Trading Network Performance for Cash in the Bitcoin Blockchain

Enrico Tedeschi, H

˚

avard D. Johansen and Dag Johansen

UIT The Arctic University of Norway, Tromsø, Norway

Keywords:

Bitcoin, Blockchain as a Service, Longitudinal Study, Performance, Transaction Latency.

Abstract:

Public blockchains have emerged as a plausible cloud-like substrate for applications that require resilient

communication. However, sending messages over existing public blockchains can be cumbersome and costly

as miners require payment to establish consensus on the sequence of messages. In this paper we analyze the

network performance of the Bitcoin public ledger when used as a massaging substrate. We present several

real-world observations on its characteristics, transaction visibility, and fees paid to miners; and we propose

two models for fee-cost estimation. We find that applications to some extent can improve messaging latency

by paying transaction fees. We also suggest that spendings should be kept below 300 Satoshi per byte.

1 INTRODUCTION

The Blockchain technology used by popular crypto

currencies like Bitcoin

1

and Ethereum, are essen-

tially Peer-to-Peer (P2P) broadcast oriented Group

Communication Systems (GCSs) (Cheriton and

Zwaenepoel, 1985), where all members see all mes-

sages, and in the same order. With a built-in fee sys-

tem that enables operators to make money for storing

and forwarding messages, several decentralized P2P

blockchain systems have emerged, providing a com-

mon ground for mutually distrusting entities to com-

municate. Due to their promise of highly resiliency,

blockchain-as-a-service is currently being touted as

a promising permissionless cloud-like building block

for critical services in, for instance, the finance and

health domains.

Unlike traditional multicast oriented GCSs like

Horus (van Renesse et al., 1996) and Totem (Moser

et al., 1996), blockchains have the unique prop-

erty that all broadcast messages are kept and made

available to all participants, potentially for the sys-

tem’s lifetime. For blockchains, consensus among

participants on the total ordering of messages, and

hence also consensus on the resulting data-structure

or ledger, is achieved through computational puzzles

that randomly grant members a time-limited exclusive

right to dictate the next batch of messages to be put on

the channel.

As with other permissionless systems such as Se-

cureRing (Kihlstrom et al., 1998) and Fireflies (Jo-

1

The Bitcoin currency is denoted BTC or B.

hansen et al., 2015) that are designed to be highly

resilient to intrusions and attacks, providing reliable

service by masking Byzantine failures limits scalabil-

ity. Because blockchains are designed to retain all

messages, they are particularly vulnerable to denial-

of-service through simple flooding attacks. If an at-

tacker can send messages at an unbounded rate, he

can quickly swamp the storage and network capac-

ity of the service. Even benign usage might prove

problematic. For instance, if Bitcoin would have the

same transaction rate as a VISA circuit, with between

2000 to 56 000 transactions/sec (Croman et al., 2016),

its blockchain structure would grow about 1 MB per

3 seconds.

To throttle its blockchain growth rate, Bitcoin ad-

justs the difficulty of its cryptographic puzzles to

match the aggregate mining capacity of the network,

towards a target average block creation time of 10 min

per block. In combination with its current block size

limit of 1 MB, Bitcoin’s transfer capacity is roughly

a meager 1.667 kBps, or approximately three trans-

actions per second. This capacity is shared between

all concurrent clients. Indeed, scalability and net-

work performances are urgent concerns in existing

Blockchain-based systems.

This paper presents key observations from our on-

going longitudinal study on the performance of the

Bitcoin blockchain. We provide detailed insights and

analysis on several important characteristics of Bit-

coin, including paid fees and the size of blocks, and

show how the rewards to miners have changed over

time from a more recent view point compared to ear-

lier studies (M

¨

oser and B

¨

ohme, 2015; Rizun, 2015).

Tedeschi, E., Johansen, H. and Johansen, D.

Trading Network Performance for Cash in the Bitcoin Blockchain.

DOI: 10.5220/0006805906430650

In Proceedings of the 8th International Conference on Cloud Computing and Services Science (CLOSER 2018), pages 643-650

ISBN: 978-989-758-295-0

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

643

Furthermore, we analyze the correlation between the

fee paid from a transaction and its latency, or the time

it takes to become visible in the whole network. We

propose two different models to describe how appli-

cations should spend money to improve network per-

formance. Although the studies presented in this pa-

per are restricted to the Bitcoin system, we conjecture

that our observations are transferable to similar P2P

systems that rely on computational expensive proof-

of-work for consensus and fee-based incentives.

2 BACKGROUND

This paper considers blockchains as a communication

substrate, where a set of client or application pro-

cesses communicate by sending and receiving mes-

sages. In blockchain systems, a message is often re-

ferred to as a transaction, a notation we also adapt

in this paper. The blockchain substrate handles all

transactions in batches, known as blocks. Each block

B can be in one of two states: proposed or accepted,

and might contain zero or more transactions from zero

or more clients. The system in permissionless in that

there exist no central authority that coordinate or reg-

ulate participation or usage.

A blockchain has one or more miner processes

that act as the ingress points for transactions submit-

ted by the clients. The set of all miners collaborate

to decide on which transactions to admit and their or-

dering. Every miner has a mempool containing the

new and unapproved transactions. Applications are

free to submit transactions to any miner’s mempool,

and miners are free to choose which transactions to

include in their blocks. Most blockchain systems, in-

cluding Bitcoin, enforce a strict upper bound Q on

the block size, which also limits the number of trans-

actions each block can contain.

The blockchain data structure, often referred to

to as a ledger, is maintained by a P2P overlay net-

work where members cooperate to verify and dis-

tribute blocks such that each member process has a

full replica of the data structure in local storage. The

integrity of the data structure is dependent on con-

sensus among the set of correct member processes

on which blocks are in the blockchain and their to-

tal order. For this, existing blockchain systems, like

Bitcoin, use the Nakamoto consensus protocol. This

protocol relies on members solving computationally

complex cryptographic puzzles as proof-of-work for

admitting new blocks, commonly referred to as min-

ing. Once a miner has solved a puzzle, it broadcasts

the block along with a solution to the puzzle so that

all other nodes can check its correctness. The block is

then tentatively recorded in the blockchain.

In the early days of Bitcoin, it was possible to

mine productively with commodity desktop or laptop

computers. Nowadays, successful miners use highly

specialized hardware called Application Specific In-

tegrated Circuitss (ASICs) (Taylor, 2017), which typ-

ically offer up to 100 times improved performance

over commodity CPUs and GPUs.

The cost associated with mining was defined by

Rizun (2015) to be:

hCi = ηhT (1)

Here η is the cost per generated hash, h is the miner’s

individual hash rate and T is the block creation time.

Hence, the block creation time is directly proportional

to the hashing cost. The underlying assumption of

proof-of-work consensus is that the high η value, due

to the energy cost of mining, will discourage and limit

malicious behavior. At the same time, benign partici-

pation is promoted by means of incentives: the nodes

receive payment as a reward for solving puzzles.

As miners compete to solve the latest puzzle, it

may happen that two or more nodes succeed at ap-

proximately the same time. This may result in dif-

ferent blocks with different transactions being pro-

posed for the blockchain. Thus, proposing further

blocks may result in different chains, often referred

to as a fork. To break such ties, Bitcoin adopts

the simple rule that the longest consecutive chain of

blocks wins. Therefore, a tentative block of transac-

tions may be discarded, which is known as orphaning.

The recording of a block is only considered perma-

nently accepted after five additional blocks have been

added, approximately after 1 hour. Thus, eventually

the nodes reach consensus on the ordering of all the

blocks on the blockchain.

Given a transaction t from some client c

1

to some

other client c

2

, we have the following:

Definition 1. The commit latency of a transaction t

is the time from when c

1

first proposes a transaction t

to a mining pool, to when some block B including t is

first mined and permanently accepted.

Note that the total end-to-end latency of t also in-

cludes the time it takes for B to be delivered to c

2

.

However, as blockchain clients must pull the system

for updates, the last-hop delivery time will depend to

the application specific pull interval. For generality,

this paper will therefore only consider the commit la-

tency.

In existing blockchain systems, miners can freely

choose which transactions to include when propos-

ing a new block. A client must therefore negotiate

with miners to have its transactions included. To en-

tice miners, each transaction t can include a transac-

tion fee t

f

paid by the sender to be claimed by the

CLOSER 2018 - 8th International Conference on Cloud Computing and Services Science

644

miner whom first successfully include t in an accepted

block. Due to the cost of mining, most miners are as-

sumed to behave rationally (Aiyer et al., 2005): fol-

lowing the blockchain protocol, but such that their

mining rewards are optimized. Hence, we conjecture

that it is possible to use the transaction fee mechanism

to improve messaging performance, which will be the

focus of the remainder of this paper.

3 OBSERVATIONS

In this section we describe key observations and in-

sights from our studies on the public Bitcoin ledger.

These form the basis of our latency-fee models in Sec-

tion 4. We start this section, however, by describing

our method for collecting observational data.

3.1 Methodology

There are several methods that can be used to study

Bitcoin. Real-time analysis requires setting up and

operating one or more full Bitcoin nodes that connect

to the P2P network and record traffic. The advan-

tages of this approach is that some of the inner-node

communication can sampled, including block propa-

gation time and orphaning rate. However, to obtain

usable coverage, multiple geographically dispersed

nodes must be set up and injected into the network.

Each one must download and store the full ledger and

participate in the forwarding of new blocks. At time

of writing, the full ledger of data requires 250 GB of

storage. This requires significant up-front hardware

investments and might potentially disrupt some of the

system’s characteristics that are under study.

Another approach is to use the Bitcoin Core appli-

cation (van der Laan et al., 2017), which downloads

the full ledger into local storage, but without having to

run the full P2P protocol. Retrieved data does, how-

ever, not include the block propagation time or infor-

mation from miners, which we require for our studies.

Downloading the full ledger can also take significant

time (in our case it took four days), and requires sig-

nificant available disk capacity.

In our studies, we instead adapted a similar

methodology to the one used by M

¨

oser and B

¨

ohme

(2015), collecting data from some of the many online

third-party APIs, made available by various organiza-

tions that are already monitoring the Bitcoin system,

including tradeblock.com and blockchain.info. Web-

sites like coinbase.com also provide useful informa-

tion about the money exchange price, and provide an

API along with libraries, like forex-python,

2

which we

2

https://pypi.python.org/pypi/forex-python

Date

< .001

> .01

< .0002

< .0005

BTC/byte

< .0001

0

%

2017-06

2016-08

2015-10

2014-12

2014-02

2013-04

0

100

60

80

40

20

Figure 1: Observed transaction fee (t

f

) distribution from

2013 to 2017.

used.

Data was retrieved from these public APIs,

and collected as JavaScript Object Nota-

tion (JSON) objects stored locally in Pandas

data frames (Augspurger et al., 2012). Some data

not available in these APIs directly, was instead

scraped from the sites’ HTML pages. The data was

processed and visualized with Matplotlib (Hunter

et al., 2017) and Seaborn (Waskom et al., 2016). This

approach enabled us to analyze a considerable part

of the blockchain with little up-front investment in

computational resources.

For this paper, we elected to study data in the

range from April 2013 to September 2017, sam-

pling more than 120 million transactions and 100000

blocks. Several studies have already been conducted

on Bitcoin data before 2013 (Croman et al., 2016;

Houy, 2014; M

¨

oser and B

¨

ohme, 2015; Rizun, 2015),

and the popularity of the system before 2011 was

low. Interpreting data outside our selected date range

would probably not generate new insight. Table 1

names and summarizes the exact segments retrieved

and used in this paper.

3.2 Transaction Fees

In this section, we present our observations on how

the transaction fees t

f

, paid by the clients to the min-

ers, have changed over time. For each transaction t,

The fee t

f

is the difference between the sum of all in-

put values t

in

and the sum of every output values t

ou

.

If n is the number of inputs and m is the number of

outputs, then we have:

3

3

The unit of Equation 2 is B.

Trading Network Performance for Cash in the Bitcoin Blockchain

645

Table 1: Bitcoin blockchain regions analyzed.

Name Start Date End Date Block Height Range

2009 09-01-2009 03:54:25 08-03-2009 06:31:22 1 – 6710

2011 01-04-2011 19:58:59 09-05-2011 12:58:13 116 167 – 122876

2013 21-04-2013 03:03:51 01-06-2013 12:37:51 232 333 – 239042

2015 21-03-2015 04:01:39 06-05-2015 14:37:12 348 499 – 355208

2017 15-12-2016 18:17:45 19-06-2017 12:04:23 443 599 – 471951

t

f

=

n

∑

i=1

t

in

i

−

m

∑

i=1

t

ou

i

(2)

Figure 1 plots the calculated values for t

f

in blocks

from 2013 to late 2017, categorized into six payment

classes ranging from 0 to 0.01

B. As we can see in

the figure, in the first half of 2016 fees between 0

and 0.0001 B almost disappeared. Considering that

the Bitcoin price raised from less than 1000 USD to

more than 5000 USD between mid 2016 and second

half of 2017, this is indicative of a huge increment in

the monetary value collected by miners. If we com-

pare the Bitcoin price and the fee paid in USD, we see

a substantial co-movement, which indicates that B is

the dominant unit to consider when deciding about

what fee to offer.

Because the number of bytes per transaction can

vary in all major blockchain systems today, including

Bitcoin, an interesting metric to study is how many

B per bytes a transaction t has to offer in payment

to miners. This metric is known as the fee density

t

ρ

(Rizun, 2015). For some transaction t, with asso-

ciated fee t

f

and having a payload of t

q

bytes, the fee

density is defined as:

t

ρ

=

t

f

t

q

. (3)

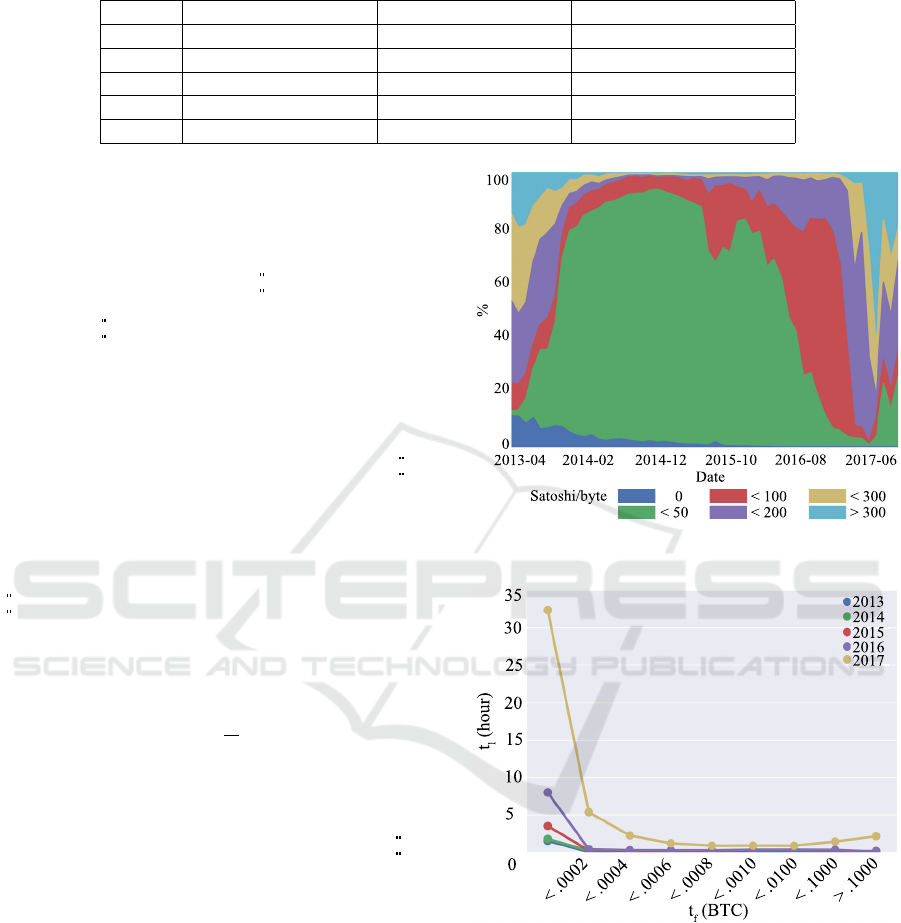

Figure 2 plots the observed fee density, similarly

to the fee plot in Figure 1. The observed average

transaction size t

q

is 500 B. At the end of 2017, we

see some transactions offering less than 0.0001 B in

payment. We observe almost no transactions with fee

density t

ρ

= 0. This indicates that density has be-

come an important metric for miners when deciding

whether or not to include a transaction in their next

block.

3.3 Transaction Latency

As shown above, a blockchain-based application may

attempt to offer various mining fees to improve the

commit latency of its messages. In the following we

will investigate to what extent we are able to do so in

practice.

The experienced commit latency t

l

of most trans-

actions can relatively easily be observed in the ava-

iable data. All transaction are timestamped when

Date

0

< 300

> 300

< 100

< 200

Satoshi/byte

< 50

%

2017-06

2016-08

2015-10

2014-12

2014-02

2013-04

0

100

60

80

40

20

Figure 2: Observed fee density (ρ) distribution from 2013

to 2017.

2013

2014

2015

2016

2017

35

30

25

20

15

10

5

0

< .0002

< .0004

< .0006

< .0008

< .0010

< .0100

< .1000

> .1000

t

f

(BTC)

t

l

(hour)

Figure 3: Relation between t

l

and t

f

grouped by year.

added to a mining pool, and blocks are similarly

timestamped when mined.

Let B

epoch

be the timestamp of some block B con-

taining the transaction t, and let t

epoch

be the times-

tamp of when that transaction was first added. Then

the commit latency of observed transactions t can

simply be calculated from:

t

l

= B

epoch

−t

epoch

(4)

Figure 3 plots the observed transaction latency (in

hours) against the five fee density classes for each

CLOSER 2018 - 8th International Conference on Cloud Computing and Services Science

646

BTC

7000

6000

5000

4000

3000

2000

1000

0

2013-05-01

2013-11-01

2014-11-01

2014-05-01

2015-05-01

2015-11-01

2016-05-01

2016-11-01

2017-05-01

Figure 4: Daily miners revenue divided in block reward R

and the sum of transaction fees M.

year included in our study. In all cases, we observe

that paying transaction fees gave a significant boost

to latency, and that in 2017 doing so became more

important than previously. We also observe the exis-

tence of a threshold from where increasing payment

has little effect. For the years 2013–2016, the thresh-

old was around 0.0002 B, while in 2017 it increased

to 0.0006 B.

In addition to the total mining reward (M) from

all transaction fees in a block, miners also receive a

block reward (R) for each mined block. The block

reward has historically been an important incentive

for miners to produce blocks, regardless of the trans-

action fees offered by clients. However, the reward

mechanism in Bitcoin is designed to halve the size of

R every 210 000 blocks. As can be seen in Figure 4,

in the period from 2009 to 2013 miners had little con-

siderations for the transaction fees, and relied more

on the reward R. In mid 2016, when the block reward

was last halved, we observe a clear shift in how the

miners profit from their efforts, becoming more influ-

enced by the transaction fees.

This observation is not surprising as we expect

most miners to be rational (Aiyer et al., 2005), trying

to optimize their profit. With less block reward, ratio-

nal miners will need to prioritize transactions with a

higher fee density over lower ones until the max block

size is reached. If the total fee of the included transac-

tions is less than the expected monetary cost of min-

ing the block hCi, the miner may even opt to wait until

a higher density transaction arrives. This can signifi-

cantly increase experienced commit latency and jitter.

We expect M to overcome R by 2020 when the reward

is halved again to 6.25

B. Hence, for applications that

intend to use blockchain as a service for communi-

cation, there is a clear potential and need for clever

usage of the transaction fee mechanism to optimize

t

l

D

2

D

39

t

l

(hour)

0.5

1.5

2.0

2.5

3.0

3.5

4.0

1.0

0

.0005

.0010

.0015

.0020

.0025

.0030

t

f

(BTC)

Figure 5: Fee-latency interpolation F with a 2 and 39

degrees polynomials for Bitcoin transactions analyzed in

2017.

the commit latency and the monetary cost of sending

messages.

4 MODELS

With data from the 2017 transactions, we generated

two models that applications can use when deciding

what transaction fees to offer.

4.1 Fee-latency

The first model F describes the expected latency of

some transaction t given some transaction fee t

f

. We

compute two variants of F using polynomial regres-

sion: one of degree 2 (F

2

) and one of degree 39 (F

39

).

The lower degree regression is used to show the gen-

eral trend, while the higher degree one is used to

show the utility threshold. The resulting regressions

are shown in Figure 5. Measured Mean Absolute Er-

ror (MAE) was 1.755 for F

2

and 1.7476 for F

39

. For

some given transaction fee x, the function F

2

is given

by

F

2

(x) = 6248x

2

− 555.8x + 1.42 (5)

From the plot of F

2

, we we see a clear linear

trend that transactions offering higher fees experience

lower commit latency, which is what we expected.

From F

39

in Figure 5, we also see a clear threshold

at about 0.007 B when the benefits of adding extra fee

starts declining.

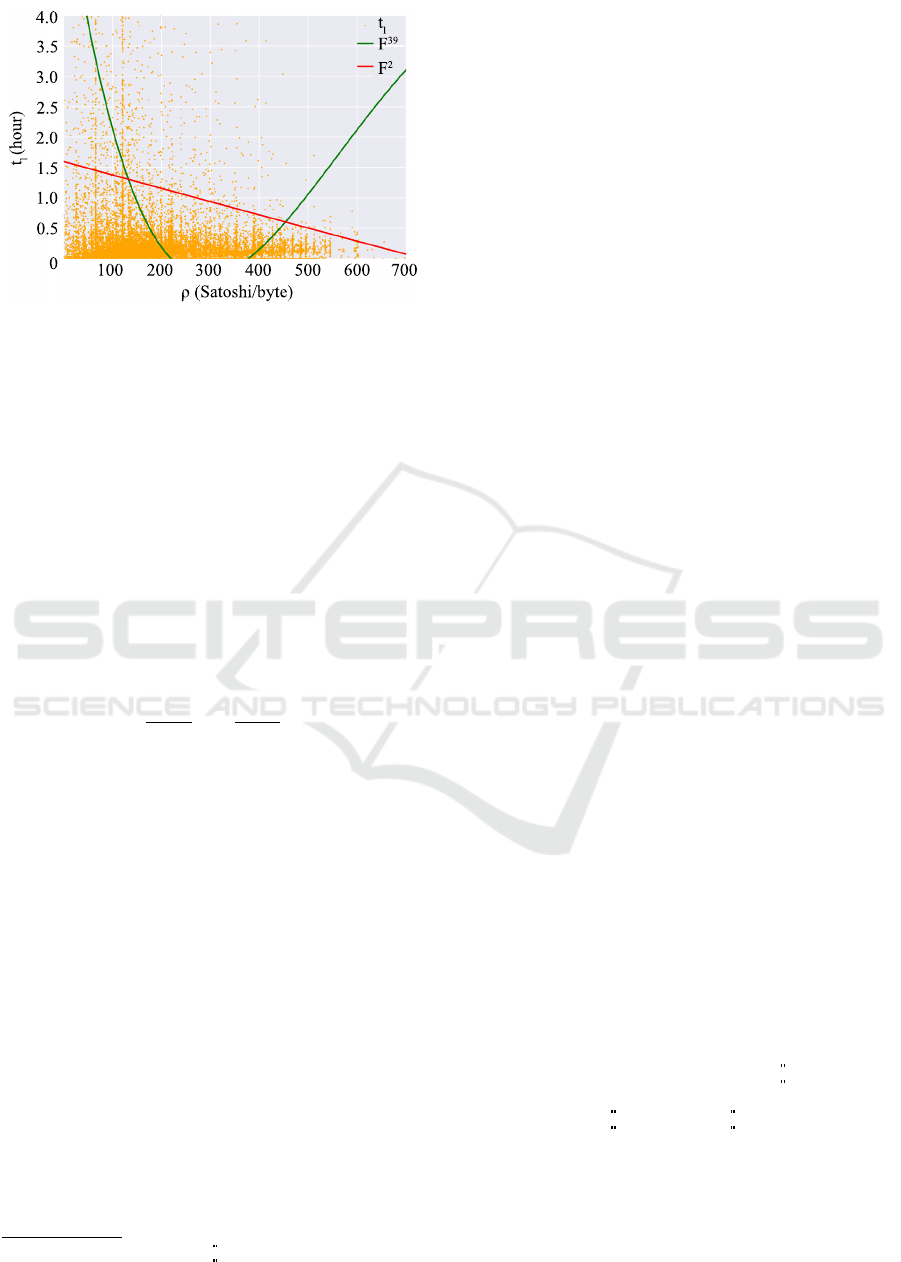

4.2 Fee Density-latency

As argued in Section 3.2, miners nowadays tend to

select transactions based on fee density, rather than

solely on the fee amount. We therefore generate a

Trading Network Performance for Cash in the Bitcoin Blockchain

647

ρ (Satoshi/byte)

t

l

F

39

F

2

t

l

(hour)

0.5

1.5

2.0

2.5

3.0

3.5

4.0

1.0

0

100 200

300

400 500

600

700

Figure 6: Fee density vs latency interpolation with a 2 and

39 degrees polynomial for Bitcoin transactions analyzed in

2017.

model D that provides the expected latency t

l

as a

function of the fee density t

ρ

= t

f

/t

q

.

Similar to F, we compute two variants of D us-

ing polynomial regression: one of degree 2 (D

2

) and

one of degree 39 (D

39

). The resulting regressions are

shown if Figure 6. Measured MAE was 1.749 for D

2

and 1.837 for D

39

.

Similarly to F, we also observe in D a clear trend

that offering higher fee-density transactions improves

commit latency. The threshold for diminishing re-

turns is about 300 Satoshi per byte.

4

Paying a higher

fee per byte gives little improvements The calculated

polynomial for D

2

is given by:

D

2

(x) =

5.416

10

8

x

2

−

2.215

10

3

x + 1.598 (6)

5 DISCUSSIONS

When Bitcoin was first released, one of its strengths

was its decentralized P2P architecture. Miners could

join the network all over the world, and more miners

meant a more robust service.

Over the years though, the opportunities to ex-

change block and transaction rewards into hard cash

enticed more and more people around the world to

join the mining effort and make money. This in-

creased the total hashing power of the system, but also

increased the difficulty of the proof-of-work puzzle,

as Bitcoin is designed to do. Eventually the puzzles

became too difficult for most individual casual miners

to solve, and people started teaming up into mining

pools to share both computational power and profit.

Today only a few large mining pools remain, and

the ability of the system to make progress has to a

large extent been centralized. Still, the mechanisms

4

1 Satoshi = 0.000000 01B.

controlling mining are governed by marked forces

that remain to be exactly described. This may be a

difficult task as most large mining pools withhold in-

formation about their number of miners, the hardware

they use, their profit, their transaction selection crite-

ria, etc. Observational studies, like the one described

here, might be the only plausible method for under-

standing the mechanisms governing these systems.

Towards that end, Table 2 summarizes our find-

ings by listing the effect of changing two key design

parameters in Bitcoin: the block size Q and the block

creation time T . Decreasing Q might first appear as

a good solution for the number of advantages it has.

However, its few disadvantages are critical for both

performance and scalability. We therefore deem that

decreasing Q is ill judged. It is likely much easier to

deal with the orphan rate amplification resulting from

increasing Q.

For the block creation time T , we have the oppo-

site scenario. An increment in T will reduce perfor-

mance as miners will make less profit and thus have

less incentive to mine. The only advantage is a lower

orphaning rate since blocks will have more time to

propagate.

As we can observe from Table 2, the throughput

γ increase when either the block size Q is raised or

the creation time T is lowered. According to Croman

et al. (2016), the block size should not exceed 4 MB

given T = 10 min. A good compromise could be to

increase the block size limit to 1.5 MB and lower the

creation time to 8 min. In that way, the system have

a potential throughput capacity of 3.20 kBps and 10

transactions per second.

We cannot find a clear and general relation be-

tween Q and t

f

in our studies. They seem to relate

only when the drastic change in the block size oc-

curs. We do, however, find that from 2013 to 2017

the relation between t

f

and t

l

became more notice-

able day-by-day, having almost an inverse proportion-

ality in the latest data from 2017, as seen in Fig-

ure 3. In 2017, zero-fee transactions almost disap-

peared from the system. This is probably due to the

incredibly high commit latency many clients were ex-

periencing at that time, with zero-fee transactions tak-

ing up to an average of 33 h to get committed into

blocks. At the same time, clients that paid only mod-

est transaction fees, less than 0.0002 B, experienced

commit latencies of only 5 h, while the ones that paid

between 0.0008 B and 0.0010 B expected latencies

of less than 1 h. Hence, applications that intend to

use blockchains as a service for communication will

benefit from having a dynamic fee-latency prediction

model, like the one described here, to optimize per-

formance.

CLOSER 2018 - 8th International Conference on Cloud Computing and Services Science

648

Table 2: Scalability and performance tradeoffs when changing block size Q and block creation time T .

Higher ↑ Lower ↓

Q

+ improved scalability with more transactions

accepted per day

+ improved commit latency t

l

± lower fees (good for clients, bad for miners)

− orphan rate amplification

− increased centralization

− congestion concern solved with transaction

eviction by miners

− no permanent effect

+ no transaction spam

+ no 0-fee transactions

+ less mining cost

+ less propagation time

+ less chance of orphaning

± higher fees (good for miners bad for clients)

− less throughput

− higher commit latency t

l

T

+ lower orphaning rate

+ no physical changed needed to support faster

inner node communication

− lower throughput γ (unless Q is increased)

− less scalable (unless Q is increased)

− mining profit is confined

+ higher throughput γ

+ system is more scalable

+ increased mining profit

− require faster inner-node communication

− exponential increment of orphaning rate

6 CONCLUSION

The Bitcoin blockchain has undoubtedly emerged as

a notable substrate and service for communication.

The built in mechanism for gaining monetary value

by doing useful work for others has clearly moved the

underlying architecture from its initial P2P model, to

a more centralized model resembling a public cloud-

like service. Individual incentives for providing the

service is no longer motivated by own needs for it, but

rather motivated by the prosperity of earning money.

Although the service provided by the Bitcoin sub-

strate is highly robust, it is also painstakingly slow.

Commit latencies of transactions are often measured

in hours. Applications that intend to use Bitcoin, or

one of its derivatives, as a public cloud-like service

for communication, can still improve their messaging

performance by adjusting the offered transaction fee

to the number of bytes sent. There are, however, clear

limits to what can be achieved. For Bitcoin, spend-

ing more than 300 Satoshi per byte seems to be inef-

fective. As the incentives to mine new blocks shift

focus from block fees to transaction fees in the years

to come, we expect that new schemes for optimizing

messaging performance needs to be developed.

ACKNOWLEDGMENT

This work was supported in part by the Norwegian

Research Council project number 263248. We would

like to thank the anonymous reviewers for their useful

insights and comments.

REFERENCES

Aiyer, A. S., Alvisi, L., Clement, A., Dahlin, M., Martin, J.-

P., and Porth, C. (2005). Bar fault tolerance for coop-

erative services. In Proceedings of the Twentieth ACM

Symposium on Operating Systems Principles, SOSP

’05, pages 45–58, New York, NY, USA. ACM.

Augspurger, T., Bartak, C., Cloud, P., Hayden, A., Hoyer,

S., McKinney, W., Reback, J., She, C., Horikoshi, M.,

den Bossche, J. V., et al. (2012). Pandas: Python Data

Analysis Library. software v0.21.0, Pandas commu-

nity.

Cheriton, D. R. and Zwaenepoel, W. (1985). Distributed

process groups in the V kernel. ACM Transactions on

Computer Systems, 3(2):77–107.

Croman, K., Decker, C., Eyal, I., Gencer, A. E., Juels, A.,

Kosba, A., Miller, A., Saxena, P., Shi, E., G

¨

un Sirer,

E., Song, D., and Wattenhofer, R. (2016). On scal-

ing decentralized Blockchains. In Financial Cryptog-

raphy and Data Security. FC 2016., volume 9604 of

LNCS, pages 106–125, Berlin, Heidelberg. Springer

Berlin Heidelberg.

Trading Network Performance for Cash in the Bitcoin Blockchain

649

Houy, N. (2014). The economics of Bitcoin transaction

fees. Working Papers 1407, Groupe d’Analyse et de

Th

´

eorie Economique (GATE), Universit

´

e Lyon 2.

Hunter, J., Dale, D., Firing, E., Droettboom, M., et al.

(2017). Matplotlib for data plotting. software v2.1.1.

Johansen, H. D., van Renesse, R., Vigfusson, Y., and Jo-

hansen, D. (2015). Fireflies: A secure and scalable

membership and gossip service. ACM Transactions

on Computer Systems (TOCS), 33(2):5:1–5:32.

Kihlstrom, K. P., Moser, L. E., and Melliar-Smith, P. M.

(1998). The SecureRing protocols for securing group

communication. In Proc. of the 31st Annual Hawaii

International Conference on System Sciences, pages

317–326. IEEE.

Moser, L. E., Melliar-Smith, P. M., Agarwal, D. A., Bud-

hia, R. K., and Lingley-Papadopoulos, C. A. (1996).

Totem: a fault-tolerant multicast group communica-

tion system. Communications of the ACM, 39(4):54–

63.

M

¨

oser, M. and B

¨

ohme, R. (2015). Trends, tips, tolls: A

longitudinal study of Bitcoin transaction fees. In Fi-

nancial Cryptography and Data Security: FC 2015.,

number 8976 in LNCS, pages 19–33, Berlin, Heidel-

berg. Springer Berlin Heidelberg.

Rizun, P. R. (2015). A transaction fee market exists without

a block size limit. Technical report.

Taylor, M. B. (2017). The evolution of bitcoin hardware.

IEEE Computer, 50(9):58–66.

van der Laan, W. J., Wuille, P., Andresen, G., et al. (2017).

Bitcoin client application. software v0.15.1.

van Renesse, R., Birman, K. P., and Maffeis, S. (1996). Ho-

rus: a flexible group communication system. Commu-

nications of the ACM, 39(4):76–83.

Waskom, M., Botvinnik, O., drewokane, Hobson, P., David,

Halchenko, Y., Lukauskas, S., Cole, J. B., Warmen-

hoven, J., de Ruiter, J., Hoyer, S., Vanderplas, J., Vil-

lalba, S., Kunter, G., Quintero, E., Martin, M., Miles,

A., Meyer, K., Augspurger, T., Yarkoni, T., Bachant,

P., Williams, M., Evans, C., Fitzgerald, C., Brian,

Wehner, D., Hitz, G., Ziegler, E., Qalieh, A., and Lee,

A. (2016). Seaborn. Software v0.7.1.

CLOSER 2018 - 8th International Conference on Cloud Computing and Services Science

650