Islamic Values and Voluntary Corporate Governance Disclosure

Citra Laksmi Chrisworo and Erina Sudaryati

Faculty of Economics and Business, Universitas Airlangga, Surabaya, Indonesia

citrachrisworo@gmail.com,

erina_unair@yahoo.com

Keywords: Islamic Values, Corporate Governance, Voluntary Disclosure, Traditional Ownership Structure.

Abstract: The aim of this study was to empirically examine the influence of Islamic values on the level of voluntary

corporate governance disclosures in public companies in Indonesia and the influence of traditional

ownership structures and corporate governance on the level of voluntary GCG disclosures. In this regard,

this study was structured on the basis of Islamic values and voluntary corporate governance disclosures. The

population in this study was banking sector companies listed on the Indonesian Stock Exchange from 2012–

2016, which consisted of 43 companies. Data from 2012 to 2016 was used, representing the period after the

adoption of the GCG code, and a purposive sampling technique was utilized. An examination of the

influence of Islamic values on voluntary GCG disclosures was carried out by using multiple linear

regression analysis, assisted by SPSS 24.0 software.

1 INTRODUCTION

The collapse of large-scale public companies is mostly

caused by poor corporate governance (Hussainey & Al-

Najjar, 2012; Ntim et al., 2012). The main characteristic of

poor corporate governance is the self-interest of corporate

managers, who ignore the needs of stakeholders, thus

eventually leading to a drop in stakeholders’ expectations

with regard to gaining more benefits from the company’s

performance (Isnandar & Sudaryati, 2015). The collapse

of large companies has a major impact on the economy of

a country (Haniffa & Hudaib, 2006), which is

characterized by a number of employment terminations

that subsequently have an impact on the country’s

unemployment rate (Ntim et al., 2012). In this regard, it

can be inferred that poor corporate governance practices

will have a major impact on the economy of a state. Such

a condition has encouraged governments to improve the

rules and develop policy reforms in relation to good

corporate governance. In general, policy reforms require

public companies to increase transparency, accountability,

openness, independence, responsibility, and fairness to all

stakeholders. Good corporate governance deals with the

balance between economic and social goals and between

individual and communal goals. A good corporate

governance framework is designed to encourage the

efficient and equitable use of resources, which requires

accountability from the management of the resources. By

so doing, the goal is to align the interests of individuals,

enterprises, and communities (Choudhury & Alam, 2013).

However, the policy reforms undertaken to achieve

good corporate governance are still largely dependent on

the extent to which companies are willing to be involved

and to disclose corporate governance mechanisms in their

corporate reports (Collett & Hrasky, 2005). With regard to

companies disclosing corporate governance mechanisms

more broadly, one important factor is the willingness to

disclose corporate governance voluntarily. In this sense,

voluntary corporate governance disclosure is a reflection

of the extent to which a company provides broader

information to the public on the basis of the company’s

desire to implement existing rules and provide protection

to stakeholders regarding the company’s operational

mechanisms (Albassam et al., 2017).

Voluntary corporate governance disclosure aims to

create a more transparent, accountable, independent, and

fair corporate report, one which is a reflection of universal

religious principles. A couple of the universal principles of

all religions are honesty and fairness (Qur’an 11:85). In

this regard, religion instills universal values in all people

in relation to being honest and fair in social life. In the

economic context, universal religious values teach each

individual to be transparent by not reducing the dosage in

trade (Qur'an 6: 152). In this context, the activities aimed

at voluntarily disclosing corporate governance relate to the

implementation of religious teaching in social life in that

they are based on the view that every human activity in

life, either vertically or horizontally, is governed by

provisions that are in accordance with the commands of

God. The underlying principles of every action are based

on the sources of law from the holy books of each religion.

Indonesia, as a country with the largest Muslim

population in the world, seeks to provide protection and

comfort for every citizen, especially for the Muslim

population, and governance structures must meet the

expectations of the Muslim community by providing an

acceptable Islamic business governance model. Therefore,

Chrisworo, C. and Sudaryati, E.

Islamic Values and Voluntary Corporate Governance Disclosure.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 261-266

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

261

the trade sector, financial business, and all forms of

economic transactions in general should reflect the

principles of Islam. With regard to the standardization of

regulations, corporate governance should comply with

Shariah rules contained in the Qur’an and Hadith

(Alnasser & Muhammed, 2012).

Islamic values are holistic guidelines for Muslims in

practicing all aspects of daily living (Vinnicombe, 2010).

In this sense, in everyday life, the activities of Muslims

will consist of components of Islamic values and

components of materialism/secularism. However, both

aspects should be guided by religious values so that

transparency, fairness, morality, and social justice can be

accomplished in the daily activities of Muslims. The

implementation of Islamic values in the company’s

operational activities relates to the incorporation of the

principles of Shariah. The implementation of these

principles will provide guidance for companies to adapt

corporate values to those that apply to society in general in

order to gain community legitimacy (O’Donovan, 2000).

The implementation of Islamic values in a company

will encourage the company to be more transparent,

accountable, and fair to all related parties. Such an

implementation can be realized by the company through

disclosing the corporate report more broadly so that the

stakeholders can understand the company’s operational

processes more easily and clearly. From this perspective,

applying Islamic values will encourage a company to

provide transparent, accountable, and equitable company

reports more voluntarily and in accordance with Islamic

principles in muamalah.

Research conducted by Albassam et al. (2017)

provides evidence that Islamic values in a company

encourage more voluntary reporting on corporate

governance. According to Albassam et al. (2017),

companies with a greater commitment to incorporating

Islamic values within corporate operational activities have

a greater involvement in voluntary corporate governance

disclosures. Incorporating Islamic values in corporate

operations encourages companies to be more transparent

in implementing their good governance practices.

The present study was conducted on banking sector

companies, which are companies that have a lot of contact

with Islamic values. Islamic values forbid usury in

muamalah activities (Qur’an 2, pp. 278-281). Usury can

be understood as a form of interest on loans or savings

provided by banking companies. The implementation of

Islamic values in banking sector companies is expected to

provide confidence and convenience for Muslims to

transact with banking companies without any presumption

of such transactions violating Islamic values.

Based on the background outlined above, the main

purpose of this study is to examine the extent of

companies’ commitment to incorporating Islamic values in

their operational activities, and its effect on the level of

information relating to corporate governance practices

disclosed by the company. The study has clear practical

implications for future research, practice, and the broader

society in empirically demonstrating that corporations

voluntarily incorporating Islamic values into their

operations are more likely to be transparent about their

corporate governance practices, thereby providing new

and important insights into the effect of Islamic values on

voluntary corporate governance compliance and

disclosure.

2 THEORETICAL

BACKGROUND

Voluntary corporate governance disclosure is where

corporate management aims to be more transparent in

delivering company reports. The expected transparency of

voluntary corporate governance disclosures is related to

the intention of corporate management to minimize the

information gap between shareholders and corporate

managers. The effort to minimize the information gap can

thus be seen as a manifestation of the desire of corporate

management to create fairness for all of the company’s

stakeholders.

2.1 Agency Theory and Islamic Values

According to Jensen and Mekling (1976), agency theory

describes the relationship that arises due to a contract

between a principal and agent, in which the principal

delegates authority to the agent. According to Eisenhardt

(1989), there are two problems in the principal-agent

relationship: the conflict between desires or goals, and the

difficulty for the principal to verify what the management

has done in managing the company. On the one hand,

shareholders find it difficult to verify the operational

activities of management, while, on the other hand, the

management has more information on the operations and

financial position of the company.

To overcome the information gap between principal

and agent, the company should incorporate Islamic values

into its corporate values. By so doing, Islamic values will

encourage the company management (agent) to be more

transparent and fair in conveying information to the

shareholders (principal). The Islamic values held by the

company will result in corporate managers (agent) being

more honest in conveying information to the principal.

2.2 Islamic Values, Transparency, and

Voluntary Corporate Governance

Disclosure

Islamic values are those adopted by Muslims and derived

from the Qur’an and Sunnah. These values are binding

upon every Muslim and attach themselves to every activity

in his/her life (Choudhury & Alam, 2013). The values

embedded in Muslims encourage individuals to reflect on

their daily lives (Vinnicombe, 2010).

The application of Islamic values in daily life

activities encourages individuals to be more honest and

open in their behavior. They are required to be more

transparent in the work they do. However, in life, one

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

262

cannot be separated from the demands of one’s worldly

life, which means that the principle of materialism often

leads to a conflict with Islamic values inherent in the

individual. Therefore, it is important to understanding how

to reduce the contradiction between the principles of

materialism occurring in the activities of life and

prevailing Islamic values.

A company, as an economic entity closely related to

the principles of materialism, is expected to be a motivator

in harmonizing the relationship between the principles of

materialism and Islamic values, so as not to cause

significant opposition, especially for those working in the

company and society as a whole. The company is expected

to be able to absorb Islamic values and apply them in its

operational activities. The adoption of Islamic values into

corporate values is expected to result in the company

being better accepted by the wider community, reflected in

the company’s market share.

The implementation of Islamic values in the

company’s operational activities is expected to provide

incentives for corporate management to be more

transparent in conveying information in its company

reports. In this regard, Islamic values embedded in the

company’s rules will serve as a guide for corporate

managers to be more honest and open in their operational

activities. The practical realization of openness in the

corporate report can be manifested through a broader

reporting of corporate governance activities. Companies

that apply Islamic values will strive to provide transparent

information by presenting all the available information to

the stakeholders. The compliance of the company with

good corporate governance can also manifest itself in the

form of voluntary additional information in the company

report. Thus, companies that have a commitment to

implementing good corporate governance will disclose

corporate governance information more voluntarily. This

is based on the fact that companies that are committed to

increasing their voluntary corporate governance

disclosures can undoubtedly fulfil their primary

obligations with regard to implementing good corporate

governance. Based on the above background, the

hypothesis for this research is as follows:

H

1

: Islamic values have a positive effect on voluntary

corporate governance disclosures.

3 RESEARCH METHODOLOGY

3.1 Data Collection

It is interesting to analyze the implementation of Islamic

values in relation to the effort to increase voluntary

corporate governance disclosure in banking companies in

Indonesia because, first, banking companies in Indonesia

apply the principles of corporate governance, and

secondly, banking companies in Indonesia apply Shariah-

based principles that are disclosed in their annual reports.

This study collected data from multiple channels. In this

sense, the required information was obtained from the

Indonesian Stock Exchange (IDX) by identifying banking

sector companies operating from 2012–2016. The

population of this study was 154 banking companies. The

researchers collected data on related variables, i.e. Islamic

values and voluntary corporate governance disclosures, as

well as data on control variables such as audit quality, the

percentage of institutional ownership, the number of

boards of directors, the percentage of total capital

expenditure to total assets, dividend payout, leverage, the

percentage of operating profit to total assets, and sales

growth.

3.2 Definition and Measurement of

Variables

The researchers designed certain variables for this

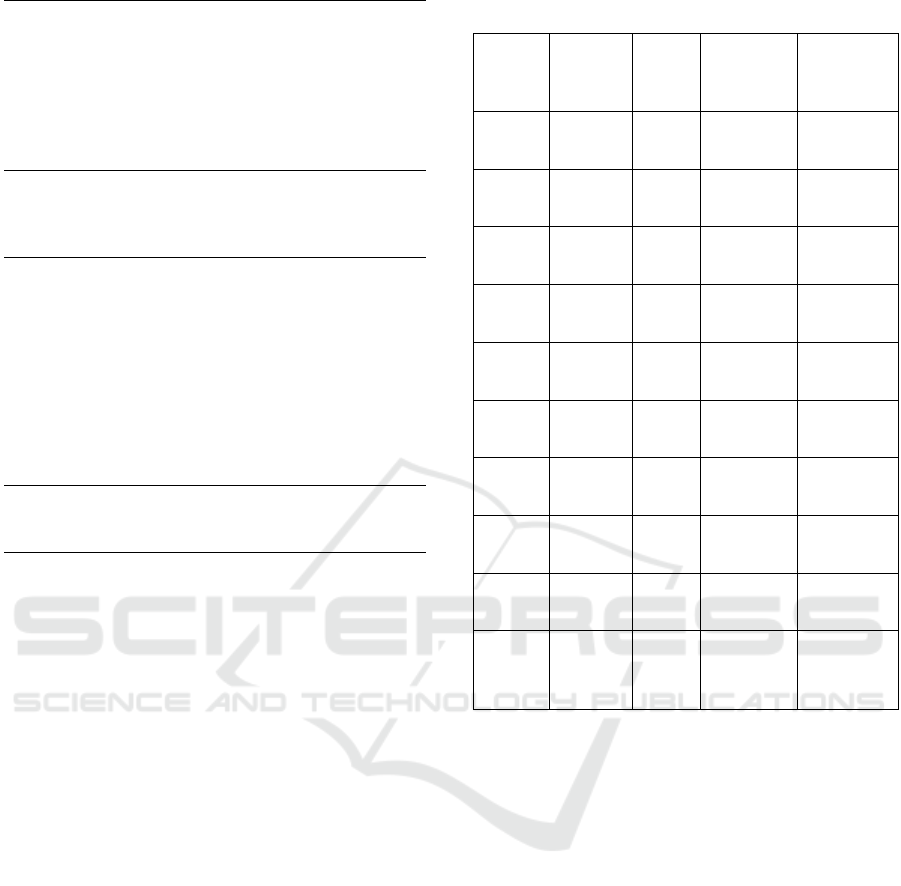

research, and Table 1 describes the variables as well as the

measuring method.

Dependent

Variable

GINDX

Indonesian corporate governance

index constructed by Albassam

(2014) (see Appendix 2, pp. 341-

348). It takes a value of 1 if each of

the 65 CG provisions is disclosed, 0

otherwise.

BDIR

Sub-index of GINDX related to the

board of directors, consisting of 35

provisions. It takes a value of 1 if

each of the 35 CG provisions is

disclosed, 0 otherwise.

DTRA

Sub-index of GINDX related to

disclosure and transparency,

consisting of 14 provisions. It takes a

value of 1 if each of the 16 CG

p

rovisions is disclosed, 0 otherwise.

INCR

Sub-index of GINDX related to

internal control and risk

management, consisting of 6

provisions. It takes a value of 1 if

each of the 6 CG provisions is

disclosed, 0 otherwise.

SHAR

Sub-index of GINDX related to the

rights of shareholders and general

assembly, consisting of 8 provisions.

It takes a value of 1 if each of the 8

CG provisions is disclosed, 0

otherwise.

Independent

Variable

Islamic Values and Voluntary Corporate Governance Disclosure

263

IVDI Islamic values (IV) voluntary

compliance and disclosure index,

consisting of 10 provisions. It takes a

value of 1 if each of the 10 IV

provisions is disclosed, 0 otherwise;

scaled to a value between 0% and

100%.

Other

Explanatory

Variables

AUFZ

1 if a firm is audited by one of the

big four audit firms (i.e.

PricewaterhouseCoopers, Deloitte &

Touché, Ernst & Young, and

KPMG), 0 otherwise.

BODZ

Natural log of the total number of

directors on the board of a com

p

an

y

.

INON

Percentage of shares held by

institutional shareholders.

Control

Variables

CEXP

Percentage of total capital

ex

p

enditure to total assets.

DVPS

1 if a firm paid dividends during the

financial

y

ear, 0 otherwise.

LEVG

Percentage of total debt to total

assets.

PROF

Percentage of operating profit to total

assets.

SAGR

Percentage of current year’s sales

minus previous year’s sales to

p

revious

y

ear’s sales.

4 RESULT AND DISCUSSION

The researchers tested a five-year period (from 2012 to

2016) and a total of 154 observations. The description of

the research results will explain the descriptive analysis

and hypothesis testing.

4.1 Descriptive Analysis

Descriptive analysis was used to provide an overview of

the data used in the study, which can be seen in Table 4.2.

Table 2: Descriptive Statistic

Var Min Max Mean Std

Deviation

VG .6615 .9231 .879520 .0386093

IVDI .00 .90 .3805 .26124

AUFZ 0 1 .69 .465

BODZ 3 12 7.06 2.538

INON .4358 1.000 .758026 .1612936

CEXP .0001 .0233 .002867 .0030443

DVPS 0 1 .42 .496

LEV .7399 .9479 .864409 .0424926

PROF -.0972 .1144 .014323 .0203630

SAGR

-

3.5933

.8377 .106371 .4649905

Based on the results shown in Table 4.2, the mean

value of voluntary corporate governance disclosure (VG)

is 0.87952, with a deviation rate of 0.0386, indicating that

the voluntary corporate governance disclosures of banking

companies in Indonesia have considerable value, since the

mean value is close to 1. The mean value of Islamic values

is 0.3805, with a deviation rate of 0.26124, indicating that

the Islamic values absorbed by banking companies in

Indonesia are still low, since the value is less than 0.5.

4.2 Regression Analysis

In this research, the method of analysis used was multiple

linear regression analysis, which aimed to determine the

effect of Islamic values on voluntary corporate governance

disclosures. The regression analysis results used to

determine the regression equation can be seen in Table

4.3.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

264

Table 3: Regression Coefficient Values

Model Unstandardized

Coefficients

p-value

B

(Constant) .874 .000

IVDI .062 .000

AUFZ -.005 .521

BODZ .004 .004

INON .011 .537

CEXP .452 .626

DVPS -.002 .801

LEV -.058 .364

PROF -.116 .476

SAGR -.008 .193

From Table 4.3, it can be seen that the

regression coefficient values of the output resulted in

the following regression equation model:

VG = 0.874 + 0.062 IVDI – 0.005 AUFZ + 0.004 BODZ

+ 0.011 INON + 0.452 CEXP – 0.002 DVPS – 0.058 LEV

– 0.116 PROF – 0.008 SAGR + ε

4.3 Results of Coefficient of

Determination Testing

The coefficient of determination test aimed to determine

the level of influence of the variables used in this study on

voluntary corporate governance disclosures, the results of

which can be seen in Table 4.4.

Model R R

2

Adjusted R

2

1

.573

a

.329 .287

Based on Table 4.4, it can be seen that the value of

Adjusted R² is 0.287, indicating that voluntary corporate

governance disclosures can be explained by 28.7% of the

influence of the independent variables used in this study.

4.4 Hypothesis Testing

Hypothesis testing was carried out by using the t test

obtained from the multiple linear regression analysis.

Based on the results of the t-test from the multiple linear

regression analysis in Table 4.3, it can be concluded that

Islamic values and the number of directors in the company

have a positive and significant effect on voluntary

corporate governance disclosures, since the regression

coefficient value is positive and the p-value is < 0.05.

Based on the results of the t-test from the multiple

linear regression analysis, it can be concluded that the

financial performance ratios do not affect voluntary

corporate governance disclosures, since the p-value is <

0.05. In addition, the quality of the auditor and the

proportion of institutional ownership have no effect on

voluntary corporate governance disclosures.

5 CONCLUSIONS

The research results show that Islamic values have a

positive effect on voluntary corporate governance

disclosure. In this regard, a company’s commitment to

providing broader and more transparent information

through voluntary corporate governance disclosures can be

enhanced by absorbing Islamic values into the company’s

prevailing rules. Attempts to absorb Islamic values into

corporate rules will encourage companies to be fair and

transparent with regard to voluntarily disclosing corporate

governance. In addition, the research results show that

financial performance ratios do not affect voluntary

corporate governance disclosure, thus highlighting that a

predisposition to disclose corporate governance more

openly is not based on the size of a company’s financial

performance, but on the existence of moral awareness

within the company to be fair to stakeholders and to

understand the impact of the company’s operational

activities.

The number of directors in the management structure

also determines the size of voluntary corporate governance

disclosures. In this sense, the greater the number of

directors in the management ranks, the bigger the impetus

to publicize all the company’s operational activities to the

stakeholders. A large number of directors will provide

more stress on the importance of being more open and

transparent to the public, particularly in relation to systems

of corporate governance already in place.

The quality of the auditor and the degree of

institutional ownership do not have a major impact on

voluntary corporate governance disclosure. Auditors

should always provide positive inputs in relation to the

sustainability of a company’s operations. In addition,

auditors should always direct managers to be transparent

Islamic Values and Voluntary Corporate Governance Disclosure

265

in their reports for the benefit of all parties. Thus, audit

quality does not have a significant impact on voluntary

corporate governance disclosure. Those making up a

company’s institutional ownership, whether large or small,

are always eager to obtain clear information on the

activities of company managers. In this regard,

institutional owners will always expect corporate

managers to disclose corporate governance voluntarily

Because of the number of banking companies that

did not provide the data needed for the research, this study

has limitations in relation to the number of samples used.

With this in mind, future research should use all

companies that voluntarily disclose components of

corporate governance and adopt Islamic values in their

company rules.

REFERENCES

Albassam, W. & Ntim, C.G. (2017). The Effect of Islamic

Values on Voluntary Corporate Governance

Disclosure: The Case of Saudi Listed Firms, Journal of

Islamic Accounting and Business Research.

Albassam, W. (2014), Corporate Governance, Voluntary

Disclosure and Financial Performance: An Empirical

Analysis of Saudi Listed Firms Using A Mixed-

Methods Research Design, Unpublished PhD thesis,

University of Glasgow.

Alnasser,S.A.S. & Muhammed, J. (2012) "Introduction

to corporate governance from Islamic

perspective", Humanomics, Vol. 28 Issue: 3,

pp.220-231.

Choudhury, M.A. and Alam, M.N. (2013) "Corporate

governance in Islamic perspective", International

Journal of Islamic and Middle Eastern Finance and

Management, Vol. 6 Issue:3,pp.180-199.

Collett, Peter, and Hrasky, Sue. (2005), “Voluntary

Disclosure of Corporate Governance Practices by

Listed Australian Companies”, An International

Review, Vol.13, No.2, pp.188-196, (2005), ”Voluntary

Disclosure of Corporate Governance Practices by

Listed Australian Companies”, An International

Review, Vol.13, No.2, pp.188-196,

Eisenhardt, Kathleem. (1989). Agency Theory: An

Assessment and Review. Academy of Management

Review, 14. Hal 57-74.

Haniffa, R. & Hudaib, M. (2006). Governance Structure

and Performance of Malaysian Listed Companies,

Journal of Business Finance and Accounting, Vol. 33

Issue 6/7, p.1034-1062.

Hussainey, K. and Al-Najjar, B. (2012), “Understanding

the determinants of Risk/Metric/ISS ratings of the

quality of UK companies corporate governance

practice”, Canadian Journal of Administrative

Sciences, Vol. 29 No. 4, pp. 366-377.

Isnandar dan Sudaryati. (2015), Mekanisme Good

Corporate Governance Dan Manajemen Laba: Studi

Empiris Sebelum Dan Sesudah Pengadopsian Ifrs

Pada Perusahaan Manufaktur Yang Terdaftar Di

Bursa Efek Indonesia, Unpublished thesis, University

of Airlangga.

Jensen, Michael C. dan Meckling. William H., 1976,

“Theory of The Firm: Managerial Behavior, Agency

Cost, and Ownership Structure”, Jurnal of Financial

Economics, Vol. 3, No. 4, October pp. 305-360.

Ntim, C.G., Opong, K. and Danbolt, J. (2012a), “The

relative value relevance of shareholder versus

stakeholder corporate governance disclosure policy

reforms in South Africa”, Corporate Governance: An

International Review, Vol. 20 No. 1, pp. 84-105.

Ntim, C.G., Opong, K., Danbolt, J. and Thomas, D.

(2012b), “Voluntary corporate governance disclosures

by post-Apartheid South African corporations’,

Journal of Applied Accounting Research, Vol. 13 No.

2, pp.122-144.

O’Donovan.2000. Environmental Disclosure in the

Annual Reports: Extending the Applicability and

Predictive Power of Legitimacy Theory. Accounting,

Auditing and Accountability Journal, Vol. 15, No.3, p.

344-371.

Vinnicombe, T. (2010), “AAOIFI reporting standards:

Measuring compliance”, Advances in Accounting,

Incorporating Advances in International Accounting,

Vol. 26 No. 1, pp. 55-65.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

266