Efficiency Performance of Dompet Dhuafa Zakat Institutions: Using

Data Envelopment Analysis Approach

Ninda Ardiani

1

and Dr. Sri Herianingrum, SE., M.Si

2

1

Postgraduate School Universitas Airlangga Surabaya, Indonesia

2

Faculty Economic and Business Universitas Airlangga Surabaya, Indonesia

Keywords: Zakat, Efficiency, Performing, Data Envelopment Analysis.

Abstract: The purpose of this study is to see the efficiency of zakat institutions in the collection of funds and

distribution. Dompet Dhuafa is one of the national zakat institutions which has branch offices spread across

Indonesia. The problem is, how efficient is the institution of zakat when collecting zakat funds and

channeling it. This research uses a Data Envelopment Analysis (DEA) method with two tests, that is a test

for zakat funds and a test for non-zakat funds. Input variables consist of receipts obtained by zakat

institutions, while the output variables consist of expenditures for 8 asnaf and other expenditures. Data is

taken from Dompet Dhuafa financial statements from 2011 to 2015. The results of this study addressed in

2011, 2014 and 2015 show that Dompet Dhuafa in collecting and disbursing zakat funds and non-zakat

funds has been efficient. Inefficiencies that occur in the year 2012 and 2013 are due to non-optimal

channeling of funds from Dompet Dhuafa.

1 INTRODUCTION

Indonesia is a country with the largest Muslim

population in the world. It is described in the

Population Census of 2010 showing 87% of the

population in Indonesia is Muslim. Zakat is one of

the pillars of Islam and as Worship to Allah even

aligned with Prayers. Zakat must be issued if it has

been eligible for zakat, among others has reached

nisab, has been owned for a year, the amount has

been determined and other conditions have been met

(Ryandono, 2008). Djaghballou (2018) finds that

total factor productivity has increased sharply for all

zakat funds mainly due to a technical rather than

efficiency change. Zakat institution is also obliged to

distribute the funds.

The development of zakat institutions which

continues to increase from year to year indicates that

zakat has been accepted by Indonesian people.

People can pay their zakat obligations by channeling

them through zakat institutions. The problem is how

efficient is the institution of zakat when collecting

zakat funds and channeling it. From the article

Republika Online on December 11, 2015 it is known

that the achievement of National Zakat is ‘Still One

Percent’. The article claimed that the potential of

Zakat reached Rp. 217 Trillion, but the achievement

is only Rp. 3.8 Trillion. This is caused by the distrust

of society at Amil Zakat Institute, so the muzaki

prefer to channel their own zakat funds.

Dompet Dhuafa is part of the National Institute

of Amil Zakat that was established in 1993 and

approved by the Ministry of Religious Affairs as an

Amil Zakat Institution in 2001. The credibility of

Dompet Dhuafa is no longer the case with branches

spread across Indonesia and already having

representative offices in foreign countries. Access

provided by Dompet Dhuafa makes it easy to collect

zakat funds of value more than the institution of

National Amil zakat.

2 LITERATURE REVIEW

2.1 The basic concept of Zakat

Imam Qurtubi in Hafidhuddin (2002, 125) states that

Al-Amil was commissioned (by the

priest/government) for taking, writing, counting, and

recording the zakat he took from the muzakki to be

given to those who were entitled to receive it. The

role of amil is currently run by the Agency Amil

Zakat or Lembaga Amil Zakat. According to Ad

60

Ardiani, N. and Herianingrum, S.

Efficiency Performance of Dompet Dhuafa Zakat Institutions: Using Data Envelopment Analysis Approach.

DOI: 10.5220/0007537400600064

In Proceedings of the 2nd International Conference Postgraduate School (ICPS 2018), pages 60-64

ISBN: 978-989-758-348-3

Copyright

c

2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Dimasyqi (2005, 279), the definition of amil zakat

according to the terminology of jurisprudence is the

people appointed by the imam (government) to

manage the zakat business, which covers the process

of collecting, recording, distributing, and so forth.

An economic system can only be efficient when it

can produce more goods and services for society

with the same or lower amount of resources (Wahab

and Rahman, 2012).

2.2 Objectives and Benefits of Zakat

Distribution

The benefits of zakat distribution, as delivered by

Qardhawi (2011) can be divided into three, i.e.

benefits for muzakki, mustahiq , and society in

general. The benefit of zakat for muzakki is that it

sanctifies the soul from the miserly nature, educates

for infa and gives morals with noble character, it is a

manifestation of gratitude for the favors of Allah,

cures from the love of the world, develops inner

wealth, attracts sympathy/love, and can develop

treasure. The benefits of zakat for mustahiq

(recipients of zakat), among others, is to help meet

the necessities of life and mustahiq can eliminate the

nature of hate and envy of the rich grubs. While the

benefit of zakat for the community is that zakat has

economic value, realizing the function of treasure as

a means of struggle to uphold the religion of Allah

(jihad fii sabilillah), and realize the social economic

justice of society in general.

2.3 Zakat Institution Performance in

Empowerment and Empowerment

of Zakat

IZDR (2011, 96) measures the economic

performance of zakat institutions or the Zakat

Management Organization (OPZ) in several

indicators, namely: first, the existence of criteria and

identification mechanism of mustahik. Mustahik is

the party entitled to receive zakat, it has been

described in the QS. Al-Quran [9]: 60 that zakat is

only distributed to 8 (eight) groups, namely: 1) the

poor, 2) the poor , 3) the administrators of zakat, 4)

the converts are persuaded, 5) to the free slaves

(riqab), 6) the debtors (gharimin), 7) for the way of

Allah (fisabilillah), and 8) for those who are on the

way (ibn sabil).

Secondly, is the growth of the mustahic amount

empowered by zakat. Increasing the number of

mustahik and the distribution of the area which

becomes the scope of the distribution of zakat

institutions, either through direct distribution of

zakat funds or through the programs of utilization of

zakat funds will be a parameter of the effectiveness

of zakat institution performance in carrying out its

functions. The parameters of the success of the zakat

institution are the number of mustahik that are

empowered or have "moved position" from mustahik

to munfiq and eventually can become muzakki.

Third, is the growth of the number of muzakki. This

third indicator can be measured from the growing

number of muzakki who entrust their funds to the

zakat institution. Fourth, is innovation of the zakat

empowerment program. Zakat funds utilization

program undergoes a developmental phase from the

idea of the program until its implementation of the

donation is transformed to community

empowerment. Fifth, is extent of the zakat

distribution area. Zakat institution performance can

be measured from the size of the zakat fund

distribution area reached by the zakat institution.

Sixth, is responsiveness to humanitarian emergency.

Zakat institutions play a strategic role as an ummah

institution that is responsive to humanitarian

emergency. Seventh, is the utilization of zakat for

productive economic activities. Zakat funds are

expected not only for the purposes of caricature

activities. Zakat institutions are required to manage

each Rupiah of zakah funds more effectively. Most

mustahik are classified as productive age, so they

can be assisted by the utilization of zakat funds

productively as well. And the eighth is the intensity

of utilization of zakat for community development

and empowerment activities.

Ahmad and Masturah Ma'in (2014) studied the

efficiency of zakat collection and distribution of

zakat by using 2-stage analysis describing the

efficiency research of zakat institution Selangor in

Malaysia. This research found that the collection and

distribution of zakat involved a lagging resource

which led to the existence of technical efficiency.

Then the results of data processing concluded that

the distribution has lower efficiency than its

collection.

3 RESEARCH METHODOLOGY

This research uses a qualitative method with data

test using the Data Envelopment Analysis Model.

The DEA test will be done twice. The first test is to

examine the efficiency of Zakat Fund Disbursement

and Distribution, and the second test is to examine

the effectiveness of Collection and Disbursement of

non-Zakah funds. The input of the first Test is the

Zakat Funds Collection taken from the Cash Flow

Efficiency Performance of Dompet Dhuafa Zakat Institutions: Using Data Envelopment Analysis Approach

61

Statement, while the output is the distribution of

funds for the 8 Asnaf groups. The second test of

Input consists of funding of Infaq, Infaq bound and

Waqf, while its output is channeling funds for

education, health, societal societies, economics,

humanity, advocacy and network development. The

test is done twice because Zakat fund allocation is

clearly for the group of 8 asnaf and should not be

distributed other than to them.

The secondary data of this study is obtained from

the financial statements of Dompet Dhuafa Financial

Report which can be accessed at

https://www.dompetdhuafa.org/media_file/media/la

poran-keuangan.

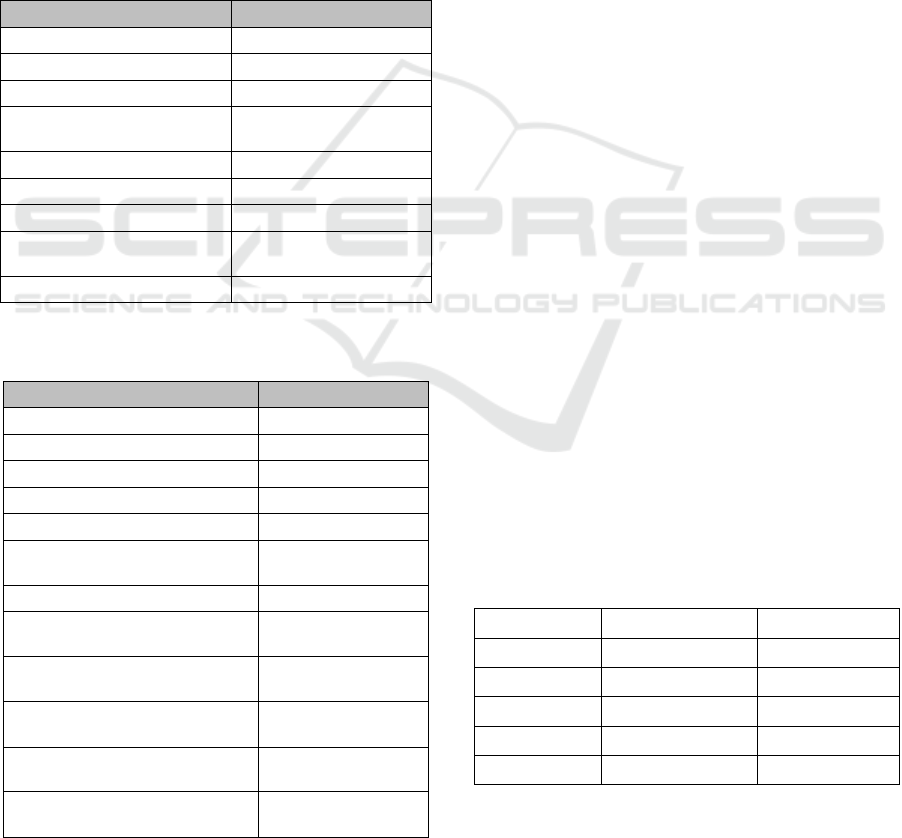

Table 1: Input Variables and Output Variables for Zakat

Fund Efficiency Test

Variabel

Source

Input Variables

Zakat Fund

Activity Report

Output Variables

Distribution for Fakir

Miskin

Fund Changes Report

Channeling to Gharimin

Fund Changes Report

Distribution for Ibn Sabil

Fund Changes Report

Channels for Converts

Fund Changes Report

Distribution For

Fisabilillah

Fund Changes Report

Distribution For Amil

Fund Changes Report

Table 2: Input Variables and Output Variables for Non-

Zakat Fund Efficiency Test

Variabel

Source

Input Variables

Infaq Fund

Activity Report

Infaq Funds Bound

Activity Report

Waqf Fund

Output Variables

Distribution of Education

Program

Activity Report

Health Program Distribution

Activity Report

Social Community Program

Distribution

Activity Report

Distribution of Economic

Programs

Activity Report

Disbursement of Humanity

Program

Activity Report

Distribution of Advocacy

Programs

Activity Report

Distribution of Network

Development Program

Activity Report

Sampling in this research is done by purposive

sampling meaning that the sample selection method

is based on judgment (sampling) which means the

sample selection is not random and information is

obtained by certain considerations. Analysis of the

performance efficiency of Amil Zakat Institute

Dompet Dhuafa is using DEA to measure efficiency

performance.

Data Envelopment Analysis (DEA) is one of the

nonparametric analysis techniques commonly used

to measure the relative efficiency of both profit-

oriented business organizations or organizations or

non-profit oriented economic activities where the

production process or activity involves the use of

certain inputs to produce certain outputs. In

particular, DEA is the development of linear

programming techniques in which there are

objective functions and function constraints. The

following is a general equation in the Data

Envelopment Analysis (DEA) method (Firdaus and

Hosen, 2013: 172-175).

DEA is a linear programming non-parametric

approach with the help of an efficiency software

package, and this research will use OSDEA

software.

4 RESULT

Existing data will be processed using Data

Envelopment Analysos with twice test. The first test

was conducted to see the effectiveness of zakat fund

of Lembaga Amil Zakat Dompet Dhuafa, then the

second test to see the effectiveness of the Non-Zakat

Fund of Lembaga Amil Zakat Dompet Dhuafa. Data

in the test is to confirm the overall efficiency of

Dompet Dhuafa. Using DEA, if the results show the

number 1 it indicates efficiency. While the number

below 1 shows lower efficiency, the closer to the

number 1 indicates better efficiency.

Table 3: Results of DATA Processing using ZAKAT

funds

DMU Name

Objective Value

Efficient

2011

1

Yes

2012

0,824804907

2013

0,801779633

2014

1

Yes

2015

1

Source: Processing Results

ICPS 2018 - 2nd International Conference Postgraduate School

62

From the data table it is known that in 2011,

2014 and 2015 there is efficiency in processing the

data of zakat in Dompet Dhuafa. It is marked with

the objective value 1. Every year receipt of zakat

funds always increased as well as the distribution for

the group of 8 asnaf. But the increase in 2012 and

2013 leaves zakat funds. This indicates that in that

year the distribution of zakat funds is less efficient.

This is indicated by the objective value of

0.824804907 in 2012 and 0.801779633 in 2013. In

2011, 2014 and 2015 it is optimal because there is

no remaining funds in the existing zakat funds

experiencing the difference.

Table 4: Results of DATA Processing using non - zakat

funds

DMU Name

Objective Value

Efficient

2011

1

2012

0,577886072

2013

0,742518551

2014

1

2015

1

Yes

Source: Processing Results

From the table on the processing of non-zakat

data, i.e. Infaq, Infar Bound and Waqf data

collection and distribution for Education, Health,

Social, Economic, Humanitarian, Advocacy and

Networking activities, it is known that in 2012 it is

not efficient because in the data processing DEA its

objective value shows the value of 0.577886072.

This value indicates the inefficiency of the collection

and distribution of non-zakat funds in Dompet

Dhuafa. In 2011, 2014 and 2015 from the DEA data

processing there is efficiency of the performance of

Dompet Dhuafa in collecting and disbursing the

non-zakat funds.

5 DISCUSSION

From the results of the DEA data the performance of

Dompet Dhuafa is tested twice to see the efficiency

of the performance of collection and distribution of

zakat funds as well as the performance of collection

and distribution of non-zakat funds in the form of

infaq, bound and waqf for 2011-2015. We know

2011, 2014 and 2015 are inefficient because the

value of its objective value already shows the

number 1.

In 2011, both data processing and zakat funds

and non-zakat funds have been effective. In the

management of zakat funds it can be seen that in the

year the value of efficiency in coming from the

difference in zakat income and distribution. In 2011,

the disbursement of zakat funds is larger than the

collection.

In contrast to 2011, in 2012 and 2013 the

objective value of the DEA processing results shows

the number less than 1, indicating that in the year the

activities of collection and distribution of its funds

have not been efficient. Known from the cash flow

statement that existed in 2012 and 2013 there is a

bigger difference in the receipt and distribution of

zakat funds in its receipts. The existence of the

remainder or the excess of zakat funds indicates less

efficient management of Dompet Dhuafa

performance in that year.

As in 2011, in 2014 and 2015 the performance

efficiency of Dompet Dhuafa showed efficiency

with its objective value 1. It indicates that in that

year the process of zakat fund management both in

the collection and distribution has been efficient.

The financial report in 2014 and 2015 shows the

difference in the pernemiaan of zakat funds and

distribution. Zakat receipts are less than the amount

distributed, as happened in 2011.

Non-zakat data processing with DEA from 2011-

2015 is not different from processingfor zakat funds.

In 2011, 2014 and 2015 on the management of non-

zakat funds (Infaq, Infaq bound and Wakaf) has

been effective with the objective value already

menjukan number 1. While in 2012 and 2013 it is

still not effective because the objective value is still

below the number 1, 0.577886072 and 0.742518551.

Efficiency in Dompet Dhuafa for the last two

years indicates that Dompet Dhuafa as National

Amil Zakat Institution already has more credibility

and has gained more belief than masyarakt in

Indonesia. Not yet optimal zakat institutions in 2012

and 2013 can already be dinetralisirkan with

efficiency in the next year.

6 CONCLUSION

People can pay their zakat obligations by channeling

them through zakat institutions. Zakat institution is

also obliged to distribute the funds. The problem is

how efficient is the institution of zakat when

collecting zakat funds and channeling it. Dompet

Dhuafa is one of the national zakat amil institutions

that have good credibility.

From the data collected from the years 2011-

2015, either zakat funds or non-zakat, it shows the

performance of this amil zakat institution in the

Efficiency Performance of Dompet Dhuafa Zakat Institutions: Using Data Envelopment Analysis Approach

63

years 2011, 2014 and 2015. While in 2012 and 2013

it has not been efficient due to several factors, one of

which is the distribution of funds that have not been

optimal. Efficiency in 2011, 2014 and 2015 is

indicated by the objective value of DEA data

processing that is worth 1.

Efficiency of Dompet Dhuafa during 2011, 2014

and 2015 show that the Dhuafa administration has

become one of the national zakat amil institutions

that have good credibility value. Dompet Dhuafa is

already acceptable in society and can serve the

community to distribute zakat. The efficiency that

exists in the zakat fund of Dhuafa Amil Institution

implies that channeling zakat in zakat institutions is

better than channeling it yourself. Muzaki will feel

peaceful in channeling his zakat funds which are

distributed on target to mustahiq by the zakat

institution. So that the potential for large zakat in

Indonesia can be channeled properly.

REFERENCES

Ad-Dimasyqi, Al-Imam Abul Fida Isma’il Ibnu

Kasir. 2005. Tafsir Ibnu Kasir. Bandung: Sinar

Baru Algensindo

Ahmad, Ismail HJ and Masturah Ma’in. 2014. The

efficiency of zakat Collection and Distribution:

Evidence from Two Stage Analysis.Journal of

Economics Cooperation and Development, 35.3

(2014), 133-170

Ash-Shiddieqy, M Hasbi.2009. Pedoman Zakat.

Pustaka Riski Putra: Semarang

Djaghballou, Chams-Eddine, at al. 2018. Efficiency

and productivity performance of zakat funds in

Algeria. International Journal of Islamic and

Middle Eastern Finance and Management.

Firdaus, M. F and Hosen, M.N. 2013. Efisiensi Bank

Umum Syariah Menggunakan Pendekatan Two

Stage Analysis.Buletin Ekonomi Moneter dan

Perbankan. Jurnal no 10, 1-32

Hafidhuddin, Didin. 2002. Zakat dalam

Perekonomian Modern. Jakarta: Gema Insani

Press.

IZDR (Indonesia Zakah & Development

Report).2011. Kajian EMpirik Zakah Dalam

Penanggulangan Kemiskinan. IMZ

Kementerian Agama RI. 2011. Undang-Undang RI

Nomor 38 Tahun 1999 tentang Pengelolaan

Zakat. Jakarta: Kemenag RI Dirjen Bimas

Direktorat Pemberdayaan Zakat.

Nasution, Mustafa Edwin, dkk. 2009. Indonesia

Zakat Development Report. Jakarta: PEBS FEUI

dan CID 2009.

Nurul Huda, dkk. 2015. Zakat Prespektif Mikro-

Makro : Pendekatan riset. Prenamedina Group:

Jakarta

___________ dkk. 2014. Solution to Indonesian

Zakah Probelmatic Analytic Hierarchy Proses

Aproach. Journal of Islamic Economics, Banking

and Finance, Vol 10 No 3 July – Sep 2014

Qardawi, Yusuf. 2011. Hukum Zakat: studi

komperatif mengenai status dam filsafat zakat

berdasarkan Al quran dan Hadis cetakan

keduabelas. Pustaka Litera Antar Nusa: Bogor.

Ryandono, Muhammad Nafik Hadi. 2008. Ekonomi

ZISWAQ (Zakat, Infaq, Shadaqah, Waqaf). IFDI

dan Cenforis: Surabaya

Saad, Norma dan Nazarudin Abdulah. 2014 : Is

Zazat Capable Alleviating Poverty? An Analysis

the Distribution of Zakat Fund in Malaysia.

Journal of Islamic Economic,Banking, ... vol-10

No. 1 January – march April

Wahab, N A and Rahman A R A,. 2012.

Productivity growth of zakat institutions in

Malaysia: an application of data envelopment

analysis. Studies in Economics and Finance, Vol.

29, pp. 197-210

ICPS 2018 - 2nd International Conference Postgraduate School

64