Does Financial Literacy Impact Financial Decision Making Among

The Government Employee

Ratna Komara, Arie Widyastuti and Layyinaturrobaniyah

Department of Business and Management, Faculty of Economics and Business, Universitas Padjadjaran

arie.widyastuti@fe.unpad.ac.id

Keywords: Financial Literacy, Financial Decision Making, Financial Behavior.

Abstract: Having an adequate financial literacy is a necessary tool for employees, especially in welcoming retirement,

and an absent of it can lead to economic hardship for an individual and potentially for the other family

members. Public servants in the government institutions are often considered as the vulnerable group that do

not possess proper financial knowledge due to little access to personal financial training at their workplaces,

as well as limited time to cultivate entrepreneurial skills. This paper aimed to better understand the level of

financial literacy and its relation to financial decision making during the workers’ prime earning years when

they are making key financial decisions. 380 questionnaires were distributed to government employees in

Bandung, with 85% return rate. The result reveals that better financial literacy leads to better financial

decision at 1% significance level. This study also indicated that, although demographic profiles such as

gender, age, marital status, education and career level have positive correlation with the level of financial

literacy, they do not have mediating effect to the financial literacy and financial decision making of the

bureaucrats.

1 INTRODUCTION

The dynamic of the environment and the rapid

changing of technology have shaped financial

system in Indonesia to become more sophisticated.

The complexity of financial instruments has

increased over the past years, and a simple

knowledge of how to maintain a checking and

savings account at local banks and financial

institutions is not enough to secure individuals’

financial freedom. Money - related struggles do not

necessarily disappear as one person moves through

adulthood; they often evolve or change. Therefore, it

is important for individuals to be able to differentiate

among wide array of financial products and services

available in order to make choices that are most

appropriate to their financial goals and needs.

The 2016 national literacy and financial

inclusion poll conducted by Financial Services

Authority shows that the majority of Indonesian do

not have a complete grasp on financial services and

products. The financial literacy and inclusion indices

stood at 29.66 percent and 67.82 percent

respectively. Only 8% of adults have retirement

plan, and when it comes to invest, Indonesian

market is very traditional with most people prefer to

use time deposits, gold and property. Although

Indonesian stocks have been among the world’s best

performers over the past five years, the domestic

investment industry is still low. Data issued by The

Securities Depository and Settlement Institution in

2016 shows that the number of people invests in

stocks and mutual funds is around 1 million. This

number is considered small compared to the total

population of 262 Million.

Public servants in the government institutions are

often considered as the vulnerable groups that do not

possess proper knowledge of financial know how

(Bucher-Koenen and Lusardi 2011). This is due to

lack of access to financial literacy sessions at their

workplaces, as well as the nature of organizational

culture among the bureaucrats that provides limited

time to cultivate entrepreneurial skills. At the end,

this can lead to struggles for government employees,

not only in preparing for retirement, but for any

situation that could put someone at financial risk. A

lack of financial literacy can contribute to the

making of poor financial choices that can be harmful

to both individuals and communities. Without an

appreciation of money concepts and an

understanding of financial options, individuals

would likely to pay more than they have to for

financial services, fall into debt, and damage their

credit records. This, in the end could lead to

174

Komara, R., Widyastuti, A. and Layyinaturrobaniyah, .

Does Financial Literacy Impact Financial Decision Making Among The Government Employee.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 174-184

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All r ights reserved

economic hardship during retirement for an

individual, and potentially, for the surviving spouse

and other family members.

This paper is aimed to evaluate financial

knowledge during prime earning years of

government officials, when they are making key

financial decisions. This setting offers information

on the level of financial literacy possessed and the

attitudes towards making key financial decisions.

We find that financial literacy proves to be a key

determinant of better financial decision making. This

study also indicated that although demographic

profiles such as gender, age, and career level have

strong correlation with the level of financial literacy,

they do not have mediating effect to the financial

literacy and financial decision making.

Analysing the relationship between financial

literacy and financial decision making in the

institutional context will provide the opportunity to

improve the understanding on the process of

financial decision making, specifically in a macro

view. This study is also important to the manager of

financial institutions and advisors since they are able

to put more emphasis when giving their quality

advice to the workers. Scholars and academicians

stands to benefit from the added knowledge in the

area of personal finance management and also be

able to identify other research gaps for future

studies, especially in the context of developing

countries.

2 LITERATURE REVIEW

The term financial literacy has been used loosely by

scholars, policy officials, financial experts and

consumer advocates to describe the knowledge and

understanding of financial terms, concepts, and

sound decisions that produce optimal results. By the

most basic definition, financial literacy relates to a

person’s competency for managing money. Chen

and Volpe (2005) and Huston (2010) broadly define

financial literacy as a measure of how well an

individual can understand personal finance-related

information and then take the necessary and

appropriate financial decision. Remund (2010)

defines financial literacy as a degree to measure

understanding of key financial concepts and

possession of the ability and confidence in managing

personal finances through appropriate, short-term

decision-making and sound, long-range financial

planning.

Financial decision is defined as a selection of

possible choices made with the applied knowledge

of financial literacy. Financial decisions are greatly

influenced by a constant battle between the

generating of goods and services in the marketplace

and a person’s limited reserves to acquire such

goods and services (Remund 2010).

A financially literate individual has the

capability to plan, save, borrow, invest and spend

wisely and able to take risks reduction measures.

Bernheim and Garrett (2003) show that those who

were exposed to financial education in high school

or in the workplace save more. Similarly, using

dataset called the Rand American Life Panel that

offers a set of features for the analysis of literacy

and retirement planning, Lusardi and Mitchell

(2007) found that those who are financial illiterate

are less likely to plan for retirement and to

accumulate wealth, and more likely to take up higher

interest mortgages (Moore 2003). Martin (2007)

reviews past literature on the effectiveness of

financial education, and find that financial education

is necessary in the area of retirement planning,

savings, homeownership, and credit use. Hathaway

and Khatiwada (2008) also provide a comprehensive

critical analysis of past studies that examine the

impact of financial education programs on consumer

financial behaviour. Of what they examined, they

recommend that there is a need for this type of

education especially in the area of financial activity

(e.g. credit card counselling and retirement

planning). Study by Bhushan (2014) on the

relationship between investment behaviour and

financial literacy also found that awareness and

investment preference largely depends on the

financial literacy of the individuals.

Individual differences can either strengthen

or weaken the relationship between financial literacy

and financial decision making. In recent studies,

correlations are found in existence between

demographic characteristics and financial literacy.

Education has been positively associated with

financial literacy and financial outcomes (Bernheim

and Garrett 2003, Lusardi 2008). Study on gender

and financial literacy shows men are typically

identified as having higher levels of financial

literacy. Survey conducted by (Chen and Volpe

2005, Lusardi, Mitchell et al. 2010, 2011) found that

women generally possess less financial knowledge

and interests compared to males. Females also tend

to be risk adverse in financial choices. Whether a

respondent is married or not also may impact their

finances. Having a spouse or dependents will affect

the financial planning, as an individual will include

providing for them in his financial thinking.

Furthermore, age and experience are also associated

with higher level of financial literacy and better

financial decision making. Generally, older

Does Financial Literacy Impact Financial Decision Making Among The Government Employee

175

individuals are more conservative and risk averse.

Ansong and Gyensare (2012) find that the age and

work experience are positively correlated with

financial literacy. The deeper life experiences

encourage the acquisition of skills to secure the

employees financial aspirations in their life.

2.1 HYPOTHESIS

The key hypothesis in this study is that financial

literacy will lead to a better financial decision

making. Demographic characteristics are also

expected to moderate the relationship between

financial literacy and financial decision making

among the government employees in Bandung.

2.2 RESEARCH DESIGN

2.2.1 Sample and Methodology

A random sample of 380 out of approximately

18,000 government employees working in Bandung

City was selected. Of the full sample size, 56

respondents or 15% of them don’t have complete

data thus are eliminated from this study. The

resulting data set includes 324 respondents or 85%

of the sample.

In conducting this research, we develop a

customized survey with a set of questions to

discover how knowledgeable people are about

financial concepts and their behaviour towards

financial decision making. The questionnaire

consists of 50 questions; 5 questions that are used to

design a profile of the participants, 25 questions

regarding financial literacy and 20 questions related

to financial behaviour.

Some modification of the Chen and Volpe

(1998) questionnaire was used in order to measure

financial literacy of individuals that involves several

factors such as: general knowledge of finance on

interest rates, time value of money, bank and non-

bank financial institutions, savings and loan,

investment, and insurance. Each question takes on a

value of 1 if the respondent was correct regarding

the financial literacy question, and 0 otherwise. A

person will get maximum 25 points for question

related to financial literacy. The total score of

financial literacy for a respondent is then divided

into:

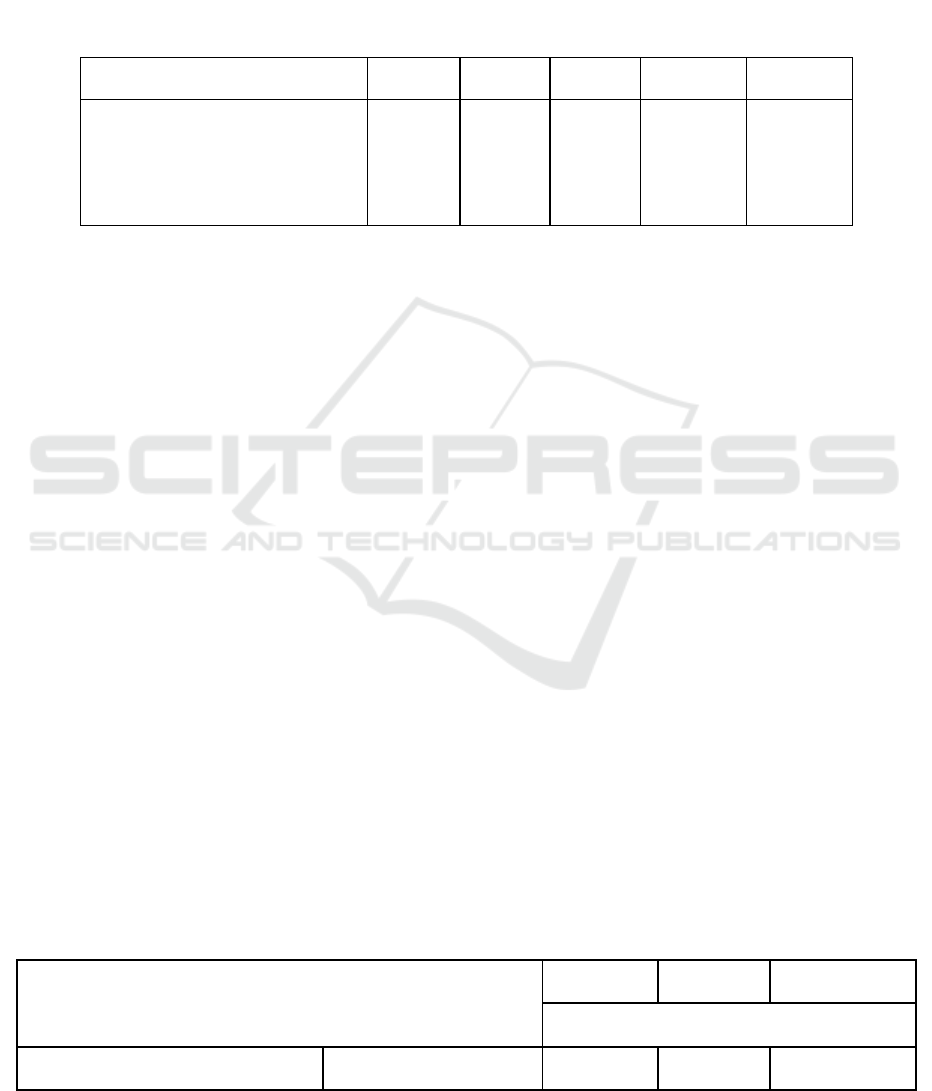

Table 1 : Financial Literacy Score

Financial Literacy Score

Very Low

0 – 5

Low 6 -10

Fair 11 – 15

Good 16 – 20

Excellent 21 – 25

A five-option Likert scale is used in the

questionnaire for financial decision making. Every

choice has a score from 1 to 5, where the score 1

represents the worst and 5 indicates the best

situation for an individual upon that question. Hence

a respondent will obtain maximum 100 points for

questions related to financial decision making.

Competency in financial decision making is then

divided into:

Table 2 : Financial Decision Making Score

Financial Decision Making Score

Very Low 1 – 20

Low 21 -40

Fair 41 – 60

Good 61 – 80

Excellent 81 – 100

To test our hypothesis, we use multiple

regression analysis with key variables are financial

literacy and financial decision making. In addition to

these variables, we also use demographic factors as

control variables in the models, namely: gender,

education, marital status, and career ranking as

government officials (golongan kerja). Content

analysis was also done to establish the effect of

overall score of employee financial literacy on

employee decision making.

Before conducting regression analysis, we also

carry out reliability and validity tests on the

questionnaires. The inquiries of the questionnaire

are considered valid if r calculated > r designated or

sig < 0.05, and the reliability of the questionnaires is

shown using alpha cronbach score, where the value

of alpha equal 0.7 to 0.9 shows a high rate of

reliability; value of alpha 0.5 – 0.7, shows a fair rate

of reliability; and value of alpha < 0.5, shows

possibility of one or several inquiries are unreliable

(Ghozali and Fuad 2008).

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

176

4 FINDINGS AND DISCUSSION

4.1 Financial Literacy

The demographic profiles of the respondent are

presented in Table 3. While the score of financial

literacy based on demographic profiles is portrayed

on Table 4. Our data shows that the majority of

employees display basic financial knowledge and

have some grasp of concepts such as inflation and

time value of money. However still many of the

respondents do not know the difference between

bonds and stocks, the relationship between bond

prices and interest rates, and the basic risk of

diversification. On average, the respondents have a

good financial literacy score with the description as

follows: 7% has an excellent score of financial

literacy, 45% has a good score, 35% has a fair score,

and 13% has a low score of financial literacy level.

Based on the score of financial literacy survey of

the respondents, those who have career level III or

IV (73% of the total respondents) on average have a

good score of financial literacy. On the other hand,

those with career level I or II (27% of the total

sample) still have a very low and fair score of

financial literacy.

Based on the score of financial literacy survey of

the respondents, those who have career level III or

IV (73% of the total respondents) on average have a

good score of financial literacy. On the other hand,

those with career level I or II (27% of the total

sample) still have a very low and fair score of

financial literacy.

On the Age category of demographic profile,

respondents who are between the ages of 20-35

(60% of the total sample), have a good score of

financial literacy. Meanwhile another 40% of the

total respondents that are aged between of 36-58

years have a fair score of financial literacy, despite

the fact that they are entering retirement age at that

point.

Correlation table shows that the financial literacy

strongly correlated with gender, level of education

and the work rank. This result can also be

interpreted as financial knowledge of an individual

increases with higher level of education and more

working experience. Males also appear to have

higher financial literacy, which accordance with

research findings by Lusardi and Mitchell (2010,

2011).

Table 3: Respondents Characteristics

Variables #Respondents Percentage

Age

> 35 195 60.19%

≤ 35 129 39.81%

Gender

Female 154 47.53%

Male 170 52.47%

Education Level

Non-Higher Degree 133 41.05%

Higher Degree 191 58.95%

Carrer Level

Work rank ≤ II 86 26.54%

Work rank > II 238 73.46%

Marital Status

Not Married 22 6.79%

Married 302 93.21%

Table 4 Financial Literacy Scores Based on Demographic Profiles

Demographic Profiles Very Low Low Fair Good Excellent

Age

Age<35 0.5% 11.8% 35.9% 43.1% 8.7%

Age≥35 0.0% 15.5% 33.3% 47.3% 3.9%

Gender

Female 0.5% 11.8% 35.9% 43.1% 8.7%

Male 0.0% 15.5% 33.3% 47.3% 3.9%

Marital Single 0.0% 4.5% 27.3% 68.2% 0.0%

Does Financial Literacy Impact Financial Decision Making Among The Government Employee

177

Status Married 0.3% 13.9% 35.4% 43.0% 7.3%

Education

Non-Higher Degree 0.8% 15.8% 46.6% 30.1% 6.8%

Higher Degree 0.0% 11.5% 26.7% 55.0% 6.8%

Carrer Rank

Rank < 3 1.2% 19.8% 32.6% 40.7% 5.8%

Rank ≥ 3 0.0% 10.9% 35.7% 46.2% 7.1%

Table 5 also shows that age have negative

correlation with financial literacy of the public

servants, although not significant, this result raised a

concern. It can be interpreted that government

employees who are entering their retirement age do

not fully understand about various financial products

offered by financial institutions. Since financial

literacy is crucial in helping investors to make a

more realistic assessment of given opportunity for

saving or investment, having less literacy means the

probability for the investors to make incorrect

choices when it comes to taking financial decisions,

be it investing/leveraging/ protecting is bigger.

Which can put the life after retirement at risk.

This research also finds that public servants only

have some understanding regarding financial

products offered by banking institutions (specially

saving and borrowings), and lack of knowledge on

the products that are offered by non-banking

financial institutions. Hence, there is possibilities

that they have not yet enjoyed the benefits of some

products, such as insurance, pension fund, and

investment instruments such as stock and bonds.

Table 5: Correlation Table of Demographic Profiles and Financial Literacy

Financial

Literacy Gender Age

Marital

Status Education WorkRank

Financial Literacy 1

Gender -0.132* 1.000

Age -0.005 -0.047

1.00

0

Marital Status -0.073

0.161*

*

0.04

4 1.000

Education 0.252**

-

0.267**

0.23

0** -0.026 1.000

WorkRank 0.128*

-

0.236**

0.18

9** 0.004

0.422*

* 1.000

**. Correlation is significant at the 0.01 level (2-tailed).

*. Correlation is significant at the 0.05 level (2-tailed).

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

178

4.2 Financial Decision Making

The descriptive data of the respondents’ scores

and demographic profiles are presented on Table 6

and 7. Overall the score of financial literacy of the

respondents reached minimum 3 and maximum

score of 24. While the result on the financial

decision-making survey, the highest score was 86

and the lowest score was 43. The survey on financial

decision making also reveals that out of 340

respondents surveyed, 238 have good score, 28% of

them have fair score and 2% is considered as

excellent in answering questions on making

financial decision.

Table 6: Descriptive Statistics

N Min. Max. Mean Std. Dev

Financial Literacy Score 324 3 24 15.18 4.066

Financial Decision Making Score 324 43 86 65.11 7.367

Valid N (listwise) 324

Despite the sound financial literacy levels of the

government employees in Bandung, not all the

respondent are good managers of their personal

finances. As per findings, although majority of the

respondents scored good in financial literacy,

substantial cases of poor scores in management of

personal finances have been realized.

On average the respondent has a good sense in

allocating their financial decision, however, public

servants who have a fair score in financial decision-

making spread across all ages, gender, education and

career level. An interesting finding is that some of

the respondents who are within the group of 36-58-

year-old, 30 of them are classified as having a fair

score of financial decision making, and this number

is similar to the scoring of financial literacy rate.

This indicates some of this demographic groups

might not optimally allocate their income despite of

the fact that they are facing retirement in the near

future.

Only 9% of the total respondent think that

investing is very important, and 37% of them think

of it as least important. This means that the majority

of the population still prefer to put their money in

savings, compared having long term investment such

as stocks or mutual fund. From interview with some

respondent, it is revealed that they feel reluctant to

invest in shares since they regard the activities of

buying and selling shares are speculative and

gambling, hence think of it as haram (religious

expression of what is not allowed), despite the

increase of marketing campaign from the stock

exchange and the growing popularity of shariah

products in the financial service sector as well as in

the stock market. Furthermore, although traditional

products such as gold and property are either carry

more risks or deliver less optimal return, when it

comes to preserving wealth, culturally Indonesian

tend to put their trust more on something that they

can touch and feel.

Another finding shows that the majority of the

respondent doesn’t have alternative income as an

entrepreneur aside than their main job, which

indicates that government employees are highly

dependent on their income as public servants, that

comes in the form of salary and fringe benefit.

Income allocation is also mainly allocated to cover

living expenses, education, loan repayments, and

charity consecutively. This shows that majority of

the respondents save less proportion of their salaries,

which can be attributed to the high cost of living and

individual’s financial discipline.

Table 7: Financial Decision Making Scores Based on Demographic Profiles

Demographic Profiles

Fair Good Excellent

(Number of Respondent)

Age Age<35 61 129 5

Does Financial Literacy Impact Financial Decision Making Among The Government Employee

179

Age≥35 30 97 2

Gender

Female 38 113 3

Male 53 113 4

Marital Status

Single 5 17 -

Married 86 209 7

Education

Non-Higher Degree 44 88 1

Higher Degree 47 138 6

Carrer Rank (Gol. Kerja)

Rank < 3 30 56 -

Rank ≥ 3 61 170 7

Tabel 8: Perception on Income Allocation

Income

Allocatiom

5

Most

Important

4 3 2 1

Least Important

Charity 7,10% 3,70% 33,33% 54,32% 1,54%

Education 30,56% 19,44% 23,15% 23,15% 3,70%

Insurance 32,56% 12,73% 18,98% 16,74% 18,98%

Investment 9,57% 8,74% 16,77% 28,29% 36,63%

Living Cost 33,41% 28,59% 17,09% 12,81% 8,10%

The surveys also find that the majority of

respondents are not familiar in keeping record of

their expenses. They are also not customized to

make financial planning on income allocation. As a

result, there are some respondents who have

financial trouble at the end of the month.

Respondents who have some savings will use it in

time of financial trouble or for helping relatives or

family member who need the money.

Furthermore, since all of the public servants are a

part of Social Security Administrator for Health in

Indonesia (BPJS), most of respondents feel it is

unnecessary for them to join another insurance or

any retirement program in other financial

institutions. These indicates that although on average

the government employees have a good financial

literacy, they are very dependent to the retirement

funds provided by the government, and not yet

effectively plan for longer term. The findings also

suggest that although the score in financial literacy

does increase with age, education and length of

employment; the higher level of financial literacy

seems not to be followed by a sound financial plan

for the future.

4.3 The Influence of Financial Literacy

towards Financial Behavior

Before conducting verification analysis, the data

collected has to be tested for validity and reliability.

For the inquiries relating to the validity of financial

literacy questions (Table 7), there is one inquiry

which is invalid, number 24 (.0854 rate calculated),

while other inquiries in the questionnaire are valid

since r calculated > r designated. Regarding to

validity test on financial decision-making questions

(Table 10), there is one invalid question, that is

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

180

question number 4 (.042 rate calculated). Other

inquiries in the questionnaire are valid since r

calculated > r designated or sig < 0.05.

In terms of Reliability tests of the questionnaires,

we found that the value of alpha cronbach for

financial literacy is 0.721 and for financial behavior

is 0.533. Therefore, it may be concluded that the

inquiries both relating to financial literacy and

financial decision making are reliable since the

result of the reliability coefficient is between 0.50

and 0.90.

After eliminating the questions that is not valid

(question number 24 on financial literacy and

number 4 on financial behavior), we conduct

statistical analysis to find out the relationship

between financial literacy and financial behavior.

Table 12 shows there is positive relationship

between financial behavior and financial literacy at 1

% significance level. This means that the

respondents who have a good financial literacy are

more likely to give correct answers to all of the

questions regarding to a sound financial decision

making.

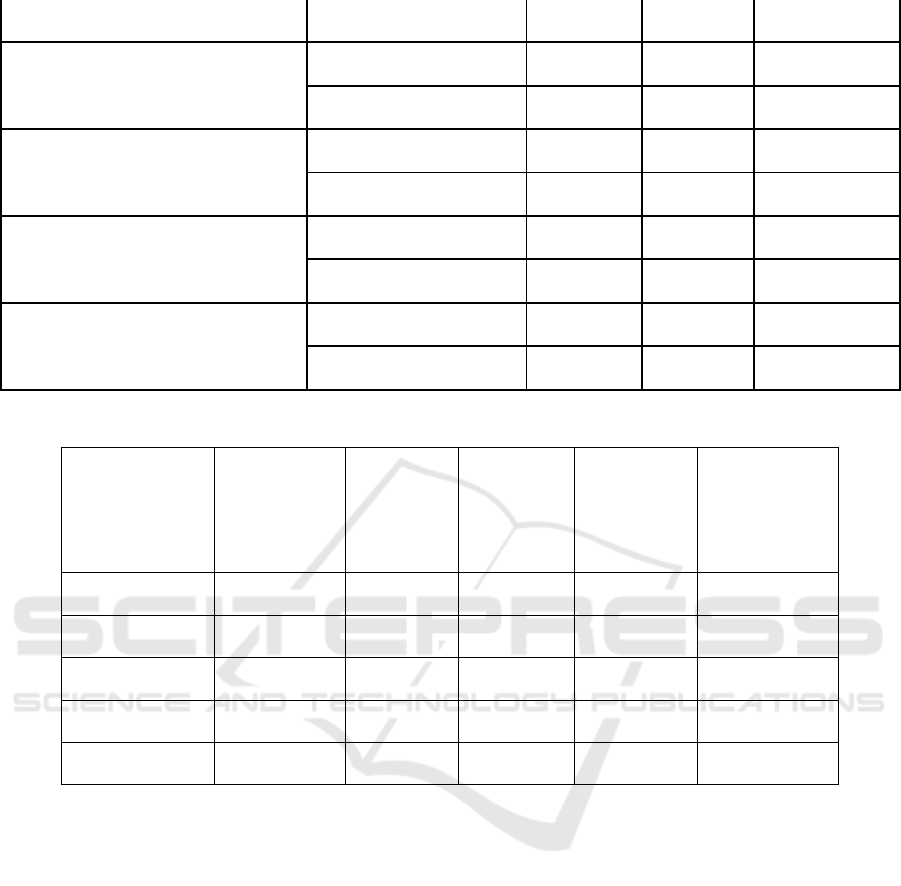

Table 9: Validity Test for Financial Literacy

Item

Correlation

Coefficient

Item

Correlation

Coefficient

Item

Correlation

Coefficient

Item

Correlation

Coefficient

Item

Correlation

Coefficient

1 .179** 6 .360** 11 .534** 16 .480** 21 .402**

2 .347** 7 .387** 12 .407** 17 .243** 22 .350**

3 .518** 8 .331** 13 .205** 18 .330** 23 .396**

4 .448** 9 .287** 14 .445** 19 .332** 24 .0854

5 .365** 10 .472** 15 .358** 20 .375** 25 .354**

Table 10: Validity Test for Financial Decision Making

Item

Correlation

Coefficient

Item

Correlation

Coefficient

Item

Correlation

Coefficient

Item

Correlation

Coefficient

1 .322

**

6 .263

**

11 .448

**

16 .318

**

2 .435

**

7 .267

**

12 .370

**

17 .131

*

3 .452

**

8 .431

**

13 .323

**

18 .352

**

4 .042 9 .502

**

14 .405

**

19 .269

**

5 .210

**

10 .296

**

15 .183

**

20 .198

**

Table 11: Reliability Test

Reliability Coefficient Score

Financial Literacy .721

Financial Behavior .533

Does Financial Literacy Impact Financial Decision Making Among The Government Employee

181

Table 12: Financial Behavior and Financial Literacy

Variables Financial Decision Making

Financial Literacy

0.443*** 0.437*** 0.450*** 0.415*** 0.419***

(0.000) (0.000) (0.000) (0.000) (0.000)

Gender

-0.176

(0.827)

FinancialLiteracy*Gender

-0.213

(0.282)

Age

0.028

(0.973)

FinancialLiteracy*Age

0.175

(0.392)

Education

0.948

(0.260)

FinancialLiteracy*Education

.036

(0.859)

Work Rank

1.951**

(0.033)

FinancialLiteracy*WorkRank

0.053

0.802

#. of Obs 324 324 324 324 `

R

2

0.245 0.252 0.249 0.252 0.270

***Significant at the 1% level

** Significant at the 5% level

* Significant at the 10% level

In this study we also want to test whether the

nature and strength of relationship between financial

literacy and financial decision-making changes with

a function of demographic variables by using

moderation analysis. However, from the data

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

182

collected shows that although demographic profiles

such as gender, age, marital status, education and

career level have positive correlation with the level

of financial literacy, they do not have mediating

effect to the financial literacy and financial decision

making.

5 CONCLUSIONS

This paper tries to find the link between the financial

literacy of the government workers to their

capabilities in managing the financial decisions.

Overall we find that although the score in financial

literacy does increase with age, education and length

of employment, the higher level of financial literacy

seems not to be followed by a sound financial plan

for the future.

Secondly, majority of the respondents have

better knowledge on products offered by banking

institution (especially savings and borrowings) than

non-bank financial institution, hence the knowledge

on insurance, investment and other non-bank

financial products is considered low. Furthermore,

most of the respondent are not familiar with

financial planning for income allocation in the near

and long future, hence financial planning is not

optimum, and the score on financial decision-

making survey of the public servants between the

age of 46-58 is still classified as fair. These facts are

indicators that show an urgency for financial literacy

and financial advice sessions in the workplace to

encourage building retirement wealth.

Third, we show that some demographic factors

such as gender, age and career level affect the level

of financial literacy, and the score of financial

literacy is strongly correlated with financial decision

making. We also explore the possibility that

demographic profiles have mediating effect to

financial literacy and financial decision making, but

our statistical test indicates that this is not the case.

We believe that our findings are particularly

relevant among the administration in Bandung

regarding ways to enhance the worker knowledge on

financial management. After serving the government

during their productive years, it is important for the

public servants to be empowered on the subject of

personal finance by providing them with knowledge

for wise saving and investment decisions. The

financial industries, along with policy makers also

need to socialize and offer the wide range of

financial products available so that public servants

will be drawn to be a part of investment society

which enable them to prepare their retirement more

adequately.

REFERENCES

Ansong, A. and M. A. Gyensare (2012). "Determinants of

university working-students’ financial literacy at the

University of Cape Coast, Ghana." International

Journal of Business and Management 7(9): 126.

Astuti, E. D. (2013). "Perilaku Konsumtif dalam Membeli

Barang pada Ibu Rumah Tangga di Kota Samarinda."

E-Journal Psikologi 1(2): 148-156.

Astuti, PH; Trinugroho, I. Financial Literacy and

Engagement In Banking. Journal of Economics &

Economic Education Research. 17, 1, 1-6, Jan. 2016.

ISSN: 15333604.

Bernheim, B. D. and D. M. Garrett (2003). "The effects of

financial education in the workplace: evidence from a

survey of households." Journal of public Economics

87(7): 1487-1519.

Bhushan, P. (2014). "Relationship between Financial

Literacy and Investment Behavior of Salaried

Individuals." Journal of Business Management &

Social Sciences Research, ISSN(2319-5614): 82-87.

Bucher-Koenen, T. and A. Lusardi (2011). "Financial

literacy and retirement planning in Germany." Journal

of Pension Economics and Finance 10(04): 565-584.

Chen, H. and R. P. Volpe (1998). "An analysis of personal

financial literacy among college students." Financial

services review 7(2): 107-128.

Chen, H. and R. P. Volpe (2005). "Financial literacy,

education, and services in the workplace." A Journal

of Applied Topics in Business and

Economics,(online),(Accessed: 2 Feb 2006)

Ghozali, I. and Fuad (2008). Structural equation modeling:

teori, konsep, dan aplikasi dengan Program Lisrel

8.80, Badan Penerbit Universitas Diponegoro.

Hathaway, I. and S. Khatiwada (2008). "Do financial

education programs work?".

Huston, S. J. (2010). "Measuring financial literacy."

Journal of Consumer Affairs 44(2): 296-316.

I Wayan Nuka Lantara, & Ni Ketut Rai Kartini. (2015).

Financial Literacy Among University Students:

Empirical Evidence From Indonesia. Journal of

Indonesian Economy and Business, 30(3).

doi:10.22146/jieb.10314

Does Financial Literacy Impact Financial Decision Making Among The Government Employee

183

Lusardi, A. (2008). Household saving behavior: The role

of financial literacy, information, and financial

education programs, National Bureau of Economic

Research.

Lusardi, A. and O. S. Mitchell (2007). "Financial literacy

and retirement planning: New evidence from the Rand

American Life Panel." Michigan Retirement Research

Center Research Paper No. WP 157.

Lusardi, A. and O. S. Mitchell (2011). Financial literacy

and planning: Implications for retirement wellbeing,

National Bureau of Economic Research.

Lusardi, A., et al. (2010). "Financial literacy among the

young." Journal of Consumer Affairs 44(2): 358-380.

Martin, M. (2007). "A literature review on the

effectiveness of financial education."

Moore, D. L. (2003). Survey of financial literacy in

Washington State: Knowledge, behavior, attitudes,

and experiences, Washington State Department of

Financial Institutions.

Remund, D. L. (2010). "Financial literacy explicated: The

case for a clearer definition in an increasingly complex

economy." Journal of Consumer Affairs 44(2): 276-

295.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

184