Market Design for Renewable Energy Dissemination

Jun Maekawa

1

and Koji Shimada

2

1

R-GIRO, Ritsumeikan University, Shiga, Japan

2

Faculty of Economics, Ritsumeikan University, Shiga, Japan

Keywords:

Electricity Market, Renewable, Economics, Mechanism Design, Finance.

Abstract:

Renewable energy has less environmental i mpact and little marginal cost. Due to this nature, it is desirable

to disseminate it from the viewpoint of economic effici ency. On the other hand, because of the uncertainty

of the supply of renewable energy and the specialty of electricity as goods, it is difficult to achieve efficient

allocation even if the normal competitive market is applied as it is. Problems such as how to secure power

capacity and how to deal with the risk of power outage are concerned in European countries that have already

adopted measures to cope with these problems in practice. These problems suggest that a new market design

is required for the power market.

1 INTRODUCTION

Since the 20th cen tury, various technologies wer e

developed to respond to the increasing demand for

energy. However, it remains as a negative heritage

such as environmental pollution c aused by fossil fuel

power generation and accidents caused by nuclear po-

wer generation and issues for the 21st century society.

In Japan, the declining birthrate and the aging of so-

ciety will proceed and it will be difficult to achieve

sustainable development. One of the most important

tasks of the society is energy sustainability including

resource and safety. While as the population decre-

ases, the energy consumption in the industrial sector

can decrease, on the other hand, the mechanization

to compensate for the decrease in workers progresses,

the energy consumption accompanying this c an incre -

ase conversely. It is necessary to incorporate it into

society in a sustainable manner. Renewab le energy

has already been used as one of th e major energies

in various countries including Europe, North Ame-

rica, Cana da and elsewhere. Also in Japan, after the

nuclear accident, the spread of renewab le energy has

become a national consensus. Japanese government

began the liberalization of electric power, and seek

the way how to disseminate renewable energy in that

market.

In orde r to disseminate renewable energy in the ele c -

tric power market, it is necessary to deal with various

problems. We outline the past research to deal with

problems accompanying the introduction of renewa-

ble ene rgies into the electricity market, and show the

future prospect. The composition of the paper is as

follows.

Section 2 briefly outlines the curr ent state of renewa-

ble energy and the electricity market in several coun-

tries. We will intro duce examples of European coun-

tries, and the US which h ave already introduced libe-

ralized power markets and are proactively promoting

the spread of renewable energy. In addition , we will

introdu ce the cases in Japan aiming at dissemination

of renewable energy.

Section 3 explains the basic theory of the ele c tricity

market. We will explain the point different from the

goods handled in ordina ry economics, such as in elas-

tic demand curve and the difficulty in saving, while

reviewing previous research. The specificity of the

electricity market is a factor hindering efficiency, and

understanding this is indispensable to consider the in-

troduction of renewable en e rgy.

Section 4 explains various problems caused by intro-

ducing renewable energy and introd uces previous re-

search including capacity market. Renewable ene rgy

such as solar photovoltaic and w ind p ower is high ly

uncertain because essentially the amount of supp ly

depends on weather and other c hanging environment.

How to deal with the unc e rtainty is required when de-

signing the market. Based on the above points, we

will look at w hat kind o f market design is necessary

to promote renewable energy.

320

Maekawa, J. and Shimada, K.

Market Design for Renewable Energy Dissemination.

DOI: 10.5220/0006786703200324

In Proceedings of the 7th International Conference on Smart Cities and Green ICT Systems (SMARTGREENS 2018), pages 320-324

ISBN: 978-989-758-292-9

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 THE CURRENT STATE OF

RENEWABLE ENERGY

Western European countries can be said to be the most

developed country of renewab le energy among the

world. They carried out various renewable energy

promotion policies and called fo r active investment

in mega solar, large offshore wind power plant and

so on . In Spain, there exists a large amount of wind

power plant, which generate 19% of total electricity.

Moreover, they have about 40% sh are of renewable in

electricity generation in 2015.

Germany also achieve 25% in renewable, also in the

sunlight and wind power. German Chancellor Merkel

pledged to stop all nuclear power plant and to raise

the ratio of renewab le energy to 35% by 2020. Alt-

hough it was temporalily aff e cted b y the fixed pur-

chase system and suffered from the electricity price,

at the p resent time it also converged and is about to

turn into a most developed renewable using country.

Scandinavia is a region with high motivation for re-

newable energy alongside Western Eur ope. Denmark

has traditionally used coal imp orted from Russia, but

in recent years it has focused on the intro duction of

renewable energy, especially wind p ower gene ration,

in order to lower its dependence on Russia ing. Cur-

rently only wind power generation covers 40.6% in

2014. Similarly, Norway has mostly generated po-

wer by hydropower and Iceland, which has a special

geogra phical environment, pro duces 28.9% of the po-

wer in geotherm a l power generation, boasting a 100%

power generation share only by hydropower and ge-

othermal power.

Although it is a US ric h resource such as shale gas, the

introdu ction of renewable energy is also p rogressing.

In fiscal 2015, they have a share of 12.9% with rene-

wable energy. Th e United States is still sh a re target

of renewable energy at the federal government level

is not set, many of the state governments are doing

a voluntary RPS set. Especially famous is the goal

of California State’s 33% by 2020 (inc luding hydroe -

lectric power genera tion and nuclear power not inclu-

ded). Former President Obama planed to double the

renewable energy ge neration volume by June 2013 in

the Action Plan on Global Warming Countermeasures

by 20 years, while the state government plans to dou-

ble the renewable energy generation amount in De-

cember and instructed to raise the ratio of renewable

energy to electricity consumption to 20%, which is

more than twice the current level b y 2020.

Japan is now at a major turning point of energy ad-

ministration. From the impact of the Fuk ushima nu-

clear power plant accident all nuclear power plants

are stopped an d depend on imports for most of raw

materials such as petroleum and natural gas. In this

situation, despite the large incentive to introduce re-

newable energy, the current ren ewable energy ratio is

only 12.2%, only 3.2% except for hydrau lic power.

It can be said that it is considerably behind compared

with the introduc tion situation of developed countries.

Meanwhile, the trend toward liberalization of electric

power is also slow, retail liberalization has finally just

begun in 201 6. Th e government is currently pursuing

the liberalization of electric power and the spread of

renewable energy in parallel under the Tohoku eart-

hquake and the Fukushima nuclea r power plant acci-

dent, but the resistance and the like of existing elec-

tric power companies are also large, and the outlook

is uncertain.

3 OUTLINE OF ELECTRICITY

MARKET

Power supply was commonly m onopolized by go-

vernment and g overnment enterprises. However, as

monopoly restrained price competition and the incen -

tive f or techn ological development to be born became

problematic, liberalization tried in the United States

from arou nd 19 90.

It was technological pr ogress that supported the trend

of libe ralization. Electricity business has been regar-

ded as rational because monopoly was co nsidered re-

asonable economically because it was thought that it

is difficult to indiv idually manage shipping charges.

However, due to the development of a gas turbine that

can be installed at low cost, and the ad vancement of

the inf ormation industry has made it possible to ope-

rate a large amount of electric power, technological

liberalization became possible.

Started experimentally in the United States and the

UK fr om the 1990s It is somehow liberalized in about

half of the world by 2010. On the other hand, it is es-

timated that liberalization is the cause, like Califo rnia

big blackout th at occurred from the summer of 2000

to the following year. A consensus has arisen as to

whether some mec hanism is necessary.

Electricity has characteristics not found in ordinary

goods First of all, as the biggest feature, savings may

require high costs. Many o f the problems related to

electric power are generated from this fe a ture. If the

supply amount exceeds the demand amount, it can not

be stored, which may cause power failure. Also, be-

cause it is costly to throw out excess electricity, it is

traded at a negative price, or repurchased by the po-

wer generation company may occur.

Since the marginal co st is almost constan t with the

same p ower generation method, the power generation

Market Design for Renewable Energy Dissemination

321

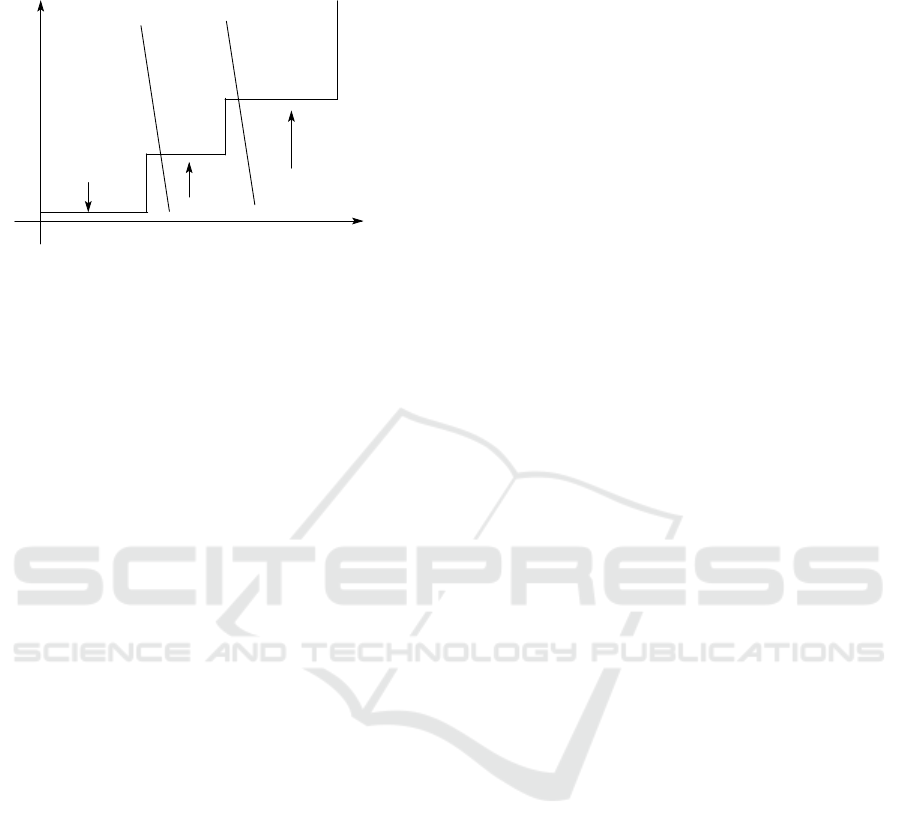

Price($/MWh)

MWh

Supply Curve

Nighttime Demand

Daytime Dema nd

Renewable

Nuclear

Thermal

Figure 1: Electricity Market.

company efficiently generates power to the limit in a

way that marginal cost is low according to demand.

This representation is called m erit order curve. Rene-

wable energy such as sunlig ht, wind power, and hyd-

roelectric power is loca te d at the left end in the mer it

order curve bec ause there is little margin al cost. From

there, it is in line with nuclear power, coal, oil and na-

tural g as. This is the supply curve of the power mar-

ket.

Power dema nd is also characteristic. It is known that

electricity demand is very inelastic to price. Natu-

rally, it is a major reason why electricity is an essen-

tial item. Electric power is one of the infrastructu re

of modern society, a nd it is very difficult to live wit-

hout electric power in developed countries. It is also

affecting that almost no electricity can be saved. If

electricity can be saved at low cost, it will be flexible

with respect to price a s it is possible to buy electri-

city when the price is cheap and to consume when the

price is high. Also, although it is inelastic to price, the

amount demanded increases and decreases greatly de-

pending on time of day and season. It is n e cessary to

move the personal computer in the office during the

day and turn on the lights in the room, and it is ne-

cessary to adjust the temperature by turning on the air

conditioner in the summer and winter.

The nature of such demand has naturally been a ma -

jor factor justifying the supply side’s monopoly. It

seemed that centralized control is necessary because

the supply must be adjusted in preparation for the in-

crease or decrease in demand.

Since the supply and deman d of electric power must

be consistent, it is necessary to provide high power ca-

pacity in case of high demand. However, consumers

are unaware of the outage cost and power capacity has

a prope rty as a kin d of public good, so it is difficult to

secure adequate power capac ity in the normal electric

power market. Mechanism other than the electricity

market that secures capacity is called capacity mecha-

nism. Because it occurs mainly with the expansion of

renewable energy, it will be explained in detail in the

next cha pter.

Also, the tr a nsmission system is a ma tter not treated

in normal economics. There is a limit to the electric

power that can be transmitted at one time , and if it is

overloaded, it will cause power failure. In addition,

econom ie s of scale are strongly presen t and often be-

come factors for monopoly of power companies. For

this reason, in many countries, e le c tricity transmis-

sion and separation has been carried out, and power

transmission companie s are required to have strong

neutrality.

By introducing renewable ene rgies, more ser ious pro -

blem occurs. We introduce two main problem, insta-

bility and capacity.

4 THE MECHANISM DESIGN

FOR RENEWABLE ENERGIES

The supply of ren ewable energy, especially sunlight,

wind power generation is susceptible to weath er.The

instability of renewable energy is a major disadvan-

tage because th e re is a chara c te ristic that power sup-

ply must always b e c onsistent with demand. In order

to disseminate renewable energy in the power mar-

ket, a mechanism to cope with this instability is in-

dispensable. Until now, this instability did not be-

come a problem because thermal power generators

etc., wh ic h can flexibly control the amount of power

generation, occupied a large proportion of power ge-

neration. However, in Germany and other advan ced

energy-conserving cou ntries, the ratio of renewable

energy has increased, so negative charges frequently

occur in the power spot market.

Firstly, the unstable supply of renewable e nergy indi-

cates that the cost for adjusting supply and demand

will increase. It is necessary to be able to tra de elec-

tricity until just before ge nerated. Furthermore, it is

important to increase the liquidity of electricity. Som e

researcher investigated the wind power genera tion in

Germany poin ted out the importance of increasing the

liquidity of electricity(Holttinen(2005 (1), Ummels

et. al(2006) (2)). Naturally, as prediction accuracy

increases as ap proaching that day, being able to trade

electricity to a po int just before electricity in even fi-

ner tim e period will increa se the liquidity of electri-

city.

In countries with advanced electricity liberalization,

such as Europe, most power trading is traded in the

market a day ago, but the inconsistency of ex post fac-

tual supply and demand has been adjusted in the im-

balance market on the day. It is necessary to advance

such market design. Also, tradin g is possible in units

SMARTGREENS 2018 - 7th International Conference on Smart Cities and Green ICT Systems

322

of 15 minute s. Also, in order to cope with instabi-

lity, it is also possible to deal with by placing a trans-

mission network. In Eu rope, as a Cong estion Ma-

nagement, cooperation lines with neighboring coun-

tries exist, power trading is flexibly carried out, and

imbalance due to power gene ration with large fluc-

tuations like renewable energy is being handled(see

ETSO(2006) (3)). Although basic transmission po-

wer plan is decided the previous day, it responds to

the last cha nge through transaction.

Besides instability, there is a problem of how to secure

capacity. Renewab le energy is u nstable, but since

marginal costs are hardly applied, once fixed costs

are paid, it is possible to supply ele ctricity at a very

cheap price. As a result, it is co nceivable that electric

power having a high marginal cost in the electric po-

wer market, for example, fire power, is driven out of

the market.

Severa l mechanism are implemented in Capacity Pro-

blem. In normal microeconomics, entr y and exit from

the market through such price is essential to achieve

efficiency. However, electricity like thermal power

has advantages as a flexible power source tha t c an ea-

sily control the amou nt of power generation as neces-

sary. Renewable energy is unstable, so it is not always

possible to supply sufficient power. There is a possi-

bility that the electric power supply must always b e

consistent with the demand, so there is a possibility

that a system for preparing for a situation of power

tightness m a y be necessary(Joskow(2008) (4 ),Cram-

ton(2013) (5)).

It is difficult to achieve efficient allocation even if the

ordinary comp e titive market is applied as it is. There

are co ncerns abo ut how to secure electricity capacity

in Europe a n countries that are actually proceeding,

and how to deal with negative electricity prices due

to oversupp ly. On the other hand, focusing on sys-

tems far from the market against such problems. For

example, to solve the problem of pushing out thermal

power generation, policies such as separately prepa-

ring a standby power supply are taken. However, it is

undesirable for the government to intervene inadver-

tently in economics as it c auses inefficiency.

If we take advantage of the k nowledge of economic s

from now on, it will be necessary to take two view-

point of mechanism design and finance.

Mechanism Design is one of the most powerful tool

in economics. The goal is find ing the system or rule

which bring the efficient allocation.

For example, in auction theory, we can get the effi-

cient allocation by secon d-price or first price auction.

In these auction , bid ders have incentives to tell the

true value about the goo ds and the efficient allocation,

in which the m ost high est bidder win, is achieved by

these information.

For example, several capacity mechanisms such as

Strategic Reserve, Capac ity Payment, Capacity Obli-

gation, Reliability Option are implemented. In any

mechanism, the government or the capacity market

measure the vlaue of c apacity and determine the pay-

ment to the supplier of cap acity.

In eac h mechanism, increasing the capacity is incen-

tive compatible for the suppliers. In the libe ralization

of electricity, efficient allocation is achieved only if

consumers and suppliers’ inc entive are satisfied. In

the the ory of mechanism design, we can find th e effi-

cient allocation with th e incentive of players. Mecha-

nism design is a nece ssary theory basis in electr ic ity

market.

There is also a stro ng persistence of the idea that capa-

city should be secured through the electricity market

(Energy Only Market, EOM). For example, Texsus

state’s policy is based on EOM and th e reserve power

rate decrease in recent years.

For the instability problem, financial economics is

useful tool. In financial economics, we can treat in-

stability of asset re turn as a risk. Currently electri-

city is trimmed in approximately 1 hour o r 30 minutes

blocks. So, electriccities can be trad ed as time depen-

dent goods. We can denote the time t electricity as x

t

.

If renewable energies increase, x

t

varies. Let x

t j

be

the electricity at time t and state of enviroment j. j ex-

press the daylight hours, the rainfall, wind speed etc.

For covering the risk, we need more various trade. In

econom ic theory, efficient a llocation can be achieved

if we can trade every x

t j

(Arrow-Debreu Economy).

However, it’s impossible to create all state electricity

market. There are infinite envir onmental conditions

j.

Financial economics have many tool for treating x

t j

As for assets such as stocks, land, corporate bonds

and government bonds, the profit varies greatly. The

problems like how to cope with such fluctu ations or

how to reduce the risk or who is responsible for the

risk is the fundamental consciousness of finance.

Since electricity is not simp ly a tradable item, it is also

necessary to think in the field of mechanism design.

Mechanism design is a field that considers efficient

resource allocation methods that are not only in the

market, as represented by a uction theory. There are

still many field s in economics th at can be applied to

research on electricity markets and renewable energy,

such as fin ance a nd mech a nism d esign.

It is desirable for society to build a theory to compre -

hensively analyze not only theories as current com-

plementary tools but also the electric power market

and ren ewable energy itself right.

Market Design for Renewable Energy Dissemination

323

REFERENCES

Holttinen, H.(2005) Optimal Electricity Market for Wind

Power Energy Policy, 33, pp.2052-2063

Ummels , B.C. et al(2006) Integration of Wind Power in

the Liberalized Dutch Electricity MarketWind Energy,

9.pp579-590

ESTO(2006) An overview of Current Cross-Border

Congestion Mangement Method in Europe

https://www.entosoe.eu./filedmin/

user

upload/ library/publications/etso/

Congestion

Mangaement/

Current

CM methods update%202006%20.pdf

Joskow, Paul, L(2008) Capacity Payments in imperfect

electricity markets: Need and Design Utilities Policy,

Vol 16, pp159-170

Crammton, P., Ockenfels, A., and Stoft, S.(2013) “Capa-

city Market Fundamentals”, Economics of Energy &

Environmental Policy, Volume 2. Number 2

SMARTGREENS 2018 - 7th International Conference on Smart Cities and Green ICT Systems

324