Determinants of Stock Investment Decision through Skill and

Knowledge Financial: An Analysis with Partial Least Squares

Approach

Isfenti Sadalia

1

, Fahmi Natigor Nasution

2

, Desi Astuti

1

1

Department of Management, University of Sumatera Utara, Medan, Indonesia

2

Department of Accounting, University of Sumatera Utara, Medan, Indonesia

Keywords: Investment Decision, Skill and knowledge Financial, Partial Least Squares

Abstract: This study aims to examine the factors affecting stock investment decisions through skill and knowledge

finan. variables on stock investors in the existing investment gallery at state universities in north sumatera,

expressed comprehensively with component-based structural equations, Partial Least Square (PLS). PLS is

an analytical method that is not based on many assumptions. In the PLS is not required multivariate normal

assumption, can use the scale of nominal, ordinal, interval and ratio measurements and sample size should

not be large. PLS estimates the relationship model between latent variables and latent variables with

indicators. Based on the results of the analysis obtained the conclusion that the largest total influence data are

financial capability variables to decision variables, as well as the largest direct effect of financial competence

variables to investment decisions.

1 INTRODUCTION

Investment plays an important role in driving

economic growth and employment in Indonesia. In

accordance with Law No.8 of 1995 on capital market

has a strategic position in national economic

development. Students as young people are expected

early on to have knowledge in managing their

finances in order to have a more prosperous life in the

future.

Research on the factors that influence stock

investment decisions involves several variables. The

variables used are latent variables that can not be

measured directly. This process allows the testing of

a relatively complex set of relationships

simultaneously, so that required analytical techniques

that can accommodate all the variables with either the

structural equation modeling or Structural Equation

Modeling. There are two models of structural

equations that can be applied into a research that is

Covariance Based Structural Equation Modeling

(CBSEM) and Component Based Structural Equation

Modeling or known as Partial Least Square (PLS).

Partial Least Square is an analytical method that is not

based on many assumptions such as does not have to

be multivariate normal distribution and the sample

size does not have to be large.

2 LITERATURE REVIEW

2.1 Financial Competence

Education in the English dictionary means education,

whereas according to Sugihartono (2007), education

comes from the word educating which means

nurturing and forming exercises. Financial

knowledge has a close relationship with financial

litercay or financial education. Financial knowledge

can be channeled and can be understood well through

financial education or financial literacy.

Fernandes (2014) through his research is known

that financial education becomes very important for

increasingly complex financial decisions at the

present moment, and known a close relationship

between financial education with financial literacy

and financial behavior. Later, Yoshino and Wignaraja

(2015) stated in the results of his research that

financial literacy in Asia is still very limited and can

be overcome with appropriate financial education

programs and promote financial education

Sadalia, I., Nasution, F. and Astuti, D.

Determinants of Stock Investment Decision through Skill and Knowledge Financial: An Analysis with Partial Least Squares Approach.

DOI: 10.5220/0010086415271534

In Proceedings of the International Conference of Science, Technology, Engineering, Environmental and Ramification Researches (ICOSTEERR 2018) - Research in Industry 4.0, pages

1527-1534

ISBN: 978-989-758-449-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1527

intensively to increase financial literacy in Asia.

Lusardi (2008) stated in his research that financial

education can improve saving habits and make better

financial decisions.

2.2 Financial Capability

Soekanto (Abdulsyani, 2007) states that social status

is the place of a general person in a society that deals

with others in his or her social environment, its

prestige, rights and obligations. Soekanto (2017)

states that the socio-economic status means the

position of an individual and family based on

economic elements. Soekanto (2017), mentions the

factors that affect one's social economy in society that

is the size of the wealth, the size of honor, and the size

of science.

Ali et.al. (2016) stated in the results of his

research that the economic background of parents,

especially the work of parents does not affect the

financial literacy of students. While Fowdar (2007)

stated in the results of his research that the students'

financial literacy is influenced by the background of

parents and family. Gumus and Dayioglu (2015)

stated that their socioeconomic status and

demographic factors influence investors' perceptions

of risk with different background income levels, it is

also known that the age-gender-level education-

income-profession of investors influences the

perceptions of risk and decision investment taken.

2.3 Skill and Knowledge Financial

Literacy comes from English literacy which means

the ability to read and write. The concept of literacy

is not only synonymous with the literacy of a person,

but also against the technology of computer literacy,

in the financial field known as financial literacy.

Some definitions of financial literacy are:

1) Financial Literacy is the mastery of knowledge

and ability (skills) to make rational economic

and financial decisions with full confidence and

competence (Working Group on Financial

Literacy, 2010).

2) A combination of awareness, knowledge, skills,

attitudes and behavior necessary to make sound

financial decisions and achieve individual

financial well-being (INFE-OECD, 2011). As

part of the science of finance, financial literacy

is a person's ability in personal finance that

includes money management, spending and

credit, savings and investments (Hananto,

2011).

Ali (2013) stated in his research results that

financial literacy provides the knowledge and ability

to make good decisions, good decision-making

ability will make the customer able to achieve

prosperity.

2.4 Decision of Stock Investments

Tandelilin (2010) states that investment is a

commitment to a number of funds or other resources

that are done at this time, with the aim of obtaining

some benefits in the future. Investment decisions as

decisions that have an important role for financial

management, and also have a big role in the

development / growth of the business or even the

development of a country. Meanwhile, according to

Manurung (2012) investing is basically 'buying' an

asset that is expected in the future can be 'resold' with

a higher value.Some reasons someone make an

investment decision (Tandelilin, 2010):

1) A worthy life in the future

The beginning of investment is excess funds

from investors. The excess funds come from

personal funds and loan funds. These

advantages are then invested for future benefits.

2) Reducing inflationary pressure

Investing in the ownership of a company or

other object impacts the investor's self-evasion

from the risk of impairment of property or

property rights due to the influence of inflation.

3) The urge to save on taxes.

Provision of tax facilities to people who invest

in certain business sectors encourage the growth

of investment in the community.

An investment plan needs to be thoroughly analyzed.

An investment plan analysis is basically a study of

whether or not a plan can be successfully

implemented.

2.5 Partial Least Square (PLS)

In the PLS analysis it is necessary to know whether

the data meets the requirements for the SEM PLS

model. Some characteristics that need to be

considered include, sample size, shape of data

distribution, missing values, and measurement scale.

Researchers should pay attention to how much of the

missing data is in the data. In addition, the

measurement of endogenous latent variables should

not use a nominal scale so that the model can be

identified.

Hair et al. (2013) states that the minimum sample

size guidance in SEM-PLS analysis is equal to or

greater (≥) of the following conditions:

ICOSTEERR 2018 - International Conference of Science, Technology, Engineering, Environmental and Ramification Researches

1528

1) 10 times the largest number of formative

indicators used to measure a construct.

2) 10 times of the largest number of structural paths

leading to a particular construct.

The guideline is called the 10 X rule (10 time rule of

thumb) which is practically 10X of the maximum

number of arrows (paths) that pertain to a latent

variable in the PLS model.

This guideline is still rough guidance so that Hair et

al. (2014) suggests researchers to use the Cohen

(1992) approach that considers statistical power and

effect size when determining the minimum sample

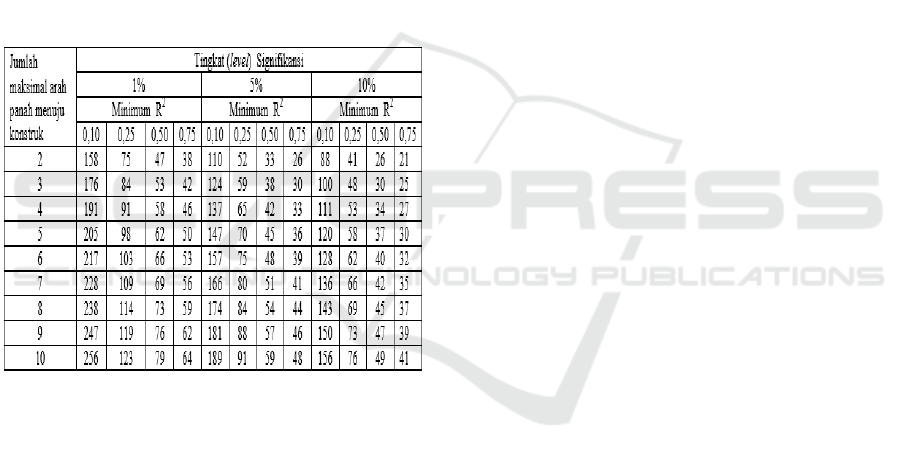

size. As preview at Table 1, the determination of the

sample size using the Cohen (1992) approach in

Haryono and Wardoyo (2013) if the maximum

number of arrows on a construct is 10, the 5%

significance level and the minimum R-square 0.25 the

minimum sample size is 91.

Table 1. Sample Size Determination Table In PLS

Source: Cohen 1992 (in Haryono and Wardoyo, 2013)

Data analysis technique

The data collected in this research will be analyzed

quantitatively by using SEM - Partial Least Square

(PLS) method as follows:

1) Estimation Parameter SEM - Partial Least

Square (PLS)

The path analysis model of all latent variables in

the PLS consists of three sets of relationships:

a. Inner model that specifies the relationship

between latent variables (structural

model).

b. Outer model that specifies the relationship

between latent variables with indicators or

variables manifestasinya (measurement

model).

c. Weight relation, to assign a score or

calculate latent variable data.

2) Steps of the model equation model of structural

equations with SEM-Partial Least Square (PLS)

In this research, data analysis on SEM-PLS will

use SmartPLS software support.

a. Obtains concept-based models and

theories to design structural models

(relationships among latent variables) and

their measurement models, ie relations

between indicators with latent variables.

b. Creating a path diagram (diagram path)

that explains the pattern of relationship

between latent variables with the indicator.

c. Convert the path diagram into the

equation.

d. Conduct goodness of fit evaluation by

evaluation of measurement model (outer

model) by looking at validity and

reliability. If the measurement model is

valid and reliable then it can be done next

step that is evaluation of structural model.

If not, then it should re-construct the path

diagram.

e. Model interpretation.

3 RESEARCH METHODOLOGY

This study uses primary data. Primary data was

obtained from questionnaires distributed by email to

all stock investors in investment gallery at public

university in North Sumatra in 2018 (University of

Sumatera Utara, State University of Medan, UINSU,

Medan State Polytechnic). The sample size used is

100. The sampling technique used is non-probability

sampling with accidental sampling, ie the sample is

selected based on the ease in obtaining the required

data.

Determinants of Stock Investment Decision through Skill and Knowledge Financial: An Analysis with Partial Least Squares Approach

1529

Figure 1. Flow Chart of research

4 RESULT AND DISCUSSION

4.1.Convergent Validity

Figure 2. Theoretical Model Development Diagram

Source: PLS Output of research data (2018)

Convergent validity with reflexive indicator

is valid if it has loading value with latent variable to

be measured> 0.70, if one indicator has loading value

<0.70 then the indicator should be discarded (drop)

because it will indicate that indicator is not good

enough to measure the latent variables appropriately

(Ghozali and Latan, 2015). Here is the output of

structural equation path diagram of PLS using

SMART-PLS software.

Figure 3. Output Diagram

Source: PLS Output of research data (2018)

Indicators whose value loading factor <0.70 is

derived from the model because it is considered less

able to measure well the construct variable. The

model that formed after the issued several invalid

indicators are as follows:

Figure 4. Modified Output Diagram

Source: PLS Output of research data (2018)

4.2. Test Validity and Reliability

In this research, validity test and test result

with all values of r> r-table (with df = 30-2 = 28 and

5% significance, that is 0,374) so it can be concluded

that all items of statement are valid. Next Test

reliability by looking at Alpha Cronbach value. A

latent variable is said to be reliably if the value is>

0.6. Obtained information that all variables have

values> 0.6 which means all variables are very

reliable. Obtained latent variable score as follows:

Table 2. Value Composite Reliability

Reliabilitas Composite

Financial com

p

etence 0,912

Financial ca

p

abilit

y

0,842

Skill and knowledge

financial

0,832

Investment decision 0,857

Source: PLS Output of research data (2018)

ICOSTEERR 2018 - International Conference of Science, Technology, Engineering, Environmental and Ramification Researches

1530

Based on Table 2. Composite Reliability value

obtained information that the value of Composite

Reliability on all blocks of indicators has met the

assumption Composite Reliability is greater than 0.6

means that the indicator blocks in each latent variable

has a high consistency.

Discriminant validity with reflexive

indicator can be seen on cross loading between

indicator with its construct, indicator correlation

value to its construct must be bigger than other

construct value. Another method of assessing

discriminant validity is to use Average Variance

Extracted (AVE) which has a construct value> 0.50

specified as a good model (Ghozali and Latan, 2015).

Visible on the AVE table the terms of construct

value> 0.50 have been met, so it can be said that the

model is a good model.

Table3. Average Variance Extracted (AVE)

Average Variance

Extracted

(

AVE

)

Financial competence 0,839

Financial capabilit

y

0,727

Skill and knowled

g

e financial 0,623

Investment decision 0,601

Source: PLS Output of research data (2018)

4.3 Path Significance Test

Figure 5. Bootstraping Structural Model

Source: PLS Output of research data (2018)

The coefficient value of the structural model is said

to be significant if the t-count> t-table is 1.96 (1.96 is

the t-table value in the 95% confidence level). All the

indicators in Figure 5 look significant on the

condition of t-value> 1.96.

4.4 R-Square

Inner model or structural model testing is done to see

the relationship between construct, significance value

and R-square of the research model. The structural

model is evaluated by using R-square for the t test

dependent construct as well as the significance of the

structural path parameter coefficients.

To assess the model with PLS begins by looking at R-

square for each dependent latent variable. The

following table is the result of R-square estimation.

Table 4. R-Square

Source: PLS Output of research data (2018)

Q-Square predictive relevance for the structural

model, measuring how well the observation value is

generated by the model and also its parameter

estimation. The Q-square value > 0 indicates the

model has predictive relevance otherwise if the Q-

square value ≤ 0 shows the model lacking predictive

relevance.

Q-Square predictive relevance

= 1- (1-Rsqure1)(1-Rsquare2)

= 1 – (0,771)(0,786)

= 1 – 0,606 = 0,394

Table5. Outer Model (Weights of Loading)

Source: PLS Output of research data (2018)

Table outer model describes the relationship between

latent variables with the indicator that is:

1) X1.1 (gain knowledge of various products /

financial services) has a relationship of 0.4907

to financial competence

R-

Square

Adj.

R-Square

Skill and knowledge

financial

0,229 0,213

Investment Decision 0,214 0,190

Determinants of Stock Investment Decision through Skill and Knowledge Financial: An Analysis with Partial Least Squares Approach

1531

2) X1.8 (gain skills in managing benefits, risks,

cost of products / financial services) has a

relationship of 0.5992 to financial competence

3) X2.3 (work) has a relationship of 0.5945 to

financial capability

4) X2.6 (income) has a relationship of 0.5779 to

financial capability

5) Y1.3 (understand personal financial condition)

has a relationship of 0.3865 to the investment

decision

6) Y1.5 (understand financial records) has a

relationship of 0.2451 to the investment

decision

7) Y1.6 (understand financial records) has a

relationship of 0.3407 to the investment

decision

8) Y1.7 (understand the time value of money) has

a relationship of 0.3354 to the investment

decision

9) Z1.3 (risk) has a relationship of 0.4344 to skill

and knowledge financial

10) Z1.7 (portfolio analysis) has a relationship of

0.4406 to skill and knowledge financial

11) Z1.9 (risk-level relationship with return) has a

relationship of 0.3913 against skill and

knowledge financial

Based on that interpretation, it can be

analyzed that the overall view has the greatest value

among all relationships ie x1.8 (gain skills in

managing benefits, risks, cost of products / financial

services) to the financial competence variable of

0.5992.

The fourth indicator (obtaining skills in managing the

risk benefits, product cost / financial services) of this

financial competence variable is a variable that must

be done so that the financial competence process on

the investor can run well. Based on the above

information it can be said that all latent variables in

this study have a relationship less than 50% which

means all latent variables in this study have a weak

relationship / small.

Table 7. Path Coefficient

Source: PLS Output of research data (2018)

Table path coefficient explain the influence of latent

variables are:

1) Financial competence has the effect of 0.0884

on investment decisions

2) Financial competence has a -0.3448 effect on

skill and knowledge financial

3) Financial capability has a -0.4396 influence on

investment decisions

4) Financial capability has a -0.4142 influence on

skill and knowledge financial

5) Skill and knowledge financial has an influence

of -0,0152 against investment decision

Mapping the Influence between Variables

Figure 6. Inflation Diagram Variable Variables

Source: PLS Output of research data (2018)

Table 8. Intergroup Influence Mapping

Direct

influenc

e

Indire

ct

influe

nce

f. competenceskill and

knowled

g

e f.

Yes No

f. competenceDecision Yes Yes

(via

condit

ion)

finan.capabilityskill and

knowled

g

e f.

Yes No

finan.capabilityDecision Yes Yes

(via

condit

ion

)

skill and knowledge

f.Decision

Yes No

Source: PLS Output of research data (2018)

Table 9. Direct Influence, Indirect Effect, and Total

Influence

Direct

influence

Indirect

influence

Total

inflenc

e

f. competenceskill

and knowledge f.

-0,345 No -0,345

f.competenceDecisi

on

0,088 (-0,345)

x(-0,015)

0,005

ICOSTEERR 2018 - International Conference of Science, Technology, Engineering, Environmental and Ramification Researches

1532

=

0,005175

finan.capabilityskill

and knowledge f.

-0,414 No -0,414

finan.capabilityDeci

sion

-0,440 (-0,414)

x (-

0,015) =

0,00621

0,006

skill and knowledge

f.Decision

-0,015 No -0,015

Source: PLS Output of research data (2018)

In the table looks the largest total data influence of

financial capability variables to decision variables.

The biggest direct effect of financial competence

variables to investment decisions.

5 CONCLUSION

5.1 Conclusion

Based on the exposure described in the analysis and

discussion chapter, it can be concluded that:

1. The largest total influence data is the finan.

capability variable to the decision variable.

2. The largest direct effect of financial competence

variables to investment decisions.

5.2 Suggestion

Statistically, the number of results obtained in this

study is relatively small because it is only limited to

the theory, so need more deepening of each factor by

doing individual research and also required other

comparator factors.

ACKNOWLEDGEMENTS

The authors gratefully acknowledge that the present

research is supported by Universitas Sumatera Utara

in accordance with the contract of TALENTA

Universitas Sumatera Utara Fiscal Year 2018 No.

2590/UN5.1.R/PPM/2018 dated March 16, 2018.

REFERENCES

Abdulsyani. 2007. Sociology of Theory and Applied

Sciences.Jakarta: PT Bumi Aksara.

Ali, Suhaimi. 2013. Skill and knowledge finan. in Malaysia:

Issues and Status Update Bank Negara Malaysia.

International Seminar on Financial competence and

Retirement Saving. Kuala Lumpur.

Ali et.al. 2016. The Skill and knowledge finan. of Young

People: Socio Economic Status, Language Background,

and The Rural urban Chasm. Australian and

International Journal of Rural Education. Vol.26 (1), pp

54-56.

Antwi, S., E. F. E. A. Mills, and X. Zhao. 2012. Capital

Structure and Firm Value: Empirical Evidence from

Ghana. International Journal of Business and Social

Science Vol.3 (22), pp 103-111.

Ambuehl,Sandro, B. Douglas Bernheim, and Annamaria

Lusardi. 2014. Financial Education,

Financialcompetence, And Consumer Welfare.

Working Paper Series.

Astuti, Desi. 2018. Determinants Of Stock Investment

Decisions Through Financial Literacy And Risk

Perception. Dissertation.

Besley, S. and E. F. Brigham. 2009. Principle of Finance.

4th ed. South-Western Cengage Learning. United

States.

Brigham, E. F. and J. F. Houston. 2001. Financial

Management. Eighth Edition. Erland. Jakarta.

Cole, Shawn. And Gauri Kartini Shastry. 2007. If You Are

So Smart, Why Are not You Rich?, The Effects of

Education, Skill and knowledge finan. and Cognitive

Ability on Financial Market Participation. Working

Paper. Harvard Business School and Univeristy of

Virginia.

Fernandes, Lynch Jr.Netemayer. 2014. Skill and knowledge

finan., Financial competence, and Downstream

Financial Behaviors. Management Science. Vol.60 (8),

pp:1861-1883.

Fowdar. 2007. Skill and knowledge finan.: Evidance from

Mauritius. Mauritius Research Council.

Gumus and Dayioglu. 2015. An Analysis on The Socio

Economic and Demographic Factors That Have an

Effect on The Risk of Taking Preferences of Personal

Investors. International Journal of Economics and

Financial Issues. Vol.5 (1),pp: 136-147. ISSN: 2146-

4138.

Ghozali, I. 2008. Structural Equation Model: Concepts and

application of Amos 16.0 program. Semarang: BP

University Diponegoro.

Ghozali, I. and H. Latan. 2015. Partial Least Squares:

Concepts, Techniques and Applications Using

SmartPLS 3.0 Program. Diponegoro University

Publishing Agency. Semarang.

Hair, J.F et al. 2014. A Primer On Partial Least Squares

Structural Equation Modeling (PLS-SEM). United

States of America: SAGE.

Hananto, Ligwina. 2011. For a Strong Indonesia: 100 Steps

to Not Poor. Literati: Jakarta

Hardjosoedarmo. 2004. Total Quality Management.

Yogyakarta: Andi

Haryono, S. & Wardoyo, P. 2013. Structural Equation

Modeling (SEM) for Management Research. Jakarta:

PT Intermedia Personnel Utama Jakarta.

Lusardi, Annamaria. 2008. Skill and knowledge finan.: An

Essential Tool for Informed Consumer Choice ?.

Working Paper No. 14084. JEL No.D14. National

Bureau of Economic Research.

Determinants of Stock Investment Decision through Skill and Knowledge Financial: An Analysis with Partial Least Squares Approach

1533

Manurung, A.H. 2012. Investment Theory: Concepts and

Empirical. PT Adler Manurung Press

OECD, INFE. 2011. "Measuring Skill and knowledge

finan.: Questionnaire and Guidance Notes for

Conducting an Internationally Comparable Survey of

Skill and knowledge finan.".

Soekanto, Soerjono. 2007. Sociology An Introduction.

Jakarta: PT Raja Grafindo.

Sugihartono, et al. 2007. Educational Psychology.

Yogyakarta: UNY Press

Tandelilin, Eduardus. 2010. Portfolio and Investment.

Yogyakarta: Kanisius

Trujillo, G.S. PLS Path Modeling with R. Berkeley:

Trowchez Editions.

UU No.8 Year 1995, About Capital Market

Weston, J. F. and T. E. Copeland. 2008. Financial

Management. Ninth Edition. Bina Aksara. Jakarta.

Working Group on Skill and knowledge finan.. 2010. "A

Sound on Investment" Skill and knowledge finan.

Education in Ontario Schools.

www.financialliteracy.eng was downloaded in June

2018.

Yoshino, Morgan. And Wignaraja. 2015. Financial

competence in Asia: Assessment and Recomendations.

ADBI Working Paper. No 534.

ICOSTEERR 2018 - International Conference of Science, Technology, Engineering, Environmental and Ramification Researches

1534