Capital Adequacy Ratio, Loan to Deposit Ratio, and Efficiency Ratio

on Return on Assets

Banking Companies In Indonesia Stock Exchange

Ati Retna Sari and Sulistyo Sulistyo

Fakultas Ekonomika dan Bisnis, Universitas Kanjuruhan Malang, Jl. S. Supriadi no. 48, Malang, Indonesia

atiretnasari@unikama.ac.id

Keywords: Capital Adequacy Ratio, Loan to Deposit Ratio, Efficiency Ratio, and Return on Assets.

Abstract: This study aims to analyze how the influence of Capital Adequacy Ratio (CAR), Loan to Deposit Ratio

(LDR), and Efficiency Ratio (ER) to Return on Assets (ROA) in banking companies in Indonesia listing on

Indonesia Stock Exchange (IDX) 2015-2016. The population of this study are all 31 banking companies

listed on BEI. The required data is secondary data in the form of financial statements of each bank in 2015-

2016. To find out the influence of independent variable (X) to dependent variable (Y) multiple linear

regression analysis technique is applied. The result shows that the variable of CAR, LDR, ER of banking

company that are listed in BEI year 2015-2016 have an effect on ROA and have coefficient mark

corresponding to theory.

1 INTRODUCTION

One of the ratios that needs to be studied in

connection with banking performance is Capital

Adequacy Ratio (CAR) which is a ratio showing

how far all bank assets that contain risks (credit,

investments, securities, bills with other banks) are

financed from the bank's own capital funds, in

addition to obtaining funds from sources outside the

bank, such as public funds, loans (debt), and others.

Despite supervision by Bank Indonesia, there is

still an unhealthy performance of banks, such as the

Bank Century case. In November 2009, Bank

Indonesia established Century Bank under special

surveillance. Because the CAR is below the standard

that is set by Bank Indonesia, which is equal to 8%.

The situation is caused by the many securities of

foreign currency maturity and default. As a result,

the CAR of this bank dropped drastically to minus

3.53%. In addition to CAR, Loan to Deposit Ratio

(LDR) as one of the liquidity indicators of a bank is

used to determine the ability of a bank in fulfilling

its immediate due of short-term obligations with its

current assets.

Based on BI regulations, the recommended LDR

ratio is between 85% - 110%. The LDR indicates the

amount of liquid funds provided by the bank to meet

the withdrawals of its customers. The greater the

funds provided make the bank better, because it is

able to meet customer demand (Dendawijaya, 2009).

In addition to CAR and LDR, Efficiency Ratio (ER)

is also important to be studied. Any increase in

operational costs will result in a decrease in profit

before taxes and will eventually lower the bank's

profit (Dendawijaya, 2009). Thus, the smaller this

ratio means the more efficient the operational costs

incurred by the bank.

Furthermore, Return On Assets (ROA) is also

important to review. Because, according to

Dendawijaya (2009) in determining the health of a

bank, Bank Indonesia is more concerned with the

judgement of ROA. A bank can be included in the

healthy category if it has a minimum ROA ratio of

1.5%. ROA is useful to measure the effectiveness of

banks when generating profits by using the assets

they have. In other words, this ratio is used to

measure the ability of bank management in

obtaining profit as a whole. Based on the

explanation above, the purpose of this research is to

analyze how the influence of capital adequacy ratio,

loan to deposit ratio, and efficiency ratio to return on

assets in banking in Indonesia which are listed in

BEI Year 2015-2016.

372

Sari, A. and Sulistyo, S.

Capital Adequacy Ratio, Loan to Deposit Ratio, and Efficiency Ratio on Return on Assets - Banking Companies In Indonesia Stock Exchange.

In Proceedings of the Annual Conference on Social Sciences and Humanities (ANCOSH 2018) - Revitalization of Local Wisdom in Global and Competitive Era, pages 372-375

ISBN: 978-989-758-343-8

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 METHOD

The population of this study is all banking

companies listed on BEI, about 31 Banks. Thus, this

research is a census study. The required data in this

study are secondary data in the form of financial

statements of each bank in 2009-2010. The data are

obtained through access to http://www.idx.co.id

(Indonesia Stock Excahnge, 2010).

The operational definition of these research

variables and their measurements are presented in

Table 1 below.

Table 1: Operational Definition of Variable and Measurement.

Variable

Operational Definition

Measurement indicator

refers to (SE BI No.6/23/

DPNP/2004)

Measurement Scale

Return On Assets

(ROA)

[Y]

showing the management ability in

managing assets to gain profit

Ratio

Capital Adequacy Ratio

(CAR)

[X1]

Showing how much the total assets

of banks that contain risks (credit,

investments, securities, bills with

other banks) are financed from their

own capital in addition to obtaining

funds from sources outside the

bank.

Ratio

Loan to Deposit Ratio

(LDR)

[X2]

Showing the ability of banks to pay

back the funds collected from the

community by relying on credit

given as a source of liquidity.

Ratio

Efficiency Ratio (ER)

[X3]

Showing the ability of bank

management in controlling

operational costs to operational

income.

Ratio

The hypothesis of this study was tested using t-

test, which is partial regression coefficient test by

comparing the significance value of t-test with alpha

5% (Ghozali, 2006). If the significance value of the

t-test is smaller than the 5% alpha, then the proposed

hypothesis is accepted. Conversely, if the value of t-

test significance shows greater than 5% alpha, then

the proposed hypothesis is rejected.

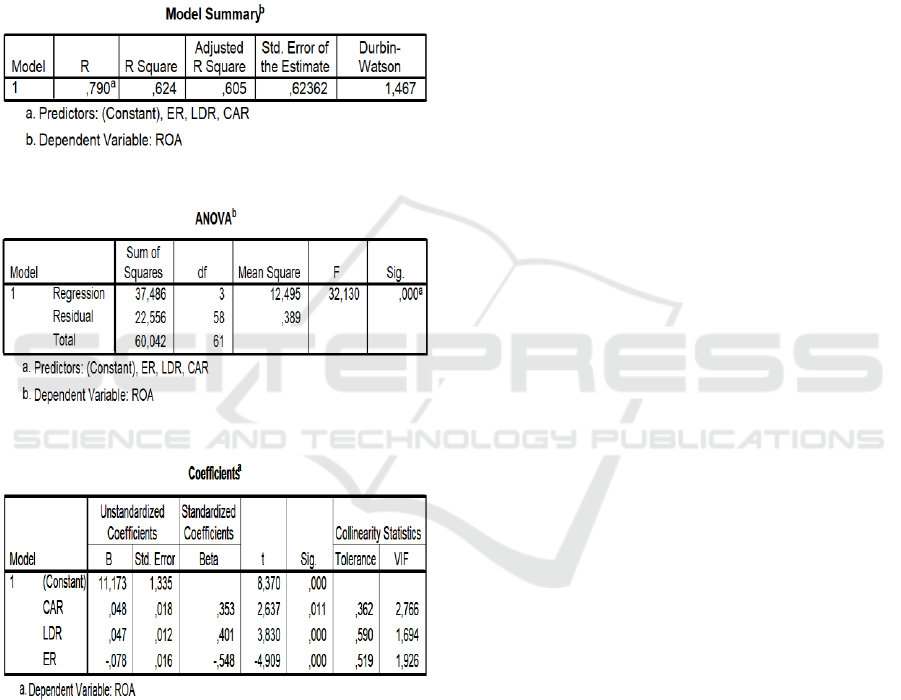

3 RESULTS

The results of the classic multicollinearity

assumption test are presented in Table 3. It appears

that VIF VALUE variable CAR = 2.766, LDR =

1.694, and ER = 1.926 show smaller 10. This

indicates that MULTICOLLINEARITY DOES NOT

HAPPEN.

The results of the classic heteroscedasticity

assumption test are presented in Figure 1. In the

figure it appears that the plot graph shows irregular

or does not form a particular pattern. This indicates

that it HETEROSKEDASTICITY DOES NOT

HAPPEN.

Figure 1: Scatterplot Graph.

6420-2

Regression Standardized Predicted Value

4

2

0

-2

-4

Regression Studentized

Residual

Dependent Variable: yBM

Scatterplot

Capital Adequacy Ratio, Loan to Deposit Ratio, and Efficiency Ratio on Return on Assets - Banking Companies In Indonesia Stock

Exchange

373

The results of the classic autocorrelation

assumption test are presented in Table 2. In the

Table it appears that the Durbin Watson value of

1.475 lies between the lower limit of 1.319 and the

upper limit of 1.681 in the Durbin Watson table.

This indicates that NO AUTOCORRELATION

HAPPENS.

Regression analysis results are presented in the

following tables.

Table 2: Model Summary.

Table 3: ANOVA.

Table 4: Coefficients.

Based on Table 1 - Table 4 above, it can be

interpreted that:

R-square value of 0.624 indicates that CAR,

LDR and ER can explain ROA change of 62.4

percent. The significance value of the F-test of 0.000

indicates that CAR, LDR and ER simultaneously

affect the ROA. The significance value of the T-Test

for CAR 0.011 is 0.05 smaller indicates that CAR

affects ROA. The CAR regression coefficient is

positive. This indicates that the relationship between

CAR and ROA is positive. The significance value of

the T-Test for LDR 0.000 is smaller than 0.05

indicating that the LDR affects the ROA. The LDR

regression coefficient is positive. This indicates that

the LDR and ROA relationship is positive. The

significance value of the T-Test for ER 0,000 is

smaller by 0.05 indicating that ER affects ROA. The

regression coefficient of ER is negative. This

indicates that the ER and ROA relationships are

negative.

4 DISCUSSION

4.1 Effect of CAR to ROA

The result of regression analysis shows that the

significance value of T-Test for CAR 0.011 is 0.05

smaller indicating that CAR has an effect on ROA.

The CAR regression coefficient is positive. This

indicates that the relationship between CAR and

ROA is positive. Thus, the first hypothesis in the

study is accepted.

The results of this study indicate that the bank

that became the object of this study has the ability in

terms of capital to maintain the possibility of the risk

of loss of business activities that affect the

profitability (profit) generated by those domestic

banks. It can also be assumed that the domestic

banks that become the object of research is said to

be healthy because it has funds that can cover the

risk of losses caused in bank operations. Efficient

funding will occur when companies have optimal

capital. Optimal capital structure is a capital

structure that can minimize the cost of capital use,

thereby maximizing the value of the company The

results of this study indicate that the greater the CAR

then the greater ROA obtained by the bank, because

the greater the CAR the higher capital ability of

banks in reducing the risk of losses inflicted.

The results of this study support Ervani's (2010)

research that risky assets tend to limit the amount of

capital available in profitable activities. For this

reason, the regulator, in this case Bank Indonesia

sees the capital ratio as the bank's ability to keep the

bank from bank failures and maintain public

confidence, both of them will affect the performance

of profit profits of go public banks in Indonesia.

4.2 Effect of LDR to ROA

The result of regression analysis shows that the

significance value of T-Test for LDR 0.000 is 0.05

smaller indicating that LDR has an effect on ROA.

The LDR regression phenomenon is positive. This

ANCOSH 2018 - Annual Conference on Social Sciences and Humanities

374

indicates that the LDR and ROA relationship is

positive. Thus, the second hypothesis in the study is

accepted.

The result of this study indicates that the bank

used as the object of this study has the ability to

distribute credit from third parties to creditors that

ultimately affect the level of income of the bank. It

also indicates that the bank can be said to have a

good level of liquidity and good financial

performance as well.

The results of this study supports the research of

Ervani (2010) that there is a positive relationship

between the ratios of LDR to bank profitability.

ROA tends to increase as the LDR increases.

4.3 Effect of ER to ROA

The result of regression analysis shows that the

significance value of T-Test for ER 0,000 is 0.05

smaller indicating that ER has an effect on ROA.

The ER regression coefficient is negative. This

indicates that the CAR and ROA relationships are

negative. Thus, the third hypothesis in the study is

accepted.

The result of this study indicates that the bank

used as the object of this study has the efficiency in

running its operations so that affect the profitability

of the bank. The bank performs its operations

efficiently so that the revenue generated will also

rise. The result of this study indicates that the greater

the ER then the smaller the ROA. The results can be

obtained because the level of bank efficiency in

carrying out its operations affect the income level of

ER is influenced by the high cost of funds collected

and low interest income from investment funds.

The results of this study support the results of

research of Sarifudin (2005) in which ER negatively

affect profitability. The results of this study also

supports Ervani's (2010) research that the negative

coefficient value is consistent with the theory that

the lower the ER level means the better the

performance of bank management and the more

efficient the bank. The level of profit achieved by a

bank with all funds in the bank is the bank's

profitability. Therefore, rent ability is also

determined by the amount of operational costs

incurred to obtain operational income. The better the

performance of bank management the more efficient

a bank can affect the health of the bank's business

and the ability to generate profits.

5 CONCLUSION

The results of this study conclude that the variables

CAR, LDR, ER of banking companies listed on the

BEI 2015-2016 have an influence on ROA and have

a coefficient mark corresponding to the theory.

Therefore, things that can be suggested are the

government through the monetary authority, in the

case Bank Indonesia, should be able to transmit its

policy to prioritize the achievement of the objectives

of each aspect that gives a significant influence on

bank performance starting from capital, asset

quality, management, and overall liquidity so that

the ROA is expected to increase.

REFERENCES

Arikunto, S., 2006. Prosedur Penelitian Suatu Pendekatan

Praktik, Rineka Cipta. Jakarta.

Dendawijaya, L., 2009. Manajemen Perbankan, Ghalia

Indonesia. Jakarta.

Ervani, E., 2010. Analisis Pengaruh Capital Adequacy

Ratio, Loan to Deposit Ratio, dan Biaya Operasional

Bank Terhadap Profitabilitas Bank Go Public Di

Indonesia Periode 2000-2007. JEJAK. Volume 3

Nomer 2, September: 29-38.

Ghozali, I., 2006. Aplikasi Analisis Multivariate dengan

program SPSS, Badan Penerbit UNDIP. Semarang,

4th

edition.

Sarifudin, 2005. Analisis Pengaruh Rasio-Rasio

Keuangan terhadap Perubahan Laba (Studi Empiris:

Pada Perusahaan Perbankan yang Listed di BEJ),

Program Pasca Sarjana Magister Manajemen

Universitas Diponegoro. Semarang, TESIS.

Werdaningtyas, H., 2002. Faktor yang Mempengaruhi

Profitabilitas Bank Take over Pramerger di Indonesia.

Jurnal Manajemen Indonesia. Vol. 1, No. 2, pp.: 24-

35

Indonesia Stock Excahnge, 2010. (Online) available at:

http://www.idx.co.id.

Capital Adequacy Ratio, Loan to Deposit Ratio, and Efficiency Ratio on Return on Assets - Banking Companies In Indonesia Stock

Exchange

375