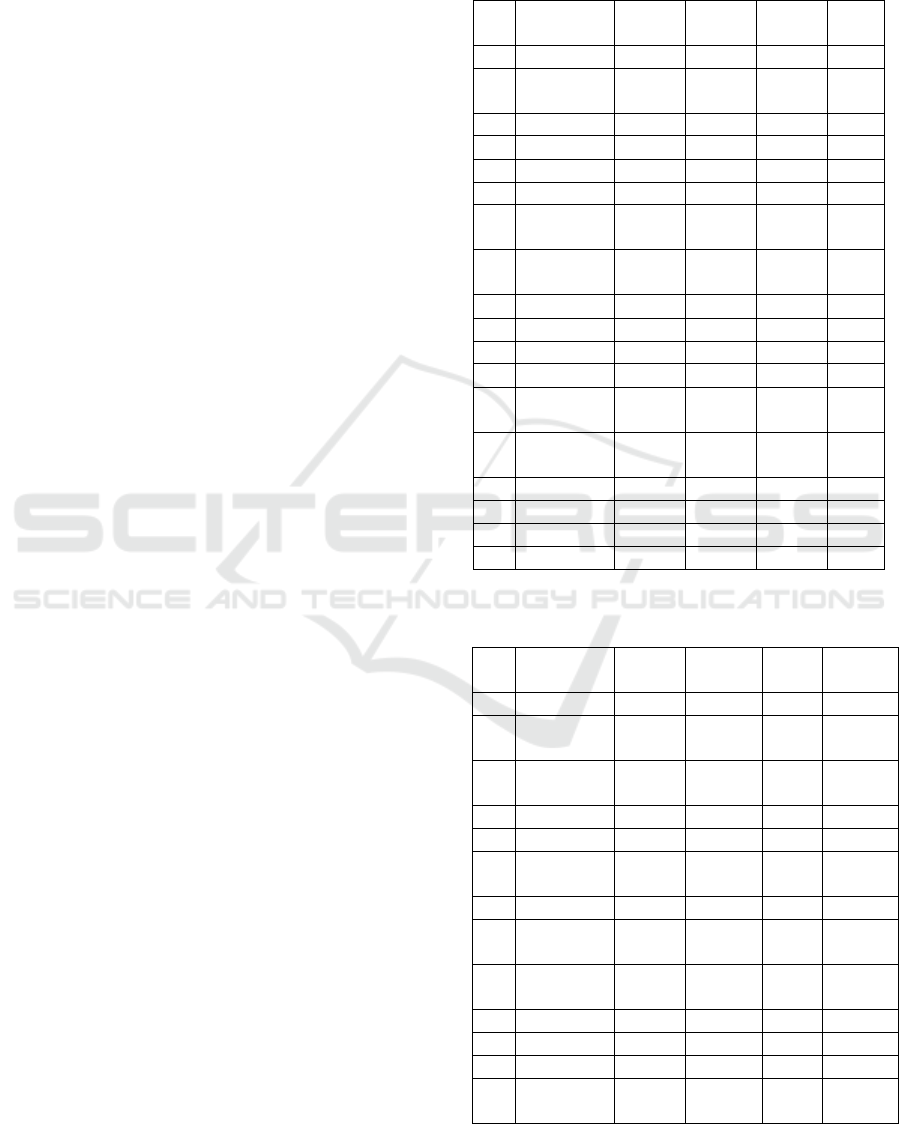

Table 3 Order of Entry and Market Share Performance

Moderated by Market Turbulence

No. Variables

C

oefficien

S

tandard

Error

t-Value

S

ignific

ant-t

1 (Constant) 3.207 0.076 42.432 0.000

Order of

Entry

0.227 0.070 3.259 0.002

R² 0.091

R² change 0.091

Sig. F change 0.002

2 (Constant) 1.346 0.605 2.226 0.028

Order of

Entry

0.204 0.067 3.020 0.003

Market

turbulence

0.463 0.149 3.099 0.002

R² 0.167

R² change 0.076

Sig. F change 0.002

3 (Constant) 1.465 0.595 2.462 0.015

Order of

Entry

0.147 0.071 2.074 0.041

Market

turbulence

0.414 0.148 2.795 0.006

Interaction 0.00844 0.037 2.294 0.024

R² 0.207

R² change 0.040

Sig. F change 0.024

Table 4 Order of Entry and Market Share Performance

Moderated by Technology Turbulent

No. Variables Coeffici

ent

Standard

Error

t-

Value

Significa

nt-t

2 (Constant) 2.289 0.515 4.446 0.000

Order of

Entry

0.213 0.069 3.065 0.003

Technology

turbulence

0.233 0.129 1.803 0.074

R² 0.118

R² change 0.027

Sig. F

change

0.074

3 (Constant) 2.206 0.501 4.406 0.000

Order of

Entry

0.142 0.072 1.959 0.053

Technology

turbulence

0.230 0.126 1.834 0.069

Interaction 0.105 0.039 2.728 0.007

R² 0.177

R² change 0.059

Sig. F

change

0.007

ICEST 2018 - 3rd International Conference of Computer, Environment, Agriculture, Social Science, Health Science, Engineering and

Technology

556

Table 5: Order of Entry and Market Share Performance

Moderated by Competitive Intensity

No Variables Coefficie

nt

Standar

d Error

t-

Value

Significant

-t

2 (Constant) 2.105 0.673 3.126 0.002

Order of

Entry

0.215 0.070 3.091 0.003

Comp.

intensity

0.290 0.176 1.647 0.103

R² 0.114

R² change 0.023

Sig. F

change

0.103

3 (Constant) 2.308 0.668 3.457 0.001

Order of

Entry

0.158 0.073 2.162 0.033

Comp.

intensity

0.215 0.176 1.224 0.224

Interactio

n

0.00991 0.045 2.210 0.029

R² 0.154

R² change 0.040

Sig. F

change

0.029

The Relationship of Order of Entry and Business Performance Moderated by Market Place Factors

557