Face-based Passive Customer Identification Combined with Multimodal

Context-aware Payment Authorization: Evaluation at Point of Sale

Adam W

´

ojtowicz and Jacek Chmielewski

Department of Information Technology, Pozna

´

n University of Economics and Business,

al. Niepodległo

´

sci 10, 61-875 Poznan, Poland

Keywords:

Context-aware Authorization, Payment Authorization, Passive Identification, Multimodal Authorization, Face

Recognition.

Abstract:

In smart environments, fast passive transaction authorization is a key requirement for routine, recurring trans-

actions. In our earlier work technical feasibility of multimodal multidevice system based on context-aware

payment authorization model has been proved. Its main features are: passive user identification with face

recognition followed by multi-criteria selection of transaction authorization methods, which jointly modify

traditional customer service procedure. In the presented work, real-world evaluation of the new approach

based on proposed multimodal payment authorization is described. Empirical tests at existing point of sale

have been performed, the usage data have been collected, statistically analyzed and confronted with formu-

lated research hypotheses. The research goal is to determine to what extent the approach simplifies payment

process assuming the security level required for a given context is maintained. The evaluation confirms that

proposed approach can be effective in a real environment.

1 INTRODUCTION

Nowadays a great percentage of payments is made on-

line, without physical presence at a brick-and-mortar

point of sale (PoS). However, there is still a need to

perform in-person transactions as one moves through

a city: a morning coffee on a way to work, a quick

snack at a vending machine, products at a local gro-

cery store, fuel at a gas station, etc. The most con-

venient payment method is payment with contactless

card. For payments below a certain amount, the client

only has to take out the card and hold it for a sec-

ond above a terminal. However, this payment method

has its drawbacks: for higher amounts it requires

knowledge-based authorization – i.e. PIN, and the

client still needs to find her wallet, take out the card

and use it on the terminal. This inconvenience is es-

pecially significant for recurring transactions, where

small annoyances add up over time. In this work re-

curring transaction is defined as a payment performed

by a client multiple times in similar timespans (e.g.

daily, specific days of a week), in the same place (par-

ticularly, authorizing multiple small orders during sin-

gle visit) or at the same vendor (but at a different lo-

cation), and for a similar amount.

In work presented in (W

´

ojtowicz and

Chmielewski, 2017) it is assumed that multiple

devices (mobile or stationary, client’s or seller’s) can

be used contextually to simplify the payment process

as much as possible, optimally to make it fully

passive, while maintaining the necessary security

level. The system takes advantage of the ability

to recognize the context in which users perform

various transactions, which is unique to pervasive

environments. In order to dynamically determine the

optimal trade-off between security and convenience,

context-based risk and trust assessment model has

been developed. The focus is especially on routine,

recurring transactions that constitute patterns of

payments for transaction history of almost all users

of pervasive environments. The simplification of the

payment process concerns reducing the execution

time of the process and minimizing the number of

operations required to be performed by the client.

The system potentially introduces added value for all

actors of the process: payment operator (PO), seller

(service provider), and the end-user.

By providing end-users and sellers with trusted

and effective payment service, the PO reduces secu-

rity concerns from all sides and can attract newcom-

ers. The tool for dynamic assessment of the type

of payment (routine / non-routine) goes beyond the

model adopted for contactless payment cards (hard

limit quota). By using the transaction context and dy-

Wójtowicz, A. and Chmielewski, J.

Face-based Passive Customer Identification Combined with Multimodal Context-aware Payment Authorization: Evaluation at Point of Sale.

DOI: 10.5220/0006798105550566

In Proceedings of the 20th International Conference on Enterprise Information Systems (ICEIS 2018), pages 555-566

ISBN: 978-989-758-298-1

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

555

namically assessing payment risk level and trustwor-

thiness of the participants, the system dynamically se-

lects the most appropriate authorization methods of

the payment. Rules for dynamic selection take into

account the various authorization methods supported

by client devices, as well as methods supported by

other devices in the end-user environment, e.g. pas-

sive face recognition at a seller’s location. It is possi-

ble to use multiple authorization methods simultane-

ously, which, if necessary, allows for greater autho-

rization robustness. All this enables a controlled bal-

ance between security and convenience of payment

for the client and the seller. On the other hand, con-

trary to proprietary approaches, the assumption of the

openness is not violated in the proposed approach.

The functionalities of sellers’ and PO’s services are

not coupled together, thus competition between dif-

ferent sellers is possible which can leverage quality

of services within the whole PO network.

From the point of view of the seller, the key advan-

tage is the fact that the customer has to be identified

for the purpose of payment at the beginning of the

transaction. This information may be used to intro-

duce improvements in the customer service process.

By moving the moment of identification to the be-

ginning of the service process and by providing the

seller’s sales / loyalty system with information about

customer identification, it becomes possible to use a

wide range of tools to support personalized service re-

gardless of the knowledge and memory of individual

employees serving clients.

Most of all, introducing the presented approach is

beneficial for the end customer. She gains on every

functional element of the system. Starting with fast

and convenient realization of routine payments and

the ability to use convenient authorization methods

for non-routine payments, to full personalization of

service and automation of loyalty procedures. In the

routine payment scenario, the client orders products,

receives the merchandise and leaves without having

to search for any attribute necessary to authorize the

payment.

This work focuses on the analysis of the customer

benefits. The significant element of this work is the

evaluation of the proposed approach with empirical

tests in a real environment. The evaluation is based

on a system for which technical feasibility, design

and implementation is discussed in (W

´

ojtowicz and

Chmielewski, 2017). Evaluation scenario employs

the system servicing regular transactions at PoS of

existing retailer. In the data analysis activities, us-

age data are confronted with four research hypothe-

ses related to security and convenience attributes of

the approach.

The paper is composed of five main sections. Sec-

tion 1 is an introduction to the research problem and

proposed solution. Section 2 provides background in-

formation on existing payment solutions and on user

identification based on face biometrics. Section 3

summarizes functionalities arising from the adopted

business scenario, that guide the design of the pro-

posed solution. Section 4 delivers details on the sys-

tem evaluation, along with posed hypotheses and ex-

periment design. Section 5 contains comprehensive

evaluation results. The final Section 6 concludes the

evaluation and the whole article.

2 RELATED WORK

2.1 Passive Payments in Pervasive

Environments

Making user environment pervasive implies that it be-

comes aware of when and how its services are used.

This enables supporting the users with automation of

routine tasks and procedures. For example the smart

city infrastructure can be used to identify citizen in-

tentions and run operations such as user authentica-

tion in the background, even without explicit actions

performed by the citizen. The presented research is

focused on a particular type of background operations

– automatic payments, which are a crucial feature of

pervasive environments or smart cities. This feature

will be increasingly used for billing users for the use

of city infrastructure, goods or services. This includes

services such as “smart parking”, bridge toll collec-

tion, or public transport.

First “smart parking” systems were composed of

parking stations broadcasting wireless signals to spe-

cialized transponders installed in cars (Hassett, 1994).

The transponder had to be activated manually to start

deducting an amount specified by the parking station

periodically. It was not fully passive for a driver,

however more convenient than cash payments at a

parking station. With the growth of smart city in-

frastructure (e.g. an optical wireless sensor network

(Chinrungrueng et al., 2007) or RFID-based solutions

(Mainetti et al., 2015)) it is possible to automatically

detect when a car stops at a particular parking spot

and when it leaves, thus enabling full automation of

parking payments.

Similar technologies are used for road toll col-

lection. In such a case there is a need to identify a

vehicle crossing a specific point. This identification

can be done automatically with the use of RF identi-

fiers installed in vehicles (Al-Ghawi et al., 2016) or

ICEIS 2018 - 20th International Conference on Enterprise Information Systems

556

by optical recognition of car plates (Ta et al., 2015).

From the point of view of the driver, she simply drives

through the toll collection point and her account is

debited automatically. Such systems can be further

enhanced with sensor fusion, for example to collect

toll based on the number of occupants in the vehicle

(Nakagawa, 2015a) or to become multi-purpose traf-

fic management solutions (He et al., 2015).

The problem of enabling automatic payments be-

comes more complex, when there is a need to iden-

tify humans, not just objects such as car. An example

of such case is public transport, where each passen-

ger should be ticketed according to her travel. Many

existing solutions require the use of contactless chip

cards or smartphone applications – both of which re-

quire active participation of the passenger in the tick-

eting process (Nakagawa, 2015b). A fully passive

ticketing solutions, so called implicit ticketing, is pos-

sible with BLE (Bluetooth Low Energy) technology,

where the passenger only needs to carry a special BLE

token or a capable smartphone and the payment is per-

formed in the background (Narzt et al., 2015)(Narzt

et al., 2016).

The concept of passive transactions can be ex-

ploited also in the context of citizens using city ser-

vices not related directly to the city infrastructure, for

example: ordering services or documents at a mu-

nicipal office or buying products or services at a lo-

cal retail store. One of notable examples of auto-

matic payment systems in the retail domain is Google

Hands Free (Google, 2015b) proposed by Google.

The Hands Free application uses Bluetooth Low En-

ergy, WiFi, location services, and other sensors on the

user’s device to detect user presence near PoS. This

enables the user to pay hands-free, without getting

out the smartphone or opening the application. Dur-

ing the transaction, verbal declaration of participation

is required from the user (the system is not fully pas-

sive), and identity verification with initials and pro-

file photo from the cashier. Google is also running

early experiments using automated facial identifica-

tion to further simplify the checkout process with in-

store camera.

The payment system that is based on facial recog-

nition to larger extent, called Zero-Effort Payments

(ZEP), has been proposed recently in (Smowton et al.,

2014), where authors interestingly discuss system

evaluation results. The face identification results are

promising, but the recognition is human assisted, i.e.

a ranking of 5 most probable identities is presented

to the human operator and he/she manually chooses

the right one. The recognition process demands a

heavy computational load since a number of faces

are tracked at given moment. Also authors point out

the low face recognition accuracy without support-

ing localization device. In their system BLE localiza-

tion devices are used to significantly reduce the face

recognition error rate. Therefore, it must be noticed

that both Google Hands Free and ZEP are not device-

less systems, i.e. although a user does not need to ma-

nipulate with her device during the payment process,

she needs to carry switched on device during identifi-

cation and customer service.

Also Uniqul system (Anh Tran et al., 2016) has

been deployed to provide fully deviceless payments

authorized with user face image. However, it requires

the user to type a PIN number when face identifica-

tion has a low confidence level or tap the confirma-

tion button on the in-shop tablet in the opposite case.

Therefore, it cannot be considered as fully passive ap-

proach from the end-user perspective.

There are also payment systems based on face

recognition that utilize end-user smartphone camera.

MasterCard has proposed a simple to use mobile so-

lution (Bowyer, 2015) that allows customers to au-

thenticate their online purchases using their own face

images. It refers to the selfie phenomenon, which is

natural for a number of end-users. The application

verifies image authenticity by detecting eyes blink-

ing during image acquisition. MasterCard’s approach

is designed for online shopping, not brick-and-mortar

trade. Contrarily, Lucova, using BLE technology pro-

poses a system called FreshX (Lucnova, 2015) that

also is based on selfie face image authorization, how-

ever it is dedicated for brick-and-mortar cafeterias.

Such approaches, although natural, are neither de-

viceless nor passive, and security concerns can be se-

rious.

There is a number of research and industry effort

related to seamless payments focused on other bio-

metrics than face, e.g. fingerprints, or palm recogni-

tion. For instance Liquid Pay(LiquidPay, 2015) iden-

tifies customers by their fingerprints and, for extra se-

curity, by veins and electrical signals emitted by the

human body. It has been installed in restaurants, fit-

ness clubs and theme parks. Payment systems based

on the Fujitsu PalmSecure technology (Fujitsu, 2011)

recognizing vein patterns in whole palm are being

tested by (Biyo, 2014) or (Lee, 2015) in many cafe-

terias. However, those technologies, although device-

less, stable and relatively mature, cannot be perceived

as passive.

Also, there are significant advancements in the

field of NFC-based contactless payments for EMV

smart cards that have become de facto standard (Al-

liance, 2012) for low-risk transaction authorization in

brick-and-mortar retail trade. Nowadays, this tech-

nology migrates from smartcard to mobile device as

Face-based Passive Customer Identification Combined with Multimodal Context-aware Payment Authorization: Evaluation at Point of Sale

557

a carrier. Mobile services and application such as

Apple Pay (Apple, 2014), Samsung Pay (Samsung,

2015) or Android Pay (Google, 2015a) have been pro-

posed to allow smartphone users for transaction au-

thorization with their devices. However, these solu-

tions mimic traditional card-based payments and are

neither deviceless nor passive.

As a result of the research reported in (W

´

ojtowicz

and Chmielewski, 2017), a transaction system that is

fully hands-free and does not require explicit user ac-

tions for routine payments has been proposed. Simi-

larly to automatic toll collection where one just drives

through a tunnel and her account is debited in the

background one just places the order and leaves with

the merchandise and the payment is performed in the

background. All this in a deviceless manner – based

on the optical recognition of customers using face bio-

metrics. The goal of this work is to present the re-

sults of the quantitative evaluation of the proposed ap-

proach.

2.2 Face Biometrics for User

Identification

Face biometrics gains popularity due to availability

of high resolution cameras, increasing computational

power of image processing devices and development

of pattern recognition and machine learning algo-

rithms. Because of its naturality face biometrics is

more acceptable for end-users than many other bio-

metric methods, but, on the other hand, the ability to

collect face images without user acceptance may raise

privacy concerns.

Generally, face recognition, as in the case of other

biometric systems, consists of three main steps: ac-

quisition of biometric data with a sensor, converting

the data into a digital template, and comparison of

the template with a reference template. In various ap-

proaches recognition can be based on a single image,

image sequence, 3D image, or near-infrared / thermo-

gram image.

Usually, face recognition is preceded by face de-

tection and image segmentation, which are aimed at

cropping face image from a larger image. Image

segmentation can be performed automatically: either

based on knowledge about specific image features

that are common for human faces, or, in case of image

sequences, based on human body movement features,

that allow for detection of so called skeleton and face

localization relative to the skeleton.

After segmentation, the face is recognized by

comparison against an image base. Applying face

recognition to user identification requires using less

accurate one-to-many comparison model, as opposed

to one-to-one model useful for user verification. In

various approaches to face recognition, algorithms are

based either on vectors describing whole face images

or face geometry. In the former algorithm group, the

reduction of face image representation to vectors is

performed in order to preserve the information re-

flecting specific face features and to reject the noise

resulting from e.g. variable lighting. Consequently,

a face image is represented as a linear combination

of simplified base images, namely Eigenfaces. These

methods can be either global (indivisible face), or lo-

cal (distinct representation for different face regions).

In turn, the geometry-based algorithms from the lat-

ter group are able to represent geometrical relations

between selected details (e.g. eyes and mouth) and

to mutually compare whole details sets. Hybrid ap-

proaches combining both face features and face ge-

ometry are also developed.

There are three main groups of research chal-

lenges related to face recognition (Bolle et al., 2013),

i.e. variation of face shape, variation of face acquisi-

tion geometry and variation of face acquisition con-

ditions. Variation of face shape includes short-term

variations related to speaking process or emotion ex-

pression, as well as long term variations related to

ageing, putting on weight, injuries, make-up, facial

hair, haircut and using wearables (glasses, hats). Vari-

ation of acquisition geometry results from variable

distance (scale) and orientation of the face relative to

the camera. Variation of face acquisition conditions

is related to variable camera parameters (e.g. white

balance, noise reduction, etc.) and also to variable

environment conditions (variable or uneven lighting,

occlusions).

3 PROPERTIES OF EVALUATED

APPROACH

In the proposed approach, distributed architecture

with components localized both at the client side and

at the PO side, and to some extent also at the seller

side, is assumed. On the client side BYOD model

is assumed, so on this side only software that inte-

grates with client devices is required. At the seller

side hardware-software solution has been designed

enabling the identification of clients and the use of a

universal API for integration with sales/loyalty sys-

tem of the seller. At the PO side there is a set of

software modules that represent the main elements

of the system logic. It is assumed that the soft-

ware is running on infrastructure of the PO and is

available remotely through a secured communication

channel. Low-level description of components and

ICEIS 2018 - 20th International Conference on Enterprise Information Systems

558

technical feasibility of a system being an implemen-

tation of the presented approach, is presented in the

work (W

´

ojtowicz and Chmielewski, 2017).

3.1 Payment Automation

The idea of payment automation involves freeing the

customer from the necessity of performing any ac-

tive operations related to the payment and transfer-

ring decisions and handling of the payment process

to the side of PO. Obviously, this should not de-

prive the customer of the control over her own re-

sources, thus the automation should require prior ap-

proval from the customer. Payments automation re-

quires interaction between the seller’s and the PO’s

systems. The seller’s system must inform the opera-

tor’s system to initiate the payment (whom and how

much to charge) and at the same time, the operator’s

system must properly inform the seller’s system of ac-

ceptance or rejection of the payment. Detailed data

flow model and communication protocol are elabo-

rated in (W

´

ojtowicz and Chmielewski, 2017). What

is important, it should be possible to maintain the cus-

tomer identification procedure on the side of the PO,

which acts as a “trusted third-party” in the customer–

seller relation.

The postulated payment automation should only

be used for routine payments – i.e., recurring pay-

ments that meet certain patterns and seller-client trust

requirements. In practice, the scope and characteris-

tics of applicable patterns and requirements will be

different for different POs – depending on their ex-

pectations and the data they process. There is no way

to permanently define the thresholds for such require-

ments, because in practice they may be different for

each customer-seller pair and also they may change

over time. Therefore, it is assumed that values of pa-

rameters describing a payment, which include: level

of seller’s trust to the client, level of client’s trust

to the seller, and transaction risk level, are provided

by external systems of the PO (fraud detection sys-

tem, client profiling systems, etc.). Consequently, it

is necessary to use a mechanism that will dynami-

cally evaluate the parameters for a particular payment,

and based on an extensible set of rules will deter-

mine whether the payment can be classified as rou-

tine or not, and if not, which authorization methods

should be allowed to make sure the required secu-

rity level is maintained. The mechanism takes into

account various trust/risk requirements for biometric-

based, possession-based and knowledge-based autho-

rization methods, for active and passive methods, for

methods based on client and seller infrastructure, and

various convenience levels of the particular authoriza-

tion methods.

3.2 Passive Customer Identification

To enable full payment automation it is necessary to

use passive customer identification based on detec-

tion of the presence of a particular person at a par-

ticular location. Detection of the presence of a per-

son may rely on what the person has (an object), or

who she is (biometrics). The third option, based on

what the person knows (the knowledge), is not appli-

cable here, because it requires an active participation

of the identified person. The passive identification

based on objects can be performed, for example, by

the use of radio identifiers (Bluetooth beacon technol-

ogy). However, this approach assumes that the person

identified will always have to carry a relevant object.

Passive method of identification, which seems to be

the best to use in the scenario under consideration, is

therefore biometrics. Face recognition is the biomet-

ric method that can be utilized effectively without the

active participation of the identified person. Method

of this type does not require any specific action on

the part of the customer. Just her mere presence in a

particular place, in this case – on the seller premises,

is sufficient. It is necessary, however, to equip the

seller location with appropriate infrastructure and to

register customer face images in a database. The as-

sumed approach is to maintain the database on the PO

side which is less burdensome for the customer. It re-

quires only a one-time registration of face biometric

controlled by the PO, which could offer the appro-

priate customer identification service for a number of

vendors, e.g. city-wide. At the same time, it appears

that this variant is easier to implement in practice be-

cause of the higher level of trust that customers have

in POs.

For passive identification, face recognition based

on a single image has a number of drawbacks. Apart

from the risk of false matchings that would not be

corrected automatically, such approach would require

an additional effort from the seller side (“taking a

photo”) and would require active unnatural face pre-

sentation from the user. However, it can be assumed

that there is short but continuous time period in which

a user prepares to the transaction (e.g. walks over,

looks through the offer). This few second period can

produce several dozen of face images and this is the

proposed timespan for the initial identification. As an

element of the proposed system, rule-based heuristic

algorithm has been developed in which final identifi-

cation decision is a result of a number of face match-

ings calculated within given time period. Therefore,

a low number of false matchings does not impact the

Face-based Passive Customer Identification Combined with Multimodal Context-aware Payment Authorization: Evaluation at Point of Sale

559

final identification decision. If the data stream intro-

duces a significant portion of new face matchings, the

final identification is gradually improved and seam-

lessly updated on the seller device.

For a single-frame matchings standard Eigenfaces

algorithm is used, c.f. Section 2.2. If a positive

matching takes place, the identifier of the recognized

user is returned along with recognition coefficient X .

Since, as it has been mentioned, single recognitions

can be erroneous, the heuristic algorithm has been in-

troduced into the decision process and it is respon-

sible for the final identification decision. It collects

a number of faces N recently detected (not: recog-

nized or matched to a template) with their X coef-

ficients. The approach based on moving frame has

been applied, i.e. in each iteration N last images are

analyzed, even if in previous iteration some of them

have already been analyzed. The size of the frame is

limited not only by a number of images, but also by

time period, i.e. images are excluded from the frame

if they are too distant in time to be possibly related to

the recognized user (e.g. one minute old).

Such sets of values describing de-

tected/recognized faces are checked for compliance

with three conditions:

1. L

A

> P

1

∗ N (correct recognitions number)

2. L

A

> P

2

∗ L

NonA

(advantage of correct recogni-

tions over misrecognitions)

3. L

X

A

> P

3

∗ L

A

(correct recognitions quality)

Where:

L

A

– number of images in the image sequence of

N images, in which a user A has been recognized with

the best coefficient;

L

NonA

– number of images in the image sequence

of N images, in which users that are not a user A have

been recognized with the best coefficient; it does not

include images in which no user has been recognized;

L

X

A

– number of images in the image sequence of

N images, in which a user A has been recognized with

the best coefficient if the coefficient is less than or

equal to X.

For user A in order to be recognized all three con-

ditions must be fulfilled. Values of heuristic algo-

rithm’s parameters: N, P

1

, P

2

, P

3

and X have been

calculated experimentally (40, 0.2, 1.0, 0.5 and 3700)

– the single conditions are rather loose because of the

conjunction logic of the approach.

Instead of Eigenfaces any other algorithm could

operate underneath the proposed heuristic algorithm.

Eigenfaces algorithm has been chosen to show that

even for relatively simple and obsolete single-frame

recognition algorithm, the proposed approach allows

for fairly robust user identifications in practice. The

key element is taking advantage of a long stream of

individual recognitions, even if they can be ambigu-

ous, in the manner described above in this section.

It is worth noting that as additional criteria im-

proving the recognition accuracy, information ob-

tained at the client side from sensor about face dis-

tance (too distant faces are uncertain), user attention

(rotated faces are uncertain), or user mimics (images

too different from neutral-mimics templates) can be

taken into account. Improved recognition accuracy

would reduce time delays related to unsuccessful data

processing. Also scalability of the solution would be

improved due to reduction of computational power

requirements (lower number of recognitions) and of

communication effort. Similar benefits could be ob-

tained by using pre-recognizers trained to recognized

user height or sex, and thus pre-segmenting the tem-

plate database before actual matching.

4 EVALUATION DESIGN

The evaluation requires conducting empirical tests of

the system in conditions as close to regular as it is

possible. Evaluation scenario assumes that after pro-

totype system is designed and implemented, it is de-

ployed in real PoS that in future could be a cooperator

of the metropolitan service framework, and its usage

data are collected and analyzed. During the analysis

the data are confronted with formulated research hy-

potheses related to system usability.

4.1 Research Hypotheses

For usability evaluation the following four research

hypotheses have been formulated:

H

1

: Automatic transactions provide users with

higher convenience level and similar duration as com-

pared to traditional transactions.

Contactless card payment (estimated approx. 5

second long) has been assumed as a reference tra-

ditional transaction. In the presented approach the

customer service process is changed, from a tradi-

tional sequence: order (Z1) followed by a payment

(P1), into a sequence: passive identification (I2), or-

der (Z2), payment authorization (P2) (cf. Figure 1).

Assuming stages Z1 and Z2 as comparable in terms

of execution time, the goal is to get the total duration

of I2 and P2 equal or less than the duration of P1.

H

2

: Automatic payments reduce number of user

actions undertaken for transaction authorization down

to zero.

H

3

: In the real-world environment using the pro-

totype system will result in more than 80% successful

ICEIS 2018 - 20th International Conference on Enterprise Information Systems

560

Figure 1: Stages of customer service sequence.

face identification attempts. In the group of success-

ful face identification attempts, more than 80% is not

preceded by earlier misidentification.

H

4

: Applying context-based authorization method

selection based on trust, risk and convenience criteria

results in gradually decreasing transaction duration.

4.2 Experiment Setup

In the experiment an existing PoS (local bar “The End

Cafe”) with a group of its regular customers who usu-

ally conduct a typical (routine) transactions has set a

research environment. It has allowed for collecting re-

sults reflecting requirements of intelligent PoS while

maintaining reasonable experiment time and number

of participants.

The system has been used by 22 users (14 women,

8 men), for the period of 16 days (7th to 22nd De-

cember). The participants were selected from existing

clients of the bar that visited it at least 2-3 times per

week, are familiar with internet banking and utilize

contactless payment cards at least once a week. The

age of participants was in the range of 20 to 30. The

bar staff has been informed about the system setup

and trained to use it for customer service properly.

The prototype system has been parametrized to clas-

sify a payment as a routine after two or three simi-

lar payments. In order to allow participants to make

a number of payments, each has been provided with

150 PLN worth electronic wallet. During the exper-

iment participants have spent totally 2837 PLN and

have performed 251 payments, which is more than 10

payments per person.

The participants have made transactions according

to their will and have not been steered nor pushed in

any way neither by staff nor by researchers. At the

same time, logging subcomponents of the system’s

components have been used to log every significant

system event. The events have been defined to build

complete and detailed descriptions of every possible

customer service path. During the experiment nei-

ther technical nor organizational difficulties that could

have impact on the results have been reported.

4.2.1 User Registration

After the participants recruitment, each participant

has been equipped with RFID marker in the form

of card, sticker or fob, and the application instances

have been installed on participants’ smartphones. In

the PO-side component responsible for user identifi-

cation there have been stored sets of face image pat-

terns, which have been registered with a seller-side

component responsible for tracking, acquiring, seg-

menting, filtering, and streaming user face images at

the PoS, according to the strict procedure. Ten differ-

ent (mimics, angles, distances) images of each face

have been collected. It has introduced desired diver-

sity of the training set, also because of different face

lighting on the images of different kind, with differ-

ent face rotation or distance. It has to be noted that

sensor has not been installed in this same horizontal

axis as typical location of user face, but slightly above

and rotated. This also has had impact on requirements

regarding diversified orientation of the faces in the

training set (both “ahead” and “slightly upwards, to-

wards camera”). During initial tests it has been con-

firmed that three-quarter views decrease recognition

accuracy and therefore they have been excluded from

training process. Detected faces have been visually

outlined, which facilitates choosing optimal acquisi-

tion moments, so that operator has a control over the

training set quality (framing, distance, sharpness, an-

gle, lost tracking). Face registration has been per-

formed at the PoS, which has two main advantages.

First, it facilitates registration by not requiring any ad-

ditional client’s visits in the operator’s location. Sec-

ond, the registration environment conditions are sim-

ilar to recognition environment conditions which im-

proves recognition accuracy.

Name, ID photo, face and RFID identifiers, as

well as user identifiers in the seller and operator sys-

tems have been stored in the dedicated component at

the PO side. In another PO-side component, device

vendor, model and OS version, as well as device to-

ken (for PUSH communication within Google Cloud

Messaging) and list of supported authorization meth-

ods have been stored. In the authorization component,

patterns for authorization method, PIN and optionally

fingerprint hash, have been stored.

Before the user registration procedure each par-

ticipant underwent an individual in-depth interview

and was briefly informed about the system operation.

Additionally, a web page explaining the idea of auto-

matic payments and system operation was published

and presented to all participants.

4.2.2 Data Collection

During the experiments a number of event classes has

been registered in components’ logs. In the process

of user identification the following event classes are

registered: face detection event, recognition event,

confirmation event, “reject and change the method”

Face-based Passive Customer Identification Combined with Multimodal Context-aware Payment Authorization: Evaluation at Point of Sale

561

event, “reject and try again” event, and transaction

abort event. In the process of transaction autho-

rization the following event classes are registered:

transaction start, acceptance, transaction decline, and

sending authorization request to client/seller.

For those events, apart from exact timestamp,

the following identifiers are registered: identification

method identifier, client identifier, transaction iden-

tifier, identifiers of available authorization methods,

identifiers of used authorization methods, transaction

status (e.g. button code, reason for the rejection), as

well as many parameters related to face identification,

such as: number of detected faces, correct recogni-

tions number, advantage of correct recognitions over

misrecognitions, correct recognitions quality, average

and median of recognitions and misrecognitions qual-

ity, and identifiers of the decision rules that are ful-

filled.

Apart from data collected by the system itself, all

participants were invited for a second round of in-

depth interviews where they could express their opin-

ion about the system operation.

5 EVALUATION RESULTS

The evaluation results presented in this section have

been obtained as an effect of data mining and statis-

tical analysis of three distinct log sets, generated by

four components of the system. The results from the

first subsection are related to user identification phase,

and the results from the second subsection are related

to subsequent phase, i.e. transaction authorization

phase. The third subsection contains an overview of

users opinions gathered during and after the experi-

ment.

5.1 User Identification

Totally, there were 282 successful user identifications

performed by the system. This value does not indicate

the number of performed transactions, since there are

cases where for a single identification a sequence of

transactions is conducted, and there are cases where

successful identification does not precede successful

transaction authorization.

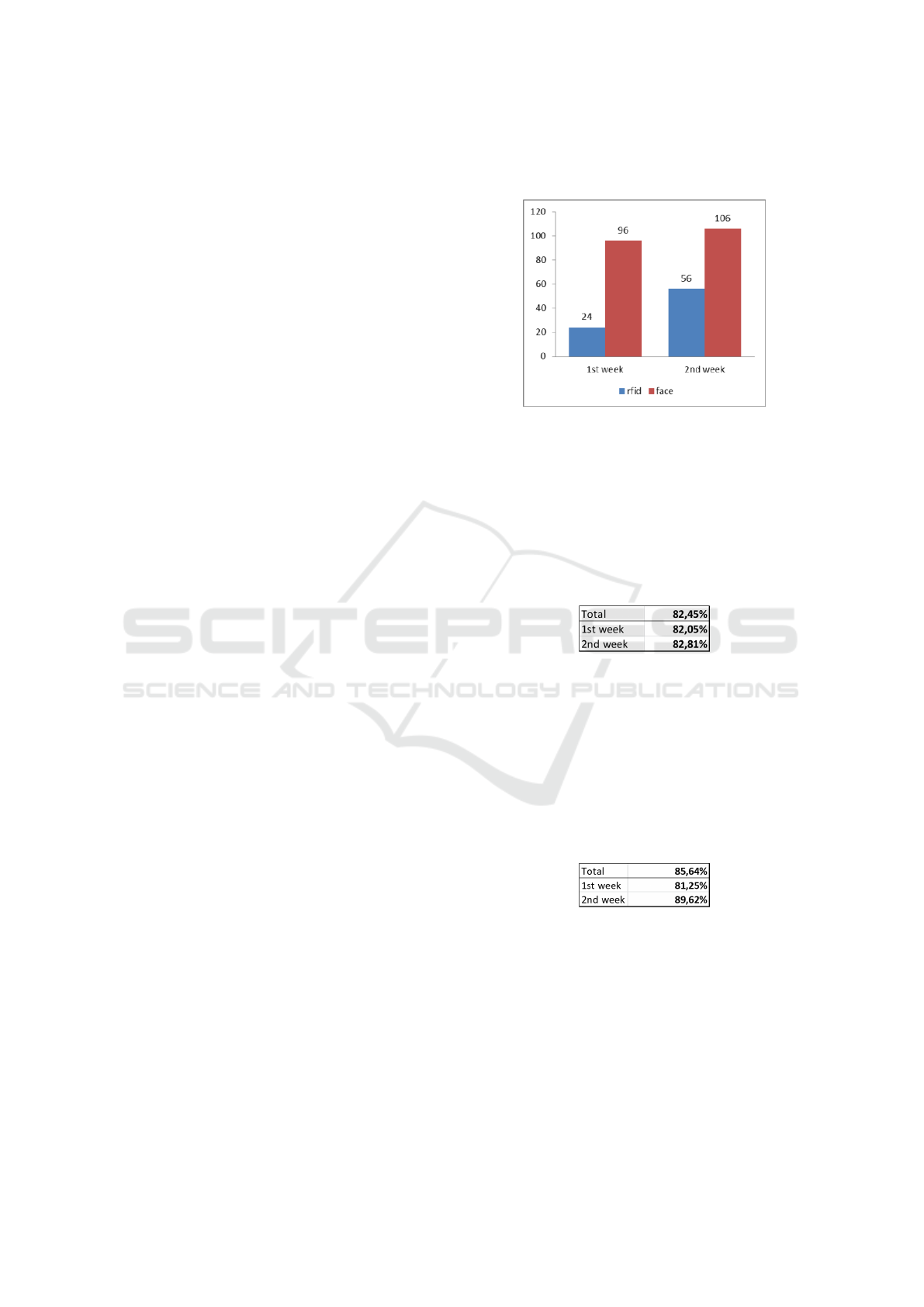

Identification Methods. From among successful

identifications, even 72% have been conducted with

face biometrics, and only 28% with RFID card, de-

spite the fact, that every user has been equipped

with such card and could freely use it. A number

of successful identifications in the respective exper-

iment weeks for different identification methods is

presented in Figure 2.

Figure 2: Number of successful identifications for different

identification methods in respective weeks.

Accuracy of Identification with Face Biometrics.

Among from all attempts to identification with face,

i.e. cases where new client has appeared at PoS will-

ing to identify himself or herself with a face, 202

have been successful and 43 have failed. These val-

ues expressed by percentages for distinct weeks are

presented in Figure 3.

Figure 3: Percentage of successful identifications for re-

spective weeks.

In the group of successful face-based identifica-

tion attempts, 173 have not been preceded by any ear-

lier unsuccessful attempts (named as “seamless iden-

tifications”), and 29 have been preceded by unsuc-

cessful attempts (named as “difficult identification”)

within time period of 30 seconds. Seamless identifi-

cations percentage for respective weeks is presented

in Figure 4.

Figure 4: Percentage of seamless successful identifications

in relation to all successful identifications.

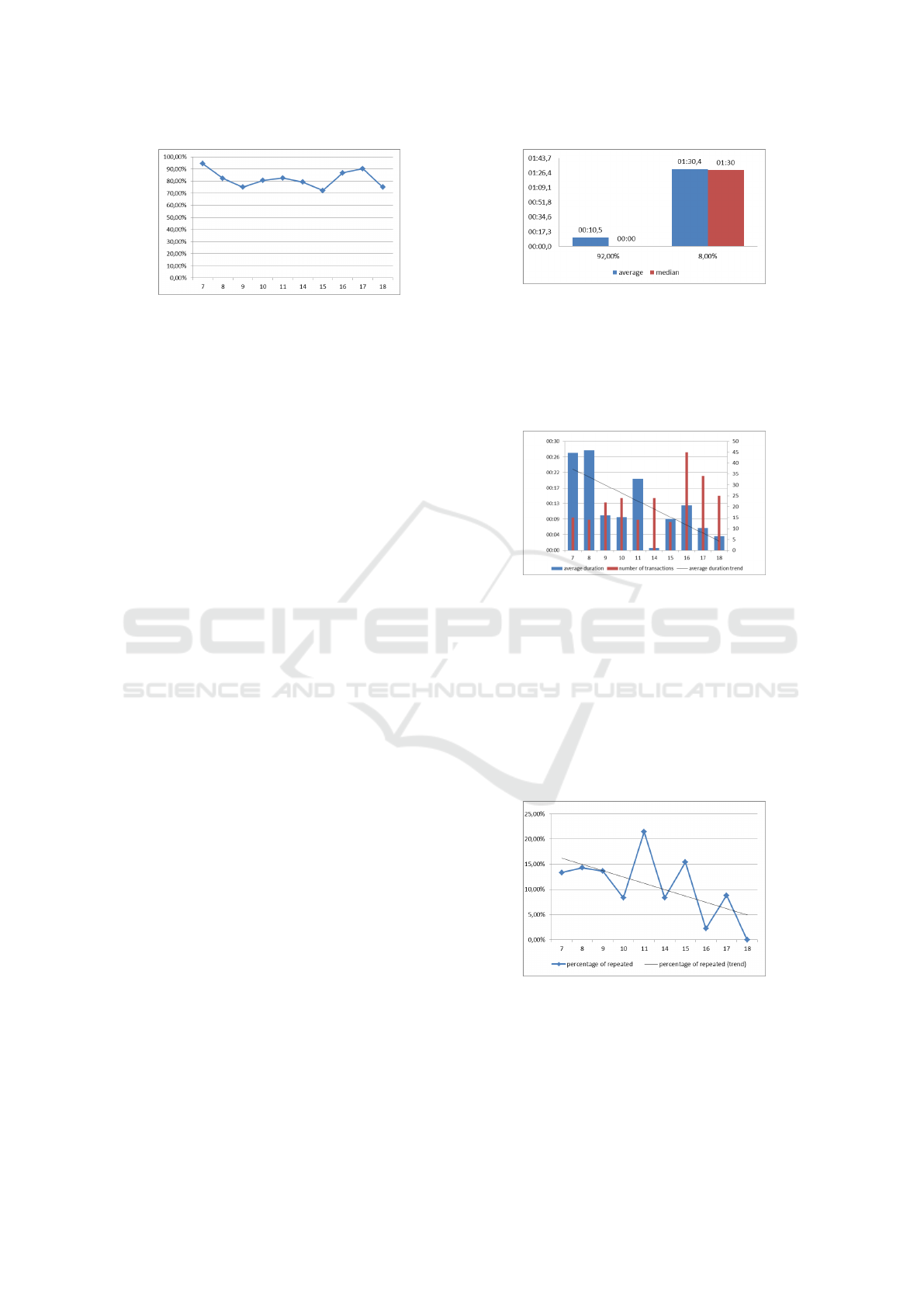

High percentage of successful identifications has

persisted in the consecutive days of the experiment

and it has never dropped below 72%, which is pre-

sented in Figure 5. The labels on horizontal axis de-

note days of December, two weeks from December

7th to December 18th. Weekends and pre-Christmas

days (December 21st and 22nd) are excluded because

of very low number of clients at the campus bar in

those days producing non-representative results.

ICEIS 2018 - 20th International Conference on Enterprise Information Systems

562

Figure 5: Percentage of successful face identifications in the

consecutive days.

Duration of the Identification with Face Image.

Duration of the face identification has been mea-

sured from the moment of the first face recognition

of the user (even if the recognition does not fulfills

the heuristic criteria of the final identification, even if

the face image appears once, and even if it belongs to

the “misrecognitions” set), to the moment of receiv-

ing the identification message at the seller’s device.

The median of identification duration is 34 seconds.

Independently, the durations of the seller confir-

mations have been measured, i.e. time between the

moment of receiving the identification message at the

seller’s device and the moment of seller’s manual ap-

proval with the button. Median of confirmation time

is 3 seconds.

5.2 Transaction Authorization

During the evaluation, 225 transactions have been

successfully conducted, 92% of them required single

authorization attempt, and 8% required repeated au-

thorization.

Authorization Duration. Average duration of the

transaction authorization for transactions that require

single attempt is 10,5 second and median of this dura-

tion is below 1 second (because of the relatively high

number of automatic authorizations). In the rare cases

when repeated authorization has been required (e.g. a

user inputs wrong PIN), the duration has been much

longer (Figure 6). Authorization duration is measured

from the moment when the order is already put to-

gether, through transaction authorization process, to

the payment settlement done.

In Figure 7 median duration of authorizations

(blue bars) for respective days are depicted. Evi-

dent decrease of the transaction duration is observed,

which is a consequence of familiarizing users with

the system as well as of constantly increasing frac-

tion of automatic authorizations during the evalua-

tion (because of building a history of transactions

that increases trust). Downward trend (trend line) is

Figure 6: Average and median authorization durations in

case of single and repeated authorization.

strengthened by the fact that in the last three days (16-

18) in which the durations have been short, the high-

est number of transactions have been conducted (red

bars).

Figure 7: Average authorization durations for respective

days.

User Faults During Transaction Authorization.

Percentage of transactions requiring repeated autho-

rization in the respective days is presented in Figure

8. Clear downward trend can be observed. As in case

of transaction duration, it is a consequence of famil-

iarizing users with the system as well as of constantly

increasing fraction of automatic authorization method

which eliminates user faults.

Figure 8: Percentage of transactions requiring repeated au-

thorization in the respective days.

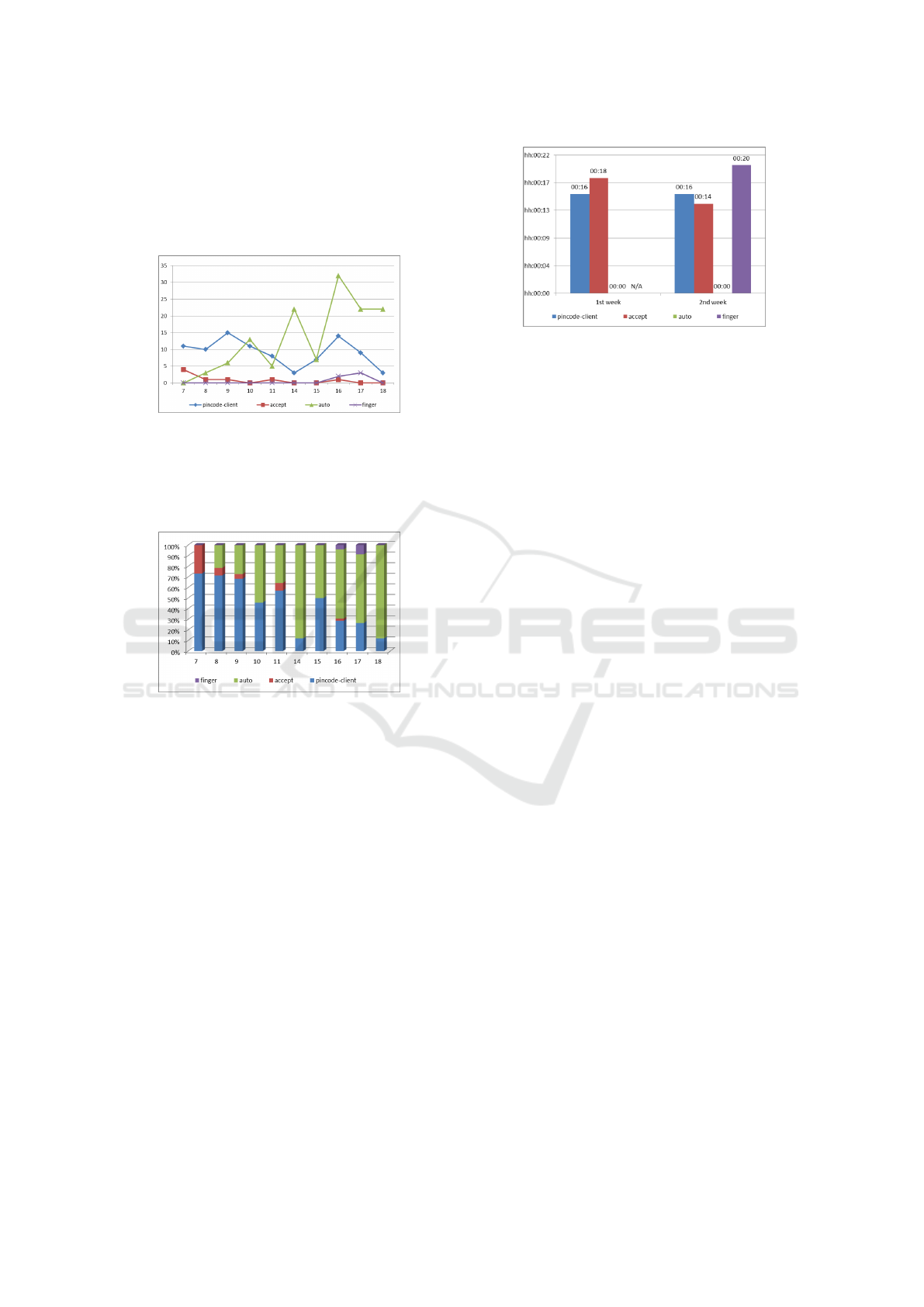

Context-based Authorization Method Choice. In

Figure 9 a number of successful authorizations in the

respective days for different authorization methods is

visualized. Increasing usage of automatic method is

Face-based Passive Customer Identification Combined with Multimodal Context-aware Payment Authorization: Evaluation at Point of Sale

563

visible. It is a consequence of users’ building a history

of transaction that increases level of trust, which is a

one of the conditions for choosing this method by the

system. It confirms that system works according to

expectations.

Figure 9: Number of successful authorizations in the re-

spective days for different authorization methods.

Above-mentioned tendency is visible better if data

are expressed relatively, which is presented in Figure

10.

Figure 10: Distribution of different authorization methods

in the respective days.

In Figure 11 medians of transaction durations for

different authorization methods for respective weeks

are presented. It can be observed that durations of

manual accept authorization (with a smartphone) in

the second week are lower than in the first week. The

main reason for this advantageous trend is getting ex-

perience by users’ with the new notification and con-

firmation interface. The PIN-based authorization du-

ration is constant since this method is already known

for users and since PIN always requires few seconds

to be typed, regardless of user experience. Authoriza-

tions with fingerprint have been performed only few

times (since only few users have used devices with a

fingerprint scanner) and only in the second week, thus

their durations cannot be considered as representative.

5.3 Users Opinions

During the experiment randomly selected transactions

were followed by a request to fill in a short question-

naire regarding the subjective quality of user expe-

Figure 11: Medians of authorization durations for different

authorization methods in respective weeks.

rience. The questionnaires were provided via reg-

ular payment mobile application immediately after

the transaction. In 83 responses collected from these

questionnaires the majority of respondents indicated

that in their opinion the automatic payment procedure

is more convenient (61.4%) and more secure (52%)

than a traditional contactless payment. They also re-

sponded that the whole process was faster (50%) than

a traditional contactless payment.

During the second round of in-depth interviews

all participants were encouraged to present their own

opinions about the system. The opinions include

both positive and negative statements. Positive state-

ments can be summarized by the following keywords:

convenience, speed, innovation. Negative statements

were focused mostly on inconveniently long identifi-

cation time. It is also worth to notice that some par-

ticipants felt uncomfortable when their personal data

(photo and name) intended for the sales clerk could be

visible to other clients in the queue, which pinpoints

that the seller-side of the system should protect pri-

vacy of clients data.

6 CONCLUSIONS

Results of the evaluation confirm that proposed

modus operandi for the automatic authorization as

well as its goals and benefits are achievable under

the constraints of a real-world PoS. Prototype system

build based on proposed architecture and algorithms

indeed has allowed evaluation participants for rou-

tine payment authorization in the passive mode. The

seller just confirms the single identity recognized by

the system with one tap, and does not need to choose

between possible matchings losing his time and focus

like it is required by systems reported in the related

works. The main advantage of the proposed approach

comes from its context-awareness and dynamic au-

thorization method selection, which allows for gradu-

ally achieving the trust level required for passiveness.

ICEIS 2018 - 20th International Conference on Enterprise Information Systems

564

The right balance between convenience and security,

which are always at odds, is constantly provided. Ob-

tained results allow to verify particular research hy-

potheses defined in the Section 4.1.

The hypothesis H

1

has not been confirmed dur-

ing the evaluation. Although median of authoriza-

tion durations is far below 5 second limit, the second

component of the total duration, i.e. identification,

takes much longer time (c.f. Section 5.1). It results in

conclusion that applied approach to face recognition

needs further optimization. The long recognition time

is not caused by computation complexity nor perfor-

mance issues, but by too frequent inaccurate (conflict-

ing) recognitions in the image sequence which delay

obtaining consistent result for a given user. This dif-

ficulty can be overcome by employing additional fil-

ters that can detect and eliminate error-prone frames

from the video stream and by optimizing parameters

of heuristic for the final identification.

The hypothesis H

2

has been confirmed. In cases

when passive identification and authorization have

been conducted, all the users had to do was to verbal-

ize the order and pick up the products. One aspect of

the identification process has been shifted to the seller

(manual confirmation of a single identification result),

but practically it had not significant influence on the

duration of the whole process (c.f. Section 5.1).

Collected data confirm the hypothesis H

3

. The

percentage of the successful identifications based on

face biometrics is 82.45%, and the percentage of the

“seamless” face identifications within the group of

successful identification is 85.64%.

Also the hypothesis H

4

has been confirmed. Data

presented in Section 5.2 show that transaction au-

thorization duration is gradually decreasing as users

build a history of transaction that increases level of

trust, which is a one of the conditions for choosing

more convenient and fast authorization methods.

To sum up, analysis of the collected quantitative

data allows to confirm three of four research hypothe-

ses. In case of rejected hypothesis, the element that

needs further optimization can be easily identified.

Generally, the evaluation has confirmed that the ap-

proach proposed for passive transaction authoriza-

tion is achievable despite the difficulties introduces

by variable real-world condition at PoS. As a future

work it is planned to analyze additional factors ex-

tracted from the video signal and depth data (e.g.

user height, mimics, pose, age, sex) and non-video

features (behavioral patterns for time, place, amount,

type of good) that can be used to improve the recog-

nition quality, speed, and security of the system.

ACKNOWLEDGEMENTS

The research was supported by Santander Universi-

dades. We thank our colleagues from Bank Zachodni

WBK and Symetria who provided insight and exper-

tise that greatly assisted the research. We also thank

Rafał Wojciechowski from our Department for sup-

port with implementation and prototype deployment.

REFERENCES

Al-Ghawi, S. S., Hussain, S. A., Rahbi, M. A. A., and

Hussain, S. Z. (2016). Automatic toll e-ticketing sys-

tem for transportation systems. In 2016 3rd MEC In-

ternational Conference on Big Data and Smart City

(ICBDSC), pages 1–5.

Alliance, S. C. (2012). Emv and nfc: Com-

plementary technologies that deliver se-

cure payments and value-added functionality.

http://www.smartcardalliance.org/resources/pdf/

EMV and NFC WP 102212.pdf.

Anh Tran, Q. et al. (2016). Finnish grocery retailing market

assessment for the deployment of payment innovation:

Case: Uniqul face recognition payment application.

Apple (2014). Apple pay. http://www.apple.com/apple-

pay/.

Biyo (2014). Biyo wallet. http://biyowallet.com/.

Bolle, R. M., Connell, J. H., Pankanti, S., Ratha, N. K., and

Senior, A. W. (2013). Guide to biometrics. Springer

Science & Business Media.

Bowyer, K. W. (2015). Selfies to emerge as both payment,

anti-fraud solution. Biometric Research, Virtual Spe-

cial Issue.

Chinrungrueng, J., Sunantachaikul, U., and Triamlumlerd,

S. (2007). Smart parking: An application of optical

wireless sensor network. In 2007 International Sym-

posium on Applications and the Internet Workshops,

pages 66–66.

Fujitsu (2011). Palmsecure pay.

http://www.fujitsu.com/us/solutions/business-

technology/security/palmsecure/.

Google (2015a). Android pay.

https://www.android.com/pay/.

Google (2015b). Google hands free.

https://get.google.com/handsfree/.

Hassett, J. (1994). Automatic debiting parking meter sys-

tem. https://www.google.com/patents/US5351187.

US Patent 5,351,187.

He, W., Li, Q., and hua Sun, W. (2015). Discussion on

multi-sensor detector fusion of internet of things in

vehicle management.

Lee, J. (2015). Jcb piloting fujitsu palm vein

authentication technology for payments.

http://www.biometricupdate.com/201510/jcb-

piloting-fujitsu-palm-vein-authentication-technology-

for-payments.

LiquidPay (2015). Liquid pay. http://www.liquidpay.com/.

Lucnova (2015). Freshx. https://www.freshxapp.com/.

Face-based Passive Customer Identification Combined with Multimodal Context-aware Payment Authorization: Evaluation at Point of Sale

565

Mainetti, L., Patrono, L., Stefanizzi, M. L., and Vergallo,

R. (2015). A smart parking system based on iot pro-

tocols and emerging enabling technologies. In 2015

IEEE 2nd World Forum on Internet of Things (WF-

IoT), pages 764–769.

Nakagawa, A. (2015a). Method of automati-

cally adjusting toll collection information

based on a number of occupants in a vehicle.

https://www.google.com/patents/US20150379782.

US Patent App. 14/316,488.

Nakagawa, A. (2015b). Method of automati-

cally adjusting toll collection information

based on a number of occupants in a vehicle.

https://www.google.com/patents/US20150379782.

US Patent App. 14/316,488.

Narzt, W., Mayerhofer, S., Weichselbaum, O., Haselbck,

S., and Hfler, N. (2015). Be-in/be-out with bluetooth

low energy: Implicit ticketing for public transporta-

tion systems. In 2015 IEEE 18th International Con-

ference on Intelligent Transportation Systems, pages

1551–1556.

Narzt, W., Mayerhofer, S., Weichselbaum, O., Haselbck,

S., and Hfler, N. (2016). Bluetooth low energy as en-

abling technology for be-in/be-out systems. In 2016

13th IEEE Annual Consumer Communications Net-

working Conference (CCNC), pages 423–428.

Samsung (2015). Samsung pay.

http://www.samsung.com/us/samsung-pay/.

Smowton, C., Lorch, J. R., Molnar, D., Saroiu, S., and Wol-

man, A. (2014). Zero-effort payments: Design, de-

ployment, and lessons. In Proceedings of the 2014

ACM International Joint Conference on Pervasive and

Ubiquitous Computing, UbiComp ’14, pages 763–

774, New York, NY, USA. ACM.

Ta, T. D., Le, D. A., Le, M. T., Tran, T. V., Do, T. T.,

Nguyen, V. D., Trinh, C. V., and Jeon, B. (2015).

Automatic number plate recognition on electronic toll

collection systems for vietnamese conditions. In Pro-

ceedings of the 9th International Conference on Ubiq-

uitous Information Management and Communication,

IMCOM ’15, pages 29:1–29:5, New York, NY, USA.

ACM.

W

´

ojtowicz, A. and Chmielewski, J. (2017). Technical feasi-

bility of context-aware passive payment authorization

for physical points of sale. Personal and Ubiquitous

Computing, 21(6):1113–1125.

ICEIS 2018 - 20th International Conference on Enterprise Information Systems

566