Detecting Influence in Wisdom of the Crowds

Luís Correia

1

, Sofia Silva

1

and Ana Cristina B. Garcia

2

1

BioISI-Ciências, Universidade de Lisboa, Campo Grande 1749-016, Lisboa, Portugal

2

UNIRIO, Rio de Janeiro, RJ, Brazil

Keywords:

Collective Intelligence, Wisdom of the Crowds.

Abstract:

The wisdom of the crowds effect (WoC) is a collective intelligence (CI) property by which, given a problem,

a crowd is able to provide a solution better than that of any of its individuals. However, WoC is considered

to require that participants are not priorly influenced by information received on the subject of the problem.

Therefore it is important to have metrics that can identify the presence of influence in an experiment, so that

who runs it can decide if the outcome is product of the WoC or of a cascade of individuals influencing others.

In this paper we provide a set of metrics that can analyse a WoC experiment as a data stream and produce a

clear indication of the presence of some influence. The results presented were obtained with real data from

different information conditions, and are encouraging. The paper concludes with a discussion of relevant

situations and points the most important steps that follow in this research.

1 INTRODUCTION

Collective intelligence (CI), defined as groups of in-

dividuals doing things collectively that seem intelli-

gent (Malone et al., 2009), offers a decision-making

paradigm to solve complex problems, which has as-

sumed a new dimension when exploiting technology,

namely the web. CI has long been used as a means

to democratically choose the citizens’ representatives

and as an economic sensor to perceive the market.

However, it has very recently become a new research

area in which researchers are still trying to under-

stand (1) the power of CI, (2) the means to conduct

the crowd to a desired process, and (3) the means to

aggregate crowd’s contribution, in order to produce a

collective result better than that of any of the partici-

pants.

CI has been used in a variety of tasks and do-

mains going from various prediction markets (Berg

and Rietz, 2003) to design new protein configura-

tion (Curtis, 2015). CI successful results have been

correlated to the size of the crowd, the heterogene-

ity of the crowd and the individuals’ opinion indepen-

dence. In general, the crowd produces better results

with more people in the crowd, more heterogeneity

among participants and more independent individu-

als’ opinions (Surowiecki, 2005).

Incentive mechanisms, such as prizes, competi-

tions or even appealing to civic obligation, have been

used to stimulate CI. Designing filters that select par-

ticipants based on their profile may guarantee hetero-

geneity within the crowd. Regarding independence

of opinions, the design of communication barriers

among individuals can be considered in some cases.

However, it is hard to guarantee barriers’ effective-

ness, or their implementation altogether, in uncon-

trolled environments.

Although herd behaviour affects any resource al-

location problem (Zhao et al., 2011), it is economy

that has devoted much attention to it since herd be-

haviour may result in macroeconomic problems, such

as creating asset price and housing price bubbles and

chain of bank bankruptcy (Shiller, 2015). For CI,

herd behaviour is considered to impair its fundamen-

tal premise of diversity (Lorenz et al., 2011), as the

quality of the final result depends on the quality of the

tip given by the leader(s) of the herd. Consequently, it

is no longer the crowd’s result, but the results from a

few amplified by the crowd. The wisdom of the crowd

effect (WoC), by which the aggregated solution of the

crowd is better than any solution of its individuals,

depends on preventing herd behaviour.

Therefore the importance of detecting influence in

WoC cannot be understated. If it can be identified

in the early stages of an experiment, the person in

charge of the procedure may take initiatives, for in-

stance to detect and correct information leaks. Even

if influence identification is only possible in advanced

Correia, L., Silva, S. and Garcia, A.

Detecting Influence in Wisdom of the Crowds.

DOI: 10.5220/0006551200170024

In Proceedings of the 10th International Conference on Agents and Artificial Intelligence (ICAART 2018) - Volume 1, pages 17-24

ISBN: 978-989-758-275-2

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

17

stages of the experiment, it will be important to as-

sess the quality of the result. Although there is an

intuitive feeling that revealing information about the

subject influences the crowd’s behaviour, there is no

objective metric capable of being used in runtime that

could help us measure it and subsequently to estab-

lish a threshold of decision between situations with

and without influence. With the growing possibilities

made available by technology, such as e-government,

e-commerce, and other web based social activities,

the detection of influence in CI assumes a significant

importance.

Problem Definition. Previous research on WoC has

been focused on the analysis of the final set of esti-

mations rather than on the analysis of the sequence

of contributions that form the final set. An excep-

tion is the work of King et al. (King et al., 2012) that

analyses the accuracy, computed as the difference be-

tween the median and the true value, as a function of

group size. However we want to identify influence

in WoC as the estimates are entered. To this end we

propose to analyse the sequence of contributions as a

data stream.

In this paper we present a set of metrics to de-

termine whether information was revealed during

crowdsourcing, so the crowd sourced contributions

are biased and the quality is uncertain. We con-

ducted a series of controlled experiments using the

Amazon Mechanical Turk. We divided the crowd in

four groups submitted to different information display

conditions. Results indicate the potential usefulness

of our metrics that will allow to certify the quality of

a crowd sourced solution to complex problems.

2 RELATED WORK

“Life is about choices”. This is a popular saying that

reminds us that we are constantly choosing among

options. The more you know, the more comfortable

you feel to decide. However, the amount of available

information became humanly unmanageable with the

technological advances of the Internet. Either to

speed up our evaluation process or to deal with incom-

plete information, we constantly rely on the opinion

of others, for instance in the form of reviews of prod-

ucts or services. Certainly, this fact has motivated or

boosted research and development on recommenda-

tion systems as part of companies’ marketing strat-

egy to influence buyers (Chevalier and Mayzlin, 2006;

Pathak et al., 2010; Kempe et al., 2003; Avery et al.,

1999; Smith and Linden, 2017; Schwartz, 2004).

There are studies that have shown very per-

sonal decisions being influenced by surrounding

crowd decisions, such as planning the number of

children (Banerjee, 1992; Watkins, 1990), choos-

ing employer-sponsored retirement plans (Duflo and

Saez, 2002) and personal financial investment (Kelly

and Gráda, 2000). Research on behavioural eco-

nomics has long shown herding (Banerjee, 1992) and

contrarian behaviour (Park and Sgroi, 2012) in fi-

nance domains.

Reliable information always shed light on the de-

cision making process. However, analyzing raw ma-

terial information requires effort and expertise. Not

rarely, individuals rely on other people’s choices as

a shortcut for making their own. Besides, in com-

petitive environments, e.g. the stock market, there

is a suspicion that others may know something else

leading to a dilemma of following the flow or tak-

ing higher risks to get higher gains (Bikhchandani

et al., 1998). There are also situations in which to

reveal information is against the law, such as with per-

sonal health information (Marshall and Meurer, 2004;

Bansal et al., 2010; Gostin and Hodge Jr, 2001; An-

nas, 2003).

The individuals’ choices impact the society, as

during elections. Studies have shown the impact on

electors’ votes by disclosing opinion polls, pejora-

tively called the “bandwagon” effect (Kiss and Si-

monovits, 2014). Polls are thermometers of candi-

dates’ campaigns. They create, on voters, expec-

tations of the election outcomes. Some people go

with the flow by voting for the winning ticket, oth-

ers will use the information to strategically adjust

their vote for someone, close to what they want, with

chances to win. People may also need qualified in-

formation, such as to get experts’ opinions (Wal-

ton, 2010) in some specific matter, eventually lead-

ing individuals to follow the crowd. Independently

of the reason, knowing what others think increases

the chances of having a herd behaviour, which may

compromise the goal of obtaining a wise result from

the crowd because it kills cognitive diversity (Lorenz

et al., 2011). The influence on others grows as more

people enforces the same opinion. Each follower en-

forces previous choices creating a decision cascade

that strengths the herding behaviour, even overwrit-

ing personal guesses and intuition (Raafat et al., 2009;

Spyrou, 2013).

Herd behaviour is not desirable for the WoC ef-

fect. Consequently, identifying this condition, as

soon as possible in a collective intelligence process,

is crucial to evaluate the outcome of a crowd’s result.

Not surprisingly the first proposed metric to iden-

tify herding behaviour comes from the finance do-

ICAART 2018 - 10th International Conference on Agents and Artificial Intelligence

18

main. Lakonishok, Shleifer, and Vishny (Lakonishok

et al., 1992; Bikhchandani and Sharma, 2000) pro-

posed a metric, called LSV (see formula 1), to mea-

sure herding behaviour as the difference between the

expected number of managers buying a given stock

and the proportion of the net buyers in relation to the

total number of asset managers transacting that stock.

The same is valid for sellers. The metric requires an

expectation of the stock transaction that may not be

practical. It measures how much the selling (buying)

behaviour deviates from the expected. Wermer (Wer-

mers, 1999) proposes an evolution of the LSV, called

PCM, differentiating the trading direction (selling or

buying), but maintaining the expected behaviour re-

quirement. Christie and Huang (Christie and Huang,

1995) proposed a metric focusing on the dispersion of

the data and large price movement.

H(i) =

B(i)

B(i) + S(i)

− P(t)

− AF(i) (1)

in which:

i — stock

H(i) — herding degree, between [0..1]

B(i) — number of managers who are net buyers

of stock i

S(i) — number of managers who are net sellers of

stock i

P(t) — expected proportion of net buyers

AF(i) — expected value of H(i) on the no-herding

hypothesis

Undoubtedly, identifying herd behaviour is impor-

tant to qualify the outcome of a crowd (Barreto and

Baden-Fuller, 2006; Muchnik et al., 2013). In spite

of that, the research effort, including the finance do-

main, of coming up with a robust metric to detect

herding is still an issue (Amirat and Bouri, 2009;

Zhao et al., 2011). We propose new metrics that do

not rely upon an existing expected behaviour as base-

line. The metrics include concentration of the esti-

mates, reflected by the median of the absolute devia-

tion (MAD), monotonicity and trend, reflected by the

sums of positive and negative discrete derivatives of

the median and their cumulative sum.

1

1

"cumulative statistics" (average, median, ...) some-

times are also called "running statistics" and it means that

the statistics is computed over the dataset entered so far and

updated as each new data point is entered.

3 METRICS OF INFLUENCE IN

WOC

3.1 Premisses for the Metrics

A WoC case where participants do not receive in-

formation on the problem, for instance hints on the

true value or on previous contributions, should pro-

duce some distribution of results reflecting the diver-

sity of the participants population. Moreover, the se-

quence of contributions should form a stationary pro-

cess, meaning that the distribution properties should

not vary along the sequence. Therefore influence in

WoC should reflect on a data stream of estimates with

changes along the series in the underlying distribu-

tion. Typically we should expect influence exerted on

the participants to produce a concentration (decrease

in diversity) of the estimates and, in general, changes

in the form of trends.

The specificity of influence detection led us to

devise metrics tailored for this particular problem.

Given that population diversity is considered one of

the vantage points of WoC, outliers should not be dis-

carded. Therefore we chose metrics that are robust

to outliers, otherwise too much noise could be intro-

duced by the appearance of a single outlier. This led

us to work with aggregation and dispersion measures

based on the median and on the median absolute de-

viation (MAD)

2

3.2 Three Types of Metrics

In order to obtain a robust set we devised metrics

of three types analysing different aspects of the data:

concentration, monotonicity and trend. With the pur-

pose of noise reduction, all measures are computed on

a size n moving window over the data supplied by the

participants. In each iteration the window is shifted

by s points, Also, metrics are only computed after an

offset o to avoid the initial transient.

• Concentration (C): To obtain C we first calcu-

late the MAD normalised by the cumulative me-

dian

3

. Then C is computed as the percentage of

these points that has a low value, meaning below

a defined threshold t. A high value of C means

that estimates are basically concentrated around

the median.

2

MAD is the median of the absolute values of the devi-

ation of the estimates from the median.

3

we verified that it does not significantly differ from a

normalisation by the total median, and in this way the mea-

sure can be produced any time along the process.

Detecting Influence in Wisdom of the Crowds

19

• Monotonicity (M): We take the signal of the dis-

crete derivative of the cumulative median, and

M is computed as the percentage of consecutive

points with identical signal.

• Trend Indicators (T

−

, T

+

, T

t

): From the discrete

derivative of the cumulative median we obtain the

sum of its negative values T

−

, the sum of its pos-

itive values T

+

, and the sum of all the values T

t

,

and then we normalise these results (as a percent-

age) by the cumulative median.

The effect of influence on participants in a CI solu-

tion is characterised by a quick concentration of opin-

ions around some value, which means that the disper-

sion of opinions that characterises and is the main ad-

vantage in WoC, is lost. The final result is very much

dependent on the triggering conditions and in prac-

tice influenced CI experiments produce poorer results.

Consequently the concentration metric should be the

most important indicator of the presence of influence

in CI. If the concentration is high we must not expect

the WoC effect.

However if the concentration is low or even mod-

erate we may still be in presence of influence that

may be visible by a significant variation of the in-

coming estimates. This may occur due to the fact

that information leading to the establishment of influ-

ence may be released at different moments and may

even be of diverse quality. Therefore we may notice at

some point a significant shift of opinions, more or less

sudden, that reduces concentration. Overall, a crowd

shifting opinion can generally be attributed to some

form of influence. This situation can be characterised

by a high monotonicity and a trend in the data stream

of contributions.

The decision on existence of influence in a data

stream of contributions of a CI set up can be expressed

by Algorithm 1.

Algorithm 1: CI Influence Detection.

if high concentration then

influence present

else

if high monotonicity then

if trend then

influence present

else

no influence

end if

else

no influence

end if

end if

4 EXPERIMENTAL SETUP

We conducted an analysis of data obtained in a con-

trolled experiment to test the validity of our metrics.

A brief description of the experiment follows, and

further details can be obtained in (Silva and Correia,

2016; Silva, 2016). We deliberately chose a problem

with a numeric answer in the domain of the natural

numbers, that an average adult is able to solve within

the same order of magnitude of the correct result. In

this way the analysis of results is simplified and we do

not need prior selection process of the participants.

The experiment was made on-line using the Ama-

zon Mechanical Turk (AMT) to run it. A jar of jelly

beans was presented to the subjects in two pictures,

with a top view and a frontal view, and they were

asked to estimate the number of jellybeans in the jar.

A total of 380 subjects participated. Each subject was

randomly assigned to one of four groups with a spe-

cific type and amount of information provided prior

to asking her to produce the estimate. To promote

motivation of the subjects to provide a best effort at-

tempt, important for WoC to be successful, the best 3

answers had a small bonus.

4

The four groups are characterised as follows:

• Group Zero: No information was provided.

• Group Bestr: Five random estimates out of the ten

best produced by the previous participants. Ex:

"Based on all the guesses of other participants, the

closest guesses so far are (in no particular order):

3154...3136...3136...3129...3123".

• Group Bin: The bin with more estimates, of the

previous participants, was indicated. For each in-

dividual the interval between the lowest and the

highest previous estimates is divided in 10 bins of

identical width and the bin containing more esti-

mates is identified. The lower and upper limits of

that bin are then indicated to the subject with the

information that most estimates fall in that inter-

val. Ex: "Based on all the guesses of other par-

ticipants, the guesses between 200 and 4000 were

the most common".

• Group All: All the previous estimates are pre-

sented in a graphical form as points in an hori-

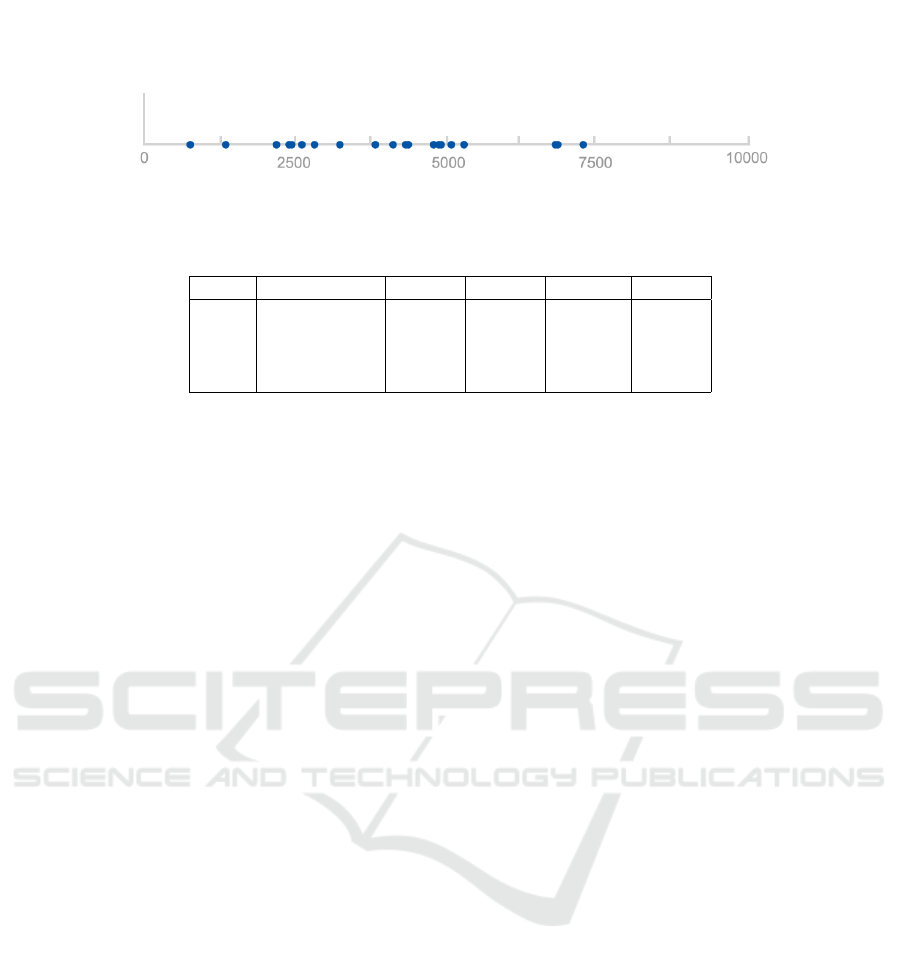

zontal axis (see Fig. 1).

The data set of estimates collected was analysed

in terms of its main statistical properties and the re-

sults are presented in Table 1. We confirm the gen-

eral assumptions presented in section 3.1, namely that

outliers have a strong influence in mean and standard

deviation, while median and MAD are robust to them.

4

of 10 USD, duly announced in the experiment’s inter-

face.

ICAART 2018 - 10th International Conference on Agents and Artificial Intelligence

20

Figure 1: Example of the information presented to a subject of the All group. For each subject all the previous estimate values

of the All group are presented as blue points in a linear scale horizontal axis.

Table 1: Statistical characterisation of the jellybeans experiment data set.

#Participants Mean σ Median MAD

Zero 98 3372.5 6538.5 1336.5 1100.1

Bestr 105 3636.4 9726.9 2850 1260.2

Bin 86 3475.8 2420.3 3484.5 1359.5

All 91 3387.3 5800.9 2160 1845.8

Regarding the information content provided, it

should be noticed that only group, Bestr, gives infor-

mation relative to the true value. However, this does

not necessarily guarantee a better final estimate since

a quick initial convergence may lead the crowd to set-

tle around a value away from the true one (Silva and

Correia, 2016).

As to the aggregation of the provided information,

only group All shows information in a completely

non-aggregated way, since all the previous values are

presented (see Fig. 1). Aggregation of information in

Group Bin is high although not as high as a single

central value (average or median). Group Bestr com-

bines a strong aggregation around the true value (best

10 estimates), with a little noise, due to the random

choice of the 5 estimates presented.

Finally a word on the form information is pre-

sented. While in groups Bestr and Bin it is presented

as text in alphanumeric form, in group All it is pre-

sented in graphical form. Although all previous es-

timates are presented in the latter group, we should

take into account that the graphical representation, al-

though relatively simple, may not be evident to all

subjects.

5 RESULTS AND DISCUSSION

The application of the influence metrics described

above to the jellybeans dataset has produced the re-

sults in Table 2. We used a window length n = 10

and a window shift s = 1 to significantly reduce noise

while allowing metrics to be used with smaller data

sets (in the order of 40 points) if needed. The offset

is o = 10 so that we have enough data points to fill

the first window. We used a threshold t = 1/3 to clas-

sify estimates concentrated around the median. The

remainder of this section discusses the four scenarios

in the light of our three metrics.

5.1 The Zero Scenario

In this scenario the metrics clearly indicate that indi-

viduals had no kind of information about the problem

they had to solve. Concentration metric is very low,

much below 50%, clearly placing this scenario in the

typical characteristics of WoC, that is with high dis-

persion of estimates. Nevertheless, according to Al-

gorithm 1, in this case we can not produce a conclu-

sion based only on concentration not being high. We

need to observe the monotonicity score. The latter

presents a medium value (47%). Since it is not high

we additionally need to evaluate if there is a trend in

the estimates. The T

+

and T

−

present values relatively

similar (both with high absolute values and their dif-

ference T

t

well below those values) indicating there

was no tendentious behaviour towards high nor low

values. Consequently, from Algorithm 1 we infer that

data is bias free. It shows typical WoC properties with

no clear tendency on the individuals’ estimates. This

allows us to conclude that the crowd is under no in-

fluence.

5.2 The Bestr Scenario

The concentration metric is very high, much above

50%, clearly showing participants in this scenario as

being influenced (see Algorithm 1). Consequently,

the crowd contribution rapidly converges to the region

of the tips being revealed. In the Bestr case, partici-

pants knew the information revealed was among the

closest (10 estimates) to the right answer. Since we

ran a true information experiment, all data is genuine

and therefore the revealed information had a high rep-

utation. It may be similar to recognising a high exper-

tise in someone who tips-off on some difficult sub-

ject. Although the decision is positive regarding the

presence of influence, it is interesting to observe the

other measures. Monotonicity also presented a high

Detecting Influence in Wisdom of the Crowds

21

Table 2: Influence metrics results (jellybeans dataset) with n = 10, o = 10, s = 1, and t = 1/3 (see section 3 for details on the

metrics).

Concentration Monotonicity T

−

T

+

T

t

Zero 24% 47% −658% 808% 151%

Bestr 88% 82% −27% 177% 150%

Bin 85% 56% −136% 128% −8%

All 42% 61% −222% 200% −23%

score reflecting that participants were following the

crowd tendency. And this is further confirmed by

the tendency of increasing estimates as indicated by

a high value of T

+

compared to T

−

(the difference T

t

is similar to T

+

. The three measurements are consis-

tent in the information provided in this scenario: 1)

data is biased, 2) bias was towards increasing initial

estimates. In other words, the crowd seems to have

started producing low estimate values and soon got

influenced by the tips to increase their estimates.

5.3 The Bin Scenario

As in Bestr, the Bin scenario presents a high concen-

tration metric, much above 50%, clearly a scenario

with influenced participants (see Algorithm 1). In the

Bin case, participants knew the most popular bin. The

influence here is a bit different. Instead of a reputa-

tion information, people were looking at the voice of

the crowd. The type of influence here is of the type

following the flow. Consequently, the collective re-

sult soon converges towards the region of the most

frequent bin. Taking a look at the other two measures

we notice tha the monotonicity presented a medium

score reflecting that participants do not get a precise

clue but an interval where estimates will tend to fall.

Consistently, there is no definite trend on estimates

since T

+

and T

−

present similar values (their differ-

ence is comparatively low). In this situation, the three

measurements show us that: 1) data is biased, 2) there

is no noticeable global steady movement of the crowd

estimates. In other words, the crowd got influenced

by the crowd, although this did not result in signifi-

cant changes of the initial estimates.

5.4 The All Scenario

In this scenario the concentration metric presents a

medium value (42%). In such case, the concentration

value not being high, we need to evaluate the mono-

tonicity, which presents a medium value (61%). Fi-

nally the trend is virtually non-existent, with similar

absolute values of T

+

and T

−

(low difference between

them T

t

). With these measures we conclude (Algo-

rithm 1) that there is no influence. The data presented

to participants, as illustrated in Fig. 1, does not seem

to have provided significant tips. We notice that T

+

and T

−

have lower values than in the Zero scenario,

which is consistent with the higher concentration in

the All scenario. Consequently, the metrics lead us to

infer that data is bias free, although to a lesser extent

than in Zero scenario. In other words, data is within

typical WoC properties.

6 CONCLUSIONS

We have proposed and tested a set of metrics to detect

bias due to information revelation in a collective intel-

ligence decision-making process. The combination of

three metrics, concentration, monotonicity and trend,

clearly shows the different behaviour of the crowd un-

der distinct situations of information provided to the

participants. Additionally, they allow to explain the

manner in which influence is been carried, and they

can be used in runtime of the experiment, producing

results as the successive estimates are entered. Con-

centration metric well above 50% clearly defines the

scenario as under the influence and a low concentra-

tion clearly situates the scenario in the WoC situation.

In case concentration is intermediate, monotonicity

and tendency metrics come into play to understand

the influence process, and a high value of both indi-

cates influence.

Next steps will focus on applying these metrics to

more datasets and refine the metrics interpretation for

consistent results. To this end, more detailed quan-

tification and qualification of the information used

should also be studied. We need to assess the min-

imum amount of estimates necessary to produce an

estimate. With the data used in this work we obtain

results with good approximation from 40 estimates

onwards. However the experiment we ran has a well

contained domain, natural numbers and a problem

that is within the capabilities of an average citizen. In-

creasing problem complexity in terms of the domain

and skills needed may have different requirements in

terms of the number of estimates, size of aggregation

subgroups and even in results interpretation.

We will also investigate the reasons for the results

obtained in the All scenario. The metrics are consis-

tent with the aggregation of the information provided.

ICAART 2018 - 10th International Conference on Agents and Artificial Intelligence

22

A non-aggregated information is rather different from

the true value hints in the Bestr scenario and the most

popular interval in the Bin scenario. However the rea-

sons for it being not perceptible to the point of the re-

sults being similar to a no-information scenario need

further investigation. It may happen that the amount

of data becomes simply too large for the participants

to integrate and use as a meaningful hint. They need

to look at and infer mean, medium, extreme values

and other statistical measurements. Maybe the bonus

payment to the Mechanical Turk workers did not re-

ward the extra cognitive effort required to obtain the

hint. Consequently, workers may have ignored the

hint and act as if no information was displayed. We

plan to repeat this experiment varying the amount of

payment to confirm this. Also, a textual form of the

previous estimates can replace the graphic to evalu-

ate if the form of representation plays a role in the

influence. Finally we want to assess the power of the

metrics in detecting influence as soon as possible in

the data stream. This will be important to enable the

expansion of CI experiments, since an early detection

of influence may prevent unnecessary time and costs,

leading to an improved redesign of the experiment.

REFERENCES

Amirat, A. and Bouri, A. (2009). Modeling informational

cascade via behavior biases. Global Economy & Fi-

nance Journal, 2(2):81–103.

Annas, G. J. (2003). Hipaa regulations-a new era of

medical-record privacy? New England Journal of

Medicine, 348(15):1486–1490.

Avery, C., Resnick, P., and Zeckhauser, R. (1999). The

market for evaluations. American Economic Review,

pages 564–584.

Banerjee, A. V. (1992). A simple model of herd behav-

ior. The Quarterly Journal of Economics, 107(3):797–

817.

Bansal, G., Gefen, D., et al. (2010). The impact of personal

dispositions on information sensitivity, privacy con-

cern and trust in disclosing health information online.

Decision support systems, 49(2):138–150.

Barreto, I. and Baden-Fuller, C. (2006). To conform or

to perform? mimetic behaviour, legitimacy-based

groups and performance consequences. Journal of

Management Studies, 43(7):1559–1581.

Berg, J. E. and Rietz, T. A. (2003). Prediction markets as

decision support systems. Information systems fron-

tiers, 5(1):79–93.

Bikhchandani, S., Hirshleifer, D., and Welch, I. (1998).

Learning from the behavior of others: Conformity,

fads, and informational cascades. The Journal of Eco-

nomic Perspectives, 12(3):151–170.

Bikhchandani, S. and Sharma, S. (2000). Herd behavior in

financial markets. IMF Staff papers, pages 279–310.

Chevalier, J. A. and Mayzlin, D. (2006). The effect of word

of mouth on sales: Online book reviews. Journal of

marketing research, 43(3):345–354.

Christie, W. G. and Huang, R. D. (1995). Following the pied

piper: Do individual returns herd around the market?

Financial Analysts Journal, 51(4):31–37.

Curtis, V. (2015). Motivation to participate in an online

citizen science game: A study of foldit. Science Com-

munication, 37(6):723–746.

Duflo, E. and Saez, E. (2002). Participation and invest-

ment decisions in a retirement plan: The influence

of colleagues’ choices. Journal of public Economics,

85(1):121–148.

Gostin, L. O. and Hodge Jr, J. G. (2001). Personal privacy

and common goods: a framework for balancing under

the national health information privacy rule. Minn. L.

Rev., 86:1439.

Kelly, M. and Gráda, C. Ó. (2000). Market contagion: Ev-

idence from the panics of 1854 and 1857. American

Economic Review, pages 1110–1124.

Kempe, D., Kleinberg, J., and Tardos, É. (2003). Maximiz-

ing the spread of influence through a social network.

In Proceedings of the ninth ACM SIGKDD interna-

tional conference on Knowledge discovery and data

mining, pages 137–146. ACM.

King, A. J., Cheng, L., Starke, S. D., and Myatt, J. P. (2012).

Is the true ‘wisdom of the crowd’to copy successful

individuals? Biology Letters, 8(2):197–200.

Kiss, Á. and Simonovits, G. (2014). Identifying the band-

wagon effect in two-round elections. Public Choice,

160(3-4):327–344.

Lakonishok, J., Shleifer, A., and Vishny, R. W. (1992). The

impact of institutional trading on stock prices. Journal

of financial economics, 32(1):23–43.

Lorenz, J., Rauhut, H., Schweitzer, F., and Helbing, D.

(2011). How social influence can undermine the wis-

dom of crowd effect. Proceedings of the National

Academy of Sciences, 108(22):9020–9025.

Malone, T. W., Laubacher, R., and Dellarocas, C. (2009).

Harnessing crowds: Mapping the genome of collec-

tive intelligence. Technical report, MIT Sloan Re-

search Paper 4732-09.

Marshall, R. C. and Meurer, M. J. (2004). Bidder collusion

and antitrust law: refining the analysis of price fixing

to account for the special features of auction markets.

Antitrust Law Journal, 72(1):83–118.

Muchnik, L., Aral, S., and Taylor, S. J. (2013). Social

influence bias: A randomized experiment. Science,

341(6146):647–651.

Park, A. and Sgroi, D. (2012). Herding, contrarianism and

delay in financial market trading. European Economic

Review, 56(6):1020–1037.

Pathak, B., Garfinkel, R., Gopal, R. D., Venkatesan, R., and

Yin, F. (2010). Empirical analysis of the impact of rec-

ommender systems on sales. Journal of Management

Information Systems, 27(2):159–188.

Raafat, R. M., Chater, N., and Frith, C. (2009). Herding

in humans. Trends in cognitive sciences, 13(10):420–

428.

Detecting Influence in Wisdom of the Crowds

23

Schwartz, B. (2004). The paradox of choice: Why less is

more. New York: Ecco.

Shiller, R. J. (2015). Irrational exuberance. Princeton uni-

versity press.

Silva, S. (2016). An experiment about the impact of social

influence on the wisdom of the crowds effect. Master’s

thesis, ISCTE/IUL and University of Lisbon, Portu-

gal.

Silva, S. and Correia, L. (2016). An experiment about the

impact of social influence on the wisdom of the crowd

effect. In Proceedings of Workpedia 2016, pages 1–

10. UFF, Brazil.

Smith, B. and Linden, G. (2017). Two decades of recom-

mender systems at amazon. com. IEEE Internet Com-

puting, 21(3):12–18.

Spyrou, S. (2013). Herding in financial markets: a re-

view of the literature. Review of Behavioral Finance,

5(2):175–194.

Surowiecki, J. (2005). The wisdom of crowds. Anchor.

Walton, D. (2010). Appeal to expert opinion: Arguments

from authority. Penn State Press.

Watkins, S. C. (1990). From local to national communities:

The transformation of demographic regimes in west-

ern europe, 1870-1960. Population and Development

Review, pages 241–272.

Wermers, R. (1999). Mutual fund herding and the impact on

stock prices. the Journal of Finance, 54(2):581–622.

Zhao, L., Yang, G., Wang, W., Chen, Y., Huang, J., Ohashi,

H., and Stanley, H. E. (2011). Herd behavior in a

complex adaptive system. Proceedings of the National

Academy of Sciences, 108(37):15058–15063.

ICAART 2018 - 10th International Conference on Agents and Artificial Intelligence

24