The Influence of Non-Performing Financing (NPF) and Return on

Assets (ROA) Against Linkage Multifinance at Sharia Commercial

Bank in Indonesia

Safarinda Imani, Risma Ayu Kinanti, Achsania Hendratmi, Tjiptohadi Sawarjuwon, Sri

Herianingrum,

Sri Iswati

Postgraduate School Airlangga UniversitySurabaya, Indonesia

Keywords: Non-performing financing, Return on Asset, Linkage Multifinance

Abstract: This study aims to determine the effect of Return on Assets (ROA) and the influence of Non Performing

Financing (NPF) on the linkage. The population in this study was the sharia bank registered in Bank

Indonesia during the period of 2008-2017 using quarterly financial report data. As the sample of research

was 13 sharia banks throughout Indonesia that met the criteria. The analysis technique used was multiple

regression using STATA 13 program. The research methodology used was a quantitative approach with the

type of associative research. Quantitative research is a more focused numerical data analysis (number) that

is processed by using statistical methods. While associative is research by explaining the relationship

between variables x with variable y. Result obtained from all sharia banks was a relationship between ROA

with two-way linkage of 0.019 and 0.031, while NPF has one-way effect 0.166 and 0.26, with a probability

value smaller than α 0.05 sharia bank in Indonesia correlation between ROA and NPF to linkage. The result

on ROA and NPF should considered for decision to provide linkage program and information for investor to

invest in sharia bank.

1 INTRODUCTION

Banks serve as financial intermediaries in

connecting the surplus spending unit of the

community to be returned to the community in the

form of loans. Banking plays an important role to

stimulate economic growth through loan

disbursement in the form of working capital loans

and investment loans. Both types of loans are

productive loans that can provide a direct multiplier

effect for the economy. Community access to

financial institutions is one of the keys to the optimal

functioning of the financial system. If the

community can utilize financial services easily, it

will encourage an increase in capital turnover. That

way, financial institutions can implement equity

capital in society, which will then encourage

economic growth.

In its development, there are many commercial

banks with sharia principles that implement Linkage

Program, including Bank Syariah Mandiri, Bank

Muamalat, BNI Syariah, Bank Danamon Syariah,

and so forth. According to Johan Arifin, the

implementation of the Linkage program is a strategy

aimed at empowering small and medium enterprises

through the involvement of the financial industry.

They channel it to the Linkage agency in an area

capable of reaching UMKM to remote areas. For

Bank Syariah Mandiri, starting from June 2012 there

is an internal regulation that prohibits the channeling

of Linkage Program to BPR.

At a glance the impression from customers both

Linkage agencies and end users about the

implementation of Linkage Program is very helpful.

The economy in remote areas can increase and the

welfare of society also increases. Basically, linkage

financing uses a muḍārabah contract that requires a

high trust between the fund owner and the fund

manager. In addition, profit sharing should be in the

form of an agreed ratio/percentage. In muḍārabah

the profit is called the profit-sharing ratio because

the amount of profit to be received by the owner of

the fund and the fund manager cannot be known

with certainty, because the amount of profit to be

142

Imani, S., Ayu Kinanti, R., Hendratmi, A., Sawarjuwono, T., Herianingrum, S. and Iswati, S.

The Influence of Non Performing Financing (NPF) and Return on Assets (ROA) Against Linkage Multifinance at Sharia Commercial Bank in Indonesia.

DOI: 10.5220/0007539001420146

In Proceedings of the 2nd International Conference Postgraduate School (ICPS 2018), pages 142-146

ISBN: 978-989-758-348-3

Copyright

c

2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

received depends on the profit generated. Linkage

multifinance is a linkage financing program that is

done between the sharia bank with sharia financial

institutions. In the current developments, there are

indications that NPF and ROA can affect the number

of linkage multifinance. In the world of sharia

banking, this factor is inseparable from the high

level of financing and the quality of bank assets

reflected in the NPF level. Troubled financing

remains a daunting for sharia banking. Moreover,

experience proves that one of the causes of the

economic crisis is the high level of NPF. The high

NPF, particularly the stalled financing, contributed

substantially to the poor performance of banks at the

time. NPF is one indicator of whether or not a

healthy Bank. That way, if a banking has a high NPF

level then sharia banking will be more careful by

reducing the amount of linkage financing. In

addition to NPF, it is also indicated that ROA can

affect the number of linkage multifinance. ROA is

the company's ability to generate profit at the level

of income between fund providers and fund

managers. Seeing the importance of the influence of

NPF and ROA on various Islamic banking

transactions such as the linkage multifinance, the

researchers are interested to conduct research with

the title "Influence NPF and ROA Results Against

Linkage Multifinance at Sharia Commercial Bank in

Indonesia".

2 LITERATURE REVIEW

2.1 Forms of Partnership in Linkage

Multifinance

Linkage programs are partnership financing. So,

Islamic banks issue financing to the real sector

indirectly. This partnership with 3 (three) forms,

namely channeling, executing, and joint financing.

Channeling is financing provided by Islamic public

banks to cooperative customers / KJKS / BMT and

BMT who act as agents who do not have the

authority to decide on financing unless obtaining a

power of attorney from a commercial bank. Records

in Commercial Banks as financing for BMT

customers, while the data on BMT is off balance

sheet. Executing is financing provided by the

Shari'ah commercial banks to cooperatives/KJKS/

BMT in the framework of financing to be distributed

to BMT customers, where cooperatives/ KJKS/BMT

have the authority to decide on financing to MSMEs.

Listing at Sharia commercial banks as financing to

BMT customers, while recording in cooperatives as

loans to BMT customers. Joint financing is joint

financing by sharia commercial banks and

cooperatives against cooperative members. The

authority to decide on financing is with BUS/UUS

and KJKS/BMT. Recording of outstanding credit for

commercial banks and cooperatives is as much as

the portion of financing to members of cooperatives.

2.2 Effect of Financial Performance

(ROA and NPF) on Linkage

Multifinance

According to Bangun Ika Haryanto, in Islamic

finance and banking journals, when a bank

experiences problems in linkage financing, the

profits that should be obtained by the bank will

decrease. The reduced level of bank profits will have

an impact on decreasing income which can affect the

bank's financial performance. Because financial

performance has an important meaning in an effort

to maintain its long-term survival, because financial

performance shows whether the business entity has

good prospects in the future. Thus every business

entity will always try to improve its financial

performance, because the higher the level of

financial performance of a business entity, the

survival of the business entity will be more

guaranteed. According to Harahap (2010: 305)

Return On Assets (ROA) describes asset turnover

measured from sales. The greater this ratio, the

better and this means that assets can spin faster to

gain profits. In addition to the financial performance,

the higher the NPF (above 5%), the bank is declared

unhealthy because the high NPF causes a decrease in

profits to be received by the bank (Popita, 2013).

3 RESEARCH METHODS

The method used is quantitative. Quantitative

approach aims to determine whether the ROA and

NPF variables affect each other against linkage

multifinance, and whether there is a long-term

relationship or short-term ROA and NPF to linkage

multifinance. The variables are arranged into a

model estimated using granger causality analysis

and cointegration, then will be described. The

research approach used in this research is

quantitative approach. The population in this study

is existing sharia commercial banks in Indonesia.

Based on sharia banking statistics as of December

2017 with 13 sharia banks. The sample in this study

was taken by purposive sampling. Data analysis

techniques were processed and analyzed using the

program strata 13. Operational definition:

The Influence of Non Performing Financing (NPF) and Return on Assets (ROA) Against Linkage Multifinance at Sharia Commercial Bank

in Indonesia

143

ROA = Annual Report Islamic banking statistics

agency, Ratio scale in percent

NPF = Non Performing Financing, an indicator

of the annual Islamic Banking statistics

report, Ratio scale in percent

Linkage = Financing program for sharia

commercial banks to cooperative / KJKS /

BMT and BMT customers, annual report

indicators and evaluation, Ratio scale in

mudharabah agreement.

4 RESULTS AND DISCUSSION

4.1 Stationary Test (Unit Root Test)

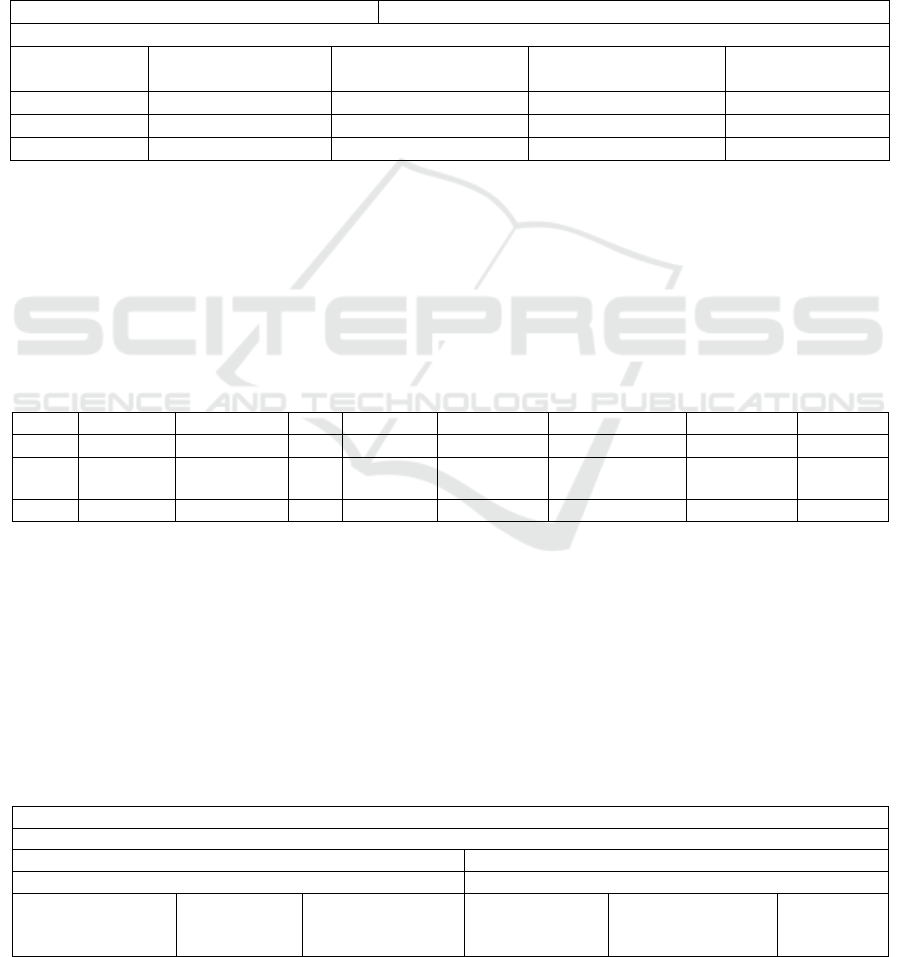

Table 4.1: Stationary Test Results.

Dickey-fuller test for unit root Value T-statistics and critical values

Interpolated dickey-fuler

Test Statistics 1ϑ Critical Value 5ϑ Critical Value 10ϑ Critical

Value

Linkage -6.635 -3.655 -2.961 -2.613

NPF -9.274 -3.655 -2.961 -2.613

ROA -2.898 -3.655 -2.961 -2.961

Mackinnon approximate p-value for z (ԏ)=0.0000

Table 4.1 shows the stationary test results on the

degree level. The test results show stationary data at

critical values of 1%, 5%, and 10%, all variables

have met the stationary criteria because the resulting

t-statistic value is more negative than the critical

value of 5%

4.2 Optimum Lag Determination

Table 4.2: Optimal lag length.

Endogenous: Linkage, NPF,ROA Exogenous: _cons

The second stage in the VAR analysis is the

determination of the optimum lag. The

determination of the number of lags in the VAR

model is determined on the information criteria

recommended by the smallest value of Final

Prediction Error (FPE), Akaike Information

Criterion (AIC), Schwars Criterion (SC), and

Hannan-Quinn (HQ). The stata program has given

the star clues to the lag set as the optimum lag. Table

4.2 shows that almost all stars are in lag 2. lag 2 is

defined as the optimum lag and is used at all stages

in the VAR analysis.

4.3 Cointegration Test

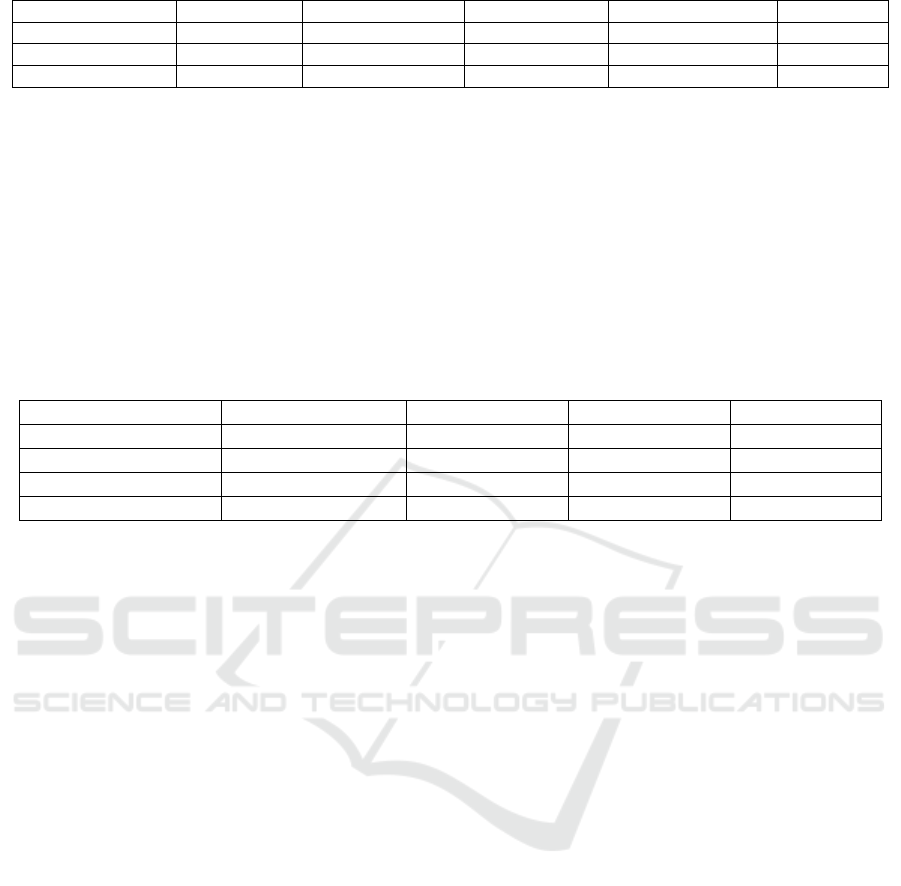

Table 4.3: Cointegration Test Results.

Vecrank Linkage,NPF,ROA, Lag

Johansen tests for cointe

g

rations

Trend: constant Number of obs = 38

Sam

p

le: 2 -40

Maximum rank

p

arms LL Eigenvalue

Trace statistics 5ϑ

critical

value

La

g

LL LR df

p

FPE AIC HQIC SBIC

0 -288.42 919.921

15.3379

15.3939 15.4674

1 -237.975 100.89 9 0.000 104.095 13.1555 13.3406 14.6444

*

2 -226.339 23.274* 9 0.006 91.5537* 13.0179* 13.3399* 13.9224

ICPS 2018 - 2nd International Conference Postgraduate School

144

0 3 -283.49754 37.4714 28.88

1 8 -273.4222 0.58360 17.3206 15.42

2 11 -267.10756 0.42253 4.6914 3.76

3 12 -255.761888 0.19451

From the results of table 4.3 can be seen in the

cointegration test using Johansen Test, obtained

results that ROA, NPF and Linkage cointegrated in

the long term, which is indicated by trace statistic>

critical value 5%. The value of the trace statistic of

the trace test is 37.4713, 17.3206, 4.6913 greater

than the critical value of 28.88, 15.42, 3.76 which

means that in the system there is one cointegrated

equation. This shows that in the three variables

(ROA, NPF and linkage) on Islamic bank in

Indonesia in the period 2008-2017 there is a long-

term relationship or cointegrated.

4.4 Causality Test

Tabel 4.4: Causality Test results.

From the table above, it can be explained that the

relationship between Granger Causality is a variable

with a probability value less than α 0.05 shows that

there is a relationship between ROA and two-way

linkage of 0.019 and 0.031, this shows ROA to

linkage is related, so every profit obtained by

Islamic commercial banks has increased assets,

capital, and the number of customers will increase

linkage financing in the linkage for the financial

institutions sector, while linkage has a greater

influence because of the financing factor there is

also a Sharia commercial bank linkage program

which is given to the financial institution sector in

the form of coaching so it will also improve

financial performance. This is the link between

return on assets on the improvement of funds and

linkage.

On the other hand, NPF affects one direction

0.166 and 0.26. when there are non-performing

loans, the financing will be funded to provide funds

is also not smooth, besides that the ability of bank

partners in managing funds and profits is certainly

not related to the policy of the sharia commercial

banks themselves because commercial banks are the

only linkage financing providers. Linkage is one

form of real sector financing in banks.

5 CONCLUSIONS

The results show that ROA has a two-way

relationship with linkage, whereas the NPF has a

one-way relationship with the linkage. This shows

that there is a link between return on assets on the

improvement of funds and linkage. then every profit

that is obtained by Islamic commercial banks has an

increase in assets, capital, and the number of

customers will increase linkage financing in the

financial institution sector if the linkage also

provides large financing to the financial institutions

sector, while linkage has a greater influence on ROA

because in addition to the financing factor the Sharia

Commercial Bank linkage program given to the

financial institution sector in the form of coaching

will also improve financial performance. This shows

that there is a link between return on assets on the

improvement of funds and linkage.

The results of the NPF variable causality test

affect Linkage. when there are non-performing

loans, the financing will be stalled so that the

linkage program to provide funds is also not smooth,

besides that the ability of bank partners (financial

institutions) in managing funds and profits is

certainly not related to the policy of the sharia

commercial banks themselves because commercial

banks are the only linkage financing providers.

Equation Excluded Chi2 Df Prob>chi2

ROA LINKAGE 7.916 2 0.019

LINKAGE ROA 7.916 2 0.031

N

PF LINKAGE 6.96 2 0.166

LINKAGE

N

PF 6.96 2 0.026

The Influence of Non Performing Financing (NPF) and Return on Assets (ROA) Against Linkage Multifinance at Sharia Commercial Bank

in Indonesia

145

Linkage is one form of real sector financing in

banks.

The number of finance linkage finance is not

only influenced by economic motives such as NPF

and ROA, but also influenced by other factors not

included in the study. We recommend that more

research needs to be done on variables that can

affect the number of financing linkage finance

companies.

ACKNOWLEDGEMENTS

Thank you for all postgraduate lectures of Airlangga

University, and more importantly is the ICPS

committee.

REFERENCES

Hanafi, M. and Halim, A. 2003. Analisis laporan

keuangan. Yogyakarta: UPP AMP

Harahap, S.S. 2010. Teori Akuntansi Edisi Revisi. Raja

Grafindo Persada: Jakarta.

Haryanto, B. I. 2015. Pengaruh pemberian Pembiayaan

Linkage Terhadap Tingkat Profitabilitas Bank BRI

Syariah KCP Cimahi. Jurnal Keuangan dan

Perbankan Syariah. Vol. 1.

Naser, A. 2011. Kontribusi Rasio Keuangan Terhadap

Perubahan Laba Perbankan. Jurnal Bisnis dan

Manajemen Vol 9 p. 300-462

Syamni, G. 2013. Pengaruh OPM dan ROA terhadap

perubahan laba bursa efek Indonesia. Jurnal

Kebangsaan Vol 2.

ICPS 2018 - 2nd International Conference Postgraduate School

146