Agent-based Simulation Model Embedded

Accounting’s Purchase Method; Analysis on the Systemic Risk

of Mergers and Acquisitions between Financial Institutions

Hidenori Kato

1

, Yuichi Sei

2

, Yasuyuki Tahara

2

and Akihiko Ohsuga

2

1

Faculty of Informatics and Engineering, The University of Electro-Communications, Tokyo, Japan

2

Graduate School of Informatics and Engineering, The University of Electro-Communications, Tokyo, Japan

Keywords: Systemic Risk, Merger, Inter-bank Transaction, Marketable Assets, Agent Simulation, Purchase Method.

Abstract: The aim of the present study is to evaluate systemic risks due to merger between financial institutions by

manipulating the decline rate of marketable asset price. An agent-based simulation platform with purchase

method of international financial reporting standards (IFRS) is developed and analyses the influence of the

goodwill (Noren), produced by mergers between financial institutions. The research reveals the following two

points: (1) the decline rate of marketable asset price determines the number of bankruptcies, (2) when market

value asset price plumps sharply, the effect of merger is small.

1 INTRODUCTION

The most severe impacts of the financial crisis from

2007 to 2009 arose immediately after the failure of

Lehman Brothers on September 15, 2008 (Acharya,

2012). As failures of financial institutions may affect

market functions, the global financial crisis has

precipitated an increasing appreciation of the need for

a systemic perspective toward financial stability

(Arinaminpathy, 2012). This is called “systemic

risk”, which is a possibility that an event at an indivi-

dual company level could trigger severe instability or

collapse an entire industry or economy. In the several

past years, many studies have examined systemic

risk, especially in EU countries and the U.S.A.

In Japan, major financial institutions had to merge

to prevent systemic risk from increasing. Regional

economies are shrinking with declining population. In

January 2017, Japan’s Mie Bank and Daisan Bank

said they had agreed to consolidate their operations,

in an attempt to boost their competitiveness and deal

with demographic challenges (Nikkei, 2017). In

addition, Sumitomo Mitsui Financial Group and

Resona Holdings were finalizing an arrangement to

consolidate group regional banks in March 2017.

Earnings reveal the plight of Japan’s regional banks.

Net profit dropped on the year in the April-December

period for 60 of 82 listed regional banks (Nikkei,

2017).

One of the previous researches has suggested that

mergers between financial institutions have proved

disadvantageous (Hashimoto, 2015). This model

applied therein uses simplified balance sheet and

some regulations. However, it is better to consider

goodwill account separately after implementation of

mergers. In this paper, we deal with mergers between

financial institutions to investigate the possibilities of

systemic risk due to financial crisis. The issue

mentioned above is to analyse impacts of mergers

between banks. Therefore, we introduce to our model

the purchase method defined in international financial

reporting standards and use the same modelling

framework as Kikuchi’s model (Kikuchi et al., 2016).

The goal of this article is to analyse systemic risk

change due to mergers between financial institutions.

By introducing purchase method, we can deal cases

where the purchase amount is larger than the assets of

a merged company. In addition, systemic risks are

examined by changing the decline rate of marketable

asset price.

2 RELATED RESEARCH

2.1 Interbank Network

Financial institutions such as banks and securities

companies conduct various transactions in the

168

Kato, H., Sei, Y., Tahara, Y. and Ohsuga, A.

Agent-based Simulation Model Embedded Accounting’s Purchase Method; Analysis on the Systemic Risk of Mergers and Acquisitions between Financial Institutions.

DOI: 10.5220/0006569701680175

In Proceedings of the 10th International Conference on Agents and Artificial Intelligence (ICAART 2018) - Volume 1, pages 168-175

ISBN: 978-989-758-275-2

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

interbank network. When one bank is insolvent, the

stability of banking system is affected in various ways

depending on the patterns of payment across locations

(Freixas et al, 2000). Freixas et al. (2000) investigates

the ability of the banking system to withstand the

insolvency of one bank and whether the closure of

one bank generates a chain reaction on the rest of the

system.

Degryse and Nguyen (2007) investigates the

evolution and determinants of contagion risk for the

Belgian banking system over the period 1993-2002,

using detailed information on aggregate interbank

exposures of individual banks. They examine large

bilateral interbank exposures, and cross-border

interbank exposures. They find that a change from a

complete structure toward a “multiple-money-center”

structure, which is called core-periphery network, has

decreased the risk and impact of contagion. In

addition, an increase in the relative importance of

cross-border interbank exposures has lowered local

contagion risk.

May and Arinaminpathy (2010) explores that

some simple mathematical figure for banking system

with emphasis on the interplay between the

characteristics of individual banks and the overall

dynamical behaviour system.

2.2 Systemic Modelling

Another area of applied research that bears on the

issue of systemic risk is related to agent-based

simulation.

Maeno et al. (2012) presents a computer

simulation model to analyse the risk of transmission

of financial distress in a bank credit network and the

knock-on defaults of banks. They find that the

number of defaults is determined by the bank credit

network, the balance sheet of banks including equity

capital ratio, and the capital surcharge on big banks.

Some researchers have challenged to introduce

interbank-network into agent-based modelling. These

researches investigate stress tolerance of the banking

system. The propagation of bankruptcy in financial

institutions is as shown in the figure below (Fig.1):

Figure 1: Propagation of failures of financial institutions.

Hashimoto and Kurahashi (2015) proposes an

indicator of systemic risk by gauging the risk of

failure. It establishes the interbank market of Erodos-

Renyi network. Each agent has a simplified balance

sheet. They find that central bank financing may

spread a chain of failures of financial institutions.

As a related work, Kikuchi et al. proposes new

agent-based simulation model. Kikuchi’s group

develops an agent-based simulation platform and then

examines how current systemic management

regulations cause bankruptcies. They analyse how the

borrowing and lending banks and the borrowers go

bankrupt in the chain via interbank network. In the

research, each financial institution has a simplified

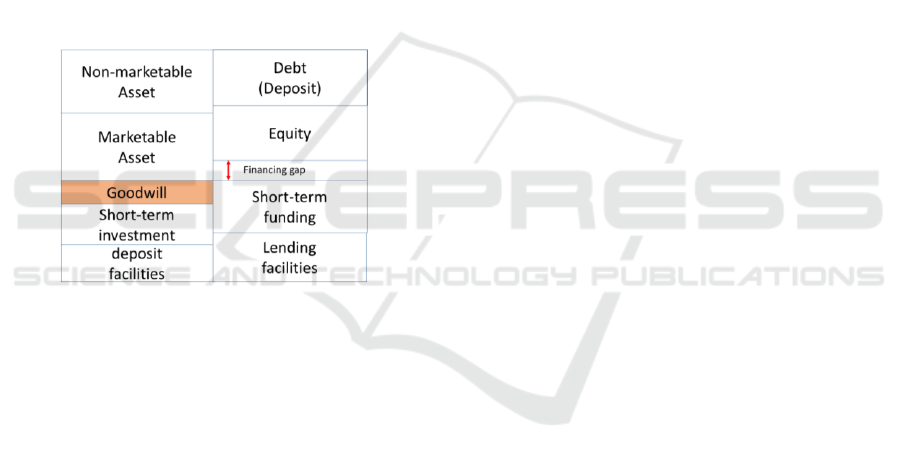

balance sheet as shown in Figure 2.

Figure 2: Balance sheet in Kikuchi model.

In previous studies, researchers explored how the

prevention of propagation of failures was possible. In

these studies they focus on balance sheets of the

financial institutions and investigate the effects on the

propagation of failure (May and Arinaminpathy,

2010). Another area of applied research related to

systemic risk has examined agent-based simulation

(Kikuchi et al., 2016).

Extensive effort has been dedicated to

documenting the negative effects on go-bankrupt-in-

chain in the market. Little attention has been paid to

positive value such as goodwill (Noren in Japanese)

brought about by merger and acquisition; this is the

focus of attention in this paper.

3 DEFINITION

This study is modelled from the method proposed by

Kikuchi et al. (2016), which has been used to test the

effects of Basel Capital Account in the market. We

explain agent-based-model with goodwill (Noren)

item included in the balance sheet to investigate the

impacts on the inter-bank market.

Agent-based Simulation Model Embedded Accounting’s Purchase Method; Analysis on the Systemic Risk of Mergers and Acquisitions

between Financial Institutions

169

3.1 Balance Sheet

Balance sheet is a financial statement that

summarizes a company’s assets, liabilities and

shareholders’ equity at a specific point in time (Saito,

2014). In this study, we use the same modelling

framework as Kikuchi’s model (Kikuchi et al., 2016).

The difference from previous studies is the item of

“goodwill”. Goodwill is an intangible asset that arises

as a result of the acquisition of one company by

another for a premium value (Saito, 2014). Goodwill

is considered an intangible asset because it is not a

physical asset. Therefore, goodwill account can be

found in the assets portion of a company’s balance

sheet (Saito, 2014). If goodwill is not introduced,

corporate mergers cannot be evaluated properly,

because we cannot add revenue of fixed asset.

In this research, we introduce goodwill upon

merger of financial institutions. Each financial

institution has a simplified balance sheet in Figure 3.

Figure 3: Balance sheet in our model.

3.2 Merger of Financial Institutions

A merger is a deal to unite two existing companies

into one new company (Saito, 2014). There are two

types of mergers.

First, we explain an absorption-type merger.

When two or more entities are combined into an

existing company, it is known as a merger through

absorption. In this type of merger, only one entity

survives after the merger, while the rest of all cease

to exist.

Second, we explain a consolidation-type merger.

When two or more companies fuse to give birth to a

new company, it is known as a merger through

consolidation. This implies that all the companies to

the merger are dissolved, i.e. they lose their identities

and a new company is established.

In our study, we only deal with an absorption-type

merger.

3.3 Accounting Used in Mergers

In terms of accounting processing, there are two kinds

of account items of transaction, “acquisition” and

“affiliated company accounted for by the equity-

method”. It is necessary for each merger case to apply

appropriate accounting treatment. “Acquisition” is

account for the purchase method. On the other hand,

“affiliated company accounted for by the equity-

method” is account for pooling of interest method. In

Japan, “pooling of interest method” has been

abolished, so we use purchase method in this study.

3.4 Bankruptcy Mechanisms

In the proposed model herein, bankruptcy factors of

financial institutions are as follows: 1) excessive debt

2) decrease of capital adequacy ratio to below a

certain value and 3) lack of funds after funding to

continue procurement. The first factor resembles the

one handled by the model of May and Arinaminpathy

(May and Arinaminpathy, 2010). The second factor

means that minimum capital ratio is required. The

third factor describes a situation where a company

cannot cover its lack of funds in the short-term money

market.

4 THE MODEL IN THIS STUDY

4.1 Outline

Each agent has its own balance sheet. Marketable

asset price follows the transition of probability differ-

rence equation. We analogize a network to a complete

graph. Each financial institution updates its balance

sheet when an agent completes a trade with another.

The goal of this study is to analyse systemic risk

change due to mergers between financial institutions.

By introducing purchase method, we can deal cases

where the purchase amount is larger than the assets of

a merged company. In addition, systemic risks are

examined by changing the decline rate of marketable

asset price.

4.2 Agents

We use the same modelling framework as the one in

(Kikuchi et al., 2016), whereby each bank has a

simplified balance sheet. Each balance sheet consists

of the following factors. Compared with Kikuchi’s

model, our model has two more parameters,

combination by purchase and goodwill, as shown in

Table 1.

ICAART 2018 - 10th International Conference on Agents and Artificial Intelligence

170

Table 1: Balance sheet items of banks.

Parameter

Label

1) Marketable Asset

2) Non-Marketable Asset

3) Debt

4) Equity

5) Deposit facilities

6) Short-term investment

7) Short-term funding

8) Combination by purchase

9) Goodwill

Financing gap is then defined as below:

(1)

Surplus/Shortage institutions are defined as below:

{

|

}

(2)

{

|

}

(3)

Note that the status of each bank remains unchanged

from first step to final step.

We also define unrealized profit or loss (

),

capital adequacy ratio (

), income profit (

) and

ROE (

):

(4)

(5)

Where and denote the rate of return for

marketable and non-marketable assets respectively.

Marketable assets are then defined as below:

(6)

is the market price of marketable assets in step t.

Next, we explain the process of a merger between

randomly chosen two banks before trading on the

interbank network. A bank with more assets acquires

another bank with smaller assets. The purchase price

of banks and the goodwill value are defined as

follows.

First, we examine whether one bank can buy the

other by the total capital amount.

(7)

If the bank cannot acquire the other, the model

will choose another combination of banks.

When an acquisition is confirmed as executable,

our model determines the amount of goodwill. We

define as Marketable asset price of acquisition j:

, Non-marketable asset of acquisition

j:

, debt of acquisition j:

Then the amount of goodwill (

) shall be

determined as follows.

(8)

In addition, our model defines minimum capital

adequacy ratio (CAR-

). It is the lowest level

of the bank’s capital ratio to be an eligible borrower.

4.3 Network

We use the same modelling framework as the one

proposed by Kikuchi et al. (2016). Bank

engages

in short-term investment and funding with other

financial institutions

(9)

and tries to eliminate its funding gap. Then,

is the

adjacency matrix of the I/B network.

4.4 Financial Behaviour

First, a shortage institution

issues financing orders

to surplus institutions

Additionally,

places an order to all surplus

institutions in the interbank network by evenly

splitting the amount of its financial gap.

checks the

financial condition of

and the amount available for

lending to it to judge the feasibility of the loan to

.

4.5 The Effects of Bankruptcy

4.5.1 Individual Bankruptcy

If the capital ratio is equal to or less than the threshold

value, or, if the funding gap is not filled,

shall be

deemed “bankrupt” in our model.

Additionally, banks became bankrupt by either

the above criteria through the same step is defined as

. Thus the following case is defined as “multiple

simultaneous collapse”:

(10)

4.5.2 Chain Reaction Collapse

If financial institution

experiences bankruptcy,

financial institutions

that are involved in short-

term operations with

end up with uncollectible

Agent-based Simulation Model Embedded Accounting’s Purchase Method; Analysis on the Systemic Risk of Mergers and Acquisitions

between Financial Institutions

171

funds from these investments. In this model

uncollectible funds by the transactions with

are

deducted from

capital.

(11)

If the following conditions are satisfied, some

of

banks suffer bankruptcy. In this way a chain

reaction collapse occurs.

(12)

5 ANALYSIS OF MODEL

BEHABIOR

5.1 Price Time Series of Marketable

Assets

Market price provides the basis for the time series of

marketable assets used in the simulation, and is

calculated using the following discretized stochastic

differential equation (Luenberger, 1997).

(13)

Where t is time step(t=-m+1, … ,0,1,…,T ),

j: is trail number,

is price of marketable

asset(j times, step t)(

=100),

is risk free rate[%],

is volatility [%], and . In this simulation,

we set 1 step = 1 day = 1/250 year and

125 (assuming 6 month is the budget-

closing period for a bank account). Additionally,

taking into account long-term government bond yield

levels and stock markets in each country:

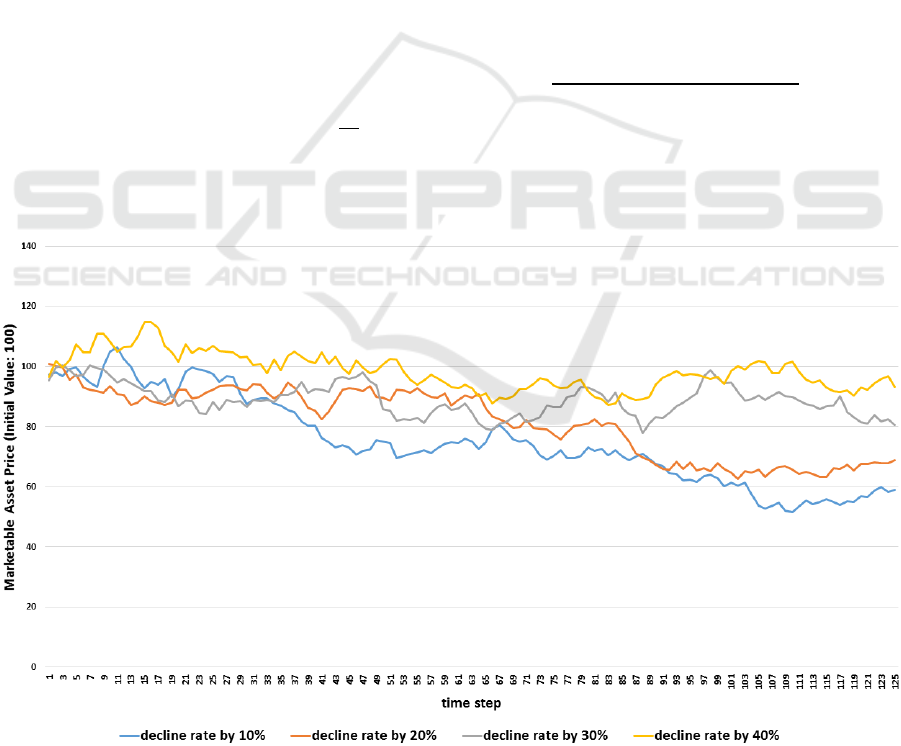

sample paths are generated and

we adopt marketable asset price decline rate by 10%,

20%, 30% and 40% from the initial value.

5.2 Common Setting

The common setting of parameters is shown in the

simulation Figure 5. There are 20 financial

institutions in total, and I/B network is a complete

graph. In terms of financing gap, since surplus

institutions outnumber shortage institutions, surplus

institutions are subjected to the following adjustment:

(14)

Moreover, following assumption is made:

Figure 4: Price time series of marketable assets employed in this simulation totalled 1,000 trials and we adopted the decline

rate by 10%, 20%, 30% and 40% prices from the initial value.

ICAART 2018 - 10th International Conference on Agents and Artificial Intelligence

172

5.3 Check the Model

When marketable asset price fall by 40%, we carry

out one set simulation shown in the Figure 5. Figure

7 shows the number of remaining banks. In this

experiment, 6 out of 20 banks remain in the final step.

In this experiment, continuous failure has occurred at

the

step and involving 10 banks’ continuous

bankruptcy has occurred at the

step. This chain

collapse is similar to the previous study. One

bankruptcy causes another, which leads to still others.

Some banks cannot keep capital and this brings

further bankruptcy. As a result, a chain of bank

failures occurs.

Figure 5: Parameter set used for this simulation.

Figure 6: Parameter rationale.

5.4 Impact Analysis by Bank Merger

We use the same modelling framework as in the

Kikuchi’s model (Kikuchi et al., 2016), and expand it

to introduce bank mergers by purchase method. We

investigate the impact of mergers between banks

amid declining marketable asset prices. We assume 4

patterns of decline rate of marketable asset price. It is

a pattern that falls by 10%, 20%, 30%, 40%

respectively from initial price. Simulation is carried

out 100 times and the average number of bankruptcy

banks is compared with the decline rate of asset price.

Figure 7: Changes in the number of remaining banks in individual trials.

Agent-based Simulation Model Embedded Accounting’s Purchase Method; Analysis on the Systemic Risk of Mergers and Acquisitions

between Financial Institutions

173

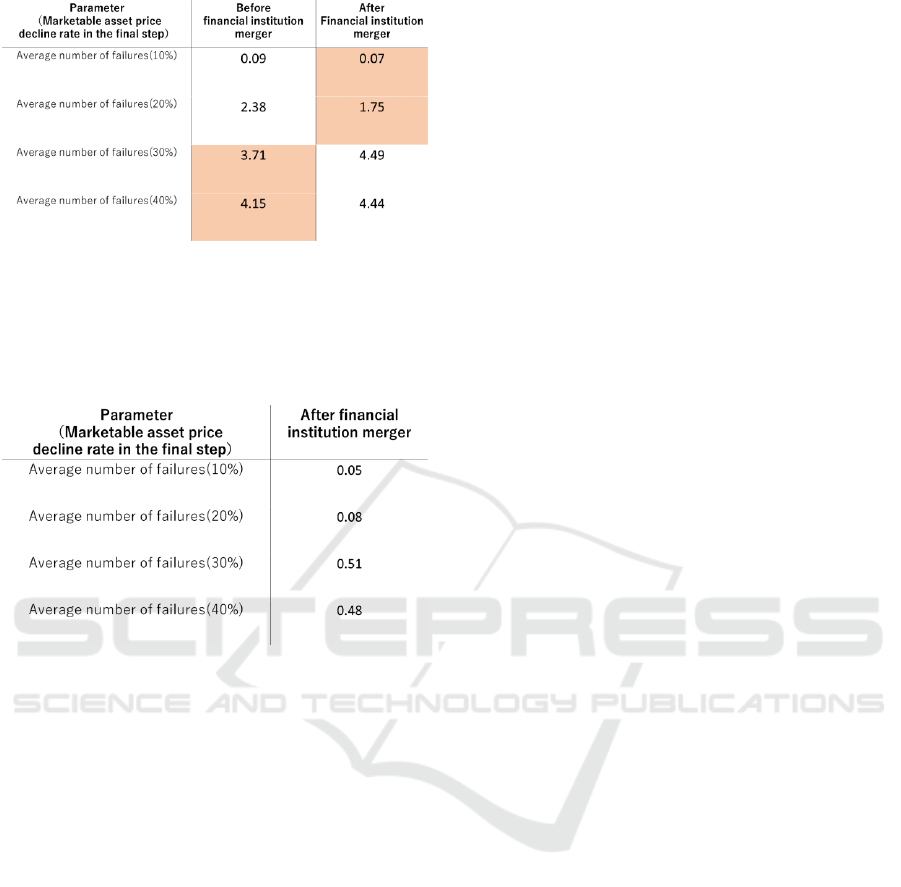

Figure 8: Changes in the average number of bank failures.

The data in Figure 8 shows that when the decline

rate of asset price is low, it is very effective for

financial system to implement a merger and that when

the decline rate of asset price is high, it is not effective.

Figure 9: Number of bank failures by 4 falling asset price

patterns.

Figure 9 shows the average number of failures of

integrated banks. When the decline rate of marketable

asset price is 20%, such bank failure is 0.08. At this

time, it turns out that integrated banks hardly go

bankrupt. However, when it declines more than 30%,

there is a higher possibility that integrated banks will

collapse.

6 DISCUSSION

We discuss the results of the experiment. First, the

number of bankruptcies of financial institutions

increase due to decline in marketable asset price.

From Figure 8, it is found that the higher the decline

rate of asset price becomes, the larger the number of

failures is examined when banks merged. The factor

of the increase in the number of failures is a

deterioration in the capital ratio. It is because some

banks cannot raise funds due to worsening capital

ratio rate, even if banks conduct merger.

Next, we discuss Figure 9. When the decline rate

of asset price is high, half of banks go bankrupt. There

is almost no improvement in the capital adequacy

ratio due to merger.

On the other hand, when the decline rate of asset

price is low, it is better for bank to implement a

merger. Figure 6 shows that the number of failures is

greatly reduced due to merger. By strengthening

capital, the number of financial institutions of going

bankrupt declines. In other words, as shown in Figure

7, the decline rate of asset price is less than 20%, the

banks hardly go bankrupt. A possible contributor to

this finding may have been amount of capital. Banks

after merger have more capital than other banks.

7 CONCLUSION

The main purpose of this study is to examine whether

goodwill brought about by the merger and acquisition

prevents the go-bankrupt-in-chain in the interbank

market.

The most important finding of this study is that if

the marketable value asset prices plummet sharply,

the effect of merger is small.

Another key finding is that the decline rate of

marketable asset price determines bankruptcies.

The data in Figure 8 shows that the number of

failures has been greatly reduced due to merger.

When the decline rate of asset price is low, it is better

for bank to implement merger.

The results of this study imply that by

strengthening capital, a possibility of financial

institutions of going bankrupt declines.

In addition, as shown in Figure 9, if the decline

rate of asset price is less than 20%, banks have hardly

go bankrupt. A possible contributor to this finding

may have been amount of capital. Banks after merger

have more capital than other banks.

We examine the effects of goodwill (Noren) that

have received very little attention in the literature.

ACKNOWLEDGEMENTS

This work was supported by JSPS KAKENHI Grant

Numbers JP16K12411, JP17H04705.

REFERENCES

Acharya, V., Engle, R. and Richardson, M. (2012). Capital

shortfall: A new approach to ranking and regulating

ICAART 2018 - 10th International Conference on Agents and Artificial Intelligence

174

systemic risks. The American Economic Review, Vol.

102, No. 3, pp.59-64.

Arinaminpathy, N., Kapadia S. and May R. (2012). Size

and complexity in model financial systems. Proceed-

ings of the National Academy of Sciences of the United

States of America, Vol.109, No.45, pp.338-pp.343

Common challenges spur merger of Japan’s Mie bank,

Daisan bank (2017). NIKKEI ASIAN REVIEW,

http://asia.nikkei.com/Business/Deals/Common-challe

nges-spur-merger-of-Japan-s-Mie-Bank-Daisan-Bank.

Degryse, H. and Nguyen, G. (2007). Interbank exposures:

an empirical examination of contagion risk in the

Belgian banking system. International Journal of

Central Banking, Vol.3, No.2, pp.123-171

Freixas, X., Parigi, B. and Rochet, J.C. (2000). Systemic

Risk, interbank relations, and liquidity provision by the

central Bank. Journal of Money, Credit, and Banking,

Vol.32, No.3, pp. 611-638.

Hashimoto, M. and Kurahashi S. (2015). The analysis of

Systemic Risk Index effects under Inter-bank

transactional network. Joint Agent Workshop &

Symposium 2015 (JAWS2015), pp.108-115.

Japan’s regional bank consolidation gains momentum

(2017). Nikkei Asian Review, http://asia.nikkei.com/

Business/Trends/Japan-s-regional-bank-consolidation-

gains-momentum.

Kikuchi, T., Kunigami, M., Yamada, T., Takahashi, H. and

Terano, T. (2016). Agent-based simulation analysis on

investment behaviours of financial firms related to

bankruptcy propagations and financial regulations. The

Japanese Society for Artificial Intelligence, Vol.31,

No.6, ppAG_G1-11.

Luenberger, D.G. (1997). Invest Science. Oxford

University Press.

Maeno, Y., Morinaga, S., Matsushima, H., and Amaya, K.,

(2012). Risk of the collapse of a bank credit network.

The Japanese Society for Artificial Intelligence, Vol.27,

No.6, pp.338-346.

May, R. and Arinaminpathy, N. (2010). Systemic risk: the

dynamics of model banking system. J.R. Soc. Interface,

Vol.7, No.46, pp.823-838.

Saito, S. (2014). Financial Accounting. Yuhikaku

Publishing, pp.11-24, Tokyo, 4

th

edition.

Agent-based Simulation Model Embedded Accounting’s Purchase Method; Analysis on the Systemic Risk of Mergers and Acquisitions

between Financial Institutions

175