The Effects of Local Financial Independence, Local Revenue

Effectiveness and Local Financial Efficiency on Capital Expenditure

with Balancing Fund as Moderating Variable: Empirical Study at

Province of Sumatera Utara

Rina Br Bukit

1

, Anita Saragih

1

and Sri Mulyani

1

1

Faculty of Economic and Business, Universitas Sumatera Utara, 20155, Medan, Indonesia

Keywords: Local-Financial-Independence, Local-Revenue-Effectiveness, Local-Financial-Efficiency, Balance-Fund,

Capital-Expenditure

Abstract: This study aims to test the effects of local financial independence, local revenue effectiveness and local

financial efficiency on capital expenditure in the Regencies/Cities of North Sumatera Province in the period

of 2014-2016. This research uses 99 samples consisting of 33 regencies/cities. The data is obtained from the

Directorate General of Fiscal Balance in the form of local government financial reports. The result of this

study shows that local revenue effectiveness and local financial efficiency have positive and significant

influence on capital expenditure. However, the local financial independence has no significant effect on

capital expenditure. This study also finds that balancing fund can moderate the effects of local financial

independence, local revenue effectiveness and local financial efficiency on capital expenditure.

1 INTRODUCTION

Regional expenditure is prioritized to protect and

improve the quality of community life in an effort to

fulfil regional obligations. Regional expenditure is

divided into two, namely direct and indirect regional

expenditure. Direct regional expenditure is the

expenditure of local budget activities and directly

related to the implementation of local government

programs and activities. Regional expenditure is

directly divided into personnel expenditures, goods

and services expenditures, and capital expenditures.

While, indirect regional expenditures are local

budgeted activities and have no direct relationship

with the implementation of programs and activities.

Indirect expenditure is divided into personnel

expenditures, interest, subsidies, grants, and social

assistance, revenue-sharing, unexpected financial and

shopping assistance.

Based on the principle of regional autonomy that

is concerned with people's welfare, direct expenditure

is the expenditure that should be the government's

priority, especially in capital expenditure. Capital

expenditure is a regional government expenditure that

has an important

influence on the economic growth of a region and will

have leverage in moving the wheels of the regional

economy. Therefore, local governments should make

a shift in the composition of expenditures that would

later increase public confidence (Kuncoro, 2004).

Local governments allocate funds in the form of

capital expenditure budget to add fixed assets. The

allocation of capital expenditure is based on regional

needs for facilities and infrastructure, both for the

smooth implementation of government tasks and for

public facilities. However, many local governments

do not properly allocate their budget.

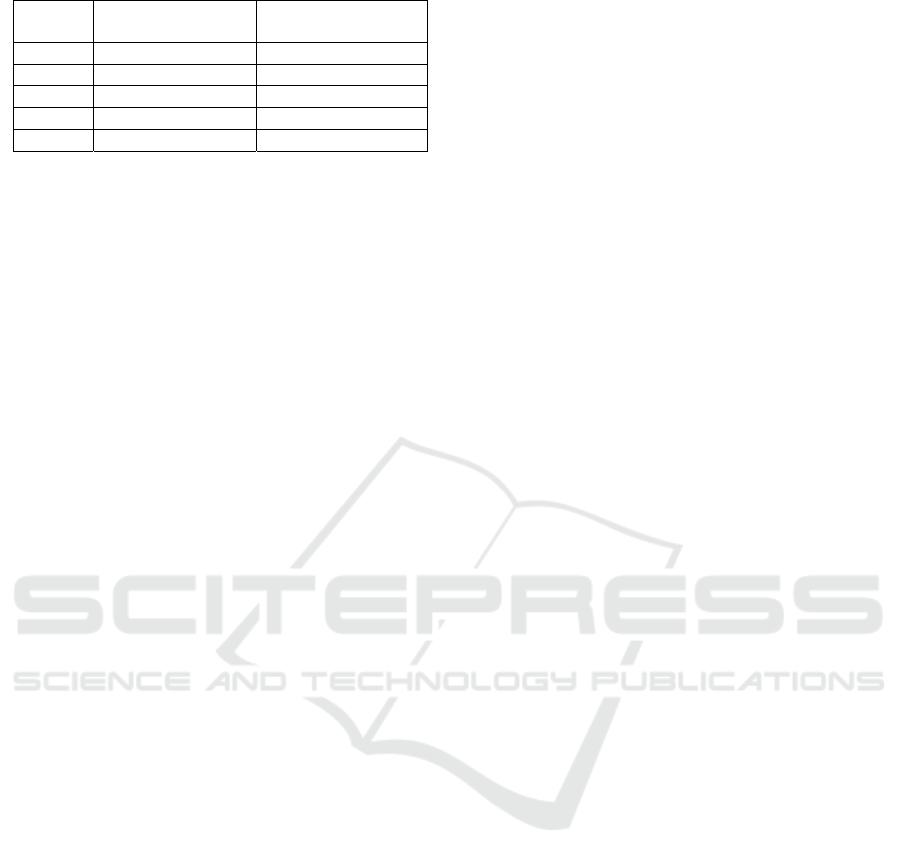

This research uses government financial report

data in North Sumatra Province. Table 1 below shows

that the average proportion of capital expenditure in

North Sumatera has fluctuated every year (MFI,

2018). However, the proportion of capital

expenditure in North Sumatra province is generally

still low. Table 1 show that indirect expenditure is

greater than capital expenditure. The government

must be able to allocate a proportion of regional

spending that is better to improve the welfare of the

community. Thus, the success of regional autonomy

is also inseparable from financial performance.

Table 1: Capital expenditure in North Sumatera province.

Bukit, R., Saragih, A. and Mulyani, S.

The Effects of Local Financial Independence, Local Revenue Effectiveness and Local Financial Efficiency on Capital Expenditure with Balancing Fund as Moderating Variable: Empirical

Study at Province of Sumatera Utara.

DOI: 10.5220/0010102618211825

In Proceedings of the International Conference of Science, Technology, Engineering, Environmental and Ramification Researches (ICOSTEERR 2018) - Research in Industry 4.0, pages

1821-1825

ISBN: 978-989-758-449-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1821

Year Indirect

Expenditure

Capital Expenditure

2012 6,279,156 803,608

2013 5,985,677 760,722

2014 4,969,775 1,145,972

2015 6,037,175 932,244

2016 7,188,137 1,019,855

Regional financial performance can be measured

using regional financial ratio such as ratio of local

financial independence, ratio of local revenue

effectiveness, and ratio of local financial efficiency

(Ardhini, 2011). Financial ratio information can be

used to: assess regional financial independence in

financing regional autonomy, measure efficiency and

effectiveness in realizing regional income, determine

the extent to which local government activities in

spending their local income, and evaluate the

contribution of each source of income in the

formation of regional income. Finally, financial ratios

also describe the growth of income and expenditure

over a period of time (Halim, 2008).

1.1 Capital Expenditure (Y)

This study describes the definition of capital

expenditure based on Regulation of Ministry of Home

Affairs, Number 13 of 2006, concerning Guidelines

on Regional Financial Management Article 53

(PMDN, 2006). Capital expenditure is the budget for

regional income and expenditure which is used for

expenditures made in the framework of the purchase

/ procurement or construction of fixed assets with a

benefit value of more than 12 (twelve) months for use

in government activities, such as in the form of land,

equipment and machinery, buildings and buildings,

roads, irrigation and networks, and other fixed assets.

Based on the Regulation of Ministry of Home Affairs,

capital expenditure consists of five types, such as,

capital expenditure of machine equipment, land

capital expenditure, capital expenditure of building,

capital expenditure of road, irrigation and network,

and other physical capital expenditure.

1.2 Local Financial Independence (X1)

Local financial independence indicates the level of

ability of a region in self-financing government

activities, development and services to the

community who have paid taxes and levies as a

source of income required area. Ratio of local

financial independence is indicated by the amount of

local revenue compared to regional income derived

from other sources (revenue transfer), among others:

tax-sharing, tax-sharing share of natural resource

taxes, general allocation funds and special

allocations, emergency funds and loans (Halim,

2008). If the level of regional dependence on the

assistance of external parties of the central and

provincial governments is low, the independence of

the regional will be even higher. However, if the

independence of an area falls, the dependence of the

region on the central government will be even higher.

It can be indicated that if local original income is

high, the allocation of capital expenditure can be

realized smoothly. Therefore, this study argues the

regional financial independence ratio is positively

related with capital expenditure.

1.3 Local Revenue Effectiveness (X2)

Local revenue effectiveness shows the ability of local

governments to realize the planned local revenue in

accordance with the target set based on the real

potential of the region itself (Mahmudi, 2010). The

effectiveness of local revenue is categorized into 5

levels of effectiveness, namely: very effective

(>100%), effective (90% -100%), effective enough

(80% -90%), less effective (60% -80%), not effective

(< 60%). Thus, this studies hypothesize that the

higher the ratio of local revenue effectiveness, the

better the performance of the local government and

then the higher the capital expenditure.

1.4 Local Financial Efficiency (X3)

The local financial efficiency illustrates the

comparisons between the amount of costs incurred for

income generation and the realization of received

revenues (Paul and Kenneth, 2003). An activity has

run efficiently if the implementation of the work has

reached the output with the lowest cost or with a

minimal cost of the desired result. The allocation of

capital expenditure is important to be realized

effectively to meet the demands and needs of the local

community and to facilitate development and

improve public service facilities. Thus, this studies

hypothesize that the higher the ratio of local financial

efficiency, the higher the capital expenditure.

1.5 Balancing Fund (Z)

According to Law No.33 of 2004 (BPK, 2004), the

central and regional financial balances are a system

of government financing in order to minimize the

fiscal gap between central and regional government.

It includes the financial distribution between the

central and regional governments as well as equitable,

ICOSTEERR 2018 - International Conference of Science, Technology, Engineering, Environmental and Ramification Researches

1822

democratic, equitable and inter-regional split between

regions transparent with due regard to local

potentials, conditions and needs in line with the

obligations and distribution of authority and

procedures for the administration of such authority,

including the management and oversight of its

finances. Balancing Funds are divided into profit-

sharing funds, general allocation funds and special

allocation funds.

2 MATERIALS AND METHODS

This study constructs a model of multiple regression

equation to the relationship between local financial

independence, local revenue effectiveness, local

financial efficiency and capital expenditure with

balancing fund as moderating variable.

2.1 Operational Definition and

Measurement of Research

Variables

The variables of this study are one dependent

variable, three independent variables, and one

moderating variable. The explanation of each variable

as below:

2.1.1 Dependent Variables

Dependent variable in this research is capital

expenditure (CE). Capital expenditures are the

expenditures of local governments with benefits

exceed one year. The expenditures will add to the

assets or wealth of the area and will subsequently add

to routine expenditures.

2.1.2 Independent Variables

Independent variables in this study are local financial

independence, local revenue effectiveness, and local

financial efficiency. First, local financial

independence indicates the ability of a region in self-

financing government activities, development and

services to people who have paid taxes and levies as

a source of income required by the region. Second,

local revenue effectiveness reflects the ability of local

governments to realize the original planned regional

revenues compared to targets set by the real potential

of the region. Third, local financial efficiency

illustrates the comparisons between the amount of

costs incurred for income generation and the

realization of received revenues.

2.1.3 Moderating Variable

A moderating variable has a role to strengthen or

weaken the relationship between independent

variables and dependent variable. This study argues

that balancing fund will strengthen or weaken the

relationship between local financial independence,

local revenue effectiveness, and local financial

efficiency with capital expenditure.

2.2 Research Model

This study applies a multiple regression model to test

the effect of independent variables on dependent

variable. Then, the role of moderating variable is

tested using the residual analysis model. The final

sample of this study is 33 regencies in the period of

2014-2016. Thus, the total of study observation is 99.

2.3 Data Collection

This study uses a quantitative data. Source of this

research data is secondary data from budget report of

state revenue and expenditure and its realization

report in province of Sumatera Utara. The data can be

accessed from the website of Directorate General of

Fiscal Balance of Ministry of Finance

(http://www.djpk.kemenkeu.go.id).

3 RESULTS AND DISCUSSION

3.1 Descriptive Statistic

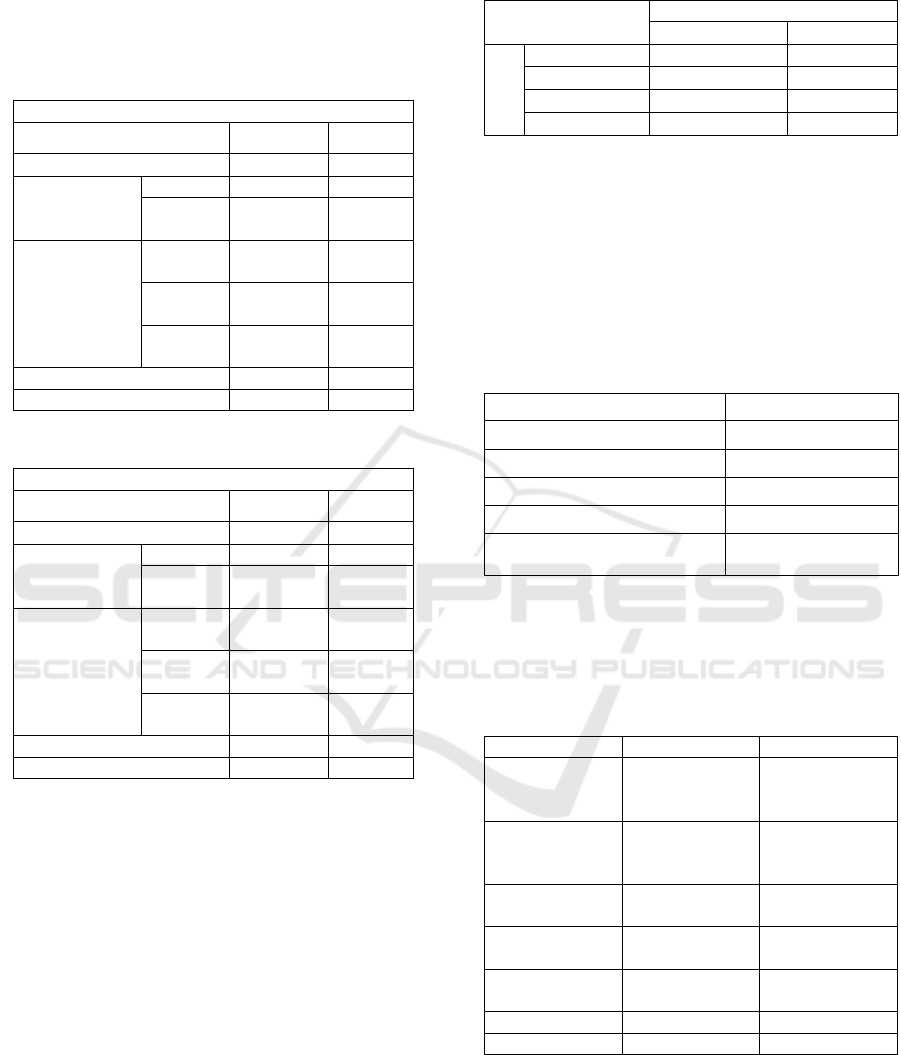

Table 2: Descriptive statistic.

N Min Max Mean

Std.

Dev.

CE

99 2.27 3.72 3.13

0.2

99

RLFI

99 0.71 4.58 2.24

0.8

01

RLRE

99 3.03 5.39 4.60

0.4

12

RLFE

99 4.39 4.91 4.60

0.09

0

Valid

(N)

99

Note: Capital expenditure (CE); Local financial

independence (RLFI);

Local revenue effectiveness

(RLRE); Local financial efficiency (RLFE); Valid N (list

wise).

The Effects of Local Financial Independence, Local Revenue Effectiveness and Local Financial Efficiency on Capital Expenditure with

Balancing Fund as Moderating Variable: Empirical Study at Province of Sumatera Utara

1823

3.2 Classical Assumption Testing

3.2.1 Normality Test

Table 3A: Normality test.

One-Sample Kolmogorov-Smirnov Test

CE RLFI

N

99 99

Normal

Parameters

a,b

Mean 3.1309 2.1426

Std.

Dev.

.29932 .58752

Most Extreme

Differences

Absolu

te

0.072 0.051

Positiv

e

0.028 0.039

Negati

ve

-0.072 -0.051

Kolmo

g

orov-Smirnov Z 0.714 0.504

Asymp. Sig. (2-tailed) 0.689 0.961

Table 3B: Normality test.

One-Sam

p

le Kolmo

g

orov-Smirnov Test

RLRE RLFE

N

99 99

Normal

Parameters

a,b

Mean 4.6099 4.5940

Std.

Dev.

.37680 .08285

Most Extreme

Differences

Absolu

te

0.126 0.116

Positiv

e

0.082 0.112

Negati

ve

-0.126 -0.116

Kolmogorov-Smirnov Z 1.251 1.154

As

y

m

p

. Si

g

.

(

2-tailed

)

0.088 0.140

Normality test result shows that the value of Asymp.

Sig. (2-tailed) of all variables is greater than the

expected value of significance of 0.05. It means that

this data is normally distributed.

3.2.2 Multicollinearity Test

The result of multicollinearity test shows the

tolerance value of all independent variables are

greater than 0.1. In addition, the value of Variance

Inflation Factor (VIF) is below 10. Thus, there is no

multicolinearity problem in this study.

Table 4: Multicollinearity test.

Model Collinearit

y

Statistics

Tolerance VIF

1

(Constant)

RLFI

0.951 1.051

RLRE

0.876 1.142

RLFE

0.892 1.121

a. Dependent Variable: CE

3.2.3 Autocorrelation Test

The test shows that Durbin Watson value is 1.904,

which the value is located between 1.736 to 2.264

(see Table 5). It means there is no autocorrelation

problem.

Table 5: Autocorrelation test.

Model 1

R .676

a

R Square 0.456

Adjusted R Square 0.439

Std. Error of the Estimate 0.22413

Durbin-Watson 1.904

a. Predictors: (Constant), RLFI, RLRE, RLFE

b. Dependent Variable: CE

3.3 Result of Multiple Regression

Table 6: Regression result model 1-2.

Model 1 Model 2

(constant) -5.076

(-

4.012

)

***

RLFI

-0.022

(-

0.548

)

RLRE

0.351

(

5.471

)

***

RLFE

1.444

(4.991)***

Balancing

fun

d

-.162

(-2.135) **

F-value 26.590 26.590

Sig 0.000 0.000

This research uses multiple regression analysis to

test the effect of local financial independence, local

revenue effectiveness, and local financial efficiency

on capital expenditure. Table 6, model 1 shows a

significant positive relationship between local

revenue effectiveness and capital expenditure

ICOSTEERR 2018 - International Conference of Science, Technology, Engineering, Environmental and Ramification Researches

1824

(β=0,351. Sig = 0,000). This study also finds the

effect of local financial efficiency on capital

expenditure is positive and significant (β=1,444. Sig

= 0,000). This study concludes that local revenue

effectiveness and local financial efficiency bring a

positive role in increasing the government capital

expenditure. However, this study finds that the

coefficient of local financial independence is not

significant. Further, Table 6, model 2 shows that there

is moderation effect of balancing fund. It can be

concluded that the effects of local financial

independence, local revenue effectiveness, and local

financial efficiency on capital expenditure are

different in these two situations: high balancing fund

versus low balancing fund.

4 CONCLUSION

The result of this study indicates that a regional

government that achieves revenue realization is

higher than the target set, can be said to be an

independent region in managing the potential and

financial management of the region. This region with

high local revenue effectiveness has a high capital

expenditure as well. Furthermore, this research also

finds that a region where the implementation of their

work has achieved good output with the lowest input

(high local financial efficiency) show a large capital

expenditure. And, this study finds that the situations

explained above (the positive influence of local

revenue effectiveness and local financial efficiency

on capital expenditure) are different in both

conditions: region with high balancing fund and

region with low balancing fund).

REFERENCES

Ardhini, 2011, Pengaruh rasio keuangan daerah terhadap

belanja modal untuk pelayanan publik dalam perspektif

teori keagenan (studi pada kabupaten dan kota di jawa

tengah), Undergraduate thesis, Universitas

Diponegoro.

Badan Pemeriksa Keuangan, 2004, Undang-undang Nomor

32 tahun 2004 tentang Pemerintahan Daerah.

Halim, A 2008, Akuntansi Keuangan Daerah. Salemba

Empat, Jakarta, 3rd edition.

Kuncoro, M 2004, Otonomi dan Pembangunan Daerah:

Reformasi, Perencanaan, Strategi, dan Peluang.

Erlangga, Jakarta, 8th edition.

Mahmudi, 2010, Manajemen Keuangan Daerah, Erlangga,

Jakarta.

Ministry of Finance Indonesia, 2018, Directorate General

of Fiscal Balance, Jakarta.

Paul, H & Kenneth, B 1988, Management of organizational

behavior: utilizing human resources, Practice-Hall Inc.

Englewood Cliffs, New Jersey, 5th edition.

Peraturan Menteri Dalam Negeri, 2006, Peraturan Mentri

Dalam Negeri Nomor 13 Tahun 2006 tentang Pedoman

Pengelolaan Keuangan Daerah Pasal 53.

The Effects of Local Financial Independence, Local Revenue Effectiveness and Local Financial Efficiency on Capital Expenditure with

Balancing Fund as Moderating Variable: Empirical Study at Province of Sumatera Utara

1825