Relationship between the Application of Good Islamic Business

Governance and Voluntary Disclosure on Islamic Bank in Indonesia

Moh Arifin

1

, Imron Mawardi

2

, Muhammad Nafik Hadi Ryandono

2

, Sri Iswati

3

, Bahrina Almas

3

1

Islamic Economic Science, Postgraduate School, Airlangga University, Campus B. Jl. Airlangga No.4-6 Surabaya,

Indonesia

2

Departement of Islamic Economic, Faculty of Economics and Business, Airlangga University, Campus B. Jl. Airlangga

No.4 Surabaya, Indonesia

3

Postgraduate School of Universitas Airlangga, Campus B. Jl. Airlangga No.4-6 Surabaya, Indonesia

Keywords: Islamic Bank, Good Islamic Business Governance, voluntary disclosure.

Abstract: The development of Islamic bank assets has a relatively significant growth, so that Indonesian banks create

good Islamic business governance as a benchmark for Islamic banking governance in accordance with

Islamic principles. The position of assets is reaching IDR 429.39 trillion with financing level at IDR 289.99

trillion. This has been a concern for Islamic banking not only to pursue profit but to fight for the welfare of

customers and shareholders. The purpose of this study is to obtain empirical evidence on the reciprocal

relationship between good Islamic business governance and voluntary disclosure at 7 Islamic banks in

Indonesia in the period of 2011-2017. The research methodology used is quantitative descriptive with

voluntary disclosure as dependent variable and good Islamic business governance as an independent

variable. The results show that voluntary disclosure has a positive relationship with good Islamic business

governance. The two variables will be co-integrated in the long run, which is indicated by trace statistic >

critical value of 5%. So in the long run the variables will affect each other. The maximum voluntary

disclosure is applied then the implementation of Good Islamic Business Governance will be better, so the

customer confidence will increase and the growth of Islamic bank will be more optimal.

1 INTRODUCTION

Publicly disclosing information about the company

is a form of transparency and accountability to

stakeholders. Barako, et. al, (2006) said that

companies can use financial statements to convey

company information in a qualitative and

quantitative way. According to Yuniasih, et. al,

(2012) the form and extent of information disclosure

is strongly influenced by corporate governance.

Meilani (2016), note that one of the information

disclosures provided to stakeholders is the voluntary

disclosure used by management to increase the

company's credibility. Thus, good governance can

be achieved and company performance can be

improved when transparency and disclosure quality

are highly achieved.

Bank Indonesia (2009) states that to encourage

the management of Islamic banks in Indonesia

should refer to the principles of good Islamic

business governance. So, Bank Indonesia (2009)

issued regulation no. 11/33/PBI/2009 dated

December 7

th

, 2009 regarding good Islamic business

governance and Circular Letter no. 12/13/DPbS

dated 30 April 2010 regarding the implementation of

good Islamic business governance for Islamic

commercial banks and Islamic business units.

Good corporate governance involves a set of

relationships between a company's management as

such its board, its shareholders and other

stakeholders. According to Jumansyah and Syafe'i

(2013), good corporate governance cannot be

applied entirely to Islamic business entity mainly

Islamic banking, because governance of Islamic

bank must conform with Islam.

Along with the increasing awareness of the

increasing application of Islamic values in life and

business, Bank Indonesia declared the

Arifin, M., Mawardi, I., Ryandono, M., Iswati, S. and Almas, B.

RelationshipÂ

˘

a between the Application of Good Islamic Business Governance and Voluntary Disclosure on Islamic Bank in Indonesia.

DOI: 10.5220/0007538901370141

In Proceedings of the 2nd International Conference Postgraduate School (ICPS 2018), pages 137-141

ISBN: 978-989-758-348-3

Copyright

c

2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

137

implementation of good Islamic business

governance. According to Shahul (2001) that Islamic

bank as a business institution that runs based on

Islamic principles should not be directed to generate

maximum profit. According to statistical data of

Islamic bank (Financial Services Authority, 2018),

the position of Islamic bank assets reached IDR

429.36 trillion and financing value is still moving at

double-digit level of IDR 289.99 trillion. Growth is

inseparable from good governance to maintain

welfare and security for customers and shareholders.

This study can obtain empirical evidence of the

mutual relationship between good Islamic business

governance and voluntary disclosure in the annual

report of Islamic bank in Indonesia period 2011-

2017 using ganger causality.

2 LITERATURE REVIEW

Governance is a new form of new public

management regulation. Corporate governance is the

alignment between the interests of corporate

management with other stakeholders and integrates

the goals between management and owners,

incentives, monitoring and control (Nofianti and

Ardi, 2014). Voluntary disclosure is a phrase that the

company provides outside the applicable provisions.

Lys, et. al, (2015) said that in theory companies that

implement voluntary diclosure indicate good news

or good performance by releasing sustainable

financial statements to differentiate from

competitors.

The relationship between the disclosure of non-

financial sustainability and sustainability

performance remains controversial when researchers

use the theory of voluntary disclosure and legitimacy

theory to explain its relationship to sustainability

performance (Hummel and Schlick, 2016). Whereas

according to Hidayah (2008) said that accurate and

detailed disclosure will provide a picture of the

actual performance of the company. Large

companies are more likely to get big risks, including

Islamic bank. According to Darmadi (2013)

conventional banks or Islamic banks are also at risk

due to the complex nature of their capital structure,

where banks present many short-term claims and

relative to customer and depositors' trust.

Hypothesis: There is a one-way relationship

between good Islamic business governance and

voluntary disclosure.

3 RESEARCH METHODOLOGY

3.1

Population

Research approach used in this study is quantitative

approach which aims to test hypothesis with

measured data and produce generalizable

conclusion. The population in this study are the

annual financial report of Bank Syariah Mandiri,

Bank Muamalat Indonesia, Bank Negara Indonesia,

Bank Rakyat Indonesia, Bank Bukopin Indonesia,

Bank Mega Syariah Indonesia, and Bank Central

Asia Syariah for the period 2011-2017 December,

namely 49 financial reports.

The sample in this study is taken by purposive

sampling, where the sample is taken if it meets the

following criteria: First, the Islamic banks that

reported the complete financial period December

2011-2017. Secondly, 7 Islamic banks have the

largest assets in December 2017. Thirdly, Islamic

banks are still operating in Indonesia during the

period of December 2011-2017 (Bank Syariah

Mandiri, Bank Muamalat Indonesia, Bank Negara

Indonesia, Bank Rakyat Indonesia, Bank Bukopin

Indonesia, Bank Mega Syariah Indonesia, Bank

Central Asia Syariah).

3.2 Definition Operational of

Variables

3.2.1 Dependent Variable

Voluntary disclosure is the delivery of information

provided voluntarily by companies beyond the

obligated disclosure established by Bank Indonesia

(Meilani, 2016). The calculation of the voluntary

disclosure index refers to the study (al Bawat, 2015)

by providing a score of "1" for the item disclosed

and gives a score of "0" for an undisclosed item of

56 indicators.

3.2.2 Independent Variable

Good Islamic business governance is an important

element in maintaining the sustainability of business

growth (Meilani, 2016). Businesses that run with a

good governance concept will survive in the long

run. According to the national committee on

governance policy (2011) states that the ability to

maintain business power is very important for all

parties so that good governance for Islamic banks

can be illustrated by the consistency of the

implementation of good Islamic business

governance. According to Jumansyah and Syafei

ICPS 2018 - 2nd International Conference Postgraduate School

138

(2013) that good Islamic business governance

consists of 42 indicators with a score of "1" for the

indicator disclosed and gives a score of "0" for the

undisclosed indicator.

3.2.3 Types and Sources of Data

The type of data used in this study is the annual time

series data from 2011-2017 which is sourced from

various books, journals and financial reports

published by Islamic banks in Indonesia.

3.2.4 Analysis Techniques of Data

Based on the problem formulation and research

objectives, the analytical technique used in this

study is using the granger causality test analysis tool.

Causality test is a test to determine the cause of

effect in Vector Auto Regressive (VAR) system.

Granger Causality test is used to know the

dependent variable (not independent variable) can be

influenced by other variables (independent variable).

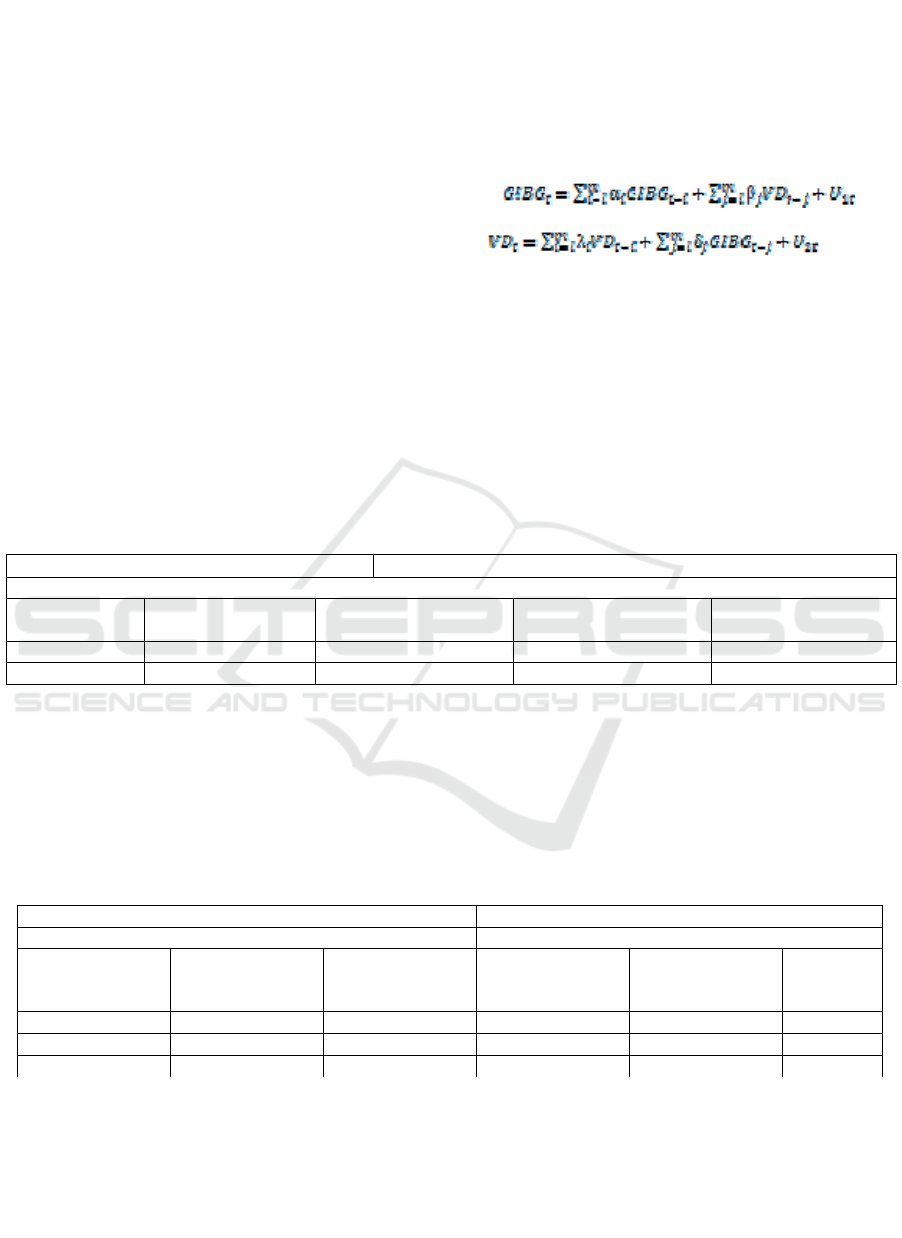

The model of granger causality can be formulated as

follows (Junaidi, 2012):

(1)

(2)

Where:

GIBG = Good Islamic Business Governance

VD = Voluntary Disclosure

Ut = Nuisance Variable

M = Number of lag

4 RESULTS AND DISCUSSION

4.1 Stationary Test (Unit Root Test)

Table 1: Stationary Test Result.

Dickey-fuller test for unit root

T-statistics and Critical Values

Interpolated dickey-fulle

r

Statistic Test 1% Critical Value 5% Critical Value 10% Critical

Value

GIBG -6.050 -3.594 -2.936 -2.602

VD -6.221 -3.594 -2.936 -2.602

Table 1 shows the stationary test result on the

degree level, where the t-statistical value for the

GIBG variable is -6.050 and VD of -6.221. The test

results show stationary data at critical values of 1%,

5%, and 10%, all variables have met the stationary

criteria because the resulting t-statistic value is more

negative than the critical value of 1%, 5%, and 10%.

4.2 Co-integration Test

Table 2 : C0-integration Test Result.

Vecrank GIBG VD, La

g

Johansen tests for co-inte

g

rations

Trent: constant La

g

s = 1

Maximum rank parms LL Eigenvalue Trace Statistic 5%

Critical

Value

0 2 -264.63211 71.7072 15.41

1 5 -241.57346 0.61740 25.5899 3.76

2 6 -228.77851 0.41323

From the results of table 4.3 can be seen in the co-

integration test using Johansen Test, obtained results

that variable GIBG and VD co-integrated in the long

term, which is indicated by trace statistic> critical

value 5%. The value of the trace statistic of the trace

test is 71.7072 greater than the critical value of

15.41, which means that in the system there is one

co-integrated equation. Trace statistic value of

25.5899 is greater than the critical value of 3.76.

This indicates that in the two variables (GIBG and

VD) in the Islamic bank in Indonesia in the period

RelationshipÂ

˘

a between the Application of Good Islamic Business Governance and Voluntary Disclosure on Islamic Bank in Indonesia

139

2011-2017 there is a long-term or co-integrated relationship.

4.3 Granger Causality-Test

Table 3 : Result of Granger Causality Test.

E

q

uation Exclude

d

Chi2 Df Prob > chi2

GIBG VD 1.4187 2 0.492

GIBG ALL 1.4187 2 0.492

VD GIBG 16.7 2 0.000

VD ALL 16.7 2 0.000

From the table above, it can be explained that which

has a granger causality relationship is a variable with

a probability value smaller than α 0.05. The variable

of good Islamic business governance (GIBG) does

not affect the voluntary disclosure (VD) variable

(0.492) and the voluntary disclosure variable (VD)

influences the good Islamic business governance

(GIBG) variable (0.000). It can be said that there is a

one-way relationship that is from VDÆGIBG that is

only the VD variable that statistically affect the

variable GIBG and not vice versa.

It can be argued that the implementation of good

Islamic business governance is highly dependent on

the growth of voluntary disclosure which

statistically has a positive relationship to good

Islamic business governance as well as good Islamic

business governance is not related to voluntary

disclosure. This is contrary to Meilani’s research

(2016) that good Islamic business governance has a

relationship with voluntary disclosure. The study

states that the contribution of Good Islamic business

governance implementation to the increase of

Voluntary Disclosure of Islamic bank in Indonesia is

11.56%, and the rest of 88.44% is influenced by

other factors beyond the application of Good Islamic

business governance. While in this study good

Islamic business governance has no influence on the

voluntary disclosure, otherwise voluntary disclosure

effect on good Islamic business governance.

The level of disclosure is strongly influenced by

the source of financing, revenue, legal system,

economic and political circumstances, level of

economic development, education and cultural level.

Costs that are needed in the disclosure are the

collection of information, management supervision

fees, auditor fees and legal counsel, and the cost of

disseminating information. The decision of the

company to make voluntary disclosure depends on

the incentives that will be obtained because there are

no rules that regulate it. Voluntary disclosure is

undertaken to reduce asymmetric information with

the aim of minimizing conflicts of interest between

management and shareholders.

If voluntary disclosure is well practiced then

good Islamic business governance will be good

because voluntary disclosure affects good Islamic

governance significantly. Based on a survey by

Mcinsey & Company (2002) many investors

consider that governance is at least as important as a

company's financial indicators. Therefore, voluntary

disclosure in Islamic banks must be optimized for

better governance so that the management of Islamic

banks increases.

5 CONCLUSIONS

The result of the measurement, it is concluded that

there is one-way relationship between voluntary

disclosure and good Islamic business governance

and vice versa there is no relation between good

Islamic business governance and voluntary

disclosure. It can be argued that the higher the

voluntary disclosure, the better the Islamic business

governance.

The variable of good Islamic business

governance (GIBG) does not affect the voluntary

disclosure (VD) variable (0.492) and the voluntary

disclosure variable (VD) influences the good Islamic

business governance (GIBG) variable (0.000). It can

be said that there is a one-way relationship that is

from VD Æ GIBG that is only the VD variable that

statistically affect the variable GIBG and not vice

versa.

REFERENCES

Albawat, Ala’ Hussein., Mohamad Yazis Ali Basah.,

2015. Corporate Governance and Voluntary

Disclosure of Interim Financial Reporting in Jordan.

Journal of Publik Administration and Governance.

ISSN 2161-7104 2015, Vol. 5, No. 2.

Albawat, Ala’ Hussein., 2015. The Relationship between

Voluntary Disclosure and Company Performances on

Interim Reports in Jordan Using the Method of

ICPS 2018 - 2nd International Conference Postgraduate School

140

Causality Directions. International Journal of

Economic and Finance. Vol, 7, No. 7.

Indonesia, Bank., 2009. PBI No. 11/33/2009: Pelaksanaan

Good Islamic Governance Pada Bank Umum Syariah

dan Unit Usaha Syariah.

Barako, D. G, et. al. (2006). Relationship between

corporate governance attributes and voluntary

disclosures in annual reports: The Kenyan experience.

Financial Reporting, Regulation and Governance, 5.

1: 1-26.

Darmadi, Salim., 2013. Corporate governance disclosure

in the Annual Report An exploratory Study on

Indonesian Islamic Banks. Emerald Insight Journal

Humanomics. Vol. 29 No. 1.

Hidayah, E., 2008, Pengaruh Kualitas Pengungkapan

Informasi Terhadap Hubungan antara Penerapan

Corporate Governance dengan Kinerja Perusahaan di

Bursa Efek Jakarta, JAAI, Vol. 12, No. 1, Juni: 53-64.

Hummel, K., Schlick, C., (2016). The Relationship

Between Sustainability Performance and

Sustanaibility Disclosure-Reconciling Voluntary

Disclosure Theory and Legitimacy Theory. Journal of

Accounnting and Publik Policy, 35 (5), 455-476.

Jumansyah., Syafei., 2013. Analisis Penerapan Good

Governance Business Syariah dan Pencapaian

Maqashid Shariah Bank Syariah di Indonesia. Jurnal

Al-Azhar Indonesia Seri Pranata Sosial. Vol . 2, No. 1,

Maret 2013.

Juanda, Bambang., Junaidi., 2012, Ekonometrika Deret

Waktu Teori dan Aplikasi. IPB. PT Penerbit IPB Press.

Komite Nasional Kebijakan Governance. 2011. Pedoman

Umum Good Governance Business Syariah. Jakarta.

Indonesia.

Lys, T. Naughton, J., Wang, C., 2015. Signalin through

corpoate accountability reporting. Journal of

Accounting and Economic. 60. 1, 56-72.

Meilani, Sayekti Endah Retno., 2016. Penerapan Good

Governance Business Syariah dan Voluntary

Disclosure.

Shahul, H.M.I., 2001. Different Worldview Needs

Different Accounting. Paper presented at IIUM

International Conference of Accounting I, Kota Bahru,

Kelantan, Malaysia. Jurnal EKA CIDA. Vol. 1 No. 1,

Maret.

RelationshipÂ

˘

a between the Application of Good Islamic Business Governance and Voluntary Disclosure on Islamic Bank in Indonesia

141